Beruflich Dokumente

Kultur Dokumente

Ch4 Solution

Hochgeladen von

Niklaus YángCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ch4 Solution

Hochgeladen von

Niklaus YángCopyright:

Verfügbare Formate

Chapter 4 Solution

Chapter 4

True-False Statements

1-6: TTTTFT

Multiple-Choice Questions

1-5: CAADA

6-10: ABCDC

11-15: BBACC

Answers to Completion Statements

1.

2.

3.

4.

5.

6.

merchandising

gross profit

perpetual

Inventory

operating expense

Sales Returns and Allowances,

Accounts Receivable

7.

8.

9.

10.

an invoice

a contra revenue, debit

cost of goods sold, net sales

net sales

Solution Ex. 1

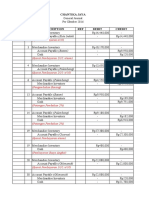

Olivias Organic Produce Ltd

Statement of Profit or Loss

For the year ended 31 March 2016

Operating Revenue

Sales revenue:

Gross sales revenue

Less: sales returns and allowances

Net sales revenue

Less: Cost of goods sold

Gross Profit

Other operating revenue:

Interest revenue

Total operating revenue

$346,000

0

346,000

235,000

111,000

2,650

Operating Expenses:

Selling expenses:

Advertising

Depreciation expense

- storage equipment

Freight out

Sales commissions expense

5,000

3,750

5,000

3,250

1

2,650

113,650

Chapter 4 Solution

Sales salaries expense

Administrative expenses:

Insurance expense

Office salaries expense

Rent expense office space

Electricity expense

Financial expenses:

Discount allowed

Interest expense

Bank charges

Total operating expenses

Profit before income tax

38,000

55,000

2,900

9,500

8,000

4,000

24,400

5,650

2,000

500

8,150

87,550

26,100

Solution Ex. 2

(a)

Date

Feb

General Journal

Account Titles

Inventory

Accounts Payable

Debit

840

Credit

840

Inventory

40

Cash

40

(Note: Freight-in charge is part of cost of inventory. You could debit inventory or a

freight-in account. In this question, you were instructed to debit the inventory account

when accounting for freight-in, however use a Freight-in account unless specifically

told otherwise in ACCT1006)

8

Accounts Receivable

900

Sales

900

Cost of Goods Sold

Inventory

10

11

13

600

600

Accounts Payable

Inventory

84

84

Inventory

Cash

Accounts Payable ($840 - $84)

Discount received ($756 x 3%)

2

300

300

756

23

Chapter 4 Solution

Cash

14

15

17

18

20

733

Inventory

Accounts Payable

500

500

Accounts Payable

Inventory

50

Inventory

Cash

30

50

30

Accounts Receivable

Sales

900

Cost of Goods Sold

Inventory

530

Cash

500

900

530

Accounts Receivable

21

27

28

500

Accounts Payable

Discount received [($500-50) x 2%)]

Cash

Sales Returns and Allowances

Accounts Receivable

Cash

450

9

441

30

30

500

Accounts Receivable

500

(b)

1-Feb Opening balance

Cash

2,500

20- Feb Accounts receivable

500

30- Feb Accounts receivable

500

7- Feb Inventory

11- Feb Inventory

13- Feb Accounts payable

40

300

733

17- Feb Inventory

21- Feb Accounts payable

30

441

28-Feb Closing balance

1-Mar Opening balance

3,500

1,956

3

1,956

3,550

Chapter 4 Solution

8- Feb Sales

Sales

1-Mar Opening balance

1-Feb Opening balance

6-Feb Accounts payable

7-Feb Cash

11-Feb Cash

14-Feb Accounts payable

17-Feb Cash

Accounts Receivable

900

20- Feb Cash

900

27- Feb Sales returns

28- Feb Cash

28-Feb Closing balance

1,800

770

Inventory

1,700

840

40

300

500

30

8-Feb COGS

10-Feb Accounts payable

15-Feb Accounts Payable

18-Feb COGS

28-Feb Closing balance

1-Mar Opening balance

3,410

2,146

500

30

500

770

1,800

600

84

50

530

2,146

3,410

Accounts Payable

10-Feb Inventory

13-Feb Discount and cash

15-Feb Inventory

21-Feb Discount and cash

84

756

50

450

6-Feb Inventory

14-Feb Inventory

1,340

840

500

1,340

Share capital

1-Feb Opening balance

4,200

Sales

8-Feb Accounts receivable

18-Feb Accounts receivable

28-Feb Closing balance

1800

1,800

1-Mar Opening balance

4

900

900

1,800

1,800

Chapter 4 Solution

27-Feb Accounts receivable

28-Feb Closing balance

8-Feb Inventory

18-Feb Inventory

Sales returns and allowances

30

Discount received

13-Feb Accounts payable

21-Feb Accounts payable

32

32

1-Mar Opening balance

32

32

COGS

600

530

28-Feb Closing balance

1-Mar Opening balance

23

9

1,130

1,130

(c)

Metal Music Limited

Trial Balance

28 February, 2016

Debit

1,956

770

2,146

Cash

Accounts receivable

Inventory

Accounts payable

Share capital

Sales

Sales returns and allowances

Discount received

Cost of goods sold

Credit

4,200

1,800

30

32

1,130

6,032

6,032

(d)

Metal Music Limited

Statement of Profit or Loss (Partial)

For the Month Ended 28, February 2016

1,130

1,130

Chapter 4 Solution

Sales revenues

Sales.......................................................................................................$1,800

Less: Sales returns and allowances.......................................................

Net sales.................................................................................................$1,770

Cost of goods sold............................................................................................1,130

Gross profit......................................................................................................$ 640

Answers to Matching

1.

2.

3.

4.

5.

6.

B

I

E

A

C

H

7.

8.

9.

10.

G

D

J

F

Short-Answer Essay Questions

Solution 1

Cost of goods sold includes the cost of obtaining goods that are held for resale; it is

deducted directly from net sales on the income statement. Operating expenses, on the

other hand, includes selling, administrative, and financial expenses, and appears

directly below the gross profit on the income statement.

Solution 2

Gross profit is expressed as a percentage by dividing the amount of gross profit by the

amount of net sales. In this way, the gross profit shows the rate of profit earned

relative to the net sales generated by an enterprise and is more useful than simply

stating either the amount of gross profit or the amount of net sales. For example, X

Company may have generated net sales of $1,000,000. In isolation, this amount has

limited usefulness does it represent an efficient operation, is it better (or worse)

than last years sales level, does it result in a profit (or a loss), is it favourable

compared to similar businesses? Gross profit allows a more meaningful comparison to

be made.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Responsibility Accounting and Transfer Pricing CTDI October 2016 IMDokument17 SeitenResponsibility Accounting and Transfer Pricing CTDI October 2016 IMFerdi LlasosNoch keine Bewertungen

- Toaz - Info Afar Backflush Costing With Answers 1 PRDokument5 SeitenToaz - Info Afar Backflush Costing With Answers 1 PRNicole Andrea TuazonNoch keine Bewertungen

- Auditing Problem For Shareholder's EquityDokument14 SeitenAuditing Problem For Shareholder's Equityblack hudieNoch keine Bewertungen

- FAP - Bodie Industrial Supply - LT 2Dokument16 SeitenFAP - Bodie Industrial Supply - LT 2Marcus McWile MorningstarNoch keine Bewertungen

- Gilbert CompanyDokument15 SeitenGilbert CompanyThricia Mae IgnacioNoch keine Bewertungen

- Financial Statements Analysis - An IntroductionDokument19 SeitenFinancial Statements Analysis - An Introductionbiniam meazanehNoch keine Bewertungen

- Budgeting Chapter Explains Key ConceptsDokument20 SeitenBudgeting Chapter Explains Key ConceptsSunny Kumar10Noch keine Bewertungen

- Chapter 4 Job Order CostingDokument1 SeiteChapter 4 Job Order Costingagm25Noch keine Bewertungen

- Cost Accounting Chapter 2 AssignmentDokument3 SeitenCost Accounting Chapter 2 AssignmentTawan VihokratanaNoch keine Bewertungen

- Assignment - EntrepreneurshipDokument71 SeitenAssignment - EntrepreneurshipNURKHAIRUNNISA100% (2)

- Merchandising - AccountingDokument9 SeitenMerchandising - AccountingKen AggabaoNoch keine Bewertungen

- PT Amar Sejahtera General LedgerDokument6 SeitenPT Amar Sejahtera General LedgerRiska GintingNoch keine Bewertungen

- Income Effects of Alternative Cost Accumulation SystemsDokument4 SeitenIncome Effects of Alternative Cost Accumulation SystemssserwaddaNoch keine Bewertungen

- Learning Activity 3 - Analysis of Financial StatementsDokument3 SeitenLearning Activity 3 - Analysis of Financial StatementsAra Joyce PermalinoNoch keine Bewertungen

- Chapter 3 - Cost AssignmentDokument28 SeitenChapter 3 - Cost Assignmentviony catelinaNoch keine Bewertungen

- Prelim ExamDokument7 SeitenPrelim ExamChristine MalayoNoch keine Bewertungen

- Module 13 - Inventories: IFRS Foundation: Training Material For The IFRSDokument47 SeitenModule 13 - Inventories: IFRS Foundation: Training Material For The IFRSSamantha DionisioNoch keine Bewertungen

- Nudjpia Far and Afar Solutions - InventoriesDokument6 SeitenNudjpia Far and Afar Solutions - InventoriesKyla Artuz Dela CruzNoch keine Bewertungen

- Inventories - Practice Set - Questionnaire-1Dokument5 SeitenInventories - Practice Set - Questionnaire-1ashleydelmundo14Noch keine Bewertungen

- An Introduction To Cost Terms and PurposesDokument33 SeitenAn Introduction To Cost Terms and PurposesCarrie ChanNoch keine Bewertungen

- P 2Dokument444 SeitenP 2Denis FernandesNoch keine Bewertungen

- Asb CX 13 Disclosure RequirementsDokument94 SeitenAsb CX 13 Disclosure RequirementsTara RizviNoch keine Bewertungen

- Tutorial 1a - Budgeting Functional QDokument4 SeitenTutorial 1a - Budgeting Functional QNur Dina AbsbNoch keine Bewertungen

- CMA ExamDokument34 SeitenCMA Examtimmy457Noch keine Bewertungen

- Kinney 8e - CH 08Dokument16 SeitenKinney 8e - CH 08Ashik Uz ZamanNoch keine Bewertungen

- Manage budgets and plans with 22-chapter solutionsDokument6 SeitenManage budgets and plans with 22-chapter solutionsMA ValdezNoch keine Bewertungen

- AccountingDokument3 SeitenAccountingFor GamingNoch keine Bewertungen

- True or False Costing QuizDokument5 SeitenTrue or False Costing Quizretchiel love calinogNoch keine Bewertungen

- Variable Costing For Management Analysis: Financial and Managerial Accounting 13eDokument26 SeitenVariable Costing For Management Analysis: Financial and Managerial Accounting 13eLay TekchhayNoch keine Bewertungen

- Cost Bookkeeping With AnswersDokument9 SeitenCost Bookkeeping With AnswersHafsa HayatNoch keine Bewertungen