Beruflich Dokumente

Kultur Dokumente

Mahindra Supply Chain

Hochgeladen von

Darshak ParikhOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Mahindra Supply Chain

Hochgeladen von

Darshak ParikhCopyright:

Verfügbare Formate

PAPER ID# 140

BEST PRACTICES AND PERFORMANCE

BENCHMARKING FOR SCM IN INDIAN AUTO INDUSTRY

Sunil Sharma, Reader, Faculty of Management Studies, University of Delhi,

DELHI 110007, INDIA;

E-mail : ssharma@fms.edu; Tel : +91-9871119464, Fax : +91-11-27667183.

The present paper first traces out the multidimensional functional relationship of supply chain

management (SCM) with material planning and delivery, lean manufacturing and total quality

systems. Consequently, based on executive judgement and literature survey, an extensive list

of sixty critical success factors has been developed for benchmarking in SCM. These factors

are then evaluated and analysed in leading Japan / Korea collaborated car manufacturing units

located in India. Some key performance parameters of SCM are thus evolved which are then

assessed in sample companies. The paper validates a potential for intensive research in area of

performance benchmarking in SCM on a global basis particularly in firms operating on joint

ventures / collaborations.

Keywords : Lean manufacturing, JIT II, SCM Performance Parameters

INTRODUCTION :

Recently there has been increased focus in organizations on improvement of value delivery

systems to customers and as a part of this strategy, supply chain management (SCM) has been

identified as a thrust area by most corporate who are now entering into strategic partnerships

with specific suppliers and distributors and even customers to improve the performance of

value delivery system and networks facilitated with information technology. This clubbed

with the physical distribution and logistics requirements is posing a great challenge to the

companies which want to make their value delivery system most effective particularly

regarding their front ending with the customers. Obviously, manufacturing and engineering

companies cannot accomplish these objectives unless their vendors meet the specified criteria

specially latters ability and willingness to participate in cost, delivery, quality, service and

logistics improvement programmes. Never has there been a greater thrust on careful selection,

rating and development of suppliers oriented towards fostering strategic alliances rather than

just meeting shot-term contractual obligations and consolidating vendors base. This is going

to be even more rigorously pursued in the first decade of new millennium. Using SCM as a

competitive strategy can now not be debated.

Relation of supply chain management with modern material planning and delivery, lean

manufacturing and total quality systems :

Since most companies including those in India are changing steadfastly towards adoption of

advanced material planning and delivery systems like MRP, JIT and even JIT-II comprising

proactive networking, and join collaboration with vendors, it becomes inevitable to tune in

their supply chain management systems with MRP and JIT requirements which in turn are

determined by the operation flow patterns existing in respective manufacturing systems and

inventory requirements therein. Hernandez (1993) has aptly described relation of TQM / JIT

with supply chain. Linkage of MRP / JIT with supply chain management is being enabled by

computerised information systems and electronic data interchange (EDI) with suppliers,

1

PAPER ID# 140

dealers, warehouses and customers alike. In fact, adoption of good supply chain management

practices is further necessitated by use of Total Quality (TQ) practices. Most of the

international quality system standards today lay down specific criteria for selection, rating and

assessment of vendors. Needless to say, supply chain management practices would have

marked effects on physical distribution processes including material handling, storage and

delivery systems, layout considerations, say, on-line delivery of parts. So, in a nutshell,

change in supply chain management practices effects a wider, more than expected, spectrum

of operations ranging from layout engineering, operations flow planning and control, material

planning, storage and delivery and also quality assurance till the finished goods are

transported to warehouses, distribution / retailing centers and finally customers. Michael

Porter (1985) has thus, been right in identifying in-bound logistics and outbound logistics as

primary activities of value chain being controlled by cross-functional support activities of

which procurement of materials is one. Manufacturing batch sizes in layouts having process

orientation and line balance and flow rates in layouts having product orientation could affect

SCM practices. In fact, volume and process variability have been identified as root causes of

unnecessary supply chain cost and variation. It has now been widely researched that contrary

to American automakers, Japanese and Korean auto-manufacturers have their production and

material reports triggered by sales demand not forecasts. (Ahmadian and Afifi, 1990) This

implies that planning, replenishment, traffic and distribution of stock is based on orders

entirely triggered by customers demand. This has been referred to as demand-driven supply

chain and is a foundation for lean supply chain. A demand driven supply chain would aim

to move from long manufacturing and delivery lead times to short ones and replacing batch

processing with flow processing preferably using group or cellular technology (GT) which

facilitates high speed supply chain. Ensuring single piece flows in a lean manufacturing

environment would always highlight the value-flow across internal/external supply chain

members.

It is now well established that Japanese and Korean automakers represent classic

examples of integrating supply chain with their plant and customer requirements. Schonberger

(1982) has enumerated some characteristics of world class firms trying to manage suppliers

towards stock reduction and short manufacturing and delivery lead times. Leading consultants

like KPMG (1997) and Mc Kinsey (1992) have also enlisted some key performance

benchmarks in world class firms following SCM. The present paper deals with an insight into

key attributes and performance benchmarks of using supply-chain management practices in

some leading Japan and Korea collaborated automobile units located in India.

LITERATURE SCAN :

Beamon (1999) presented a number of characteristics that are found in effective performance

measurement systems for SCM. Camp (1989) has provided a comprehensive treatment of

benchmarking for best practices related to superior performance.

In order to study the large number of supply chain performance measures available,

researchers have categorized them. Neely, et. al. (1995) presented a few of the categories

namely quality, time, flexibility and cost. The SCOR (Supply Chain Operations Reference)

Model of the Supply Chain Council suggests metrics related to reliability (on-time delivery,

order fulfillment lead time, fill rate), Flexibility (supply chain response time and upside

production flexibility), Expenses (all SCM costs, warranty cost as a percentage of revenue and

value added per employee) and assets/utilization (total inventory days of supply, cash-to-cash

cycle time and net asset turns).

PAPER ID# 140

The performance measures utilized in the models proposed by various authors as

Bytheway (1995), Waters-Fuller (1995), Lamming (1996) etc., directly relate with real-world

applicability in terms of different performance measures mostly categorized into :

(i)

cost

(ii)

time

(iii)

customer responsiveness

(iv)

(volume and variety-) flexibility

(v)

a combination of two or more than two of the above.

Costs may include inventory costs and other operating costs as procurement,

manufacturing and distribution cost. Customer responsiveness measures include lead time,

on-time and available-to-promise (ATP) delivery, stock-out probability and fill rate.

Interestingly Lee and Bellington (1992) also cite a number of trade-offs that a corporate might

have to do for best results from a supply-chain. These are lot size inventory trade-off,

inventory-transportation cost trade off, lead-time-transportation cost trade-off, product variety

inventory trade-off and production and distribution costs customer service trade-off.

Various measurement categories and corresponding criteria are summarized in Table 1.

Table 1 :

Sr.

No.

1.

SCM Performance parameters as cited by different researchers.

Performance

Measurement

Categories

Cost

Corresponding

Researchers

Key Parameters

Cohen and Lee (1988)

Cohen and Moon (1990)

Lee and Feitzinger (1995)

Costs related with procurement,

manufacturing, transportation,

inventory,

warhousing,

distribution etc.

Pyke and Cohen (1993)

Tzafestas and Kapsiotis (1994)

2.

Cost and Time

Arntzen et. al. (1995)

Customer

response

time

manufacturing

lead

time,

available-to-promise

(ATP)

performance, order fulfillment

cost.

3.

Cost

and Christy and Grout (1994)

Customer

Cook and Rogowski (1996)

Responsiveness

Davis (1993)

Making a trade-off between cost

and customer responsiveness to

optimize

the

return

on

investments.

Ishii et. al. ( 1988)

Newhart,

( 1993)

Stott

Wikner,

(1991)

Towill

and

Vasko

and Naim

PAPER ID# 140

4.

Customer

Responsivess

Lee and Billington (1993)

High level of customer service

judged by on-time deliveries,

customer satisfaction, fill rate,

stock-out probability, warranty

costs and product returns etc.

5.

Flexibility

Voudouris (1996)

Volume and variety flexibility to

meet customer demand.

Examples of other performance measures are : customer satisfaction (Christopher, 1994),

information flow (Nicoll, 1994), supplier performance (Davis, 1993), risk management

(Johnson and Randolph, 1995). Stevenson (2005) reports another interesting factor Velocity

in terms of inventory velocity which refers to the rate at which inventory goes through the

supply chain (faster is better) and information velocity which would refer to the rate at which

information is transferred within a supply chain.

METHODOLOGY :

A sample of leading Japan and Korea collaborated car manufacturing units located in India

were selected. Three of them were located in NCR (National Capital Region) of Delhi and

one located near Chennai and the other one in Bangalore. These are namely : Honda Siel

Motors, Maruti Udyog Ltd., (the then) Daewoo Motors (I) Ltd., Hyundai Motors (I) Ltd. and

Toyota Kirloskar Motors Ltd. A list of key success factors (KSFs) was prepared on the basis

of literature survey, executive judgement and cues provided by professional studies done by

consultants like KPMG, Mc Kinsey on a global basis and the ET (Economic Times)

Intelligence Group in India. A questionnaire, which listed key success factors (KSFs) for

supply chain management practices, was administered to senior executives of materials,

purchasing and/or vendor development departments of these companies. A comparative

analysis is done as to what extent these companies are following supply chain management

practices. The manufacturing system and flow patterns were similar in selected companies.

Moreover, the companies selected had Japanese or Korean collaborators who had

demonstrated potential of integrating supply chain management systems and practices

particularly in a lean environment.

The Questionnaire :

The questionnaire was administered through visits to various plants located in National

Capital Region and through mail to plants located near Chennai and Bangalore. The

questionnaire was framed keeping into view the factors that are attributed to best practices in

supply chain management in the contemporary environment. The questionnaire listed sixty

key success factors (KSFs). As indicated, KSFs were derived on judgemental and literature

survey basis by this researcher.

OBSERVATIONS

A comparative analysis of the sixty identified critical success factors in the select sample

companies namely Honda-Siel Motors, Maruti Udyog Ltd., Daewoo Motors (I) Ltd., Hyundai

Motors (I) Ltd. and Toyota Kirloskar Motors Ltd. is done. A point rating of 1 is given if a

company is very strongly following the management practice given in the form of a key

success factor (KSF) while a rating of 0.5 is given if a company is partially following or is in

the process of implementing a practice. A rating of zero is given if a company does not at all

4

PAPER ID# 140

follow a practice. A 5-point equal-interval rating scale is used to represent degree of presence

of a particular supply chain attribute in a company. The results are tabulated in Table 2 and

Table 3.

INTERPRETATION :

It is clear from Tables 2 and 3 that the select companies have significantly followed supplychain management practices, vendor integration and consolidation strategies. These

companies are common in aiming for :

i) High level of sole-sourcing.

ii) Having most vendors located proximally.

iii) Better span of control for their purchasing executives for better follow-up, expediting

and control.

iv) Reduction of delivery lead time with vendors.

v) Keeping vendors informed about production schedule changes on a regular basis.

vi) Minimum lead time in placing orders with vendors.

vii) Higher level of strategic alliances with suppliers including Joint Ventures (JVs).

viii) Giving preference to vendors having material planning and information systems and

on-line access to production schedules of OEM purchasing companies.

ix) Need for less frequent contract reviews / negotiations and encouraging blanket

ordering.

x) Preferentially selecting vendors with ISO 9001/02 quality assurance systems.

xi) Giving flexibility to vendors in design change, process improvement and cost

reduction.

xii) Encouraging vendors to supply on-line and in small frequent lots.

xiii) Assisting vendors in reducing their manufacturing lead times.

xiv) Vendors assistance and development schemes for joint collaboration.

xv) Development of supplier quality assurance systems and practices.

xvi) Reduced followup and expediting efforts with vendors.

xvii) Simplifying and consolidating logistics operations and practices.

The selected companies however, lacked in :

i) Following strategic classification of materials

ii) Controlling late deliveries from vendors which still cluster around 15%

iii) Controlling rejects from vendors as lot control systems / acceptance sampling plans

are inadequate or are not properly contractually obligated. Rejects still hover around

5%.

iv) Controlling number of line stoppages due to material / component shortages.

v) Extensive strategic partnerships / alliances in form of coalition / joint ventures

vi) Preferential selection of vendors with QS-9000 and ISO 14001 system

vii) Encouraging more vendors to follow recirculatory packaging and handling and

enabling them to deliver right on / near the line (JIT II)

viii) Giving vendors more design and processing flexibility i.e. focusing on performance

specifications rather than design specifications.

ix) Properly arbitrating contractual clauses so that disputes related to cost, quality and

delivery are reduced

5

PAPER ID# 140

x) Rationalising purchasing costs which still amount to 10-15%

xi) Encouraging far-off vendors to develop transit stores / contract warehousing and own

transport by giving them financial assistance.

xii) Intensive consolidation of out-bound freight and encouraging contract warehousing

and company owned transport at the focal firm end.

xiii) Design and installation of a transporter rating system.

CONCLUSIONS

From this study, it is concluded that automobile companies with Japanese / Korean

collaboration are going in a big way to consolidate and integrate their supply chain and value

delivery networks. For this they are striving towards attaining better logistics and

communication system with their vendors. However, they are still giving less flexibility in

design and process changes to vendors and most of the vendors are at receiving end. May be,

vendors also have to change their attitude and have to be more particular in terms of cost,

speed of delivery, quality, service and flexibility criteria. It is to be appreciated that backward

vertical integration may also not be a good proposition always and should be resorted to on

selective basis. Also successful negotiations on a win-win basis could be strategically used to

arbitrate purchasing contracts on mutual basis for long term partnerships and develop strategic

coalition in value delivery systems. More and more OEM companies should go in for

encouraging and assisting vendors to adopt material planning, information and

communication systems including MRP, e-networking, etc. Sometimes there is inadequate

sharing of real time information about material planning, delivery and production routing and

scheduling by OEM with their vendors. Companies need not see SCM in an isolated manner

and should analyze for variability cause of SCM tracing back to even their production flow

systems and bottlenecks and volume and design flexibilities. Both capacity and capability

assessments are to be done at vendors end. Emphasis must be there to remove waste (muda)

in processes to remove unnecessary cost and variation in supply-chain. To cap it all, even

traditional mid-sets at a company could be stumbling blocks in implementation of SCM

practices. Lot control systems and plans must be rigidly followed. What is required in Indian

context is, that companies should make their manufacturing and supplies systems more

reactive and responsive to needs of changing demand patterns for which vendor consolidation,

integration and development in tune with individual needs may only provide the final

solution. Lastly the importance of third party relationship in case of outsourced logistics

should not be under-estimated. This particularly holds true for Indian companies who have to

work out a functional relationship using proper coordination while dealing with third party

logistic (3PL) providers. By next decade, most buying companies in India should have all

vendors equipped with on-line communication, a developed ability to deliver zero-defect

small lots on-line at a short notice, a strong system to plan and control materials and a

strategic intent to follow international quality, environmental and safety standards throughout

the supply chain.

PAPER ID# 140

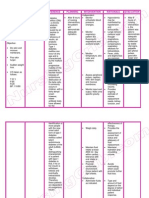

Table 2 :

ANALYSIS OF KEY SUCCESS FACTORS OF SUPPLY CHAIN

MANAGEMENT IN SELECT COMPANIES

(Legend :

Very strong Strong { Medium Weak

Very weak strength of KSF

/ attribute presence)

Daewoo

Honda-Siel

MUL1

HML2

1. Carrying out strategic

classification of materials

2. Maintenance of Approved

Supplier List

3. Regular assessment and

upgradation of vendors list

4. Keeping number of suppliers

per part minimum

5. Assignment of minimum

suppliers to each purchasing

executive

6. Maximising percent

components sole-sourced

7. Maximising percent suppliers

located within 100 kms

8. Pursuing advance material

quantity planning

9. Pursuing advance material

quality planning

10. Keeping lead time minimum

with suppliers

11. Minimisation of time spent in

placing order

12. Minimisation of percent late

deliveries

13. Minimisation of percent

rejected material

14. Minimisation of time lost in line

stoppages due to material

shortages per year

15. Minimum times the stock

overflows in4 A class items

KEY SUCCESS FACTORS OF

SUPPLY CHAIN MANAGEMENT

.

.

3

.

2

TKM3

Maruti Udyog Ltd.

Hyundai Motors Ltd.

Toyota Kirloskar Motor Ltd.

PAPER ID# 140

Daewoo

Honda-Siel

MUL1

HML2

16. Maximum percent blanket

orders / open orders of total

orders

17. Frequent release of production

schedules to vendors

18. Release of Purchase Orders

(P.O.) through modern

communication aids e.g., e-mail

19. Getting orders from dealers

through modern modern

communication aids e.g., e-mail.

20. Development of design

capability in vendors with focus

on performance specifications

21. Enabling suppliers to undertake

value analysis for cost reduction

22. Disregarding vertical

integration and encouraging

coalition / JVs with suppliers

23. Preferred and advantageous

contracts against parent foreign

collaborators

24. Capability to arbitrate /

negotiate reasonable contracts

with supply sources for strategic

partnerships

25. Limiting competitive bidding to

only new purchases

26. Policy of always storing

materials only at point of

manufacture

27. Vendor incentive / development

schemes for superior and

inferior vendors respectively.

28. Testing, measurement and

calibration system in operations

29. Ensuring single piece flow

control system / lean

environment

KEY SUCCESS FACTORS OF

SUPPLY CHAIN MANAGEMENT

TKM3

Assessment at vendors end of

(28-44)

PAPER ID# 140

KEY SUCCESS FACTORS OF

SUPPLY CHAIN MANAGEMENT

MUL1

HML2

Daewoo

Honda-Siel

30. Supplier quality assurance

system

31. Information system / EDI / e-mail

facilities at vendor

32. Managements competence and

attitude for quality, cost

reduction and continuous

improvement

33. PPM analysis to pursue zero

defects

34. Ability to produce and supply in

frequent small-sized lots

35. Communicational accessibility

of vendor

36. Milk-run to verify material,

engineering and design

specifications

37. Establishment of Lot Control

systems ie. labeling of lot with

reliable information on quality

and quantity and submission of

inspection plans

38. Maintenance of process output

data (SPC etc.) for critical

processes

39. Documentation of process

improvement over a period of

time

40. Assessment and validation of

machine capabilities of special

processes so that Cp index is

equal to or greater than 1.33

41. Ability of vendors to extend JIT

purchasing to their vendors

42. Compliance with ISO

9001/9002 requirements

43. Compliance with QS-9000

/other specific requiremen

44. Compliance with ISO

14001/other environmental and

safety standards

TKM3

PAPER ID# 140

KEY SUCCESS FACTORS OF

SUPPLY CHAIN MANAGEMENT

MUL1

HML2

TKM3

Daewoo

Honda-Siel

45. Use of recirculatory / reusable

material packaging / handling

equipments

46. Use of computerized material

planning (MRP/MRP II) by

vendors

47. Delivery by suppliers right near

production lines rather than to

receipt stores (on-line delivery)

48. Regular source development

and audit practices particularly

for new parts

49. Frequency of contract reviews /

negotiations

50. Extent of disputed supplies

regarding quality / cost /

delivery with vendors

51. Reduced efforts in follow-up

and expediting with vendors

52. Development and

implementation of a Transporter

Rating System

53. Encouraging company owned /

contract warehousing and

shipping / discouraging

common carriers

54. Consolidation of freight for

transportation

55. Maintenance of schedules for

inbound and outbound freights

56. Flow synchronized concurrent

material movement and

handling with simple

documentation

57. Adoption of standards and

protective packaging with

proper container labeling

especially for K.D. assemblies

58. Adoption of total quality (TQ)

approach in operations

10

PAPER ID# 140

KEY SUCCESS FACTORS OF

SUPPLY CHAIN MANAGEMENT

Daewoo

Honda-Siel

MUL5

HML6

59. Adoption of Material

Requirement Planning (MRP)

Push and /or JITPull system in

spirit

60. Strategic intent for implantation

of ERP

Table 2 :

TKM7

KEY PERFORMANCE PARAMETERS OF SUPPLY CHAIN

MANAGEMENT IN SELECT COMPANIES

KEY PERFORMANCE

PARAMETERS

i) Minimum number of

suppliers per part

ii) Maximum number of

suppliers per part

iii) Approximate number of

suppliers per purchasing

executive

iv) Percent components solesourced

v) Percent suppliers located

within 100 kms

vi) Minimum lead time with

suppliers

vii) Maximum lead time with

suppliers

viii) Time spent in placing the

order with vendor

ix) Average percent late

deliveries

x) Maximum percent reject

material

xi) Average time in line

stoppages due to material

shortage per month

xii) Average time stock

overflowing of A class

items in a year

Daewoo

01

HondaSiel

01

MUL

HML

TKM

01

01

01

02

01

03

03

02

08

07

05

07

03

95%

95%

15%

75%

95%

80%

80%

80%

75%

90%

1 week

1 day

2-4hrs

3 days

2-3hrs

4 week

6days

10 days

1 week

1-3 days

1-3 days

1 day

1 day

35%

10%

3hrs day

10%

15%

15 min3-4 hrs

5%

15%

05%

2.5%

3%

2%

20 min

5-10

min

120 min

60 min

45 min

10

12

10

12

11

PAPER ID# 140

KEY PERFORMANCE

PARAMETERS

xiii) % Blanket Orders of Total

orders

98%

HondaSiel

98%

95%

90%

95%

xiv) Frequency of release of

production schedules to

vendors

1/month

1/month

1/month

1/month

1/month

xv) Number of exclusive Joint

Ventures (JVs) with

suppliers

Not

known

xvi) Percent vendors com-plying

ISO 9001/ 02

80%

70%

70%

60%

90%

xvii) Percent vendors complying

QS-9000

5%

10-15%

Below

5%

5%

20%

xviii) Percent vendors complying

ISO 14001 (environmental

and safety standards)

Nil

Nil

A few

Nil

A few

xix) Percent vendors using

recirculatory material

handling and packaging

2%

70%

70%

50%

80%

xx) Percent vendors following

MRP / MRP II

30%

50-60%

30%

40%

60%

xxi) Percent vendors directly

delivering on to production

lines

2%

Negligible 60%

30%

90%

xxii)

Daewoo

MUL

HML

TKM

Normally

Frequency of contract -----------------------------once a year----------------------------------reviews / negotiations

xxiii) Percent disputed supplies of

total annual supplies

3%

5%

5-10%

3-5%

2-3%

xxiv) Percent vendors having

computerised information

systems and e-mail)

5%

20%

80%

40%

90%

xxv) Cost of purchasing as

percent of purchasing value

5-10%

15%

15%

10%

15%

(These responses are as collected from material and purchasing executives of respective

companies and may not represent company postulated standards/practices).

12

PAPER ID# 140

REFERENCES

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

Ahmad Ahmadian and Rasoul Afifi, 1998, Adopting JIT; The Transfer of Japanese

Practices of US Industries, in Readings in Production and Operations Management

(Ed.) Ahmadian A., Afifi R., Chandler W.D., Allyn and Bacon, Needham Heights,

U.S.A.

Ansari, A. and Modaress B., 1990, JIT Purchasing, The Free Press, Macmillan.

Ayres James B., 2001, Handbook of Supply Chain Management, St. Lucie

Press/APICS series, CRC Press, Boca Raton, Florida.

Beamon Benita M., (1999), Measuring Supply Chain Performance, International

Journal of Operations and Production Management, Vol. 19, No. 3, pp. 275-292.

Bytheway Andy, 1995, A review of Current Logistics Practices, Cranfield School of

Management Working Paper Series, SWP 10/95.

Camp, R.C., 1989, Benchmarking-The Search for Industry Best Practices that lead to

Superior Performance, ASQC Quality Press, Milwaukee.

Cook, R.L. and Rogoswski R.A., 1996, Applying JIT Principles to Continuous Process

Manufacturing Supply Chains, Production and Inventory Management Journal, I

quarter, pp. 12-17.

Corbett Lawrence, M., 1992, Deliver Windows A New View on Improving

Manufacturing Flexibility and On-time Delivery Performance, Production and

Inventory Management Journal, Vol. 33, No.3, pp. 74-79.

Ellram, Lisa M., and Martha C. Cooper, 1990, Supply Chain Management, Partnerships

and Shipper-Third Party Relationship, The International Journal of Logistics

Management, Vol 1, No. 2.

Gray, C.D., January 1999, Does Your Supply Chain Measure Up ?, APICS The

Performance Advantage, 9, No. 1, 56.

Hau L. and Billington C., Spring 1992, Managing Supply Chain Inventory: Pitfalls and

Opportunities, Sloan Management Review, pp. 65-73.

Hernandez, Arnaldo, 1993, JIT Quality A Practical Approach, Prentice Hall,

Englewoof Cliffs, New Jersey.

Johnson, Eric and Davis Tom, 1985, Gaining an Edge with Supply Chain

Management, APICS The Performance Advantage, Dec., 1995, pp 26-31.

KPMG Peat Marwick, 1997, Global Supply Chain Benchmarking Study, KPMG

consultants, USA.

Lamming, Richard, 1996, Squaring Lean Supply with Supply Chain Management,

International Journal of Operations and Production Management, Vol. 16, No.2, pp.

183-196.

Levy, D.L., Winter 1997, Lean Production in an International Supply Chain, Sloan

Management Review, 38, No. 2, pp.94-101.

Mc. Kinsey and Co., 1992, Business Week, Nov., 30, p72.

Neely, A. Gregory M. and Platts K., 1995, Performance Measurement System Design,

International Journal of Operations and Production Management, Vol. 15, No. 14, pp.

80-116.

Porter Michael E., 1985, Competitive Advantage ; Creating and Sustaining Superior

Performance, Free Press, New York.

13

PAPER ID# 140

20. Schonberger, Richard J., 1982, Japanese Manufacturing Techniques; Nine Hidden

Lessons in Simplicity, Free Press, New York, 1982.

21. Taylor, David and Brunt David, 2001, Supply Chain Management : The Lean

Approach, Thomson Learning, London.

22. Waters-Fuller Niall, 1995, JIT Purchasing and Supply : A Review of the Literature,

International Journal of Operations and Production Management, Vol. 15, No. 9, pp.

220-236.

23. Wikner J., Towill D.R. and Naim M., 1991, Smoothing Supply Chain Dynamics,

International Journal of Production Economics, Vol. 22, No.3, pp. 231-248.

24. Womack, J.P. and Jones D.T., 1996, Lean Thinking : Banish Waste and Create Wealth

in your Corporation, Simon and Schuster, New York.

14

Das könnte Ihnen auch gefallen

- Nursing Care Plan Diabetes Mellitus Type 1Dokument2 SeitenNursing Care Plan Diabetes Mellitus Type 1deric85% (46)

- Appollo Case StudyDokument1 SeiteAppollo Case StudyNirmalya MukherjeeNoch keine Bewertungen

- Innovation Done by CompanyDokument15 SeitenInnovation Done by Companyndim betaNoch keine Bewertungen

- PROJECT TITLE - Value Chain Analysis of Hindustan Unilever LimitedDokument39 SeitenPROJECT TITLE - Value Chain Analysis of Hindustan Unilever LimitedAnkita100% (1)

- Amul Desk ReportDokument51 SeitenAmul Desk ReportInternational Business0% (1)

- Group 4 SGVS Case Study - CA1Dokument5 SeitenGroup 4 SGVS Case Study - CA1Yash ChaudharyNoch keine Bewertungen

- One Mission, Multiple Roads: Aravind Eye Care System in 2009Dokument2 SeitenOne Mission, Multiple Roads: Aravind Eye Care System in 2009Mitul SanghviNoch keine Bewertungen

- CASE STUDY-1 and 2 - WORDDokument7 SeitenCASE STUDY-1 and 2 - WORDAbdul Khaliq Choudhary100% (1)

- Case Tata TocDokument6 SeitenCase Tata TocPrasenjit DeyNoch keine Bewertungen

- Co-WIN - Winning Over COVID: Digital Platform For COVID-19 Vaccine DeliveryDokument9 SeitenCo-WIN - Winning Over COVID: Digital Platform For COVID-19 Vaccine DeliveryU VenkateshNoch keine Bewertungen

- Neoclassical CounterrevolutionDokument1 SeiteNeoclassical CounterrevolutionGraziella ValerioNoch keine Bewertungen

- Sustainability in Supply ChainDokument7 SeitenSustainability in Supply ChainInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Operations ManagementDokument15 SeitenOperations ManagementSunil KumarNoch keine Bewertungen

- Indian Suv Scorpio' Takes On Global Players in Us Market: Presented To - Dr. Gautam DuttaDokument14 SeitenIndian Suv Scorpio' Takes On Global Players in Us Market: Presented To - Dr. Gautam DuttaAmrit PatnaikNoch keine Bewertungen

- Cost Leadership - Bajaj Auto LTDDokument23 SeitenCost Leadership - Bajaj Auto LTDspodalNoch keine Bewertungen

- GRI - GCI CalculationDokument4 SeitenGRI - GCI Calculationniraj kumarNoch keine Bewertungen

- Supply Chain Management in Indian Automobile SectorDokument65 SeitenSupply Chain Management in Indian Automobile SectorDevanshu Shroff100% (1)

- ACPC Cut Off 2019 For MBADokument9 SeitenACPC Cut Off 2019 For MBAParth PatelNoch keine Bewertungen

- Hero Honda Case StudyDokument28 SeitenHero Honda Case StudySantosh Gupte67% (3)

- Bajaj Auto SM - PPTDokument46 SeitenBajaj Auto SM - PPTWaibhav KrishnaNoch keine Bewertungen

- CeatDokument3 SeitenCeatAnoop SinghNoch keine Bewertungen

- Zero Defect Quality in The Automobile Industry: A SIX SIGMADokument3 SeitenZero Defect Quality in The Automobile Industry: A SIX SIGMAshivi73Noch keine Bewertungen

- Supply Chain ManagmentDokument48 SeitenSupply Chain ManagmentJahanvi PandyaNoch keine Bewertungen

- Be - Term 2 B 36 2019Dokument6 SeitenBe - Term 2 B 36 2019santosh vighneshwar hegdeNoch keine Bewertungen

- Group 9 - CRM Project - Hero Honda Vs TVS MotorsDokument15 SeitenGroup 9 - CRM Project - Hero Honda Vs TVS MotorsVaibhav GuptaNoch keine Bewertungen

- CSR ActivitiesDokument30 SeitenCSR Activitiesanon_1454944010% (1)

- Comparative Study of BSNL and AritelDokument15 SeitenComparative Study of BSNL and AriteldiviprabhuNoch keine Bewertungen

- Supply Chain Tata MotorsDokument4 SeitenSupply Chain Tata MotorsAditya Khunteta0% (1)

- Tata Motors:cost of CapitalDokument10 SeitenTata Motors:cost of CapitalAnkit GuptaNoch keine Bewertungen

- Tata Motors: Supply Chain Analysis SC Cycles Location of Push/ Pull BoundaryDokument7 SeitenTata Motors: Supply Chain Analysis SC Cycles Location of Push/ Pull BoundaryLaxmi PriyaNoch keine Bewertungen

- Demand For CastingDokument20 SeitenDemand For Castingchamanrai100% (1)

- Auto World Case StudyDokument3 SeitenAuto World Case Studyfatima rahimNoch keine Bewertungen

- Jio Creative Labs JD InternsDokument8 SeitenJio Creative Labs JD InternsRashmi JainNoch keine Bewertungen

- Group 1, Section D IOCLDokument27 SeitenGroup 1, Section D IOCLPradeep RajagopalNoch keine Bewertungen

- Summer Internship RamDokument73 SeitenSummer Internship RamManish Saun0% (1)

- Eicher Motors ProjectDokument34 SeitenEicher Motors ProjectJainish ShahIMI KOLKATANoch keine Bewertungen

- Globalization of Indian Automobile IndustryDokument25 SeitenGlobalization of Indian Automobile IndustryAjay Singla100% (2)

- Strategic Product Development of E-VehicleDokument32 SeitenStrategic Product Development of E-VehiclesanchitNoch keine Bewertungen

- STP AnalysisDokument22 SeitenSTP AnalysisNikita Dhoot100% (3)

- Assignment On "AUTOMOBILE SECTOR OF ECONOMY"Dokument7 SeitenAssignment On "AUTOMOBILE SECTOR OF ECONOMY"salil12356Noch keine Bewertungen

- Ford's Marketing PlanDokument12 SeitenFord's Marketing PlanHanna Vanya100% (2)

- Electric Vehicle ScenarioDokument3 SeitenElectric Vehicle ScenarioChinmay VSNoch keine Bewertungen

- Project Report EditedDokument16 SeitenProject Report EditedKishor PakhareNoch keine Bewertungen

- Shah Publicity Summer ProjectDokument88 SeitenShah Publicity Summer ProjectVatsal MehtaNoch keine Bewertungen

- 2 CRM AT TATA SKY - Group 2Dokument17 Seiten2 CRM AT TATA SKY - Group 2manmeet kaurNoch keine Bewertungen

- Maruti Suzuki-Case StudyDokument11 SeitenMaruti Suzuki-Case Studyjanurag1993Noch keine Bewertungen

- Pestel Analysis For Maruti SuzukiDokument8 SeitenPestel Analysis For Maruti Suzukikarthi keyanNoch keine Bewertungen

- GEP GamEPlan2017 CaseDokument6 SeitenGEP GamEPlan2017 CaseVaibhavNoch keine Bewertungen

- Just in Time and Total Quality Management - Synergistic Processes - An OverviewDokument19 SeitenJust in Time and Total Quality Management - Synergistic Processes - An OverviewAmol ZarkarNoch keine Bewertungen

- Structure of A Good CVDokument1 SeiteStructure of A Good CVlochau88Noch keine Bewertungen

- Abrams Company Case SolutionDokument4 SeitenAbrams Company Case Solutionhssh8Noch keine Bewertungen

- Distribution Strategy of Tata NexonDokument2 SeitenDistribution Strategy of Tata NexonSanJana NahataNoch keine Bewertungen

- Supply Chain Management at AmulDokument25 SeitenSupply Chain Management at AmulSanu KumarNoch keine Bewertungen

- TATA MOTORS Atif PDFDokument9 SeitenTATA MOTORS Atif PDFAtif Raza AkbarNoch keine Bewertungen

- Impact of Supply Chain Management in Organized Apparel Retail Outlets On Sales - Pricing A Study in Selected Cities of India Anurag Shrivastava PDFDokument382 SeitenImpact of Supply Chain Management in Organized Apparel Retail Outlets On Sales - Pricing A Study in Selected Cities of India Anurag Shrivastava PDFlniyer55Noch keine Bewertungen

- V Guard Case Assignment 2Dokument4 SeitenV Guard Case Assignment 2RohitSuryaNoch keine Bewertungen

- Strategic Management in Auto Mobile IndustryDokument10 SeitenStrategic Management in Auto Mobile IndustryVikramaditya ReddyNoch keine Bewertungen

- Brand Personality (Amitabh Bachan)Dokument41 SeitenBrand Personality (Amitabh Bachan)shonreshbishwasNoch keine Bewertungen

- Measures For Evaluating Supply Chain Performance in Transport LogisticsDokument18 SeitenMeasures For Evaluating Supply Chain Performance in Transport LogisticsrezasattariNoch keine Bewertungen

- Delivery Performance Measurement in An Integrated Supply Chain Management: Case Study in Batteries Manufacturing FirmDokument16 SeitenDelivery Performance Measurement in An Integrated Supply Chain Management: Case Study in Batteries Manufacturing FirmFélicité ramandimbisonNoch keine Bewertungen

- SC Perf Measurement Acase Study For Applicability of The SCOR ModelDokument10 SeitenSC Perf Measurement Acase Study For Applicability of The SCOR ModelSanjay SethiNoch keine Bewertungen

- Conceptual Framework of ModelDokument29 SeitenConceptual Framework of ModelSabeeb M RazeenNoch keine Bewertungen

- New Doc 2020-01-18 11.35.57Dokument19 SeitenNew Doc 2020-01-18 11.35.57Darshak ParikhNoch keine Bewertungen

- ps2 Assi3Dokument6 Seitenps2 Assi3Darshak ParikhNoch keine Bewertungen

- Pin InfarinaDokument21 SeitenPin InfarinaDarshak ParikhNoch keine Bewertungen

- Total Seats Vacant in Govt./GIA Institutes & IITRAM BE After Round - 03Dokument3 SeitenTotal Seats Vacant in Govt./GIA Institutes & IITRAM BE After Round - 03Darshak ParikhNoch keine Bewertungen

- Admission Committee For Professional Courses, AhmedabadDokument1 SeiteAdmission Committee For Professional Courses, AhmedabadDarshak ParikhNoch keine Bewertungen

- Print Admission CH All An BobDokument1 SeitePrint Admission CH All An BobDarshak ParikhNoch keine Bewertungen

- Reading in MCJ 216Dokument4 SeitenReading in MCJ 216Shela Lapeña EscalonaNoch keine Bewertungen

- Pro Con ChartDokument3 SeitenPro Con Chartapi-461614875Noch keine Bewertungen

- PWC - Digital Pocket Tax Book 2023 - SlovakiaDokument52 SeitenPWC - Digital Pocket Tax Book 2023 - SlovakiaRoman SlovinecNoch keine Bewertungen

- SolBridge Application 2012Dokument14 SeitenSolBridge Application 2012Corissa WandmacherNoch keine Bewertungen

- Edagogy of Anguages: VerviewDokument54 SeitenEdagogy of Anguages: VerviewMukesh MalviyaNoch keine Bewertungen

- (1908) Mack's Barbers' Guide: A Practical Hand-BookDokument124 Seiten(1908) Mack's Barbers' Guide: A Practical Hand-BookHerbert Hillary Booker 2nd100% (1)

- Mooka Panchsati Arya SatakamDokument18 SeitenMooka Panchsati Arya SatakamPrasad Raviprolu100% (1)

- Steve Talbott Getting Over The Code DelusionDokument57 SeitenSteve Talbott Getting Over The Code DelusionAlexandra DaleNoch keine Bewertungen

- D2165151-003 Preliminary SGRE ON SG 6.0-170 Site Roads and HardstandsDokument46 SeitenD2165151-003 Preliminary SGRE ON SG 6.0-170 Site Roads and HardstandsMarcelo Gonçalves100% (1)

- Diploma Thesis-P AdamecDokument82 SeitenDiploma Thesis-P AdamecKristine Guia CastilloNoch keine Bewertungen

- A A ADokument5 SeitenA A ASalvador__DaliNoch keine Bewertungen

- IBDP Physics Oxford David - Homer Course Ebook 4th Edition-2014 CH-1Dokument27 SeitenIBDP Physics Oxford David - Homer Course Ebook 4th Edition-2014 CH-1Milek Anil KumarNoch keine Bewertungen

- Nexus 1500+ Power Quality Meter User Manual - E154713Dokument362 SeitenNexus 1500+ Power Quality Meter User Manual - E154713Antonio BocanegraNoch keine Bewertungen

- FORM 2 Enrolment Form CTU SF 2 v.4 1Dokument1 SeiteFORM 2 Enrolment Form CTU SF 2 v.4 1Ivy Mie HerdaNoch keine Bewertungen

- Plato, Timaeus, Section 17aDokument2 SeitenPlato, Timaeus, Section 17aguitar_theoryNoch keine Bewertungen

- Siemens 6SL31622AA000AA0 CatalogDokument20 SeitenSiemens 6SL31622AA000AA0 CatalogIrfan NurdiansyahNoch keine Bewertungen

- Lesson 2.4Dokument8 SeitenLesson 2.4Tobi TobiasNoch keine Bewertungen

- Psychological Well Being - 18 ItemsDokument5 SeitenPsychological Well Being - 18 ItemsIqra LatifNoch keine Bewertungen

- Operating Instructions: Vacuum Drying Oven Pump ModuleDokument56 SeitenOperating Instructions: Vacuum Drying Oven Pump ModuleSarah NeoSkyrerNoch keine Bewertungen

- Bob Jones: This CV Template Will Suit Jobseekers With Senior Management ExperienceDokument3 SeitenBob Jones: This CV Template Will Suit Jobseekers With Senior Management ExperienceDickson AllelaNoch keine Bewertungen

- Note 15-Feb-2023Dokument4 SeitenNote 15-Feb-2023Oliver ScissorsNoch keine Bewertungen

- Cues Nursing Diagnosis Background Knowledge Goal and Objectives Nursing Interventions and Rationale Evaluation Subjective: Noc: NIC: Fluid ManagementDokument10 SeitenCues Nursing Diagnosis Background Knowledge Goal and Objectives Nursing Interventions and Rationale Evaluation Subjective: Noc: NIC: Fluid ManagementSkyla FiestaNoch keine Bewertungen

- A Review of Automatic License Plate Recognition System in Mobile-Based PlatformDokument6 SeitenA Review of Automatic License Plate Recognition System in Mobile-Based PlatformadiaNoch keine Bewertungen

- C779-C779M - 12 Standard Test Method For Abrasion of Horizontal Concrete SurfacesDokument7 SeitenC779-C779M - 12 Standard Test Method For Abrasion of Horizontal Concrete SurfacesFahad RedaNoch keine Bewertungen

- Moodle2Word Word Template: Startup Menu: Supported Question TypesDokument6 SeitenMoodle2Word Word Template: Startup Menu: Supported Question TypesinamNoch keine Bewertungen

- Mechatronics MaterialDokument86 SeitenMechatronics MaterialKota Tarun ReddyNoch keine Bewertungen

- Causal Relationships WorksheetDokument2 SeitenCausal Relationships Worksheetledmabaya23Noch keine Bewertungen

- Syncretism and SeparationDokument15 SeitenSyncretism and SeparationdairingprincessNoch keine Bewertungen