Beruflich Dokumente

Kultur Dokumente

Sector Analysis - Automobile (India)

Hochgeladen von

Cheetal SuroliaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Sector Analysis - Automobile (India)

Hochgeladen von

Cheetal SuroliaCopyright:

Verfügbare Formate

SECTOR ANALYSIS- AUTOMOBILE (INDIA)

India being the developing nation generates higher opportunities for the automobile industry.

With the advancement in technology, growth in purchasing power and standard of living of the

population the demand for automobile is rising day by day. The Indian automotive market is one

of the most competitive markets with low cost, which make it an attractive assembly base for

foreign automotive manufacturers. India is the second fastest growing automobile market in the

world after China. Cars is the major segment in the Indian automotive industry with a growth

rate of more than 19% annually. The Indian car industry is witnessing a shift in demand going

from two wheelers to cars due to rising availability of low cost cars and the car being a symbol

of high prestige.

It is estimated that by 2016, Indian automotive industry will become the third largest industry

and worlds second largest two wheeler manufacturer. By 2020, it is estimated that Indias share

in the global passenger vehicle market to double to 8% from 4% over 2010-11. It is also

estimated that two wheeler production will rise from 16.9 million in financial year 2014 to 28.8

million by financial year 2021. It is also estimated that passenger vehicle sales will nearly triple

by 2021 with passenger vehicle production to increase from 3.1 million in financial year 2014 to

10 million in financial year 2021.

ADVANTAGE IN INDIA

Growing Demand

Strong growth in demand due to rising income, middle class, and a young population is

likely to propel India among the worlds top five auto manufacturers by 2015.

Growth in export demand is set to accelerate.

Innovation Opportunities

Tata Nano and the upcoming Pixel have opened up the potentially large ultra low-cost car

segment.

Innovation is likely to intensify among engine technology and alternative fuels.

Rising Investments

India has significant cost advantages; auto firms save 10-25 per cent on operations vis-vis Europe and Latin America.

A large pool of skilled manpower and a growing technology base would induce greater

investments.

Policy Support

The government aims to develop India as a global manufacturing as well as R&D hub.

There has been a wide array of policy support in the form of sops, taxes and FDI

encouragement.

EVOLUTION OF INDIAN AUTOMOTIVES SECTOR

BEFORE 1982(0.4 million units in 1982)

Closed market.

Five players.

Long waiting periods and outdated models.

Sellers market.

1983-1992(0.6 million units in 1992)

Joint Venture (JV): Indian government and Suzuki formed Maruti Udyog; commenced production in

1983.

Component manufacturers entered the market via JV.

Buyers market.

1993-2007(11 million units in 2007)

Sector de-licensed in 1993.

Major Original Equipment Manufacturers (OEMs) started assembly operations in India.

Imports permitted from April 2001.

Introduction of value- added tax in 2005.

2008 ONWARDS (21.5 million units in 2014)

More than 35 market players.

Removal of most import controls.

Indian companies gaining acceptance on a global scale.

Setting up of National Automotive Board to act as facilitator between the government and industry.

Government has proposed GST to support lower raw material cost.

SWOT ANALYSIS

STRENGHTS

Investments by foreign car manufacturers.

Increase in the export levels.

Low cost and cheap labor.

Rise in working and middle class income.

Increasing demand for European quality.

Large pool of engineers.

Expert skills in producing small cars good for environment.

WEAKNESSES

Low quality compared to other automotive countries.

Low labor productivity.

High interest rate and overhead level.

Production cost higher than China.

Low investment in R&D area.

OPPORTUNITIES

Growing population in the country.

Focus from the government in improving the road infrastructure.

Rising living standards.

Increase in income level.

Better car technology is demanded.

Rising rural demand.

Increase in the number of women drivers.

THREATS

Less skilled labor.

Lack of technology for Indian companies.

Increase in the import tariff and technology cost.

Increased congestion in urban areas.

Smaller players do not fulfill international standards.

NOTABLE TRENDS IN THE INDIAN AUTOMOTIVES SECTOR

NEW PRODUCT LAUNCHES

Large number of products available to consumers across various segments; this has gathered pace

with the entry of a number of foreign players.

Reduced overall product lifecycle have forced players to employ quick product launches.

IMPROVING PRODUCT DEVELOPMENT CAPABILITIES

Increasing R&D investments from both the government and the private sector.

Private sector innovation has been a key determinant of growth in the sector; two good examples

are Tata Nano and Tata Pixel; while the former has been a success in India, the latter is intended

for foreign markets.

ALTERNATIVE FUELS

In FY11, the CNG market was worth more than USD330 million; CNG cars and taxis are

expected to register a CAGR of 28 per cent over FY11FY14.

The CNG distribution network in India is expected to increase to 250 cities by 2018 from 30

cities in 2009.

NEW FINANCING OPTIONS

Carmakers such as BMW, Audi, Toyota, Skoda, Volkswagen and Mercedes-Benz have started

providing customized finance to customers through NBFCs.

Major MNC and Indian corporate houses are moving towards taking cars on operating lease

instead of buying them.

CHEETAL SUROLIA

15S616

SECTION 6

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Salumber ProjectDokument103 SeitenSalumber ProjectVandhana RajasekaranNoch keine Bewertungen

- Boeing 247 NotesDokument5 SeitenBoeing 247 Notesalbloi100% (1)

- A Job InterviewDokument8 SeitenA Job Interviewa.rodriguezmarcoNoch keine Bewertungen

- Question BankDokument42 SeitenQuestion Bank02 - CM Ankita AdamNoch keine Bewertungen

- 09 20 17Dokument26 Seiten09 20 17WoodsNoch keine Bewertungen

- University of MauritiusDokument4 SeitenUniversity of MauritiusAtish KissoonNoch keine Bewertungen

- Standard Wiring Colors - Automation & Control Engineering ForumDokument1 SeiteStandard Wiring Colors - Automation & Control Engineering ForumHBNBILNoch keine Bewertungen

- BroucherDokument2 SeitenBroucherVishal PoulNoch keine Bewertungen

- Guide To Downloading and Installing The WebMethods Free Trial Version - Wiki - CommunitiesDokument19 SeitenGuide To Downloading and Installing The WebMethods Free Trial Version - Wiki - CommunitiesHieu NguyenNoch keine Bewertungen

- White and Yellow Reflective Thermoplastic Striping Material (Solid Form)Dokument2 SeitenWhite and Yellow Reflective Thermoplastic Striping Material (Solid Form)FRANZ RICHARD SARDINAS MALLCONoch keine Bewertungen

- Role of SpeakerDokument11 SeitenRole of SpeakerSnehil AnandNoch keine Bewertungen

- Addendum No.1: Indianapolis Metropolitan Airport T-Hangar Taxilane Rehabilitation IAA Project No. M-12-032Dokument22 SeitenAddendum No.1: Indianapolis Metropolitan Airport T-Hangar Taxilane Rehabilitation IAA Project No. M-12-032stretch317Noch keine Bewertungen

- Drg-25 Parts List: Key No Parts No Parts Name Key No Parts No Parts NameDokument1 SeiteDrg-25 Parts List: Key No Parts No Parts Name Key No Parts No Parts NameGergely IvánovicsNoch keine Bewertungen

- Comprehensive Drug Abuse Prevention and Control Act of 1970Dokument2 SeitenComprehensive Drug Abuse Prevention and Control Act of 1970Bryan AbestaNoch keine Bewertungen

- MAYA1010 EnglishDokument30 SeitenMAYA1010 EnglishjailsondelimaNoch keine Bewertungen

- 2018 Master Piping Products Price ListDokument84 Seiten2018 Master Piping Products Price ListSuman DeyNoch keine Bewertungen

- ACC 101 - 3rd QuizDokument3 SeitenACC 101 - 3rd QuizAdyangNoch keine Bewertungen

- Manual Teclado GK - 340Dokument24 SeitenManual Teclado GK - 340gciamissNoch keine Bewertungen

- 1178-Addendum-Change in Sponsor - HDFC LTD To HDFC Bank - July 1, 2023Dokument3 Seiten1178-Addendum-Change in Sponsor - HDFC LTD To HDFC Bank - July 1, 2023Jai Shree Ambe EnterprisesNoch keine Bewertungen

- UNIT 2 - ConnectivityDokument41 SeitenUNIT 2 - ConnectivityZain BuhariNoch keine Bewertungen

- (English) 362L Stereoselective Wittig Reaction - Synthesis of Ethyl Trans-Cinnamate (#7) (DownSub - Com)Dokument6 Seiten(English) 362L Stereoselective Wittig Reaction - Synthesis of Ethyl Trans-Cinnamate (#7) (DownSub - Com)moNoch keine Bewertungen

- MBA-CM - ME - Lecture 16 Market Structure AnalysisDokument11 SeitenMBA-CM - ME - Lecture 16 Market Structure Analysisrohan_solomonNoch keine Bewertungen

- Webdynpro ResumeDokument4 SeitenWebdynpro ResumeAmarnath ReddyNoch keine Bewertungen

- Msds 77211 enDokument13 SeitenMsds 77211 enJulius MwakaNoch keine Bewertungen

- A 150.xx Service Black/ITU Cartridge Motor Error On A Lexmark C54x and X54x Series PrinterDokument4 SeitenA 150.xx Service Black/ITU Cartridge Motor Error On A Lexmark C54x and X54x Series Printerahmed salemNoch keine Bewertungen

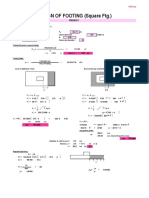

- Design of Footing (Square FTG.) : M Say, L 3.75Dokument2 SeitenDesign of Footing (Square FTG.) : M Say, L 3.75victoriaNoch keine Bewertungen

- Class Assignment 2Dokument3 SeitenClass Assignment 2fathiahNoch keine Bewertungen

- Week 17-Animal NutritionDokument18 SeitenWeek 17-Animal NutritionEugine Paul RamboyonNoch keine Bewertungen

- Installing Oracle Fail SafeDokument14 SeitenInstalling Oracle Fail SafeSantiago ArgibayNoch keine Bewertungen

- Assignment of Killamsetty Rasmita Scam 1992Dokument8 SeitenAssignment of Killamsetty Rasmita Scam 1992rkillamsettyNoch keine Bewertungen