Beruflich Dokumente

Kultur Dokumente

Tariff Regular BSDA

Hochgeladen von

BhanuprakashReddyDandavolu0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

28 Ansichten1 Seitentg

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenntg

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

28 Ansichten1 SeiteTariff Regular BSDA

Hochgeladen von

BhanuprakashReddyDandavoluntg

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

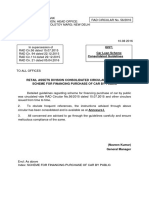

Tariff Sheet for HDFC Bank Individual Demat Account - Regular / Basic Services Demat Account

Sr.

No.

Fee Head

Type

Account opening charges

SPEED-e / Easiest

Debit Transactions Equity / Mutual

HDFC Securities

Funds

(Market / Off Market)

Manual

3

4

Debit Transactions Debt / Mutual

Funds

(Market / Off Market)

Min

HDFC Securities

Rs.40/Rs.45/-

Rs. 40/-

Rs. 60/-

Rs. 20/-

0.04% of the value of the txn.

(Max Rs 5000/-)

Rs.40/-

0.06% of the value of the txn.

(Max Rs 5000/-)

Rs. 25/-

Manual

Rs.45/-

Rs. 40/-

Rs. 60/Nil

If Pledge is marked in

favour of HDFC Bank

0.02% of the value of the Txn.

Rs. 40/-

0.04% of the value of the Txn.

Rs.60/-

If Pledge is marked to

other than HDFC Bank

0.04% of the value of the Txn.

Rs. 40/-

0.06% of the value of the Txn.

Rs.60/-

Dematerialisation

Rs.75/- per booklet

Certificate +

Dematerialisation

Request

Rs.5/- per certificate + Rs. 35/- per

request

Rematerialisation

Request

Rs.30/- per request + NSDL /

CDSL actuals, Currently

a) Rs. 10/- for every hundred

securities or part thereof; or

b) a flat fee of Rs. 10/- per

certificate whichever is higher

Rematerialisation

Reconversion of Mutual

Funds/

Redemption of Mutual

Fund units

Courier / Postal Charges only

( Adhoc Statement )

Min

0.06% of the value of the txn.

Rs. 25/-

Credit Transactions

Pledge Services(Creation /

Invocation / Closure)

Fees

Rs. 20/0.04% of the value of the txn.

SPEED-e / Easiest

Reissuance of Delivery Instruction Booklet (DIB)

Fees

Basic Services Demat account (BSDA)

Nil

Regular Demat account

Rs. 75/- per booklet

Rs.40/-

Rs.5/- per certificate + Rs. 35/- per

request

Rs.30/- per request + NSDL / CDSL

actuals, Currently

Rs.40/- (min) Rs.5,00,000 a) Rs. 10/- for every hundred securities

or part thereof; or

(max)

b) a flat fee of Rs. 10/- per certificate

whichever is higher

Rs.40/-

Rs.40/- (min)

Rs.5,00,000 (max)

Reconversion of Mutual Funds

Rs 30/- per request + NSDL / CDSL actuals,Currently Rs 10/per request in NSDL & Rs 5.50/- per request in CDSL

Reconversion of Mutual Funds

Rs 30/- per request + NSDL / CDSL actuals,Currently Rs 10/- per

request in NSDL & Rs 5.50/- per request in CDSL

Redemption of Mutual Fund units

Rs 30/- per request + NSDL / CDSL actuals, Currently Rs 4.50/per request in NSDL &

Rs 5.50/- per request in CDSL

Redemption of Mutual Fund units

Rs 30/- per request + NSDL / CDSL actuals, Currently Rs 4.50/- per

request in NSDL &

Rs 5.50/- per request in CDSL

Inland Address

Rs.35/- per request

Rs.35/- per request

Foreign Address

Rs.500/- per request

Rs.500/- per request

*** Holding Value between 0 to 50,000 - Nil AMC

10 Annual Maintenance Charges

AMC

Rs. 750 p.a.

*** Holding Value between 50,001 to 2 Lacs - Rs.100 p.a.

*** Holding Value more than 2 Lacs - Rs.750 p.a.

Terms & Conditions:

Demat customers eligible for the BSDA facility need to register their mobile number for the SMS alert facility for debit transactions

Customers who have a banking relationship with HDFC Bank to provide a debit authorisation for the recovery of service charges.

The above charges are exclusive of Service Tax levied @ 14%, Swachh Bharat Cess levied @ 0.50% and Krishi Kalyan Cess levied @ 0.50% and other taxes / statutory charges levied by

Government bodies / statutory authorities from time to time, which will be charged as applicable.

All charges / service standards are subject to revision at the Banks sole discretion and as per the notifications given by ordinary post / courier companies, at any given point of time.

Customers who have only a Depository relationship will be required to pay an advance fee of Rs. 7,500/- , for each Demat account, which will be adjusted against the service charges. The customer

also needs to replenish the balances immediately if and when it falls below Rs. 5,000/ *** The Annual Maintenance Charges are levied, in advance, for a period of one year at the beginning of the billing cycle. For the computation of AMC for Managed Program, the transactions for the

previous year will be evaluated, and basis the number of transactions done by the customer, AMC will be levied as per the transaction slabs defined.

To evaluate the eligibility for Basic Services Demat Accounts (BSDA), the value of holdings will be determined on a daily basis, as per the file sent by the NSDL / CDSL The AMC will be calculated at

the pro-rata basis based on the value of holding of securities in the account.

In case of BSDA, such accounts would be levied AMC applicable basis the value of holdings exceeding the prescribed limit immediately from the next day of exceeding such limit.

Incase the Demat accounts with BSDA facility does not meet the listed eligibility as per guideline issued by SEBI or any such authority at any point of time, such BSDA accounts will be converted to

Standard program Demat accounts without further reference to the respective customers and will be levied standard Program pricing.

Incase if the Demat accounts with BSDA facility exceed the prescribed limits and move out of the stipulated BSDA criteria, the eligibility of such accounts for BSDA facility will be evaluated on the last

day of the Annual billing cycle.

The value of the transaction will be in accordance with rates provided by Depositories (NSDL / CDSL)

The transaction charges will be payable monthly. The charges quoted above are for the services listed. Any service not quoted above will be charged separately.

The operating instructions for the joint accounts must be signed by all the holders.

All instructions for transfer must be received at the designated DP servicing branches of the Bank at least 24 hours before the execution date.

The charges for processing of instructions submitted on the execution date (accepted at client's risk) will be 0.25 % on the value of transaction, minimum of Rs.25/- per instruction.

In case of non-recovery of service charges due to inadequate balance in your linked bank account or inadequate advance fees or invalid bank account, the Depository services for your account will be

temporarily discontinued. Any request for resuming the services will be charged at Rs. 250/- and services will be resumed in a minimum of three working days from the date of receipt of request with

HDFC Bank and post payment of all outstanding dues towards Depository charges.

In case the Demat accounts are with nil balances / transactions or incase if the customer defaults in payment of AMC, the physical statement shall not be sent to the customer after period of 1 year.

However the electronic statement of holding will be sent only to the customers whose email IDs are registered for e-statement.

The Depositories have started dispatching Consolidated Account Statement (CAS) to the customers from March 2015 onwards, hence sending one annual physical statement will be discontinued.

Das könnte Ihnen auch gefallen

- Schedule of Charges Without SignatureDokument1 SeiteSchedule of Charges Without SignatureNandita ThukralNoch keine Bewertungen

- SUPERCARD Most Important Terms and Conditions (MITC)Dokument14 SeitenSUPERCARD Most Important Terms and Conditions (MITC)Diwana Hai dilNoch keine Bewertungen

- Crown salary account benefitsDokument2 SeitenCrown salary account benefitsVikram IsgodNoch keine Bewertungen

- Bank service charges guideDokument17 SeitenBank service charges guideshaantnuNoch keine Bewertungen

- Axis Bank savings account chargesDokument6 SeitenAxis Bank savings account chargesArnab Nandi100% (1)

- Notification FinalDokument4 SeitenNotification FinalBrahmanand DasreNoch keine Bewertungen

- Simplified Nri Savings Account Tarrif Structure W.E.F April 01, 2014Dokument5 SeitenSimplified Nri Savings Account Tarrif Structure W.E.F April 01, 2014gaddipati_ramuNoch keine Bewertungen

- SuperCard MITC PDFDokument47 SeitenSuperCard MITC PDFPrudhvi RajNoch keine Bewertungen

- CC Common MITCDokument6 SeitenCC Common MITCRamarao ChNoch keine Bewertungen

- Barclays Business Loan ChargesDokument1 SeiteBarclays Business Loan Chargesk kaulNoch keine Bewertungen

- Savings Accounts: Non Resident External Savings Account (NRE) Non Resident Ordinary Savings Account (NRO)Dokument15 SeitenSavings Accounts: Non Resident External Savings Account (NRE) Non Resident Ordinary Savings Account (NRO)Jennifer AguilarNoch keine Bewertungen

- Most Important Terms & ConditionsDokument6 SeitenMost Important Terms & ConditionsshanmarsNoch keine Bewertungen

- Monthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Dokument2 SeitenMonthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Shoaib MohammedNoch keine Bewertungen

- Sabka Basic Savings Account Complete KYC 10-10-2013Dokument2 SeitenSabka Basic Savings Account Complete KYC 10-10-2013Nikhil Raj SharmaNoch keine Bewertungen

- Noor CardDokument12 SeitenNoor CardArslan KhalidNoch keine Bewertungen

- New Schedule of Charges For Current AccountDokument2 SeitenNew Schedule of Charges For Current AccountKishan DhootNoch keine Bewertungen

- HSBC Credit Card T&C SummaryDokument10 SeitenHSBC Credit Card T&C SummaryMohit AroraNoch keine Bewertungen

- Bank Alfalah Schedule of Islamic Banking ChargesDokument16 SeitenBank Alfalah Schedule of Islamic Banking Chargesfaisal_ahsan7919Noch keine Bewertungen

- Senior Citizen Saving Account: As A Senior Citizen, You Can Enjoy A Host of Benefits On Your AccountDokument13 SeitenSenior Citizen Saving Account: As A Senior Citizen, You Can Enjoy A Host of Benefits On Your AccountRohan MohantyNoch keine Bewertungen

- Regular Saving AccountDokument92 SeitenRegular Saving AccountSimu MatharuNoch keine Bewertungen

- RB Chapter 2 - Current DepositsDokument6 SeitenRB Chapter 2 - Current DepositsHarish YadavNoch keine Bewertungen

- Annex 2 Super Savings AccountDokument2 SeitenAnnex 2 Super Savings AccountPhani BhupathirajuNoch keine Bewertungen

- SOC Final July December 2014 For OSC Approval AHB 3 After Additions and DelitionsDokument26 SeitenSOC Final July December 2014 For OSC Approval AHB 3 After Additions and DelitionsZeynab AbrezNoch keine Bewertungen

- Savings Account DetailsDokument2 SeitenSavings Account Detailsmysto9Noch keine Bewertungen

- IOB-Commission ChartDokument5 SeitenIOB-Commission ChartSubham Pnb RoyNoch keine Bewertungen

- "Being Me" Savings Account: W.E.F. 1st April 2014Dokument2 Seiten"Being Me" Savings Account: W.E.F. 1st April 2014praveenpersonelNoch keine Bewertungen

- Saadiq SOCDokument31 SeitenSaadiq SOCjoshmalikNoch keine Bewertungen

- Schedule of Charges 2011-12Dokument28 SeitenSchedule of Charges 2011-12Aamir ShehzadNoch keine Bewertungen

- PDS Revision Eng & BM Online (Final)Dokument6 SeitenPDS Revision Eng & BM Online (Final)Faiziya BanuNoch keine Bewertungen

- MITCs AND FEESDokument5 SeitenMITCs AND FEESLoesh WaranNoch keine Bewertungen

- Account Number Deposit Amount Interest Rate (%P.A.) Start Date Maturity Date Maturity AmountDokument2 SeitenAccount Number Deposit Amount Interest Rate (%P.A.) Start Date Maturity Date Maturity AmountKhushbu NanavatiNoch keine Bewertungen

- Bank Alfalah Islamic Banking Schedule of Charges July-Dec 2013Dokument14 SeitenBank Alfalah Islamic Banking Schedule of Charges July-Dec 2013krishmasethiNoch keine Bewertungen

- Mitc RupifiDokument13 SeitenMitc RupifiKARTHIKEYAN K.DNoch keine Bewertungen

- Schedule of Charges: Savings ValueDokument2 SeitenSchedule of Charges: Savings ValueNavjot SinghNoch keine Bewertungen

- 16.06.2022 Final Cent ParamDokument7 Seiten16.06.2022 Final Cent ParamMaruthi Kadamuddi KHNoch keine Bewertungen

- New Schedule of Charges - Value Based Current Accounts - 15 Dec 2012Dokument2 SeitenNew Schedule of Charges - Value Based Current Accounts - 15 Dec 2012anon_948025741Noch keine Bewertungen

- Rca SocDokument3 SeitenRca SocKrishna Kiran VyasNoch keine Bewertungen

- Prepaid Instruments in India Feb 27Dokument11 SeitenPrepaid Instruments in India Feb 27nish21inNoch keine Bewertungen

- Particulars Sanman Savings Bank Account Standard Charges (RS.)Dokument2 SeitenParticulars Sanman Savings Bank Account Standard Charges (RS.)Bella BishaNoch keine Bewertungen

- Account Tariff Structure Basic Savings AccountDokument1 SeiteAccount Tariff Structure Basic Savings Accountgaddipati_ramuNoch keine Bewertungen

- Saving Account GeneralDokument6 SeitenSaving Account GeneralDurgeshNoch keine Bewertungen

- Product Disclosure Sheet: What Is This Product About?Dokument6 SeitenProduct Disclosure Sheet: What Is This Product About?faisal_ahsan7919Noch keine Bewertungen

- Sme BookDokument397 SeitenSme BookVivek Godgift J0% (1)

- Change of Broker - Marcellus PMSDokument6 SeitenChange of Broker - Marcellus PMSDOLLY KHAPRENoch keine Bewertungen

- NPS-HDFC-Frequently Asked QuestionsDokument7 SeitenNPS-HDFC-Frequently Asked QuestionsSudip MukhopadhyayNoch keine Bewertungen

- RBI SERVICE CHARGES GUIDELINESDokument11 SeitenRBI SERVICE CHARGES GUIDELINESJithin VijayanNoch keine Bewertungen

- Citigold Account - Schedule of Charges: All Below Mentioned Benefits Are Now Free of ChargeDokument1 SeiteCitigold Account - Schedule of Charges: All Below Mentioned Benefits Are Now Free of ChargeNikhil RaviNoch keine Bewertungen

- RetailServiceCharges Adv EnglishDokument4 SeitenRetailServiceCharges Adv EnglishMohit KumarNoch keine Bewertungen

- Service Charges - BoB - As On 6.11.17Dokument63 SeitenService Charges - BoB - As On 6.11.17Praneta pandeyNoch keine Bewertungen

- CC Common MITCDokument6 SeitenCC Common MITCSharadNoch keine Bewertungen

- Encash TNC NEFTDokument10 SeitenEncash TNC NEFTSurajNoch keine Bewertungen

- RBL Mitc FinalDokument16 SeitenRBL Mitc FinalVivekNoch keine Bewertungen

- CUB Credit Card T&CDokument7 SeitenCUB Credit Card T&CPushpa RajNoch keine Bewertungen

- Car FinanceDokument32 SeitenCar FinanceAshish V MeshramNoch keine Bewertungen

- SUPERCARD Most Important Terms and Conditions (MITC)Dokument17 SeitenSUPERCARD Most Important Terms and Conditions (MITC)jinesh vgNoch keine Bewertungen

- DEMAT TARIFF SHEET FOR INDIVIDUAL AND OTHER ACCOUNTSDokument1 SeiteDEMAT TARIFF SHEET FOR INDIVIDUAL AND OTHER ACCOUNTSsonamkhanchandaniNoch keine Bewertungen

- HBL Credit Card SummaryDokument3 SeitenHBL Credit Card SummaryMubin AshrafNoch keine Bewertungen

- Switch GearDokument7 SeitenSwitch GearpanduranganraghuramaNoch keine Bewertungen

- PTA Model Question Paper 2019-2020 Social ScienceDokument48 SeitenPTA Model Question Paper 2019-2020 Social SciencepanduranganraghuramaNoch keine Bewertungen

- Filler Metal Data Handbook - CompleteDokument330 SeitenFiller Metal Data Handbook - Completeessnelson100% (2)

- 10 TH SSDokument36 Seiten10 TH SSpanduranganraghurama80% (5)

- How to Determine the Right Preheating and Interpass TemperaturesDokument4 SeitenHow to Determine the Right Preheating and Interpass TemperaturesMohammad RizwanNoch keine Bewertungen

- ThiruppavaiDokument114 SeitenThiruppavaiKeerthi RameshNoch keine Bewertungen

- Fans & Blowers-Calculation of PowerDokument20 SeitenFans & Blowers-Calculation of PowerPramod B.Wankhade92% (24)

- 10th Tamil Pta Public Exam Model Question PapersDokument29 Seiten10th Tamil Pta Public Exam Model Question PaperspanduranganraghuramaNoch keine Bewertungen

- Home Education Resources NDT Course Material Ultrasound: Calibration MethodsDokument7 SeitenHome Education Resources NDT Course Material Ultrasound: Calibration MethodspanduranganraghuramaNoch keine Bewertungen

- 10th ScienceDokument4 Seiten10th SciencepanduranganraghuramaNoch keine Bewertungen

- ThirupavaiDokument1 SeiteThirupavaipanduranganraghuramaNoch keine Bewertungen

- பிரபாகரன் கதைDokument30 Seitenபிரபாகரன் கதைElayathambi ThayananthaNoch keine Bewertungen

- YogaDokument12 SeitenYogaRahfyahamedNoch keine Bewertungen

- Siddha VaidhiyamDokument15 SeitenSiddha VaidhiyampanduranganraghuramaNoch keine Bewertungen

- Weld Filler Metal SelectionDokument7 SeitenWeld Filler Metal SelectionsusanwebNoch keine Bewertungen

- Repair of ConcreteDokument3 SeitenRepair of ConcretepanduranganraghuramaNoch keine Bewertungen

- Dew Point CalculatorDokument1 SeiteDew Point CalculatorpanduranganraghuramaNoch keine Bewertungen

- Structural Temples of Mahabalipuram, Tamil Nadu - Archaeological Survey of India PDFDokument3 SeitenStructural Temples of Mahabalipuram, Tamil Nadu - Archaeological Survey of India PDFpanduranganraghuramaNoch keine Bewertungen

- Electrical Machin 1 NoteDokument5 SeitenElectrical Machin 1 NoteRavi DuttaNoch keine Bewertungen

- How To Clean The ComputerDokument6 SeitenHow To Clean The ComputerpanduranganraghuramaNoch keine Bewertungen

- Fan Shop Testing Procedure BS 848Dokument3 SeitenFan Shop Testing Procedure BS 848panduranganraghurama0% (1)

- Right PostureDokument8 SeitenRight PosturepanduranganraghuramaNoch keine Bewertungen

- Pipng Codes and StandardsDokument26 SeitenPipng Codes and Standardspanduranganraghurama100% (1)

- Phase ArrayDokument2 SeitenPhase ArraypanduranganraghuramaNoch keine Bewertungen

- Latrel Expansion RequirementDokument1 SeiteLatrel Expansion RequirementpanduranganraghuramaNoch keine Bewertungen

- What is acute pancreatitis? Causes, symptoms and treatmentDokument6 SeitenWhat is acute pancreatitis? Causes, symptoms and treatmentpanduranganraghuramaNoch keine Bewertungen

- AcharapakkamDokument3 SeitenAcharapakkampanduranganraghuramaNoch keine Bewertungen

- Repair of ConcreteDokument3 SeitenRepair of ConcretepanduranganraghuramaNoch keine Bewertungen

- Cave Temples of Mahabalipuram, Tamil Nadu - Archaeological Survey of India PDFDokument4 SeitenCave Temples of Mahabalipuram, Tamil Nadu - Archaeological Survey of India PDFpanduranganraghurama100% (1)

- Weld Filler Metal SelectionDokument7 SeitenWeld Filler Metal SelectionsusanwebNoch keine Bewertungen