Beruflich Dokumente

Kultur Dokumente

Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)

Hochgeladen von

Shyam SunderOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)

Hochgeladen von

Shyam SunderCopyright:

Verfügbare Formate

Krebs Biochemicals & Industries Limited

CIN : 124110AP1991P1C103912

14th September, 2016

To,

To,

The Manager,

Departrnent of Corporate Relations,

The Manager,

BSE Limited,

National Stock Exchange of India Ltd.,

Exchange Plaza, Bandra Kurla Complex,

Bandra @), Mumbai- 40005 1.

Listing Depaftnent,

Towers, Dalal Street,

Fort, Mumbai- 400001

Dear Sir/Madam,

Sub: Outcome of Board Meeting held on 14th Sqrtembe4 2016.

We refer to the above mentioned subject, we herewith intimate the Exchange, and that the Board of

Directors at their meeting held on 14th September, 2016 has considered and approved interalia the

following items of business:

l.

Unaudited Financial results and the Limited Review Report for the quarter ended 30th June,

20 16, enclosed herewith.

This is for the information and records of the Exchange, Please.

Kindly note that the board meeting corunenced at 12:05 PM and concluded at 03:20 PM.

Thanking You,

Yours Faithfirlly,

Limited

Encl. As above

Regd. Office : Kothapalli (V), Kasimkota (M), Anakapalli, Visakhapatnam, Andhra Pradesh-531031

8-2-577 lB, Plot No. 34, 3rd Floor, Maas Heights, Road No. 8, Banjara Hills, Hyderabad-5O0 034

Tel : 040-66808040 E-mail : marketing@krebsbiochem.com Website : www.krebsbiochem.com

Corporate Office

/ (Loss) froD ODentiors bfo.e other iDcom, finance cosls rnd

/ (Loss)

frod ordi.r.y activities bfor.

flnaoce costs

& erceptiorrl

Profit on Sale ofFood Division's Inmovables

Profit / (Losr) after Trx 19+

otal Conprehetrsire ltrcom aftel

T{t(lJ + l4)

Reserve Excluditrg Revaluafion Resedes as per Brlancc Sht of previous

Ernirg

Per Sh{r (bfore exfrao.dirarry

Per Sbr re

(!ftrr

lteDs)

rt tr{ ordinarrJ llens) (or

(ofRs.10/- e{ch)

Rs. |

0l qch,

(trot

iThe alove resulls have ben rviewd by the Audit Comnittee al ils meeting held on 14th Seplember 2016, and alproved by the Board ofDi.e.lors of

r.he

TheComDanvis oDeratine in onesesDe.t onlv hence no sunent resulls have ben disclosed

Compary has adoptd Ind-As wiih efrect iom I st April 201 6

Opding res.ves as ar I sr April 2015 md aI Lhe

witl

comparitives beirg restated Accordingty the inpact of transition has been provided

the

result for rhe quaner erded 31rt march 2016, 30th June 2015 and previous yee ended 31st N,Iarch 2016 have

betr

KREBS BIOCHEMICATS

& INDUSTRIES TIMITED

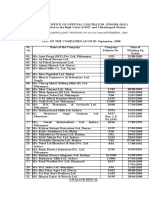

RECONCIIATION OF PROFIT AND RESERVE BETWEEN INDAS AND PREVIOUS INDIAN GAAP FOR EARTIER PERIOD

AND AS AT MARCH 31, 2015

Rs.in lakhs

Reserve

reconciliation

Profit reconciliation

quarter

slf

Nature of adiustments

Net Profit / Reserves as per Previous Indian

ended

31st

Note March

ref, 20t6

GAAP

Quarter

ended

30th June

2015

1624.r3l.

(295.16)

Year ended

at 31st

March 2016

31st March

As

2016

(1,632.04)

1r,477.971

Fair valuation as deemed cost for Property, Plant

L

and Equipment

Fair valuation of Intangible Assets

Fair Valuation of for Financial Assets

1.

4,743.25

(3,r.26.96)

.379.28].

(1.31.30)

Defered Tax

Sub Total

Net profit/ Reserves as per Ind As

1,1O5.71

1624.r31

(2es.16)

(1,632.041

1372.261

&!gri

1

valution as deemed cost for Propertv, Plant and Eouipment

Considered fair value for property, viz land admeasuring 110.7 acres, situated in Andhra Pradesh

Fair

in India, with

impact of Rs.4743-25 lakhs in accordance with stipulations of Ind AS 101 (see Ind As 1.6) with the resultant

impact being accounted for in the reserves.

2 Fair Valuation of Intansible Assets

Considered fair value of Intangible Assets based on expected future economic benefits using reasonable and

supportable assumptions in accordance with stipulations of Ind As 38 with the resultant impact being

accounted for in the reserves.

3 Fair valuation for FinancialAssets

The Company has valued financial assets at fair value. lmpact of fair value changes as on the date of transition,

is recognised in opening reserves and changes thereafter are recongnised in Profit and Loss Account

or Other

Comprehensive Income, as the case may be,

4 Defered Tax

The lmpact of transition adjustments together with Ind As mandate of using balance sheet approch (against

profit and loss approch in the previous GMP) for computation of deferred taxes has resulted in charge to the

Reserves, on the date of transition, with consequential impact to the Profit and Loss account for the

subsequent periods.

5 The Audit Committee has reviewed the above results and the Board

of Directors has approved the

results and its release at their resepective meetings held on 14th September 2016. The

the Company have carried out a Limited Review of the results for the current quarter.

Place: Hyderabad

Date:14.09.2016

Managing Director

DIN:01616152

Das könnte Ihnen auch gefallen

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument8 SeitenStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument7 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument8 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokument15 SeitenStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument10 SeitenStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument9 SeitenStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Corrected Financial Results For The Period Ended March 31, 2016 & June 30, 2016 (Result)Dokument4 SeitenCorrected Financial Results For The Period Ended March 31, 2016 & June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Announces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Dokument3 SeitenAnnounces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument8 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument7 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument2 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument7 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument9 SeitenStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Announces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Dokument4 SeitenAnnounces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNoch keine Bewertungen

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23Von EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23Noch keine Bewertungen

- HINDUNILVR: Hindustan Unilever LimitedDokument1 SeiteHINDUNILVR: Hindustan Unilever LimitedShyam SunderNoch keine Bewertungen

- JUSTDIAL Mutual Fund HoldingsDokument2 SeitenJUSTDIAL Mutual Fund HoldingsShyam SunderNoch keine Bewertungen

- Mutual Fund Holdings in DHFLDokument7 SeitenMutual Fund Holdings in DHFLShyam SunderNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDokument2 SeitenSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNoch keine Bewertungen

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Dokument1 SeitePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNoch keine Bewertungen

- Order of Hon'ble Supreme Court in The Matter of The SaharasDokument6 SeitenOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNoch keine Bewertungen

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDokument5 SeitenExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNoch keine Bewertungen

- Financial Results For Mar 31, 2014 (Result)Dokument2 SeitenFinancial Results For Mar 31, 2014 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For June 30, 2014 (Audited) (Result)Dokument3 SeitenFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Settlement Order in Respect of R.R. Corporate Securities LimitedDokument2 SeitenSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNoch keine Bewertungen

- Financial Results For Dec 31, 2013 (Result)Dokument4 SeitenFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results For September 30, 2013 (Result)Dokument2 SeitenFinancial Results For September 30, 2013 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- PDF Processed With Cutepdf Evaluation EditionDokument3 SeitenPDF Processed With Cutepdf Evaluation EditionShyam SunderNoch keine Bewertungen

- Standalone Financial Results For September 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For March 31, 2016 (Result)Dokument11 SeitenStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For June 30, 2013 (Audited) (Result)Dokument2 SeitenFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For June 30, 2016 (Result)Dokument2 SeitenStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Transcript of The Investors / Analysts Con Call (Company Update)Dokument15 SeitenTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNoch keine Bewertungen

- Investor Presentation For December 31, 2016 (Company Update)Dokument27 SeitenInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Doe v. Myspace, Inc. Et Al - Document No. 37Dokument2 SeitenDoe v. Myspace, Inc. Et Al - Document No. 37Justia.comNoch keine Bewertungen

- ASTM D256-10 - Standard Test Methods For Determining The Izod Pendulum Impact Resistance of PlasticsDokument20 SeitenASTM D256-10 - Standard Test Methods For Determining The Izod Pendulum Impact Resistance of PlasticsEng. Emílio DechenNoch keine Bewertungen

- MORTGAGE Short NotesDokument11 SeitenMORTGAGE Short Noteshamzatariq015Noch keine Bewertungen

- Course: Citizenship Education and Community Engagement: (8604) Assignment # 1Dokument16 SeitenCourse: Citizenship Education and Community Engagement: (8604) Assignment # 1Amyna Rafy AwanNoch keine Bewertungen

- Electrosteel Castings Limited (ECL) - Technology That CaresDokument4 SeitenElectrosteel Castings Limited (ECL) - Technology That CaresUjjawal PrakashNoch keine Bewertungen

- Chapter 2Dokument22 SeitenChapter 2Okorie Chinedu PNoch keine Bewertungen

- Expressive Matter Vendor FaqDokument14 SeitenExpressive Matter Vendor FaqRobert LedermanNoch keine Bewertungen

- sl2018 667 PDFDokument8 Seitensl2018 667 PDFGaurav MaithilNoch keine Bewertungen

- BPO UNIT - 5 Types of Securities Mode of Creating Charge Bank Guarantees Basel NormsDokument61 SeitenBPO UNIT - 5 Types of Securities Mode of Creating Charge Bank Guarantees Basel NormsDishank JohriNoch keine Bewertungen

- Clogging in Permeable (A Review)Dokument13 SeitenClogging in Permeable (A Review)Chong Ting ShengNoch keine Bewertungen

- 'K Is Mentally Ill' The Anatomy of A Factual AccountDokument32 Seiten'K Is Mentally Ill' The Anatomy of A Factual AccountDiego TorresNoch keine Bewertungen

- S2 Retake Practice Exam PDFDokument3 SeitenS2 Retake Practice Exam PDFWinnie MeiNoch keine Bewertungen

- Product CycleDokument2 SeitenProduct CycleoldinaNoch keine Bewertungen

- CGV 18cs67 Lab ManualDokument45 SeitenCGV 18cs67 Lab ManualNagamani DNoch keine Bewertungen

- Obiafatimajane Chapter 3 Lesson 7Dokument17 SeitenObiafatimajane Chapter 3 Lesson 7Ayela Kim PiliNoch keine Bewertungen

- HistoryDokument144 SeitenHistoryranju.lakkidiNoch keine Bewertungen

- Um 0ah0a 006 EngDokument1 SeiteUm 0ah0a 006 EngGaudencio LingamenNoch keine Bewertungen

- 2019-10 Best Practices For Ovirt Backup and Recovery PDFDokument33 Seiten2019-10 Best Practices For Ovirt Backup and Recovery PDFAntonius SonyNoch keine Bewertungen

- Spsi RDokument2 SeitenSpsi RBrandy ANoch keine Bewertungen

- TransistorDokument1 SeiteTransistorXhaNoch keine Bewertungen

- Political Reporting:: Political Reporting in Journalism Is A Branch of Journalism, Which SpecificallyDokument6 SeitenPolitical Reporting:: Political Reporting in Journalism Is A Branch of Journalism, Which SpecificallyParth MehtaNoch keine Bewertungen

- Post Marketing SurveillanceDokument19 SeitenPost Marketing SurveillanceRamanjeet SinghNoch keine Bewertungen

- Modified Release Drug ProductsDokument58 SeitenModified Release Drug Productsmailtorubal2573100% (2)

- Statement of Compulsory Winding Up As On 30 SEPTEMBER, 2008Dokument4 SeitenStatement of Compulsory Winding Up As On 30 SEPTEMBER, 2008abchavhan20Noch keine Bewertungen

- Assessing Gross Efficiency and Propelling Efficiency in Swimming Paola Zamparo Department of Neurological Sciences, Faculty of Exercise and Sport Sciences, University of Verona, Verona, ItalyDokument4 SeitenAssessing Gross Efficiency and Propelling Efficiency in Swimming Paola Zamparo Department of Neurological Sciences, Faculty of Exercise and Sport Sciences, University of Verona, Verona, ItalyVijay KumarNoch keine Bewertungen

- Lecture 1 Family PlanningDokument84 SeitenLecture 1 Family PlanningAlfie Adam Ramillano100% (4)

- Reflection Paper #1 - Introduction To Action ResearchDokument1 SeiteReflection Paper #1 - Introduction To Action Researchronan.villagonzaloNoch keine Bewertungen

- Ks3 Science 2008 Level 5 7 Paper 1Dokument28 SeitenKs3 Science 2008 Level 5 7 Paper 1Saima Usman - 41700/TCHR/MGBNoch keine Bewertungen

- Liber Chao (Final - Eng)Dokument27 SeitenLiber Chao (Final - Eng)solgrae8409100% (2)

- Chapter 1: The Critical Role of Classroom Management DescriptionDokument2 SeitenChapter 1: The Critical Role of Classroom Management DescriptionJoyce Ann May BautistaNoch keine Bewertungen