Beruflich Dokumente

Kultur Dokumente

Re Entry 2013

Hochgeladen von

Anonymous ZRsuuxNcC0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

52 Ansichten11 Seiten990

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument melden990

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

52 Ansichten11 SeitenRe Entry 2013

Hochgeladen von

Anonymous ZRsuuxNcC990

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 11

Short Form nea no 15451180

rom 990-EZ Return of Organization Exempt From Income Tax

under section 501(c), 527, o 4947(a(1) ofthe Internal Revenue Code (except prwvate foundations)

. > Do not enter Social Security numbers on this form as it may be made public

Department of te Treasury DiS ray

Fiera ovrue

> Information about Form 990-E2 and its instructions is at wwwsie.govitormo00.

1 Forte 2073 calendar yor, fax year Begining Way 20 Big andendng December 31.2013

8 cect ascae Teel oaNSIST Epler ncaton amber

Clasiesome [re-entry Alliance Pensacola, Inc 30-3908303

OD name change ‘Number and street (or O box, f mais not delivered to street address) oomsuie |e Telephone number

ts feoeas 502 Commendencia street (950) 932-3014

Bee ‘Gay artown slate or romnes, country, and ZF orlrog paula cade cy

Pensacola, Florida 32502 “Number

6 Accourtng Methow’ Tesh CY Reerea Ofer pect TT Ghack » ithe oganaaton swat

Website www zeapreentry.org Tequredtatach Schedule

‘Texerenpt tas Gk enon) Song) CISOTO Tj @ etna) Taser oc Likzr| erm o90, 260-2, or s20-A)

K Form of organization: EX] Corporation L] Trust Tlassociation [J Other __

{Aad ines 8b, 6, and 7, tone to determne goss recaps ties rect ar $20,000 oa, 6 HIG

{Pari column blow re $500,000 oF mor, le Frm S80 stead of For 90-62 Dee

EGY Revenue, Expenses and Changes n Net Assls or Fund Balances ee the wstuctonsTorPart

Ciheckif the organization used Schedule Oto respond to any question in his Part | eo

1.430

7 Gontrisutions, os, orants, and similar amounts recewed

2 Program sernce revenue including government fee and contracts

3 Membership dues and assessments

4 Investment income :

$52 Gross amount fom sale of assets other than inventory

bb Less: cost or other bass and sales expenses

© Gain or (oss) from sale of assets other than inventory eae Sb from i

L4 1

2

eis

i

|

|

|

|

|

|

|

|

| 6 Gaming and fundraising events i

a Gross income from gaming (attach Schedule G i gf

3] ~ $15,000)

S| b Gross income from fundraising events (not nciuding $

| from fundraising events reported on line 1) attach Schedu $ i

sum of such grass income and contnbutions exceeds $15,000) eo

€ Lass: direct expenses from gaming and fundraising events. |

4. Net income of (ass) from gaming and fundraising events (add lines 6a and 6B and subtract

line 62) ao

Ta Gross sales of ventory, les returns and allowances Ta

Less: cost of goods sold : 7b

€ Gross profit or (oss) from sales of inventory (Subtract ine 7b from line 73)

Other revenue (descnbe in Schedule O) - a

11 Benefits paid to orfor members... -__—

42 Salanes, other compensation, and employee benefits

13 Professional fees and other payments to independent contractors

14 Occupancy, rent, uities, and maintenance

15 Printing, publications, postage, and shipping

16 Other expenses (descnbe in Schedule O)

expenses. Add hnes 10 through 16

Z6a%

ire

Bg 18- Exc2ss or (defi forthe year Subtract ine 17 om ine 8).

7 B|19 Net assets or fund balances at beginning of year (rom line 27, column (A) (must agree with

8] end-of-year igure reported on pror year’s return)

| 20 Other changes in net assets or fund balances (explain in Schedule 0) [ao]

2} 21 _ Net assets or fund balances at end of year. Combine lines 18 through 20 » [at & 143.00

For Paperwork Reduction Act Notice, se the separate instructions. Fam GO-EZ foi)

Fox 850-62 2015)

EGEEIE Balance Sheets (see the instructions for Part ip

(Check if the organization used Schedule O to respond to any question in this Part Il.

Page 2

Oo

A Begrang year

esac year

‘Cash, savings, and investments

Land and buildings .

Totalassets. te toe 0.09)

0.00

22

23

24 Other assets (desenbe in Schedule 0)

25

=

Total liabilities (descnbe mn Schedule 0)

Net assets or fund balances (ne 27 of column (B) must agree wth line 21) 0.00

8/3)8/8/3]/8|

0.00

Eur ‘Statement of Program Service Accomplishments (see the instructions for Part ill)

Check ifthe organization used Schedule O to respond to any question in this Parti. .

‘Whats the organization's primary exempt purpose? Charitable--See Schedule 0

Describe the organization's program service accomplishments for each of its three largest program services,

as measured by expenses. In a clear and concise manner, descnbe the services provided, the number of

persons benefited, and other relevant information for each pragram til.

Expenses

equres or action

ove) ana 0H)

‘ganzatens and secton

S47 aQt busts, optonat

‘oreters)

28

ind_provides

developing 12

(Grants $ 0) if this amount includes foreign grants, check here 28a 1,501

2

Gants [i aroun lies foreign grata, chasis EET | 200!

ian a 0a!

31 Othor program sonviees (dasenbe m Schedule O) ae

(Grants $ ) tf this amount includes foreign grants, check here... > C1 [31a

32_Total program service expenses (add lines 28a through 3fa) .. > | 32 1,501.00

[EEDA ust of oicers, Directors, Trustees, and Key Employees isteach one event nok compensated ses the netustions for Part N)

‘Check ifthe organization used Schedule O to respond to any question in this Part IV oO

TReprabr a aainban

wh Average, ‘compensation tnbubons 10 :stimated amount

(oe and upeion Jost sonstred on ceraeamoitt

(Porm W100 MISC)

Gerciedto poston "(rot ard, enfor-0) | celonedcomerstion|

2

3 ° o| o

Pavia Lb. MeGes, Director,

3 ° 9| °

Ronald W. Johnson, Director

3 © ° o

3 ° © o

Margery, Tamburro, Secretary and

Director 3 ° © 2

David ¢, Penzone, Treasurer and

3 ° o 0

6 ° ° °

as ° ° 2

Fom 990-EZ (2013)

Form $002 2019) rage 3

‘Other information (Note the Schedule A and personal benelit contract statement requirements in the

instructions f

33. ‘Did the organization engage in any significant actly not previously reported to the IRS? If “Yes,” prowde a

detailed description of each activity in Schedule O 33, x

34 Were any significant changes made to the organizing or governing documents? If “Yes,” attach a conformed

eS ————C — Fr

Change on Schedule O (see nstructons) ss nee Pris

35a_Dxd te orgarizaton have unrelated business gross income of $1,000 or more during the year ftom business }

activites (suchas those reported on ines 2, 6a, and 7a, among others? a ale

'b%es toi a, has the eganaton Heda Form 890-7 forte yea No” provide an expanaten nSeheaule O [288] |x

© Wes the organization a section SO1(}4), S01(6), or 501(6() orgaeaton subject to secon 60'e) notee, t

reporting, and proxy tx requirements during the year? "Yes," complete Schedule G, Pat Il eae

28 id ne anton undergo a quan, deci, emnaton. or srt ceponton of not ast |

Shuring tho year tes," complete appeabl pats of Schedule N meal

ata Enter amount of potical expenditures, direct or ncrec, as desebed nthe instructions» [37a

Ded the organization tie Form 1120-POL for ths year? « 3m

38a Did he organization borow fom, or make any loans f, any offer, decor, asta, or key employee of were

any such ears made wa per year and stl outstanding atthe end ofthe tax year covered by suri? = [gga__| x

b {f"Yes,” complete Schedule L, Part !I and enter the total amount involved |38b!

39° Section 501(c}(7) organizations. Enter: |

‘a Intiation fees and capital contributions included on line 9 |30a o}

Gross reer, nluded on ine 8, for public use of club facies [306 3

40a. Section 501()9)organzattons. Enter arnount of tax mposed on te organization dunng the year under

secon 4911 Or oecton 4912 Br section 4058 °

b_ Section 501(c)(3) and 501(6\(4) organizations. Did the organization engage in any section 4958 excess benefit

‘ransaction dung the year, or did it engage in an excess benefit transaction in a pnor year that has not been

reported on any of ts prior Forms 990 or 990-£2? If “Yes,” complete Schedule L, Part | 40b x

© Section 501(c}{3) and 501(0)() organizations. Enter amount of tax imposed on

crgarmaton managers or daqualfed persons cing the year under sectors 4912,

44955, and 4988 is

4 Section S0%(0\8) and 50¥(c\a) organzations. Enter amount of tax on tine 406

reimbursed by the organzation : is

‘© Al organizations. At anytime dunng tho tax year, was the organzation a party to a prohibited Tax Shalt

transaction? "Yes," complete Form 6886-T . ave] | x

41 List the states with which a copy of this return is fled > Florida ae

42a The organization's books are incare of Ralph A. Peterson Telephoneno, (950) 432-2451.

Located at ® $01. Commendencia sé ZIP +4

'bAtany time dung the calendar year, dd the organation have an iniefest nor a Sigal or other authonty ver

2 financial account in a foreign county (such as a bank account, secures account, or other finaneal account)? [4am] | x

if "Yes," entor the name ofthe foreign country: clams

‘See the instructions for exceptions and filing requirements for Form TD F 90-22.1, Report of Foreign Bank |

and Financial Accounts. |

© Atany time dung the calendar year, did the organtzation maintan an office outside the US?. . . . . [a2e| | x

iF "Yes," enter the name ofthe foreign country:

43 Section 4947(9)1) nonexempt chantable trusts fling Farm 890-EZ in lieu of Farm 1041

and enter the amount of tax-exempt interest receved or accrued during the tax year «

44a Did the organization maintain any donor advised funds during the year? if "Yes," Form 990 must be

completed instead of Form 990-EZ

'b Did the organization operate one or more hospital facilities during the year? If *Yes," Form 990 must be

completed instead of Form 990-EZ. :

© Did the organization receive any payments for indoor tanning services dunng the year?

dif "Yes" to line 440, has the organization filed a Form 720 to report these payments? if"

‘explanation in Schedtulo 0

45a. Did the organization have a controlled entity within the meaning of section S12(5K19)?

445b Did the organization receive any payment from or engage n any transaction wih a controlled entity vain the

‘meaning of section 512(0)(13)? If "Yes," Form 990 and Schedule R may need to be completed instead of

Form 990-EZ (see instructions) G00 paceeeraarae _ |45b x

For 990-EZ 01a

" provide an

els iss lf

Form 980-62 2015) Page 4

[Yes] Ne

46 Did the organization engage, directly or indirectly, in politcal campaxgn activities on behalf of orn opposition

to candidates for public office? If "Yes," complete Schedule C, Part! - 46 x

EZERII Section 501(c)(3) organizations only

Al section 501(c}(2) organizations must answer questions 47-49b and 52, and complete the tables for lines

50 and 51

Check ifthe organization used Schedule O to respond to any question in this Part VI

47 Did the organzation engage in lobbying activites or have a section 501(h) election in effect during the tax

year? If "Yes," complete Schedule C, Part Il dogg a x

48's the organization a school as described in section 170(0)(1)A\()? if"Yes," complete Schedule E 48. x

49a Did the organtzation make any transfers to an exempt nion-chantable related organtzation? .. [aoa x

If *Yes," was the related organization a section 527 organization? 49

50 Complete this table for the organization's five highest compensated employees (other than officers, directors, trustees and Key

employees) who each received more than $100,000 of compensation from the organization. i there is none, enter “None.”

a (a) oath bot

ons to employee} (o) Esterated amount of

Iserait plang, and astaneg} | cinercompensaton

trverna, | (a Repeabie

(ame ar te ofc one rovaperscek | Somperaton

nntedtopeston | fome a9 4480 [

|

—

TH ota nara ot itor empoyeos

51 Gomplte ths tale fr the erganzatin's five highest compensated dependent Conraciors who each receved more than

(6) Compensation

‘d- Total number of other independent contractors each recewing aver $100,000... >

52 Didtheorganaaton complete Schedule A? Note Al sexton S00) organizations anda soar.)

onexempt chantable trusts must attach a completed ScheduleA No

‘Under pais of oyun, declare at have exazaned ts er, wun eccompanng schedes and caterers and io tho best of ry Knowodge and bok 8

Sign

Here

Paid

Preparer |_

Use Only [Esesans_—>

May the IRS discuss this return with the

hown above? See instructions:

_> Les CINo

Fo 990-EZ 20:3)

Scuepures Public Charity Status and Public Support eee ee

bears Complete it the organizations a ection SO) organization a section 2013

'4947(a)(}) nonexempt charitable trust.

opt tne ans > attach to Form 990 or Form 990-82. Open to Public

PisTedcA eee” | ntrmation about Sahedle Form 990 or 90-2 ands nstrotons eat ww. gov foro a

Fare cite oranaon T Ensareridereaton umber

Re-Entry Alliance Pensacola, tac |30-3500363

Reason for Public Charity Status (All organizations must completo this part) See instrucions.

“Te organization isnot a pavaie foundation because tis: (For ines 1 through 11, check only one Box)

1 CAchurch, convention of churches, of association of churches described in section 17006) 1)AN.

2 ClAschool descnbed in section 170(b){1ANfi). (Attach Schedule E.)

3 C)Ahospital or a cooperative hospital service organization described in section 170(o)(1)(AY(i).

4. [)Amedical research organization operated in conjunction with a hospital described in section 170(0){1ANGi) Enter the

hospita’s name, city, and state:

An organization operated forthe beni

section 170(b})(A)fv) (Complete Par Il)

6 (CIA federal, state, or local government or govemnmental unit descnbed in section 170(b)(1)(A)(v)-

7 ClAn organization that normaly receives a substantial pat of is suppor from a goverrmental unt or from the general pubic

described in section 170(6)(1)(A)v). (Complete Part I!)

8 [JA community trust descnbed in section 170(b)(1)(A)(vi). (Complete Part I)

9 An organization that normaly recewes: (1) more than 331/59 of ts support from contributions, membership fees, and gross

receipts from activites related to ts exempt functions—subject to certain exceptions, and (2) no more than 38%% of ts

Support ftom gross investment income and unrelated business taxable income (ess section 511 tax) from businesses

acquired by the organization after June 30, 1975, See section 509(a)2). (Complete Pat I)

10 CJAn organization organized and operated exclusively to test for pubic safely. See section 500(a(4).

41 CJAn organization organized and operated excluswely for the benaft of, to perform the functions of, or to cary out the

purposes of one of more publicly supported organizations deserted in section S09(aK) or section 509(4(2) See section

§509(0)(). Check the box that desonbes the type of cupparting organization and complete ines 110 through 11h,

a ClType! b CO Typell c 1) Typelli-Functionally integrated — d_ [1] Type Ill-Non-functionally integrated

C1By checking this box, | certify that the organization is not controlled directly or indirectly by one or more disqualified persons

cther than foundation managers and other than one or mote publicly supported organizations described in section 509(a)(t)

or section 509(a)(2).

ft te xganizanon rceveda writen deterinton fom the IAS that isa Type 1 Type Mor Type Ml supporting

organization, check ths Box . vee o

9 Since August 17, 2006, has the organization accepted any git oF contabution from any of the

following persons?

{@ A person who directly oF melrectly controls, ether alone or together with persons desenbed in (0) and

‘or university owned or operated by @ governmental unit described in

(ui) below, the governing body of the supported organization? fron

{iA family member of a person described in () above? .. . hol

(i) A.35% controlled entity of a person described in () or (i) above? fatal

__h_Provide the following information about the supported organization(s). __ _

Nae of sported WEN] (Type ofergancaton | Optete asanaaton | bayeurcuy | Ww)lstho [Wy Anountat moray

‘maton (Gosenod ones 1-3 | meal Uiteamyur | thaorgancatenim | organaaton not ‘apport

Shove iRe accion | govern cocument | "cal Wot your” | (enganged athe

(Gee inert) ‘suppor us?

We Yes_[_Ne

)

©

©

e

Total 0.90

For Paperwork Reduction Act Notice, see the Instructions for ‘Senedule A (Forrn 900 oF O90-EF) 2013,

Form 990 or 990-2.

Shadi A Fm 900 99062) 2019, one 2

‘Support Schedule for Organizations Described in Sections 17OTB)LINANIN) and 17OHITIANI)

(Complete only if you checked the box on line §, 7, or 8 of Part I or ifthe organization failed to qualify under

Part Il the organization fails to qualify under the tests listed below, please complete Part I

‘ction A. Public Support

Calendar year (or fiscal year beginning in)

1 Gifts, grants, contebutions, and

membership fees received. (Do not

include any “unusual grats.”)

2 Tax revenues levied forthe

organzation’s bent and either paid

to. expended on sts behalf

3 The value of serwces or facities

{urished by a governmental unt to the

‘organization without charge

4 Total. Add lines 1 through 3

‘5 Tho portion of total contnbutions. by

each person (other than a

governmental unt or publily

Supported organization) included on

ling 1 that exceeds 296 of the amount

showin on ine 14, column ()

6 __Public support. Subtract ine 5 trom ine 4 30,000.00

Section B. Total Support

Calendar year (or fiscal year Beginning in) >

7 Amounts from line 4

8 Gross income from interest, dividends,

payments recewed on secunties ioans,

fens, royalties and income from simiar

9 Net income from unrelated business

activities, whether or not the business

's regularly cared on I

10 Other income Do not include gain or | 1

loss from the sale of capital assets

(Explain in Part v) |

“fe201t [2012 | (e201 [Total

10,000] 10,000.00

]20, 000.00|10, 000.00

ewe eae waa

11 Total supper Add ines Myough 16) [TEE = Ta bon.

42 Gross recaps trom related actives, etc (508 TsTacbons) @

48 Fret five years. If the Form 800 1s for the organzations frst, second, thed, fourth, or Hith tax year as a Sacto BOWEN)

‘organization, check this box and stop here >a

Section C. Computation of Public Support Percentage

14 Public support percentage for 2013 (ine 6, column (f divided by line 17, column (9)

45 Public support percentage from 2012 Schedule A Part, Ine 14... :

16a 391% support test—2013. I the organzation dd not check the box on ine 13, and line 14 1 832% or more, check Ths

box and stop here. The organization qualifies as a publicly supported organization. coe

b 33'2% support test—2012. If the organization did not check a box on line 19 of 16a, and line 15 18 93°5% or more,

check this box and stop here. The organization qualifies as a publicly supported organrzation » oOo

17a 10%-tacts-and-circumstances test—2013. Ifthe organization did not check a box on line 13, 16a, or 16b, and line 14 1s

10% or more, and i the organization meets the “facts-and-crrcumstances" test, check this box and stop here. Explain m

Part IV how the organvzation meets the “facts-and-circumstances” test. The organization qualifies as a publicly supported

organization... te oe »~ ao

b 10%-facts-and-circumstances test—2012. If the organization did not check a box on line 13, 16a, 16b, or 17a, and line

18 is 10% or more, and if the organization meets the “facts-and-circumstances” test, check this box and stop here.

Explain in Part IV how the organization meets the “facts-and-circumstances” test The organzation qualifies as a publicly

‘supported organization ae B55 tol

18 Private foundation. Ifthe organization did not check a box on line 13, 16a, 16b, 17a, oF 17b, check this box and seo

instructons . cance A eel

‘Schedule A (Farm 980 oF 800-82) 2013,

Sehadula A Fenn 900 2 980-E2 2013

FREI Support Schedule for Organizations Described in Section S0ST=)2)

Page 3

(Complete only if you checked the box on line 9 of Part lor ifthe organization failed to qualify under Part I.

Ifthe organization falls to qualify under the tests listed below, please complete Part I)

Section A. Public Support

Calendar year (oF fiscal year beginning in) ® | (a) 2008]

[12071

(2012 [ (2013 | (Total

1 Git, gars, conrbutors, and menboshp ess

received (Do not ruse any "nus rts.)

2 Gross rocopis rom admssions, merchanase | —————}

sod. of services. performed, or facies

fumeted many act tht rated fo he |

organtzaton's tx exempt purpose

32, 430]12, 430.00

2 Ghserecopistomecvies fat arenotan_ |

unto ade orbooess under seton 13 |

4 Tax revenues levied for the

organization's benetit and either paid

to oF expended on its behalf

5 The value of semces or facilities

fumished by a governmental unt tothe |

cxganization without charge |

6 Total. Add lines through 5

T

_

|___s|_s.00

F |

| | o| 0.00

| |

:

ee

11,430.00)

|

7a Amounts included on lines 1, 2, and 3 [

received from disqualified persons. |

Beery Ta |

|

|

t

recawed from othar than disqualified

persons that exceed the greater of $5,000

(0r 196 ofthe amount on ine 13 forthe year

—

© Add tines 7a and 7b

8° Public support Gubtiact dow e rom |

tine6) ae |

of 0.00

0.00) 0.00

{ [a1, 430.00

Section B. Total Support

Calendar year (or fiscal year beginaina a) > [ a} 2008

(2011

(2012

eae [aia

‘9 Amounts from line 6

i ,430.00/31, 430.00

Oa Gross income from interest, dividends, | ———S«

payments received on sects loans, et, |

royles andincome rom smiar sources » |

b Unrelated business taxable income (less |

section 511 taxes) from businesses |

acqured after June 30,1975... . |

© Addlnes t0aand102 . 2...

11 Net income from unrelated business |

actnties not included in ina 106, whether |

or not the business ts regularly caried on | _

42 Other income. Do not include gain or |

loss from the sale of capital assets |

(Explain in Part 1V) 50 I

13 Total support. (Add lines 9, 10c, 11

and 12)

|

be ee

|

|

0.00

T 0.00) 0.00

t

|

{ft eee 000)

|

{ o| 0.00

1

i 11,430.00

14 First five years. If the Form 990 1s for thé Grganwation’s frst, Second, third, fourth, oF Nh tax year as @ section 50123)

‘organization, check this box and stop

Section

‘Computation of Public Support Percentage

15 Public suppor percentage for 2013 fine 8, column (divided by ine 18, coloma fA)

16 _ Public support percontaga irom 2012 Schedule A, Par I ine 15.

Section D. Computation of Investment Income Percentage

17 Investment income percentage for 2013 (ine 106, column {*) divided by ine 13, column Cf)

18 Investment income percentage from 2012 Schedule A, Parti, ine 17

> ow

= %

%

> az %

18 %

19a 33'a% support tests—2083. If the organization did not check the box on line 14, and line 15 is more than 381a%, and Ine

{71s not more than 330%, check this box and stop here. The organization qualifies 2s a publicly supported organization. (]

b 33'a% support tests—2012. If the organization did nat check a box on line 14 or ine 19, and ine 16 1s more than 33"3%, and

line 18 s not more than 331396, check this box and stop here. The organization qualifies as a publicly supported organization > C]

20 Private foundation. If the organization did not check a box on line 14, 19a, or 19b, check this box and see instructions >

‘Schedule A (Form 900 oF 900-E7) 2013,

‘SCHEDULE 0 ‘Supplemental Information to Form 990 or 990-EZ

(Form 990 or 990-€2) ‘Complete to provide information for responses to speciic questions on

5 Form 990 or 990-E2 orto provide any adational information.

Depart fit Tras > Aitach to Form 990 or 990-62. ‘Open to Public.

brs Rerun mee "| PInformation about Schedule O (Form 990 or 890-E7) ands istrictions is at wo. goviformasc. EST

Rane ot he oganzaton Employer denteabon number

Re-Entry Alliance Pensacola, ne 38.390838,

Ik, Re-Entry Alliance Pensacola, ne. CREA") is a Florida notor profit corporation organized to provide assistance, support and community

olunteer services to moderate to high isk ex-offenders reentering Pensacola and its surrounding communities from prison, REAP is

les thot are experiencing

ly works closely with re-entering federal excofe

expands

expects:

the commun, whether from federa, stale, or county incarceration fai

REAP,

-0ks to increase opportunities for individual ex offenders 1 successfully transition into mainstream society by offenng assistance in a.

umber of ways, while also contributing tothe reduction of governmental burdens. REAP's main objective Is to furnish programs and engage,

entry stort ater thet

entering ctizens into society and provide positive sung

2 the sranstion of

partnering w

in Pensacola and neighboring.

ies atso are drawn to permit

sdoral government agencies, the legal community, local businesses, faith,

19.600

instres, community based organizauons, and individual volunteers.

res of REAP is. that iLutlizes a mentoring component together with evidence

veloping th

stu

based cognitive behavior therapy i order to assiat exons,

-supporung eiizens. This program affects 20-100 persons (mentors and mentees).

_. THE COMMUNITY GARDEN: The mentoring component involves, among other things, the creation, design and maintenance of a

collaborative community garden to serve 2s.one ofthe pea

orids, and the mentoring component

1M eyoying ther th

pent byde ships wth =

them 2s productive,

itograted, and contributing members of the community. This program affects mentors, mentees, and returning eiizens,

(50.100) and azo exizens and fants inthe local community and nelahbordhoods (approximately 3,000).

dependable housing, dependable food, dependable modicalimental healthcare, dependable wansportation and healthy relationshups. The Re.

For Paperwork Reduction Act Notice, see the Instructions for Form 990 or 990-EZ. Cal No SY05GK Schedule O (Frm 00 or 9502) BOB)

‘Snel 0 Gorm 880 $60 ED 2012) Page 2

Hare oe cigansaton Enplayerdenicabon namber

Re-Entry Alliance Pensacola, ne 38.3000385

led Methodist Community Ministnes, Ine, and supported by REAP, provides returning ox

{uth information, reterrals and many of these necessary resources. Housed at The Re-Entry Center are other health, educational, cognitive.

bbchavioral therapy traiung classes, counseling, workforce, veteran, and governmental ofices—all working together withthe reentering._

3. This progr

EMPLOYER RECRUITMENT: So many of life's challenges are avorcome when you have stable employment paying a lable wage, One of.

REAP’ s on-going roles in the community i 9 ink re-entering citzens wath communty-rinded employers who understand the many

section because there was ne money spent on these inatves in 2013

be developed andlor were eaeled out

“Scheade © Form 000 or 80 EZ (DIS)

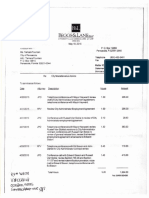

Power of Attorney

and Declaration of Representative

etypo oral os

the separate instructions

HEN Power of Anorney

auton: A sorsrat For

Prony pe

8 ota

3 Migges pees

Sou corer Seat

Pensacola

[BESET aSEOTTE TS Ti en ee ES TE

| 2 Rapresontetvela) =f cin 23st tis ss a _

iret ints

Eee'Btn

501 Commendone Hil Se-gu

asi acs

cok

soy ates

income ee 0 7 emesis =

- is . -

Specie isa not reenrdad on Centralized Authoraation Fis (CAF), he pow ale ons warm murrimeaedencak

eh wine susan Lite ¢ Speeite Uses Hot Recorded on CAF . eat

Acts wutnonee.

me oh pect cereal >

dt eon ey meget an

Emeuss fa dts tie sheet a Gore ONSET Heats 9 Bel oF hethst MEd ah

nese suppres Res halna Senet tegen ea so teerctn -uiccvoa te! onatoora tte eam

en onnke scion ta pr cand fpeseeniet ovo pda bjt tepeninicts | oneete tone

Ciencram vances

For Bray Rel and Paperwork Reauston Ret Notice, sea the aleNane oe Fo 88

© Retention

Sou ne hae» Cobt OF at POWER OF ATTORNEY YOU WANT 7 REMAWIN EFFECT.

7 Signatute ftareayer tex store

evocation of prior powers) of 3

ioeimtna inte eg cemie See

ey. > a he BA

Sea ogres

fear 1p een

ae C

las Sites

rai

Ea:

‘rc pie

‘om sore vegans ent

Om

Fam

jeclaration of Representaive

Fn Yea

ordtshamers Hers perenie balers eben AP sen Se

now GV GFR Pee 19. as amend cea m

LeeateninPa tere

sere se 3p

tefl a

b Cantina Puste Ae

© Erk Aged sre ae gens

EAE betes crite

9 Eres et

tented

nu

es

a acter bette

mind

Feta Sr

Bert fe ts Ee

< va

Rosin Braver eee authanty 9 the heed rete Sere

yrcton gat ove wien ecm See Notice 204

ret Vous sheen abe leven ba

ils See Nonce 2041-6 and Speci ules fr ragsterd tax stv prepares pag anni tue preparers tne nstetons

sk Swunont ators @ CPA- vernes pment seca elon Mery eye

> IF THIS DECLARATION OF REPRESENTATIVE IS NOT SIGNED AND DATED, THE POWER OF ATTORNEY WILL BE

RETURNED. REPRESENTATIVES MUST SIGN IN THE ORDER LISTEG IN LINE 2 ABOVE, Sse ret cto ot

De gration

"er fac

nfene Pen roneuenee

eer Deiter

Pasi

Sarat tue

2imedlet ter tevb Foe

ane Specs ues Yor regisoved Se return prepaners nd unestated

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- PR-Sisson Personnel FileDokument51 SeitenPR-Sisson Personnel FileAnonymous ZRsuuxNcCNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Schmitt SchedulingDokument7 SeitenSchmitt SchedulingAnonymous ZRsuuxNcCNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Potential SuspectDokument6 SeitenPotential SuspectAnonymous ZRsuuxNcCNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Scan Doc0035Dokument1 SeiteScan Doc0035Anonymous ZRsuuxNcCNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- M. Casey Rodgers: United States District Court Northern District of Florida Pensacola DivisionDokument1 SeiteM. Casey Rodgers: United States District Court Northern District of Florida Pensacola DivisionAnonymous ZRsuuxNcCNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- DocumentsDokument6 SeitenDocumentsAnonymous ZRsuuxNcCNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Handwritten NotesDokument1 SeiteHandwritten NotesAnonymous ZRsuuxNcCNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Taxi Denied Appeal ListDokument3 SeitenTaxi Denied Appeal ListAnonymous ZRsuuxNcCNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- B&L InvoicesDokument6 SeitenB&L InvoicesAnonymous ZRsuuxNcCNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Scan Doc0005Dokument3 SeitenScan Doc0005Anonymous ZRsuuxNcCNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Scan Doc0004Dokument2 SeitenScan Doc0004Anonymous ZRsuuxNcCNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- MX-2615N 20160204 171738Dokument24 SeitenMX-2615N 20160204 171738Anonymous ZRsuuxNcCNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- City of Pensacola Penny For Progress Unfunded Projects: T T R RiDokument1 SeiteCity of Pensacola Penny For Progress Unfunded Projects: T T R RiAnonymous ZRsuuxNcCNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Scan Doc0001Dokument1 SeiteScan Doc0001Anonymous ZRsuuxNcCNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)