Beruflich Dokumente

Kultur Dokumente

Mergers Aquisitions PDF

Hochgeladen von

Pankaj MehendirattaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Mergers Aquisitions PDF

Hochgeladen von

Pankaj MehendirattaCopyright:

Verfügbare Formate

M&A in Indian Banking System An Executive Handbook

Edition: November 2005

Published by Banknet India

Email: info@banknetindia.com

Website: www.banknetindia.com

COPY RIGHT: The contents of this Handbook are strictly under copyright and no part of this study can be photocopied,

extracted or reproduced in any manner whatsoever without permission in writing from Banknet India.

DISCLAIMER: Bnet India Pvt Limited (hereinafter referred to as Banknet India) has not verified any of the information

furnished/compiled in this publication/handbook and makes no claims about the correctness or the accuracy of the

information provided and does not accept any responsibility for any errors or omissions. Banknet India disclaims all

warranties, whether express or implied, for the information provided in the handbook. Neither Banknet India nor its

Directors accept any liability whatsoever nor do they accept responsibility for any financial consequences arising from the

use of the information provided herein & will not be liable for any direct, indirect, incidental, consequential loss of profits or

special damages OR any loss, injury or accident arising from the use of this data, advice or other information it contains.

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

SECTION ONE

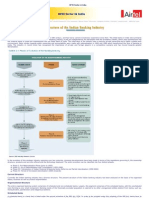

Chapter- I- Over view of Indian banking Industry

Indian Banking System

Structure & regional spread

Chapter- II Essentials of M &A.?

a) Merger and amalgamation.

b) Acquisition.

c) Take over.

Chapter- III- Benefits of Consolidation

a) Why Merger in banks- the benefits

b) Why Consolidation in Indian banking industry- 15 reasons

Chapter- IV- Merger in Indian banks

a) Four category of target banks

b) List of 72 bank mergers in India since 1961

c) Indian Banks listed on the stock exchanges

SECTION TWO

Chapter- V- Existing Legal Framework

a) Legal Categorization of banks

b) Compliance with Banking Regulation Act

c) Compliance with Securities & Exchange Board in India (SEBI) Regulations

d) Shareholders approval

e) Creditors/Financial Institutions/Banks approval

f) High Court approvals

g) Reserve Bank of Indias approval

Chapter- VI- Accounting, Taxation & Valuation

a) Accounting Procedure

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

b) Taxation

c) Valuation methods

d) Methods of acquisition pricing

e) Bank earnings and stock prices: Which earnings matter

Chapter- VII- Reserve Banks Review Process

Reserve Bank of Indias bank merger review process

Chapter- VIII- Procedure for merger/amalgamation of banks

a) Merger of private banks

b) Merger of a private bank with a nationalized bank

c) Merger of nationalized banks

d) Merger of a nationalized bank with SBI

e) Merger of a nationalized bank with subsidiary of SBI

f) Merger of a private bank with the SBI or its subsidiaries

g) Merger/Amalgamation in the cooperative banking sector

Chapter- IX- A Case Study

Merger/Amalgamation of Global Trust Bank with Oriental Bank of Commerce

SECTION THREE

Chapter- X- Foreign Direct Investment (FDI) in banking

a) Main Guidelines

b) Cross Border M&A in Banks

c) Foreign Bank stakes in Indian Banks

Chapter- XI- Road map for foreign banks

RBIs Road map for foreign banks in India

a) Phase I: (March 2005 to March 2009)

b) Phase II: April 2009

Chapter- XII- Critical Factors for merger success

a) Why bank merger generally do not succeed

b) How to make mergers successful

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

Chapter- XIII- Future of M&A in Indian Banking Industry

a) State Bank of India, a global bank in making- A case study

b) The Road Ahead

ANNEXURES

Annexure 1- Complete List of Banks in India (as on 30/9/2005)

a) Public Sector Banks

i) Nationalized Banks (19)

ii) State Bank Group (8)

iii) Other Public sector Bank (1)

b) Old Private Banks (20)

c) New Private Banks (9)

d) Foreign Banks (31)

e) Scheduled Urban Co-operative Banks (55)

Annexure 2- Bank valuation worksheet

a) Using the balance sheet as an enterprise value model.

b) The banks free cash flow method.

Annexure 3- RBI circulars related to merger/amalgamation

a) Guidelines for merger/amalgamation of private sector banks

b) Amalgamation/Merger of Non-Banking Finance Companies with Banks

c) Guidelines for merger / amalgamation of Urban Co-operative Banks (UCBs)

Annexure 4- Foreign bank entry and expansion norms in India

Annexure 5-Guidelines on Ownership & Governance in Private Banks

Annexure 6- Narasimhan Committee Report (1991 & 1998)

Annexure 7- M&A Terminology

Annexure 8- Sources and References

ABOUT BANKNET INDIA

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

Chapter- I- Over view of Indian banking Industry

India has an extensive banking network, in both urban and rural areas. All large Indian

banks are nationalized, and all Indian financial institutions are in the public sector. The

Reserve Bank of India is the central banking institution. It is the sole authority for issuing

bank notes and the supervisory body for banking operations in India. It supervises and

administers exchange control and banking regulations, and administers the

government's monetary policy. It is also responsible for granting licenses for new bank

branches. 36 foreign banks operate in India with full banking licenses.

Indian Banking System

The banking system has three tiers. These are the scheduled commercial banks; the

regional rural banks which operate in rural areas not covered by the scheduled banks;

and the cooperative and special purpose rural banks.

Commercial banks are categorized as scheduled and non-scheduled banks, but for the

purpose of assessment of performance of banks, the Reserve Bank of India categories

them as public sector banks, old private sector banks, new private sector banks and

foreign banks.

Scheduled and non Scheduled Banks

There are 93 scheduled commercial banks, Indian and foreign; 196 regional rural banks.

In cooperative sector- nearly 2000 cooperative banks operate, which include non

scheduled banks. In terms of business, the public sector banks, namely the State Bank

of India and the nationalized banks, dominate the banking sector.

Scheduled Commercial Banks (SCBs) in India are categorized in five different groups

according to their ownership and/or nature of operation. These bank groups are: (I) State

Bank of India and its associates, (ii) Nationalized Banks, (iii) Regional Rural Banks, (iv)

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

Foreign Banks and (v) Other Indian Scheduled Commercial Banks (in the private sector).

The site provides facility of aggregating data for various bank-groups.

Scheduled Banking Structure in India (As on March 31, 2003)

Regional Spread of Banking

The total number of branches of SCBs as at end-June 2004 stood at 67,097 comprising

32,207 rural branches, 15,028 semi-urban branches and 19,837 urban and metropolitan

branches. In line with the regional distribution of income, the Southern region accounted

for the highest percentage of bank branches, followed by Eastern Region, Northern

Region, Western Region and North-Eastern region.

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

The State Bank and its seven associates have about 14,000 branches; 19 nationalized

banks 34,000 branches; the RRBs 14,700 branches; and foreign banks around 225

branches. If one includes the branch network of old and new private banks, collectively

the spread could be over 68,000 branches across the country. Besides, there are a few

thousand co-operative bank branches. On an average, one bank branch caters to

15,000 people.

India is the 4th largest economy in terms of the purchasing price parity and 10th place in

terms of the GDP. Indian economy is registering consistent 6 per cent annual growth for

last 5 years. However, only one bank -- State Bank of India -- is among the top 200

banks in the world.

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

Chapter- II - What is M &A.?

Merger is a combination of two or more companies into one company. In India, mergers

are called as amalgamations, in legal parlance. The acquiring company, (also referred to

as the amalgamated company or the merged company) acquires the assets and

liabilities of the target company (or amalgamating company). Typically, shareholders of

the amalgamating company get shares of the amalgamated company in exchange for

their existing shares in the target company. Merger may involve absorption or

consolidation.

A) Merger and amalgamation: the term merger or amalgamation refers to a

combination of two or more corporate into a single entity. It may involve either;

a) absorption- one bank acquires the other.

Or

b) consolidation- two or more banks combine to former a new entity. In India the legal

term for merger is amalgamation.

Other way of classifying merger is upon the basis of what type of corporate

combine. It can be of following types-

1) Horizontal merger: This is the merger of the corporate engaged in the same

kind of business. E.g.: Merger of bank with another bank.

2) Vertical merger: This is the merger of the corporate engaged in various stages of

production in an industry. A vertical merger (entities with different product profiles) may

help in optimal achievement of profit efficiency. Consolidation through vertical merger

would facilitate convergence of commercial banking, insurance and investment banking.

3) Conglomerate merger- A conglomerate merger arises when two or more firms in

different markets producing unrelated goods join together to form a single firm. An

example of a conglomerate merger is that between an athletic shoe company and a soft

drink company. The firms are not competitors producing similar products (which would

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

make it a horizontal merger) nor do they have an input-output relation (which would

make it a vertical merger).

B) Acquisition: This may be defined as an act of acquiring effective control by one

corporate over the assets or management of the other corporate without any

combination of both of them. For example recently oracle major software firm has

agreed to acquire a majority stake in Indian banking software company I-flex Solutions.

It can be characterized in terms of the following:

a) The corporate remain independent.

b) They have a separate legal entity.

C) Take over: Under the monopolies and restrictive trade practices act, lake over means

acquisition of not less than 25% of voting powers in a corporate.

Difference between acquisition and take over:

Although the term acquisition and take over are used interchangeably but in fact the

term Take over generally shows a hostile act. To put in simple words, when an

acquisition is forced or unwilling act, then it is called take over.

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

Chapter- III- Benefits of Consolidation

Why Merger in banks- the benefits.

A merger involves a marriage of two or more banks. It is generally accepted that

mergers promote synergies. The basic idea is that the combined will create more value

than the individual banks operating independently. Economist refers to the phenomenon

of the 2+2=5 effect brought about by synergy.

Economies of scale refer to the lower operating costs (per unit) arising from spreading

the fixed costs over a wider scale of production and economies of scope refer to the

utilization of skill assets employed in the production in order to produced similar products

or services.

The resulting combined entity gains from operating and financial synergies. In a

combined entity, the skill used to produce separate and limited results will be used to

produce results on wider scale. Additional financial synergies refer to the effect of a

merger on the financial activities of the resulting company. The cash flows arising from

the merger are expected to present opportunities in respect of the cost of financing and

investment.

Greater efficiency

Banks often are able to operate more cost effectively by increasing their size. The costs

of many functions don't double when the scale of operation doubles. As a result,

mergers are one way to keep costs and prices down.

Leveraging technology

Banks and their customers have become increasingly accustomed to the advantages of

new and expensive technologies. Many of these technologies are too expensive unless

costs can be spread over a large number of customers. Mergers are often

necessary to allow banks to introduce and maintain the technologies customers

increasingly demand.

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

Changing laws

Laws which had prevented many banks from operating in more than one state recently

have been removed or overridden. The advent of interstate banking and branching

means more opportunities for banks operating in different states to merge with each

other.

Diversification

One effective method of controlling risks inherent in bank lending is to diversify

operations across different geographic regions and different types of customers.

Mergers can help diversify such risks.

Broader array of products

Mergers may give banking institutions an opportunity to offer a broader array of services.

A merger of two banks with different expertise can result in a combination more to the

liking of customers looking for one-stop shopping.

Why Consolidation in Indian banking industry

Financial Sector Reforms set in motion in 1991 have greatly changed the face of Indian

Banking. The banking industry has moved gradually from a regulated environment to a

deregulated market economy. The pace of changes gained momentum in the last few

years. Globalization would gain greater speed in the coming years particularly on

account of expected opening up of financial services under WTO.

Banks in India are gradually going for- 1) Consolidation of players through mergers and

acquisitions, 2) Globalization of operations, 3) Development of new technology and 4)

Universalisation of banking.

With the international banking scenario being dominated by larger banks, it is

important that India too should have a fair number of large banks, which could

play a meaningful role in the emerging economics. Among the top twenty banks

in the emerging economics, India has only one, whereas China has five banks

and Brazil had six banks.

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

The performance of banks in India indicates that certain performance

characteristic is not restricted to a particular bank. Therefore, consolidation of

banking industry is critical from several aspects. Mainly, the reasons for mergers

and acquisitions can include motives for value maximizations well non-value

maximization. The factors including mergers and acquisitions usually include

technological progress, excess capacity, emerging opportunities, consolidation of

international banking markets and deregulations of geographic, functional and

product restrictions. Policy inducements such as the governments incentives that

could accrue to the top managers are also other important factors, which may

determine the pace of consolidation.

It is found that in all major economics, banking industry undergoes some sort of

restructuring process. The economy, which delays this process, leads to

stagnation. That is why, it is important from the point of view of long term

prospect of the economy, the consolidation process should be given prime

attention.

The major gains perceived from bank consolidation are the ability to withstand

the pressures of emerging global competition, to strengthen the performance of

the banks, to effectively absorb the new technologies and demand for

sophisticated products and services, to arrange funding for major development

products in the realm of infrastructure, telecommunication, etc. which require

huge financial outlays and to streamline human resources functions and skills in

tune with the emerging competitive environment.

The international experience reveals a wide range of processes and practices

involving consolidation, their impact on the banking market and the trends in post

merger performance of banking institutions. These experiences could provide

useful inputs to the banking policy in India.

An important observation which may be induced from various past mergers that

the merger between big and small banks led to greater gains as compared to

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

merger between equals. It is also observed from past experiences that if the

merger follows business aided by appropriated technology and diversified

product range, it could lead to greater gains for the banking industry as a whole.

Similarly, consolidation increases the market power and does not cause any

damage to the availability of services to small customers.

Evaluation of banks carried out by individual banks reveal that higher capital

adequacy and lower nonperforming assets explain to a greater extent the growth,

Profitability and productivity of banks since increase in capital and steep

reduction in non-performing assets cannot be entirely left to the individual banks

in the present scenario. Consolidation in the banking industry is of great

relevance to the economy.

A diagnostic performance evolution study would reveal out important aspects of

divergence in the performance of the domestic banking institutions. A high

degree of variations is found in the performance of various groups of banks.

Since, public sector banks account for the large scale of banking assets and the

lower performance ratio reflect the entire banking industry, it is considered

important that suitable consolidation process may be initiated at the earliest, so

that, the efficiency gain made by the large number of banks of other groups will

be reflected which could lead to a positive impact on the image of banking.

Consolidation can also be considered critical from the point of view of quantum of

resources required for strengthening the ability of banks in assets creation. It

indicates that restructuring in Indian banking may not be viewed from the point of

particular group rather it can be evolved across the bank groups.

Indians banks have unique character in displaying similar characteristics of

performance despite consisting of different size and ownership. This trend further

substantiates the scope for consolidation across banks group.

As per the Quantitative Impact Study published by Basel Committee in May

2003, there would be increase in capital requirements by 12% for banks in

developing countries on the implementations of the Basel II Accord. Mergers

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

among the banks will be one of the ways to increase market power and thereby

increase the revenue-generation of the Banks.

The Reserve Bank of India (central bank) has set up an experts committee to

implement Basel II accord by 2006 to strengthen the financial health of banks by

adopting globally accepted norms for capital adequacy. The RBI also wants all

banks in India to have a capital base of Rs 300 crore (Rs 3 billion) over the next

three years. This will bring about number of acquisitions in the banking industry.

Over the last two years, the RBI has stopped issuing branch licenses to cooperative banks, after the unbridled growth of co-operative banks during the last

decade. For cooperative banks to expand there is no alternative to go for merger

an amalgamation. The Mumbai-based Saraswat Co-operative Bank is now

poised to take over Maharashtra-based Maratha Mandir Co-operative Bank

which is in trouble. This could mark the beginning of voluntary mergers of cooperative banks after the Reserve Bank of India (RBI) unveiled for mergers and

amalgamations among urban co-operative banks. The other suitor for Maratha

Mandir was Pune-based Cosmos Co-operative Bank.

Last but most important reason for consolidation in any industry is tax saving and

this thing is true for the banking industry also.

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

Chapter- IV- Merger in Indian banks

Target Group of Banks for M&A

There are four categories of banks interested in M&A in a big way.

1) First, there are banks (like Indian Bank) that have survived on the government's

largesse in the form of thousands of crores of recapitalization bonds over the past

decade. They are now keen to take over other banks to become strong and acquire

widespread reach.

2) In the second category are two types of banks. In one group are strong public sector

banks with large domestic presence (like State Bank of India) that want to acquire a

bank with an overseas presence to become global entities.

The other group of banks has been looking at increasing their domestic presence and

reach. For instance, Bank of Baroda -- which has a solid presence in western India -has started looking out for opportunities in the north, east and south. Vijaya Bank, which

is based in Bangalore, is interested in picking up a northern bank. North India major

Punjab National Bank, headquartered in Delhi, is looking southwards.

3) In the third category, are "make-believe" M&As that are purely personality-driven.

These are banks headed by CEOs who were denied opportunities to head big banks

and are believed to be taking the initiative to acquire other banks so that they can prove

their leadership qualities.

4) In the fourth category is a weak and small bank, which needs to be taken over by

larger banks to remain viable. These can be the potential targets of foreign banks and

investors.

Over 90 per cent of private sector banks have a capital base of less than Rs 100 crore

(Rs 1 billion). Some of them even do not have a net worth of Rs 300 crore. Large

numbers of urban cooperative banks are in trouble and looking for take-over/acquisition

to survive.

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

List of the bank mergers in India since 1961Mergers and amalgamations are not new to the Indian banking system too. However, it

is pertinent to note that a majority of such mergers have been undertaken by banks

voluntarily for strategic purposes

Name of Bank Merged

Sr.No (Transferor Bank)

Merged /Amalgamated

Date of

with (Transferee Bank)

Merger/Amalgamation

National Bank of Lahore

1 Prabhat Bank Ltd

Ltd.

9-3-1961

2 Indo-Commercial Bank Ltd

Punjab National Bank

25-3-1961

3 Bank of Nagpur Ltd

Bank of Maharastra

27-3-1961

4 New Citizen Bank Ltd

Bank of Baroda

29-4-1961

State Bank of

5

Travancore Forward Bank Ltd

Travancore

15-5-1961

6 Bank of Kerala Ltd.

Canara Bank

20-5-1961

7 Bank of Poona Ltd.

Sangli Bank Ltd

3-6-1961

State Bank of

8 Bank of New India Ltd.

Travancore

17-6-1961

9 Venadu Bank Ltd

South Indian Bank Ltd

17-6-1961

10 Wankaner Bank Ltd

Dena Bank

17-6-1961

11 Seasia Midland Bank Ltd

Canara Bank

17-6-1961

State Bank of

12 Kottayam Orient Bank Ltd

Travancore

17-6-1961

13 Bank of Konkan Ltd.

Bank of Maharastra

19-6-1961

14 Poona Investors Bank Ltd

Sangli Bank

28-6-1961

15 Bharat Industrial Bank Ltd

Bank of Maharastra

1-7-1961

16 Rayalaseema Bank Ltd

Indian Bank

1-9-1961

17 Cuttack Bank Ltd

United Bank of India

4-9-1961

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

18 Pie Money Bank Pvt.Ltd

Syndicate Bank

4-9-1961

19 Moolky Bank Ltd

Syndicate Bank

4-9-1961

Tanjore Permanent Bank

20 Merchants Bank Ltd

Ltd.

4-9-1961

21 Tezpur Industrial Bank Ltd.

United Bank of India

4-9-1961

22 G.Raghunathmull Bank Ltd.

Canara Bank

4-9-1961

Satara Swadeshi Commercial

United Western Bank Ltd

23 Bank Ltd.

6-9-1961

24 Catholic Bank Ltd .

Syndicate Bank

11-9-1961

25 Phaltan Bank

Sangli Bank Ltd

11-9-1961

26 Jodhpur Commerical Bank Ltd.

Central Bank of India

16-1-1961

Canara Banking

27 Bank of Citizen Ltd.

Corporation Ltd

17-10-1961

28 Karur Mercantile Bank Ltd

Laxmi Vilas Bank Ltd.

19-10-1961

29 People Bank Ltd

Syndicate Bank

14-11-1961

Lakshmi Commercial

30 Pratab Bank Ltd

Bank Ltd.

11-12-1961

31 Unity Bank Ltd

State Bank of India

20-8-1962

32 Bank of Algapuri Ltd.

Indian Bank

14-8-1962

33 Metropolitan Bank Ltd

Indian Bank

14-8-1963

State Bank of

34 Cochin Nayar Bank Ltd

Travancore

8-2-1964

35 Bank Ltd.

Karur Vysya

1-6-1964

36 Unnao Commerical Ltd.

Bareilly Corporation Ltd

12-8-1964

Salem Shri Kannikaprameshwari

State Bank of

37 Latin Christian Bank Ltd.

Travancore

17-08-1964

United Industrial Bank

38 Southern Bank Ltd

Ltd

24-8-1964

Belgaum Bank Ltd

26-10-1964

Shri Jadeya Shankarling Bank

39 Ltd.

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

40 Bareilly Bank Ltd.

Benarus State Bank Ltd.

16-11-1964

41 Thiya Bank Ltd

Lord Krishna Bank Ltd.

16-11-1964

State of india Ltd.

1-9-1965

43 Ltd.

Bank of Madura Ltd

1-9-1965

44 Malnad Bank Ltd

State Bank of Mysore

6-10-1965

45 Josna Bank Ltd

Lord Krishna Bank Ltd.

13-10-1965

46 Amrit Bank Ltd

State Bank of Patiala

3-2-1965

47 Chawla Bank Ltd

New Bank of India

23-4-1969

Allahabad Trading & Bkg. Corp

42 .Ltd

Vettaikaran Padur Mahajan Bank

Banks Amalgamated/ Merged

Nationalisation of

since

Banks in India

48 Bank of Bihar Ltd

State Bank of India

8-11-1969

49 National Bank of Lahore Ltd.

State Bank of India

20-2-1970

50 Miraj State Bank Ltd

Union Bank of India

29-7-1985

51 Lakshmi Commercial Bank Ltd

Canara Bank

24-08-1985

52 Bank of Cochin Ltd

State Bank of India

26-08-1985

53 Hindustan Commercial Bank Ltd.

Punjab National Bank

19-12-1986

54 Traders Bank Ltd

Bank of Baroda

13-05-1988

55 United Industrial Bank Ltd.

Allahabad Bank

31-10-1989

56 Bank of Tamilnadu Ltd

Indian Overseas Bank

20-02-1990

57 Bank of Thanjavur Ltd.

Indian Bank

20-02-1990

58 Parur Central Bank Ltd

Bank of India

20-02-1990

59 Purbanchal Bank Ltd

Central Bank of India

29-08-1990

60 New Bank of India

Punjab National Bank

4-9-1993

61 Bank of Karad Ltd.

Bank of India

1993-1994

62 Kashi Nath Seth Bank

State Bank of India

I-01-1996

Oriental Bank of

63 Punjab Co-op. Bank Ltd.

Commerce

8-4-1997

Oriental Bank of

64 Bari Doab Bank Ltd

Commerce

Banknet India- Banking Knowledge, Research & Conferences

8-4-1997

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

65 Bareilly Corp. Bank Ltd.

Bank of Baroda

3-6-1999

66 Sikkam Bank Ltd

Union Bank of India

22-12-1996

67 Times Bank India

HDFC Bank Ltd

26-02-2000

68 Benaras State Bank Ltd

Bank of Baroda

20-07-2002

69 Nedungadi Bank Ltd

Punjab National Bank

1-2-2003

70 Bank of Madura

ICICI Bank

10-3-2001

Oriental Bank of

71 Global Trust Bank Ltd.

Commerce

14-08-2004

Effective from 1-4-2005

Announced date (29-

72

Bank of Punjab (BoP)

Centurion Bank

Banknet India- Banking Knowledge, Research & Conferences

06-05)

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

Federal Bank and Lord Krishna Bank Ltd (LKBL) have decided to call off their proposed

merger as they could not reach a mutually agreeable valuation for the purpose. However

two new private sector banks Bank of Punjab and Centurian Bank successfully merged

recently to form Centurion Bank of Punjab.

The process of consolidation in the urban co-operative banking sector has been kicked

off with regulatory approval for three mergers.

1. The Mumbai-based Saraswat Co-operative Bank is to take over Maharashtra-based

Maratha Mandir Co-operative Bank which is in trouble.

2. RBI, has also approved a proposal from Pune based Cosmos Bank to acquire

Secunderabad-based Premier Co-operative Bank.

3. Gujarat-based Kalupur Co-operative Bank has got approval to acquire Mahila Cooperative Bank.

Mumbai -based Shamrao Vittal Co-operative (SVC) Bank has embarked into an

acquisition spree of smaller co-operative banking entities and all set to acquire Samartha

Nagar Co-operative bank. It is also acquiring similar entities in Maharashtra and

Karnataka.

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

Indian Banks listed on the Stock Exchanges:

NAME OF THE LISTED BANKS

Allahabad Bank

Andhra Bank

Bank of Baroda

Bank of India

Bank of Punjab Ltd.

Bank of Rajasthan Ltd.

Canara Bank

Centurion Bank Ltd.

City Union Bank Ltd.

Corporation Bank

Dena Bank

Federal Bank Ltd.

HDFC Bank Ltd.

ICICI Bank Ltd.

IDBI Bank Ltd.

Indian Overseas Bank

IndusInd Bank Ltd.

Jammu and Kashmir Bank Ltd.

Karnataka Bank Ltd.

Karur Vysya Bank Ltd.

Oriental Bank of Commerce

Punjab National Bank

South Indian Bank Ltd.

State Bank of Bikaner and Jaipur

State Bank of India

State Bank of Travancore

Syndicate Bank

Union Bank of India

United Western Bank

UTI Bank Ltd.

Vijaya Bank

Vysya Bank Ltd.

Yes Bank Ltd

WEB SITE

http://www.allahabadbank.com/

http://www.andhrabank-india.com/

http://www.bankofbaroda.com/

http://www.boi.com/

http://www.bankofpunjab.com/

http://www.bankofrajasthan.com/

http://www.canbankindia.com/

http://www.centurionbank.com/

http://www.cityunionbank.com/

http://www.corpbank.com/

http://www.denabank.com

http://www.federal-bank.com/

http://www.hdfcbank.com/

http://www.icicibank.com/

http://www.idbi.com/

http://iob.com/

http://www.indusind.com/

http://www.jammuandkashmirbank.com/

http://www.ktkbankltd.com/ktk/Index.jsp

http://www.kvb.co.in/

http://www.obcindia.com/

http://www.pnbindia.com/

http://www.southindianbank.com/

http://www.sbbjbank.com

http://www.statebankofindia.com/

http://www.sbtr.com/

http://www.syndicatebank.com/

http://www.unionbankofindia.com

http://www.uwbankindia.com/

http://www.utibank.com/

http://www.vijayabank.com/

http://www.vysbank.com/

http://www.yesbankltd.com/

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

Chapter- V- Existing Legal Framework

Legal Categorization of banks

Legal categorization of banks is with reference to the statute under which they are

constituted. They are classified as nationalized banks, banking companies, SBI and its

subsidiaries, RRBs, Cooperatives and Multi-state cooperative banks.

Nationalized Banks

Nationalized banks are corporate bodies established by the Banking Companies

(Acquisition and Transfer of Undertaking) Act, 1970 and Banking Companies

(Acquisition and Transfer of Undertaking) Act, 1980. The total numbers of such banks is

19. These are predominantly owned and controlled by the Central Government. All these

are constituted by an Act of parliament and governed by the aforesaid statutes.

By section 51 of the Banking Regulation Act, 1949 (BR Act), certain provisions of the BR

Act are made applicable to these banks, however the provisions of the Companies Act

do not apply to these banks.

Banking Companies

Although all private sector banks are companies registered under the Companies Act,

1956 and operating as banking companies after obtaining banking license from Reserve

Bank of India such banks further grouped into following categories:

Old private sector banks

New private sector banks

Local area banks

All the above category of banks are banking companies except that their minimum share

capitals are different.

In the matter of amalgamation /merger and winding up of banking companies, the

concerned High Court will continue to have jurisdiction under the provisions of the

Companies Act.

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

State Bank of India and its Subsidiaries

The State Bank of India is constituted under the State Bank of India Act, 1955 by

transfer of the undertaking of the Imperial Bank of India to the State Bank of India and all

the shares in the capital of Imperial Bank of India were transferred to the Reserve Bank

of India. By section 51 of the Banking Regulation Act, 1949 certain of the said Act are

made applicable to State Bank of India, but the provisions of the Companies Act do not

apply. The subsidiaries of state Bank of India are constituted as subsidiary banks under

State Bank of India (Subsidiary Banks) Act, 1959. The subsidiary banks are bodies

corporate and are governed by the provisions of the above Act and the provisions of the

Companies Act do not apply. Like other public sector banks, provisions of the BR Act,

1949 are made applicable to subsidiary banks by virtue of section 51 of the said Act.

Regional Rural Banks (RRBs)

Regional Rural Banks (RRBs) are constituted under Regional Rural Banks Act, 1976

(RRB Act, 1976). Section 6(2) of the RRB Act, 1976.

Such RRBs are bodies corporate governed by the RRB Act, 1976 and the provisions of

the Companies Act do not apply. For the purpose of Income Tax Act or any other law for

the time being in force relating to any tax on income, profits or gains, the RRB shall be

deemed to be a co-operative society (section 22 of the RRB Act) and provisions of the

companies Act do not apply to the RRBs. Provisions of Banking Regulation Act as

specified under section 51 of the BR Act, apply to the RRBs to the extent specified

therein.

Co-operative Banks

The definition of banking company contained in the BR Act, 1949 as modified by

section 56 of the Act includes co-operative banks within the definition of banking

company. While the provisions relating to regulation and supervision of the co-operative

banks are contained in the BR Act, 1949 the status for such co-operative banks as cooperative societies are governed by the respective co-operative societies laws in force in

various States under which the concerned co-operative bank may be registered as a cooperative society.

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

Multi-State Co-operative Banks

In the category of co-operative banks, there is a special category of co-operative banks

having their area of operation in more than one States and such societies are registered

under a central law viz. Multi-State Co-operative Societies Act, 2002.

b) Compliance with Regulations of the Banking Regulation Act

Under Banking Regulation Act, there is presently no provision for obtaining approval of

the Reserve Bank of India for any acquisition or merger of any financial business by any

banking institution. In other words, if a banking institution desires to acquire a nonbanking finance company there is no requirement of approval of the Reserve Bank of

India. Further, in case of a merger of an all India financial institution with own subsidiary

bank, there was no express requirement of obtaining the approval of Reserve Bank of

India for such merger, under the provisions of the Banking Regulation Act or the

Reserve Bank of India Act. Such approval of the Reserve Bank of India is required only

in the context of relaxation of regulatory norms to be complied with by a bank.

However, for a regulator, it is a matter of concern to ensure that such acquisitions or

mergers do not adversely affect the concerned banking institutions or the depositors of

such banking institutions.

c) Compliance with Securities and Exchange Board of India (SEBI) Regulations

The regulations apply to the companies registered under the Companies Act as well as

to corporations established by Acts of Parliament by virtue of listing agreements. It is for

this reason that corresponding new banks increasing capital by issue of shares to the

public are required to comply with SEBI regulations in spite of the fact that the other

provisions of the companies Act in regard to issue of shares etc. do not apply to the

corresponding new banks. In view of this position in respect of acquisitions and mergers

of any banking institutions whose shares are listed at the Stock Exchanges will be

required to comply with all the relevant regulations of SEBI.

In India take-over are regulated by SEBIs Takeover Code for substantial

acquisitions of shares in listed companies of November 1994. SEBI announced a

take-over code for the regulation of substantial acquisition of shares, aimed at

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

ensuring better transparency and minimizing the occurrence of clandestine deals.

In accordance with the regulations prescribed in the code, on any acquisition in a

company which makes acquirers aggregate shareholding exceed 15%, the

acquirer is required to make a public offer. The take-over code covers three types

of takeovers-negotiated takeovers, open market takeovers and bail-out takeovers.

d) Shareholder approval

The shareholders of the amalgamating and the amalgamated companies are

directed to hold meetings by the respective High Courts to consider the scheme of

amalgamation. The scheme is required to be approved by 75% of the

shareholders, present and voting, and in terms of the voting power of the shares

held (in value terms).

Further, Section 395 of the Companies act stipulates that the shareholding of

dissenting shareholders can be purchased, provided 90% of the shareholders, in

value terms, agree to the scheme of amalgamation. In terms of section 81(IA) of

the Companies Act, the shareholders of the "amalgamated company" also are

required to pass a special resolution for issue of shares to the shareholders of the

"amalgamating company".

e) Creditors/Financial Institutions/Banks approval

Approvals from these are required for the scheme of amalgamation in terms of the

agreement signed with them.

f) High Court approvals

Approvals of the High courts of the States in which registered offices of the

amalgamating and the amalgamated companies are situated are required.

g) Reserve Bank of India approval

In terms of section 19 of FERA, 1973 Reserve Bank of India permission is

required when the amalgamated company issues shares to the nonresident

shareholders of the amalgamating company or any cash option is exercised.

Reserve Bank approval is also required in case of mergers involving a banking

entity.

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

Chapter- VI- Accounting, Taxation & Valuation

a) Accounting Procedure

Section 29 of the Banking Regulation Act, 1949 requires every banking company to

prepare a balance-sheet and profit and loss account in the forms set out in the Third

Schedule to the Act. Sub-section (3) of section 29 further provides that provisions of the

Companies Act, 1956 relating to balance sheet and profit and loss account shall apply

to banking companies to the extent they are not inconsistent with the Banking

Regulation Act.

In view of the above position , the system of maintaining account , forms of balance

sheet , profit and loss account and other related accounting practices are standardized

any merger of two banks may not pose problems in relation to accounting practices

except a need to fine-tune any divergent practices in respect of specific heads of income

or expenditure.

One critical area that needs careful consideration is integration of different technology

platforms and software which not only have process and control implications but may

involve substantial costs in terms of money and time and retraining of personnel.

In regard to actual banking operations each bank has different nomenclatures for deposit

schemes and loan products. Similarly in the internal working and inter-branch

transaction, the banks have different nomenclatures for the debit and credit vouchers.

On any merger, such variations in the schemes and products and other practices will

need to be integrated.

b) Taxation

Under section 72A (1) of the Income Tax Act where there has been an amalgamation of

a banking company referred to in clause (c) of the Section 5 of the Banking Regulation

Act with a specified bank the accumulated loss and the unabsorbed depreciation of the

amalgamating company shall be deemed to be loss or as the case may be allowance for

depreciation of the amalgamated company for the previous year in which the

amalgamation was effected and the provisions of the Income tax Act relating to set-off

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

and carry forward of loss and allowance for depreciation shall apply accordingly. The

expression specified bank in sub-section (1) above is defined as State Bank of India or

corresponding new bank. The effect of this provision is that benefit of carry forward loss

and unabsorbed depreciation is available only in case where a banking company is

merged with State Bank of India or subsidiary of State Bank of India or a corresponding

new bank. If there are mergers of corresponding new banks or State Bank of India and

corresponding new bank or subsidiary and corresponding new bank the benefit now

section 72A is not available.

Bank mergers prompted by the Government action - `Involuntary' mergers - would be

given tax breaks under the Income-Tax Act with the Finance Minister, proposing

insertion of a new clause to provide for set off of losses of a banking company against

profit of a banking institution under a scheme of amalgamation.

"With a view to provide carry forward and set off of accumulated loss and unabsorbed

depreciation allowance of a baking company against the profits of a banking institution

under a scheme of amalgamation sanctioned by the Central Government, it is proposed

to insert a new Section 72AA in the Income Tax Act, 1961," the Budget 2005-06 has

said.

The Section propose that the accumulated loss and unabsorbed depreciation of the

amalgamating banking company will be deemed to be the loss or the allowance for

depreciation of the banking company for the previous year in which the scheme of

amalgamation is brought into force and that all the provisions of the I-T Act relating to set

off and carry forward of loss and depreciation shall apply to the merger.

The Reserve Bank of India, in a bid to smoothen the merger/amalgamation of Urban

Cooperative Banks (UCBs), has proposed to permit the acquirer UCB to amortize the

losses taken over from the acquired UCB, for a period not in excess of five years. This

period includes the year of merger.

c) Valuation methods

Beauty lies in the eyes of the beholder; valuation in those of the buyer.

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

Value of a business is a function of the business logic driving the M&A and is

based on the bargaining powers of buyers and sellers.

Since business is based on expectations which is dynamic, valuation also tends

to be dynamic and not static which means that that same transaction would be

valued by the same players at different values at two different times.

There are several techniques to value a business and broadly they are classified as

under:A) Earnings based valuation

Discounted Cash flow / Free cash flow

Cost to create approach

Capitalized earnings method.

B) Market based valuation

Market capitalization for listed companies

Market multiples of comparable companies for unlisted company.

C) Asset based valuation

Net Adjusted Asset Value or economic book value

Intangible Asset Valuation

Liquidation Value.

There are several approaches to valuation. The important ones are the

discounted cash flow approach, the comparable company approach, and the

adjusted book value approach.

Traditionally, the comparable company approach and the adjusted book value

approach were used more commonly. In the last few years, however, the

discounted cash flow approach has received greater attention, emphasis, and

acceptance. This is mainly because of its conceptual superiority and its strong

endorsement by leading consultancy organizations.

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

The discounted cash flow approach to corporate valuation involves four broad

steps:

Forecast the free cash flow

Compute the cost of the capital

Estimate the continuing value

Calculate and interpret results

d) Methods of acquisition pricing

Rhoades study:

Merger premiums paid to target banks dependent on target asset growth,

growth of its market share, and capital/assets ratio of target

Fraser and Kolari study:

Compared to low premium target banks, high premium target banks have:

Higher net income.

Larger fractions of non-interest bearing deposits.

Lower loan losses.

Beatty, Santomero, and Smirlock study:

Higher merger premiums paid to target banks with:

Higher net income.

Lower ratios of U.S. Treasury securities/total assets.

Lower loan losses.

e) Bank earnings and stock prices: Which earnings matter?

Earnings before securities gains and losses:

Focus on fundamental deposit taking and lending activities of banks.

Securities gains and losses:

More transitory and volatile than other components of earnings.

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

The market may capitalize operating earnings at a higher multiple than securities

gains or losses:

Barth, Beaver, and Wolfson study found that bank stock prices were

positively related to operating earnings and negatively related to

securities gains and losses.

Apparently, the market views securities

gains and losses as an attempt by bank management to smooth earnings

(which does not fool the market).

Evidence from market responses to bank M&A announcements.

Hawawini and Swary study:

Price of target banks increases on average about 11.5% during the week

of an M&A announcement. Cash transactions were more profitable for

targets than stock deals.

Bidding bank stock values dropped by 1% to 2%.

Why buy other banks if your stock price falls?

Managerial agency costs (maximize their welfare at expense of

shareholders).

Cornett and Tehranian study:

In the long run banks involved in acquisitions showed higher than normal

cash flow performance and greater asset growth. Thus, in the long run

both targets and bidders benefited from an acquisition.

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

Chapter- VII- Reserve Banks Review Process

Reserve bank of India has laid down guidelines for the process of merger proposal,

determination of swap ratios, disclosures, the stages at which boards will get involved in

the merger process and norms of buying and selling of shares by the promoters before

and during the process of merger

Reserve bank of India (RBI) in its capacity of the primary regulator and supervisor of the

banking systems has information on the present functioning of all the banks in India, the

RBI is the best suited to undertake the merger review process.

While undertaking the merger review process, RBI will need to examine the proposal for

the merger from a prudential perspective to gauge the impact on the stability and the

financial well being of the merger applicants and on the financial systems. In addition to

the assessment of the proposed merger on the competitiveness and stability of the

financial systems, RBI will also need to examine the implications on regional

development, impact on society etc. as a result of merger since banks in India also have

to fulfill have to fulfill various social obligations.

The RBI will need to examine the reasonableness of financial projection, including

business plan and earning assumptions as well as the effect of the proposed merger on

the merged entitys capital position. Finally RBI will have to consider potential changes to

risk profile and the capacity of the merger applicants ` risk management systems,

particularly the extent to which the level of risk would change as a result of the proposed

merger and the merged entitys ability to measure, monitor and manage those risks.

Broadly the information that will need to be examined by RBI while evaluating a proposal

for merger would include:

The objective to be achieved by the merger.

What impact could the merger have on the financial markets?

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

What impact could be the creations of mega bank have on monetary policy, the

management of interest rates. What threat to the Indian economy would be

posed by the difficulties experienced by a mega bank in its international

activities?

The impact that the merger might have on the overall structure of the industry.

The possible costs and benefits to customer and to small and medium size

businesses, including the impact on bank branches the availability of financing

price, quality and the availability of services.

The timing and the socioeconomic impact of any branch closures resulting from

the merger.

The manner in which the proposal will contribute to the international

competitiveness of the financial services sector.

The manner in which the proposal would

indirectly affect employment and the

quality of jobs in the sector, with a distinction made between transitional and

permanent effects.

The manner in which the proposal would increase the ability of the banks to

develop and adopt new technologies.

Remedial steps that the merger applicants would be willing to take to mitigate the

adverse effects identified to arise from the merger.

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

Chapter- VIII- Procedure for merger/amalgamation of banks

a) Merger of private banksThe Reserve of India has the power to sanction of merger of banking companies under

section 44A of the Banking Regulation Act. Various steps for such a scheme are as

under:

i.

Draft scheme of merger has to be placed before shareholders of each banking

Company and approved by the majority representing 2/3rd in value of

shareholders of each banking company present and voting (including proxies)

ii.

Notice of meeting to be given to shareholders of each banking company and

notice of meeting to be published in two newspapers of the locality at least once

in week for three consecutive weeks.

iii.

Any dissenting shareholder to be paid value of shares held by as fixed by

Reserve Bank of India while approving in draft scheme.

iv.

On obtaining shareholders approval, scheme to be submitted to Reserve Bank of

India for approval /sanction.

v.

Reserve Bank of India to issue an order sanctioning the scheme. Consequences

of such amalgamation scheme such as vesting of assets and liabilities in the

transferee bank etc ensure as provided in sub-sections (6), (6A), (6B), (6C) of

section 44A.

vi.

Except the variations on account of requirement of sections 44A, other

requirement for actual framing of the scheme will apply as stated in section on

power of Acquisition or Takeover of banking Institutions (Section 4.1)

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

b) Merger of a private bank with a nationalized banki.

Since the definition of banking institution under section 9 of the bank

nationalization Act includes a banking company, a scheme under section 9(2) (C

) can be framed by the Central Government for the purpose of mergers of a

banking company will corresponding new bank. All the requirement stated under

section on power of Acquisition Takeover of banking Institution (Section 4.1)

would apply in respect of such a scheme.

ii.

If such a banking company to be merged with corresponding new bank is a listed

company it would be necessary to comply with the requirement of the Listing

Agreement.

iii.

To protect the right of the shareholders of the banking company it will also be

necessary to give an option to the shareholders of the banking company to

accept the shares of the merged entity as per the swap ratio as fixed by the

scheme or accept the shares of the merged entity as per the swap ratio as fixed

by the scheme or accept the payment for shareholders. Since the merger

scheme is to be framed under section 9(2) (C) of the Nationalization Act, there is

no express statutory requirement for the purpose of obtaining the consent of the

shareholders of the banking company for the mergers.

c) Merger of nationalized banksThe following steps will need to be undertaken:

i.

CMDs of the two Banks approach GOI and obtain clearance to proceed to

evaluate proposal.

ii.

The Central Government may then ask the Two CMDs to conduct a strategic

due diligence to be able to further evaluate the logic of the merger.

iii.

The CMDs would go back to GOI with the results of the strategic due diligence.

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

iv.

If the proposal finds favor with the Central Government, it would then frame a

draft scheme under section 9 of the Banking Companies (Acquisition and

Transfer of Undertakings) Act, 1980. The Central Government would require

valuation to be conducted by experts to work out the swap ratios. The experts so

chosen should be requested to submit their report in a sealed cover directly to

the Central Government. This is necessary so that persons connected with the

corresponding new banks who are involved in the process are protected from

any allegation that sensitive information was leaked or disclosed.

v.

The Central Government would then place all the material before the Reserve

Bank of India by way of consultation in terms of Section 9(1).After the Reserve

Bank offers its comments and suggestions, if any, the draft scheme could be

fine-tuned.

vi.

The Government scheme so fine-tuned would be placed before the Boards of

both Banks. At this stage, it would be necessary for listed entities to ensure that

compliance with SEBI guidelines is ensured.

vii.

The next step would be to publish the draft scheme in its final form in various

newspapers across the country for the information of the investing shareholders

and inviting them to make their suggestions, if any, in relation to the scheme. A

reasonable period for not less than 21 to 30 days could be given for this purpose.

Natural justice dose not entail personal hearing in all cases. This is particularly so

in cases where a large body of persons are involved. In such cases natural

justice is complied with if the persons concerned are given an opportunity for

making suggestions or objections. It would be perfectly reasonable to give an

opportunity of placing objection and suggestions in writing, which could then be

considered by the Central Government in a fair and objective manner.

viii.

Since the merger scheme is to be framed under section 9(2) (C) of the

Nationalization Act, there is no express statutory requirement for the purpose of

obtaining the consent of the shareholders of the banking company for the

mergers.

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

ix.

The treatment of transferee bank employees will need to be indicated by the

GOI. It will be necessary to provide an option to workmen staff to continue in

service on same terms and conditions or accept retrenchment compensation and

other terminal benefits as may be payable under the rules, as governed by the

Industrial Disputes Act 1947. As far as non-workmen employees are concerned

the scheme may offer continuation initially for a specified period on same terms

and conditions and from the date to be specified on terms that are applicable to

such employees in the transferee bank. Those who do not accept the offer may

be paid terminal benefits as per the rules applicable.

x.

After all the suggestions that are received from minority shareholders are

considered, the Central Government could proceed to notify the scheme. The

effective date will need to be indicated in the notification.

xi.

Thereafter the scheme would have to be placed before both the Houses of

Parliament as provided in Section 9(6).

d) Merger of a nationalized bank with State Bank of India (SBI)i.

In a corresponding new bank the controlling shares are held by the Central

Government and respect of State bank of India, the controlling shares are held

by Reserve Bank of India. Initiation of any proposal for merger of corresponding

new bank with State Bank of India would therefore need approval of the Central

Government as well as the Reserve Bank of India.

ii.

Since the provision of section 9(2) (c) read with explanation I to section 9(5) of

the Nationalization Act contemplate the merger of a public sector bank with State

Bank of India, it would be permissible for the Central Government of formulate a

scheme under section 9(2) (c) for the purpose of amalgamation of a

corresponding new bank with State Bank of India.

iii.

If the corresponding new bank has raised capital by issue of shares to public it

will be necessary to make a valuation of shares and decide the swap ratio for

shares of the state Bank of India. Provision will have to be made for payment of

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

compensation in cash to the dissenting shareholders of the corresponding new

bank, who do not dissenting shareholders of corresponding new bank, who do

not accept the shares of the State Bank of India as per the swap ratio.

iv.

In addition to the requirement stated above, the other requirement in the matter

of formulation of the scheme under section 9 (2) (c) as stated earlier above will

apply in respect of merger of a corresponding new bank with State Bank of India.

e) Merger of a nationalized bank with a subsidiary bank of State Bank of India

The position as stated earlier, in respect of merger of a corresponding new bank with

State Bank of India shall apply in respect of merger of corresponding new bank with a

subsidiary of State bank of India also. The only modification that may be required is that

approval of State Bank of India in addition to Reserve Bank of India and the Central

Government would be necessary for initiation of negotiation for merger, since the entire

shareholding of a subsidiary bank vests in State Bank of India; expect the above

modification, rest of the steps and applicable law will be the same as stated in 4.1

above.

f) Merger of a private bank with State bank of India or its subsidiaries

Although the State Bank of India has power to acquire any banking institution under

section 35 of the State Bank of India Act, 1955 the definition Banking Institution does

not expressly include a banking company. It is therefore doubtful whether powers under

section 35 of the State Bank of India Act, 1955 or under section 38 of the State Bank of

India (Subsidiary Banks) Act, 1959 can be exercised for the purpose of such merger. As

far as the power of the Central Government is concerned a scheme under section 9(2)

(c) cannot be framed for the purpose of merger of a banking company with State Bank of

India or subsidiary bank.

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

g) Merger/Amalgamation in the cooperative banking sectorAs co-operative banks are under dual control, with both the RBI and the RCS (Registrar

of Co-operative Societies) .for merger to take place the RBI must issue a no-objection

certificate (NOC) to RCS. Amalgamation and mergers of co-operative banks falls under

the purview of the RCS.

Reserve Bank of India will consider proposals for merger and amalgamation in the urban

banks sector in the following circumstances:

1) When the networth of the acquired bank is positive and the acquirer bank assures to

protect entire deposits of all the depositors of the acquired bank;

2) When the networth of acquired bank is negative but the acquirer bank on its own

assures to protect deposits of all the depositors of the acquired bank; and

3) When the networth of the acquired bank is negative and the acquirer bank assures to

protect the deposits of all the depositors with financial support from the State

Government extended upfront as part of the process of merger.

The Reserve Bank also proposes that in all cases of merger/amalgamation, the financial

parameters of the acquirer bank post merger will have to conform to the prescribed

minimum prudential and regulatory requirement for urban co-operative banks. The

realizable value of assets will have to be assessed through a process of due diligence.

(See detailed guidelines in the annexure)

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

Chapter- IX- A Case Study

Merger/Amalgamation of Global Trust Bank with Oriental Bank of

Commerce- A Case Study

The Reserve Bank had granted license to Global Trust Bank (GTB) Ltd. In September

1994 as a part of the policy to set up new private sector banks. The bank was promoted

by a group of professionals led by Dr. Jayanta Madhab and Shri Ramesh Gelli, the then

Chairman of Vysya Bank Ltd. with the participation of International Finance Corporation

(IFC) and Asian Development Bank (ADB) as associates.

The financial position of GTB started weakening in 2002 due to very high exposure to

capital market which had turned into problem assets. After it came to the notice of the

Reserve Bank that the bank had incurred huge net loss in 2002, it was put under close

monitoring. The bank was instructed to adopt a prudential policy of containing growth of

risk weighted assets, to make maximum recoveries of NPAs, to reduce its high capital

market exposure to the prudential limit, provide against impairment of assets out of the

operating

profits

and

to

take

immediate

steps

to

augment

the

capital.

The bank reported some progress in making recoveries and also the attempts underway

to have equity infusion. However, it was not able to finalize a programme of capital

augmentation till June 2004 through domestic sources as advised. Later, the bank

submitted in July 2004, a proposal received from an overseas equity investor fund for

recapitalization of the bank. The proposal was not found acceptable by Reserve Bank on

prudential and other considerations.

As the financial position of the bank was deteriorating progressively and the solvency of

the bank was being seriously affected, the Reserve Bank had to place the bank under

moratorium on July 24, 2004 to protect the interests of the large body of small depositors

of the bank and in the interest of the banking system.

A firm proposal for merger of the bank was received from Oriental Bank of Commerce

(OBC). OBCs perception on the issue was examined by the Reserve Bank, keeping in

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

view, its financial parameters, its retail network and synergies as well as strategic

advantages. Taking into account the interests of OBC and depositors of GTB, as well as

the banks strengths and weaknesses, GTB was merged with OBC with effect from

August 14, 2004 under the powers vested with the Reserve Bank under the Banking

Regulations Act, 1949 through a scheme sanctioned by the Government of India.

FINANCIALS BEFORE AND AFTER

Oriental Bank of Commerce:

Company Profile:

Oriental Bank of Commerce (OBC) is a Delhi Based public sector bank with a Major

presence in northern India. With the recent acquisition of the ailing erstwhile Global Trust

Bank (GTB), OBC has expanded its presence in the Southern and Western India. The

bank caters to the Corporate, Retail and the Agricultural sector With various loan and fee

based products. It reaches out to its 8mn strong customer base through a network of

1121 branches and 396 ATMs.

At FY04, the bank held a market share of 2.2% and 2.4% in credit and deposit

respectively of all the SCBs In India. The financial of the OBC given bellow before GTB

merger. Just by seeing the number we can tell that financial condition of OBC bank is

quit strong. There is a clear 50% increase in the net profit from 2003 to 2004 and

maintaining 14% CAR (Capital Adequacy Ratio) is sign of financial soundness.

OBC financial result as on 31 All figure in

march 2004

crore

31.03.04

31.03.03

S.N

Particulars

Interest Earned

3300.54

3304.27

Other Income

721.71

531.39

(A) TOTAL INCOME(1+2)

4022.25

3835.66

Interest Expended

1844.74

2089.94

Operating Expenses

644.48

582.66

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

(B) TOTAL EXPENDITURE

2489.22

2672.6

1533.33

1163.6

contingencies

387.43

427.55

(E)Provision for Taxes

459.53

278.56

(F)Net Profit/Loss(C-D-E)

686.07

456.95

Capital adequacy ratio (%)

14.47

14.04

Earning per shares(in RS)

35.63

23.73

OPERATING PROFIT /LOSS (AB)

(D)Other

provisions

and

Analytical ratio

Global Trust Bank:

Global Trust Bank Ltd., (GTB) was placed under an Order of Moratorium on July 24,

2004. The option available with the Reserve Bank was to compulsory merger under

section 45 of the Banking Regulation Act, 1949. Oriental Bank of Commerce (OBC)

interest was examined by the Reserve Bank of India keeping in view its financial

parameters, its retail network and its synergies as well as strategic advantages. GTB

strongly present in western part of India having 1million costumer and 1300 employees

taken over by OBC.

If we see the financial of the GTB before to the merged with the OBC it is quite evident

that Net profit was continuously deteriorating.

All figure

GTB financial result as on 31 march 2004

in crore

31.03.04

31.03.03

s.no

Particulars

Interest Earned

354.19

539.59

Other Income

161.06

191.36

(A) TOTAL INCOME(1+2)

515.25

730.95

Interest Expended

435.13

517.41

Operating Expenses

158.91

177.1

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

(B) TOTAL EXPENDITURE

594.04

694.51

OPERATING PROFIT /LOSS (A-B)

-78.79

36.44

(D)Other provisions and contingencies

708.19

309.09

(E)Provision for Taxes

25.4

0.05

(F)Net Profit/Loss(C-D-E)

-812.38

-272.7

Capital adequacy ratio (%)

Earning per shares(in RS)

-66.94

-22.47

Analytical ratio

OBC after merger with GTBAs per the scheme of amalgamation notified by the Government of India the erstwhile

Global Trust Bank Ltd. (GTB) has been amalgamated with Oriental Bank of Commerce

w.e.f. 14.08.2004.

It is observed that as per the scheme of amalgamation the valuation of Assets and the

determination of Liabilities have been made by the Auditors nominated by the Reserve

Bank of India and the assets are classified into Readily Realizable and Not Readily

Realizable.

The excess of liabilities over assets taken over amounting to Rs. 1225.72 crores has

been debited to an account titled Amalgamation Adjustment Account and included

under Other Assets. The Bank has decided to write off the intangible asset

Amalgamation Adjustment Account equally over a period of five years commencing

from the year ended March 31, 2005.

We can see the financial of the OBC after merger with GTB %CAR gown down

significantly from 14 % in 2004 to 9% in 2005 and net profit gown up just up by just 10%

in 2005 one should keep in mind that before merger this figure was 50%.

OBC financial result as on 31 march 2005

s.no

Particulars

Interest Earned

Banknet India- Banking Knowledge, Research & Conferences

31.03.05

31.03.04

3571.9

3300.54

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook

Other Income

505.2

721.71

(A) TOTAL INCOME(1+2)

4077.1

4022.25

Interest Expended

2048.22

1844.74

Operating Expenses

795.73

644.48

(B) TOTAL EXPENDITURE

2843.95

2489.22

OPERATING PROFIT /LOSS (A-B)

1233.15

1533.33

(D)Other provisions and contingencies

400.15

387.43

(E)Provision for Taxes

72.19

459.53

(F)Net Profit/Loss(C-D-E)

760.81

686.07

Capital adequacy ratio (%)

9.21

14.47

Earning per shares(in RS)

39.51

35.63

Liabilities

Deposits

Analytical ratio

The Detail of Asset and Liabilities Taken Over are as under

(Amount in crore)

Rs

Assets

5187.87 Cash and Bank Balance

Borrowings

Other Liabilities and

provision

Total

Contingent liabilities

185 Balance with Banks

Rs

367.12

162.44

692.04 Investment

Advances

Fixed Assets

Other Assets

Excess of liabilities over assets

taken over

6064.71 Total

2083.17

1808.9

1712.97

252.69

534.87

1225.72

6064.71

The accounting treatment for the amalgamation is given on the basis of the purchasing

method as per the accounting standards 14 accounting of the amalgamation issued by

the institute of chartered accountants of the India. The prudential norms in respect of the

investment and advances taken over have been applies on an ongoing basis.

Challenges in front of OBC after merger with GTBa) Recovery of the bad loans:

For OBC acquisition of GTB rather than a matter of choice, was a mandate from the

Banknet India- Banking Knowledge, Research & Conferences

www.banknetindia.com

M&A in Indian Banking System An Executive Handbook