Beruflich Dokumente

Kultur Dokumente

Group 4 - MANAC Report - Draft

Hochgeladen von

viewpawanOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Group 4 - MANAC Report - Draft

Hochgeladen von

viewpawanCopyright:

Verfügbare Formate

A

Report on

Cash Flow Statement

Managerial Accounting

Submitted by: Group 4

September 15, 2016

MANAC Report

Abstract

September 15, 2016

MANAC Report

Acknowledgement

We have taken efforts in this report. However, it would not have been possible without the kind

support and help of many individuals. We would like to extend our sincere thanks to all of them.

We are highly indebted to Prof. Debashish Kundu for their guidance and constant supervision as well

as for providing necessary information regarding the report & also for their support in completing the

report.

We would like to express our gratitude towards our parents & PDM participants for their kind cooperation and encouragement which help us in completion of this report.

Our thanks and appreciations also go to the people who have willingly helped us out with their

abilities.

September 15, 2016

MANAC Report

Contents

ABSTRACT ........................................................................................................................................................ 1

ACKNOWLEDGEMENT ...................................................................................................................................... 2

CONTENTS ....................................................................................................................................................... 3

INTRODUCTION ............................................................................................................................................... 4

OPERATIONS .......................................................................................................................................................... 4

INVESTING ............................................................................................................................................................. 5

FINANCING ............................................................................................................................................................ 5

QUESTION 1 AKD LIMITED ............................................................................................................................... 6

SOLUTION 1 AKD LIMITED ................................................................................................................................ 7

QUESTION 2 BABULAL GRAIN MERCHANTS ..................................................................................................... 8

SOLUTION 2 BABULAL GRAINS MERCHANT...................................................................................................... 9

BIBLIOGRAPHY ............................................................................................................................................... 10

September 15, 2016

MANAC Report

Introduction

In financial accounting, a cash flow statement, also known as statement of cash flows, is a financial

statement that shows how changes in balance sheet accounts and income affect cash and cash

equivalents, and breaks the analysis down to operating, investing and financing activities. Essentially,

the cash flow statement is concerned with the flow of cash in and out of the business. The statement

captures both the current operating results and the accompanying changes in the balance sheet. As

an analytical tool, the statement of cash flows is useful in determining the short-term viability of a

company. (Helfert)

Cash flow is determined by looking at three components by which cash enters and leaves a company:

core operations, investing and financing, (Heakal, 2016)

Operations

Measuring the cash inflows and outflows caused by core business operations, the operations

component of cash flow reflects how much cash is generated from a company's products or services.

Generally, changes made in cash, accounts receivable, depreciation, inventory and accounts payable

are reflected in cash from operations.

Cash flow is calculated by making certain adjustments to net income by adding or subtracting

differences in revenue, expenses and credit transactions (appearing on the balance sheet and income

statement) resulting from transactions that occur from one period to the next. These adjustments are

made because non-cash items are calculated into net income (income statement) and total assets and

liabilities (balance sheet). So, because not all transactions involve actual cash items, many items have

to be re-evaluated when calculating cash flow from operations.

For example, depreciation is not really a cash expense; it is an amount that is deducted from the total

value of an asset that has previously been accounted for. That is why it is added back into net sales

for calculating cash flow. The only time income from an asset is accounted for in CFS calculations is

when the asset is sold.

Changes in accounts receivable on the balance sheet from one accounting period to the next must

also be reflected in cash flow. If accounts receivable decreases, this implies that more cash has entered

the company from customers paying off their credit accounts - the amount by which AR has decreased

is then added to net sales. If accounts receivable increase from one accounting period to the next, the

amount of the increase must be deducted from net sales because, although the amounts represented

in AR are revenue, they are not cash. (Heakal, 2016)

An increase in inventory, on the other hand, signals that a company has spent more money to

purchase more raw materials. If the inventory was paid with cash, the increase in the value of

inventory is deducted from net sales. A decrease in inventory would be added to net sales. If inventory

was purchased on credit, an increase in accounts payable would occur on the balance sheet, and the

amount of the increase from one year to the other would be added to net sales.

The same logic holds true for taxes payable, salaries payable and prepaid insurance. If something has

been paid off, then the difference in the value owed from one year to the next has to be subtracted

September 15, 2016

MANAC Report

from net income. If there is an amount that is still owed, then any differences will have to be added

to net earnings. (Heakal, 2016)

Investing

Changes in equipment, assets or investments relate to cash from investing. Usually cash changes from

investing are a "cash out" item, because cash is used to buy new equipment, buildings or short-term

assets such as marketable securities. However, when a company divests of an asset, the transaction

is considered "cash in" for calculating cash from investing. (Heakal, 2016)

Financing

Changes in debt, loans or dividends are accounted for in cash from financing. Changes in cash from

financing are "cash in" when capital is raised, and they're "cash out" when dividends are paid. Thus, if

a company issues a bond to the public, the company receives cash financing; however, when interest

is paid to bondholders, the company is reducing its cash. (Heakal, 2016)

September 15, 2016

MANAC Report

Question 1 AKD Limited

The summarized balance sheet of AKD limited as on March 2006 & 2007 are as follows:

Liabilities

Share Capital

General Reserves

Profit & Loss

account

Bank loan long

term

Sundry creditors

Provision for tax

2006 ()

90,000

20,000

2007()

1,25,000

25,000

Assets

Land & Building

Machinery

2006()

85,000

44,700

2007()

80,000

58,100

15,000

15,500

Stock

60,000

50,000

30,000

70,000

10,000

65,000

13,000

Sundry Debtors

Cash

Bank

Goodwill

45,000

300

2,35,000

2,43,500

40,000

400

7,000

8,000

2,43,500

2,35,000

Additional Information

Dividend 11,000paid to shareholders

Asset worth 40,000 payables in shares of another company is bought. The composition of

asset is stock= 12,000; Machinery= 20,000. Remaining is goodwill

Another Machinery worth 5,000 was bought

Depreciation written off on machinery 5,000

Income tax paid for the year is 18,000

Loss on sale of the machine 200 was written off to General Reserve

Required

I.

II.

III.

Prepare the cash flow statement at the end of fiscal year 2007?

Company wants a bank loan of 10,00,000 for its business activities. Should such loan be given

after assessing the liquidity position of the company?

Should the company be given further days of credit by the creditors? Elaborate.

September 15, 2016

MANAC Report

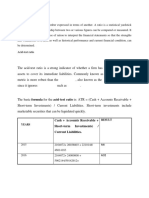

Solution 1 AKD Limited

I.

Profit & Loss Account

Expense

To General Reserve

To Provision for Taxation

To Dividend

To Bal C/D

Amount

5,200

21,000

11,000

15,500

52,700

Revenue

To Bal B/D

Amount

15,000

To P&L A/C

(Profit before Tax)

37,700

52,700

AKD LIMITED CASH FLOW STATEMENT

CASH FLOW FROM OPERATING ACTIVITY

NET PROFIT,FROM P&L A/C

37,700

DEPRICIATION ON MACHINE

5,000

INVENTORY

22,000

CREDITORS (Less)

(5,000)

INCOME TAX PAID (Less)

(18,000)

DEBTOR

5,000

DEPRICIATION ON LAND % BUILDING

5,000

51,700

CASH FLOW FROM INVESTING ACTIVITY

PURCHASE MACHINERY (Less)

(5,000)

SALE OF MACHINERY

6,400

1,400

CASH FLOW FROM FINANCING ACTIVITY

DIVIDEND PAID TO SHARE HOLDER (Less)

(11,000)

BANK LOAN REPAYMENT (Less)

(30,000)

EQUITY SHARE BUY BACK (Less)

(5,000)

(46,000)

CASH AND CASH EQUIVALENT

OPENING CASH

CLOSING CASH AND BANK

II.

III.

7,100

300

7,400

By assessing the liquidity position of the company, current ratio = 1.24:1 and acid test ratio =

0.60:1. It is evident that the liquidity position of cash is less than the standard. Hence, the

bank would not give the loan as it would be very risky.

Yes, the company should be given further days of credit by creditors because the current ratio

is 1.24 which is greater than 1. Company have more current asset than current liability and it

is good for creditors also that they can recover their money in future.

September 15, 2016

MANAC Report

Question 2 Babulal Grain Merchants

The comparative Balance sheet and profit & loss statement for Babulal Grain Merchants are given

below:

Babulal Grains Merchant

Liabilities & Capital

Bank Borrowings

Creditors

Outstanding expenses

Total Current Liabilities

Owner's capital

Total

Assets

Cash

Debtor

Stock

Expenses paid in advance

Total current assets

Building, furnitures etc.

Total

Comparative balance sheet Dec 31

1983

1982

12300

8610

103006

64427

5843

3797

121149

76834

228220

214019

349369

290853

54485

33638

120725

4311

213159

136210

349369

16218

60495

90526

2269

169508

121345

290853

1981

2460

63622

1921

68003

214339

282342

29179

54364

83454

1299

168296

114046

282342

Summarized Profit & Loss statement

1983

1982

1981

Sales

538211

458618

428253

Cost of Goods sold

318133

276174

258703

Gross profit

220078

182444

169550

Expenses

199982

166029

147802

Net profit

20096

16415

21748

Comment on the overall performance and indicate the areas which require investigation. Analyze the

ratios as applicable in grain merchants business.

September 15, 2016

MANAC Report

Solution 2 Babulal Grains Merchant

For Year 1983

Return on Assets

(20096/349369)*100

5.7%

Return on Investments capital

20096/(20096+228220)*100

Return on equity

(20096/248316)*100

40.80%

Gross Margin %

(220078/538211)*100

40.80%

Profit Margin

(20096/538211)*100

3.70%

Assets Turnover

538211/349369

Debt Equity

349369/(20096+228220)

Investment Capital Turnover

538211/248316

Days Inventory

(120725/318133)*365

Inventory turnover

318133/120725

2.6

Current Ratio

213159/121149

1.75:1

Working Capital Turnover

538211/(213159-121149)

Quicks Ratio

(54485+33688)/121149

Financial Leverage Ratio

349369/248316

1.4:1

Capital intensity

538211/136210

For Year 1982

3.95

Return on Assets

(16415/290853)*100

5.60%

Return on s.t Equity

16415/(214019+16415)*100

7.10%

Gross Margin %

(182444/458618)*100

Profit Margin %

(16415/458618)*100

3.5%

Asset Turnover

458618/290853

1.576

Debt Equity

290853/(16415+214019)

12.6%

Investment Capital Turnover

458618/(214019+16415)

1.99

Days inventories

(90526/276174)*365

Inventory turnover

276174/90526

3.05

Working Capital Turnover

458618/92674

4.94

Current Ratio

169508/76834

2.2:1

Quicks Ratio

76713/76834

0.99:1

Financial Leverage Ratio

290853/230434

1.25:1

Capital intensity

458618/121345

3.76

8%

1.34

14.06%

2.16

138.5 Days

5.84

4.09:1

39.70%

119.6 Days

The overall performance of a company is better than previous year except the current ratio which is

declining. So, the company needs to investigate the area of current ratio because current liabilities are

higher than current assets, which means company will not able to pay the creditors easily.

September 15, 2016

MANAC Report

Bibliography

Heakal, R. (2016, September 11). What Is A Cash Flow Statement? Retrieved from Investopedia:

http://www.investopedia.com/articles/04/033104.asp

Helfert, E. A. (n.d.). The Nature of Financial Statements: The Cash Flow Statement. Financial Analysis

- Tools and Techniques - A Guide for Managers.

September 15, 2016

10

Das könnte Ihnen auch gefallen

- Cash Flow Statement - Kotak Mahindra-2019Dokument13 SeitenCash Flow Statement - Kotak Mahindra-2019MohmmedKhayyumNoch keine Bewertungen

- Financial Accounting - Want to Become Financial Accountant in 30 Days?Von EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Bewertung: 5 von 5 Sternen5/5 (1)

- StatementsDokument72 SeitenStatementswmtmtj9bpmNoch keine Bewertungen

- Cash Flow StatementDokument11 SeitenCash Flow StatementTagele gashawNoch keine Bewertungen

- Cash Flow Statement Kotak Mahindra 2016Dokument80 SeitenCash Flow Statement Kotak Mahindra 2016Nagireddy Kalluri100% (2)

- What Is A Cash Flow StatementDokument4 SeitenWhat Is A Cash Flow StatementDaniel GarciaNoch keine Bewertungen

- How Is It Important For Banks?: Investopedia SaysDokument5 SeitenHow Is It Important For Banks?: Investopedia SaysSushant Dilip SalviNoch keine Bewertungen

- Understanding Cash Flow StatementsDokument6 SeitenUnderstanding Cash Flow Statementsumair iqbalNoch keine Bewertungen

- Amaysim Australia LimitedDokument9 SeitenAmaysim Australia LimitedMahnoor NooriNoch keine Bewertungen

- Analyze Cash FlowsDokument36 SeitenAnalyze Cash Flowsthilaganadar100% (5)

- Statement of Cash FlowsDokument35 SeitenStatement of Cash Flowsonthelinealways100% (4)

- Accounting 3 Cash Flow Statement DiscussionDokument6 SeitenAccounting 3 Cash Flow Statement DiscussionNoah HNoch keine Bewertungen

- Analyze Cash Flows and Company FinancesDokument32 SeitenAnalyze Cash Flows and Company FinancesThimme Gowda RGNoch keine Bewertungen

- How to analyze a company's cash flow statementDokument1 SeiteHow to analyze a company's cash flow statementnational coursesNoch keine Bewertungen

- Análisis EmpresaDokument20 SeitenAnálisis EmpresaJorge GrubeNoch keine Bewertungen

- Statement of Cash Flows: Hascol PetroleumDokument14 SeitenStatement of Cash Flows: Hascol Petroleumtungeena waseemNoch keine Bewertungen

- Cash FlowDokument4 SeitenCash FlowRalph EgeNoch keine Bewertungen

- Cash Flow StatementDokument7 SeitenCash Flow Statementlianapha.dohNoch keine Bewertungen

- Business FinanceDokument11 SeitenBusiness Financeionvidrascu2013Noch keine Bewertungen

- Cash Flow StatementDokument4 SeitenCash Flow StatementRakin HasanNoch keine Bewertungen

- Accounting Lec - 1Dokument3 SeitenAccounting Lec - 1Fahomeda Rahman SumoniNoch keine Bewertungen

- Analyzing Financial Statements and Cash FlowDokument13 SeitenAnalyzing Financial Statements and Cash FlowAldrin John TungolNoch keine Bewertungen

- Understanding Cash Flow Analysis: File C3-14 December 2009 WWW - Extension.iastate - Edu/agdmDokument4 SeitenUnderstanding Cash Flow Analysis: File C3-14 December 2009 WWW - Extension.iastate - Edu/agdmVijayabhaskarareddy VemireddyNoch keine Bewertungen

- Financial Management - Chapter 8Dokument23 SeitenFinancial Management - Chapter 8rksp99999Noch keine Bewertungen

- Accounting QuestionsDokument12 SeitenAccounting QuestionsFLORENCE DE CASTRONoch keine Bewertungen

- Finance QuestionsDokument10 SeitenFinance QuestionsNaina GuptaNoch keine Bewertungen

- Terminalogies Used in Financial Statements and Insights From Annual ReportsDokument24 SeitenTerminalogies Used in Financial Statements and Insights From Annual ReportsKaydawala Saifuddin 20100% (1)

- Cash Flow Note (19743)Dokument10 SeitenCash Flow Note (19743)Abhimanyu Singh RaghavNoch keine Bewertungen

- Understanding Cash FlowsDokument30 SeitenUnderstanding Cash FlowsNocturnal Bee100% (1)

- Cashflow STMT of Honda MotorsDokument22 SeitenCashflow STMT of Honda Motorsmir musaweer aliNoch keine Bewertungen

- Brindha Csash Flow StatementDokument32 SeitenBrindha Csash Flow Statementgkvimal nathan100% (1)

- Technical Accounting Interview QuestionsDokument14 SeitenTechnical Accounting Interview QuestionsRudra PatidarNoch keine Bewertungen

- Task 2: Part B (Annex C) : Statement of Working Capital (FY 2015 and 2016)Dokument6 SeitenTask 2: Part B (Annex C) : Statement of Working Capital (FY 2015 and 2016)nikita pareekNoch keine Bewertungen

- Financial AnalysisDokument22 SeitenFinancial Analysisnomaan khanNoch keine Bewertungen

- Business Competitor Analysis: Finance For MarketersDokument17 SeitenBusiness Competitor Analysis: Finance For MarketersMuhammad Ramiz AminNoch keine Bewertungen

- Fundamentals of Accounting ExplainedDokument46 SeitenFundamentals of Accounting ExplainedJames OwusuNoch keine Bewertungen

- Cash Flow Statement Quarter Income StatementDokument3 SeitenCash Flow Statement Quarter Income StatementjaydipdesaiNoch keine Bewertungen

- SruidurgaDokument4 SeitenSruidurgaEswara kumar JNoch keine Bewertungen

- Chapter No. 8: Financial Statements AnalysisDokument23 SeitenChapter No. 8: Financial Statements AnalysisBalakrishna ChakaliNoch keine Bewertungen

- Cash FlowDokument19 SeitenCash FlowZulqarnain JamilNoch keine Bewertungen

- The Cash Flow StatementDokument6 SeitenThe Cash Flow Statementacuna.alexNoch keine Bewertungen

- Fixed CostDokument13 SeitenFixed CostSujith PSNoch keine Bewertungen

- Account EssayDokument11 SeitenAccount EssayJoyce TanNoch keine Bewertungen

- Cash FlowDokument19 SeitenCash FlowHira FarooqNoch keine Bewertungen

- Free Cash FlowDokument6 SeitenFree Cash FlowAnh KietNoch keine Bewertungen

- 4 Common Types of Financial Statements To Know: 1. What Is A Statmemt of Financial Position (Balance Sheets) ?Dokument15 Seiten4 Common Types of Financial Statements To Know: 1. What Is A Statmemt of Financial Position (Balance Sheets) ?Ray Allen Uy100% (1)

- Comparison of Operating ActivitiesDokument13 SeitenComparison of Operating ActivitiesPankaj MahantaNoch keine Bewertungen

- Acc English 6 - Cash Flow StatementDokument13 SeitenAcc English 6 - Cash Flow StatementEllia JuniartiNoch keine Bewertungen

- Financial Plan PerbisDokument9 SeitenFinancial Plan PerbisDamas Pandya JanottamaNoch keine Bewertungen

- Finance QuestionsDokument14 SeitenFinance QuestionsGeetika YadavNoch keine Bewertungen

- Ratio AnalysisDokument8 SeitenRatio AnalysisikramNoch keine Bewertungen

- The Cash Flow StatementsDokument13 SeitenThe Cash Flow Statementsdeo omachNoch keine Bewertungen

- Financial Statement AnalysisDokument9 SeitenFinancial Statement AnalysisQaisar BasheerNoch keine Bewertungen

- Alwadi International School Accounting Grade 12 Notes: Statement of Cash FlowsDokument14 SeitenAlwadi International School Accounting Grade 12 Notes: Statement of Cash FlowsFarrukhsgNoch keine Bewertungen

- Sample Market Analysis - 2Dokument11 SeitenSample Market Analysis - 2MohammedNoch keine Bewertungen

- Acc201 Su6Dokument15 SeitenAcc201 Su6Gwyneth LimNoch keine Bewertungen

- Financial Statements - IntroductionDokument75 SeitenFinancial Statements - Introductiontopeq100% (6)

- Ca3 Acc306 PankajDokument13 SeitenCa3 Acc306 PankajPankaj MahantaNoch keine Bewertungen

- Programming Peanutbutter and JellyDokument2 SeitenProgramming Peanutbutter and Jellynadji habibiNoch keine Bewertungen

- LGS: Session 3 73 and 74 Constitutional Amendments 23-11-2016Dokument11 SeitenLGS: Session 3 73 and 74 Constitutional Amendments 23-11-2016viewpawanNoch keine Bewertungen

- Pankaj Pawan MSP Farmers Entry Aniket Swarn Ashish Bipin: Task1 Name Plan Achievment RemarkDokument48 SeitenPankaj Pawan MSP Farmers Entry Aniket Swarn Ashish Bipin: Task1 Name Plan Achievment RemarkviewpawanNoch keine Bewertungen

- Covid Tracking Sheet - Ashish Ji - 2 - April - NewDokument6 SeitenCovid Tracking Sheet - Ashish Ji - 2 - April - NewviewpawanNoch keine Bewertungen

- Vikalpa 1993 Mookherjee 15 26Dokument10 SeitenVikalpa 1993 Mookherjee 15 26viewpawanNoch keine Bewertungen

- Sharon Construction CorpDokument12 SeitenSharon Construction CorpviewpawanNoch keine Bewertungen

- Legal Implications of PlachimadaDokument20 SeitenLegal Implications of PlachimadaviewpawanNoch keine Bewertungen

- MIS Officer Job Description and Person SpecificationDokument3 SeitenMIS Officer Job Description and Person SpecificationviewpawanNoch keine Bewertungen

- MSME Schemes English 0Dokument266 SeitenMSME Schemes English 0Sk.Abdul NaveedNoch keine Bewertungen

- MarDokument4 SeitenMarviewpawanNoch keine Bewertungen

- IRDA FAQ On General QuestionsDokument3 SeitenIRDA FAQ On General QuestionsviewpawanNoch keine Bewertungen

- Global Perspectives on the Growth of PhilanthropyDokument10 SeitenGlobal Perspectives on the Growth of PhilanthropyviewpawanNoch keine Bewertungen

- Mixed Economy: Presented by Group 3Dokument5 SeitenMixed Economy: Presented by Group 3viewpawanNoch keine Bewertungen

- Nobody Trusts The Farmer With Money' PDFDokument9 SeitenNobody Trusts The Farmer With Money' PDFviewpawanNoch keine Bewertungen

- Group 2Dokument14 SeitenGroup 2viewpawanNoch keine Bewertungen

- Mini Dal Mill for Processing PulsesDokument7 SeitenMini Dal Mill for Processing PulsesviewpawanNoch keine Bewertungen

- Safe Drinking Water Issue in Bihar VillagesDokument1 SeiteSafe Drinking Water Issue in Bihar VillagesviewpawanNoch keine Bewertungen

- Sharon Construction CorpDokument12 SeitenSharon Construction CorpviewpawanNoch keine Bewertungen

- GHHFDokument14 SeitenGHHFviewpawanNoch keine Bewertungen

- Annual Report 2012Dokument33 SeitenAnnual Report 2012Karam Vir SinghNoch keine Bewertungen

- Tender SecurityOtherServicesDokument6 SeitenTender SecurityOtherServicesviewpawanNoch keine Bewertungen

- Pulses Production (Rabi-2013-14) IN BIHAR: Department of Agriculture Government of BiharDokument13 SeitenPulses Production (Rabi-2013-14) IN BIHAR: Department of Agriculture Government of BiharviewpawanNoch keine Bewertungen

- Tender SecurityOtherServicesDokument6 SeitenTender SecurityOtherServicesviewpawanNoch keine Bewertungen

- OrgStruct 12WDokument1 SeiteOrgStruct 12WFrance Chris ChanNoch keine Bewertungen

- HRMP - Session 11 - Ethics, Employee Relations and Fair Treatment at WorkDokument5 SeitenHRMP - Session 11 - Ethics, Employee Relations and Fair Treatment at WorkviewpawanNoch keine Bewertungen

- Cooperative Equity and OwnershipDokument49 SeitenCooperative Equity and OwnershipviewpawanNoch keine Bewertungen

- HRMP - Session 6 - Training and DevelopmentDokument13 SeitenHRMP - Session 6 - Training and DevelopmentviewpawanNoch keine Bewertungen

- HRMP - Session 4 - Human Resource PlanningDokument13 SeitenHRMP - Session 4 - Human Resource PlanningviewpawanNoch keine Bewertungen

- HRMP - Session 5 - Recruitment and SelectionDokument27 SeitenHRMP - Session 5 - Recruitment and SelectionviewpawanNoch keine Bewertungen

- HRMP - Session 3 - Job AnalysisDokument13 SeitenHRMP - Session 3 - Job AnalysisviewpawanNoch keine Bewertungen

- Partnership Formation GuideDokument6 SeitenPartnership Formation GuideLee SuarezNoch keine Bewertungen

- LBO Excel ModelDokument6 SeitenLBO Excel Modelrf_1238100% (2)

- Final 4.3 Health ANIMA Nov1 4.3Dokument12 SeitenFinal 4.3 Health ANIMA Nov1 4.3Brendan KiernanNoch keine Bewertungen

- Startup Finance-A Entrepreneur ManualDokument37 SeitenStartup Finance-A Entrepreneur ManualDhananjay SharmaNoch keine Bewertungen

- General Banking Act RA 8791Dokument48 SeitenGeneral Banking Act RA 8791NHASSER PASANDALANNoch keine Bewertungen

- Financial Literacy: Challenges For Indian EconomyDokument14 SeitenFinancial Literacy: Challenges For Indian EconomyJediGodNoch keine Bewertungen

- Stock Market OrginalDokument31 SeitenStock Market OrginalKartic JainNoch keine Bewertungen

- Lecture7 STRAT CorporateStrategyDokument18 SeitenLecture7 STRAT CorporateStrategyDemonSideNoch keine Bewertungen

- ACCA Financial Reporting (FR) Further Question Practice Practice & Apply Questions & AnswersDokument7 SeitenACCA Financial Reporting (FR) Further Question Practice Practice & Apply Questions & AnswersMr.XworldNoch keine Bewertungen

- Fabm Dipolog Rice MillDokument10 SeitenFabm Dipolog Rice Millgamer boyNoch keine Bewertungen

- Introduction of Investment BankingDokument18 SeitenIntroduction of Investment Bankingshubham100% (2)

- Tertiary sector servicesDokument2 SeitenTertiary sector servicesDaniel RandolphNoch keine Bewertungen

- SABV Topic 5 QuestionsDokument5 SeitenSABV Topic 5 QuestionsNgoc Hoang Ngan NgoNoch keine Bewertungen

- CA FINAL SFM Solution Nov2011Dokument15 SeitenCA FINAL SFM Solution Nov2011Pravinn_MahajanNoch keine Bewertungen

- Indore-Smart-City-Case-Study RemnameDokument63 SeitenIndore-Smart-City-Case-Study RemnameGokul NathanNoch keine Bewertungen

- Securities Industry in IndonesiaDokument139 SeitenSecurities Industry in Indonesiathe1uploaderNoch keine Bewertungen

- Westminsterresearch: Eva and Shareholder Value Creation: An Empirical Study Wajeeh ElaliDokument195 SeitenWestminsterresearch: Eva and Shareholder Value Creation: An Empirical Study Wajeeh Elalijafar11Noch keine Bewertungen

- Standalone Balance Sheet (Tata Motors) : AssetsDokument43 SeitenStandalone Balance Sheet (Tata Motors) : AssetsAniketNoch keine Bewertungen

- RM PPT SwapDokument10 SeitenRM PPT SwappankajkubadiyaNoch keine Bewertungen

- Commodity MarketDokument88 SeitenCommodity MarketShravan TilluNoch keine Bewertungen

- Tally Assignment AfrozDokument17 SeitenTally Assignment AfrozAfrozNoch keine Bewertungen

- Malaysian Airline SWOT Analysis Highlights Strengths, Weaknesses, Opportunities, ThreatsDokument5 SeitenMalaysian Airline SWOT Analysis Highlights Strengths, Weaknesses, Opportunities, ThreatsutemianNoch keine Bewertungen

- Advanced Financial Accounting and Reporting Accounting For PartnershipDokument6 SeitenAdvanced Financial Accounting and Reporting Accounting For PartnershipMaria BeatriceNoch keine Bewertungen

- Transitional Living Program For Young AdultsDokument5 SeitenTransitional Living Program For Young AdultsBrian HaraNoch keine Bewertungen

- My Crusade Against Permanent Gold BackwardationDokument12 SeitenMy Crusade Against Permanent Gold BackwardationlarsrordamNoch keine Bewertungen

- Sample Company Profile-TCSDokument25 SeitenSample Company Profile-TCSSALONI JaiswalNoch keine Bewertungen

- Deloitte Approach On IRRBBDokument4 SeitenDeloitte Approach On IRRBBraiden9413Noch keine Bewertungen

- Macroeconomics Midterm Exam KeyDokument8 SeitenMacroeconomics Midterm Exam Keyshush10Noch keine Bewertungen

- Wise & Co., Inc. v. Meer (June 30, 1947)Dokument13 SeitenWise & Co., Inc. v. Meer (June 30, 1947)Crizza RondinaNoch keine Bewertungen

- Singer Annual Report 2011Dokument88 SeitenSinger Annual Report 2011Cryptic MishuNoch keine Bewertungen

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Von EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Bewertung: 4.5 von 5 Sternen4.5/5 (5)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?Von EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Bewertung: 5 von 5 Sternen5/5 (1)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Von EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Bewertung: 4.5 von 5 Sternen4.5/5 (12)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindVon EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindBewertung: 5 von 5 Sternen5/5 (231)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesVon EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesBewertung: 4.5 von 5 Sternen4.5/5 (30)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaVon EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaBewertung: 4.5 von 5 Sternen4.5/5 (14)

- Financial Accounting For Dummies: 2nd EditionVon EverandFinancial Accounting For Dummies: 2nd EditionBewertung: 5 von 5 Sternen5/5 (10)

- Profit First for Therapists: A Simple Framework for Financial FreedomVon EverandProfit First for Therapists: A Simple Framework for Financial FreedomNoch keine Bewertungen

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItVon EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItBewertung: 5 von 5 Sternen5/5 (13)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantVon EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantBewertung: 4.5 von 5 Sternen4.5/5 (146)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesVon EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNoch keine Bewertungen

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsVon EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNoch keine Bewertungen

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Von EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Bewertung: 4.5 von 5 Sternen4.5/5 (14)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanVon EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanBewertung: 4.5 von 5 Sternen4.5/5 (79)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetVon EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNoch keine Bewertungen

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyVon EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyBewertung: 5 von 5 Sternen5/5 (1)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisVon EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisBewertung: 5 von 5 Sternen5/5 (6)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistVon EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistBewertung: 4.5 von 5 Sternen4.5/5 (73)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthVon EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNoch keine Bewertungen

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityVon EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityBewertung: 4.5 von 5 Sternen4.5/5 (4)

- Value: The Four Cornerstones of Corporate FinanceVon EverandValue: The Four Cornerstones of Corporate FinanceBewertung: 4.5 von 5 Sternen4.5/5 (18)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsVon EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsBewertung: 4 von 5 Sternen4/5 (7)