Beruflich Dokumente

Kultur Dokumente

Harmonized System (HS) Code

Hochgeladen von

Anand VermaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Harmonized System (HS) Code

Hochgeladen von

Anand VermaCopyright:

Verfügbare Formate

The Harmonized Commodity Description and Coding System generally referred to as

Harmonized System or simply HS is a multipurpose international product

nomenclature developed by the World Customs Organization (WCO).

It comprises about 5,000 commodity groups; each identified by a six digit code,

arranged in a legal and logical structure and is supported by well-defined rules to

achieve uniform classification.

The system is used by more than 200 countries and economies as a basis for their

Customs tariffs and for the collection of international trade statistics. Over 98 % of

the merchandise in international trade is classified in terms of the HS.

The HS contributes to the harmonization of Customs and trade procedures, and the

non-documentary trade data interchange in connection with such procedures, thus

reducing the costs related to international trade.

It is also extensively used by governments, international organizations and the

private sector for many other purposes such as internal taxes, trade policies,

monitoring of controlled goods, rules of origin, freight tariffs, transport statistics,

price monitoring, quota controls, compilation of national accounts, and economic

research and analysis. The HS is thus a universal economic language and code for

goods, and an indispensable tool for international trade.

The Harmonized System is governed by The International Convention on the

Harmonized Commodity Description and Coding System. The official interpretation

of the HS is given in the Explanatory Notes (5 volumes in English and French)

published by the WCO. The Explanatory Notes are also available on online and on

CD-ROM, as part of a database which groups all the available HS Tools, by adding to

the information on the Nomenclature, the Compendium of Classification Opinions

and the Explanatory Notes, that relating to the Alphabetical Index and the Brochure

on Classification Decisions taken by the Harmonized System Committee.

The maintenance of the HS is a WCO priority. This activity includes measures to

secure uniform interpretation of the HS and its periodic updating in light of

developments in technology and changes in trade patterns. The WCO manages this

process through the Harmonized System Committee (representing the Contracting

Parties to the HS Convention), which examines policy matters, takes decisions on

classification questions, settles disputes and prepares amendments to the

Explanatory Notes. The HS Committee also prepares amendments updating the HS

every 5 6 years.

Decisions concerning the interpretation and application of the Harmonized System,

such as classification decisions and amendments to the Explanatory Notes or to the

Compendium of Classification Opinions, become effective two months after the

approval by the HS Committee. These are reflected in the amending supplements of

the relevant WCO Publications.

Difference between HS and ITC Code

Difference between HS number and ITC

number

What is the difference between Harmonized System code and Indian Tariff Code?

Are HS code and ITC code same?

Most of us in the trade believe that ITC code and HS code are the same. However, you may

read below the distinguish between HS number and ITC number.

What is H.S.code

H.S code system means Harmonized System code. In some

countries HS code is also known as HTS (Harmonized Tariff System)

. HS system has been developed by World Customs Organization

uniformly applied by more than 140 countries worldwide. H.S.code

classifies goods as 4 digit heading and 6 digit sub heading (four

digit heading followed by two digits). Customs department of more

than 140 major countries have been functioning on the basis of the

said 6 digit tariff code.

What is ITC CODE?

ITC means Indian Trade Classification, also known as Indian Tariff Code (ITC). This schedule

has two parts First schedule with an eight digit nomenclature and the second schedule

with description of goods chargeable to export duty. The first

schedule is based on H.S code system. The Indian Tariff

Code has 8 digit which has been designed in such a way

without any modification of first 6 digit as per H.S code system,

but followed by another two digit classified as tariff item. So

ITC has been classified as first four-digit code called heading

and every six digit code called subheading and 8-digit code

called Tariff Item. This addition is done, within the permissible

limit of World Customs Organization WCO, without any

changes in H.S.code system.

From the above clarification, it is not true that HS code and ITC code are same

Das könnte Ihnen auch gefallen

- Harmonized System CodeDokument20 SeitenHarmonized System Codelito77100% (4)

- 6 - T-6 Transit & TransshipmentDokument3 Seiten6 - T-6 Transit & TransshipmentKesTerJeeeNoch keine Bewertungen

- Flowchart of Work Flow Document For A Manufacturing CompanyDokument2 SeitenFlowchart of Work Flow Document For A Manufacturing CompanyNicasio AquinoNoch keine Bewertungen

- Classification of Imported and Export Goods: Learning OutcomesDokument19 SeitenClassification of Imported and Export Goods: Learning OutcomesKaarthvya ChodeyNoch keine Bewertungen

- DubaiCustoms AboutMirsal2Dokument14 SeitenDubaiCustoms AboutMirsal2Hassan Eleyyan100% (1)

- Duckademy LFI-RFI How LFI and RFI WorkDokument42 SeitenDuckademy LFI-RFI How LFI and RFI WorkKlentiB.ÇukariNoch keine Bewertungen

- Azure-Planning and Finding Solutions For Migration - MOPDokument7 SeitenAzure-Planning and Finding Solutions For Migration - MOPVijay RajendiranNoch keine Bewertungen

- BCI ICT ResilienceDokument57 SeitenBCI ICT ResilienceOana DragusinNoch keine Bewertungen

- The Harmonized System and Ahtn Presentation October 82019Dokument13 SeitenThe Harmonized System and Ahtn Presentation October 82019Niño Esco DizorNoch keine Bewertungen

- OCR Services Corporate BrochureDokument12 SeitenOCR Services Corporate BrochureOCR ServicesNoch keine Bewertungen

- Desiderio Bergami Customs Management TechniquesDokument11 SeitenDesiderio Bergami Customs Management TechniquesDanilo DesiderioNoch keine Bewertungen

- Introduction To ImportsDokument2 SeitenIntroduction To Importsyagay100% (2)

- Procedure For Import and ExportDokument10 SeitenProcedure For Import and Exportswapneel234Noch keine Bewertungen

- Import Export ProcedureDokument13 SeitenImport Export ProcedureManinder SinghNoch keine Bewertungen

- E2MDokument2 SeitenE2MEdward JohnNoch keine Bewertungen

- Eway BillDokument35 SeitenEway BillShivaniNoch keine Bewertungen

- What Is Capacity PlanningDokument6 SeitenWhat Is Capacity Planningswathi krishnaNoch keine Bewertungen

- Differences & Similarities Between Anti Dumping & SafeguardsDokument2 SeitenDifferences & Similarities Between Anti Dumping & SafeguardsShalu Singh100% (3)

- Role of Infarmation Technology in WalDokument12 SeitenRole of Infarmation Technology in WalMukesh KumarNoch keine Bewertungen

- RA 7844 Export Development Act of 1994Dokument21 SeitenRA 7844 Export Development Act of 1994Crislene CruzNoch keine Bewertungen

- VALUE ADDED TAX Value Added Tax, Popularly Known AsDokument6 SeitenVALUE ADDED TAX Value Added Tax, Popularly Known AsCAclubindia100% (1)

- Customs ValuationDokument44 SeitenCustoms ValuationIman Nurakhmad FajarNoch keine Bewertungen

- Custom Clearnence ProcedureDokument7 SeitenCustom Clearnence ProcedureAdeeb AkmalNoch keine Bewertungen

- Procedure - Section711 - Rev2 - 28july 2020Dokument3 SeitenProcedure - Section711 - Rev2 - 28july 2020AceNoch keine Bewertungen

- Shipping Documents: Bill of LadingDokument15 SeitenShipping Documents: Bill of LadingCristina DeluNoch keine Bewertungen

- Incoterms: Eneral NformationDokument4 SeitenIncoterms: Eneral NformationrooswahyoeNoch keine Bewertungen

- Greening The Business Partners-Amkor Technology PhilippinesDokument44 SeitenGreening The Business Partners-Amkor Technology Philippinesjervz16Noch keine Bewertungen

- Best Practices Shipping DocumentationDokument11 SeitenBest Practices Shipping DocumentationgtoquirozNoch keine Bewertungen

- Impact of GST On Logistic Sector in IndiaDokument12 SeitenImpact of GST On Logistic Sector in IndiaAshwathej100% (1)

- DGFT or Directorate General of Foreign Trade Is The Agency of TheDokument4 SeitenDGFT or Directorate General of Foreign Trade Is The Agency of TheDharam ShahNoch keine Bewertungen

- Industrial LicensingDokument26 SeitenIndustrial LicensingJuiÇý ßitëNoch keine Bewertungen

- Visual ImpexDokument2 SeitenVisual ImpexShirish BatheNoch keine Bewertungen

- Tarrif and Non TarrifDokument7 SeitenTarrif and Non TarrifGaurav SinghNoch keine Bewertungen

- SCM Research PaperDokument8 SeitenSCM Research PaperKameswara Rao PorankiNoch keine Bewertungen

- A Brief About The INCOTERMS (International Commercial Terms)Dokument5 SeitenA Brief About The INCOTERMS (International Commercial Terms)Shrinivas Meherkar100% (1)

- Custom Clearance Procedure For ImportDokument13 SeitenCustom Clearance Procedure For ImportUsman89% (9)

- How To Start A Firm in IndiaDokument15 SeitenHow To Start A Firm in IndiaAnonymous bAoFyANoch keine Bewertungen

- Customs Valuation DivyasomDokument19 SeitenCustoms Valuation DivyasomDivyasom MalhanNoch keine Bewertungen

- Wala Dito Yung Theoretical and Di Pa Nadadagdagan DefinitionDokument39 SeitenWala Dito Yung Theoretical and Di Pa Nadadagdagan Definitionthe girl in blackNoch keine Bewertungen

- Handling Customs Tax Audits and RemediesDokument23 SeitenHandling Customs Tax Audits and Remedieslito77Noch keine Bewertungen

- Following Health, Safety and Security ProceduresDokument2 SeitenFollowing Health, Safety and Security ProceduresJohn simpson100% (1)

- Tax 2. Q&A Compilation (R.A. 9135, 8751, 8752 & 8800)Dokument13 SeitenTax 2. Q&A Compilation (R.A. 9135, 8751, 8752 & 8800)pa3ciaNoch keine Bewertungen

- Procedure For Clearance of Imported and Export GoodsDokument74 SeitenProcedure For Clearance of Imported and Export GoodsA. Gaffar ShaikNoch keine Bewertungen

- Collection Districts or Ports of Entry PDFDokument1 SeiteCollection Districts or Ports of Entry PDFnicole gonzalesNoch keine Bewertungen

- Procurement and Supplies Professionals A PDFDokument115 SeitenProcurement and Supplies Professionals A PDFNyeko FrancisNoch keine Bewertungen

- Vodafone Case StudyDokument35 SeitenVodafone Case StudyRidhima SharmaNoch keine Bewertungen

- DGFTDokument29 SeitenDGFTyes456Noch keine Bewertungen

- Counter TradeDokument38 SeitenCounter TradethomasNoch keine Bewertungen

- RA 8751 Countervailing LawDokument6 SeitenRA 8751 Countervailing LawAgnus SiorNoch keine Bewertungen

- Supply Chain ManagementDokument6 SeitenSupply Chain ManagementZehra Abbas rizviNoch keine Bewertungen

- Syllabi 2017 Customs Broker Licensure ExaminationDokument5 SeitenSyllabi 2017 Customs Broker Licensure Examinationmarjo estrellaNoch keine Bewertungen

- Inventory Management at Iffco - ShaliniDokument96 SeitenInventory Management at Iffco - ShaliniTahir HussainNoch keine Bewertungen

- Supply Chain Security - EDIDokument76 SeitenSupply Chain Security - EDISrihari PatelNoch keine Bewertungen

- International Commercial Terms 2010Dokument57 SeitenInternational Commercial Terms 2010vipul boyllaNoch keine Bewertungen

- Import Export Customs Clearance ProcessDokument5 SeitenImport Export Customs Clearance ProcessRajvir SinghNoch keine Bewertungen

- Final Project Report NimbusDokument29 SeitenFinal Project Report NimbusSawan YadavNoch keine Bewertungen

- Contribution of Customs Information System To The Performance of The Customs Department UgandaDokument54 SeitenContribution of Customs Information System To The Performance of The Customs Department UgandaSt. Lawrence University SLAUNoch keine Bewertungen

- 073-116-020 (Accounting Practice in Bangladesh)Dokument26 Seiten073-116-020 (Accounting Practice in Bangladesh)Bazlur Rahman Khan67% (9)

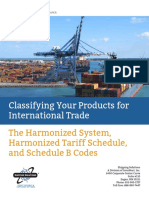

- Shipping Solutions Classifying Your Products WhitepaperDokument24 SeitenShipping Solutions Classifying Your Products WhitepaperJonniel De GuzmanNoch keine Bewertungen

- Concept of HS CodeDokument4 SeitenConcept of HS CodeAnand VermaNoch keine Bewertungen

- Tarrif Codes and Commodity CodesDokument12 SeitenTarrif Codes and Commodity CodesAnjan RaoNoch keine Bewertungen

- Cad 207 - Classification SystemDokument14 SeitenCad 207 - Classification SystemKyla Theresa NavalesNoch keine Bewertungen

- HSN Code - Last 4 Digits ImportanceDokument4 SeitenHSN Code - Last 4 Digits ImportanceJEEBAK DUTTA CHOUDHURY MBA IB(KOL) 2019-22Noch keine Bewertungen

- The Power of Branding - Design CouncilDokument9 SeitenThe Power of Branding - Design CouncilAnand VermaNoch keine Bewertungen

- Indian Export Overview in Aug'22 - Oct'22Dokument1 SeiteIndian Export Overview in Aug'22 - Oct'22Anand VermaNoch keine Bewertungen

- Shell India Marketing CampaignDokument4 SeitenShell India Marketing CampaignAnand VermaNoch keine Bewertungen

- Digital Marketing Trends 2022 - 25 Practical Recommendations To ImplementDokument24 SeitenDigital Marketing Trends 2022 - 25 Practical Recommendations To ImplementAnand Verma100% (1)

- Ad Targeting OptionsDokument3 SeitenAd Targeting OptionsAnand VermaNoch keine Bewertungen

- Ten Ingredients of A Successful Customized Leadership ProgramDokument9 SeitenTen Ingredients of A Successful Customized Leadership ProgramAnand VermaNoch keine Bewertungen

- Initial Approach FunnelDokument3 SeitenInitial Approach FunnelAnand VermaNoch keine Bewertungen

- Philippines Exporters ListDokument4 SeitenPhilippines Exporters ListAnand VermaNoch keine Bewertungen

- Keller's Brand Equity ModelDokument5 SeitenKeller's Brand Equity ModelAnand Verma100% (1)

- The Future of Knowledge WorkDokument18 SeitenThe Future of Knowledge WorkAnand VermaNoch keine Bewertungen

- Vroom's and McGregor's Theory of MotivationDokument1 SeiteVroom's and McGregor's Theory of MotivationAnand VermaNoch keine Bewertungen

- Consumer Behaviour ConceptDokument7 SeitenConsumer Behaviour ConceptAnand VermaNoch keine Bewertungen

- McClelland's Theory of NeedsDokument1 SeiteMcClelland's Theory of NeedsAnand VermaNoch keine Bewertungen

- McGregor's Theory X and Theory YDokument1 SeiteMcGregor's Theory X and Theory YAnand Verma0% (1)

- Concept of HS CodeDokument4 SeitenConcept of HS CodeAnand VermaNoch keine Bewertungen

- Letter of Credit - Concept & ProcedureDokument4 SeitenLetter of Credit - Concept & ProcedureAnand VermaNoch keine Bewertungen

- Apr'21 Export and ImportDokument8 SeitenApr'21 Export and ImportAnand VermaNoch keine Bewertungen

- Bill of Lading in ShippingDokument9 SeitenBill of Lading in ShippingAnand Verma100% (2)

- Vroom's Theory of ExpectancyDokument1 SeiteVroom's Theory of ExpectancyAnand VermaNoch keine Bewertungen

- Limitations of Z TheoryDokument6 SeitenLimitations of Z TheoryAnand VermaNoch keine Bewertungen

- Highlights of Union Interim Budget 2019-20Dokument9 SeitenHighlights of Union Interim Budget 2019-20Anand VermaNoch keine Bewertungen

- Distinguish Between Shipping Bill, Bill of Lading and Charter PartyDokument1 SeiteDistinguish Between Shipping Bill, Bill of Lading and Charter PartyAnand VermaNoch keine Bewertungen

- Introduction of Quantum MechanicsDokument2 SeitenIntroduction of Quantum MechanicsAnand Verma0% (1)

- Limitations of Z TheoryDokument6 SeitenLimitations of Z TheoryAnand VermaNoch keine Bewertungen

- Import Procedure and Regulations in GermanyDokument7 SeitenImport Procedure and Regulations in GermanyAnand VermaNoch keine Bewertungen

- EXIM Business Sole ProprietorshipDokument2 SeitenEXIM Business Sole ProprietorshipAnand VermaNoch keine Bewertungen

- Export Procedure of MadagascarDokument8 SeitenExport Procedure of MadagascarAnand VermaNoch keine Bewertungen

- Maslow's Theory Merits and CriticismDokument2 SeitenMaslow's Theory Merits and CriticismAnand VermaNoch keine Bewertungen

- William Ouchi's Theory Z of MotivationDokument5 SeitenWilliam Ouchi's Theory Z of MotivationAnand VermaNoch keine Bewertungen

- Export Import Regulations in MadagascarDokument2 SeitenExport Import Regulations in MadagascarAnand VermaNoch keine Bewertungen

- Notes: Nama: Indah Ayuning Tyas Nim:170100926Dokument4 SeitenNotes: Nama: Indah Ayuning Tyas Nim:170100926indahNoch keine Bewertungen

- Table of Contents For Computer Architecture: A Minimalist PerspectiveDokument6 SeitenTable of Contents For Computer Architecture: A Minimalist PerspectiveWilliam GilreathNoch keine Bewertungen

- Link LayerDokument58 SeitenLink LayerrajindermmathNoch keine Bewertungen

- P2P Technology User's ManualDokument8 SeitenP2P Technology User's ManualElenilto Oliveira de AlmeidaNoch keine Bewertungen

- Y6A Practice Book Answers White Rose Maths EditionDokument23 SeitenY6A Practice Book Answers White Rose Maths EditionmadajjuanNoch keine Bewertungen

- WoodwardCatalog PDFDokument48 SeitenWoodwardCatalog PDFJul Cesar100% (1)

- Source Code Ijtima Falakiyin NUsanataraDokument187 SeitenSource Code Ijtima Falakiyin NUsanataraUlum NiNoch keine Bewertungen

- DVR User Manual: For H.264 4/8/16-Channel Digital Video Recorder All Rights ReservedDokument73 SeitenDVR User Manual: For H.264 4/8/16-Channel Digital Video Recorder All Rights ReservedchnkhrmnNoch keine Bewertungen

- Covenant UniversityDokument5 SeitenCovenant UniversityWilkie MofeNoch keine Bewertungen

- Niladri - Ganguly New BioDokument3 SeitenNiladri - Ganguly New Biohresab_banerjeeNoch keine Bewertungen

- Idoc Error Handling For Everyone: How It WorksDokument2 SeitenIdoc Error Handling For Everyone: How It WorksSudheer KumarNoch keine Bewertungen

- Excel ExerciseDokument296 SeitenExcel ExerciseshubhamNoch keine Bewertungen

- Return To Castle Wolfenstein Cheats: The Web Ign. ComDokument16 SeitenReturn To Castle Wolfenstein Cheats: The Web Ign. ComSiddharth Dey0% (1)

- Payment Notification FNBDokument1 SeitePayment Notification FNBChequeNoch keine Bewertungen

- HSMC Spec PDFDokument81 SeitenHSMC Spec PDFClyde CauchiNoch keine Bewertungen

- ACESYS V8.0 - User Manual - AlternateDokument12 SeitenACESYS V8.0 - User Manual - AlternateMohamed AdelNoch keine Bewertungen

- CIS201 Chapter 1 Test Review: Indicate Whether The Statement Is True or FalseDokument5 SeitenCIS201 Chapter 1 Test Review: Indicate Whether The Statement Is True or FalseBrian GeneralNoch keine Bewertungen

- A New Method For Encryption Using Fuzzy Set TheoryDokument7 SeitenA New Method For Encryption Using Fuzzy Set TheoryAgus S'toNoch keine Bewertungen

- Harshitha C P ResumeDokument3 SeitenHarshitha C P ResumeHarshitha C PNoch keine Bewertungen

- THE Football Analytics HandbookDokument26 SeitenTHE Football Analytics HandbookAlvaro Zabala100% (2)

- Slides Agile Impacting ChangeDokument20 SeitenSlides Agile Impacting ChangeJayaraman Ramdas100% (1)

- Linear Amps For Mobile OperationDokument10 SeitenLinear Amps For Mobile OperationIan McNairNoch keine Bewertungen

- Burkina Faso Position PaperDokument2 SeitenBurkina Faso Position Paperaryan mehtaNoch keine Bewertungen

- Browse by FlairDokument3 SeitenBrowse by FlairzacanemaNoch keine Bewertungen

- Hipaa Information and Consent FormDokument1 SeiteHipaa Information and Consent FormJake HennemanNoch keine Bewertungen

- DP Sound Conexant 14062 DriversDokument242 SeitenDP Sound Conexant 14062 DriversRamesh BabuNoch keine Bewertungen

- Praveen Ya (Final)Dokument3 SeitenPraveen Ya (Final)Priyanka VijayvargiyaNoch keine Bewertungen