Beruflich Dokumente

Kultur Dokumente

Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)

Hochgeladen von

Shyam SunderOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)

Hochgeladen von

Shyam SunderCopyright:

Verfügbare Formate

ffi NCCFNA

CI N

Ref

CELIMITET)

t65993TG 1994P1q,

17 7 ?7

: NCCFABSE/SEC-I0 l?:oLG

Date : 11-0&2AL6

To,

The Secretary

THE BOMBAY STOCK EXCHANGE LTD

1" Floor, New Trading Ring

Rotunda Building, PJ Towers

Dalal Street, Fort

MUM84T-4{Xr001.

Dear Sir,

Scrip

Sub: Un-Arditd Financial

Code

No

53!t52

Resultsforthe quarter ended !r(}OG2016

ln compliance with Regulation 33 & 30 of the SEB! (Listing Obligations and Disclosure

Requirements), Regulations, 20t5, we are enclosing herewith statement containing

the Un-Audited Financial Results for the quarter ended 3dn June, 2015 which have

been reviewed by the Audit C-ommittee and approved by the Board at their

respective meetings held on lttn August,2}!6along with the Limited Review Report

furnished by Statutory Auditors of the C,ompany.

We would request you to please take note of the sarne.

Thanking you,

Yours sincerely,

Far ltCC FIHAIIICE LIMITED

,..t

\\JN

c

Compliance Officer

Regd. Office : NCC House, Madhapur, Hyderabad - 500 081.

Phone z 040-2326 8888, Fax : 040-2312 5555, E-mail : ho.secr@nccltd.in

ffire

ffi@P

NCCFNA NCELIMITEI)

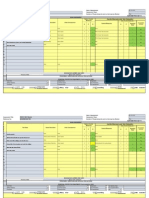

Statement of Unaudited Financial Results for the Quarter ended 30 th, June 2016

Quarter ended

Particulars

No.

30.06.16

3{.03.16

30.06.15

31.03.16

Un Audited

Audited

Un Audited

Audited

lncome from operations

a) Other Operating income

Total lncome from operations(net)

2

Expenses

a) Other expenses

3.25

1.03

2.80

5.18

Total expenses

3.25

1.03

2.80

5.18

(3,25)

(1.03)

(2.80)

(5.18)

ProfiU(Loss) from operations before Other lncome, finance costs and exceptional items(l-2)

Other lncome

ProfiU (Loss) from ordinary

Finance Costs

ProfiU(Loss) from ordinary activities after finance costs but before Exceptional ltems(5.6)

activities before finance costs and exceptional items (3+4)

Exceptional items

Profit /(Loss) from Ordinary Activities before tax (7+8)

10

Tax Expenses

11

Net Profit l(Loss) from Ordinary Activities after tax (9.10)

12

Extraordinary items(net of tax expenses)

13

Net Profit /(Loss)for the Period (11+12)

14

Paid-up Equity Share Caiptal (Face value Rs 101 per Share)

15

Reserve Excluding Revaluation Reserves as per balance sheet of previous Accounting Year

16

Earnings Per Share -Basic & Diluted ( Not Annualised)

Note:

The above results have been reviewed by the Audit Committee and approved by the Board

0.12

0.43

0.20

1.08

(3.13)

(0.60)

(2.60)

(4.10)

(3.13)

(0.60)

(2.60)

(4.10)

(3.13)

(0.60)

(2.60)

(4.10)

(3.'13)

(0 60)

(2.60)

(4.10)

(3.13)

(0.60)

(2.60)

(4.10)

602.40

602.40

602.40

602.40

(0.05)

(0.01)

(0.04)

(5e5.67)

of Directors of the Company

in their meetings held on

'l'lth August,2016.

The Statutory Auditons of the Company have conducted limited review of the above results as required under the SEBI ( Listing Obligation and Disclosure

Requiremenb) Regulations,20l 5.

Previous year/period figures have been regrouped, wherever necessary, to conform to the cunent period classification.

There is no reportable segment pursuant to AS-'17 ("segmental Reporting") issued by the lnstitute of Chartered Accountants of lndia.

By order of the Board

For NCC FINANCE LIMITED

Soq)C>

Place:

Hyderabad

Date:

1 1

.08.2016

AGKRAJU

DIRECTOR

Regd. Office : NCC House, Madhapur,Ilyderabad - 500 081.

Phone :040-2326 8888, Fax : 040-2312 5555, E-mail : ho.secr@nccltd.in

(0.07)

M. BHASKARA FTAO & CO.

CHARTERED ACCOUNTANT$

PHONES i 23311245, 23393900

FAX : 040-23399248

il\$r)[p#simfi lvr

S-D, FIFTH FLOOR, "KAUTILYA",

s-3-65e, SoMAJIGUDA,

HYDERABAO-sOO O82. INDIA.

e-mail : mhr-co@ mbrc.co.in

Al,ulT#fr's frfivlHw n[PsRT

T# YHf, ffi#AffiS frF SlfiTff#ft$

M/s NCC FltrA$\$Cf HMffES

We have reviewed the accornpanying statement of M/s. NCC FINANCE LlMlTtD ('the

Cumparry")"UNAUDITED FINANCIAL RESULTS fOR THE QUARTER INDED .lune 30, 203.6"

{"the Statement"}.This Statement is the responsibility of the Company's Management and

has treerr approved by the Board of Directors on August 11, 2016. Our responsibility is to

issue a report on these financial results based on our review.

W* cnnducted our review in accordance with the Standard on Review Engagenrents (SRE)

?4:10, "Heview of lnterim Financlal lnformation Performed by the lndependent Auditor of

lht: tntily" issued by the lnstitute of Chartered Accountants of lndia. This $tandard reqr:ires

that we plan nnd perform the review to ohtain moderate assurance as to whethcr llru

financial statements are free of material misstatements. A review is limited primarily to

inc;uiries of Con:pany Fersonnel and analytlcal procedures applied to financial data aild thus

providr: less assurance than an audit. We lrave not performed an audit and accordingly we

clo n*t expre$s an audit opiniorr.

[.ta.;ed rrn r:rrr review, nothing has come to our attention that causeS us to believe that the

accnmpanying Statement prepared in accordarrse with Accounting StantJards specified

uncler $ecti*n 133 of the Companies Act, 2013 ("the Act") read with Rule 7 of the

{orrrlr;rrri*r {Accourrts} Rules 201.4 and other applicable provisions of the Act'and other

sccounting practices and policies has not disclesed the inforrnation required ts be disclosed

in turrrs of Re$ulation 33 of the Stlll {t..isting t)bligations and Disclosure R*quirements}

ftegulations, 1015 including the manner in which it is to lre rJiscloserl, r:r that it cantains any

m*torial misst8tsment,

f-nr M. Shaskars Rao & Cg.

Chartered AccCIuntunts

Hegi.*tr

No.tJtJ(J4595

{a

V K fvlr-rralidliar

Pa rtn er

Menrbership No"

!:r

i;:i

r',

: i-l yfit*: t";I i}ft ff

i.)ate: ..iir,'gui:rt LL, ?t16

3,01"570

Das könnte Ihnen auch gefallen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument3 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument3 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument3 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Dokument9 SeitenStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review For June 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument7 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument12 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument8 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument6 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Dokument3 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument8 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23Von EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23Noch keine Bewertungen

- Codification of Statements on Standards for Accounting and Review Services: Numbers 21-24Von EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 21-24Noch keine Bewertungen

- Mutual Fund Holdings in DHFLDokument7 SeitenMutual Fund Holdings in DHFLShyam SunderNoch keine Bewertungen

- Order of Hon'ble Supreme Court in The Matter of The SaharasDokument6 SeitenOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNoch keine Bewertungen

- JUSTDIAL Mutual Fund HoldingsDokument2 SeitenJUSTDIAL Mutual Fund HoldingsShyam SunderNoch keine Bewertungen

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDokument5 SeitenExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNoch keine Bewertungen

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDokument2 SeitenSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNoch keine Bewertungen

- HINDUNILVR: Hindustan Unilever LimitedDokument1 SeiteHINDUNILVR: Hindustan Unilever LimitedShyam SunderNoch keine Bewertungen

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Dokument1 SeitePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For September 30, 2013 (Result)Dokument2 SeitenFinancial Results For September 30, 2013 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Settlement Order in Respect of R.R. Corporate Securities LimitedDokument2 SeitenSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNoch keine Bewertungen

- Financial Results For Dec 31, 2013 (Result)Dokument4 SeitenFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For June 30, 2014 (Audited) (Result)Dokument3 SeitenFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For March 31, 2016 (Result)Dokument11 SeitenStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For Mar 31, 2014 (Result)Dokument2 SeitenFinancial Results For Mar 31, 2014 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For June 30, 2013 (Audited) (Result)Dokument2 SeitenFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- PDF Processed With Cutepdf Evaluation EditionDokument3 SeitenPDF Processed With Cutepdf Evaluation EditionShyam SunderNoch keine Bewertungen

- Standalone Financial Results For September 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Transcript of The Investors / Analysts Con Call (Company Update)Dokument15 SeitenTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For June 30, 2016 (Result)Dokument2 SeitenStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Investor Presentation For December 31, 2016 (Company Update)Dokument27 SeitenInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Time Series Forecasting - Project ReportDokument68 SeitenTime Series Forecasting - Project ReportKhursheedKhan50% (2)

- Introduction Electrical MotorDokument36 SeitenIntroduction Electrical MotorYajidNoch keine Bewertungen

- Error 500 Unknown Column 'A.note' in 'Field List' - Joomla! Forum - Community, Help and SupportDokument1 SeiteError 500 Unknown Column 'A.note' in 'Field List' - Joomla! Forum - Community, Help and Supportsmart.engineerNoch keine Bewertungen

- Recognition & Derecognition 5Dokument27 SeitenRecognition & Derecognition 5sajedulNoch keine Bewertungen

- Klasifikasi Industri Perusahaan TercatatDokument39 SeitenKlasifikasi Industri Perusahaan TercatatFz FuadiNoch keine Bewertungen

- D882 - Pruebas A Películas.Dokument11 SeitenD882 - Pruebas A Películas.CamiloSilvaNoch keine Bewertungen

- Guidelines Regarding The Handling of Cable Drums During Transport and StorageDokument5 SeitenGuidelines Regarding The Handling of Cable Drums During Transport and StorageJegan SureshNoch keine Bewertungen

- Dep 32.32.00.11-Custody Transfer Measurement Systems For LiquidDokument69 SeitenDep 32.32.00.11-Custody Transfer Measurement Systems For LiquidDAYONoch keine Bewertungen

- Block P2P Traffic with pfSense using Suricata IPSDokument6 SeitenBlock P2P Traffic with pfSense using Suricata IPSEder Luiz Alves PintoNoch keine Bewertungen

- 2008 Application FormDokument12 Seiten2008 Application FormVishal PonugotiNoch keine Bewertungen

- Consumer Preference and Demand For Rice Grain QualityDokument38 SeitenConsumer Preference and Demand For Rice Grain QualityIRRI_SSDNoch keine Bewertungen

- Lesson 3 - Subtract Two 4-Digit Numbers - More Than One Exchange 2019Dokument2 SeitenLesson 3 - Subtract Two 4-Digit Numbers - More Than One Exchange 2019mNoch keine Bewertungen

- 2021 A Review of Image Based Pavement Crack Detection AlgorithmsDokument7 Seiten2021 A Review of Image Based Pavement Crack Detection Algorithmsgandhara11Noch keine Bewertungen

- Nikita Project 01-06-2016Dokument38 SeitenNikita Project 01-06-2016Shobhit GoswamiNoch keine Bewertungen

- Daa M-4Dokument28 SeitenDaa M-4Vairavel ChenniyappanNoch keine Bewertungen

- Managerial Accounting and Cost ConceptsDokument67 SeitenManagerial Accounting and Cost ConceptsTristan AdrianNoch keine Bewertungen

- A320 21 Air Conditioning SystemDokument41 SeitenA320 21 Air Conditioning SystemBernard Xavier95% (22)

- TROOP - of - District 2013 Scouting's Journey To ExcellenceDokument2 SeitenTROOP - of - District 2013 Scouting's Journey To ExcellenceAReliableSourceNoch keine Bewertungen

- Siemens ProjectDokument17 SeitenSiemens ProjectMayisha Alamgir100% (1)

- Black Bruin Hydraulic Motors On-Demand Wheel Drives EN CDokument11 SeitenBlack Bruin Hydraulic Motors On-Demand Wheel Drives EN CDiego AlbarracinNoch keine Bewertungen

- Y-Site Drug Compatibility TableDokument6 SeitenY-Site Drug Compatibility TableArvenaa SubramaniamNoch keine Bewertungen

- Imantanout LLGDDokument4 SeitenImantanout LLGDNABILNoch keine Bewertungen

- Section 2 in The Forest (Conservation) Act, 1980Dokument1 SeiteSection 2 in The Forest (Conservation) Act, 1980amit singhNoch keine Bewertungen

- 11 EngineDokument556 Seiten11 Enginerumen80100% (3)

- CANDIDATE'S BIO DATADokument2 SeitenCANDIDATE'S BIO DATAAamir ArainNoch keine Bewertungen

- Pg-586-591 - Annexure 13.1 - AllEmployeesDokument7 SeitenPg-586-591 - Annexure 13.1 - AllEmployeesaxomprintNoch keine Bewertungen

- Motorola l6Dokument54 SeitenMotorola l6Marcelo AriasNoch keine Bewertungen

- CO2 System OperationDokument19 SeitenCO2 System OperationJoni NezNoch keine Bewertungen

- Task Based Risk Assesment FormDokument2 SeitenTask Based Risk Assesment FormKolluri SrinivasNoch keine Bewertungen

- Stock Futures Are Flat in Overnight Trading After A Losing WeekDokument2 SeitenStock Futures Are Flat in Overnight Trading After A Losing WeekVina Rahma AuliyaNoch keine Bewertungen