Beruflich Dokumente

Kultur Dokumente

IBHFL IPO Abridged Prospectus

Hochgeladen von

ratan203Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

IBHFL IPO Abridged Prospectus

Hochgeladen von

ratan203Copyright:

Verfügbare Formate

TEAR HERE

M k

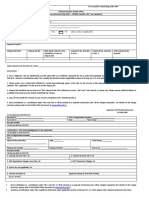

INDIABULLS HOUSING FINANCE LIMITED

application form

(FOR resident Applicants)

Credit Rating : CARE AAA (Triple A) by CARE and BWR AAA by Brickwork

COMMON APPLICATION FORM

FOR ASBA / NON ASBA

Application

Form No.

To, The Board of Directors,

INDIABULLS HOUSING FINANCE LIMITED

ISSUE OPENS ON : September 15, 2016

ISSUE CLOSES ON* : September 23, 2016

*For early closure or extension of the issue, refer overleaf

66500101

PUBLIC ISSUE OF SECURED AND UNSECURED REDEEMABLE NON-CONVERTIBLE DEBENTURES (NCDs) VIDE PROSPECTUS DATED SEPTEMBER 9, 2016

I/we hereby confirm that I/we have read and understood the terms and conditions of this Application Form and the attached Abridged Prospectus and agree to the Applicants Undertaking as given overleaf. I/we hereby confirm

that I/we have read the instructions for filling up the Application Form given overleaf.

BANK BRANCH

REGISTRARS / SCSB

DATE OF

ESCROW BANK / SCSB BRANCH

LEAD MANAGER/ CONSORTIUM MEMBER /

SUB- CONSORTIUM MEMBER /

SUB BROKER/AGENTS

SERIAL NO.

RECEIPT

CODE

TRADING MEMBERS STAMP & CODE

BROKERS STAMP & CODE

SERIAL NO.

STAMP & CODE

Trust Financial Consultancy Services Private Ltd.

3284

Trust Financial Consultancy Services Private Ltd.

3284

1. APPLICANTS DETAILS - PLEASE FILL IN BLOCK LETTERS (Please refer to point no. 27 of the attached Abridged Prospectus)

First Applicant (Mr./ Ms./M/s.)

Date of Birth D D M M Y Y Y Y

Address

Name of Guardian (if applicant is minor)

Pin Code (Compulsory)

Tel No. (with STD Code) / Mobile

Second Applicant (Mr./ Ms./M/s.)

Third Applicant (Mr./ Ms./M/s.)

2. Investor Category (Please refer overleaf) Category I

Category II

Category III

Category IV

Sub Category Code (Please refer overleaf)

3. IN CASE OF APPLICATION IN DEMATERIALISED FORM, PLEASE PROVIDE APPLICANTS DEPOSITORY DETAILS

(Please refer to page no. 12 of the attached Abridged Prospectus) For Nsdl Enter 8 Digit Dp Id followed by 8 digit Client ID / For Cdsl enter 16 digit Client Id

NSDL /

CDSL

4. IN CASE OF APPLICATION TO HOLD THE NCDs IN PHYSICAL FORM, PLEASE PROVIDE FOLLOWING DETAILS

(Please enclose self attested copies of the KYC documents along with the Application Form. For list of KYC documents, please refer overleaf)

Bank Details for payment of Refund / Interest / Maturity Amount (Mandatory)

NOMINATION (Please see point no. 55 of the Abridged Prospectus)

Name of the Nominee : _____________________________________________________ Bank Name : _____________________________________ Branch : ____________________

Please Fill in Block Letters

If Nominee is Minor, Guardians Name : ____________________________________________ Account No.: __________________ IFSC : ______________ MICR Code: ________________

5. INVESTMENT DETAILS (For details, please refer Issue Structure overleaf)

Secured/Unsecured

Secured

Unsecured

Series

I

II

III

IV

V

VI

VII

VIII

IX

X

Issue Price of NCDs (` / NCD)

` 1,000 across all Series of NCDs

Frequency of Interest Payment

Annual

Cumulative

Annual

Cumulative

Monthly Annual

Cumulative

Monthly Annual

Cumulative

Tenor (in years)

3

3

5

5

10

10

10

10

10

10

Minimum Application Size & thereafter in multiple of

` 10,000 (10 NCDs) (individually or collectively across all Series of NCDs) and in multiple of ` 1,000 (1 NCD) thereafter

Coupon (%) for NCD Holders in Category I and Category II 8.55%

NA

8.75%

NA

8.51% 8.85%

NA

8.65% 9.00%

NA

Coupon (%) for NCD holders in Category III

8.65%

NA

8.90%

NA

8.65% 9.00%

NA

8.79% 9.15%

NA

8.70%

NA

8.90%

NA

8.65% 9.00%

NA

8.79% 9.15%

NA

Coupon (%) for NCD holders in Category IV#

For Category I and II For Category I and II ` 1,000 ` 1,000

Redemption Amount (`/NCD)

`

For Category I and II - ` 1,278.47, ` 1,000 For Category I and II - ` 1,000 ` 1,000

` 1,521.41, For Category

` 2,336.07, For Category

` 2,368.48, For Category

1,000 For Category III - ` 1,282.01 For

III and IV - ` 1,531.93

III and IV - ` 2,368.48

III and IV - ` 2,401.30

Category IV - ` 1,283.78

Effective Yield (per annum) for Category I and II

8.55%

8.55%

8.75%

8.75%

8.85% 8.85%

8.85%

9.00% 9.00%

9.00%

Effective Yield (per annum) for Category III

8.65%

8.65%

8.90%

8.90%

9.00% 9.00%

9.00%

9.15% 9.15%

9.15%

Effective Yield (per annum) for Category IV

8.70%

8.70%

8.90%

8.90%

9.00% 9.00%

9.00%

9.15% 9.15%

9.15%

No. of NCDs applied

Amount Payable (`)

Grand Total (`)

#

Additional coupon of 0.10% per annum for senior citizens

6. PAYMENT DETAILS (Please tick () any one of payment option A or B below) Please write a Sole/First Applicants Name, Phone No. and Application No. on the reverse of Cheque/DD.

Amount Paid (` in figures)

(` in words)

(B) ASBA

Bank A/c No.

A. CHEQUE/ DEMAND DRAFT (DD) to be drawn in favour of IHFL NCD Escrow Account

Dated D D M M Y Y

Cheque/DD No.

Asba A/c. Holder Name ___________________________________________________________

(in case Applicant is different from ASBA A/c. Holder)

Bank Name & Branch ______________________________________________________________

____________________________________________________________________________________________________

Drawn on (Bank Name & Branch)

6a. pan & signature OF

SOLE/ first APPLICant

6b. pan & signature OF

SECOND APPLICant

6C. PAN & signature OF

third APPLICant

pan

pan

pan

6D. Signature of ASBA Bank Account Holder(s)

(as per Bank Records)(for ASBA Option only)

I/We authorize the SCSB to do all acts as are necessary to

make the Application in the Issue

1)

2)

Furnishing PAN of the Applicant is mandatory.

Please refer point no. 27 of the Abridged Prospectus

Date : ___________________, 2016

3)

TEAR HERE

Application

Form No.

Acknowledgement Slip for Lead Managers/

Consortium Members / Sub-Consortium Member/

Sub-Brokers / Trading Members / SCSBs

INDIABULLS HOUSING

FINANCE LIMITED

DPID/

CLID

LEAD MANAGERS / CONSORTIUM /

SUB-CONSORTIUM MEMBERS /

SUB-BROKERS / TRADING MEMBERS /

SCSB BRANCHS STAMP

(Acknowledging upload of Application

in Stock Exchange system) (Mandatory)

66500101

PAN

Amount Paid (` in figures)

Date, Stamp & Signature of Escrow

Bank (Mandatory)

Bank & Branch

Cheque / DD/ASBA Bank A/c No.

Dated___________,2016

Received from Mr./Ms. /M/s.

Telephone / Mobile

INDIABULLS HOUSING

FINANCE LIMITED

TEAR HERE

TEAR HERE

PUBLIC ISSUE OF SECURED AND UNSECURED REDEEMABLE NON-CONVERTIBLE DEBENTURES (NCDs) VIDE PROSPECTUS DATED SEPTEMBER 9, 2016

Series

II

Issue Price (` / NCD)

III

IV

VI

VII

VIII

IX

` 1000

Date Stamp & Signature of Lead Manager/ Name of Sole / First Applicant (Mr./ Ms./ M/s.)

Consortium Members / Sub-Consortium

Members / Trading Members / SCSB ___________________________________________

___________________________________________

No. of NCDs applied for

Applications submitted without being uploaded on the terminals of the Stock Exchange

will be rejected.

Amount Payable (`)

Grand Total (`)

Cheque / DD/ASBA Bank A/c No.

Drawn on (Name of Bank & Branch)

Acknowledgement Slip for Applicant

Dated

,2016

All future communication in connection with this application

should be addressed to the Registrar to the Issue. For

details, pleaser refer overleaf. Acknowledgement is subject

to realization of Cheque / Demand Draft.

Application

Form No.

66500101

While submitting the Application Form, the Applicant should ensure that the date stamp being put on the Application Form by the Lead Manager/Consortium Member /Sub-Consortium Member/Sub Broker/Trading Member/SCSB matches with the date stamp on the Acknowledgement Slip

M k

APPLICANTS UNDERTAKING

I/We hereby agree and confirm that:

1. I/We have read, understood and agreed to the contents and terms and conditions of INDIABULLS HOUSING FINANCE LIMITED, Prospectus dated September 9, 2016 (Prospectus).

2. I/We hereby apply for allotment of the NCDs to me/us and the amount payable on application is remitted herewith.

3. I/We hereby agree to accept the NCDs applied for or such lesser number as may be allotted to me/us in accordance with the contents of the Prospectus subject to applicable statutory and/or regulatory requirements.

4. I/We irrevocably give my/our authority and consent to IDBI TRUSTEESHIP SERVICES LIMITED to act as my/our trustees and for doing such acts as are necessary to carry out their duties in such capacity.

5. I am/We are Indian National(s) resident in India and I am/ we are not applying for the said NCDs as nominee(s) of any person resident outside India and/or Foreign National(s).

6. The application made by me/us do not exceed the investment limit on the maximum number of NCDs which may be held by me/us under applicable statutory and/or regulatory requirements.

7. In making my/our investment decision I/We have relied on my/our own examination of the INDIABULLS HOUSING FINANCE LIMITED and the terms of the issue, including the merits and risks involved and my/our decision to make this

application is solely based on disclosures contained in the Prospectus.

8. I/We have obtained the necessary statutory and/or regulatory permissions/approvals for applying for, subscribing to, and seeking allotment of the NCDs applied for.

9. Additional Undertaking, in case of ASBA Applicants:

1) I/We hereby undertake that I/We am/are an ASBA Applicant(s) as per applicable provisions of the SEBI Regulations; 2) In accordance with ASBA process provided in the SEBI Regulations and disclosed in the Prospectus, I/We authorize

(a) the Lead Manager(s)/Consortium Members/Sub-Consortium Members and Trading Members (in Specified cities only) or the SCSBs, as the case may be, to do all acts as are necessary to make the Application in the Issue, including

uploading my/our application, blocking or unblocking of funds in the bank account maintained with the SCSB as specified in the Application Form, transfer of funds to the Public Issue Account on receipt of instruction from the Lead Manager,

Registrar to the Issue, after finalization of Basis of Allotment; and (b) the Registrar to the Issue to issue instruction to the SCSBs to unblock the funds in the specified bank account upon finalization of the Basis of Allotment. 3) In case

the amount available in the specified Bank Account is insufficient as per the Application, the SCSB shall reject the Application.

10. Additional Undertaking in case the Applicant wishes to hold the NCDs in physical form:

1) In terms of Section (8)(1) of the Depositories Act, 1996, I/we wish to hold the NCDs in physical form. 2) I/We confirm that the information provided in this form is true and correct and I/We enclose herewith self attested copies of the

KYC Documents. 3) I/We confirm that we do not hold any Demat Account.

ISSUE RELATED INFORMATION FOR FILLING THE APPLICATION FORM

KYC Documents: (To be submitted only for holding NCDs in Physical Form): Please provide the following documents along with the Application Form: (a) Self-attested copy of the PAN card; (b) Self-attested copy of your proof of

residence. Any of the following documents shall be considered as a verifiable proof of residence: ration card issued by the Government of India (GOI); or valid driving license issued by any transport authority of the Republic of India; or electricity

bill (not older than three months); or landline telephone bill (not older than three months); or valid passport issued by the GoI; or voters identity card issued by the GoI; or passbook or latest bank statement issued by a bank operating in India; or

registered leave and license agreement or agreement for sale or rent agreement or fl at maintenance bill; or AADHAR letter; or life insurance policy. Self-attested copy of a cancelled cheque of the bank account to which the amounts pertaining

to payment of refunds, interest and redemption, as applicable, should be credited. (c) In absence of the cancelled cheque, the Company reserves the right to reject the Application or to consider the bank details given on the Application Form at its sole

discretion. In such case the Company, Lead Managers and Registrar shall not be liable for any delays/ errors in payment of refund and/ or interest. For information pertaining to KYC Documents, please refer on page 14 of the Abridged Prospectus

INVESTOR CATEGORIES:

Category I (Qualified Institutional Buyers)/(QIBs)

Sub Category Code Category II (Corporates)

Sub Category Code

Public Financial Institutions

11

Statutory bodies/corporations

24

Venture Capital Funds / Alternative Investment Funds, subject to investment

12

Public/Private Charitable/Religious Trusts

25

conditions applicable to them under the Securities and Exchange Board of India

Partnership

firms

in

the

name

of

partners

26

(Alternative Investment Funds) Regulations, 2012

Scheduled commercial banks

13

Association of Persons

27

Mutual Funds

14

Co-operative banks incorporated in India

28

State industrial development corporations

15

Regional Rural Banks incorporated in India

29

Insurance companies registered with the IRDA

16

Scientific and/or industrial research organisations, which are authorised to

57

invest in the NCDs and its Sub Category

17

Any other incorporated and/or unincorporated body of persons

58

Provident funds, pension funds with minimum corpus of ` 2500.00 lacs

superannuation funds and gratuity funds, which are authorised to invest in the NCDs

Category III (High Networth Individuals)/(HNIs)

The National Investment Fund set up by resolution F. No. 2/3/2005-DD-II dated

19

The following Investors applying for an amount aggregating to more than

November 23, 2005 of the GoI, published in the Gazette of India

` 10 lakhs across all Series of NCDs in this Issue:

Insurance funds set up and managed by the army, navy, or air force of the Union of India

20

Resident Indian Individuals

31

Insurance funds set up and managed by the Department of Posts, India

55

Hindu Undivided Families through the Karta

32

Indian Multilateral and bilateral development financial institutions

56

Category IV (Retail Individual Investors) /(RIIs)

Category II (Corporates)

The following Investors applying for an amount aggregating upto and including

` 10 lakhs across all Series of NCDs in this Issue:

Companies within the meaning of section 2 (20) of the Companies Act 2013

21

Limited Liability Partnerships registered under the provisions of the LLP Act

22

Resident Indian Individuals

41

Societies registered under the applicable laws in India

23

Hindu Undivided Families through the Karta

42

Secured/Unsecured

Series

Issue Price of NCDs (` / NCD)

Frequency of Interest Payment

Tenor (in years)

Minimum Application Size & thereafter in multiple of

Coupon (%) for NCD Holders in Category I and Category II

Coupon (%) for NCD holders in Category III

Coupon (%) for NCD holders in Category IV#

Redemption Amount (`/NCD)

Effective Yield (per annum) for Category I and II

Effective Yield (per annum) for Category III

Effective Yield (per annum) for Category IV

Put and call option

Security and Asset Cover

Unsecured

V

VI

VII

VIII

IX

X

` 1,000 across all Series of NCDs

Annual

Cumulative

Annual

Cumulative

Monthly Annual

Cumulative

Monthly Annual

Cumulative

3

3

5

5

10

10

10

10

10

10

` 10,000 (10 NCDs) (individually or collectively across all Series of NCDs) and in multiple of ` 1,000 (1 NCD) thereafter

8.55%

NA

8.75%

NA

8.51% 8.85%

NA

8.65% 9.00%

NA

8.65%

NA

8.90%

NA

8.65% 9.00%

NA

8.79% 9.15%

NA

8.70%

NA

8.90%

NA

8.65% 9.00%

NA

8.79% 9.15%

NA

For Category I and II For Category I and II - ` 1,000 ` 1,000 For Category I and II - ` 1,000 ` 1,000 For Category I and II `

`

` 2,336.07, For Category

` 2,368.48, For Category

1,000 ` 1,278.47, For Category 1,000 ` 1,521.41, For Category

III - ` 1,282.01 For

III and IV - ` 1,531.93

III and IV - ` 2,368.48

III and IV - ` 2,401.30

Category IV - ` 1,283.78

8.55%

8.55%

8.75%

8.75%

8.85% 8.85%

8.85%

9.00% 9.00%

9.00%

8.65%

8.65%

8.90%

8.90%

9.00% 9.00%

9.00%

9.15% 9.15%

9.15%

8.70%

8.70%

8.90%

8.90%

9.00% 9.00%

9.00%

9.15% 9.15%

9.15%

NA

The Secured NCDs (Series I to VII) proposed to be issued will be secured by a first ranking pari passu charge on the current assets (including

investments) of the Issuer, both present and future; and on present and future loan assets of the Issuer, including all monies receivable thereunder for

the principal amount and interest thereon. The Secured NCDs will have an asset cover of one time on the principal amount and interest thereon. The

Issuer reserves the right to sell or otherwise deal with the receivables, both present and future, including without limitation to create a charge on pari

passu basis thereon for its present and future financial requirements, without requiring the consent of, or intimation to, the Secured NCD holders or the

Debenture Trustee in this connection, provided that a minimum security cover of one time on the principal amount and interest thereon, is maintained.

No security will be created for Unsecured NCD in the nature of Subordinated Debt (Series VIII to X).

I

II

III

Secured

IV

Additional coupon of 0.10% per annum for senior citizens.

*In case of application for Secured NCDs wherein the Applicants have not indicated their choice of the relevant NCD series, our Company shall allocate series VI NCDs.

*In case of application for Unsecured NCDs wherein the Applicants have not indicated their choice of the relevant NCD series, our Company shall allocate series IX NCDs.

If the Deemed Date of Allotment undergoes a change, the coupon payment dates, redemption dates, redemption amounts and other cash flow workings shall be changed accordingly.

For Grounds for Technical Rejection, Please refer to page no. 17 of the Abridged Prospectus.

For further information please refer to section titled Issue Related Informationon page no. 221 of the Prospectus.

#

TEAR HERE

In case of queries related to Allotment/ credit of Allotted NCDs/Refund, the Applicants should contact

Registrar to the Issue.

In case of ASBA Application submitted to the SCSBs, the Applicants should contact the relevant SCSB.

In case of queries related to upload of Applications submitted to the Lead Managers/ Consortium

Members/Sub-Consortium Members/Sub Brokers/Trading Member should contact the relevant Lead

Managers/Consortium Members /Sub-Consortium Members/Sub Brokers/ Trading Member.

The grievances arising out of Applications for the NCDs made through Trading Members may be

addressed directly to stock exchanges.

COMPANY CONTACT DETAILS

INDIABULLS HOUSING FINANCE LIMITED

Registered Office: M-62 & 63, First Floor, Connaught Place, New

Delhi 110 001, India. Telephone No.: +91 11 3025 2900; Fascimile

No.: +91 11 3025 2501; Website: www.indiabullshomeloans.com;

Email: ihflpublicncd@indiabulls.com Company Secretary and Compliance

Officer: Mr. Amit Jain; Telephone No.: + 91 124 398 9666; Facsimile No.: + 91

124 308 1006; E-mail: ajain@indiabulls.com; CIN: L65922DL2005PLC136029

INDIABULLS HOUSING FINANCE LIMITED

REGISTRAR CONTACT DETAILS

KARVY COMPUTERSHARE PRIVATE LIMITED

Karvy Selenium Tower B, Plot 31-32, Financial District,

Nanakramguda, Gachibowli, Hyderabad 500 032, Telangana, India.

Te l : 0 4 0 - 6 7 1 6 2 2 2 2 F a x : 0 4 0 - 2 3 4 3 1 5 5 1

Email: einward.ris@karvy.com Investor Grievance Email:

indiabullshousing.ncdipo@karvy.com Website: www.karisma.karvy.com

Contact Person: Mr. M Murali Krishna SEBI Registration Number:

INR000000221 CIN: U74140TG2003PTC041636

IN THE NATURE OF FORM 2A - MEMORANDUM CONTAINING SALIENT FEATURES OF THE PROSPECTUS

THIS ABRIDGED PROSPECTUS CONSISTS OF 46 PAGES, PLEASE ENSURE THAT YOU GET ALL PAGES

Please ensure that you read the Prospectus and the general instructions contained in this Memorandum before applying in the Issue. Unless

otherwise specified, all capitalised terms used in this form shall have the meaning ascribed to such terms in the Prospectus. The investors are

advised to retain a copy of Prospectus/Abridged Prospectus for their future reference

INDIABULLS HOUSING FINANCE LIMITED

Our Company was incorporated under the Companies Act, 1956 on May 10, 2005 with the Registrar of Companies, National Capital Territory of Delhi and Haryana

(RoC) and received a certificate for commencement of business from the RoC on January 10, 2006. The CIN of our Company is L65922DL2005PLC136029.

For further details regarding changes to the name and registered office of our Company, please see History and other Corporate Matters on page 112 of the Prospectus.

Registered Office: M-62 & 63, First Floor, Connaught Place, New Delhi 110 001, India.

Corporate Office(s): Indiabulls House, Indiabulls Finance Centre, Senapati Bapat Marg, Elphinstone Road, Mumbai-400 013

and Indiabulls House, 448-451, Udyog Vihar, Phase-V, Gurgaon-122 016

Telephone No.: +91 11 3025 2900; Fascimile No.: +91 11 3025 2501; Website: www.indiabullshomeloans.com; Email: ihflpublicncd@indiabulls.com

Company Secretary and Compliance Officer: Mr. Amit Jain; Telephone No.: + 91 124 398 9666; Facsimile No.: + 91 124 308 1006; E-mail: ajain@indiabulls.com

PUBLIC ISSUE BY INDIABULLS HOUSING FINANCE LIMITED, (COMPANY OR ISSUER) OF SECURED REDEEMABLE NON-CONVERTIBLE

DEBENTURES AND UNSECURED REDEEMABLE NON-CONVERTIBLE DEBENTURES OF FACE VALUE OF ` 1,000 EACH, (NCDs), BASE ISSUE OF

UP TO ` 35,000 MILLION WITH AN OPTION TO RETAIN OVER-SUBSCRIPTION UP TO ` 35,000 MILLION FOR ISSUANCE OF ADDITIONAL NCDS

AGGREGATING UP TO ` 70,000 MILLION, HEREINAFTER REFERRED TO AS THE ISSUE. THE UNSECURED REDEEMABLE NON CONVERTIBLE

DEBENTURES WILL BE IN THE NATURE OF SUBORDINATED DEBT AND WILL BE ELIGIBLE FOR TIER II CAPITAL. THE ISSUE IS BEING MADE

PURSUANT TO THE PROVISIONS OF SECURITIES AND EXCHANGE BOARD OF INDIA (ISSUE AND LISTING OF DEBT SECURITIES) REGULATIONS,

2008 AS AMENDED (THE SEBI DEBT REGULATIONS), THE COMPANIES ACT, 2013 AND RULES MADE THEREUNDER AS AMENDED TO THE

EXTENT NOTIFIED.

OUR PROMOTER

Our promoter is Mr. Sameer Gehlaut. For further details refer to the section Our Promoter on page 137 of the Prospectus.

GENERAL RISKS

For taking an investment decision, investors must rely on their own examination of the Issuer and the Issue, including the risks involved, specific attention of the Investor

is invited to Risk Factors and Material Developments on page 12 and 139 respectively of the Prospectus. The Prospectus has not been and will not be approved by any

regulatory authority in India, including the Securities and Exchange Board of India (SEBI), the National Housing Board (NHB), the Reserve Bank of India (RBI),

any registrar of companies or any stock exchange in India.

ISSUERS ABSOLUTE RESPONSIBILITY

The Issuer, having made all reasonable inquiries, accepts responsibility for, and confirms that the Prospectus contains all information with regard to the Issuer, which is

material in the context of the Issue. The information contained in the Prospectus is true and correct in all material respects and is not misleading in any material respect, that

the opinions and intentions expressed herein are honestly held and that there are no other facts, the omission of which makes the Prospectus as a whole or any of part of such

information or the expression of any such opinions or intentions misleading, in any material respect.

COUPON RATE, COUPON PAYMENT FREQUENCY, REDEMPTION DATE, REDEMPTION AMOUNT & ELIGIBLE INVESTORS

For the details relating to Coupon Rate, Coupon Payment Frequency, Redemption Date and Redemption Amount of the NCDs, see Terms of the Issue on page 227 of the

Prospectus. For details relating to Eligible Investors please see Issue related information on page 221 of the Prospectus.

CREDIT RATINGS

The NCDs proposed to be issued under this Issue have been rated CARE AAA (Triple A) for an amount of ` 70,000 million, by Credit Analysis & Research Ltd. (CARE)

vide their letter no. CARE/HO/RL/2016-17/2033 dated August 19, 2016, BWR AAA with stable outlook an amount of ` 70,000 million, by Brickwork Ratings India

Private Limited (Brickwork) vide their letter no. BWR/NCD/HO/ERC/MM/0266/2016-17 dated August 18, 2016. The rating of NCDs by CARE and Brickwork indicate

that instruments with this rating are considered to have high degree of safety regarding timely servicing of financial obligations and carry very low credit risk. For the

rationale for these ratings, see Annexure A & B of the Prospectus. This rating is not a recommendation to buy, sell or hold securities and investors should take their own

decision. This rating is subject to revision or withdrawal at any time by the assigning rating agencies and should be evaluated independently of any other ratings.

LISTING

The NCDs offered through the Prospectus are proposed to be listed on the BSE Limited (BSE) and the National Stock Exchange of India Limited (NSE along with BSE,

the Stock Exchanges). Our Company has received an in-principle approval from the BSE Limited vide its letter no. DCS/BM/PI-BOND/2/16-17 dated August 26, 2016

and NSE vide its letter no. NSE/LIST/85172 dated August 26, 2016. For the purposes of the Issue BSE shall be the Designated Stock Exchange.

PUBLIC COMMENTS

The Draft Prospectus dated August 19, 2016 has been filed with BSE and NSE, pursuant to Regulation 6(2) of the SEBI Debt Regulations and was open for public comments

for a period of seven Working Days (i.e., until 5 p.m.) from the date of filing of the Draft Prospectus with the Designated Stock Exchange.

ISSUE OPENS ON: September 15, 2016

ISSUE CLOSES ON: September 23, 2016

*The Issue shall remain open for subscription on Working Days from 10 a.m. to 5 p.m. during the period indicated above, except that the Issue may close on such earlier date or extended date as

may be decided by the Board of Director of our Company (Board) or a duly constituted committee thereof. In the event of an early closure or extension of the Issue, our Company shall ensure

that notice of the same is provided to the prospective investors through an advertisement in a reputed daily national newspaper with wide circulation on or before such earlier or extended date of

Issue closure. On the Issue Closing Date, the Application Forms will be accepted only between 10 a.m. and 3 p.m. (Indian Standard Time) and uploaded until 5 p.m. or such extended time as may

be permitted by the BSE and NSE.

**IDBI Trusteeship Services Limited under regulation 4(4) of SEBI Debt Regulations has by its letter dated August 18, 2016 has given its consent for its appointment as Debenture Trustee to the

Issue and for its name to be included in the Prospectus and inall the subsequent periodical communications sent to the holders of the Debentures issued pursuant to this Issue.

A copy of the Prospectus shall be filed with the Registrar of Companies, National Capital Territory of Delhi and Haryana, in terms of section 26 of the Companies Act, 2013, applicable as on date

of the Prospectus along with the endorsed/certified copies of all requisite documents. For further details please see Material Contracts and Documents for Inspection beginning on page 282

of the Prospectus.

INDIABULLS HOUSING FINANCE LIMITED

IN THE NATURE OF FORM 2A - MEMORANDUM CONTAINING SALIENT FEATURES OF THE PROSPECTUS

LEAD MANAGERS TO THE ISSUE

YES SECURITIES (INDIA) LIMITED

IFC, Tower 1 & 2, Unit no. 602 A, 6th Floor, Senapati Bapat Marg,

Elphinstone, Road, Mumbai 400 013 Maharashtra, India.

Telephone No..: +91 22 3347 9606

Facsimile No.: +91 22 2421 4511

Email: ibhf.ncd@yessecuritiesltd.in

Investor Grievance Email: igc@yessecuritiesltd.in

Website: www.yesinvest.in

Contact Person: Mr. Devendra Maydeo

SEBI Regn. No.: MB/INM000012227

EDELWEISS FINANCIAL SERVICES LIMITED

Edelweiss House, Off CST Road, Kalina,

Mumbai - 400 098, Maharashtra, India.

Telephone No.: +91 22 4086 3535

Facsimile No.: +91 22 4086 3610

Email: ibhfl.ncd@edelweissfin.com

Investor Grievance Email: customerservice.mb@edelweissfin.com

Website: www.edelweissfin.com

Contact Person: Mr. Lokesh Singhi/ Mr. Mandeep Singh

SEBI Regn. No.: INM0000010650

A. K. CAPITAL SERVICES LIMITED

30-39 Free Press House, 3rd Floor, Free Press Journal Marg,

215, Nariman Point, Mumbai 400 021, Maharashtra, India.

Telephone No.: +91 22 6754 6500

Facsimile No.: +91 22 6610 0594

Email: ibhflncd@akgroup.co.in

Investor Grievance Email: investor.grievance@akgroup.co.in

Website: www.akcapindia.com

Contact Person: Mr. Girish Sharma/ Mr. Malay Shah

SEBI Regn. No.: INM0000104111

AXIS BANK LIMITED

Axis House, 8th Floor, C-2, Wadia International Centre,

P.B.Marg, Worli, Mumbai 400 025, Maharashtra, India.

Telephone No.: +91 22 6604 3293

Facsimile No.: +91 22 2425 3800

Email: indiabullsaug2016@axisbank.com

Investor Grievance Email: sharad.sawant@axisbank.com

Website: www.axisbank.com

Contact Person: Mr. Vikas Shinde

SEBI Regn. No.: INM000006104

4

INDIABULLS HOUSING FINANCE LIMITED

IIFL HOLDINGS LIMITED

10th Floor, IIFL Centre Kamala City, Senapati Bapat Marg,

Lower Parel (West) Mumbai 400 013, Maharashtra, India.

Telephone No.: +91 22 4646 4600

Facsimile No.: +91 22 2493 1073

E-mail: ibhfl.ncd@iiflcap.com

Investor Grievance Email: ig.ib@iiflcap.com

Website: www.iiflcap.com

Contact Person: Mr. Ankur Agarwal/ Mr. Sachin Kapoor

SEBI Regn. No.: INM000010940

IndusInd Bank Limited

One Indiabulls Centre, Tower I, 8th Floor 841 Senapati Bapat Marg,

Elphinstone Road (W), Mumbai 400 013, Maharashtra, India.

Telephone No.: +91 22 3049 3999

Facsimile No.: +91 22 2423 1998

E-mail: ibhl.ncd@indiabulls.com

Investor Grievance Email: investmentbanking@indusind.com

Website: www.indusind.com

Contact Person: Mr. Farman Siddiqui

SEBI Regn. No.: INM000005031

SBI CAPITAL MARKETS LIMITED

202, Maker Tower E, Cuffe Parade,

Mumbai 400 005, Maharashtra, India.

Telephone No.: + 91 22 2217 8300

Facsimile No.: +91 22 2218 8332

E-mail: ibhfl.ncd@sbicaps.com

Investor Grievance Email: investor.relations@sbicaps.com

Website: www.sbicaps.com

Contact Person: Mr. Gitesh Vargantwar

SEBI Regn. No.: INM000003531

TRUST INVESTMENT ADVISORS PRIVATE LIMITED

109/110, Balarama, Bandra Kurla Complex,

Bandra (E), Mumbai 400 051, Maharashtra, India.

Telephone No.: +91 22 4084 5000

Facsimile No.: +91 22 4084 5007

Email: mbd.trust@trustgroup.in

Investor Grievance Email: customercare@trustgroup.in

Website: www.trustgroup.in

Contact Person: Ms. Hani Jalan

SEBI Regn. No.: INM000011120

IN THE NATURE OF FORM 2A - MEMORANDUM CONTAINING SALIENT FEATURES OF THE PROSPECTUS

CONSORTIUM MEMBERS

A.K. Stockmart Private Limited

30-39 Free Press House, 3rd Floor, Free Press Journal Marg

215, Nariman Point, Mumbai - 400 021 Maharashtra, India.

Telephone No:+91 22 6754 6500

Facsimile No: +91 22 6610 0594

Email:ankit@akgroup.co.in/sanjay.shah@akgroup.co.in

Contact Person: Ankit Gupta, Sanjay Shah

Website: akcapindia.com

Axis Capital Limited

Axis House, 8th floor, C- 2, Wadia International Centre

PB Marg, Worli, Mumbai 400 025 Maharashtra, India.

Telephone No: +91 22 4325 1199 Facsimile No: +91 22 4325 3000

Email: vinayak.ketkar@aaxiscap.in

Contact Person: Vinayak Ketkar

Website: www.axiscap.co.in

Edelweiss Securities Limited

2nd floor, MB Towers, Plot No. 5, Road No. 2,

Banjara Hills, Hyderabad 500 034.

Telephone No: +91 22 4063 5569 Facsimile No: +91 22 6747 1347

Email: ibhfl.ncd@edelweissfin.com

Contact Person: Prakash Boricha

Website: www.edelweissfin.com

India Infoline Limited

IIFL Centre, Kamala City, Senapati Bapat Marg,

Lower Parel (W), Mumbai - 400 0013 Maharashtra, India.

Telephone No: +91 22 4249 9000 Facsimile No: +91 22 2495 4313

Email: cs@indiainfoline.com

Contact Person: Prasad Umarale

Website: www.indiainfoline.com

SBICAP Securities Limited

Marathon Futurex, 12th Floor, A & B Wing, Mafatlal Mill Compound,

N. M. Joshi Marg, Lower Parel, Mumbai 400 013 Maharashtra, India.

Telephone No: +91 22 4227 3300 Facsimile No: +91 22 4227 3390

Email: archana.dedhia@sbicapsec.com

Contact Person: Archana Dedhia

Website: www.sbismart.com

Trust Financial Consultancy Services Private Limited

109/110, Balarama, Bandra Kurla Complex,

Bandra (E), Mumbai 400 051 Maharashtra, India.

Telephone No: +91 22 4084 5000 Facsimile No: +91 22 4084 5007

Email: pranav.inamdar@trustgroup.in

Contact Person: Pranav Inamdar

Website: www.trustgroup.in

DEBENTURE TRUSTEE

IDBI Trusteeship Services Limited

Asian Building, Ground Floor, 17 R, Kamani Marg,

Ballard Estate, Mumbai 400 001, India.

Telephone No.: +91 22 4080 7018 Facsimile No.: +91 22 4080 7080

Email: anjalee@idbitrustee.co.in

Website: www.idbitrustee.com

Contact Person: Anjalee Athalye

SEBI Registration No.: IND000000460

REGISTRAR

Karvy Computershare Private Limited

Karvy Selenium Tower B, Plot 31-32, Financial District,

Nanakramguda, Gachibowli, Hyderabad 500 032,

Telangana, India.

Telephone No.: +91 40 6716 2222

Facsimile No.: +91 40 2343 1551

Email: einward.ris@karvy.com

Investor Grievance Email: indiabullshousing.ncdipo@karvy.com

Website: www.karisma.karvy.com

Contact Person: M. Murali Krishna

SEBI Registration No.: INR000000221

COMPLIANCE OFFICER AND COMPANY SECRETARY

Mr. Amit Jain

Company Secretary & Compliance Officer

Indiabulls House, 448-451, Udyog Vihar, Phase - V

Gurgaon - 122 016 New Delhi 110 001.

Telephone No.: + 91 124 668 1199 Facsimile No.: + 91 124 668 1240

E-mail: ajain@indiabulls.com

Investors may contact the Registrar to the Issue or the Compliance

Officer in case of any pre-issue or post Issue related issues such as nonreceipt of Allotment Advice, demat credit, refund orders, non-receipt of

Debenture Certificates, transfers, or interest on application money etc.

All grievances relating to the Issue may be addressed to the Registrar to

the Issue, giving full details such as name, Application Form number,

address of the Applicant, number of NCDs applied for, amount paid

on application, Depository Participant and the collection centre of the

Members of the Consortium where the Application was submitted.

All grievances relating to the ASBA process may be addressed to the

Registrar to the Issue with a copy to the relevant SCSB, giving full

details such as name, address of Applicant, Application Form number,

number of NCDs applied for, amount blocked on Application and the

Designated Branch or the collection center of the SCSB where the

Application Form was submitted by the ASBA Applicant.

All grievances arising out of Applications for the NCDs made through

the Online Stock Exchanges Mechanism or through Trading Members

may be addressed directly to the respective Stock Exchanges.

REFUND BANK

Axis Bank Limited

Ground floor, GL 005, 006, 007, 008, Cross Point,

DLF Phase IV, Gurgaon 122 009, Haryana.

Telephone No: +91 95828 01312/ +91 98918 46758

Facsimile No: +91 12 4505 0593

Email: DlfGurgaon.Operationshead@axisbank.com/

Gaurav.Tandon@axisbank.com

Contact Person: Sheenam Pahwa/ Gaurav Tandon

Website: www.axisbank.com

ESCROW COLLECTION BANKS/ BANKERS TO THE ISSUE

HDFC Bank Limited, Axis Bank Limited, IndusInd Bank Limited,

Yes Bank Limited, State Bank Of India

INDIABULLS HOUSING FINANCE LIMITED

IN THE NATURE OF FORM 2A - MEMORANDUM CONTAINING SALIENT FEATURES OF THE PROSPECTUS

SELF CERTIFIED SYNDICATE BANKS

The banks which are registered with SEBI under Securities and

Exchange Board of India (Bankers to an Issue) Regulations, 1994 and

offer services in relation to ASBA, including blocking of an ASBA

Account, a list of which is available on http://www.sebi.gov.in or at

such other website as may be prescribed by SEBI from time to time.

TABLE OF CONTENTS

Page No.

OBJECTS OF THE ISSUE

ISSUE PROCEDURE

BASIS OF ALLOTMENT

19

BMR Legal

Ground Floor, Dhapla House, General Nagesh Marg

Off Dr. S. S. Rao Road, Parel, Mumbai 400 012.

TERMS OF THE ISSUE

21

OTHER INSTRUCTIONS

29

STATUTORY AUDITOR

Deloitte Haskins & Sells LLP

Chartered Accountants

Indiabulls Finance Centre, Tower 3, 32nd Floor,

Elphinstone Mill Compound, Senapati Bapat Marg,

Elphinstone (W), Mumbai 400 013, India

Telephone No.: +91 22 6185 4000 Facsimile No..: + 91 22 6185 4601

Email: asiddharth@deloitte.com

Firm registration number: 117366W / W-100018

Contact Person: A. Siddharth

Date of appointment as Statutory Auditors: August 11, 2014

DETAILS PERTAINING TO THE ISSUER

30

FINANCIAL INFORMATION

36

OUTSTANDING LITIGATIONS AND

DEFAULTS

37

OTHER REGULATORY AND STATUTORY

DISCLOSURES

40

RISK FACTORS

43

CREDIT RATING AGENCIES

Brickwork Ratings India Private Limited

C-502, Business Square, 151, Andheri Kurla Road, Chakala

Andheri (east), Mumbai 400 093 Maharashtra, India.

Telephone No.: +91 22 2831 1426 Facsimile No.: +91 22 2838 9144

Email: kn.suvarna@brickworkratings.com

Website: www.brickworkratings.com

Contact Person: K. N. Suvarna

SEBI Registration No.: IN/CRA/005/2008

DECLARATION

44

CENTERS FOR AVAILABILITY AND

ACCEPTANCE OF APPLICATION FORMS

45

LEGAL ADVISOR TO THE ISSUE

Credit Analysis & Research Limited

4th Floor, Godrej Coliseum, Somaiya Hospital Road,

Off Eastern Express Highway, Sion (East), Mumbai 400 022

Maharashtra, India

Telephone No.: +91 22 6754 3456 Facsimile No.: +91 22 6754 3457

Email: vijay.agrawal@careratings.com

Website: www.careratings.com

Contact Person: Vijay Agrawal

SEBI Registration No.: IN/CRA/004/1999

INDIABULLS HOUSING FINANCE LIMITED

LIST OF SELF CERTIFIED SYNDICATE BANKS

(SCSBS) UNDER THE ASBA PROCESS

DISCLAIMER

Participation by any of eligible category of Applicants in this Issue will be

subject to applicable statutory and/or regulatory requirements. Applicants

are advised to ensure that Applications made by them do not exceed the

investment limits or maximum number of NCDs that can be held by them

under applicable statutory and/or regulatory provisions. Applicants are

advised to ensure that they have obtained the necessary statutory and/ or

regulatory permissions/consents/approvals in connection with applying for,

subscribing to, or seeking Allotment of NCDs pursuant to the Issue. For

details pertaining to Eligible Investors please refer to Issue Procedure- Who

can apply on page 251 of the Prospectus.

IN THE NATURE OF FORM 2A - MEMORANDUM CONTAINING SALIENT FEATURES OF THE PROSPECTUS

DETAILS PERTAINING TO THE ISSUE

OBJECTS OF THE ISSUE

Our Company has filed the Prospectus for a public issue of Secured NCDs and

Unsecured NCDs aggregating up to ` 35,000 million with an option to retain

over-subscription up to ` 35,000 million for issuance of additional Secured

NCDs and Unsecured NCDs aggregating up to ` 70,000 million.

Our Company proposes to utilise the funds which are being raised through

the Issue, after deducting the Issue related expenses to the extent payable

by our Company (Net Proceeds), towards funding the following objects

(collectively, referred to herein as the Objects):

1. For the purpose of onward lending, financing, and for repayment of interest

and principal of existing borrowings of the Company; and

2. General corporate purposes.

The Main Objects clause of the Memorandum of Association of our Company

permits our Company to undertake the activities for which the funds are being

raised through the present Issue and also the activities which our Company has

been carrying on till date.

The details of the Proceeds of the Issue are set forth in the following table:

(` in million)

Sr. No.

Description

Amount

1.

Gross Proceeds of the Issue

70,000

2.

Issue Related Expenses*

660.50

3.

69,339.50

Net Proceeds (i.e. Gross Proceeds less

Issue related expenses)

*The above Issue related expenses are indicative and are subject to change

depending on the actual level of subscription to the Issue, the number of

allottees, market conditions and other relevant factors.

3. Requirement of funds and Utilisation of Net Proceeds

The following table details the objects of the Issue and the amount proposed to

be financed from the Net Proceeds:

Sr. No.

Objects of the Issue

Percentage of amount

proposed to be

financed from Net

Proceeds

1

For the purpose of onward lending,

At least 75%

financing, and for repayment of

interest and principal of existing

borrowings of the Company

2

General Corporate Purposes*

Maximum of up to 25%

Total

100%

*The Net Proceeds will be first utilized towards the Objects mentioned above.

The balance is proposed to be utilized for general corporate purposes, subject

to such utilization not exceeding 25% of the amount raised in the Issue, in

compliance with the SEBI Debt Regulations.

Funding plan

NA

Summary of the project appraisal report

NA

Schedule of implementation of the project

NA

4. Interim Use of Proceeds

Our Board of Directors, in accordance with the policies formulated by it from

time to time, will have flexibility in deploying the proceeds received from the

Issue. Pending utilization of the proceeds out of the Issue for the purposes

described above, our Company intends to temporarily invest funds in high

quality interest bearing liquid instruments including money market mutual

funds, deposits with banks or temporarily deploy the funds in investment grade

interest bearing securities as may be approved by the Board. Such investment

would be in accordance with the investment policies approved by the Board or

any committee thereof from time to time.

5. Monitoring of Utilization of Funds

There is no requirement for appointment of a monitoring agency in terms of the

SEBI Debt Regulations. The Board shall monitor the utilization of the proceeds

of the Issue. For the relevant Financial Years commencing from Financial Year

2016-17, our Company will disclose in our financial statements, the utilization

of the net proceeds of the Issue under a separate head along with details, if any,

in relation to all such proceeds of the Issue that have not been utilized thereby

also indicating investments, if any, of such unutilized proceeds of the Issue.

Our Company shall utilize the proceeds of the Issue only upon the execution

of the documents for creation of security and receipt of final listing and trading

approval from the Stock Exchanges.

Issue Expenses

A portion of the Issue proceeds will be used to meet Issue expenses. The

following are the estimated Issue expenses:

Particulars

As percentage of

Amount (`in

million) Issue proceeds (in%)

574.0

0.82%

Lead Managers Fee, Selling and

Brokerage Commission, SCSB

Processing Fee*

Registrar to the Issue

0.3

0.00%

Debenture Trustee

1.2

0.00%

Advertising and Marketing

25.0

0.04%

Printing and Stationery Costs

4.0

0.01%

Other Miscellaneous Expenses

56.0

0.08%

Grand Total

660.5

0.94%

* Our Company shall pay processing fees to the SCSBs for ASBA forms procured

by Lead Managers/ Consortium Members/ sub-consortium members/ brokers/

sub-brokers/ Trading Members and submitted to the SCSBs for blocking the

Application amount of the Applicant at the rate of ` 15 per Application Form

procured (plus service tax and other applicable taxes). However, it is clarified

that in case of ASBA Application Forms procured directly by the SCSBs, the

relevant SCSBs shall not be entitled to any ASBA processing fees.

6. Other Confirmation

In accordance with the SEBI Debt Regulations, our Company will not utilize

the proceeds of the Issue for providing loans to or for acquisitions of shares of

any person who is a part of the same group as our Company or who is under the

same management of our Company and our Subsidiaries.

No part of the proceeds from this Issue will be paid by us as consideration to our

Promoters, our Directors, Key Managerial Personnel, or companies promoted

by our Promoters.

The Issue proceeds shall not be used for any purpose which is in contravention

of the NHB guidelines applicable to Housing Finance Companies.

The Issue proceeds shall not be utilised directly/indirectly towards capital

markets and real estate purposes. Hence, the subscription of the NCDs would

not be considered/ treated as a capital market exposure.

Variation in terms of contract or objects

The Company shall not, in terms of Section 27 of the Companies Act, 2013,

at any time, vary the terms of the objects for which the Prospectus is issued,

except as may be prescribed under the applicable laws and under Section 27 of

the Companies Act, 2013.

ISSUE PROCEDURE

This chapter applies to all Applicants. ASBA Applicants should note that the

ASBA process involves application procedures which may be different from the

procedures applicable to Applicants who apply for NCDs through any of the

other channels, and accordingly should carefully read the provisions applicable

to ASBA Applications hereunder. Please note that all Applicants are required

to make payment of the full Application Amount along with the Application

Form. In case of ASBA Applicants, an amount equivalent to the full Application

Amount will be blocked by the Designated Branches of the SCSBs.

ASBA Applicants should note that they may submit their ASBA Applications

to the Members of Consortium, or Trading Members of the Stock Exchange

only in the Specified Cities or directly to the Designated Branches of the

SCSBs. Applicants other than ASBA Applicants are required to submit their

Applications to the Lead Manager, or Trading Members of the Stock Exchange

at the centres mentioned in the Application Form. For further information,

please refer to - Submission of Completed Application Forms on page 267

of the Prospectus.

Applicants are advised to make their independent investigations and ensure

that their Applications do not exceed the investment limits or maximum number

of NCDs that can be held by them under applicable law or as specified in the

Prospectus.

INDIABULLS HOUSING FINANCE LIMITED

IN THE NATURE OF FORM 2A - MEMORANDUM CONTAINING SALIENT FEATURES OF THE PROSPECTUS

Please note that this chapter has been prepared based on the Circular No. CIR./

IMD/DF-1/20/2012 dated July 27, 2012 issued by SEBI. The following Issue

procedure is subject to the functioning and operations of the necessary systems

and infrastructure put in place by the Stock Exchange for implementation

of the provisions of the abovementioned circular, including the systems and

infrastructure required in relation to Direct Online Applications through the

online platform and online payment facility to be offered by the Stock Exchange

and is also subject to any further clarifications, notification, modification,

direction, instructions and/or correspondence that may be issued by the Stock

Exchange and/or SEBI. Please note that the Applicants will not have the option

to apply for NCDs under the Issue, through the direct online applications

mechanism of the Stock Exchange. Please note that clarifications and/or

confirmations regarding the implementation of the requisite infrastructure

and facilities in relation to direct online applications and online payment

facility have been sought from the Stock Exchange and the Stock Exchange has

confirmed that the necessary infrastructure and facilities for the same have not

been implemented by the Stock Exchange. Hence, the Direct Online Application

facility will not be available for this Issue.

Specific attention is drawn to the circular (No. CIR/IMD/DF/18/2013) dated

October 29, 2013 issued by SEBI, which amends the provisions of the 2012

SEBI Circular to the extent that it provides for allotment in public issues of debt

securities to be made on the basis of date of upload of each application into

the electronic book of the Stock Exchanges, as opposed to the date and time of

upload of each such application.

PLEASE NOTE THAT ALL TRADING MEMBERS OF THE

STOCK EXCHANGE WHO WISH TO COLLECT AND UPLOAD

APPLICATIONS IN THIS ISSUE ON THE ELECTRONIC

APPLICATION PLATFORM PROVIDED BY THE STOCK

EXCHANGE WILL NEED TO APPROACH THE RESPECTIVE STOCK

EXCHANGE AND FOLLOW THE REQUISITE PROCEDURES AS

MAY BE PRESCRIBED BY THE RELEVANT STOCK EXCHANGE.

THE LEAD MANAGERS, THE CONSORTIUM MEMBERS AND

THE COMPANY SHALL NOT BE RESPONSIBLE OR LIABLE FOR

ANY ERRORS OR OMMISSIONS ON THE PART OF THE TRADING

MEMBERS IN CONNECTION WITH THE RESPONSIBILITIES OF

SUCH TRADING MEMBERS INCLUDING BUT NOT LIMITED TO

COLLECTION AND UPLOAD OF APPLICATIONS IN THIS ISSUE

ON THE ELECTRONIC APPLICATION PLATFORM PROVIDED

BY THE STOCK EXCHANGE. FURTHER, THE RELEVANT STOCK

EXCHANGE SHALL BE RESPONSIBLE FOR ADDRESSING

INVESTOR GREIVANCES ARISING FROM APPLICATIONS

THROUGH TRADING MEMBERS REGISTERED WITH SUCH

STOCK EXCHANGE.

For purposes of the Issue, the term Working Day shall mean all days

excluding Sundays or a holiday of commercial banks in Mumbai, except with

reference to Issue Period, where Working Days shall mean all days, excluding

Saturdays, Sundays and public holiday in India. Furthermore, for the purpose

of post issue period, i.e. period beginning from Issue Closure to listing of the

securities, Working Days shall mean all days excluding Sundays or a holiday of

commercial banks in Mumbai or a public holiday in India.

The information below is given for the benefit of the investors. Our Company

and the Members of Consortium are not liable for any amendment or

modification or changes in applicable laws or regulations, which may occur

after the date of the Prospectus.

PROCEDURE FOR APPLICATION

7. Availability of the Abridged Prospectus and Application Forms

Please note that there is a single Application Form for ASBA Applicants as

well as Non-ASBA Applicants who are Persons Resident in India.

Physical copies of the abridged Prospectus containing the salient features of the

Prospectus together with Application Forms may be obtained from:

(a) Our Companys Registered Office and Corporate Office;

(b) Offices of the Lead Managers/ Consortium Members;

(c) Trading Members; and

(d) Designated Branches of the SCSBs.

Electronic Application Forms may be available for download on the websites of

the Stock Exchange and on the websites of the SCSBs that permit submission of

ASBA Applications electronically. A unique application number (UAN) will

be generated for every Application Form downloaded from the websites of the

8

INDIABULLS HOUSING FINANCE LIMITED

Stock Exchange. Our Company may also provide Application Forms for being

downloaded and filled at such websites as it may deem fit. In addition, brokers

having online demat account portals may also provide a facility of submitting

the Application Forms virtually online to their account holders.

Trading Members of the Stock Exchange can download Application Forms

from the websites of the Stock Exchange. Further, Application Forms will be

provided to Trading Members of the Stock Exchange at their request.

On a request being made by any Applicant before the Issue Closing Date,

physical copies of the Prospectus and Application Form can be obtained from

our Companys Registered and Corporate Office, as well as offices of the Lead

Managers. Electronic copies of the Draft Prospectus and the Prospectus will

be available on the websites of the Lead Managers, the Stock Exchange, SEBI

and the SCSBs.

8. Who can apply?

The following categories of persons are eligible to apply in the Issue:

Category I

Institutional Investors

Category II

Non Institutional

Investors

Category III Category IV

High NetRetail

worth

Individual

Individual

Investors

Investors

(HNIs),

Public financial

Companies within Resident

Resident

institutions,

the meaning of

Indian

Indian

scheduled

section 2(20) of

individuals

individuals

commercial banks,

the Companies

and Hindu

and Hindu

Indian multilateral

Act, 2013; coUndivided

Undivided

and bilateral

operative banks,

Families

Families

development

and societies

through

through

financial institution

registered under

the Karta

the Karta

which are authorised

the applicable

applying for

applying for

to invest in the

laws in India and

an amount

an amount

NCDs;

authorised to invest aggregating

aggregating

Provident funds,

in the NCDs;

to above

up to and

pension funds,

Statutory Bodies/

` 1 million

including

superannuation funds Corporations,

across all

` 1 million

and gratuity funds, Regional Rural

series of

across all

which are authorised

Banks

NCDs

series of

to invest in the

Public/private

NCDs

NCDs;

charitable/

Venture Capital

religious trusts

Funds/ Alternative

which are

Investment Fund

authorised to invest

registered with

in the NCDs;

SEBI;

Scientific and/or

Insurance Companies industrial research

registered with

organisations,

IRDA;

which are

State industrial

authorised to invest

development

in the NCDs;

corporations;

Partnership firms

Insurance funds set

in the name of the

up and managed by

partners;

the army, navy, or air Limited liability

force of the Union of

partnerships

India;

formed and

Insurance funds set

registered under

up and managed by

the provisions

the Department of

of the Limited

Posts, the Union of

Liability

India;

Partnership Act,

National Investment

2008 (No. 6 of

Fund set up by

2009);

resolution no. F. No. Association of

2/3/2005-DDII dated

Persons; and

November 23, 2005 Any other

of the Government

incorporated and/

of India published in

or unincorporated

the Gazette of India;

body of persons

and

Mutual Funds.

Please note that it is clarified that Persons Resident outside India shall

not be entitled to participate in the Issue and any applications from such

persons are liable to be rejected.

IN THE NATURE OF FORM 2A - MEMORANDUM CONTAINING SALIENT FEATURES OF THE PROSPECTUS

Participation of any of the aforementioned categories of persons or entities

is subject to the applicable statutory and/or regulatory requirements in

connection with the subscription to Indian securities by such categories of

persons or entities. Applicants are advised to ensure that Applications made

by them do not exceed the investment limits or maximum number of NCDs

that can be held by them under applicable statutory and or regulatory

provisions. Applicants are advised to ensure that they have obtained the

necessary statutory and/or regulatory permissions/ consents/ approvals in

connection with applying for, subscribing to, or seeking Allotment of NCDs

pursuant to the Issue.

The Members of Consortium and their respective associates and affiliates are

permitted to subscribe in the Issue.

9. Who are not eligible to apply for NCDs?

The following categories of persons, and entities, shall not be eligible to

participate in the Issue and any Applications from such persons and entities are

liable to be rejected:

a) Minors without a guardian name*(A guardian may apply on behalf of a

minor. However, Applications by minors must be made through Application

Forms that contain the names of both the minor Applicant and the guardian);

b) Foreign nationals, NRI inter-alia including any NRIs who are (i) based in

the USA, and/or, (ii) domiciled in the USA, and/or, (iii) residents/citizens of the

USA, and/or, (iv) subject to any taxation laws of the USA;

c) Persons resident outside India and other foreign entities;

d) Foreign Institutional Investors;

e) Foreign Portfolio Investors;

f) Foreign Venture Capital Investors

g) Qualified Foreign Investors;

h) Overseas Corporate Bodies; and

i) Persons ineligible to contract under applicable statutory/regulatory requirements.

*Applicant shall ensure that guardian is competent to contract under Indian

Contract Act, 1872

Based on the information provided by the Depositories, our Company shall

have the right to accept Applications belonging to an account for the benefit

of a minor (under guardianship). In case of such Applications, the Registrar

to the Issue shall verify the above on the basis of the records provided by the

Depositories based on the DP ID and Client ID provided by the Applicants in

the Application Form and uploaded onto the electronic system of the Stock

Exchange.

The concept of Overseas Corporate Bodies (meaning any company, partnership

firm, society and other corporate body or overseas trust irrevocably owned/

held directly or indirectly to the extent of at least 60% by NRIs), which was

in existence until 2003, was withdrawn by the Foreign Exchange Management

(Withdrawal of General Permission to Overseas Corporate Bodies) Regulations,

2003. Accordingly, OCBs are not permitted to invest in the Issue.

No offer to the public (as defined under Directive 20003/71/EC, together

with any amendments and implementing measures thereto, the Prospectus

Directive) has been or will be made in respect of the Issue or otherwise in

respect of the NCDs, in any Member State of the European Economic Area

which has implemented the Prospectus Directive (a Relevant Member

State) except for any such offer made under exemptions available under the

Prospectus Directive, provided that no such offer shall result in a requirement

to publish or supplement a prospectus pursuant to the Prospectus Directive, in

respect of the Issue or otherwise in respect of the NCDs.

Please refer to - Rejection of Applications on page 270 of the Prospectus for

information on rejection of Applications .

10 Modes of Making Applications

Applicants may use any of the following facilities for making Applications:

(a) ASBA Applications through the Members of Consortium, or the Trading

Members of the Stock Exchange only in the Specified Cities (namely, Mumbai,

Chennai, Kolkata, Delhi, Ahmedabad, Rajkot, Jaipur, Bengaluru, Hyderabad,

Pune, Vadodara and Surat) (Syndicate ASBA). For further details, see

Submission of ASBA Applications on page 257 of the Prospectus;

(b) ASBA Applications through the Designated Branches of the SCSBs. For

further details, see - Submission of ASBA Applications on page 257 of the

Prospectus; and

(c) Non-ASBA Applications through the Members of Consortium or the Trading

Members of the Stock Exchange at the centres mentioned in Application Form.

For further details, see Submission of Non-ASBA Applications (other than

Direct Online Applications) on page 258 of the Prospectus.

(d) Non-ASBA Applications for Allotment in physical form through the

Members of Consortium, Consortium Members, sub-brokers or the Trading

Members of the Stock Exchange at the centres mentioned in Application Form.

For further details, please refer to Submission of Non-ASBA Applications for

Allotment of the NCDs in Physical Form on page 256 of the Prospectus.

Please note that clarifications and/or confirmations regarding the

implementation of the requisite infrastructure and facilities in relation to direct

online applications and online payment facility have been sought from the

Stock Exchange and is subject to confirmation from Stock Exchange.

APPLICATIONS FOR ALLOTMENT OF NCDS

Details for Applications by certain categories of Applicants including

documents to be submitted are summarized below.

11. Applications by Mutual Funds

Pursuant to the SEBI circular SEBI/HO/IMD/DF2/CIR/P/2016/35 dated

February 15, 2016 (SEBI Circular 2016), mutual funds are required to

ensure that the total exposure of debt schemes of mutual funds in a particular

sector shall not exceed 25.0% of the net assets value of the scheme. Further, the

additional exposure limit provided for financial services sector towards HFCs

is reduced from 10.0% of net assets value to 5.0% of net assets value and single

issuer limit is reduced to 10.0% of net assets value (extendable to 12% of net

assets value, after trustee approval). The SEBI Circular 2016 also introduces

group level limits for debt schemes and the ceiling be fixed at 20.0% of net

assets value extendable to 25.0% of net assets value after trustee approval.

A separate Application can be made in respect of each scheme of an Indian

mutual fund registered with SEBI and such Applications shall not be treated

as multiple Applications. Applications made by the AMCs or custodians of

a Mutual Fund shall clearly indicate the name of the concerned scheme for

which Application is being made. In case of Applications made by Mutual

Fund registered with SEBI, a certified copy of their SEBI registration certificate

must be submitted with the Application Form. The Applications must be also

accompanied by certified true copies of (i) SEBI Registration Certificate and

trust deed (ii) resolution authorising investment and containing operating

instructions and (iii) specimen signatures of authorized signatories. Failing

this, our Company reserves the right to accept or reject any Application

in whole or in part, in either case, without assigning any reason therefor.

12. Application by Commercial Banks, Co-operative Banks and Regional

Rural Banks

Commercial Banks, Co-operative banks and Regional Rural Banks can apply in

the Issue based on their own investment limits and approvals. The Application

Form must be accompanied by certified true copies of their (i) memorandum

and articles of association/charter of constitution; (ii) power of attorney; (iii)

resolution authorising investments/containing operating instructions; and (iv)

specimen signatures of authorised signatories. Failing this, our Company

reserves the right to accept or reject any Application in whole or in part, in

either case, without assigning any reason therefor.

Pursuant to SEBI Circular no. CIR/CFD/DIL/1/2013 dated January

2, 2013, SCSBs making applications on their own account using ASBA

facility, should have a separate account in their own name with any other

SEBI registered SCSB. Further, such account shall be used solely for the

purpose of making application in public issues and clear demarcated funds

should be available in such account for ASBA applications.

13. Application by Insurance Companies

In case of Applications made by insurance companies registered with the

Insurance Regulatory and Development Authority, a certified copy of certificate

of registration issued by Insurance Regulatory and Development Authority must

be lodged along with Application Form. The Applications must be accompanied

by certified copies of (i) Memorandum and Articles of Association (ii) Power

of Attorney (iii) Resolution authorising investment and containing operating

instructions (iv) Specimen signatures of authorized signatories. Failing this,

our Company reserves the right to accept or reject any Application in

whole or in part, in either case, without assigning any reason therefore.

14. Application by Indian Alternative Investment Funds

Applications made by Alternative Investment Funds eligible to invest in

accordance with the Securities and Exchange Board of India (Alternative

Investment Fund) Regulations, 2012, as amended (the SEBI AIF

Regulations) for Allotment of the NCDs must be accompanied by certified

INDIABULLS HOUSING FINANCE LIMITED

IN THE NATURE OF FORM 2A - MEMORANDUM CONTAINING SALIENT FEATURES OF THE PROSPECTUS

true copies of (i) SEBI registration certificate; (ii) a resolution authorising

investment and containing operating instructions; and (iii) specimen signatures of

authorised persons. The Alternative Investment Funds shall at all times comply with

the requirements applicable to it under the SEBI AIF Regulations and the relevant

notifications issued by SEBI. Failing this, our Company reserves the right to

accept or reject any Application in whole or in part, in either case, without

assigning any reason therefor.

15. Applications by Associations of persons and/or bodies established pursuant

to or registered under any central or state statutory enactment

In case of Applications made by Applications by Associations of persons and/or

bodies established pursuant to or registered under any central or state statutory

enactment, must submit a (i) certified copy of the certificate of registration or proof

of constitution, as applicable, (ii) Power of Attorney, if any, in favour of one or

more persons thereof, (iii) such other documents evidencing registration thereof

under applicable statutory/regulatory requirements. Further, any trusts applying for

NCDs pursuant to the Issue must ensure that (a) they are authorized under applicable

statutory/regulatory requirements and their constitution instrument to hold and

invest in debentures, (b) they have obtained all necessary approvals, consents or

other authorisations, which may be required under applicable statutory and/or

regulatory requirements to invest in debentures, and (c) Applications made by them

do not exceed the investment limits or maximum number of NCDs that can be held

by them under applicable statutory and or regulatory provisions. Failing this, our

Company reserves the right to accept or reject any Applications in whole or in

part, in either case, without assigning any reason therefor.

16. Applications by Trusts

In case of Applications made by trusts, settled under the Indian Trusts Act, 1882, as

amended, or any other statutory and/or regulatory provision governing the settlement

of trusts in India, must submit a (i) certified copy of the registered instrument for

creation of such trust, (ii) Power of Attorney, if any, in favour of one or more trustees

thereof, (iii) such other documents evidencing registration thereof under applicable

statutory/regulatory requirements. Further, any trusts applying for NCDs pursuant

to the Issue must ensure that (a) they are authorized under applicable statutory/

regulatory requirements and their constitution instrument to hold and invest

in debentures, (b) they have obtained all necessary approvals, consents or other

authorisations, which may be required under applicable statutory and/or regulatory

requirements to invest in debentures, and (c) Applications made by them do not

exceed the investment limits or maximum number of NCDs that can be held by them

under applicable statutory and or regulatory provisions. Failing this, our Company

reserves the right to accept or reject any Applications in whole or in part, in

either case, without assigning any reason therefor.

17. Applications by Public Financial Institutions, Statutory Corporations,

which are authorized to invest in the NCDs

The Application must be accompanied by certified true copies of: (i) Any Act/ Rules

under which they are incorporated; (ii) Board Resolution authorising investments;

and (iii) Specimen signature of authorized person. Failing this, our Company

reserves the right to accept or reject any Applications in whole or in part, in

either case, without assigning any reason therefor.

18. Applications by Provident Funds, Pension Funds, Superannuation Funds

and Gratuity Fund, which are authorized to invest in the NCDs

The Application must be accompanied by certified true copies of: (i) Any Act/Rules

under which they are incorporated; (ii) Power of Attorney, if any, in favour of one or

more trustees thereof, (iii) Board Resolution authorising investments; (iv) such other

documents evidencing registration thereof under applicable statutory/regulatory

requirements; (v) Specimen signature of authorized person; (vi) certified copy of

the registered instrument for creation of such fund/trust; and (vii) Tax Exemption

certificate issued by Income Tax Authorities, if exempt from Tax. Failing this, our

Company reserves the right to accept or reject any Application in whole or in

part, in either case, without assigning any reason therefor.

19. Applications by National Investment Fund

The application must be accompanied by certified true copies of: (i) resolution

authorising investment and containing operating instructions; and (ii) Specimen

signature of authorized person. Failing this, our Company reserves the right to

accept or reject any Application in whole or in part, in either case, without

assigning any reason therefor.

20. Companies, bodies corporate and societies registered under the applicable

laws in India

The Application must be accompanied by certified true copies of: (i) Any Act/ Rules

under which they are incorporated; (ii) Board Resolution authorising investments;

and (iii) Specimen signature of authorized person. Failing this, our Company

reserves the right to accept or reject any Applications in whole or in part, in

10

INDIABULLS HOUSING FINANCE LIMITED

either case, without assigning any reason therefor.

21. Applications by Indian Scientific and/or industrial research organizations,

which are authorized to invest in the NCDs

The Application must be accompanied by certified true copies of: (i) Any Act/ Rules

under which they are incorporated; (ii) Board Resolution authorising investments;

and (iii) Specimen signature of authorized person. Failing this, our Company

reserves the right to accept or reject any Applications in whole or in part, in either

case, without assigning any reason therefor.

Applications by Partnership firms formed under applicable Indian laws in the

name of the partners and Limited Liability Partnerships formed and registered

under the provisions of the Limited Liability Partnership Act, 2008 (No. 6 of

2009)

The Application must be accompanied by certified true copies of: (i) Partnership

Deed; (ii) Any documents evidencing registration thereof under applicable statutory/

regulatory requirements; (iii) Resolution authorizing investment and containing

operating instructions; (iv) Specimen signature of authorized person. Failing this,

our Company reserves the right to accept or reject any Applications in whole or

in part, in either case, without assigning any reason therefor.

22. Applications under Power of Attorney

In case of Applications made pursuant to a power of attorney by Applicants who

are Institutional Investors or Non Institutional Investors, a certified copy of the

power of attorney or the relevant resolution or authority, as the case may be, with

a certified copy of the memorandum of association and articles of association and/

or bye laws must be submitted with the Application Form. In case of Applications

made pursuant to a power of attorney by Applicants who are HNI Investors or Retail

Individual Investors, a certified copy of the power of attorney must be submitted

with the Application Form. Failing this, our Company reserves the right to accept

or reject any Application in whole or in part, in either case, without assigning

any reason therefor. Our Company, in its absolute discretion, reserves the

right to relax the above condition of attaching the power of attorney with the

Application Forms subject to such terms and conditions that our Company, the

Lead Managers may deem fit.

Brokers having online demat account portals may also provide a facility of submitting

the Application Forms (ASBA as well as non-ASBA Applications) online to their

account holders. Under this facility, a broker receives an online instruction through

its portal from the Applicant for making an Application on his/ her behalf. Based on

such instruction, and a power of attorney granted by the Applicant to authorise the

broker, the broker makes an Application on behalf of the Applicant.

APPLICATIONS FOR ALLOTMENT OF NCDs IN THE PHYSICAL AND

DEMATERIALIZED FORM

23. Application for allotment in the physical form