Beruflich Dokumente

Kultur Dokumente

Bank Marketing Startegy Using Clustering

Hochgeladen von

Alok Kumar SinghCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bank Marketing Startegy Using Clustering

Hochgeladen von

Alok Kumar SinghCopyright:

Verfügbare Formate

International Journal of Computer Applications (0975 8887)

Volume 45 No.17, May 2012

Segmenting the Banking Market Strategy by Clustering

Varun Kumar. M

Vishnu Chaitanya. M

Madhavan. M

Assistant Professor (Junior)

Assistant Professor

Research Assistant

School of Information Technology & School of Information Technology & School of Information Technology &

Engineering

Engineering

Engineering

VIT University-Vellore

Tamil Nadu-India

VIT University-Vellore

Tamil Nadu-India

ABSTRACT

Customer segmentation is the practice of dividing a customer

base into groups of individuals that are similar in specific

ways relevant to marketing such as age, gender, interests,

spending habits, and so on. One of the easiest definitions is "a

group of customers with shared needs". From this definition,

it's clear what we need to identify customers with shared

needs. The customer segmentation consists of two phases.

First phase includes K-Means clustering, where the customers

are clustered according to their RFM (Recency Frequency

Monetary). In the Second phase, with demographic data, each

cluster is again partitioned into new clusters. Finally LTV

(Life Time Value of the customers) are used to generate

customers profile.

Keywords

RFM

- Recency Frequency Monetary

SOM

- Self Organizing Map

LTV

- Life Time Value of a customer

MARC

- Mining Association Rule using Clustering

CRM

- Customer Relationship Management

OSI-ISO - Open Systems Interconnection International

Standards Organization

1. INTRODUCTION

Marketing has become the significant function in banking

industry which makes bank to pay more attention to improve

their marketing strategy. In order to attain a huge success over

their market, they have to boost their strategy to identify,

understand and target the profitable or valuable customers

from other non-profitable customers. It is highly impossible

for banks to serve customers on a one-to-one basis to find

this. To overcome this problem, a two phase clustering

method has been adopted where CRM plays major role in

segmenting customers. Customer Segmentation is the primary

stage of CRM. To enhance better customer service and to

reduce operational costs we resolve on customer

segmentation. In this two phase clustering method the first

phase includes

k-means clustering, where RFM is used as the input variable

to cluster the customers. Second, demographic data is used to

form new clusters from the existing clusters that were derived

from the first phase. The demographic parameters are selected

by applying a variable selection procedure using Self

Organizing Map (SOM) method that identifies relevant

customer groups. Finally an LTV is used to generate customer

profile that recognizes profitable customers.

VIT University-Vellore

Tamil Nadu-India

The objectives are,

To establish link between customer segmentation

and marketing campaign and also to enhance by

using RFM.

The Profiles of customers in each group could be

analyzed by marketers to make better strategies for

each group.

To establish better customer relationship

management strategies.

The targeted customers can be identified by new

segmentation method in the data mining domain and through

some models of CRM like RFM, LTV and demographic

variables. The method that is currently used is based on twophase clustering model and this can be achieved through Kmeans technique. The existing customers are clustered into

different groups of customers based on their transactional

behaviors and characteristics. To set market strategies, the

profile of customers in each group is analyzed by the

marketers.

2. FEASIBILITY STUDY

The two phase clustering method has received an increasing

attention in todays marketing and commercial areas. This is

due to the fact that there is a fast access to the profitable

customers by segmenting the customers into profitable and

non-profitable. This method has overcome the disadvantages

of spending more time and resources over the non-profitable

segments which is unworthy. This method makes us to

identify the targeted profitable customers, always retains the

customer to our application for a longer period, utilizing the

right amount of money and time over the profitable segments,

customer satisfaction and maintaining good relationship with

clients. Customer segmentation will add value by enabling it

to: Target appropriate products to different consumers, Utilize

marketing resources more efficiently, stay side by side of

emerging market trends. Using segmentation, we can speak to

the needs and interests of different groups, we can determine

whether there is a product/service that fit in high opportunity

segments, we can weigh whether product enhancements or

new products might appeal to targeted groups. Segmentation

often improves average retention and profitability of

customers on a segment by segment basis. Implement

individual marketing plans for each targeted segment.

3. LITERATURE SURVEY

Clustering e- Banking Customer using Data Mining

techniques and Marketing Segmentation [1] discusses about

data mining techniques like SOM, K-Means algorithm and

Marketing technique-RFM analysis which are used to

10

International Journal of Computer Applications (0975 8887)

Volume 45 No.17, May 2012

segment customers into groups according to their personal

profiles and e-banking usages. Later Apriori algorithm is used

to find e-Banking services that are similar or applicable for

segmented groups of customers.

A general approach to the automatic content- based

organization and visualization of large digital music

collections [2] discusses about Cross national analysis for

online game marketing which focuses to target the loyal

customers (domestic and foreign) and to concentrate their

limited resources for them. The general methodology consists

of two phases 1.MCFA Multi group Confirmatory Factor

Analysis to test differences between national clustering factors

and 2.SOM to develop actual clusters inside each nation.

Intelligent Structuring and Exploration of Digital Music

Collections [3] aims at finding similar songs. For this they

consider content based data like rhythm, timbre, tempo, etc.

and various metadata like instrumentation, style, artist, etc. of

songs to get the degrees of similarity between pieces of music.

These similarities are captured to train a SOM which is

projected by smoothed histograms that shows clusters with

similar songs.

Enhancing consumer behavior analysis using Data Mining

Techniques [4] presents a two stage framework of consumer

behavior and key feature is a cascade involving SOM neural

network to divide customers into homogeneous groups of

customers and a decision tree method is simplified to identify

relevant knowledge.

Customer Behavior Analysis using CBA (Data Mining

Approach) [5] focus on customer classification and

prediction of banking sector by using Nave Bayesian

classifier that accommodates the uncertainty inherent in

predicting behavior of the customers. Here CRM takes

customer as the center and optimizes the business process and

provides way to retain profitable customers.

Customer

Registration

Store in MySQL

Transaction

Details

RFM

Customer

Profiles

Selection of

Customers using SOM

K-Means Clustering

Demographic Data

K-Means Clustering

Neural Network Customer

Classification

4. PROPOSED SYSTEM

Customer segmentation is the practice of dividing a customer

base into groups of individuals that are similar in specific

ways relevant to marketing such as age, gender, interests,

spending habits, and so on. One of the easiest definitions is "a

group of customers with shared needs". From this definition,

it's clear what we need to do is to identify customers with

shared needs. The customer segmentation consists of two

phases. First phase includes K-Means clustering, where the

customers are clustered according to their RFM (Recency

Frequency Monetary). In the second phase, with demographic

data each cluster is again partitioned into new clusters. Finally

LTV (Life Time Value of the customers) are used to generate

customers profile.

LTV Prediction

Improves Market Strategy

Fig 1: System Architecture

5. MODULES OF THE SYSTEM

5.1

Neural

Network

Customer

Classification

CRM is a business strategy, the outcome of which optimizes

profitability, revenue and customer satisfaction by organizing

around customer segments, supporting customer satisfying

behaviors and implementing customer-centric processes.

CRM in Internet banking is used to improve the marketing

strategy. E-banking services are offered by Fully

Transactional Websites which allow the customers to operate

on their accounts for transfer of funds, payment of different

11

International Journal of Computer Applications (0975 8887)

Volume 45 No.17, May 2012

bills, subscribing to other products of the bank and to transact

purchase and sale of securities, etc.

5.2 K-Means Clustering Model

It generally partition n-observations into k-clusters. Clusters

created based on central mean value. We consider the

registered customers as n-observations using demographic

data values and through RFM they are clustered (i.e.) in each

cluster we consider demographic data values (student, current

employee, retired people, former, senior citizen) and using

RFM values (deposit, withdraw, transactions) as the central

mean value, customers are grouped.

5.3 Clustering using Association Rule

Mining

Here clusters consider the input variables as RFM. RFM is a

method used for analyzing customer behavior and defining

market segments. To create an RFM analysis, three categories

for each attributes are created. Recency, Frequency and

Monetary attributes can be viewed in three operations such as

deposit, withdrawal and transaction.

5.4 Application Profiles for Self Organizing

Map

The SOM process examines group of customer profiles and

also emphasize on particular profile to perform profile

integration. SOM studies user classification and customer

profile and consider as data sets. These data sets are trained

through unsupervised learning using existing class field thus

SOM positioned arbitrarily over the data space. After

performing n no. of iterations nodes near trained nodes are

found and thus the grid moved to the trained data. Therefore,

training data will be found.

6.2 Category of Customers

Customers are categorized into 5 groups namely,

Students

Current

Employee

Retired people

Senior citizen.

6.3 Type of Transactions

Withdrawal

Deposit

Money Transfer

6.4 Date

Customers are segmented based on the date of transactions

performed (i.e. on particular date). RFM and SOM are used to

perform data clustering and the information is stored into

database. For clustering MARC (Mining Association Rule

using Clustering) algorithm is used. The usage of this

algorithm is to make a full pass over the entire database. It

segments the collection of transaction so that similar

transactions fall into same cluster. Then examines group of

customer profiles and also emphasize on particular customer

profile to perform profile integration so that trained data will

be found. Then, it is given to Neural Network. It is used to

repeat the transaction behavior and segment the customers of

similar kind.

LTV is predicted using

Mortgage Amount

___________________________

Appraised Value of the property

5.5 Demographic Data Collection in Life

Time Value

Loan to value Ratio =

LTV is a tactical model that is a snapshot of customer state

at a point in time, the customers likelihood to respond.

Frequently used names for these customer states include

active, lapsing, lapsed, and defected. Lifecycle is the movie

one might put together from these snapshots of RFM states

the migration from one customer state to the next are the

Lifecycle trigger points.

Managing various customer behavior clusters will be very

helpful for understanding the customers. This goal is achieved

by employing clustering techniques and training the samples

of customer behavior variables. The proposed framework is a

hybrid approach which uses clustering techniques to

preprocess input samples into homogeneous clusters using Kmeans, and Neural network to build cluster profiles.

5.6 Cluster Formation for Customer Based

on Transaction

7. SYSTEM IMPLEMENTATION

A frequent (used to be called large) item set is an item set

whose support (S) is minSup. Apriori property (downward

closure): any subsets of a frequent item set are also frequent

item set.

6. ADVANTAGES OF THE PROPOSED

FRAME WORK

6.1 Data Sets

Customer data is considered as data set, and assume n no of

customers and their transactions. During segmentation some

of the factors for e-banking users are considered. They are,

RFM...

Recency: It will let you know about the date of the

recently visited users transaction.

Frequency: It defines number of frequent

transactions that user conduct.

Monetary: The total value of financial transactions

that user made within particular period.

The link between customer segmentation and marketing

campaign is enhanced through using RFM. Profiles of

customers in each group could be analyzed by marketers to

make strategies for each group. In application of the method

on our case study (in banking industry), the customers were

divided into nine groups of customers according to their

shared transactional behavior and characteristics. Firstly, with

K-means clustering arithmetic, customers are clustered into

different segments by similar survival characters (i.e. churn

trend). Secondly, each clusters Survival/hazard function is

predicted by survival analyzing, then, the validity of Profiles

of customers in each group could be analyzed by marketers to

make strategies for each group. Beyond simply understanding

customer value in each cluster, they would gain the

opportunities to establish better customer relationship

management strategies, improve customer loyalty and revenue

and find opportunities for up and cross selling.

12

International Journal of Computer Applications (0975 8887)

Volume 45 No.17, May 2012

7.1 Implementation Procedures

Customer network Classification

Clustering using association rules

Application profiles for SOM process

K-Means clustering model

Demographic data collection in LTV Prediction

Model

Cluster formation for customer based on transaction

7.1.1 Customer network Classification

CRM is a business strategy, the outcomes of which optimize

profitability, revenue and customer satisfaction by organizing

around customer segments, supporting customer satisfying

behaviors and implementing customer-centric processes.

CRM is used in Internet banking to improve the marketing

strategy. E-banking services are offered by Fully

Transactional Websites which allow the customers to operate

on their accounts for transfer of funds, payment of different

bills, subscribing to other products of the bank and to transact

purchase and sale of securities, etc. The above forms of

Internet banking services are offered by traditional banks, as

an additional method of serving the customer or by new

banks, who deliver banking services primarily through

Internet or other electronic delivery channels as the value

added services. Some of these banks are known as virtual

banks or Internet only banks and may not have any physical

presence in a country despite offering different banking

services. The term customer Network Classification means the

role specification. Here user role, administrator role and the

network between the customer and the administrator is

specified. This allows customer to access e-banking

operations by registering so they are allowed to perform

deposit, withdrawal and transaction. They can also find loan

amount value based on their property value. They can even

change some of the details. Administrator also has their

separate login so that they can view, update and also can

process the customer details such as deposit, withdrawal and

transaction details.

7.1.2 Clustering using association rules

RFM

I. Recency: It let know u about the date of the

recently visited users transaction.

II. Frequency: It defines number of frequent

transactions that user conduct.

III. Monetary: The total value of financial

transactions that user made within particular period.

Type of transactions

i. Withdrawal

ii. Deposit

iii. Money Transfer.

Date

We segment customers based on date of customer transactions

(i.e. from date and to date). Association rule finds co-relation

between variables in larger databases. Here clusters consider

the input variables as RFM. RFM is a method used for

analyzing customer behavior and defining market segments.

To create an RFM analysis, categories for each attribute are

first created. Recency, Frequency and Monetary attributes can

be viewed in three operations such as deposit, withdrawal and

transaction. Administrator can view customers RFM values

by mentioning From date and To date. In the database table,

the support value has been calculated (i.e.) the number of

times deposit, withdrawal and transaction has been done. Here

this process is achieved only by applying one of the Data

Mining Technique (i.e.) Association rule. For clustering we

use MARC (Mining Association Rule using Clustering)

algorithm. The usage of this algorithm is to make a full pass

over the entire database. It segments the collection of

transaction so that similar transactions fall into same cluster.

It partition the collection of transactions so that similar

transactions fall into same category, here we categorize

transactions using (Recency, Frequency, Monetary) RFM then

we apply association rules to classify each cluster. It has

advantage of applying association rules to each cluster instead

of entire data sets. It also learns association rules efficiently in

single database pass.

Yields

Support A

B

B = no of transactions A no of Transactions

Total no of transactions

Instead of entire data set, we summarize cluster using all the

frequent item sets with predetermined support and count

values,

I. Based on the number of transactions the customer perform

& II. By the amount value

7.1.3 Application profiles for SOM process

The SOM (Self Organizing Map) process examines group of

customer profiles and also emphasize on particular profile to

perform profile integration. SOM studies user classification

and customer profile and consider as data sets. These data sets

are trained through unsupervised learning using existing class

field thus, SOM positioned arbitrarily over the data space.

After, performing n no. of iterations nodes near trained

nodes is found and thus the grid moved to the trained data.

Therefore, training data will be found.

Self-organizing maps (SOMs) are a data visualization

technique which reduces the dimensions of data through the

use of self-organizing neural networks. The problem is that

humans cannot visualize the high dimensional data, so this

technique is created to help us understand this high

dimensional data. Here demographic values are taken as the

training data, this categorizes customers into 5 groups i)

Students ii) Current Employee iii) Retired people iv)Former

v) Senior citizen.

13

International Journal of Computer Applications (0975 8887)

Volume 45 No.17, May 2012

SOM Studies

User Classification

Data Sets

Customer Profile

Train Data Sets

Using

Existing

Class Field

Unsupervised Learning

Arbitrary Positioned SOM

Iterations

Nodes near Trained

Nodes Found

Grid Moved To TD

Training Data Will

Be Found

Fig 2: SOM Process

Fig 3: K- Means Cluster Formation

7.1.5 Demographic data collection in LTV

Prediction Model

LTV is a tactical model that is a snapshot of customer state

at a point in time, the customers likelihood to respond.

Frequently used names for these customer states include

active, lapsing, lapsed, and defected. Lifecycle is the movie

one might put together from these snapshots of RFM states;

the migration from one customer state to the next is the

Lifecycle trigger points. The trans is the source table for

LTV prediction model. This table is subset of the churn model

source table reg. The customer joined in less than three

years are filtered out from the training data set to provide a

valid input into the model. Life Time Span and Life Time

Value (LTV) are the two target measures to predict.

Transaction

Data

7.1.4 K-Means clustering model

K-mean algorithm creates clusters by determining a central

mean for each cluster. The algorithm starts by randomly select

K entities as the means of K clusters and randomly adds

entities to each cluster. Then, it re-computes cluster mean and

re-assigns entities to clusters to which it is most similar, based

on the distance between entity and the cluster mean. Then, the

mean is recomputed at each cluster, and previous entities

either stay / move to a different cluster and one iteration

completes. Algorithm iterates until there is no change of the

means at each clusters. It generally partition n-observations

into k-clusters. Clusters created based on central mean value.

We consider the registered customers as n-observations using

demographic data values and through RFM they are clustered

(i.e.) in each cluster we consider demographic data values

(student, current employee, retired people, former, senior

citizen) and using RFM values (deposit, withdraw,

transactions) as the central mean value, customers are

grouped.

Demographic

Data

LTV Model

Current

Value

Potential

Value

Customer Life Time

Value Computation for

Campaign

Fig 4: LTV Prediction Model

Campaign

Database

Campaign

Contribution

Factor

Prediction

7.1.6 Cluster formation for customer based

on transaction

A frequent (used to be called large) itemset is an

itemset whose support (S) is minSup.

Apriori property (downward closure): any subsets of

a frequent itemset are also frequent itemset.

Definitions:

An item: an article in a basket, or an attribute-value

pair

A transaction: items purchased in a basket; it may

have TID (transaction ID)

A transactional dataset: A set of transactions

An itemset is a set of items.

An itemset is a set of items.

A k-itemset is an itemset with k items.

14

International Journal of Computer Applications (0975 8887)

Volume 45 No.17, May 2012

profitable customers, Maximize investments in sales and

delivery channels, Secure a competitive advantage in the

marketplace, Distribute branches more effectively, Align

branches with defendable strategic performance, goals rooted

in real-world customer behaviors and comprehensive market

data Explore and quantify potential opportunities before

making the critical decisions that impact the bottom line.

Beyond simply understanding customer value in each cluster,

the bank would gain opportunities to establish better customer

relationship management strategies, improve customer loyalty

and revenue and find opportunities for up and cross selling.

Given a dataset D, an itemset X has a (frequency)

count in D

An association rule is about relationships between

two disjoint itemsets X and Y

X Y

It presents the pattern when X occurs, Y also occurs.

7.2 Modeling Techniques used

7.2.1 Pipes and Filters

Each component has a set of inputs and outputs. A component

reads a stream of data on its input and produces a stream of

data on its outputs. Input is transformed both locally and

incrementally so that output begins before input is consumed

(a parallel system). Components are called filters. Connectors

serve as conduits for the information streams and are termed

pipes.

Pipe

Pipe

9. FUTURE ENHANCEMENTS

The future work will be on, the less profitable customers their

accounts require highly automated interactions, while the

high-yield accounts benefit from differentiated and better

levels of service. Not only the marketing message will be

delivered, institutions can alert the right departments and sales

staff when customer communications are received, enabling

appropriate and timely follow-up.

Pipe

10. REFERENCES

Pump

Filter

Filter

Fig 5: Pipe and Filter Architectural Style

7.2.2 Layered Systems

A layered system is organized hierarchically with

each

layer providing service to the layer above it and serv - ing as

a client to the layer below. In some systems inner layers are

hidden from all except the adjacent outer layer. Connectors

are defined by the protocols that determine how layers will

interact. Constraints include limiting interactions to adjacent

layers. The best known example of this style appears in

layered communication protocols OSI-ISO (Open Systems

Interconnection International Standards Organization)

communication system. Lower levels describe hardware

connections and higher levels describe application. Layered

systems support designs based on increasing levels of

abstraction. Complex problems may be partitioned into a

series of steps. Enhancement is supported through limiting the

number of other layers with which communication occurs.

Disadvantages include the difficulty in structuring some

systems in a layered fashion.

8. CONCLUSION

This paper focuses on clustering e-banking customer to

analyze customer characteristics and behaviors with

appropriated criteria: access time, transaction access and RFM

Analysis, LTV, demographic variables. The benefits are

valuable for the bank to improve services and the benefits

includes Gain unparalleled insight into markets, Attract more

Pump

[1] Waminee Niyagas, Anongnart Srivihok, and sukumal

Kitisin Clustering e-Banking Customer using Data

Mining and Marketing Segmentation The dataset of this

study is Internet Banking customer data from one

commercial bank in Thailand between January 1st and

December 11th of the year 2005.

[2] Sang Chul Lee, Yung Ho Suh, Jae Kyeong Kim, Kyoung

Jun Lee A cross-national market segmentation of online

game industry using SOM in Elsevier Expert Systems

with Applications 27 (2004) 559 570.

[3] Markus Schedl, Elias Pampalk, and Gerhard Widmer 2004

Intelligent Structuring and Exploration of Digital Music

Collection in Austrian Research Institute for Artificial

Intelligence.

[4] Nan-Chen Hsieh, Kuo-Chung Chu 2009 Enhancing

Consumer Behavior Analysis by Data Mining

Techniques in International journal of information

management and sciences.

[5] K.V.Nagendra, C.Rajendra 2012 Customer Behavior

Analysis using CBA (Data Mining Approach) in

National Conference on Research trends in Computer

Science and Technology.

[6] Derya Birant, Dokuz Eylul University, Turkey Data

Mining Using RFM Analysis in an article Knowledge

oriented applications in Data Mining.

[7] E.W.T. Ngai, Li Xiu, D.C.K. Chau, 2009 Application of

data mining techniques in customer relationship

management: A literature review and classication in

ELSEVIER.

15

Das könnte Ihnen auch gefallen

- Inferring Behavior On Rejected Credit Applicants-Three ApproachesDokument4 SeitenInferring Behavior On Rejected Credit Applicants-Three ApproachesAlok Kumar SinghNoch keine Bewertungen

- XgboostDokument153 SeitenXgboostAlok Kumar SinghNoch keine Bewertungen

- Arima Modelingforecasting CodeDokument2 SeitenArima Modelingforecasting CodeAlok Kumar SinghNoch keine Bewertungen

- LogisticDokument49 SeitenLogisticAlok Kumar Singh100% (1)

- Forecast Time Series-NotesDokument138 SeitenForecast Time Series-NotesflorinNoch keine Bewertungen

- Chap 7Dokument109 SeitenChap 7struggler17Noch keine Bewertungen

- Proc Esm PDFDokument43 SeitenProc Esm PDFAlok Kumar SinghNoch keine Bewertungen

- Proc SgplotDokument20 SeitenProc SgplotAlok Kumar SinghNoch keine Bewertungen

- Proc Esm 2Dokument11 SeitenProc Esm 2Alok Kumar SinghNoch keine Bewertungen

- Service QualityDokument19 SeitenService QualityAlok Kumar SinghNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Credit Assessment of Bank Customers by A Fuzzy ExpDokument6 SeitenCredit Assessment of Bank Customers by A Fuzzy ExpTrần NgaNoch keine Bewertungen

- BDA Assignment (Savi Bilandi)Dokument10 SeitenBDA Assignment (Savi Bilandi)SAVINoch keine Bewertungen

- MODULE 3 - Question &answer-2Dokument32 SeitenMODULE 3 - Question &answer-2Vaishnavi G . RaoNoch keine Bewertungen

- Data Mining and Data Warehousing: Unit - III Association RulesDokument19 SeitenData Mining and Data Warehousing: Unit - III Association RulesNitheeshNoch keine Bewertungen

- 4 - Data Analytics Using DM and ML Algorithms - 1Dokument71 Seiten4 - Data Analytics Using DM and ML Algorithms - 1Tariku WodajoNoch keine Bewertungen

- Data Warehousing and Mining April 2019Dokument4 SeitenData Warehousing and Mining April 2019phanikumarsindheNoch keine Bewertungen

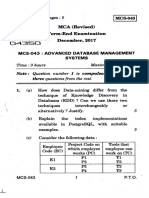

- MCS 043 PDFDokument5 SeitenMCS 043 PDFShahim AkarmNoch keine Bewertungen

- Addis Ababa UniversityDokument6 SeitenAddis Ababa Universityaskual assefaNoch keine Bewertungen

- Data Mining Method Based On LatticeDokument3 SeitenData Mining Method Based On LatticeNurhasanah AnaNoch keine Bewertungen

- 1.IJAEST Vol No 11 Issue No 2 Association Rule For Classification of Heart Attack Patients 253 257Dokument5 Seiten1.IJAEST Vol No 11 Issue No 2 Association Rule For Classification of Heart Attack Patients 253 257ديبثي ڤاكيتيNoch keine Bewertungen

- BA 321 Final Exams: Instructions: Please Read Carefully and Follow The Instructions Given. Good Luck!Dokument10 SeitenBA 321 Final Exams: Instructions: Please Read Carefully and Follow The Instructions Given. Good Luck!Minute EnterpriseNoch keine Bewertungen

- Assignment 05Dokument2 SeitenAssignment 05Gabriel JauNoch keine Bewertungen

- Cse3054 - Data-Mining - Concepts-And-Techniques - Eth - 1.0 - 66 - Cse3054 - 61 AcpDokument2 SeitenCse3054 - Data-Mining - Concepts-And-Techniques - Eth - 1.0 - 66 - Cse3054 - 61 AcpdragonnishanthNoch keine Bewertungen

- An Introduction To WEKADokument85 SeitenAn Introduction To WEKAJamilNoch keine Bewertungen

- A Survey of Correlated High Utility Pattern MiningDokument15 SeitenA Survey of Correlated High Utility Pattern MiningBaranishankarNoch keine Bewertungen

- AprioriDokument27 SeitenAprioriShanmugasundaram MuthuswamyNoch keine Bewertungen

- Data Mining For Web PersonalizationDokument59 SeitenData Mining For Web PersonalizationBằng NguyễnNoch keine Bewertungen

- Applying Data Mining Techniques To Football Data From European ChampionshipsDokument14 SeitenApplying Data Mining Techniques To Football Data From European ChampionshipscmohanraNoch keine Bewertungen

- Data Mining Techniques (DMT) by Kushal Anjaria Session-2: Tid ItemsDokument4 SeitenData Mining Techniques (DMT) by Kushal Anjaria Session-2: Tid ItemsMighty SinghNoch keine Bewertungen

- Questions-For-Data-Mining-2020 Eng MarwanDokument19 SeitenQuestions-For-Data-Mining-2020 Eng Marwansohila aliNoch keine Bewertungen

- Association Rule LearningDokument16 SeitenAssociation Rule Learningjoshuapeter961204Noch keine Bewertungen

- Unit-4object Segmentation Regression Vs Segmentation Supervised and Unsupervised Learning Tree Building Regression Classification Overfitting Pruning and Complexity Multiple Decision TreesDokument25 SeitenUnit-4object Segmentation Regression Vs Segmentation Supervised and Unsupervised Learning Tree Building Regression Classification Overfitting Pruning and Complexity Multiple Decision TreesShalinichowdary ThulluriNoch keine Bewertungen

- Mining High Utility Patterns in One Phase Without Generating CandidatesDokument17 SeitenMining High Utility Patterns in One Phase Without Generating CandidatesrekhaNoch keine Bewertungen

- Data Warehousing and DatabySRSDokument8 SeitenData Warehousing and DatabySRSkinglokyNoch keine Bewertungen

- Association RulesDokument64 SeitenAssociation RuleskiranrekhiNoch keine Bewertungen

- M-CO - VISemDataWarehousingAndMining (CO, IF) - NEW - 141220181910Dokument9 SeitenM-CO - VISemDataWarehousingAndMining (CO, IF) - NEW - 141220181910Sadik PimpalkarNoch keine Bewertungen

- MCQDokument37 SeitenMCQsathiya100% (6)

- Ekgkjktk Xaxk Flag Fo'ofo - Ky Chdkusj: M.Sc. Computer ScienceDokument21 SeitenEkgkjktk Xaxk Flag Fo'ofo - Ky Chdkusj: M.Sc. Computer SciencePankaj DadhichNoch keine Bewertungen

- Market Basket Analysis: Rengarajan R (19049)Dokument12 SeitenMarket Basket Analysis: Rengarajan R (19049)Akshaya LakshminarasimhanNoch keine Bewertungen

- Syllabus DataminingDokument4 SeitenSyllabus DataminingManish PadhraNoch keine Bewertungen