Beruflich Dokumente

Kultur Dokumente

Chap 004

Hochgeladen von

wasiq999Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chap 004

Hochgeladen von

wasiq999Copyright:

Verfügbare Formate

Chapter 04 - The Accounting Cycle:Accruals and Deferrals

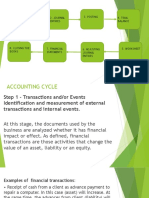

THE ACCOUNTING CYCLE:

ACCRUALS AND DEFERRALS

Chapter Summary

In order for revenues and expenses to be reported in which they are earned or incurred,

adjusting entries must be made at the end of the accounting period. Adjusting entries are made so

the revenue recognition and matching principles are followed. Chapter 4 completes the treatment

of the accounting cycle for service type businesses. It focuses on the year-end activities

culminating in the annual report. These include the preparation of adjusting entries, preparing the

financial statements themselves, drafting the footnotes to the statements, closing the accounts, and

preparing for the audit. These topics form the content of Chapter 4.

The chapter begins with a thorough review of various adjusting entries. The adjustments

are classified into four categories: converting assets to expenses; converting liabilities to revenue;

accruing unpaid expenses and; accruing uncollected revenues. The categories are discussed and

illustrated in this order. We briefly explain that the adjusting entries are needed to satisfy the

realization and matching principles. The concept of materiality is introduced and its relevance to

the adjusting entries is explained next.

Learning Objectives

1.

Explain the purpose of adjusting entries.

2.

Describe and prepare the four basic types of adjusting entries.

3.

Prepare adjusting entries to convert assets to expenses.

4.

Prepare adjusting entries to convert liabilities to revenue.

5.

Prepare adjusting entries to accrue unpaid expenses.

6.

Prepare adjusting entries to accrue uncollected revenue.

7.

Explain how the principles of recognition and matching relate to adjusting entries.

8.

Explain the concept of materiality.

9.

Prepare an adjusted trial balance and describe its purpose.

4-1

Chapter 04 - The accounting cycle:Accruals and deferrals

Brief topical outline

A

Adjusting entries

1 The need for adjusting entries

2 Types of adjusting entries

3 Adjusting entries and timing differences

4

Characteristics of adjusting entries

5 Year-end at Overnight Auto Service

6 Converting assets to expenses

a Prepaid expenses

b Shop supplies

c Insurance policies - see Your Turn (page 147)

d Recording prepayments directly in the expense accounts

7 The concept of depreciation

a What is deprecation?

b Depreciation is only an estimate - see Case in Point (page 149)

c Depreciation of Overnight's building

d Depreciation of tools and equipment

e Depreciation - a noncash expense

8 Converting liabilities to revenue

a Recording advance collections directly in the revenue accounts

9

Accruing unpaid expenses

a Accrual of wages (or salaries) expense

b Accrual of interest expense

10 Accruing uncollected revenue

11 Accruing income taxes expense: the final adjusting entry - see Case in Point

(page 155)

a Income taxes in unprofitable periods

Adjusting entries and accounting principles

1 The concept of materiality

a Materiality and adjusting entries

b Materiality is a matter of professional judgment see Your Turn (page

158)

2 Effects of the adjusting entries see Ethics, Fraud & Corporate Governance

(page 161)

Concluding remarks

4-2

Chapter 04 - The Accounting Cycle:Accruals and Deferrals

Topical coverage and suggested assignment

Homework Assignment

(To Be Completed Prior to Class)

Class

Meetings

on Chapter

1

2

3

Topical

Outline

Coverage

A

A

B-C

Discussion

Questions

1, 2, 4

8, 9

10, 11

Brief

Exercises

1, 2

4, 5

9, 10

Exercises

2, 3, 6

7, 9

10, 11

Problems

1

3, 4

6

Critical

Thinking

Cases

1

2

Comments and observations

Teaching objectives for Chapter 4

In Chapter 4 we cover the numerous accounting activities, both analytical and procedural, that

take place at the end of a fiscal year. In covering this chapter, our teaching objectives are to:

1

Explain the need for adjusting entries in accrual accounting.

Illustrate the four basic types of adjusting entries.

Review in sequence the steps in the complete accounting cycle.

Introduce the principle of materiality and discuss its relevance to adjusting entries.

General comments

The need for adjusting entries stems from the most basic concepts of accrual accounting,

the concepts that revenue is recognized when it is earned and that expenses are recognized when

the related goods and services are used. We find that students who do not fully understand the

nature and purpose of adjusting entries have difficulty with other accrual accounting concepts

throughout the course. We find Exercises 2, 3, 5, and 9 particularly useful. Exercise 2 illustrates

the effects of the four basic types of adjusting entries upon both the income statement and balance

sheet. Exercise 3 focuses upon those adjustments that apportion previously recorded amounts,

while Exercise 5 illustrates adjustments needed to accrue unrecorded amounts. Exercise 9

demonstrates that the need for adjusting entries arises from transactions spanning more than one

accounting period. We also like Exercise 6, which focuses upon unearned revenue in the

accounting records of Cathay Pacific.

4-3

Chapter 04 - The accounting cycle:Accruals and deferrals

We personally spend quite a bit of class time on materiality, as we consider it to be one of

the most important concepts in accounting. The chapter has several good assignments on

materiality, including Discussion Questions 10 and 11, Exercise 10, and Case 2. We always assign

at least two of these and discuss them in class.An aside Some students may ask why the word

"debit" is abbreviated "Dr." in the columnar headings of the worksheet, as there is no "r" in

"debit." The word "debit" is derived from the Latin verb debere, which means "to owe." "Credit"

stems from the Latin verb credere, meaning "to entrust" or "to lend." In modern usage, of course,

the term debit has come to mean any entry in the left-hand side of a ledger account, and credit has

come to mean any entry in the right-hand side.

4-4

Chapter 04 - The Accounting Cycle:Accruals and Deferrals

CHAPTER 4

NAME

10-MINUTE QUIZ A SECTION

Indicate the best answer for each question in the space provided.

1

Joseph Jewelers purchased display shelves on March 1 for $36,000. If

this asset has an estimated useful life of five years, what is the book

value of the display shelves on April 30?

a $600.

b $34,800.

c $33,600.

d $900.

The adjusting entry to recognize an unrecorded expense is necessary:

a When an expense is paid in advance.

b When an expense has been neither paid nor recorded as of the end

of the accounting period.

c Whenever an expense remains unpaid at the end of an accounting

period.

d Because the accountant is likely to forget to pay these unrecorded

expenses.

Before any month-end adjustments are made, the profit of Lawrence

Company is $550,000.

However, the following adjustments are

necessary: office supplies used, $35,000; services performed for clients

but not yet recorded or collected, $12,300; interest accrued on note

payable to bank, $14,100. After adjusting entries are made for the

items listed above, Lawrence Companys profit would be:

a $541,400.

b $488,600.

c $583,200.

d $513,200.

Of the following adjusting entries, which one results in an increase in

liabilities and the recognition of an expense at the end of an

accounting period?

a The entry to accrue salaries owed to employees at the end of the

period.

b The entry to record revenue earned but not yet collected or

recorded.

c

The entry to record earned portion of rent previously received in

advance from a tenant.

d The entry to write off a portion of unexpired insurance.

5

The CPA firm auditing Indian Company found that profit had been

overstated. Which of the following errors could be the cause?

a Failure to record depreciation expense for the period.

b No entry made to record purchase of land for cash on the last day

of the year.

c

Failure to record payment of an account payable on the last day of

the year.

4-5

Chapter 04 - The accounting cycle:Accruals and deferrals

d Failure to make an adjusting entry to record revenue which had

been earned but not yet billed to customers.

4-6

Chapter 04 - The Accounting Cycle:Accruals and Deferrals

CHAPTER 4

NAME

10-MINUTE QUIZ B SECTION

Manhattan Park adjusts its books each month and closes its books on

December 31 each year. The trial balance at January 31, 2010, before

adjustments, follows:

Debit

Cash................................................................. $ 6,600

Supplies............................................................

5,400

Unexpired Insurance..........................................

12,600

Equipment.........................................................

72,000

Accumulated Depreciation: Equipment..............

Unearned Admission Revenue...........................

Share Capital.....................................................

Retained Earnings, January 1, 2008...................

Admissions Revenue..........................................

Salaries Expense...............................................

8,100

Utilities Expense................................................

5,700

Rent Expense....................................................

5,400

$115,800

Credit

$ 18,000

12,000

20,000

38,200

27,600

_________

$115,800

Refer to the above data. According to attendance records, $8,200 of

the Unearned Admission Revenue has been earned in January.

Compute the amount of admissions revenue to be shown in the January

income statement:

a $35,800.

b $19,400.

c $8,200.

d $3,800.

Refer to the above data. At January 31, the amount of supplies on

hand is $2,300. What amount is shown on the January income

statement for supplies expense?

a $2,300.

b $5,400.

c $3,100.

d $7,700.

Refer to the above data. The equipment has an original estimated

useful life of six years. Compute the book value of the equipment at

January 31 after the proper January adjustment is recorded:

a $1,000.

b $71,000.

c $53,000.

d $60,000.

Refer to the above data. Employees are owed $1,200 for services

since the last payday in January to be paid the first week of February.

No adjustment was made for this item. As a result of this error:

a Assets at January 31 are overstated.

b January profit is overstated.

c Liabilities at January 31 are overstated.

d Equity at January 31 is understated.

Refer to the above data. On August 1, 2007, the park purchased a

12-month insurance policy. The necessary adjusting entry at January

31 includes which of the following entries? (Hint: The company has

adjusted its books on a monthly basis.)

a A debit to Insurance Expense for $1,050.

4-7

Chapter 04 - The accounting cycle:Accruals and deferrals

b A credit to Unexpired Insurance for $11,550.

c A credit to Unexpired Insurance for $1,800.

d A debit to Unexpired Insurance for $10,800.

4-8

Chapter 04 - The Accounting Cycle:Accruals and Deferrals

CHAPTER 4 NAME

10-MINUTE QUIZ C SECTION

Scorpio Travel adjusts its books each month and closes its books on

December 31 each year. The trial balance at January 31, 2009, before

adjustments, follows:

Debit

Cash................................................................. $ 3,300

Supplies............................................................

2,700

Unexpired Insurance..........................................

6,300

Equipment.........................................................

36,000

Accumulated Depreciation: Equipment..............

Unearned Admission Revenue...........................

Share Capital.....................................................

Retained Earnings, January 1, 2007...................

Admissions Revenue..........................................

Salaries Expense...............................................

4,050

Utilities Expense................................................

2,850

Rent Expense....................................................

2,700

$57,900

Credit

$9,000

6,000

7,500

21,600

13,800

________

$57,900

1 Refer to the above data. According to attendance records, $4,800 of the

Unearned Admission Revenue has been earned in January. Compute the balance in

the following accounts after the proper adjustment is made.

Unearned Admission Revenue account balance $_1200_________

Admission Revenue account balance $___18600_______

2 Refer to the above data. At January 31, the amount of supplies still on hand

was determined to be $675. What amount should be reported in the January

income statement for supplies expense?

$__________

3 Refer to the above data. The equipment has an original useful life of eight

years. Compute the book value of the equipment at January 31 after the proper

January adjustment is recorded.

$__________

4 Refer to the above data. $900 is owed to employees for work since the last

payday in January, to be paid the first week of February. What is the effect on

January profit if the accountant fails to make any January 31 adjustment for this

item?

5 Refer to the above data. On June 1, 2007, the park purchased a 12-month

insurance policy. Give the adjusting entry to record insurance coverage expiring in

January. (Hint: The company adjusts its books on a monthly basis.)

4-9

Chapter 04 - The accounting cycle:Accruals and deferrals

CHAPTER 4

NAME

10-MINUTE QUIZ D SECTION

The accountant for Roses Emporium Limited prepared the following trial balance at

January 31, 2010, after one month of operations:

Debit

Credit

Cash................................................................................ $ 5,700

Accounts Receivable.........................................................

4,500

Unexpired Insurance.........................................................

2,100

Office Equipment..............................................................

18,000

Unearned Consulting Fees.................................................

$ 3,300

Share Capital....................................................................

15,600

Retained Earnings, January 1, 2005..................................

0

Dividends..........................................................................

3,300

Consulting Fees Earned.....................................................

26,800

Salaries Expense...............................................................

7700

Utilities Expense...............................................................

1,700

Rent Expense....................................................................

2,100

Supplies Expense..............................................................

600

______

$45,700

$45,700

Additional information items:

a

Consulting services rendered to a client in January, not yet billed or recorded,

$2,400.

b

Portion of insurance expiring in January, $300.

c

Income taxes expense for January of $2,500.

d

The office equipment has a life of 5 years.

Instructions. Prepare adjusting entries for a through d.

Adjusting Entries

Jan. 31

4-10

Chapter 04 - The Accounting Cycle:Accruals and Deferrals

SOLUTIONS TO CHAPTER 4 10-MINUTE QUIZZES

QUIZ A

QUIZ B

1

B

1

A

2

B

2

C

3

D

3

C

4

A

4

B

5

A

5

C

Learning Objective:

Learning Objective:

36

3, 4, 5

QUIZ C

1

Unearned Admission Revenue: $6,000 $4,800 = $1,200 credit

Admission Revenue: $13,800 + $4,800 = $18,600 credit

2

$2,700 $675 = $2,025

[This is the asset Supplies. The expense should be

$675.]

3

January depreciation = $36,000 8 (1/12) = $375

$36,000 $9,000 $375 = $26,625 book value

4

Profit is overstated by $900.

5

Insurance Expense.......................................................

Unexpired Insurance............................................

1,260

Computation $6,300 5 months remaining = $1,260 per month

Learning Objective: 3, 4, 5

4-11

1,260

Chapter 04 - The accounting cycle:Accruals and deferrals

QUIZ D

Adjusting Entries

Jan 31

A

Accounts Receivable

2,400

Consulting Fees Earned

2,400

Insurance Expense

300

Unexpired Insurance

300

Income Tax Expense

2,500

Income Taxes Payable

2,500

Depreciation Expense

300

Accumulated Depreciation

Learning Objective: 3, 5, 6

4-12

300

Chapter 04 - The Accounting Cycle:Accruals and Deferrals

Assignment Guide to Chapter 4

Time estimate (in minutes)

Difficulty rating

Learning Objectives:

1. Explain the purpose

of adjusting entries.

2. Describe and prepare

the four basic types

of adjusting entries.

3. Prepare adjusting

entries to convert

assets to expenses.

4. Prepare adjusting

entries to convert

liabilities to revenue.

5. Prepare adjusting

entries to accrue

unpaid expenses.

6. Prepare adjusting

entries to accrue

uncollected revenue.

7. Explain how the

principles of

recognition and

matching related to

adjusting entries.

8. Explain the concept of

materiality.

Brief

Exercis

es

1 10

< 10

E

1, 2, 3,

4

1, 2, 6

7, 8, 9

5

Exercises

1 15

< 15

E

1, 2, 3, 4, 5, 6,

7, 8, 9, 10, 11,

12, 13, 14, 15

1, 2, 3, 4, 5, 6,

7, 8, 9, 12, 13,

14, 15

1, 2, 3, 4, 5,

7, 9, 10, 12,

13, 14

1, 2, 3, 4, 5, 6,

7, 9, 10, 11,

12, 13, 14

1, 2, 3, 4, 5,

7, 8, 9, 10, 12,

13, 14

1, 2, 3, 4, 5,

7, 9, 12, 13,

14

1, 3, 4, 5, 7, 9,

10, 11, 12, 14

Problems

Cases

1

40

M

2

40

M

3

40

M

4

25

S

5

30

M

6

60

S

7

60

S

8

60

S

1

30

M

2

30

M

3

30

M

1, 14

4-13

10

Ne

t

4

30

M

Chapter 04 - The accounting cycle:Accruals and deferrals

9. Prepare an adjusted

trial balance and

describe its purpose.

1, 2, 9, 12

4-14

Das könnte Ihnen auch gefallen

- Vocabulary Quiz: Chapter 4: Accrual Accounting ConceptsDokument11 SeitenVocabulary Quiz: Chapter 4: Accrual Accounting ConceptsThien Phuc LeNoch keine Bewertungen

- C4 Accrual Accounting ConceptDokument72 SeitenC4 Accrual Accounting ConceptAllen Allen100% (2)

- FABM AJE and Adjusted Trial Balance Service BusinessDokument18 SeitenFABM AJE and Adjusted Trial Balance Service BusinessMarchyrella Uoiea Olin Jovenir50% (4)

- Answer and Question Financial Accounting Chapter 6 InventoryDokument7 SeitenAnswer and Question Financial Accounting Chapter 6 Inventoryukandi rukmanaNoch keine Bewertungen

- Grade11 Fabm1 Q2 Week1Dokument22 SeitenGrade11 Fabm1 Q2 Week1Mickaela MonterolaNoch keine Bewertungen

- ABM FABM1-Q4-Week-1Dokument26 SeitenABM FABM1-Q4-Week-1Just OkayNoch keine Bewertungen

- Math-11-ABM-FABM1-Q2-Week-1-for-studentsDokument19 SeitenMath-11-ABM-FABM1-Q2-Week-1-for-studentsRich Allen Mier UyNoch keine Bewertungen

- The Adjusting Process True/False QuizDokument13 SeitenThe Adjusting Process True/False QuizEly IseijinNoch keine Bewertungen

- Q3-Module-1Dokument15 SeitenQ3-Module-1shamrockjusayNoch keine Bewertungen

- Chapter 4Dokument56 SeitenChapter 4Crystal Brown100% (1)

- Accounting 04Dokument91 SeitenAccounting 04Tamara WilsonNoch keine Bewertungen

- Chap 004Dokument30 SeitenChap 004Tariq Kanhar100% (1)

- Ncert SolutionsDokument33 SeitenNcert SolutionsArif ShaikhNoch keine Bewertungen

- Chapter 3 Adjusting The AccountsDokument28 SeitenChapter 3 Adjusting The AccountsfuriousTaherNoch keine Bewertungen

- Review of The Accounting ProcessDokument5 SeitenReview of The Accounting Processrufamaegarcia07Noch keine Bewertungen

- Financial Managerial Accounting 3Rd Edition Horngren Solutions Manual Full Chapter PDFDokument31 SeitenFinancial Managerial Accounting 3Rd Edition Horngren Solutions Manual Full Chapter PDFMeganPrestonceim100% (12)

- Financial Managerial Accounting 3rd Edition Horngren Solutions ManualDokument10 SeitenFinancial Managerial Accounting 3rd Edition Horngren Solutions Manualexsect.drizzlezu100% (15)

- Module 3 - The Adjusting ProcessDokument2 SeitenModule 3 - The Adjusting ProcessTBA PacificNoch keine Bewertungen

- CH 4 - End of Chapter Exercises SolutionsDokument80 SeitenCH 4 - End of Chapter Exercises SolutionsPatrick AlphonseNoch keine Bewertungen

- Business FInance Week 5 and 6Dokument51 SeitenBusiness FInance Week 5 and 6Jonathan De villa100% (1)

- Business FInance Week 3 and 4Dokument68 SeitenBusiness FInance Week 3 and 4Jonathan De villa100% (1)

- Business FInance Week 3 and 4Dokument75 SeitenBusiness FInance Week 3 and 4Hyakkima NasumeNoch keine Bewertungen

- Fabm 1 - Q2 - Week 1 - Module 1 - Preparing Adjusting Entries of A Service Business - For ReproductionDokument16 SeitenFabm 1 - Q2 - Week 1 - Module 1 - Preparing Adjusting Entries of A Service Business - For ReproductionJosephine C QuibidoNoch keine Bewertungen

- Chaper 4 Completing The Accounting CycleDokument41 SeitenChaper 4 Completing The Accounting CycleAssassin ClassroomNoch keine Bewertungen

- Business Math 9: Department of Education SPTVEDokument10 SeitenBusiness Math 9: Department of Education SPTVESunday MochicanaNoch keine Bewertungen

- Fabm1 Preparing Adjusting EntriesDokument19 SeitenFabm1 Preparing Adjusting EntriesVenice0% (1)

- Study Objectives-: Chapter 3-The Basics of Adjusting EntriesDokument19 SeitenStudy Objectives-: Chapter 3-The Basics of Adjusting EntriesMayann UrbanoNoch keine Bewertungen

- Completing Accounting Cycle for Service BusinessDokument10 SeitenCompleting Accounting Cycle for Service BusinessZairah HamanaNoch keine Bewertungen

- Fabm1: Quarter 4 - Module 9: Preparing Adjusting EntriesDokument17 SeitenFabm1: Quarter 4 - Module 9: Preparing Adjusting EntriesIva Milli Ayson100% (2)

- ACTBAS1 - Lecture 11 (Completion of Acctg Cycle)Dokument14 SeitenACTBAS1 - Lecture 11 (Completion of Acctg Cycle)AA Del Rosario AlipioNoch keine Bewertungen

- Accounting For ManagersDokument10 SeitenAccounting For ManagersThandapani PalaniNoch keine Bewertungen

- Accrual Accounting Concepts: Learning ObjectivesDokument32 SeitenAccrual Accounting Concepts: Learning ObjectiveszemeNoch keine Bewertungen

- Completing the Accounting Cycle: Steps and StatementsDokument16 SeitenCompleting the Accounting Cycle: Steps and StatementsVeniceNoch keine Bewertungen

- Ch04 SM Larson FAP16Dokument64 SeitenCh04 SM Larson FAP16josjhNoch keine Bewertungen

- Accrual Accounting Concepts PDFDokument21 SeitenAccrual Accounting Concepts PDFPhillip Gordon MulesNoch keine Bewertungen

- Adjusting Accounts for Financial StatementsDokument60 SeitenAdjusting Accounts for Financial Statementssamas7480Noch keine Bewertungen

- RETADokument37 SeitenRETAJoshua ChavezNoch keine Bewertungen

- Chapter 5 Income Concepts MCQsDokument6 SeitenChapter 5 Income Concepts MCQsAbood FSNoch keine Bewertungen

- ACCOUNTING CYCLE STEPSDokument33 SeitenACCOUNTING CYCLE STEPSKristelle JoyceNoch keine Bewertungen

- AssignmentDokument8 SeitenAssignmentNegil Patrick DolorNoch keine Bewertungen

- Computer Accounting Essentials With Quickbooks 2014 7th Edition Yacht Solutions ManualDokument11 SeitenComputer Accounting Essentials With Quickbooks 2014 7th Edition Yacht Solutions Manualboredomake0ahb100% (23)

- Acctg11e - SM - CH03 For 25 - 29 Sept 2017Dokument114 SeitenAcctg11e - SM - CH03 For 25 - 29 Sept 2017Dylan Rabin Pereira100% (1)

- Assignm NTDokument12 SeitenAssignm NTSami ullah khan BabarNoch keine Bewertungen

- Adjusting Entries for Prepaid ExpensesDokument85 SeitenAdjusting Entries for Prepaid ExpensesKei HanzuNoch keine Bewertungen

- Chapter 3 CPA ACC2200Dokument2 SeitenChapter 3 CPA ACC2200Asfawosen DingamaNoch keine Bewertungen

- Module 8. FARDokument9 SeitenModule 8. FARAntonNoch keine Bewertungen

- Solution Manual For Financial Accounting A Business Process Approach 3 e 3rd Edition Jane L ReimersDokument11 SeitenSolution Manual For Financial Accounting A Business Process Approach 3 e 3rd Edition Jane L ReimersLoriSmithamdt100% (40)

- The Accounting CycleDokument21 SeitenThe Accounting Cycleulquira grimamajowNoch keine Bewertungen

- The Accounting Cycle: Step 1: Analyze Business TransactionsDokument4 SeitenThe Accounting Cycle: Step 1: Analyze Business TransactionsUnkownamousNoch keine Bewertungen

- 2 REVEIW OF FINANCIAL STATEMENTS PREPARATION (1)Dokument5 Seiten2 REVEIW OF FINANCIAL STATEMENTS PREPARATION (1)Hommer CorderoNoch keine Bewertungen

- NCERT Class 11 Accountancy Part 2Dokument296 SeitenNCERT Class 11 Accountancy Part 2AnoojxNoch keine Bewertungen

- 02 Accounting Process (Student)Dokument31 Seiten02 Accounting Process (Student)Christina DulayNoch keine Bewertungen

- Budgeting: Accounting CycleDokument3 SeitenBudgeting: Accounting CycleDyane CruzNoch keine Bewertungen

- Adjusting Entries Chapter $Dokument56 SeitenAdjusting Entries Chapter $Arzan AliNoch keine Bewertungen

- Acb3 02Dokument42 SeitenAcb3 02rameNoch keine Bewertungen

- CH 03Dokument58 SeitenCH 03indahmuliasariNoch keine Bewertungen

- New Microsoft Word DocumentDokument2 SeitenNew Microsoft Word Documentracc wooyoNoch keine Bewertungen

- Day 4 Income Statement and Statement of Cash FlowDokument31 SeitenDay 4 Income Statement and Statement of Cash FlowSue-Allen Mardenborough100% (1)

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursVon EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursNoch keine Bewertungen

- Summary of Richard A. Lambert's Financial Literacy for ManagersVon EverandSummary of Richard A. Lambert's Financial Literacy for ManagersNoch keine Bewertungen

- Pilkington GlassDokument1 SeitePilkington Glasswasiq999Noch keine Bewertungen

- ODDEVNDokument1 SeiteODDEVNwasiq999Noch keine Bewertungen

- Chapter1 SolvedDokument6 SeitenChapter1 Solvedwasiq999Noch keine Bewertungen

- Osborne Reynolds' Experiment Visualises Laminar and Turbulent FlowDokument9 SeitenOsborne Reynolds' Experiment Visualises Laminar and Turbulent Flowwasiq999Noch keine Bewertungen

- Hyper BoDokument1 SeiteHyper Bowasiq999Noch keine Bewertungen

- ShapesDokument1 SeiteShapeswasiq999Noch keine Bewertungen

- Cost of CapitalDokument37 SeitenCost of Capitalwasiq999Noch keine Bewertungen

- Chap 002Dokument13 SeitenChap 002wasiq999Noch keine Bewertungen

- The Business GuideDokument13 SeitenThe Business Guidewasiq999Noch keine Bewertungen

- ShapesDokument1 SeiteShapeswasiq999Noch keine Bewertungen

- ROOTSDokument1 SeiteROOTSwasiq999Noch keine Bewertungen

- Hosts UmbrellaDokument1 SeiteHosts UmbrellaFabsor SoralNoch keine Bewertungen

- This Is Life of The Manhattan CrowsDokument1 SeiteThis Is Life of The Manhattan Crowswasiq999Noch keine Bewertungen

- Engineering, IT and Computer Sciences - 29 Aug 2014 PDFDokument258 SeitenEngineering, IT and Computer Sciences - 29 Aug 2014 PDFwasiq999Noch keine Bewertungen

- HelloDokument1 SeiteHellowasiq999Noch keine Bewertungen

- Hosts UmbrellaDokument1 SeiteHosts UmbrellaFabsor SoralNoch keine Bewertungen

- Learner Guide EslDokument28 SeitenLearner Guide Eslapi-264330068Noch keine Bewertungen

- University of The Cordilleras College of Accountancy Quiz On Partnership Formation 1Dokument6 SeitenUniversity of The Cordilleras College of Accountancy Quiz On Partnership Formation 1Ian Ranilopa100% (1)

- Book Keeping & Accounts/Series-3-2007 (Code2006)Dokument11 SeitenBook Keeping & Accounts/Series-3-2007 (Code2006)Hein Linn Kyaw100% (3)

- ReSA B44 AUD Final PB With AnswerDokument21 SeitenReSA B44 AUD Final PB With AnswerAlliah Mae Acosta100% (1)

- The Contribution of Systems TheoryDokument14 SeitenThe Contribution of Systems TheoryDaniela LomarttiNoch keine Bewertungen

- 2 CVP and Break-Even AnalysisDokument7 Seiten2 CVP and Break-Even AnalysisXyril MañagoNoch keine Bewertungen

- Foundations in Accountancy Ffa/Acca F: Nguyen Thi Phuong Mai (PHD, Cpa VN) Email: Maintp@Ftu - Edu.VnDokument166 SeitenFoundations in Accountancy Ffa/Acca F: Nguyen Thi Phuong Mai (PHD, Cpa VN) Email: Maintp@Ftu - Edu.VnMy TranNoch keine Bewertungen

- Accounting and AccountantsDokument44 SeitenAccounting and AccountantsYani BarriosNoch keine Bewertungen

- LIFO Method Periodic InvtyDokument9 SeitenLIFO Method Periodic InvtyHassleBustNoch keine Bewertungen

- Chap 2 Quiz - BA211Dokument5 SeitenChap 2 Quiz - BA211kenozin272100% (2)

- Monthly Sales: PriceDokument5 SeitenMonthly Sales: PriceChicken NoodlesNoch keine Bewertungen

- Ways To Teach AccountDokument7 SeitenWays To Teach AccountMicheal HaastrupNoch keine Bewertungen

- Cog3 2Dokument58 SeitenCog3 2sanjeev19_ynrNoch keine Bewertungen

- Ultralift Corp Manufactures Chain Hoists The Raw Materials Inventories OnDokument3 SeitenUltralift Corp Manufactures Chain Hoists The Raw Materials Inventories OnAmit PandeyNoch keine Bewertungen

- Cash and Accounts Receivable PDFDokument11 SeitenCash and Accounts Receivable PDFAndrew Benedict PardilloNoch keine Bewertungen

- ACCT6003 Assessment 2 T1 2020 Brief PDFDokument7 SeitenACCT6003 Assessment 2 T1 2020 Brief PDFbhavikaNoch keine Bewertungen

- 01 - Audit of Cash & Cash EquivalentsDokument4 Seiten01 - Audit of Cash & Cash EquivalentsEARL JOHN RosalesNoch keine Bewertungen

- City Pages April 2010Dokument76 SeitenCity Pages April 2010febbinsNoch keine Bewertungen

- Internal Audit ChecklistDokument44 SeitenInternal Audit ChecklistGlenn Padilla100% (3)

- Cost Accounting March 2021Dokument28 SeitenCost Accounting March 2021humayun kabirNoch keine Bewertungen

- Orientation Kits Sept. 2020 IntakeDokument26 SeitenOrientation Kits Sept. 2020 IntakeImran HusainiNoch keine Bewertungen

- SAP Standard Reports - ERP Operations - SCN WikiDokument8 SeitenSAP Standard Reports - ERP Operations - SCN WikiRaksha RaniNoch keine Bewertungen

- AAFR Book (Publish) - 2023Dokument166 SeitenAAFR Book (Publish) - 2023Muhammad Asif KhanNoch keine Bewertungen

- IFA Week 3 Tutorial Solutions Brockville SolutionsDokument9 SeitenIFA Week 3 Tutorial Solutions Brockville SolutionskajsdkjqwelNoch keine Bewertungen

- Seminar 5 Audit Evidence - StudentDokument48 SeitenSeminar 5 Audit Evidence - StudentLIAW ANN YINoch keine Bewertungen

- Uniform CostingDokument8 SeitenUniform CostingFenilNoch keine Bewertungen

- Ba PDFDokument19 SeitenBa PDFSuganthi SuganthiNoch keine Bewertungen

- Government Accounting ManualDokument62 SeitenGovernment Accounting ManualDez Za100% (1)

- Regional Financial Accounting System AnalysisDokument12 SeitenRegional Financial Accounting System AnalysisMaia NahakNoch keine Bewertungen

- White Corporation Depreciation CalculationsDokument8 SeitenWhite Corporation Depreciation CalculationsAlbert Macapagal100% (2)

- General Ledger Debits and Credits Normal Account Balances Journal Entries The Income StatementDokument15 SeitenGeneral Ledger Debits and Credits Normal Account Balances Journal Entries The Income StatementPriyashini RajasegaranNoch keine Bewertungen