Beruflich Dokumente

Kultur Dokumente

UK Distribution Dynamics 2Q 2012

Hochgeladen von

g_simpson1160Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

UK Distribution Dynamics 2Q 2012

Hochgeladen von

g_simpson1160Copyright:

Verfügbare Formate

Q212 ISSUE AUG12

Distribution dynamics

Page 1

Wholesale distribution

Page 3

Primary business channels

Page 8

Products and asset classes

Page 16

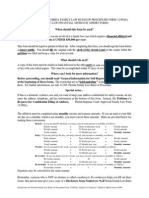

DISTRIBUTION DYNAMICS

Summary

As concerns resurfaced about the Eurozone and the

Key data 1

global economy in general, investors became more

cautious again and gross sales declined by 13% in the

second quarter. Net sales were down 59%.

Hargreaves Lansdown maintained top distributor

position but other intermediaries are closing the gap.

Platform sales bucked the downward trend and rose by

1.6% as financial advisers pushed more business in

their direction.

Second quarter 2012 gross sales

25.3bn

Q212 v Q112 (%)

+35.3%

Q212 v Q211 (%)

+3.3%

Second quarter 2012 net sales

1.7bn

Direct intermediary (gross)

8.9bn

Life and pension providers (gross)

2.2bn

Platforms (gross)

Life & Pensions (wholesale and primary business

11.0bn

channels) suffered from downturn in pension business

after a stronger first quarter.

28,000

24,000

20,000

16,000

12,000

8,000

4,000

0

Q1

Q2

Q3

2008

For channel definitions, see page 21.

Q4

Q1

Q2

Q3

Q4

Q1

Q2

2009

Direct/Interm

Q3

Q4

2010

L&P

Platform

Q1

Q2

Q3

2011

Q4

Q1

Q2

2012

DISTRIBUTION DYNAMICS

Renewed uncertainty about the Eurozone and the state of the UK

economy led to a fall in fund sales in the second quarter. Gross

business dropped 13% on the previous quarter and was 10% lower

than at the same time last year. A disappointing start to 2012; sales

in the second quarter are often higher due to a surge in early-bird

ISA investors taking up their new allowance. The fall in net sales was

even more dramatic at 59% and highlighted weaker sentiment.

Although ISA sales were higher, they did not

offset a more cautious approach to general

investment and a reduction in pension

business. But not all wholesale distribution

channels suffered a reduction in business.

Platforms actually saw their gross sales increase by 1.6% while their

market share advanced to a record-breaking 49.5%. Platforms have

now decisively overtaken the direct/intermediary channel. Less than

two years ago the roles were reversed. Meanwhile, the fall-off in

pension business saw the L&P channels market share decline to its

lowest level on Financial-Clarity records at 10%.

PLATFORMS LEAD

THE CHARGE

Sales by wholesale channel (bn)

Q212 v Q112 (m)

12,000

100

10,000

80

8,000

60

6,000

40

4,000

20

2,000

0

2010

2011

Direct/Interm

2011 YTD 2012 YTD

L&P

Platform

Market share trends (%)

Direct/interm

Q211

L&P

Q112

Platform

Q212

Market share in Q212 (%)

Direct/

Interm

L&P

Platform

2010

50.5%

13.6%

35.9%

2011

46.4%

13.6%

40.0%

2011 YTD

44.2%

12.5%

43.3%

2012 YTD

41.5%

12.8%

45.7%

Fundscape LLP and Matrix-Data Ltd

Direct/

Interm

40.4%

Platform

49.5%

L&P

10.1%

WHOLESALE DISTRIBUTION

LEADING DISTRIBUTORS

The top 25 distributors in the

second quarter are shown alongside

the leading distributors for the year

to date. The majority of the firms

that did well in the first quarter are

also among the frontrunners in the

second quarter.

However, a number of new

distributors entered the frame

including C Hoare, Grant Thornton,

Mattioli Woods, and Kellands (Hale);

four quite different distributors.

C Hoare is a long-established private

bank, while Grant Thornton is an

accountancy firm. However, Mattioli

Woods started life as a pension

consultant 20 years ago, but has

been spreading its wings. Last year it

acquired Kudos Independent

Financial Services, an employee

benefits consultant and wealth

manager. It recently announced that

its full-year revenues from wealth

management increased by nearly

50% and account for around a third

of its total group revenues. It has

just launched a new portfolio

management service.

Kellands, meanwhile, is a national IFA

company, although its really a cross

between a national and a network

since its partnership programme

allows companies to retain their

ownership. Its Hale company, which

is featured in this quarters tables,

covers the wider Cheshire and

Greater Manchester area... in other

words the wealthy footballer belt.

Distributor sales fell in the second

quarter in line with the general trend

but there were some firms that

produced increased business. One of

the biggest improvements was at

Quilter, where sales were up over

60%. Quilter, now owned by private

Top 25 distributors in

Q212

Top 25 distributors

2012 YTD

Hargreaves Lansdown

468

Hargreaves Lansdown

Sesame

253

Brewin Dolphin

516

Tenetconnect

250

Sesame

510

Brewin Dolphin

213

Skipton

491

Skipton

170

HSBC Bank

317

Quilter & Co

162

Positive Solutions

298

Positive Solutions

146

Quilter & Co

262

HSBC Bank

128

J P Morgan Chase Bank

254

UBS

120

Tenetconnect

465

Financial

112

Joseph R Lamb

243

AWD Chase de Vere

108

Financial

242

Seven IM

100

Lighthouse

212

Lighthouse

94

Seven IM

208

Saunderson House

89

UBS

208

Bestinvest

87

AWD Chase de Vere

191

C Hoare & Co

78

Bestinvest

187

Coutts & Co

69

Saunderson House

170

Mattioli Woods

68

MPS Mortgage Services

166

Grant Thornton

67

Raymond James

162

Kellands (Hale)

66

Coutts & Co

162

Raymond James

66

C Hoare & Co

157

MPS Mortgage Services

65

KMG Independent

149

Gerrard

65

Gerrard

148

Riverbourne

65

Kellands (Hale)

146

Joseph R Lamb

65

Riverbourne

143

equity firm Bridgepoint, has been

focusing on building its links with

advisers in recent years and

continues to expand its support

team. It was one of the first wealth

managers to offer discretionary

management services to IFAs and

provides the choice of five model

portfolios on a range of platforms.

TenetConnect, the IFA network, also

saw its flows increase in the second

quarter. It offers a wrap service

1,120

called Clear, and has its own asset

management company Sinfonia

which has a range of five risk-rated

funds, managed by BNP Paribass

Fundquest.

The second half of the year is likely

to prove much quieter for

distributors as firms focus on refining

their propositions and making final

preparations for the arrival of RDR.

Fundscape LLP and Matrix-Data Ltd

WHOLESALE DISTRIBUTION

CHANNEL SNAPSHOT: PLATFORMS

It was another record-breaking quarter for

the platform wholesale channel. Despite

the general decline in fund sales, flows

through platforms bucked the trend and

rose to close to 11bn. In market share

terms, platforms have now overtaken the

previously dominant fund manager channel

(direct/interm).

The reason for the increase in sales is the

growing support from financial advisers.

Although the total volume of adviser

business fell, the proportion they placed

through platforms rose by 5%, while flows

from other primary channels declined.

Business through platforms during the

quarter was underpinned by increased ISA

sales. Few fund managers now sell their

own ISAs as most IFAs prefer their clients

to have the greater range of choice offered

by platform-based wrappers. Sales of

platform-hosted personal pensions also

rose during the second quarter.

Top products in Q212

Direct/general investments

5,041.5m

ISAs

2,685.2m

Personal pensions

1,816.0 m

SIPPs

522.8m

Unit-linked bonds

343.4m

Investment bonds

269.1m

Rest

292.7m

Total

10,970.8m

Key data for platforms

Second quarter 2012

11.0bn

YTD 2012 sales

21.8bn

Q212 v Q112 (%)

1.6%

Q212 v Q211 (%)

1.8%

Share of total sales in 2011

40.0%

Share of total sales in 2012

45.7%

Platform sales by underlying primary business channel

Financial advisers

7,146m

B2B platforms

1,168m

Wealth managers

Fund managers

1,156m

600m

B2C platforms/other 1

392m

Rest

509m

Top products in Q212

DIA

46.0%

New v switches in Q212

ISA

24.5%

PP

16.6%

Switches

37.2%

Newsales

62.8%

SIPP

Rest

Invbond ULbond 4.8%

2.7%

3.1%

2.5%

Top and bottom five sectors in Q212

Top five sectors

Bottom five sectors

Sterling Corporate Bond

893

European Smaller Companies

12

UK All Companies

829

Asia Pacific Including Japan

11

Sterling Strategic Bond

748

Japanese Smaller Companies

Mixed Investment 20-60% Shares

711

Protected / Guaranteed Funds

UK Equity Income

638

Europe Including UK

1. Wholesale channels shown here are generally those that do not yet provide data to Financial-Clarity or do not provide breakdowns of their data. L&P providers = L&P providers that do not provide a breakdown of sales. B2B platforms = platforms for intermediaries., B2C platforms/other= direct-to-consumer platforms, stockbrokers etc. See glossary

and notes to data on back page.

Fundscape LLP and Matrix-Data Ltd

WHOLESALE DISTRIBUTION

CHANNEL SNAPSHOT: LIFE AND PENSIONS

After a strong recovery in the first quarter,

flows through the L&P wholesale channel

fell back heavily in the second quarter.

Sales shrank to their lowest level since

2009. This sharp decline was partly due to

the fact that extra pension contributions

had been brought forward after rumours

that higher-rate tax- relief was to be

abolished in the budget. This shift left less

money available for pension contributions

in the second quarter.

The declines occurred across all major

primary distribution channels and all life

and pension product areas. Financial

adviser business was down most with sales

reducing by a half in the second quarter,

while personal pension sales fell 21%. This

situation underlines the shift of business

away from the wholesale L&P channel to

platforms which saw fund sales through

both financial adviser and personal

pensions increase in the second quarter.

Key data for L&Ps

Second quarter 2012

2.2bn

YTD 2012 sales

6.1bn

Q212 v Q112 (%)

-41.4%

Q212 v Q211 (%)

-27.3%

Share of total sales in 2011

13.6%

Share of total sales in 2012

12.8%

L&P sales by underlying primary business channel

Financial adviser

1,368m

EBC

309m

Wealth managers

249m

Unclassified

83m

B2C platforms/other1

74m

Rest

94m

Top products in Q212

Top products in Q212

Group personal pensions

782.0m

Personal pensions

590.1m

Offshore bonds

346.2m

Unit-linked bonds

192.9m

SIPPs

134.1m

Rest

198.6m

Total

2,243.9m

Pers

pension

26.3%

Grp pers

pension

34.9%

Offshr

bond

15.4%

UL bond

8.6%

Rest

8.9%

SIPP

6.0%

Fundscape LLP and Matrix-Data Ltd

WHOLESALE DISTRIBUTION

CHANNEL SNAPSHOT: DIRECT INTERMEDIARIES

Direct intermediary is business transacted

directly with fund managers as opposed to

indirect business through the platform and

L&P channels. After a temporary boost to

sales in the first quarter when investors

became more risk-on, direct business fell

back again in the second quarter, resuming

the downward trend of recent years.

Key data for direct intermediaries

Until around two years ago, this channel

had accounted for 50% or more of all

fund sales but business routed through

platforms has gradually moved ahead.

This development has mostly suited fund

managers as it has taken away some of

their admin costs and given them a wider

audience.

Almost all of the direct sales are pure

investment business nowadays, so it is

sensitive to market conditions. However

in the second quarter there was a modest

increase in the proportion of ISA wrapped

sales.

Second quarter 2012

8.9bn

YTD 2012 sales

19.8bn

Q212 v Q112 (%)

-17.1%

Q212 v Q211 (%)

-16.5%

Share of total sales in 2011

46.4%

Share of total sales in 2012

41.5%

Direct sales by underlying primary business channel

Fund managers 2

4,316

Life & pensions

1,842

B2C platforms/other 2

945

Wealth managers

890

Banks/building societies

461

Rest

495

Top products in Q212

Direct/general investments

8,830.7m

ISA

118.3m

Total

DIA

98.7%

ISA

1.3%

Top and bottom five sectors in Q212

Top five sectors

UK All Companies

2,035

Bottom five sectors

North American Smaller Companies

North America

753

European Smaller Companies

Sterling Corporate Bond

607

Asia Pacific Including Japan

UK Equity Income

511

Japanese Smaller Companies

Specialist

504

Europe Including UK

2. Fund managers= mainly funds of funds and multi-manager activity. B2C platforms/other (direct-to-consumer platforms, stockbrokers etc) that do not yet provide data to

Financial-Clarity. L&P= direct purchase of funds via L&P products. See glossary and notes to data on back page.

Fundscape LLP and Matrix-Data Ltd

WHOLESALE DISTRIBUTION

CHANNEL SNAPSHOT: FUNDS OF FUNDS

Funds of funds are not a channel per se,

but they are an important source of

business for managers and are expected to

become more so in the future as a

consequence of outsourcing by advisers in

response to RDR. As a result, the data is

shown for comparison with other channel

trends.

They certainly bucked the general

downward trend in the second quarter

with flows rising by 9%. Based on year-todate figures, their market share is also

increasing relative to last year.

Sales through financial advisers rose by a

modest 3% quarter on quarter. The largest

increase of 23% was in sales via fund

managers themselves, though they remain

modest in total. However, this channel

could become increasingly important post

RDR. Funds of funds could be particularly

appealing to investors who do not want to

pay for financial advice.

Key data for funds of funds

Second quarter 2012

1.2bn

YTD 2012 sales

2.3bn

Q212 v Q112 (%)

9.0%

Q212 v Q211 (%)

-7.7%

Share of total sales in 2011

4.6%

Share of total sales in 2012

4.8%

FOF sales by underlying channel

Financial advisers

737m

Life & pensions3

107m

Banks/building societies

71m

Wealth managers

59m

Fund managers

58m

Rest

145m

Top products in Q212

Direct/general investments

591.6m

ISAs

408.9m

Personal pensions

98.4m

Investment bonds

40.0m

SIPPs

27.6m

Rest

9.7m

Total

1,176.3m

ISA

34.8%

PP

8.4% Invbond

3.4%

DIA

50.3%

Rest

0.8%

SIPP

2.3%

Top and bottom five sectors in Q212

Top five sectors

Bottom five sectors

Mixed Investment 20-60% Shares

427

Short Term Money Market

1.058

Flexible Investment

206

Global Emerging Markets

0.239

Mixed Investment 40-85% Shares

131

Global Bonds

0.233

Global

61

Europe Excluding UK

0.054

Mixed Investment 0-35% Shares

21

Global Equity Income

0.005

3. B2B platforms that do not yet provide data to Financial-Clarity. B2C platforms/other (direct-to-consumer platforms, stockbrokers etc) that do not yet provide data to FinancialClarity. L&P= direct purchase of funds via L&P products. See glossary and notes to data on back page.

Fundscape LLP and Matrix-Data Ltd

PRIMARY BUSINESS CHANNELS

PRIMARY BUSINESS CHANNELS

In this section of the report we examine the sales trends in the

primary, investor-facing business channels which are generating

the flows to the wholesale distribution channels. Some of these

channels, such as IFAs, provide business to more than one

wholesale distributor. It should also be noted that the life and

pensions channel referred to in this section relates to sales

generated by insurance company staff.

Direct

business

(through fund

managers and

B2C platforms)

There was an average decline in sales of 13% across all primary

channels in the second quarter although some were more badly

affected than others. IFAs and wealth managers, which together

account for around half of total sales, accounted for a somewhat

smaller-than-average fall in business of around 11%. Despite

concerns about the deteriorating situation in the Eurozone and

the outlook for the UK economy, advisers were still encouraging

investors to take up their ISA allowances.

rose sharply in

the first

quarter

Historical trends by primary business channels (m) 5

IFAs

WMs

Direct/interm

L&P

Q309

4,794.1

2,610.1

2,626.9

2,475.1

926.2

466.1

960.6

244.8

432.6

Q409

6,110.5

2,928.9

3,567.1

2,673.5

1,340.9

667.8

868.7

407.4

551.0

Q110

6,702.6

3,018.6

3,292.4

2,456.7

1,395.7

844.8

748.5

361.1

394.7

Q210

7,145.8

3,004.7

4,843.6

2,706.8

1,525.6

893.7

636.8

421.8

467.4

Q310

6,950.5

2,852.8

3,719.6

2,746.5

1,277.1

878.0

1,542.4

365.6

436.2

Q410

7,569.1

3,258.1

4,214.4

2,911.8

1,484.4

982.3

1,428.3

578.8

505.5

Q111

9,774.8

3,404.0

4,722.3

2,809.3

1,592.4

1,245.2

1,213.0

576.6

459.6

Q211

9,379.8

3,039.2

4,477.6

2,430.6

1,595.2

1,360.1

1,263.6

558.4

462.9

Q311

8,387.1

2,968.2

4,025.8

2,751.7

1,676.9

1,255.2

1,027.8

513.5

572.9

Q411

8,091.0

2,088.5

3,272.2

2,531.3

1,109.7

998.5

851.2

500.3

400.8

Q112

9,887.4

2,579.2

5,209.4

3,187.4

1,658.5

1,256.8

683.7

420.0

548.0

Q212

8,763.0

2,295.3

4,946.0

2,053.1

1,403.6

1,192.5

584.7

417.3

508.3

Quarter

B2C Platforms B2B Platforms

Banks

EBCs

Uncl

QOQ sales by primary channel (m)

10,000

Q112

8,000

Q212

6,000

4,000

2,000

0

IFA

WM

FM

L&P

Oth

Platform

Bank

EBC

Uncl

5. Wholesale channels shown here are generally those that do not provide data to Financial-Clarity or do not provide full breakdowns of their data. Specifically: B2B platforms =

platforms that do not yet contribute data and so primary channels are not known. L&P = L&P data that is not disaggregated into other channels. Unclassified = distributors that are

not easily classified in the primary channels.

Fundscape LLP and Matrix-Data Ltd

PRIMARY BUSINESS CHANNELS

Leading primary business channel in each wholesale channel

Q212

Leading primary business channel

Platforms

L&P

Direct intermediaries

IFAs

IFAs

FM

Gross sales

7.1bn

1.4bn

4.3bn

Market share of each channel

61.1%

61.0%

48.2%

However, compared to the same quarter last year, wealth manager

business was considerably lower. It was down 25% on the second

quarter of 2011, compared to a fall of 6.6% in IFA business. Since last

year, wealth managers have become increasingly cautious, or have been

using alternative products for their clients. Preparing for RDR is also a

major concern.

The largest fall in fund sales in the second quarter was in the life and

pension channel. This is perhaps not surprising given the time of year,

and the fact that a record amount of business had gone through this

channel in the first quarter as the tax year came to an end. It had been

boosted by the threat that higher-rate tax-relief on pensions might be

removed in the Budget, meaning that some contributions were

undoubtedly brought forward and less was available for investment in

the second quarter. As a result, sales via the life and pensions channel

fell to their lowest level since 2008 according to Matrix data.

Employee benefit consultant sales saw only a modest reduction of less

than 1%. This business tends to be less sensitive to seasonal and market

factors as much of it relates to regular pension contributions. However it

has been reducing steadily since the end of 2010, reflecting the squeeze

on incomes and consequently a declining ability to save.

Fund manager business also held up well with a reduction of just 5%.

These sales are underpinned by the increased proliferation of multimanager funds that are being offered by a growing variety of providers.

Platform business also held up well during the quarter declining by just

5%. Investors via platforms know they have considerable flexibility and

choice which helps to encourage flows.

By contrast, sales through banks continued to fall. They are more than

50% lower than like-for-like sales in 2011 and there has been a longterm downward trend in sales since mid 2010. Banks have been sidetracked by many factors including the ongoing ripple effects of the global

financial crisis, as well as regulation and the approach of RDR, which

have curtailed their ability to sell funds. Sales forces are being

reorganised with Barclays leading the way and deciding to close its

financial advice arm at the beginning of 2011.The latest bank to

announce a reduction in its sales force and switch to a tied service is

Royal Bank of Scotland. Only Santander has managed to buck the trend

with the sales of its latest generation of multi-manager funds.

Fundscape LLP and Matrix-Data Ltd

10

PRIMARY BUSINESS CHANNELS

PRIMARY BUSINESS: IFA SNAPSHOT

Expected in Q312:

Key data for IFAs

Second quarter 2012

8.8bn

YTD 2012 sales

18.7bn

Q212 v Q112 (%)

-11.4%

Q212 v Q211 (%)

-6.4%

Share of total sales in 2011

33.9%

Share of total sales in 2012

39.3%

Top five IFA firms in Q212

Numerous factors point to an ongoing downturn in

IFA flows. Getting ready for RDR is one factor, but

flows will also be dampened by the summer holiday season, the Olympics and the ongoing Eurozone crisis.

Top products in Q212

Sesame

236m

Direct/general investments

2,371m

Tenetconnect

204m

ISAs

2,263m

Skipton

170m

Personal pensions

2,147m

Positive Solutions

146m

Financial

108m

Rest

1,042m

9.9%

Total

8,763m

Top five as % of total:

SIPPs

534m

Group personal pensions

405m

Top and bottom five sectors in Q212

Top five sectors

Bottom five sectors

Mixed Investment 20-60% Shares

529

Asia Pacific Including Japan

UK All Companies

517

Japanese Smaller Companies

Sterling Corporate Bond

509

Personal Pensions

Sterling Strategic Bond

457

Protected / Guaranteed Funds

UK Equity Income

407

Europe Including UK

Rising sectors (qtr on qtr)

Sector

Japanese Smaller Companies

Falling sectors (qtr on qtr)

% change in sales

v last quarter

113.4

Sector

% change in sales

v last quarter

Protected / guaranteed funds

-49.9

Short Term Money Market

16.9

Personal pensions

-37.7

Money Market

14.7

North American Smaller Companies

-36.1

Sterling High Yield

13.1

Specialist

-26.0

China/Greater China

-25.3

All sectors

-11.4

Sterling Corporate Bond

All sectors

Fundscape LLP and Matrix-Data Ltd

7.3

-11.4

11

PRIMARY BUSINESS CHANNELS

COMMENT

The decline in IFA business in the second quarter this year was not completely

unexpected, even though in past years fund sales through this channel have

tended to be maintained or even increased in the second quarter. This is partly

due to the fact that IFAs tend to encourage investors to take up their new

annual ISA allowance early in the new tax year to maximise the tax benefits.

And, indeed, ISA sales through IFAs were 11% higher in the second quarter this

year compared to the first quarter.

However, personal pension business was down. It was the top source of fund

sales through IFAs in the first quarter as investors brought forward their

contributions prompted by concerns about the possible abolition of higher-rate

tax-relief in the Budget. Consequently sales fell back by 20% in the second

quarter. Sales within SIPPs also declined by 25%.

The best-selling sector funds among IFAs during the quarter were Mixed

Investment 20%-60% Shares. Advisers renewed worries about the Eurozone

and the state of the UK economy encouraged them to recommend these more

cautious funds ahead of UK All Companies funds which had led the field the

previous quarter. Sales of Corporate Bond and Strategic Bond funds also rose.

However the fixed income sector, which saw the largest increase during the

quarter with sales rising by 13%, was High Yield Bond. These funds are often

regarded as a half-way house between equity and conventional fixed income

funds.

Advisers

renewed worries

about the

Eurozone and the

UK economy led

them to more

cautious

recommendations

than the previous

quarter

But some IFAs clearly felt an even more cautious approach was advisable and

as a result they opted to put clients investments into money market and shortterm money market funds which were two of the sectors that saw the

strongest percentage increases in flows during the quarter. At the other end of

the spectrum, support for China continued to wane with sales of these funds

down by 25%.

IFA NEWS

Sesame Bankhall Group, which

topped the list of IFA fund

distributors in the second quarter,

has recently announced the launch

of a new joint venture with

Henderson, called Optimum

Investment Management. Optimum

is offering four multi-manager

portfolio funds which it says can be

combined by advisers to meet

different risk appetites.

Hendersons multi-manager team

will choose the funds to populate

the portfolios from across the

whole market. The funds will be

available through SBG One, its inhouse version of AXA Elevates

wrap platform, as well as on other

platforms.

Royal Bank of Scotland has

confirmed that its IFA arm will

become restricted from October. It

will sell products from the RBS

Group and a set of third-party

providers.

Under the new regime, its advisers

will be called specialist financial

advice managers. Meanwhile, Sanlam

UK is building up its advisory

division with further IFA acquisitions.

All firms will be rebranded by 2017.

Overall, while the implementation

of RDR appears to be having a

more limited impact on IFA

numbers than originally anticipated,

research among advisers by Tenet

indicates it is regulatory costs that

are likely to have a greater impact.

Of those canvassed, 86% stated that

they feared the cost of regulation

will force up to 30% of advisers out

of the market over the next three

years.

Fundscape LLP and Matrix-Data Ltd

12

PRIMARY BUSINESS CHANNELS

PRIMARY BUSINESS: WEALTH MANAGER SNAPSHOT

Expected in Q312:

Key data for WMs

Second quarter 2012

2.3bn

YTD 2012 sales

4.9bn

Q212 v Q112 (%)

-11.0%

Q212 v Q211 (%)

-24.5%

Share of total sales in 2011

14.0%

Share of total sales in 2012

10.3%

Top five wealth manager firms in Q212

Caution has characterised wealth manager

behaviour, and given the economic outlook, will

continue to do so in Q312. Structured products

may play a bigger part in their investments to the

detriment of funds.

Top products in Q212

Brewin Dolphin

213.4m

Direct/general investments

Quilter & Co

162.0m

ISAs

273m

UBS

119.9m

Offshore bonds

175m

AWD Chase de Vere

108.1m

Personal pensions

137m

C Hoare & Co

Top five as % of total:

1,444m

Unit-linked bond

82m

78.2m

Rest

185m

33.5%

Total

2,295m

Top and bottom five sectors in Q212

Top five sectors

Bottom five sectors

UK All Companies

217

China/Greater China

1.04

Sterling Corporate Bond

201

Asia Pacific Including Japan

1.03

North America

190

Japanese Smaller Companies

0.24

UK Equity Income

145

Protected / Guaranteed Funds

0.13

Global Emerging Markets

134

Europe Including UK

0.10

Rising sectors (qtr on qtr)

Sector

Personal Pensions

Falling sectors (qtr on qtr)

% change in sales

v last quarter

3,098.8

Sector

% change in sales

v last quarter

Japanese Smaller Companies

-84.1

North American Smaller Companies

99.8

Europe Including UK

-67.9

Global Emerging Markets

83.3

China/Greater China

-64.5

UK Gilts

80.0

Japan

-64.4

Money Market

37.3

Mixed Investment 0-35% Shares

-63.1

All sectors

-11.0

All sectors

-11.0

Fundscape LLP and Matrix-Data Ltd

13

PRIMARY BUSINESS CHANNELS

COMMENT

The revival in wealth manager business seen in the first quarter of the year proved

short-lived with sales falling back again in the second quarter. It means the wealth

managers share of fund business has once again declined and now stands at 10%

compared with 15% in 2009. It appears that wealth managers are still being

cautious about committing client money to the markets and are choosing

alternatives such as structured products instead.

The bulk of wealth manager fund purchases are direct, with funds being used in

the construction of investment portfolios for clients. However, the proportion

of direct investment fell from 68% to 63% in the second quarter. The beginning

of the tax year had heralded new opportunities for tax planning and more

purchases were made via wrappers with ISA sales rising by 8% and sales via

offshore bonds increasing by 6%.

The Global

Emerging

Markets

sector was a

Wealth managers first choices of funds were mainstream UK All Companies and

Sterling Corporate Bond funds. However, they also remained relatively bullish

about the outlook for North American equities. This sector, which had been

the top-seller in the first quarter, remained among the top five, although sales

were lower in the second quarter.

new entrant

in wealth

managers top

five sectors for

A new entry among the best-selling sectors was Global Emerging Markets; it was

also one of those which saw the most rapid rise in sales in the second quarter.

Other strong increases were seen in the sales of North American Smaller

Companies funds and UK Gilt funds.

the quarter

A look at the rising and falling sectors sometimes reveals how wealth managers

are setting the trend with their fund purchases. In the first quarter, wealth

managers had sharply increased their purchases of Japan and Japanese Smaller

Companies funds. In the second quarter, sales of Japanese Smaller Companies

funds via IFAs grew. However, by then, wealth managers enthusiasm had cooled

and the Japan sectors were among those that saw the largest reductions in sales.

WEALTH MANAGER NEWS

Concerns about the effect of RDR

on wealth managers fees are

continuing to grow. Greater

transparency is expected to result in

downward pressure on fees even

though costs are rising. Many firms

have indicated that they are sticking

to their current rates for the time

being.

However, if advisers outsource their

investment business to wealth

managers, this will involve feesharing which could affect their

margins. Wealth managers may

therefore put more effort into

attracting direct clients to help

protect their margins.

An example of such a move is

Brewin Dolphins announcement

that it is to cater for smaller

investors by offering a managed

portfolio service, designed to meet

the needs of clients with

investments of between 10,000

and 150,000. Five risk profiles will

be offered. The portfolios will invest

mainly in collectives with some

exposure to passives. Clients will be

charged a fee of 1.2% plus VAT.

There is also talk of more

convergence

between

wealth

managers and top-end IFAs,

especially those that are already fee

-based. Many of these IFAs have

started to move into discretionary

management in recent years.

A recent report from Compeer

found that many wealth managers

had found it difficult to add value

for clients over the past five years.

The average discretionary manager

had only just managed to beat the

FTSE/Apcims Balanced index before

the deduction of fees .

Fundscape LLP and Matrix-Data Ltd

14

PRIMARY BUSINESS CHANNELS

PRIMARY BUSINESS: D2C/OTHER

Expected in Q312:

Key data for D2C/Other

Second quarter 2012

1.4bn

YTD 2012 sales

3.1bn

Q212 v Q112 (%)

-15.4%

Q212 v Q211 (%)

-12.0%

Share of total sales in 2011

7.3%

Share of total sales in 2012

6.5%

Top five D2C platforms in Q212

Confidence weakened in the second quarter and

with no change in the economic outlook for Q3,

flows are likely to remain below par in the third

quarter. Nonetheless, the summers stock-market

rally may encourage some investors into funds.

Top products in Q212

Hargreaves Lansdown

469m

Barclays Stockbrokers

35m

Chelsea Financial Services

32m

Cavendish Online

21m

TD Direct Investing (Europe)

18m

Top five as % of total:

41.0%

Direct/general investments

ISAs

1,213m

101m

Offshore bonds

29m

Personal pensions

22m

Unit-linked bonds

13m

Rest

23m

Total

1,400m

Top and bottom five sectors in Q112

Top five sectors

Bottom five sectors

UK Equity Income

184

Asia Pacific Including Japan

1.90

UK All Companies

132

European Smaller Companies

1.70

Sterling Corporate Bond

120

Japanese Smaller Companies

0.43

Sterling Strategic Bond

117

Europe Including UK

0.31

Protected / Guaranteed Funds

0.06

Asia Pacific Excluding Japan

94

Rising sectors (qtr on qtr)

Sector

UK Index Linked Gilts

Falling sectors (qtr on qtr)

% change in sales

v last quarter

106.0

Sector

% change in sales

v last quarter

Protected / Guaranteed Funds

-86.8

Short Term Money Market

95.3

North American Smaller Companies

-69.5

Japanese Smaller Companies

66.4

Flexible Investment

-52.5

Absolute Return

45.9

Europe Including UK

-51.4

Money Market

41.2

Sterling Corporate Bond

-44.0

All sectors

-15.4

All sectors

-15.4

Fundscape LLP and Matrix-Data Ltd

15

PRIMARY BUSINESS CHANNELS

COMMENT

Weakening confidence among investors saw non-advised business drop back

by somewhat more than average in the second quarter with fund sales

through this channel falling by 15%. However, business remained higher than

in the fourth quarter of 2011 when sentiment had been particularly bleak.

IMA data shows that retail investors were still relatively enthusiastic about

funds in April but that net flows fell significantly in June.

Self-directed investors are generally less likely to buy funds through wrappers

than advised clients. However, there was an increase in wrapper sales in the

second quarter with the proportion of direct investment falling from 93% to

87% as a result of rising sales through ISAs, Offshore Bonds and Personal

Pensions.

Despite the overall reduction in sales, those people who were prepared to

invest for themselves were more likely to choose equity over bond funds.

Their top choice was UK Equity Income funds, rather than Sterling Corporate

Bond funds as it had been in the first quarter, while UK All Companies funds

overtook Sterling Strategic Bond funds on investors buy lists.

Indeed sales of Sterling Corporate Bond funds fell by 44%. However,

execution-only investors did not ignore safer options altogether. On the

contrary, some of the strongest increases in sales were in the more cautious

sectors. Flows into UK Index Linked Gilt funds rose by over 100% despite

the increasing price of these securities. Sales of Absolute Return funds also

increased by 46%, making it one of the ten most popular sectors among

direct investors.

Despite the

overall

reduction in

sales, investors

were still more

likely to choose

equity over

bond funds .

Some investors were even more cautious and sales of Money Market funds

also rose. Their proclivity for playing it safe was also shown by a fall in the

sales of Flexible Investment funds, while flows into Mixed Investment 0-35%

increased, though the amounts remained modest.

D2C NEWS

Recently published research by

Deloitte based on a survey of

2,000 people found that 84% are

unaware of RDR and that they will

be required to pay a fee for advice

in future. More than half (54%) said

that would not pay a fee, while

47% said they would be likely to

reduce the number of times they

use financial advisers if charged a

fee of between 400-600 or 3%

of invested assets. The survey

found that bank customers are five

times as likely (60%) as IFAs (12%)

customers to reject the idea of

paying fees for advice.

To cater for those advisers with

clients who cant or wont pay,

AXA Wealth has recently launched

AXA Self Investor. It will provide

self-directed clients with the choice

of around 170 funds include a

favourites range selected by the

Architas investment team. Six lowcost, multi-asset risk-rated passive

funds from Architas will also be

available. Minimum investment will

be 2,000, or 200 per month.

Using the Elevate platform, AXA

Self Investor is intended to help

advisers remain indirectly engaged

with their clients. There will be a

co-branded website and a service

providing marketing support and

the production of literature on the

advisers behalf. A UK-based

customer support team will also be

available.

Fundscape LLP and Matrix-Data Ltd

16

PRODUCTS AND ASSET CLASSES

PRODUCT CLASSES AND PRODUCTS

Direct investment and sales of funds through most product

wrappers declined during the second quarter in line with the

general trend. But there were two exceptions; ISAs and

group personal pensions both saw increased flows. ISA sales

rose by 13% and group personal pensions were up 7%.

Qtr-on-qtr flows by product class (m)

21,000

14,000

The second quarter has now become the peak period for

ISA sales through a combination of last-minute investment in

the final few days of the old tax year and early bird investors

using up their new annual allowance. Although this years

ISA sales were down on the same period last year, despite

the inflation-linked increase in the annual ISA allowance to

11,280 for 2012/13, many investors were clearly prepared

to overlook economic uncertainties to take advantage of

these popular investment vehicles.

The pattern was reversed with sales through pension

wrappers, where business tends to be more concentrated in

the first quarter. Sipp sales saw the sharpest reduction in the

second quarter, they were down by 23%, while fund sales

through personal pensions decreased by 19%. As previously

mentioned, the fall partly resulted from contributions being

brought forward to the first quarter by fears that higher-rate

tax may be abolished in the Budget.

Group personal pension fund business, however, went

against the trend and was higher in the second quarter,

reflecting the approaching start of auto-enrolment in

October. At the same time the dominance of Life and

Pension providers as the main wholesale channel for this

business declined from 100% to 93%. In the individual

pension arena, Platforms increased their wholesale share

from 60% to 73%.

7,000

0

Group

Pension

Q112

Individual

Pension

Inv&

Savings

Q212

Overall product sales (Qtr-on-qtr) m

Top products

Q112

Q212

Direct/general

16,388.5

13,906.7

ISAs

2,504.8

2,824.5

Personal pensions

2,959.1

2,406.1

Grp personal pensions

728.2

782.0

SIPPs

850.0

656.9

Unit-linked bonds

808.3

536.3

Offshore bonds

562.7

530.8

Rest

629.0

520.0

25,431

22,163

Leading channels in product classes

Q212

Wholesale channel

Investment & Savings

Individual pension

Group pension

Direct/Interm

Platforms

L&Ps

Sales

8.9bn

2.3bn

817.7m

Market share

49.1%

72.9%

92.8%

IFA

IFA

IFA

Sales

5.6bn

2.7bn

480.1m

Market share

30.9%

87.0%

54.5%

Primary business channel

Fundscape LLP and Matrix-Data Ltd

17

PRODUCTS AND ASSET CLASSES

ASSET CLASSES AND SECTORS

As an asset class, fixed income was once again the top choice

for investors in the second quarter which was hardly surprising

in view of the uncertainty and decreasing interest rates on

savings accounts. Mixed asset funds were the next most

favoured group while equity funds suffered net redemptions

during the quarter according to IMA statistics.

Top and bottom sectors in Q212

Top five

In terms of sector buying patterns, there was more

diversification in the second quarter with the dominance of

the top five sectors declining somewhat from 45% of sales in

the first quarter to 35% in second. There were also two

changes among the top five sectors, although the two leading

sectors remained the same. UK All Companies funds

continued to lead the field as a key component in most

investors and portfolio managers asset allocations. Indeed,

gross sales of these funds were up by more than a third on

the first quarter.

Mainstream Sterling Corporate Bond was the second most

popular sector and Sterling Strategic Bond also made it into

the top five, although sales in both sectors were down on the

previous quarter. The fixed income sector that saw the

sharpest rise in sales was UK Index Linked Gilt, while sales of

conventional UK Gilt funds also declined. Besides Sterling

Corporate Bond, North American replaced Global and Global

Bonds in the top five selling sectors. The latter were both

among those sectors that saw the most marked reduction,

with flows into Global funds down 60% and Global Bond fund

sales down 42%. North American funds, on the other hand,

have come back into favour thanks to the improving

economic outlook there.

UK All Companies

2,863

Sterling Corporate Bond

1,500

North America

1,258

UK Equity Income

1,149

Sterling Strategic Bond

1,052

Bottom five

Asia Pacific Including Japan

15

Personal Pensions

13

Protected / Guaranteed Funds

11

Japanese Smaller Companies

Europe Including UK

Top 5 sectors v rest in Q212

Rest

64.7%

Topfive

sectors

35.3%

The top selling mixed asset sector is 20-60% with sales of

almost double the flows of the 40-85% sector, where in turn

the sales were roughly double the sales of Flexible funds.

Rising sectors (qtr on qtr)

Sector

Falling sectors (qtr on qtr)

% change in sales

v last quarter

Sector

% change in sales

v last quarter

Personal Pensions

45.4

Global

-59.5

Japanese Smaller Companies

45.2

UK Gilts

-42.5

UK All Companies

38.2

Global Bonds

-41.5

UK Equity & Bond Income

23.3

North American Smaller Companies

-32.5

UK Index Linked Gilts

20.8

Protected / Guaranteed Funds

-28.8

All sectors

-12.8

All sectors

-12.8

Fundscape LLP and Matrix-Data Ltd

18

NOTES

DISTRIBUTION AND TERMINOLOGY EXPLAINED

Fund distribution landscape in the UK

Fundmanagers(akaDirect/Interm)

Wholesale

channels

L&P

Primary

business

channels

IFAs

Platforms

WMs

L&Ps

B2C

platforms

Banks

Investors

Twenty years ago doing business in

the UK was relatively straightforward;

investors went to financial advisers

who placed their orders directly with

fund managers and/or life & pension

providers (L&Ps). But the advent of

platforms has had a profound effect

on the asset management industry in

the UK.

Their role as a conduit of financial

service provision is changing the rules

of the game for fund managers,

intermediaries and regulators alike.

The introduction of an additional

step in the value chain has created

confusion in terminology and

perception, as well as a lack of

understanding of which channels are

actually driving fund sales. This report

aims to shed light on these very

issues.

Fundscape LLP and Matrix-Data Ltd

Financial-Clarity data is organised

into two layers of data. The first level

covers the primary generators of

business (those with direct contact

with the end investor) and these are

known as primary business channels.

The second layer encompasses those

channels that aggregate sales from

the primary business channels, and

which are known in this report as

wholesale distribution channels. They

include life and pension groups,

platforms and also fund managers

(direct intermediary) who still attract

a significant amount of business

direct from intermediaries. Platforms

are not a stand-alone distribution

channel, but instead provide services

with clear transactional and

administrative benefits for fund

managers, intermediaries and end-

consumers. Equally, life and pension

providers are nowadays more likely

to provide products that wrap thirdparty funds and so also play an

aggregating role in distribution.

Having said that, their buying power

and influence has a significant impact

on fund manager activity, hence their

inclusion in this report.

Apart from the B2C platform

channel, direct consumer to fund

manager business is not captured in

the Financial-Clarity database.

19

NOTES

This report is organised to provide insight and analysis

on both the wholesale distribution channels and

primary business channels, since these are the primary

drivers of sales in the UK fund industry.

Platforms are not

a stand-alone

distribution

But in addition to channel analysis, there is also

explanation and insight into the products, funds and

sectors being transacted across the Financial-Clarity

universe.

channel; they

provide services

with clear

Only fund-based products are covered in this report,

though the Financial-Clarity database also includes

other L&P products. These fund-based products are

categorised into three different product classes:

investment & savings, individual pensions and group

pensions. Beneath the product class and product

layer, there is also analysis by asset class and sectors,

as defined by the Investment Management Association

(IMA).

transactional and

administrative

benefits for fund

managers,

intermediaries and

The diagram below sets out how products are

categorised in the Financial-Clarity database.

end-consumers

The product mix

Investment&

Sa vi ngs

Product

cl a sses

Products

As s etcl asses

Sectors

Direct investment account

Distributionbond

Endowment policy

Guarantd investment bond

ISAs

Offshoreinvestment bond

Offshorepersonal bond

Unitlinked bond

Ca s h

Indivi dual

pensions

Personal pension

SIPP

Stakeholder pension

Equity

Group

pensions

UKallcompanies

UKEquityIncome

etc

Fixed

i ncome

Executive pensionplan

Groupmoney purchase

scheme

SSAS

Trustee investment plan

Mixed

As s ets

Cautiousmgd

Balancedmgd

Activemgd

Specialist

Absreturn

etc

Fundscape LLP and Matrix-Data Ltd

20

NOTES

Notes to data

1. The figures used in this report are actual gross flows of fund-based

products in the UK.

2. Financial-Clarity collects and analyses data from platforms, fund

managers and life and pension providers. The data is disaggregated

and reconciled with the Matrix Financial Intermediary Database.

3. Between 5% and 9% of sales are potentially double-counted. In Q212

this equated to approximately 1.9bn: 800m of L&P purchases by

L&P companies which contribute to Financial-Clarity and a further

1.1bn of fund manager purchases by fund managers that contribute to

Financial-Clarity.

4. Coverage: fund manager coverage is estimated to represent 85% of

total fund manager activity in the UK. Platform coverage is estimated to

represent 90-95% of the platform activity in the UK. Life and pension

provider coverage is estimated to represent 50-60% of the L&P activity

in the UK.

Glossary

IFAs: independent financial advisers.

WMs: wealth managers.

EBC: employee benefit consultants.

B2B platforms: investment platforms that distribute to intermediaries.

B2C platforms: investment platforms that distribute direct to consumers.

Wholesale distribution channel: wholesale aggregators such as

platforms and life and pension providers. Direct intermediary business to

fund managers is also considered wholesale for the purpose of this report.

Primary business channel: primary generators of business such as

financial advisers, wealth managers, banks etc.

Product class: umbrella term for type of products being distributed:

investment & savings, group pensions and individual pensions.

Products: tax-wrappers and other products with funds as the underlying

investment.

About this publication

Jointly published by Matrix Solutions and Fundscape. All rights

reserved.

Matrix Solutions, 55 New Oxford St, London WC1A 1BS

Tel +44 (0)20 7074 1200, Email: info@matrixsolutions.co.uk

Fundscape, 109 Conway Road, London N14 7BH

Tel +44 (0)20 7627 1145, Email: info@fundscape.co.uk

Warning:

This publication has been written for fund industry professionals. It is intended for their general guidance and interest and

does not constitute professional advice. All views expressed are those of the publishers but no representation or warranties

are given on the accuracy or completeness of the information included. Matrix Solutions and Fundscape accept no liability for

the consequences of any reader acting or refraining to act on information in this publication, or for any decisions based on it.

Das könnte Ihnen auch gefallen

- The Signs Were There: The clues for investors that a company is heading for a fallVon EverandThe Signs Were There: The clues for investors that a company is heading for a fallBewertung: 4.5 von 5 Sternen4.5/5 (2)

- Supply Chain Finance Solutions: Relevance - Propositions - Market ValueVon EverandSupply Chain Finance Solutions: Relevance - Propositions - Market ValueNoch keine Bewertungen

- Corporate FinanceDokument39 SeitenCorporate FinanceAbhishek BiswasNoch keine Bewertungen

- Global Ma h1 LeagDokument39 SeitenGlobal Ma h1 LeagSohini Mo BanerjeeNoch keine Bewertungen

- Bloomberg Q1 2012 M&a Global League TablesDokument39 SeitenBloomberg Q1 2012 M&a Global League TablesMandeep SoorNoch keine Bewertungen

- Marks and SpencerDokument5 SeitenMarks and SpencerSudesh Panwar100% (1)

- Vodafone Annual Report 12Dokument176 SeitenVodafone Annual Report 12josé_rodrigues_86Noch keine Bewertungen

- Vodafone Group PLC: GradeDokument5 SeitenVodafone Group PLC: GradeTurcan Ciprian SebastianNoch keine Bewertungen

- Imprtant Final For Next PLC AIC Case StudyDokument6 SeitenImprtant Final For Next PLC AIC Case StudyBhavin MehtaNoch keine Bewertungen

- Mergermarket League Tables of Legal Advisers To Global M&A For Q1 2012Dokument53 SeitenMergermarket League Tables of Legal Advisers To Global M&A For Q1 2012Pallavi SawhneyNoch keine Bewertungen

- David Einhorn's Greenlight Capital Q3 LetterDokument5 SeitenDavid Einhorn's Greenlight Capital Q3 Lettermarketfolly.com100% (1)

- Li FungDokument26 SeitenLi FungSanit SadhuNoch keine Bewertungen

- Cib Investor Day 2016Dokument35 SeitenCib Investor Day 2016hvsbouaNoch keine Bewertungen

- Top Activist Stories - 5 - A Review of Financial Activism by Geneva PartnersDokument8 SeitenTop Activist Stories - 5 - A Review of Financial Activism by Geneva PartnersBassignotNoch keine Bewertungen

- Global Financial Advisory Mergers & Acquisitions Rankings 2013Dokument40 SeitenGlobal Financial Advisory Mergers & Acquisitions Rankings 2013Ajay SamuelNoch keine Bewertungen

- A Helpline For European TelcosDokument9 SeitenA Helpline For European TelcosdkrirayNoch keine Bewertungen

- 2015 Financial StatementDokument105 Seiten2015 Financial StatementBVMF_RINoch keine Bewertungen

- GOME 2012Q3 Results en Final 1700Dokument30 SeitenGOME 2012Q3 Results en Final 1700Deniz TuracNoch keine Bewertungen

- PHPNN 76 QCDokument5 SeitenPHPNN 76 QCfred607Noch keine Bewertungen

- Bloomberg 2014 MA Financial RankingsDokument38 SeitenBloomberg 2014 MA Financial Rankingsed_nycNoch keine Bewertungen

- PWC Deals Retail Consumer Insights q2 2016Dokument5 SeitenPWC Deals Retail Consumer Insights q2 2016Peter ShiNoch keine Bewertungen

- Manchester United PLC Risultati Q2 2013 (31.12.2013)Dokument13 SeitenManchester United PLC Risultati Q2 2013 (31.12.2013)Tifoso BilanciatoNoch keine Bewertungen

- BM&FBOVESPA S.A. Announces Results For The First Quarter 2012Dokument9 SeitenBM&FBOVESPA S.A. Announces Results For The First Quarter 2012BVMF_RINoch keine Bewertungen

- MediaFactBook2012 InitiativeDokument58 SeitenMediaFactBook2012 Initiativebehemoth01Noch keine Bewertungen

- HSBC Holdings PLC: Company ProfileDokument9 SeitenHSBC Holdings PLC: Company ProfileCaro YangNoch keine Bewertungen

- Third Point Q4 Investor Letter FinalDokument12 SeitenThird Point Q4 Investor Letter FinalZerohedge100% (3)

- Equity Analysis of Vodafone PLCDokument11 SeitenEquity Analysis of Vodafone PLCBethelNoch keine Bewertungen

- SME Trade Finance Research FinalDokument70 SeitenSME Trade Finance Research FinalMikeNoch keine Bewertungen

- VCCEdge Half Yearly Deal Report - 2016Dokument24 SeitenVCCEdge Half Yearly Deal Report - 2016duttasaikatNoch keine Bewertungen

- Finweek - September 10, 2015Dokument48 SeitenFinweek - September 10, 2015mariusNoch keine Bewertungen

- Fina4050 - Jai Paul VasudevaDokument9 SeitenFina4050 - Jai Paul VasudevaJai PaulNoch keine Bewertungen

- Marks & Spencer PLCDokument9 SeitenMarks & Spencer PLCAsha SJNoch keine Bewertungen

- Our Goal Is To Materially Improve Returns To Our Shareholders Over Time While Maintaining A Strong Capital RatioDokument6 SeitenOur Goal Is To Materially Improve Returns To Our Shareholders Over Time While Maintaining A Strong Capital RatioPaa JoeNoch keine Bewertungen

- Goldman Sachs Presentation To Credit Suisse Financial Services ConferenceDokument10 SeitenGoldman Sachs Presentation To Credit Suisse Financial Services ConferenceGravity The NewtonsNoch keine Bewertungen

- UntitledDokument8 SeitenUntitledapi-239404108Noch keine Bewertungen

- REA Group 2H12 PDFDokument3 SeitenREA Group 2H12 PDFBernardo MirandaNoch keine Bewertungen

- PHP OJucjfDokument5 SeitenPHP OJucjffred607Noch keine Bewertungen

- Flash Report For Conference Call: Jax Watch Company IncDokument14 SeitenFlash Report For Conference Call: Jax Watch Company IncShirley HuangNoch keine Bewertungen

- Voda RevenueDokument2 SeitenVoda Revenuetheanuuradha1993gmaiNoch keine Bewertungen

- Pija Doc 1581907800Dokument8 SeitenPija Doc 1581907800lamp vicNoch keine Bewertungen

- June 30, 2000Dokument4 SeitenJune 30, 2000grrarrNoch keine Bewertungen

- Q1 2013 CMI EarningsDokument51 SeitenQ1 2013 CMI EarningsMichael WildNoch keine Bewertungen

- Adidas Performed Well in A Challenging Environment During Q3 2021Dokument9 SeitenAdidas Performed Well in A Challenging Environment During Q3 2021LT COL VIKRAM SINGH EPGDIB 2021-22Noch keine Bewertungen

- IFA39 LoresDokument68 SeitenIFA39 LoresMarkus MilliganNoch keine Bewertungen

- Top Track 250 Re PukDokument37 SeitenTop Track 250 Re PukKishor WaghmareNoch keine Bewertungen

- PF I League Tables 2014Dokument34 SeitenPF I League Tables 2014stavros7Noch keine Bewertungen

- September 7th, 2012: Market OverviewDokument9 SeitenSeptember 7th, 2012: Market OverviewValuEngine.comNoch keine Bewertungen

- Apresenta??o Da Confer?ncia Do Bank of America Merril Lynch em Nova York (Vers?o em Ingl?s)Dokument14 SeitenApresenta??o Da Confer?ncia Do Bank of America Merril Lynch em Nova York (Vers?o em Ingl?s)Multiplan RINoch keine Bewertungen

- IDFC Sterling Value Fund Apr'20Dokument5 SeitenIDFC Sterling Value Fund Apr'20GNoch keine Bewertungen

- SBL BPP Kit-2019 Copy 455Dokument1 SeiteSBL BPP Kit-2019 Copy 455Reever RiverNoch keine Bewertungen

- Solutiondone 214Dokument1 SeiteSolutiondone 214trilocksp SinghNoch keine Bewertungen

- Third Point Q3 2021 Investor Letter TPILDokument10 SeitenThird Point Q3 2021 Investor Letter TPILZerohedge100% (2)

- Bloomberg M&a 2011 Q1Dokument39 SeitenBloomberg M&a 2011 Q1Victor PangNoch keine Bewertungen

- Q1 2019 Frequently Asked Investor Questions How Was The Group's Financial Performance in Q1 2019?Dokument7 SeitenQ1 2019 Frequently Asked Investor Questions How Was The Group's Financial Performance in Q1 2019?saxobobNoch keine Bewertungen

- Greenlight Q2 Letter To InvestorsDokument5 SeitenGreenlight Q2 Letter To InvestorsVALUEWALK LLCNoch keine Bewertungen

- Financing Trends For Q2 2015Dokument8 SeitenFinancing Trends For Q2 2015David BozinNoch keine Bewertungen

- Deal Drivers EMEA H1 2010Dokument68 SeitenDeal Drivers EMEA H1 2010Remark, The Mergermarket GroupNoch keine Bewertungen

- Secondary Market Financing Revenues World Summary: Market Values & Financials by CountryVon EverandSecondary Market Financing Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersVon EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNoch keine Bewertungen

- Top Stocks 2017: A Sharebuyer's Guide to Leading Australian CompaniesVon EverandTop Stocks 2017: A Sharebuyer's Guide to Leading Australian CompaniesNoch keine Bewertungen

- Recruitment and Selection ProcessDokument33 SeitenRecruitment and Selection Processurmi_patel22Noch keine Bewertungen

- 7PR 0004473 248199801436 0199Dokument2 Seiten7PR 0004473 248199801436 0199Anik MukherjeeNoch keine Bewertungen

- Bajaj Alianz Life InsuranceDokument145 SeitenBajaj Alianz Life InsuranceAnil JhaNoch keine Bewertungen

- Fin e 39234 2009Dokument2 SeitenFin e 39234 2009venkatasubramaniyanNoch keine Bewertungen

- Employee and Self-Employed Worker by François Auger, Department of Justice Canada, 2002Dokument70 SeitenEmployee and Self-Employed Worker by François Auger, Department of Justice Canada, 2002Wesley KenzieNoch keine Bewertungen

- Taxation - Income TaxDokument158 SeitenTaxation - Income Taxnaren197667% (6)

- SNGPLDokument26 SeitenSNGPLAli HassanNoch keine Bewertungen

- 014 National Assembly Staff ActDokument9 Seiten014 National Assembly Staff ActOlaNoch keine Bewertungen

- Claremont COURIER 8.21.10Dokument27 SeitenClaremont COURIER 8.21.10Claremont CourierNoch keine Bewertungen

- Chapter 10Dokument69 SeitenChapter 10kosasih wendelinNoch keine Bewertungen

- FNB Pension Fund Irp5Dokument1 SeiteFNB Pension Fund Irp5Vovo SolutionsNoch keine Bewertungen

- Benefits GuideDokument13 SeitenBenefits GuideIstván NagyvátiNoch keine Bewertungen

- Icici BankDokument70 SeitenIcici BankvipinkathpalNoch keine Bewertungen

- Gsis v. MontesclarosDokument6 SeitenGsis v. Montesclarosmaida daniotNoch keine Bewertungen

- Unit 1 Notes and HomeworkDokument34 SeitenUnit 1 Notes and Homeworkludy louisNoch keine Bewertungen

- Pension Provision in Germany - The First and Second Pillars in FocusDokument6 SeitenPension Provision in Germany - The First and Second Pillars in FocuspensiontalkNoch keine Bewertungen

- Edelweiss Retirement Plan Investor PresentationDokument28 SeitenEdelweiss Retirement Plan Investor Presentationnarayan.mitNoch keine Bewertungen

- Beginners' Guide On How To Become A Successful InvestorDokument51 SeitenBeginners' Guide On How To Become A Successful InvestorAoButterflyNoch keine Bewertungen

- GSIS v. Montesclaros (434 SCRA 441)Dokument2 SeitenGSIS v. Montesclaros (434 SCRA 441)Void Less50% (2)

- Information GuideDokument30 SeitenInformation GuideJames Theauphaeul Osei-KufuorNoch keine Bewertungen

- Income From SalariesDokument28 SeitenIncome From SalariesAshok Kumar Meheta100% (2)

- 8Dokument47 Seiten8Putri SariNoch keine Bewertungen

- AP - A05 Audit of LiabilitiesDokument7 SeitenAP - A05 Audit of LiabilitiesJane DizonNoch keine Bewertungen

- EditionDokument17 SeitenEditionCarlos FerreiraNoch keine Bewertungen

- Exempted Incomes: Section-10 (10) - Sec-10 (A) - Sec-10 (AA) - Sec-10 (B)Dokument3 SeitenExempted Incomes: Section-10 (10) - Sec-10 (A) - Sec-10 (AA) - Sec-10 (B)Aneesh VelluvalappilNoch keine Bewertungen

- LLMsyllabusDokument41 SeitenLLMsyllabusRamesh Babu TatapudiNoch keine Bewertungen

- Department of Labor: 97 13179Dokument5 SeitenDepartment of Labor: 97 13179USA_DepartmentOfLaborNoch keine Bewertungen

- Family Law Financial Affidavit Short FormDokument9 SeitenFamily Law Financial Affidavit Short Formscadam817Noch keine Bewertungen

- Manpower Planning and Resourcing (MCQ)Dokument25 SeitenManpower Planning and Resourcing (MCQ)bijay67% (3)

- Summary of Gsis BenefitsDokument4 SeitenSummary of Gsis BenefitsFrank Lloyd CadornaNoch keine Bewertungen