Beruflich Dokumente

Kultur Dokumente

Interim Union Budget Proposals: 2014-15

Hochgeladen von

Mohit AnandOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Interim Union Budget Proposals: 2014-15

Hochgeladen von

Mohit AnandCopyright:

Verfügbare Formate

A Monthly Newsletter of Indian Institute of Banking & Finance

(Rs. 40/- per annum)

(ISO 9001 : 2008 CERTIFIED)

Committed to

professional excellence

Volume No. : 6

Issue No. : 8

March 2014

Interim Union Budget Proposals : 2014-15

Provision

of `11,200 crore for capital infusion in

public sector banks in 2014-15.

Ministry of MSME to create the India Inclusive

Innovation Fund to promote grassroots innovations

with social returns to support enterprises in the

MSME sector. It is proposed to make an initial

contribution of `100 crore to the corpus of the

Fund.

Agricultural credit target of `8,00,000 crore for

2014-15. Continuation of interest subvention

(subvention of 2 percent and an incentive of 3

percent for prompt payment) scheme on farm loans

in 2014-15.

A moratorium period for all education loans taken

upto 31/03/2009 and outstanding on 31/12/2013.

Government to take over the interest liability for

outstanding as on 31/12/2013.

Centrally Sponsored Schemes to be restructured into

66 programmes for greater synergy.

To establish a non-statutory Public Debt

Management Agency (PDMA) that can begin

work in 2014-15.

To amend the Forward Contracts (Regulation)

Act to strengthen the regulatory framework of the

commodity derivatives market.

Steps envisaged to deepen the Indian financial

markets : comprehensively revamp the ADR /

GDR scheme and enlarge the scope of Depository

Receipts, liberalise the rupee-denominated corporate

bond market, deepen and strengthen the currency

derivatives market to enable Indian companies to

fully hedge against foreign currency risks, create

one record for all financial assets of every individual

and enable smoother clearing and settlement for

international investors looking to invest in Indian

bonds.

Fiscal deficit in 2014-15 estimated to be 4.1 percent.

The mission of the

Institute is "to develop

professionally qualified and

competent bankers and

finance professionals

primarily through a process

of education, training,

examination, consultancy /

counselling and continuing

professional development

programs."

INSIDE

Interim Union Budget Proposals..................1

Top Stories / Banking Policies .....................2

Banking Developments ...............................3

Regulator's Speak .......................................4

Forex / Economy .........................................5

New Appointments / Rural Banking.............5

Products & Alliances....................................6

Basel III-Capital Regulations .......................6

Financial Basics / Glossary..........................7

Institute's Training Activities ........................7

News from the Institute................................7

Market Roundup..........................................8

"The information / news items contained in this publication have appeared in various external sources / media for public use

or consumption and are now meant only for members and subscribers. The views expressed and / or events narrated /

stated in the said information / news items are as perceived by the respective sources. IIBF neither holds nor assumes any

responsibility for the correctness or adequacy or otherwise of the news items / events or any information whatsoever."

Top Stories - Banking Policies

bank account. Instead, they may consider converting such

accounts to Basic Savings Bank Deposit Accounts, said

RBI in the Annual Report of the Banking Ombudsman

Scheme for 2012-13. Furthermore, for improving

customer protection, banks and Indian Banks Association

(IBA) will revisit the reasonability of the proposed fee, on

transactions done by customers at banks' own ATMs.

Interest on pre-March 2009 education loans waived

Mr. P. Chidambaram, Finance Minister in his 2014-15

interim budget speech, has announced a moratorium on

interest payments for education loans taken before March

31, 2009. The Government will pay the `2,600 crore of

outstanding interest as on December 31, 2013. However,

the borrower will have to pay interest for the period after

January 1, 2014. Nearly 9 lakh student borrowers will

benefit due to this gesture. At the end of December, 2013,

PSBs had 25,70,254 student loan accounts with an

outstanding amount of `57,700 crore.

RBI guidelines for banks' exposure to group entities

RBI has prescribed guidelines exclusively meant for bank

transactions and exposures to the entities belonging to their

own group. The guidelines contain quantitative limits on

financial Intra Group Transactions and Exposures (ITEs)

and prudential measures for the non-financial ITEs. This is

to ensure that banks engage in ITEs in a safe manner, so as

to contain the concentration and contagion risks arising

out of ITEs. As per the RBI guidelines, banks should

adhere to the following intra-group exposure limits :

For single-group entity exposure

5% of the paid-up capital and reserves for non-financial

companies and unregulated financial services

companies

10% of paid-up capital and reserves for regulated

financial services companies

For aggregate-group exposure

10% of paid-up capital and reserves for all nonfinancial companies and unregulated financial services

companies taken together,

20% of paid-up capital and reserves for the group

i.e., all group entities (financial and non-financial)

taken together

Banks cannot invest in the equity / debt capital

instruments of any financial entities under NOFHC

Banks cannot take any credit or investments exposure

on NOFHC

They can't take credit or investments exposure on

group entities / individuals associated with the

promoter group

Top Stories

Flash Aadhaar to get debit card

Soon, people in rural areas would just need to walk into a

grocery store with their Aadhaar number to instantly get a

debit card. Launched in New Delhi initially under the

name Saral Money, major private and public sector lenders

are planning to enable Banking Correspondents (BCs)

and grocery stores to issue instant debit cards in order to

utilize the Aadhaar database for financial inclusion. The

Government will be able to send money to people with

such cards even if the person does not have a bank

account. This would be initiated in two ways - with the

help of BCs visiting households and also through Pointof-Sale (PoS) terminals installed at various grocery stores.

According to a report by a panel headed by Dr. Nachiket

Mor, by January 1, 2016, the number and distribution of

electronic payment access points would be such that every

resident would be within 15 minutes walking distance

from such a point anywhere in the country.

Banking Policies

Investment limit for foreign investors raised to $10

billion

In order to attract more long-term dollars into

Government bonds, Reserve Bank of India (RBI) has

hiked the investment limit for foreign investors (viz.

sovereign wealth funds, pension funds and foreign central

banks) from $5 billion to $10 billion. The hike will reduce

the debt available for short-term investments to $20

billion from the earlier $25 billion. However, the overall

investment limit in Government bonds for Foreign

Institutional Investors (FII) has been kept at $30 billion.

RBI eases third party payment norms for export and

import

Reserve Bank of India liberalised the third party payment

norms for import of goods by removing the ceiling of

$100,000. Earlier, the amount of an import transaction

for third party payment could not exceed $100,000. RBI

also simplified certain documentation norms related with

third party payments for export and import transactions.

Non-maintenance of minimum balance not chargeable

RBI has asked banks to stop levying penalty on nonmaintenance of minimum balance in ordinary savings

IIBF VISION

March 2014

Banking Policies - Banking Developments

Banks

should establish internal limits on intra-group

liquidity support

They must maintain transparency when cross-selling

products of group companies.

RBI's norms for distressed assets

RBI has notified the rules for forming a Joint Lenders

Forum and adopting a Corrective Action Plan for distressed

assets. It has also put certain riders for refinancing project

loans and selling Non-Performing Assets (NPAs). The

guidelines - Framework for Revitalising Distressed Assets

in the Economy - will become operational from April

1, 2014. These include measures such as accelerated

provisioning, wherein, if banks conceal the actual status of

certain accounts, those accounts will face accelerated

provisioning by RBI. In 2002, RBI introduced the Special

Mention Accounts (SMA). Before a loan account turns

into a NPA, banks are required to identify incipient stress

in the account by creating three sub-categories under

the Special Mention Accounts. As per RBI guidelines,

banks are required to report credit information including

classification of an account as SMA to Central Repository

of Information on Large Credits (CRILC) on all their

borrowers having aggregate fund-based and non-fund

based exposure of `50 million and above with them.

A report on mobile banking by a technical committee

of RBI has recommended a standardized procedure

for registration and authentication of customers for

mobile banking services. It has also recommended the

adoption of a common application platform across

all banks, which can work on any handset.

Banks may not get PSLs from RRBs at below market

prices

PSBs may no longer get a lower-than-market price whilst

purchasing priority sector loans (PSLs) from the regional

rural banks (RRBs) they sponsor. The Department of

Financial Services and the National Bank for Agriculture

and Rural Development (NABARD) are keeping a close

watch on such pricing. The former has asked NABARD

to work out a methodology in consultation with RBI,

for selling the priority sector portfolio at market-driven

prices. During financial year end, banks typically buy PSLs

via Inter Bank Participation Certificates (IBPCs) from

entities such as RRBs to meet shortfalls in their PSL targets.

RBI has mandated that banks lend 40% of their total loans

to priority sectors such as agriculture, micro and small

enterprises, education and affordable housing. However,

banks which are unable to meet this target, buy it from the

market. For RRBs, the PSLs for the last three years have

been more than 80% as against the targeted level of 60%.

So, RRBs are at liberty to sell their excess PSLs to banks

seeking them.

IBA advisory to banks about Win XP

IBA has issued an advisory to banks to ensure business

continuity even after Microsoft ends support for its

popular Windows XP operating system on April 8, 2014.

Over 34,000 PSB branches would become vulnerable

following Microsoft's extrication from Windows XP.

Bank recoveries improve on tougher steps

Amid a tough macroeconomic environment that has kept

asset quality under pressure, banks are trying to recover as

much money as they can. From September 2013 to

December 2013, most Public Sector Banks have managed

to recover money primarily through the sale of bad loans

to Asset Reconstruction Companies (ARCs). Experts also

feel that banks are being well-collateralized in the form of

property or machinery, which compels borrowers to settle

their dues rather than default. However, most banks still

have concerns regarding asset quality, for which they may

have to restructure more loans.

RBI panel to examine recommendations on financial

sector reforms

RBI will constitute a committee to examine the

recommendations of the Financial Sector Legislative

Banking Developments

Banks, cash management firms to talk ATM security

In keeping with RBI's directives to the banks, the Indian

Banks' Association (IBA) has formed a working group to

look into critical issues of outsourcing cash management

services. The directive stems from the increasing risks such

as looting of cash vans, hindering such activities. The

working group headed by Mr. K. Unnikrishnan, Deputy

Chief Executive, IBA, has representatives from Public Sector

Banks like SBI as well as private sector banks. With ATMs

expanding rapidly across the country, cash management

service companies are having a tough time keeping up with

the demand due to a shortage of armed security guards, who

mandatorily need to be in the cash vans.

ATM transactions without bank account

In another effort towards financial inclusion, RBI has

given in-principle approval for establishing a new

payment system to facilitate fund transfers from bankaccount holders to those without accounts through

Automated Teller Machines (ATMs). An intermediary

will process the payment and send a code to the recipient

on his/her mobile. The code will allow the recipient

to withdraw the money from any nearby bank's ATM.

IIBF VISION

March 2014

Banking Developments - Regulator's Speak..

Reforms Commission (FSLRC) relating to capacitybuilding in the banking sector. It will examine if the

members on bank boards need to be certified-by an

appropriately designed course which could be mandatory

for every individual before appointment to the board.

The committee headed by Mr. G. Gopalakrishna,

Executive Director, RBI, will identify capacity building

requirements, keeping in view the role of financial sector

and what it should deliver. FSLRC has made important

recommendations pertaining to nine areas, viz. consumer

protection, micro-prudential regulation, capital controls,

systemic risk, monetary policy, public debt management,

contracts, trading and market abuse.

New code may keep bank transactions secure

Now, customers can carry out banking transactions

through the internet without worrying about confidential

information being accessed by undesired elements.

According to the Banking Codes and Standards Board

of India's (BCSBI) revised code of commitment of

customers, from January, banks will have to take more

responsibility for any unauthorised transactions.

Similarly, banks have been asked to desist from upgrading

accounts without the customer's consent. Though banks

cannot insist on a FD, they can still ask for a FD to cover

the rent for the locker facility. Banks will also be advised to

service customers at their home. This will especially

benefit differently-abled customers and senior citizens.

However, the new code can also have an adverse impact

on customer's credit score, as it takes an ambiguous stand

on banks sending repayment data to Credit Information

Companies (CIC). Customer can file a complaint with

bank's grievance redressal officer or then the bank's nodal

officer. If they do not redress customer's grievances,

he/she can approach the banking ombudsman.

IMF to RBI : Weakening bank balance-sheets is a worry

International Monetary Fund (IMF) has cautioned

Indian authorities to closely monitor the deteriorating

corporate financial position and weakening balance

sheets of banks, especially of PSBs. There is a need to

strengthen prudential regulations of banks' asset quality

classification and concentration risks. Indian authorities

need to heed the inter-linkages between corporate

vulnerabilities and the banking system's health. They also

need to modernize the legal and insolvency framework

the Fund said in its wrap-up of the 2014 Article IV

consultations with India.

RBI permits 4 non-bank entities to set up white label ATMs

Reserve Bank of India has issued certificate of authorisation

to four non-bank entities, namely Tata Communications

IIBF VISION

Payment Solutions, Muthoot Finance, Prizm Payment

Services and Vakrangee Ltd to set up White Label ATMs

(WLAs) in the country.

Regulator's Speak...

Macroeconomic factors key for financial stability : RBI

Mr. Deepak Mohanty, Executive Director, RBI has

stated that macroeconomic stability is important for

maintaining stability in the financial system. However

refined the financial regulation might be, it cannot

compensate for weaknesses in the real economy. Hence,

macroeconomic stability characterised by fiscal

prudence and sustainable growth with low inflation

is important to preserve the overall financial systemic

stability. The global financial crisis has given a greater

macro-prudential orientation to financial regulation

and has emphasized on better quality capital to safeguard

financial stability.

'Fight inflation for a better future' : Dr. Rajan

Dr. Raghuram Rajan, Governor, RBI has continued

his crusade against inflation arguing that his high

interest rate policy will make things better. Growthbackers have been critical of the Urjit Patel Committee's

suggestion that the RBI should peg the consumer

price inflation at 4% in the long-term, with a band

of 2% around it. They argue that high interest rates

will not tame the prices, since farm prices are

expanding the inflation rate. However, Dr. Rajan argues

that even the high Minimum Support Prices (MSPs)

could be working against lower prices, as they also drive

input costs. Since rice and wheat are the primary food

commodities procured at MSP, production is distorted

towards them both; thus leading to a suboptimal

production mix by farmers.

Policy rate appropriately set : Dr. Rajan

Dr. Raghuram Rajan, Governor, RBI has emphasized

that India's policy interest rate is appropriately set.

Since September 2013, Dr. Rajan has raised rates three

times by a combined 75 bps despite economic growth

being at a decade-low. He said RBI does not believe

in administering a shock-therapy to a weak economy. It

prefers to disinflate over time rather than abruptly, while

being prepared to take necessary steps if the economy

deviates from the projected inflation path. We are waiting

to act until inflation expectations become entrenched,

but will overlook temporary spikes in inflation. The

monetary policy committee will not put on blinkers and

focus only on the inflation number.

March 2014

Regulator's Speak.. - Forex - Economy - New Appointments - Rural Banking

Financial inclusion should be the priority in India

Dr. K. C. Chakrabarty, Deputy Governor, Reserve Bank

of India said "Financial inclusion is more important

than consolidation of banks," at an investor conference.

"I don't think it is the time for consolidation. In a

society where 50 per cent of the people do not have bank

accounts, and 90 per cent of them do not have access to

bank credit, and 99 per cent do not have access to capital

account, you cannot talk of consolidation," he said.

Step up focus on agriculture insurance : IRDA chief

According to Mr. T. S. Vijayan, Chairman, Insurance

Regulatory and Development Authority (IRDA), the

insurance sector should increase its focus on agricultural

insurance products and their distribution. Agricultural

insurance has largely remained Government-driven

and there is greater scope for expansion in the segment.

Brokers may focus on agriculture, allied sectors and

disaster management insurance products being aided

by geometric and remote-sensing technologies.

Forex dealers to get new IT system

RBI has stated that a comprehensive IT-based system

will be available to banks authorized to deal in forex,

to report all the returns / statements relating to export of

goods / services through a single platform. The Export

Data Processing and Monitoring System (EDPMS) will

enable banks to submit various returns such as export

outstanding statements, export bills negotiated / sent for

collection, realization of export proceeds, write-off of

export bills and extension of realization of export. As of

now, these returns are being managed on a different solo

application or manually.

Economy

NCAER lowers India FY14 growth forecast to 4.7-4.9%

National Council of Applied Economic Research

(NCAER) has lowered the GDP projection for the current

fiscal to 4.7-4.9% due to exchange rate depreciation.

GDP growth rate for 2013-14 (based on quarterly and

annual models) points to a growth of 4.7-4.9%. Earlier

in November 2013, NCAER had lowered the growth

projection to 4.8-5.3% for 2013-14 from its previous

forecast of 5.9%. An economist with the think-tank said

Since we saw a better rainfall and the baseline oil price

increased by 1%, earlier we had assumed a depreciation of

9.5% in the exchange rate on a y-o-y basis. But now we

assume the exchange rate depreciation to be 11%. This

makes a significant dent to growth of GDP.

Forex

Foreign Exchange Reserves

As on 21st February 2014

Item

`Bn.

US$ Mn.

Total Reserves

18,244.9

293,405.6

(a) Foreign Currency Assets

16,589.0

266,868.4

20,075.7

(b) Gold

1,254.3

(c) SDRs

276.9

4,455.7

(d) Reserve Position in the IMF

124.7

2,005.8

New Appointments

Source : Reserve Bank of India (RBI)

Benchmark Rates for FCNR(B) Deposits

applicable for the month of March 2014

LIBOR / SWAP For FCNR(B) Deposits

LIBOR

Currency

SWAPS

1 Year

2 Years

3 Years

4 Years

5 Years

USD

0.73150

0.427

0.533

0.728

0.948

GBP

0.90938

0.6319

0.6876

0.7950

0.9737

EUR

0.42786

0.515

0.616

0.762

0.925

JPY

0.45071

0.235

0.239

0.259

0.293

CAD

1.79350

1.325

1.425

1.552

1.679

AUD

3.57500

3.105

3.250

3.455

3.578

CHF

0.25600

0.113

0.193

0.314

0.463

DKK

0.69500

0.7025

0.7950

0.9310

1.1000

NZD

2.69000

2.880

3.068

3.245

3.380

SEK

1.71750

1.432

1.555

1.674

1.804

SGD

0.38500

0.445

0.560

0.780

0.895

HKD

0.42000

0.470

0.570

0.730

0.930

MYR

3.24000

3.250

3.320

3.380

3.460

Designation / Organisation

Mr. Jatinderbir Singh

Chairman and Managing Director,

Punjab & Sind Bank.

Mr. Yaduvendra Mathur

Chairman & Managing Director,

Export Import Bank of India (Exim Bank)

Mr. D. K. Divakara

Executive Director, Central Bank of India

Mr. R. K. Takkar

Executive Director, Dena Bank

Rural Banking

NABARD to help fund tiny infrastructure projects in

villages

With banks concentrating on funding main-stream

infrastructure projects, NABARD is exploring the feasibility

of supporting micro-infrastructure in villages. NABARD

could support the gram panchayat to develop microinfrastructure projects in villages viz. bore-wells, sanitation,

electrification (solar / biogas / windmill), warehouse to store

Source : FEDAI

IIBF VISION

Name

March 2014

Rural Banking - Products & Alliances - Basel III-Capital Regulations

farm produce, and farm equipment - power-tillers, combine

harvesters, reapers, etc. According to Dr. Harsh Kumar

Bhanwala, Chairman, NABARD there is a need to evolve a

framework for meeting the funding requirements of microinfrastructure projects so that villages prosper.

NABARD gives fillip to warehouse infrastructure

In order to meet the additional storage requirements

arising out of the National Food Security Act, 2013; as

also, to augment the storage requirements of agricultural

commodities for greater market access & liquidity

support, NABARD has been encouraging the creation of

warehousing infrastructure in rural areas. NABARD

warehousing scheme was introduced in 2013-14 as a sequel

to the Union Budgetary announcement with a corpus of

`5,000 crore. The scheme envisages financial support for

warehouses, godowns, silos, cold storages and cold chain

infrastructure to store agricultural produce in the public and

private sectors. The warehouses funded under the scheme

relate to storage of food grains for public distribution

system, storage of food grains & commercial crops, as well

as storage infrastructure in Kisan bazaars and APMCs.

NABARD intends to give a special focus on augmenting

warehousing infrastructure in States with food deficit such

as Jharkhand, Chhattisgarh and North Eastern States.

Basel III - Capital Regulations (Continued...)

The risk weight in respect of the unsecured portion of

Other Specified categories shall be as under :

Sr. Category

No.

01. Venture capital

Organisation

Organisation

tied up with

Purpose

RBI

The Central

Bank of

Sri Lanka

Memorandum of understanding

(MoU) on Supervisory

co-operation and exchange

of supervisory information

Small Industries

Development

Bank of India

(SIDBI)

Bahrain

Development

Bank

To help Indian MSMEs expand

their business to Bahrain

Canara Bank

National

Collateral

Management

Services Ltd.

(NCML)

For collateral management and

warehousing services. The main

objective of the partnership is to

assist industries, traders and

farmers in financing their capital

requirements at all stages of the

supply chain, ranging from preharvesting to the marketing and

export stages

Bharatiya

Mahila Bank

(BMB)

SBI Cards and

Payments

Services

Private Limited

(SBICPSL)

For issuing of credit cards to

customers of Bharatiya Mahila

Bank Ltd.,

IIBF VISION

150 or higher

02. Consumer credit including personal loans,

credit card receivables,

but excl. educational loan

125

03. Capital market exposure

125

04. Investment in capital instruments of NBFC

125

05. The exposure to equity instruments issued

by NBFCs

250

05. Investment in paid up equity of non-financial

entities (other than subsidiaries) where

investment is below 10% of equity of

investee entity.

Above 10%

125

1111

06. Staff loans backed fully by superannuation

benefits and/or mortgage of flat / house

20

07. Other loans and advances to staff eligible

for inclusion under retail portfolio

75

08. All other assets

Products

& Alliances

Risk

Weight (%)

100

09. Off balance sheet items (Market related

and non-market related items)

As detailed in

the RBI Circular.

10. Securitization Exposure

As per Cir.

Based on rating

by external

credit agency

11. Commercial real estate (MBS backed)

-do-

External Credit Assessment

RBI has identified various credit agencies whose ratings

may be used by banks for the purposes of risk weighting

their claims for capital adequacy purposes under the

revised framework as under :

a) Brickwork Ratings India Pvt. Limited (Brickwork);

b) Credit Analysis and Research Limited;

c) CRISIL Limited;

d) ICRA Limited;

e) India Ratings and Research Private Limited (India

Ratings); and

f ) SME Rating Agency of India Ltd. (SMERA)

International Agencies

a. Fitch

b. Moodys; and

c. Standard & Poor's

Banks are required to use the chosen credit rating agencies

and their ratings consistently for each type of claim,

for both risk weighting and risk management purposes.

March 2014

Financial Basics - Glossary - Institute's Training Activities - News from the Institute

The revised framework recommends development of

a mapping process to assign the ratings issued by eligible

credit rating agencies to the risk weights available under

the Standardized risk weighting framework. Under the

Framework, ratings have been mapped for appropriate risk

weights applicable as per Standardized approach. The risk

weight mapping for Long Term and Short Term Ratings

are detailed in the RBI Circular dated 01/07/2013.

Source : Reserve Bank of India(RBI)

Sr. No. Programme

3.

Training activities completed during the month of February

2014

Sr. No. Programme

Financial Basics

Restructuring

A restructured account is one where the bank grants

to the borrower concessions that the bank would

not otherwise consider. Restructuring would normally

involve modification of terms of the advances / securities,

which would generally include, among others, alteration

of repayment period / repayable amount / the amount

of instalments and rate of interest. It is a mechanism

to nurture an otherwise viable unit, which has been

adversely impacted, back to health.

Institute's Training Activities

Training Programme Schedule for the month of March 2014

Date

Certified Banking Compliance Programmes 3rd to 7th

March, 2014

at Delhi and

Chennai

2.

Certified Banking Compliance Programme

IIBF VISION

Programme for newly recruited officers of

Bharatiya Mahila Bank

4th to 15th

February, 2014

2.

International Training Programme for

trainers of banks, Banking Institutes

and Financial Institutions

10th to 15th

February, 2014

3.

Programme on forex operations for officers 20th to 22nd

of DBS Bank Ltd.

February, 2014

4.

Certified Banking Compliance programme

24th to 28th

February, 2014

(Mumbai)

Cut off date for Regulatory Guidelines

Candidates may note that in respect of the exams to be

conducted by the Institute during November / December

and May / June of a particular year, instructions /

guidelines issued by the regulator(s) up to 31st July and 31st

January respectively of that year will only be considered

for examination purpose.

Diamond Jubilee & CH Bhabha Banking Overseas

Research Fellowship 2014

The last date for submission of applications for

the Diamond Jubilee and CH Bhabha Banking

Overseas Research Fellowship (DJCHBBORF) - 201314 is extended up to 31st March 2014. For details visit

www.iibf.org.in.

Additional Reading Materials for Institute's examination

The Institute has put on its web site additional reading

material, for various examinations, culled out from the

Master Circulars of RBI and other sources. These are

important from examination view point. For more details

visit Institute's web site www.iibf.org.in.

Collaboration

IIBF has entered into an MOU with Bahrain Institute

of Banking & Finance on 21/02/2014 at Mumbai for

collaborating in the area of banking education & training.

IIBF Vision via E-mail

The Institute is e-mailing IIBF Vision to all the e-mail

addresses registered with the Institute. Members, who

have not registered their e-mail ids, are requested to

register the same with the Institute at the earliest. IIBF

Credit Information Company

A Credit Information Company collects and maintains

records of an individual's payments pertaining to loans

and credit cards. These records are submitted to the CIC

by banks and other Credit Institutions, on a monthly

basis. This information is then used to create Credit

Information Reports (credit reports) which are provided

to Credit Institutions in order to help evaluate and

approve loan applications or any other credit applications.

If required by the loan provider a CIC will also provide

a Credit Score, which is a 3 digit numeric summary of

borrower's credit report. CICs are also commonly referred

to as Credit Bureaus.

1.

Date

1.

News From the Institute

Glossary

Sr. No. Programme

Date

Certified Bank Trainer Training Programme 3rd to 7th

March, 2014

at NIBM, Pune

10th to 14th

March, 2014

at Mumbai

March 2014

News from the Institute - Market Roundup

Registered with Registrar of Newspapers under RNI No. : 69228 / 98

Posted at

Postal Registration No. : MH / MR / North East / 295 / 2013 - 15

Posting

Published on 25

th

Mumbai Patrika Channel Sorting Office, Mumbai - 1

Date : 25th to 30th of every month.

of every month.

Vision is also available for download from the Institute's

web site www.iibf.org.in.

Green Initiative

Members are requested to update their e-mail address with

the Institute and send their consent to receive the Annual

Report via e-mail in future.

- Rupee slightly depreciated by 0.63% and 0.53% against GBP and EURO

respectively during the month.

- Rupee however, showed slight appreciation of 0.68% against JPY during

February 2014.

% p.a.

9.50

Weighted Average Call Rates

9.00

8.50

Market Roundup

28/02/14

22/02/14

20/02/14

17/02/14

15/02/14

13/02/14

12/02/14

10/02/14

08/02/14

05/02/14

7.00

03/02/14

7.50

RBI Reference Rates

108.00

103.00

98.00

93.00

88.00

83.00

78.00

73.00

68.00

63.00

58.00

EURO

100 Jap Yen

% p.a.

21200

28/02/14

25/02/14

24/02/14

20/02/14

17/02/14

12/02/14

11/02/14

10/02/14

05/02/14

Source : CCIL Newsletter for February 2014

- Call rates oscillated between a low of 7.41 and a high of 9 per cent.

- Very tight liquidity conditions prevailed during mid-month.

- The call money market exhibited tight money conditions throughout, with spells

of easy conditions in between.

03/02/14

USD

8.00

BSE Sensex

21000

20800

POUND STERLING

20600

Source : Reserve Bank of India (RBI)

- Rupee oscillated between 62.11 and 62.58 during the first 13 days of

the month.

- Rupee closes at 61.86 to a dollar on 17th on the day of budget.

- The rupee on 20th softened by a paise to close at 62.23 against the dollar on late

demand for the American currency from importers and tracking weakness in

local equities .

- Rupee closed finally on the last day at 62.072 to a dollar recording an

appreciation of 0.98% during the month.

20400

28/02/14

26/02/14

24/02/14

21/02/14

20/02/14

19/02/14

18/02/14

14/02/14

13/02/14

11/02/14

10/02/14

07/02/14

05/02/14

20000

03/02/14

20200

Source : Bombay Stock Exchange (BSE)

Printed by Dr. R. Bhaskaran, published by Dr.R. Bhaskaran on behalf of

Indian Institute of Banking & Finance, and printed at Quality Printers (I),

6-B, Mohatta Bhavan, 3rd Floor, Dr. E. Moses Road, Worli, Mumbai - 400 018

and published from Indian Institute of Banking & Finance, Kohinoor City,

Commercial-II, Tower-I, 2nd Floor, Kirol Road, Kurla (W), Mumbai - 400 070.

Editor : Dr. R. Bhaskaran.

INDIAN INSTITUTE OF BANKING & FINANCE

Kohinoor City, Commercial-II, Tower-I, 2nd Floor, Kirol Road, Kurla (W),

Mumbai - 400 070.

Tel. : 91-22-2503 9604 / 9746 / 9907

Fax : 91-22-2503 7332

Telegram : INSTIEXAM

E-mail : iibgen@iibf.org.in

Website : www.iibf.org.in

IIBF VISION

March 2014

Das könnte Ihnen auch gefallen

- 5359IIBF Vision Nov 2015Dokument8 Seiten5359IIBF Vision Nov 2015Abhijit PhoenixNoch keine Bewertungen

- 4163IIBF Vision March 2015Dokument8 Seiten4163IIBF Vision March 2015Madhumita PandeyNoch keine Bewertungen

- 1939IIBF Vision April 2012Dokument8 Seiten1939IIBF Vision April 2012Shambhu KumarNoch keine Bewertungen

- RBI Circular On Financing SMEDokument14 SeitenRBI Circular On Financing SMEImran AkbarNoch keine Bewertungen

- Weekly BeePedia 1st To 8th Aug 2020 PDFDokument36 SeitenWeekly BeePedia 1st To 8th Aug 2020 PDFSpringNoch keine Bewertungen

- B BB Bbanking Anking Anking Anking Anking: U Uu Uupdate Pdate Pdate Pdate PdateDokument20 SeitenB BB Bbanking Anking Anking Anking Anking: U Uu Uupdate Pdate Pdate Pdate PdateGuruswami PrakashNoch keine Bewertungen

- IIBF Vision February 2016 For WebDokument8 SeitenIIBF Vision February 2016 For WebparulvrmNoch keine Bewertungen

- 2631IIBF Vision January 2013Dokument8 Seiten2631IIBF Vision January 2013Sukanta DasNoch keine Bewertungen

- Handbook On MSME Products 20210818110228Dokument68 SeitenHandbook On MSME Products 20210818110228omvir singhNoch keine Bewertungen

- PIB 2-14 MarchDokument122 SeitenPIB 2-14 MarchgaganNoch keine Bewertungen

- Finsight 18march2012Dokument11 SeitenFinsight 18march2012Rahul UnnikrishnanNoch keine Bewertungen

- The Federation of Universities: SBI LTDDokument26 SeitenThe Federation of Universities: SBI LTDkohinoor_roy5447Noch keine Bewertungen

- Overview of Financial System of BangladeshDokument13 SeitenOverview of Financial System of BangladeshMonjurul Hassan50% (2)

- Banking Law ProjectDokument9 SeitenBanking Law ProjectPrakhya ShahNoch keine Bewertungen

- Here's Why We Need To Watch Closely The Effects of Demonetisation On The Banking SystemDokument4 SeitenHere's Why We Need To Watch Closely The Effects of Demonetisation On The Banking SystemDILLIP KUMAR MAHAPATRANoch keine Bewertungen

- Thousands Small Steps 3rd Edition - FinalDokument44 SeitenThousands Small Steps 3rd Edition - FinaljayeshbhandariNoch keine Bewertungen

- 8-MM 8A-MSME FinancingDokument42 Seiten8-MM 8A-MSME Financingsenthamarai krishnan0% (1)

- RMCBDokument36 SeitenRMCBSharvil Vikram SinghNoch keine Bewertungen

- Eco Final 3RD SemDokument10 SeitenEco Final 3RD Semnagendra yanamalaNoch keine Bewertungen

- CRM AssignmentDokument13 SeitenCRM AssignmentAaron RodriguesNoch keine Bewertungen

- Emerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaVon EverandEmerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaNoch keine Bewertungen

- Bank ManagementAssignment 2Dokument7 SeitenBank ManagementAssignment 2Yasir ArafatNoch keine Bewertungen

- Banking Today Nov 15Dokument22 SeitenBanking Today Nov 15Apurva JhaNoch keine Bewertungen

- Micro, Small and Medium EnterpricesDokument7 SeitenMicro, Small and Medium EnterpricesTarun BhatejaNoch keine Bewertungen

- Budget and The Financial Sector Promises of Profound Changes in The FrameworkDokument4 SeitenBudget and The Financial Sector Promises of Profound Changes in The Frameworkamli22Noch keine Bewertungen

- Lecture 1.5 Recent Development in BankingDokument6 SeitenLecture 1.5 Recent Development in BankingCharu Saxena16Noch keine Bewertungen

- Key Development in BanksDokument19 SeitenKey Development in BanksPrem Prem KumarNoch keine Bewertungen

- Banking Paper Very NewDokument23 SeitenBanking Paper Very NewTanishq MishraNoch keine Bewertungen

- Key Highlights of 7 Bi-Monthly Monetary Policy 2019-20: IIBF Vision April 2020Dokument9 SeitenKey Highlights of 7 Bi-Monthly Monetary Policy 2019-20: IIBF Vision April 2020go4ibibo 15Noch keine Bewertungen

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Von EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Noch keine Bewertungen

- Gradestack Clerk Mains CapsuleDokument51 SeitenGradestack Clerk Mains CapsuleunikxocizmNoch keine Bewertungen

- February 2021 BOLTDokument60 SeitenFebruary 2021 BOLTbakede1552Noch keine Bewertungen

- Genesis Institute of Business ManagementPuneDokument22 SeitenGenesis Institute of Business ManagementPunemanoj jaiswalNoch keine Bewertungen

- Top Stories: Banking PoliciesDokument8 SeitenTop Stories: Banking PoliciesHatakishore BeheraNoch keine Bewertungen

- NRB Regulation of Bank. Group BBBBBBBBBBBBBBDokument37 SeitenNRB Regulation of Bank. Group BBBBBBBBBBBBBBMohan BanjaraNoch keine Bewertungen

- In Case of Manufacturing Enterprises The Calculations of Original Cost ofDokument12 SeitenIn Case of Manufacturing Enterprises The Calculations of Original Cost ofVimal kumarNoch keine Bewertungen

- Recent Devt BankingDokument29 SeitenRecent Devt BankingshivaNoch keine Bewertungen

- E-Internship Report 1Dokument13 SeitenE-Internship Report 1Avani TomarNoch keine Bewertungen

- Foreign Banks and GuidelinesDokument7 SeitenForeign Banks and GuidelinesprasannarbNoch keine Bewertungen

- Assignment FinancialSectorReforms1991Dokument4 SeitenAssignment FinancialSectorReforms1991Swathi SriNoch keine Bewertungen

- Beepedia Weekly Current Affairs (Beepedia) 9th-15th June 2023Dokument46 SeitenBeepedia Weekly Current Affairs (Beepedia) 9th-15th June 2023Sahil KalerNoch keine Bewertungen

- Class 01 (Banking Regulators)Dokument4 SeitenClass 01 (Banking Regulators)Irfan Sadique IsmamNoch keine Bewertungen

- Assignment 3Dokument3 SeitenAssignment 3RiturajPaulNoch keine Bewertungen

- Corporate CreditDokument69 SeitenCorporate CreditAshish chanchlani100% (1)

- Idbi Bank: Presented By: Chetan Goel Meenakshi Surbhi Agarwal Pallavi TikooDokument15 SeitenIdbi Bank: Presented By: Chetan Goel Meenakshi Surbhi Agarwal Pallavi TikooChetan GoelNoch keine Bewertungen

- Impact of Covid-19 On "Financial Service Sector" & "Pharmaceutical Sector"Dokument16 SeitenImpact of Covid-19 On "Financial Service Sector" & "Pharmaceutical Sector"Milind VatsiNoch keine Bewertungen

- Narasimhan CommitteeDokument10 SeitenNarasimhan CommitteeAshwini VNoch keine Bewertungen

- GK Power Capsule NICL AO Assistant 2015Dokument45 SeitenGK Power Capsule NICL AO Assistant 2015Abbie HudsonNoch keine Bewertungen

- Analysis of Financial Statement of Punjab National Bank and Icici Bank-RevisedDokument56 SeitenAnalysis of Financial Statement of Punjab National Bank and Icici Bank-Revisedniharika1310Noch keine Bewertungen

- Financial MarketDokument24 SeitenFinancial MarketAjay BhoiNoch keine Bewertungen

- Hospitality Indusrty Top 10Dokument6 SeitenHospitality Indusrty Top 10pooja36Noch keine Bewertungen

- Monetary PolicyDokument20 SeitenMonetary PolicynitikaNoch keine Bewertungen

- General Banking Activities of Banking System in Bangladesh.: 1. Account Opening SectionDokument7 SeitenGeneral Banking Activities of Banking System in Bangladesh.: 1. Account Opening SectionFozle Rabby 182-11-5893Noch keine Bewertungen

- Consolidation & Mergers in BankingDokument7 SeitenConsolidation & Mergers in BankingISHAN CHAUDHARYNoch keine Bewertungen

- Bank Exam 2019: Special Class On Banking and Economic Affairs (1-15 AUG)Dokument30 SeitenBank Exam 2019: Special Class On Banking and Economic Affairs (1-15 AUG)jyottsnaNoch keine Bewertungen

- Bank of BarodaDokument12 SeitenBank of BarodaRahul Panchigar0% (1)

- Group - 2 - NBFC REPORTDokument13 SeitenGroup - 2 - NBFC REPORTSheetalNoch keine Bewertungen

- Reserve Bank of IndiaDokument57 SeitenReserve Bank of IndiaAjinkya AghamkarNoch keine Bewertungen

- State Bank of Pakistan Various DepartmentsDokument43 SeitenState Bank of Pakistan Various DepartmentsArman KhanNoch keine Bewertungen

- Small Scale Industries ProjectDokument64 SeitenSmall Scale Industries ProjectDon Rocker100% (2)

- Welcome_Note_srws612Dokument1 SeiteWelcome_Note_srws612Mohit AnandNoch keine Bewertungen

- Education PPT - UCO Bank Fee Collection ModuleDokument12 SeitenEducation PPT - UCO Bank Fee Collection ModuleMohit AnandNoch keine Bewertungen

- Change of Place of Registered Office Within A StateDokument50 SeitenChange of Place of Registered Office Within A StateMohit AnandNoch keine Bewertungen

- SCDL - PGDBA - Finance - Sem 1 - Business LawDokument17 SeitenSCDL - PGDBA - Finance - Sem 1 - Business Lawapi-3762419100% (1)

- Chapter 5: Managing Investment RiskDokument13 SeitenChapter 5: Managing Investment RiskMayank GuptaNoch keine Bewertungen

- 108 Emergency Medical Transport ServicesDokument4 Seiten108 Emergency Medical Transport ServicesData CentrumNoch keine Bewertungen

- Subprime Mortgage CrisisDokument35 SeitenSubprime Mortgage CrisisParaggNoch keine Bewertungen

- Ifrs9 Scenario Implementation and Ecl Calculation For Retail Portfolios Presentation SlidesDokument39 SeitenIfrs9 Scenario Implementation and Ecl Calculation For Retail Portfolios Presentation SlidesSrNoch keine Bewertungen

- 4295Dokument205 Seiten4295Viper 6058Noch keine Bewertungen

- NF 998-Canara BankDokument10 SeitenNF 998-Canara BankJitendra Kumar Jha100% (2)

- 2010 - Chatterji - How Firms Respond To Being Rated PDFDokument29 Seiten2010 - Chatterji - How Firms Respond To Being Rated PDFahmed sharkasNoch keine Bewertungen

- Nabina Saha ThesisDokument283 SeitenNabina Saha Thesissurendra reddyNoch keine Bewertungen

- LGB Forge Limited: Summary of Rating ActionDokument7 SeitenLGB Forge Limited: Summary of Rating ActionPuneet367Noch keine Bewertungen

- Credit Rating Agency in IndiaDokument81 SeitenCredit Rating Agency in IndiaMaaz Kazi100% (1)

- Securitas I OnDokument11 SeitenSecuritas I OnLaxmi WankhedeNoch keine Bewertungen

- Woodpecker Distilleries & Breweries - R - 17092019Dokument7 SeitenWoodpecker Distilleries & Breweries - R - 17092019Koustubh MohantyNoch keine Bewertungen

- Basel II SAMAs Detailed Guidance DocumentDokument174 SeitenBasel II SAMAs Detailed Guidance DocumentAsghar AliNoch keine Bewertungen

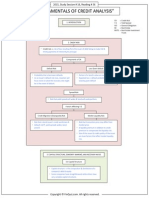

- R56 Fundamentals of Credit AnalysisDokument23 SeitenR56 Fundamentals of Credit AnalysisDiegoNoch keine Bewertungen

- Amman TRY Sponge and Power Private LimitedDokument4 SeitenAmman TRY Sponge and Power Private LimitedKathiresan Mathavi's SonNoch keine Bewertungen

- Benjamin Graham and The Birth of Value InvestingDokument85 SeitenBenjamin Graham and The Birth of Value InvestingTara GorurNoch keine Bewertungen

- Credit Rating: by Shailesh Baheti-BCOM, ACS, (L.L.B) B5 Consulting Private LimitedDokument47 SeitenCredit Rating: by Shailesh Baheti-BCOM, ACS, (L.L.B) B5 Consulting Private LimitedSarat ChandraNoch keine Bewertungen

- Singer India Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDokument6 SeitenSinger India Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionSaravanan BalakrishnanNoch keine Bewertungen

- 2005 WinterDokument64 Seiten2005 WinterNye LavalleNoch keine Bewertungen

- Pettet, Lowry and Reisberg's Company LawDokument705 SeitenPettet, Lowry and Reisberg's Company LawIbtikar MuntazirNoch keine Bewertungen

- FinQuiz - Smart Summary - Study Session 16 - Reading 56Dokument7 SeitenFinQuiz - Smart Summary - Study Session 16 - Reading 56Rafael100% (1)

- Press Release Saksoft Limited: Details of Instruments/facilities in Annexure-1Dokument5 SeitenPress Release Saksoft Limited: Details of Instruments/facilities in Annexure-1Sandy SanNoch keine Bewertungen

- Corporate BondDokument14 SeitenCorporate BondRavi WadherNoch keine Bewertungen

- Credit Attributes of Project FinanceDokument5 SeitenCredit Attributes of Project FinanceAndreea CismaruNoch keine Bewertungen

- Credit Default Swaps and The Global Financial Crisis: Reframing Credit Default Swaps As Quasi-InsuranceDokument14 SeitenCredit Default Swaps and The Global Financial Crisis: Reframing Credit Default Swaps As Quasi-InsuranceGaurav KarwaNoch keine Bewertungen

- Amarth Ifestyle RetailingDokument5 SeitenAmarth Ifestyle Retailingheera lal thakurNoch keine Bewertungen

- Barclays CMBS Strategy Weekly Comparing Moodys and Kroll Valuations On 2015 CondDokument20 SeitenBarclays CMBS Strategy Weekly Comparing Moodys and Kroll Valuations On 2015 CondykkwonNoch keine Bewertungen

- History of Credit RatingDokument3 SeitenHistory of Credit RatingAzhar KhanNoch keine Bewertungen

- Assignment 1 Emerging MarketsDokument6 SeitenAssignment 1 Emerging MarketsRamneek JainNoch keine Bewertungen

- Crisil - Corporate Presentation: September, 2011Dokument8 SeitenCrisil - Corporate Presentation: September, 2011Sherlynn D'CostaNoch keine Bewertungen