Beruflich Dokumente

Kultur Dokumente

Calamity HMDF

Hochgeladen von

chennieCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Calamity HMDF

Hochgeladen von

chennieCopyright:

Verfügbare Formate

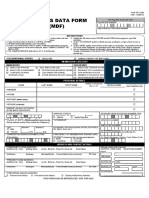

HQP-SLF-066

CALAMITY LOAN

APPLICATION FORM (CLAF)

For IISP

LAST NAME

FIRST NAME

AGREEMENT ID

(TO BE FILLED OUT BY APPLICANT)

Type or print entries

NAME EXTENSION (e.g., Jr., II)

MIDDLE NAME

MAIDEN NAME

MARITAL STATUS

(For married women) Single/Unmarried

Widow/er

Legally Separated

Married

PRESENT HOME ADDRESS

Unit/Room No., Floor

Subdivision

Municipality/City

BIRTHDATE

mm

Barangay

Building Name

Lot No., Block No., Phase No. House

Province/State/Country (if abroad

BIRTHPLACE

dd

Street Name MOBILE PHONE No. (Required)

HOME TEL. No.

ZIP Code

Pag-IBIG MID No. /RTN

SEX

Male

MOTHER'S MAIDEN NAME

Female

LOAN PURPOSE

yyyy

EMPLOYER/BUSINESS NAME

EMPLOYER/BUSINESS ADDRESS

Street Name

Annulled

Subdivision

OFFICE TEL. NO.

Unit/Room No., Floor

Barangay

TYPE OF LOAN

New

Renewal

Building Name

Municipality/City

Lot No., Block No., Phase No. House FOR AFP EMP-SERIAL/ACCOUNT No.

FOR DECS EMP - DIV. CODE/STATION CODE/

EMPLOYEE No.

Province/State/Country (if abroad)

ZIP Code TIN

SSS/GSIS ID No.

EMPLOYMENT HISTORY FROM DATE OF Pag-IBIG MEMBERSHIP (Use another sheet if necessary)

NAME OF EMPLOYER

DATE OF Pag-IBIG MEMBERSHIP

ADDRESS

IN THE EVENT OF THE APPROVAL OF MY APPLICATION FOR CALAMITY LOAN,

I HEREBY AUTHORIZE Pag-IBIG FUND TO CREDIT MY LOAN PROCEEDS

THROUGH MY PAYROLL ACCOUNT/DISBURSEMENT CARD THAT I HAVE

INDICATED ON THE RIGHT PORTION.

(Mo.Yr.)

FROM (Mo./Yr.)

SIGNATURE OF APPLICANT

TO (Mo./Yr.)

MEMBER'S PAYROLL ACCOUNT/DISBURSEMENT CARD NUMBER

NAME OF BANK/BRANCH

BANK ADDRESS

APPLICATION AGREEMENT

In consideration of the loan that may be granted by virtue of this application subject to the pertinent provisions of

the Implementing Rules and Regulations of Pag-IBIG Fund, I hereby waive my rights under R.A. No. 1405 and

authorize Pag-IBIG Fund to verify/validate my payroll account/disbursement card. Furthermore, I hereby

authorize my present employer

__________________________________________________________________________ or any employer

with whom I may get employed in the future, to deduct the monthly Pag-IBIG contribution and amortization due

from my salary and remit the same to Pag-IBIG Fund. If the resulting monthly net take home pay after deducting

the computed monthly amortization on Calamity Loan falls below the monthly net take home pay as required

under the GAA/company policy, I authorize Pag-IBIG Fund to compute for a lower loanable amount.

I understand that should I fail to pay the monthly amortization due, I shall be charged a penalty of 1/20 of 1% of

any unpaid amount for every day of delay.

If for any reason excess loan proceeds are erroneously credited to my payroll account/disbursement card, I

hereby authorize Pag-IBIG Fund to debit/deduct the excess amount from my account without need of further

notice of demand. Should my account balance be insufficient, the Fund has the right to demand for the excess

amount to be refunded.

This office agrees to collect the corresponding monthly

amortizations on this loan and the monthly contributions of

herein applicant through payroll deduction, together with the

employer counterpart contributions, and remit said amounts

to Pag-IBIG Fund on or before the 15 th day of every month, for

the duration that the loan remains outstanding. However,

should we deduct the monthly amortization due from the

applicant's salary but failed to remit it on due date, this office

agrees to shoulder the corresponding penalty charged to

applicant equivalent to 1/20 of 1% of any unpaid amount for

every day of delay and penalty for non-remittance

equivalent to 1/10 of 1% per day of delay of the amount

payable from the date the loan amortizations or payments

fall due until paid.

_________________________________________

HEAD OF OFFICE OR AUTHORIZED SIGNATORY

(Signature over printed name)

I certify that the information given and any or all statements made herein are true and correct to the best of my

knowledge and belief. I hereby certify under pain of perjury that my signature appearing herein is genuine and

authentic.

________________________________________________

DESIGNATION

_______________

Pag-IBIG

EMPLOYER ID NO.

________________________________

Signature of Applicant over Printed Name

______________

AGENCY CODE

____________

BRANCH CODE

PROMISSORY NOTE

For value received, I promise to pay on due date without need of demand to the order of PagIBIG Fund with principal office at Petron MegaPlaza, 358 Sen. Gil Puyat Avenue, City of Makati, the

sum of Pesos:

(P_______________) Philippine Currency, with the interest rate of 5.95% p.a. for the duration of

the loan.

I hereby waive notice of demand for payment and agree that any legal action, which may

arise in relation to this note, may be instituted in the proper court of Makati City.

Finally, this note shall likewise be subject to the following terms and conditions:

1. The borrower shall pay the amount of Pesos: _______________________________

(P_______________) through salary deduction, whenever feasible over a period of 24

months with a grace period of 3 months. In case of suspension from work, leave of

absence without pay, or insufficiency of take home pay during the term of the loan,

payments should be made directly to the Pag-IBIG Fund office where the loan was

released.

2. Payments are due on or before the ___________________ of the month starting on

_________________________ and 23 succeeding months thereafter.

3. Payments made by the borrower after due date shall be applied in the following order of

priorities: Penalties, Interest and Principal.

4. A penalty of 1/20 of 1% of any unpaid amount for every day of delay shall be charged to the

borrower.

5. The borrower shall be considered in default in any of the following cases:

a. Any willful misrepresentation made by the borrower in any of the documents executed

in relation hereto.

b. Failure of the borrower to pay any 3 consecutive monthly amortizations.

Signed in the presence of:

_________________________

_________________________

Witness

Witness

(Signature over Printed Name)

(Signature over Printed Name)

c. Failure of the borrower to pay any 3 consecutive Pag-IBIG Fund monthly contributions.

d. Violation made by the borrower of any of the policies, rules, regulations and guidelines of

Pag-IBIG Fund.

6. In the event of default, the outstanding loan obligation shall become due and demandable. As

a consequence thereof, the outstanding loan obligation, consisting of the principal, interest

and penalties shall be subjected to offsetting against the borrowers Total Accumulated Value

(TAV). ). However, immediate offsetting of the borrowers outstanding loan obligation may be

effected immediately upon approval of the borrowers request, provided such request is

based on the following justifiable reasons and upon validation by the Fund: Borrowers

unemployment; illness of the member-borrower or any of his immediate family member as

certified by a licensed physician, by reason thereof, resulted in his failure to pay the required

amortizations when due; or death of any of his immediate family members, by reason thereof,

resulted in his failure to pay the required amortizations when due.

7. In the event of membership termination prior to loan maturity, any outstanding loan balance,

including the unpaid interest, penalties and charges, shall be deducted from the borrowers

TAV and/or any amount due him or his beneficiaries in the possession of the Fund.

8. In case of falsification, misrepresentation or any similar acts committed by the borrower, PagIBIG Fund shall automatically suspend his loan privileges indefinitely. The borrower shall

abide with all the applicable rules and regulations governing this lending program that PagIBIG Fund may promulgate from time to time.

___________________________________

Signature of Applicant over Printed Name

SIGNATURE OF APPLICANT

In case of retirement/separation from employment, I hereby authorize my employer to deduct any outstanding Calamity loan balance from my

retirement or separation benefits to fully settle my loan obligation. In the event that my retirement/separation benefits is not sufficient to settle

the outstanding balance of my Calamity Loan or my employer fails for whatever reason, to deduct the same from said retirement/separation

benefits, I hereby authorize Pag-IBIG Fund to apply whatever benefits are due me from the Fund to settle the said obligation.

THIS PORTION IS FOR Pag-IBIG FUND USE ONLY

CLAIM/HOUSING LOAN/STL VERIFICATION

PARTICULARS

NONE

WITH

DV/CHECK NO. / APPLICATION NO.

DATE FILED / DV NO.

VERIFIED

DATE

CLAIMS

HOUSING LOAN

MPL/CL

LOAN APPROVAL

LOAN AMOUNT GRANTED

REVIEWED BY

INTEREST

DATE

PREVIOUS LOAN BALANCE

APPROVED BY

LOAN PROCEEDS

DATE

MONTHLY AMORT

DISAPPROVED BY

DATE

NOTE: A notification on the approval/disapproval of the application shall be sent through SMS. For disapproved application, you may claim your submitted application form and supporting documents within five (5)

working days upon receipt of the notification, otherwise such documents shall be disposed.

THIS FORM CAN BE REPRODUCED. NOT FOR SALE

(11/2012)

GUIDELINES AND INSTRUCTIONS

A. Who May File

CERTIFICATE OF NET PAY

NAME OF BORROWER

Any Pag-IBIG Fund member who satisfies the following requirements may apply for a calamity

loan:

1. The member has made at least 24 monthly contributions.

2. Has made five (5) MCs for the last six (6) months as of month prior to date of loan application

and commits to continuously remit contributions at least for the term of the loan.

3. If with existing Pag-IBIG Housing Loan and/or Multi-Purpose Loan (MPL) and/or Calamity

Loan, the account must not be in default as of date of application.

4. The member is a resident of the area which is declared under a state of calamity.

B. Availment Period

The loan shall be availed within a period of ninety (90) days from the declaration of the calamity.

C. How to File

For the month of:

__________________

Basic Salary

__________________

Add: Allowances

The applicant shall:

1. Secure the Calamity Loan Application Form (CLAF) from any Pag-IBIG Fund NCR/Regional

branch.

2. Accomplish 1 copy of the application form.

3. Attach photocopy of payroll account/disbursement card/deposit slip (for newly-opened

account).

4. Submit complete application, together with the required documents to any Pag-IBIG Fund

NCR/Regional branch. Processing of loans shall commence only upon submission of

complete documents.

D. Loan Features

________________________

___________

________________________

___________

________________________

___________

________________________

___________

________________________

___________

________________________

___________

Gross Monthly Income

___________

Less: Deductions

________________________

___________

________________________

___________

________________________

___________

________________________

___________

________________________

___________

Total Deductions

___________

Net Monthly Income

___________

Issued this _______ day of ____________, 20__.

I certify under pain of perjury that the abovementioned information is true and correct.

1. Loan Entitlement

The loanable amount shall be 80% of the members Total Accumulated Value (TAV). However,

for members with existing MPL, the loanable amount shall be the difference between 80% of

the borrowers TAV and the outstanding balance of his MPL.

2. Capacity to Pay

An eligible borrowers loan shall be limited to an amount for which statutory deductions,

the monthly repayment of principal and interest, and other obligations will not render the

borrowers net take home pay to fall below the minimum requirement as prescribed by the

General Appropriation Act (GAA) or company policy, whichever is applicable.

3. Interest

The loan shall be charged interest based on the Funds Risk-Based Pricing Framework for the

entire duration of the loan including the grace period.

4. Loan Period

The loan shall be amortized over a period of 24 months with a grace period of three (3)

months.

5. Loan Payments

5.1 The loan shall be paid in equal monthly payments in such amounts as may fully cover the

obligation over the loan period. Said payments shall be made whenever feasible, through

salary deduction.

5.2 Payments shall be remitted to Pag-IBIG Fund on or before the fifteenth (15 th) day of each

month starting on the fourth (4th) month following the date on the DV/Check.

5.3 Payments shall be applied according to the following order of priorities:

a) Penalties

b) Interest

c) Principal

5.4 Accelerated Payments - any amount in excess of the required monthly amortization shall

be applied to future amortizations when due.

5.5 The borrower may fully pay the outstanding balance of the loan prior to loan maturity.

5.6 The borrower shall pay directly to the Fund in case the borrower is unable to pay through

salary deduction for any of the following circumstances such as but not limited to:

a. Suspension from work

b. Leave of absence without pay

c. Insufficiency of take home pay at any time during the term of the loan

6. Loan Release

The loan proceeds shall be released through any of the following modes:

a) Crediting to the borrowers payroll account/disbursement card;

b) Crediting to the borrowers bank account through LANDBANKs Payroll Credit Systems

Validation (PACSVAL);

c) Through check payable to the borrower;

d) Other similar modes of payment.

7. Penalty

A penalty of 1/20 of 1% of any unpaid amount shall be charged to the borrower for every day

of delay. Said penalty shall only be reversed upon presentation of proof that the non-payment

of amortization is due to the fault of the employer.

However, for member-borrowers paying their calamity loans through automatic salary

deduction, no penalty shall be charged against the borrower, if non-payment of the loan is

due to the fault of the employer. The said penalties including the penalty for non-remittance

equivalent to 1/10 of 1% per day of delay of the amount payable from the date the loan

amortizations or payments fall due until paid shall then be charged against the employer.

8. Default

The borrower shall be in default in any of the following cases:

a. Any willful representation made by the borrower in any of the documents executed in

relation hereto.

b. Failure of the borrower to pay any three (3) consecutive Pag-IBIG monthly amortizations.

c. Failure of the borrower to pay any three (3) consecutive Pag-IBIG monthly savings.

d. Violation by the borrower of any of the policies, rules, regulations and guidelines of PagIBIG Fund.

E. Other Loan Provisions

______________________________________________

HEAD OF OFFICE/AUTHORIZED SIGNATORY

(Signature over printed name)

1. The Calamity Loan and MPL programs shall be treated separate and distinct from each other.

Hence, the member shall be allowed to avail of a Calamity Loan while he still has an

outstanding MPL, and vice versa. In no case, however, shall the aggregate short-term loan

exceed eighty percent (80%) of the borrowers TAV.

2. For member-borrower with existing MPL at the time of availment of Calamity Loan, the

outstanding loan balance of the MPL shall not be applied to the proceeds of the Calamity

Loan.

I hereby authorize ______________________________,

our Fund Coordinator or Liaison Officer to file my

Calamity Loan Application and receive the Pag-IBIG Fund

Check in my behalf.

________________________________

Signature of Applicant over Printed Name

F. Loan Renewal

Should another calamity occur in the same area, a borrower may renew his calamity loan

anytime. The outstanding balance of his existing loan, together with any accrued interests,

penalties and charges, shall be deducted from the proceeds of the new loan.

Das könnte Ihnen auch gefallen

- Ford Wiring DiagramsDokument59 SeitenFord Wiring DiagramsSkidanje Uputstava72% (145)

- Your Own Intl TrustDokument17 SeitenYour Own Intl TrustCredServicos SA100% (5)

- How To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionVon EverandHow To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionNoch keine Bewertungen

- Care Credit AppDokument7 SeitenCare Credit AppwvhvetNoch keine Bewertungen

- Credit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsVon EverandCredit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsNoch keine Bewertungen

- Fix Your Credit Score: Add Up To 100 Points in 30 Days or LessVon EverandFix Your Credit Score: Add Up To 100 Points in 30 Days or LessNoch keine Bewertungen

- Profit Sharing AgreementDokument4 SeitenProfit Sharing Agreementchennie50% (2)

- Credit Report Secrets: How to Understand What Your Credit Report Says About You and What You Can Do About It!Von EverandCredit Report Secrets: How to Understand What Your Credit Report Says About You and What You Can Do About It!Bewertung: 1 von 5 Sternen1/5 (1)

- Promissory Note OrigDokument2 SeitenPromissory Note Origcarlo laguraNoch keine Bewertungen

- Non-Profit Organizations: Learning ObjectivesDokument12 SeitenNon-Profit Organizations: Learning Objectivesbobo kaNoch keine Bewertungen

- Sample SPADokument3 SeitenSample SPAiamyni96% (26)

- Sample SPADokument3 SeitenSample SPAiamyni96% (26)

- How to Raise your Credit Score: Proven Strategies to Repair Your Credit Score, Increase Your Credit Score, Overcome Credit Card Debt and Increase Your Credit Limit Volume 2Von EverandHow to Raise your Credit Score: Proven Strategies to Repair Your Credit Score, Increase Your Credit Score, Overcome Credit Card Debt and Increase Your Credit Limit Volume 2Noch keine Bewertungen

- Leynes vs. CoaDokument8 SeitenLeynes vs. CoaRustom IbañezNoch keine Bewertungen

- Distribution Agreement TemplateDokument27 SeitenDistribution Agreement TemplateQiuyu ChenNoch keine Bewertungen

- Distribution Agreement TemplateDokument27 SeitenDistribution Agreement TemplateQiuyu ChenNoch keine Bewertungen

- H LoanDokument136 SeitenH LoanElango PaulchamyNoch keine Bewertungen

- Al 01Dokument2 SeitenAl 01chennie100% (1)

- How to Increase or Build Your Credit Score in One Month: Add Over 100 Points Without The Need of Credit Repair ServicesVon EverandHow to Increase or Build Your Credit Score in One Month: Add Over 100 Points Without The Need of Credit Repair ServicesBewertung: 3 von 5 Sternen3/5 (1)

- FLS011 Application For PenCon Special STLDokument2 SeitenFLS011 Application For PenCon Special STLwillienorNoch keine Bewertungen

- Roshan Second ProjectDokument51 SeitenRoshan Second ProjectMir WaisNoch keine Bewertungen

- Types of Business LetterDokument13 SeitenTypes of Business LetterWalaa Elamry94% (47)

- Lean Pricing StartupsDokument31 SeitenLean Pricing StartupsJuan PC100% (2)

- Multi-Purpose Loan Application Form (MPLAF, HQP-SLF-001, V01) EDS2Dokument2 SeitenMulti-Purpose Loan Application Form (MPLAF, HQP-SLF-001, V01) EDS2Edelyn Lindero Ambos100% (1)

- SLF002 Calamity Loan Application FormDokument2 SeitenSLF002 Calamity Loan Application FormRoy NarapNoch keine Bewertungen

- SSS Form Salary LoanDokument4 SeitenSSS Form Salary LoanMikoy Lacson100% (4)

- Asian Homes - Pag-IBIG Multi-Purpose Loan ApplicationDokument1 SeiteAsian Homes - Pag-IBIG Multi-Purpose Loan ApplicationRodolfo Gamboa Pinzon100% (1)

- SSS Member Loan ApplicationDokument2 SeitenSSS Member Loan ApplicationRj Santos95% (20)

- A Young Engineer Applied For A Position That Was To Last Six MonthsDokument6 SeitenA Young Engineer Applied For A Position That Was To Last Six MonthsNeco Carlo PalNoch keine Bewertungen

- Distribution AgreementDokument4 SeitenDistribution AgreementAmel Sanhaji100% (1)

- Juridical Entity Application For Regular License: License Control No.: Type of License: LRR LCRDokument1 SeiteJuridical Entity Application For Regular License: License Control No.: Type of License: LRR LCRchennie92% (12)

- Bank Authorization (BA) FormDokument4 SeitenBank Authorization (BA) FormAilec FinancesNoch keine Bewertungen

- Pag-Ibig Multi Purpose Loan Application FormDokument2 SeitenPag-Ibig Multi Purpose Loan Application Formhailglee192580% (5)

- Contemporary Issues in Accounting MCQ PDFDokument16 SeitenContemporary Issues in Accounting MCQ PDFKamal samaNoch keine Bewertungen

- MGB Form 29-13Dokument1 SeiteMGB Form 29-13chennieNoch keine Bewertungen

- CLSADokument218 SeitenCLSAHanan Asrawi MustafaNoch keine Bewertungen

- Deed of Absolute Sale of TractorsDokument2 SeitenDeed of Absolute Sale of Tractorschennie25% (4)

- The Rice Bistro PowerpointDokument69 SeitenThe Rice Bistro PowerpointChienny HocosolNoch keine Bewertungen

- Account Opening Form BOIDokument4 SeitenAccount Opening Form BOIhrocking1Noch keine Bewertungen

- Welcome To Prosperous Living: Application FormDokument6 SeitenWelcome To Prosperous Living: Application FormHeeresh Kumar AryaNoch keine Bewertungen

- Calamity Loan Application Form (CLAF, HQP-SLF-066) (Applicable To Imus Branch Members Only)Dokument2 SeitenCalamity Loan Application Form (CLAF, HQP-SLF-066) (Applicable To Imus Branch Members Only)egabad78% (9)

- Pagibig Calamity LoanDokument2 SeitenPagibig Calamity LoanJenny Mauricio BassigNoch keine Bewertungen

- Calamity LoanDokument2 SeitenCalamity LoanJu LanNoch keine Bewertungen

- PagIbig SLF001 MultiPurposeLoanApplicationForm (MPLAF) 065Dokument2 SeitenPagIbig SLF001 MultiPurposeLoanApplicationForm (MPLAF) 065gosmiley100% (1)

- Pag-IBIG Fund Multi Purpose Loan Application SLF001 V03Dokument2 SeitenPag-IBIG Fund Multi Purpose Loan Application SLF001 V03Jazz Adaza67% (3)

- SLF002 CalamityLoanApplication V05-2Dokument2 SeitenSLF002 CalamityLoanApplication V05-2LouiseNoch keine Bewertungen

- FLS020 HDMF Calamity Loan Application Form Aug 09 - 092809 - FDokument2 SeitenFLS020 HDMF Calamity Loan Application Form Aug 09 - 092809 - FRochelle Esteban100% (2)

- SLF001 MultiPurposeLoanApplicationForm (MPLAF) V01Dokument2 SeitenSLF001 MultiPurposeLoanApplicationForm (MPLAF) V01mitzi_0350% (2)

- HDMF Mplaf-Stl SampleDokument2 SeitenHDMF Mplaf-Stl SampleHarold Quindica DaronNoch keine Bewertungen

- FLS010 HDMF MPL Application Form Aug 09 - 092809Dokument2 SeitenFLS010 HDMF MPL Application Form Aug 09 - 092809Amz Sau Bon100% (1)

- Pagibig Loan Fill in Form2Dokument2 SeitenPagibig Loan Fill in Form2froilan1010100% (1)

- Emerson Rosaupan Calamity LoanDokument3 SeitenEmerson Rosaupan Calamity LoanErere RosaupanNoch keine Bewertungen

- Policy Surrender Form PDFDokument2 SeitenPolicy Surrender Form PDF1012804201Noch keine Bewertungen

- Application For Provident BenefitDokument2 SeitenApplication For Provident BenefitcaesarbaNoch keine Bewertungen

- Salary and Medal New Form2Dokument3 SeitenSalary and Medal New Form2diamajolu gaygons100% (1)

- Mandate Form For Electronic Transfer of Claim / Refund Payments To Bajaj Allianz General Insurance Company LTDDokument1 SeiteMandate Form For Electronic Transfer of Claim / Refund Payments To Bajaj Allianz General Insurance Company LTDSwarup GadeNoch keine Bewertungen

- Partial Withdrawal FormDokument2 SeitenPartial Withdrawal FormPinkys Venkat100% (1)

- Standard PN For Corporation - Aug2021Dokument2 SeitenStandard PN For Corporation - Aug2021Jose Rico ColigadoNoch keine Bewertungen

- MetlifeDokument2 SeitenMetlifeShantu ShirurmathNoch keine Bewertungen

- Regular Policy Loan Applicationnnb BBGHJN Form 3Dokument2 SeitenRegular Policy Loan Applicationnnb BBGHJN Form 3Greg BeloroNoch keine Bewertungen

- BJMP-Coop Housing Loan FormDokument3 SeitenBJMP-Coop Housing Loan FormAdah AbubacarNoch keine Bewertungen

- Cancellation FormDokument2 SeitenCancellation FormAkash TebaliyaNoch keine Bewertungen

- Maturity FormDokument3 SeitenMaturity FormNashitNoch keine Bewertungen

- Application Form For Personal Loan To PensionersDokument7 SeitenApplication Form For Personal Loan To PensionersPrudhuu PrudhviNoch keine Bewertungen

- Risalah Ansuran Bulanan Rumah Ogos 2012 EngDokument4 SeitenRisalah Ansuran Bulanan Rumah Ogos 2012 EngcheqmateNoch keine Bewertungen

- Form CPFMCDokument4 SeitenForm CPFMCJeyavikinesh SelvakkuganNoch keine Bewertungen

- 5062 Policy Payout FormDokument2 Seiten5062 Policy Payout Formbpd21Noch keine Bewertungen

- FPC010 Application For Providnet Benefits ClaimDokument2 SeitenFPC010 Application For Providnet Benefits ClaimFe Pastor100% (1)

- Pension Loan Otc Final 2012Dokument2 SeitenPension Loan Otc Final 2012Claire RoxasNoch keine Bewertungen

- Application and Credit Card Account Agreement: 1. APPLICANT INFORMATION: Please Tell Us About YourselfDokument8 SeitenApplication and Credit Card Account Agreement: 1. APPLICANT INFORMATION: Please Tell Us About Yourselfsaxmachine1411Noch keine Bewertungen

- FD Form RevisedDokument2 SeitenFD Form RevisedAshutosh TiwariNoch keine Bewertungen

- New Salary Apds Dep-Ed Loan Application: (Last Name) (First Name) (Middle Initial) (Suffix)Dokument6 SeitenNew Salary Apds Dep-Ed Loan Application: (Last Name) (First Name) (Middle Initial) (Suffix)En-en FrioNoch keine Bewertungen

- 2016 SSS Loan Form PDFDokument4 Seiten2016 SSS Loan Form PDFAnonymous 1AXVu3Gh60% (5)

- Payout FormDokument5 SeitenPayout FormMMayoor1984Noch keine Bewertungen

- Payout RequestDokument2 SeitenPayout RequestInfopedia OnlinehereNoch keine Bewertungen

- Risk Assessment Matrix Template by TeamGanttDokument3 SeitenRisk Assessment Matrix Template by TeamGanttchennieNoch keine Bewertungen

- Revised Establishment Report On COVID-19 - CAMPDokument1 SeiteRevised Establishment Report On COVID-19 - CAMPMarjorie BulawanNoch keine Bewertungen

- Wage Order No. RB VI 25Dokument28 SeitenWage Order No. RB VI 25chennieNoch keine Bewertungen

- Member's Data PDFDokument1 SeiteMember's Data PDFchennieNoch keine Bewertungen

- Trends and CareersDokument11 SeitenTrends and CareerschennieNoch keine Bewertungen

- Script of Graduation Ceremonies For EMCEEDokument2 SeitenScript of Graduation Ceremonies For EMCEESharlen GalarioNoch keine Bewertungen

- Work Report TemplateDokument5 SeitenWork Report TemplatechennieNoch keine Bewertungen

- Fitled Tfftrty Information: (Ta by andDokument1 SeiteFitled Tfftrty Information: (Ta by andchennieNoch keine Bewertungen

- SCO ModelDokument2 SeitenSCO ModelhannaNoch keine Bewertungen

- Eating Healthy For Fat Loss at 150 Pesos A DayDokument18 SeitenEating Healthy For Fat Loss at 150 Pesos A DayJoann Saballero HamiliNoch keine Bewertungen

- Wedding MissaletDokument12 SeitenWedding MissaletchennieNoch keine Bewertungen

- AUTHORIZATIONDokument1 SeiteAUTHORIZATIONchennieNoch keine Bewertungen

- EarthquakeDokument33 SeitenEarthquakechennieNoch keine Bewertungen

- Membership FormDokument1 SeiteMembership FormchennieNoch keine Bewertungen

- Buy Sell AgreementsDokument23 SeitenBuy Sell AgreementschennieNoch keine Bewertungen

- Blood Donation ProgramDokument1 SeiteBlood Donation ProgramMhOt AmAdNoch keine Bewertungen

- RCHLDokument16 SeitenRCHLchennieNoch keine Bewertungen

- Technical ScopeDokument3 SeitenTechnical ScopechennieNoch keine Bewertungen

- CYIENT Kotak 22102018Dokument6 SeitenCYIENT Kotak 22102018ADNoch keine Bewertungen

- Hedge Fund Strategies: A Do It Yourself Approach: DisclaimerDokument27 SeitenHedge Fund Strategies: A Do It Yourself Approach: DisclaimerdjbenbrownNoch keine Bewertungen

- Worldcom ScandalDokument70 SeitenWorldcom ScandalRavi PrabhatNoch keine Bewertungen

- Indian Capital MarketDokument35 SeitenIndian Capital MarketVivek Rai100% (1)

- Pay-for-Performance and Financial IncentivesDokument23 SeitenPay-for-Performance and Financial IncentivesUsama AlviNoch keine Bewertungen

- Does Economics Growth Bring Increased Living StandardsDokument6 SeitenDoes Economics Growth Bring Increased Living StandardsViet Quoc CaoNoch keine Bewertungen

- CIR V General Foods IncDokument6 SeitenCIR V General Foods IncmisterdodiNoch keine Bewertungen

- ACC12 - Statement of Cash FlowsDokument1 SeiteACC12 - Statement of Cash FlowsVimal KvNoch keine Bewertungen

- Resources and Needs: GRADES 1 To 12 Daily Lesson Log Monday Tuesday Wednesday Thursday FridayDokument10 SeitenResources and Needs: GRADES 1 To 12 Daily Lesson Log Monday Tuesday Wednesday Thursday FridayRey Mark RamosNoch keine Bewertungen

- ProjectDokument24 SeitenProjectLohith Sunny Reddy KaipuNoch keine Bewertungen

- Revised January 1992 Daily Wage PayrollDokument4 SeitenRevised January 1992 Daily Wage PayrollJhem Martinez100% (1)

- BancoMacroPitch 1Dokument9 SeitenBancoMacroPitch 1elephantowerNoch keine Bewertungen

- Problem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementDokument4 SeitenProblem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementRavena ReyesNoch keine Bewertungen

- SM5 Strategy Formulation Multibusiness StrategyDokument19 SeitenSM5 Strategy Formulation Multibusiness StrategyTirtha NandiNoch keine Bewertungen

- Intermediate Accounting 2 Week 1 Lecture AY 2020-2021 Chapter 1: Current LiabilitiesDokument7 SeitenIntermediate Accounting 2 Week 1 Lecture AY 2020-2021 Chapter 1: Current LiabilitiesdeeznutsNoch keine Bewertungen

- SME Programme Lending: Overview Group Best Practices & Key ChallengesDokument29 SeitenSME Programme Lending: Overview Group Best Practices & Key ChallengesSaif IqbalNoch keine Bewertungen

- Class Xi AccountancyDokument3 SeitenClass Xi AccountancySWASTIKNoch keine Bewertungen

- Problems - Capital BudgetingDokument5 SeitenProblems - Capital BudgetingDianne TorresNoch keine Bewertungen

- Exide Pakistan Limited: Five Year Financial AnalysisDokument13 SeitenExide Pakistan Limited: Five Year Financial AnalysisziaNoch keine Bewertungen

- 9706 Y16 SM 2Dokument12 Seiten9706 Y16 SM 2Wi Mae RiNoch keine Bewertungen