Beruflich Dokumente

Kultur Dokumente

322 CH 8

Hochgeladen von

swangOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

322 CH 8

Hochgeladen von

swangCopyright:

Verfügbare Formate

10/5/2016

IEBWireframe

SUMMARY

Statisticalresearchhasshownthattoacloseapproximationstockpricesseemtofollowarandomwalk

withnodiscerniblepredictablepatternsthatinvestorscanexploit.Suchfindingsarenowtakentobe

evidenceofmarketefficiency,thatis,evidencethatmarketpricesreflectallcurrentlyavailable

information.Onlynewinformationwillmovestockprices,andthisinformationisequallylikelytobe

goodnewsorbadnews.

Marketparticipantsdistinguishamongthreeformsoftheefficientmarkethypothesis.Theweakform

assertsthatallinformationtobederivedfrompasttradingdataalreadyisreflectedinstockprices.The

semistrongformclaimsthatallpubliclyavailableinformationisalreadyreflected.Thestrongform,which

generallyisacknowledgedtobeextreme,assertsthatallinformation,includinginsiderinformation,is

reflectedinprices.

Technicalanalysisfocusesonstockpricepatternsandonproxiesforbuyorsellpressureinthemarket.

Fundamentalanalysisfocusesonthedeterminantsoftheunderlyingvalueofthefirm,suchascurrent

profitabilityandgrowthprospects.Becausebothtypesofanalysisarebasedonpublicinformation,neither

shouldgenerateexcessprofitsifmarketsareoperatingefficiently.

Page257

Proponentsoftheefficientmarkethypothesisoftenadvocatepassiveasopposedtoactiveinvestment

strategies.Thepolicyofpassiveinvestorsistobuyandholdabroadbasedmarketindex.Theyexpend

resourcesneitheronmarketresearchnoronfrequentpurchaseandsaleofstocks.Passivestrategiesmay

betailoredtomeetindividualinvestorrequirements.

Empiricalstudiesoftechnicalanalysisdonotgenerallysupportthehypothesisthatsuchanalysiscan

generatesuperiortradingprofits.Onenotableexceptiontothisconclusionistheapparentsuccessof

momentumbasedstrategiesoverintermediatetermhorizons.

Severalanomaliesregardingfundamentalanalysishavebeenuncovered.TheseincludetheP/Eeffect,the

smallfirminJanuaryeffect,theneglectedfirmeffect,postearningsannouncementpricedrift,andthe

booktomarketeffect.Whethertheseanomaliesrepresentmarketinefficiencyorpoorlyunderstoodrisk

premiumsisstillamatterofdebate.

Byandlarge,theperformancerecordofprofessionallymanagedfundslendslittlecredencetoclaimsthat

mostprofessionalscanconsistentlybeatthemarket.

KEYTERMS

anomalies,245

booktomarketeffect,246

efficientmarkethypothesis,233

fundamentalanalysis,238

indexfund,239

momentumeffect,243

neglectedfirmeffect,246

passiveinvestmentstrategy,239

http://textflow.mheducation.com/parser.php?secload=8.f&fake&print

1/12

10/5/2016

IEBWireframe

P/Eeffect,245

randomwalk,233

resistancelevel,237

reversaleffect,244

semistrongformEMH,236

smallfirmeffect,245

strongformEMH,236

supportlevel,237

technicalanalysis,237

weakformEMH,236

PROBLEMSETS

SelectproblemsareavailableinMcGrawHill'sConnect.Pleaseseethe

Supplementssectionofthebook'sfrontmatterformoreinformation.

1. Ifmarketsareefficient,whatshouldbethecorrelationcoefficientbetweenstockreturnsfortwo

nonoverlappingtimeperiods?(LO81)

2. Ifallsecuritiesarefairlypriced,allmustofferequalexpectedratesofreturn.Comment.(LO81)

3. Ifpricesareaslikelytoincreaseasdecrease,whydoinvestorsearnpositivereturnsfromthemarketon

average?(LO81)

4. AsuccessfulfirmlikeMicrosofthasconsistentlygeneratedlargeprofitsforyears.Isthisaviolationofthe

EMH?(LO82)

5. Atacocktailparty,yourcoworkertellsyouthathehasbeatenthemarketforeachofthelastthreeyears.

Supposeyoubelievehim.Doesthisshakeyourbeliefinefficientmarkets?(LO82)

6. Whichofthefollowingstatementsaretrueiftheefficientmarkethypothesisholds?(LO81)

a. Itimpliesthatfutureeventscanbeforecastwithperfectaccuracy.

b. Itimpliesthatpricesreflectallavailableinformation.

http://textflow.mheducation.com/parser.php?secload=8.f&fake&print

2/12

10/5/2016

IEBWireframe

c. Itimpliesthatsecuritypriceschangefornodiscerniblereason.

d. Itimpliesthatpricesdonotfluctuate.

7. Inanefficientmarket,professionalportfoliomanagementcanofferallofthefollowingbenefitsexcept

whichofthefollowing?(LO84)

a. Lowcostdiversification.

b. Atargetedrisklevel.

c. Lowcostrecordkeeping.

d. Asuperiorriskreturntradeoff.

8.

Page258

Whichversionoftheefficientmarkethypothesis(weak,semistrong,orstrongform)focusesonthemost

inclusivesetofinformation?(LO81)

9. Highlyvariablestockpricessuggestthatthemarketdoesnotknowhowtopricestocks.Respond.(LO8

1)

10.

Whichofthefollowingsourcesofmarketinefficiencywouldbemosteasilyexploited?(LO

84)

a. Astockpricedropssuddenlyduetoalargeblocksalebyaninstitution.

b. Astockisoverpricedbecausetradersarerestrictedfromshortsales.

c. Stocksareovervaluedbecauseinvestorsareexuberantoverincreasedproductivityintheeconomy.

11. Whichofthefollowingmostappearstocontradictthepropositionthatthestockmarketisweaklyefficient?

Explain.(LO83)

a. Over25%ofmutualfundsoutperformthemarketonaverage.

http://textflow.mheducation.com/parser.php?secload=8.f&fake&print

3/12

10/5/2016

IEBWireframe

b. Insidersearnabnormaltradingprofits.

c. EveryJanuary,thestockmarketearnsabnormalreturns.

12. Supposethat,afterconductingananalysisofpaststockprices,youcomeupwiththefollowing

observations.Whichwouldappeartocontradicttheweakformoftheefficientmarkethypothesis?Explain.

(LO83)

a. Theaveragerateofreturnissignificantlygreaterthanzero.

b. Thecorrelationbetweenthereturnduringagivenweekandthereturnduringthefollowingweekis

zero.

c. Onecouldhavemadesuperiorreturnsbybuyingstockaftera10%riseinpriceandsellingaftera10%

fall.

d. Onecouldhavemadehigherthanaveragecapitalgainsbyholdingstockswithlowdividendyields.

13. Whichofthefollowingobservationswouldprovideevidenceagainstthesemistrongformoftheefficient

markettheory?Explain.(LO83)

a. Mutualfundmanagersdonotonaveragemakesuperiorreturns.

b. Youcannotmakesuperiorprofitsbybuying(orselling)stocksaftertheannouncementofanabnormal

riseindividends.

c. LowP/Estockstendtohavepositiveabnormalreturns.

d. Inanyyearapproximately50%ofpensionfundsoutperformthemarket.

14. SteadyGrowthIndustrieshasnevermissedadividendpaymentinits94yearhistory.Doesthismakeit

moreattractivetoyouasapossiblepurchaseforyourstockportfolio?(LO84)

15. Supposeyoufindthatpricesofstocksbeforelargedividendincreasesshowonaverageconsistently

positiveabnormalreturns.IsthisaviolationoftheEMH?(LO83)

http://textflow.mheducation.com/parser.php?secload=8.f&fake&print

4/12

10/5/2016

IEBWireframe

16. Ifthebusinesscycleispredictable,andastockhasapositivebeta,thestock'sreturnsalsomustbe

predictable.Respond.(LO81)

17. Whichofthefollowingphenomenawouldbeeitherconsistentwithoraviolationoftheefficientmarket

hypothesis?Explainbriefly.(LO83)

a. NearlyhalfofallprofessionallymanagedmutualfundsareabletooutperformtheS&P500inatypical

year.

b. Moneymanagerswhooutperformthemarket(onariskadjustedbasis)inoneyeararelikelyto

outperforminthefollowingyear.

c. StockpricestendtobepredictablymorevolatileinJanuarythaninothermonths.

d. StockpricesofcompaniesthatannounceincreasedearningsinJanuarytendtooutperformthemarketin

February.

e. Stocksthatperformwellinoneweekperformpoorlyinthefollowingweek.

18. Whyarethefollowingeffectsconsideredefficientmarketanomalies?Arethererationalexplanationsfor

theseeffects?(LO82)

a. P/Eeffect

b. Booktomarketeffect

c.

Page259

Momentumeffect

d. Smallfirmeffect

19. Dollarcostaveragingmeansthatyoubuyequaldollaramountsofastockeveryperiod,forexample,$500

permonth.Thestrategyisbasedontheideathatwhenthestockpriceislow,yourfixedmonthlypurchase

willbuymoreshares,andwhenthepriceishigh,fewershares.Averagingovertime,youwillendup

buyingmoreshareswhenthestockischeaperandfewerwhenitisrelativelyexpensive.Therefore,by

design,youwillexhibitgoodmarkettiming.Evaluatethisstrategy.(LO84)

20. Weknowthatthemarketshouldrespondpositivelytogoodnewsandthatgoodnewseventssuchasthe

comingendofarecessioncanbepredictedwithatleastsomeaccuracy.Why,then,canwenotpredictthat

http://textflow.mheducation.com/parser.php?secload=8.f&fake&print

5/12

10/5/2016

IEBWireframe

themarketwillgoupastheeconomyrecovers?(LO81)

21. YouknowthatfirmXYZisverypoorlyrun.Onascaleof1(worst)to10(best),youwouldgiveitascore

of3.Themarketconsensusevaluationisthatthemanagementscoreisonly2.Shouldyoubuyorsellthe

stock?(LO84)

22. GoodNews,Inc.,justannouncedanincreaseinitsannualearnings,yetitsstockpricefell.Istherea

rationalexplanationforthisphenomenon?(LO81)

23. SharesofsmallfirmswiththinlytradedstockstendtoshowpositiveCAPMalphas.Isthisaviolationofthe

efficientmarkethypothesis?(LO83)

Challenge

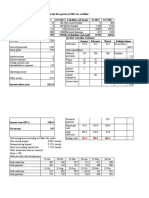

24. Examinetheaccompanyingfigure,whichpresentscumulativeabnormalreturnsbothbeforeandafterdates

onwhichinsidersbuyorsellsharesintheirfirms.Howdoyouinterpretthisfigure?Whatarewetomake

ofthepatternofCARsbeforeandaftertheeventdate?(LO83)

25.

Source:NejatH.Seyhun,Insiders,Profits,CostsofTradingandMarketEfficiency,JournalofFinancial

Economics16pp.189212.

Page260

Supposethatastheeconomymovesthroughabusinesscycle,riskpremiumsalsochange.Forexample,ina

recessionwhenpeopleareconcernedabouttheirjobs,risktolerancemightbelowerandriskpremiums

mightbehigher.Inaboomingeconomy,toleranceforriskmightbehigherandriskpremiumslower.(LO8

3)

a. Wouldapredictablyshiftingriskpremiumsuchasdescribedherebeaviolationoftheefficientmarket

hypothesis?

http://textflow.mheducation.com/parser.php?secload=8.f&fake&print

6/12

10/5/2016

IEBWireframe

b. Howmightacycleofincreasinganddecreasingriskpremiumscreateanappearancethatstockprices

overreact,firstfallingexcessivelyandthenseemingtorecover?

CFAProblems

1. Thesemistrongformoftheefficientmarkethypothesisassertsthatstockprices:(LO81)

a. Fullyreflectallhistoricalpriceinformation.

b. Fullyreflectallpubliclyavailableinformation.

c. Fullyreflectallrelevantinformationincludinginsiderinformation.

d. Maybepredictable.

2. Assumethatacompanyannouncesanunexpectedlylargecashdividendtoitsshareholders.Inanefficient

marketwithoutinformationleakage,onemightexpect:(LO81)

a. Anabnormalpricechangeattheannouncement.

b. Anabnormalpriceincreasebeforetheannouncement.

c. Anabnormalpricedecreaseaftertheannouncement.

d. Noabnormalpricechangebeforeoraftertheannouncement.

3. Whichoneofthefollowingwouldprovideevidenceagainstthesemistrongformoftheefficientmarket

theory?(LO83)

a. About50%ofpensionfundsoutperformthemarketinanyyear.

b. Youcannotmakeabnormalprofitsbybuyingstocksafteranannouncementofstrongearnings.

c. Trendanalysisisworthlessinforecastingstockprices.

http://textflow.mheducation.com/parser.php?secload=8.f&fake&print

7/12

10/5/2016

IEBWireframe

d. LowP/Estockstendtohavepositiveabnormalreturnsoverthelongrun.

4. Accordingtotheefficientmarkethypothesis:(LO83)

a. Highbetastocksareconsistentlyoverpriced.

b. Lowbetastocksareconsistentlyoverpriced.

c. Positivealphasonstockswillquicklydisappear.

d. Negativealphastocksconsistentlyyieldlowreturnsforarbitrageurs.

5. Arandomwalkoccurswhen:(LO81)

a. Stockpricechangesarerandombutpredictable.

b. Stockpricesrespondslowlytobothnewandoldinformation.

c. Futurepricechangesareuncorrelatedwithpastpricechanges.

d. Pastinformationisusefulinpredictingfutureprices.

6. Amarketanomalyrefersto:(LO83)

a. Anexogenousshocktothemarketthatissharpbutnotpersistent.

b. Apriceorvolumeeventthatisinconsistentwithhistoricalpriceorvolumetrends.

c. Atradingorpricingstructurethatinterfereswithefficientbuyingandsellingofsecurities.

d. Pricebehaviorthatdiffersfromthebehaviorpredictedbytheefficientmarkethypothesis.

7. Somescholarscontendthatprofessionalmanagersareincapableofoutperformingthemarket.Otherscome

toanoppositeconclusion.Compareandcontrasttheassumptionsaboutthestockmarketthatsupport(a)

http://textflow.mheducation.com/parser.php?secload=8.f&fake&print

8/12

10/5/2016

IEBWireframe

passiveportfoliomanagementand(b)activeportfoliomanagement.(LO82)

8.

Page261

Youareaportfoliomanagermeetingaclient.Duringtheconversationthatfollowsyourformalreviewof

heraccount,yourclientasksthefollowingquestion:(LO82)

Mygrandson,whoisstudyinginvestments,tellsmethatoneofthebestwaystomakemoneyinthestock

marketistobuythestocksofsmallcapitalizationfirmslateinDecemberandtosellthestocksonemonth

later.Whatishetalkingabout?

a. Identifytheapparentmarketanomaliesthatwouldjustifytheproposedstrategy.

b. Explainwhyyoubelievesuchastrategymightormightnotworkinthefuture.

9.

a. Brieflyexplaintheconceptoftheefficientmarkethypothesis(EMH)andeachofitsthreeformsweak,

semistrong,andstrongandbrieflydiscussthedegreetowhichexistingempiricalevidencesupports

eachofthethreeformsoftheEMH.(LO82)

b. Brieflydiscusstheimplicationsoftheefficientmarkethypothesisforinvestmentpolicyasitappliesto:

(LO84)

i. Technicalanalysisintheformofcharting.

ii. Fundamentalanalysis.

c. Brieflyexplaintherolesorresponsibilitiesofportfoliomanagersinanefficientmarketenvironment.

(LO84)

10. Growthandvaluecanbedefinedinseveralways.Growthusuallyconveystheideaofaportfolio

emphasizingorincludingonlycompaniesbelievedtopossessaboveaveragefutureratesofpershare

earningsgrowth.Lowcurrentyield,highpricetobookratios,andhighpricetoearningsratiosaretypical

characteristicsofsuchportfolios.Valueusuallyconveystheideaofportfoliosemphasizingorincluding

onlyissuescurrentlyshowinglowpricetobookratios,lowpricetoearningsratios,aboveaveragelevels

ofdividendyield,andmarketpricesbelievedtobebelowtheissues'intrinsicvalues.(LO83)

a. Identifyandprovidereasonswhy,overanextendedperiodoftime,valuestockinvestingmight

outperformgrowthstockinvesting.

b.

http://textflow.mheducation.com/parser.php?secload=8.f&fake&print

9/12

10/5/2016

IEBWireframe

Explainwhytheoutcomesuggestedin(a)shouldnotbepossibleinamarketwidelyregardedasbeing

highlyefficient.

11. Yourinvestmentclientasksforinformationconcerningthebenefitsofactiveportfoliomanagement.Sheis

particularlyinterestedinthequestionofwhetheractivemanagerscanbeexpectedtoconsistentlyexploit

inefficienciesinthecapitalmarketstoproduceaboveaveragereturnswithoutassuminghigherrisk.

Thesemistrongformoftheefficientmarkethypothesisassertsthatallpubliclyavailableinformationis

rapidlyandcorrectlyreflectedinsecuritiesprices.Thisimpliesthatinvestorscannotexpecttoderive

aboveaverageprofitsfrompurchasesmadeafterinformationhasbecomepublicbecausesecurityprices

alreadyreflecttheinformation'sfulleffects.(LO82)

a. IdentifyandexplaintwoexamplesofempiricalevidencethattendtosupporttheEMHimplication

statedabove.

b. IdentifyandexplaintwoexamplesofempiricalevidencethattendtorefutetheEMHimplicationstated

above.

c. Discussreasonswhyaninvestormightchoosenottoindexevenifthemarketswere,infact,

semistrongformefficient.

WEBmaster

1. Usedatafromfinance.yahoo.comtoanswerthefollowingquestions.

a. Collectthefollowingdatafor25firmsofyourchoosing.

i. Booktomarketratio.

ii. Priceearningsratio.

iii. Marketcapitalization(size).

iv. Pricecashflowratio(i.e,marketcapitalization/operatingcashflow).

v. Anothercriterionthatinterestsyou.

Page262

YoucanfindthisinformationbychoosingacompanyandthenclickingonKeyStatistics.Rankthefirms

basedoneachofthecriteriaseparately,anddividethefirmsintofivegroupsbasedontheirrankingfor

http://textflow.mheducation.com/parser.php?secload=8.f&fake&print

10/12

10/5/2016

IEBWireframe

eachcriterion.Calculatetheaveragerateofreturnforeachgroupoffirms.

Doyouconfirmorrejectanyoftheanomaliescitedinthischapter?Canyouuncoveranewanomaly?

Note:Foryourtesttobevalid,youmustformyourportfoliosbasedoncriteriaobservedatthebeginning

oftheperiodwhenyouformthestockgroups.Why?

b. UsethepricehistoryfromtheHistoricalPricestabtocalculatethebetaofeachofthefirmsinpart(a).

Usethisbeta,theTbillrate,andthereturnontheS&P500tocalculatetheriskadjustedabnormalreturn

ofeachstockgroup.Doesanyanomalyuncoveredinthepreviousquestionpersistaftercontrollingfor

risk?

c. Nowformstockgroupsthatusetwocriteriasimultaneously.Forexample,formaportfolioofstocksthat

arebothinthelowestquintileofpriceearningsratioandinthehighestquintileofbooktomarketratio.

Doesselectingstocksbasedonmorethanonecharacteristicimproveyourabilitytodeviseportfolioswith

abnormalreturns?Repeattheanalysisbyforminggroupsthatmeetthreecriteriasimultaneously.Does

thisyieldanyfurtherimprovementinabnormalreturns?

SOLUTIONSTO

CONCEPTchecks

8.1

a. Ahighlevelmanagermightwellhaveprivateinformationaboutthefirm.Herabilitytotradeprofitably

onthatinformationisnotsurprising.Thisabilitydoesnotviolateweakformefficiency:Theabnormal

profitsarenotderivedfromananalysisofpastpriceandtradingdata.Iftheywere,thiswouldindicate

thatthereisvaluableinformationthatcanbegleanedfromsuchanalysis.Butthisabilitydoesviolate

strongformefficiency.Apparently,thereissomeprivateinformationthatisnotalreadyreflectedin

stockprices.

b. Theinformationsetsthatpertaintotheweak,semistrong,andstrongformoftheEMHcanbedescribed

bythefollowingillustration:

Theweakforminformationsetincludesonlythehistoryofpricesandvolumes.Thesemistrongform

setincludestheweakformsetplusallotherpubliclyavailableinformation.Inturn,thestrongformset

includesthesemistrongsetplusinsiders'information.Itisillegaltoactonthisincrementalinformation

(insiders'privateinformation).Thedirectionofvalidimplicationis

Thereversedirectionimplicationisnotvalid.Forexample,stockpricesmayreflectallpastpricedata

(weakformefficiency)butmaynotreflectrelevantfundamentaldata(semistrongforminefficiency).

http://textflow.mheducation.com/parser.php?secload=8.f&fake&print

11/12

10/5/2016

IEBWireframe

8.2 Thepointwemadeintheprecedingdiscussionisthattheveryfactthatweobservestockpricesnearso

calledresistancelevelsbeliestheassumptionthatthepricecanbearesistancelevel.Ifastockisobserved

tosellatanyprice,theninvestorsmustbelievethatafairrateofreturncanbeearnedifthestockis

purchasedatthatprice.Itislogicallyimpossibleforastocktohavearesistancelevelandofferafairrateof

returnatpricesjustbelowtheresistancelevel.Ifweacceptthatpricesareappropriate,wemustrejectany

presumptionconcerningresistancelevels.

8.3

Page263

Ifeveryonefollowsapassivestrategy,soonerorlaterpriceswillfailtoreflectnewinformation.Atthis

pointthereareprofitopportunitiesforactiveinvestorswhouncovermispricedsecurities.Astheybuyand

selltheseassets,pricesagainwillbedriventofairlevels.

8.4 Theanswerdependsonyourpriorbeliefsaboutmarketefficiency.Miller'sinitialrecordwasincredibly

strong.Ontheotherhand,withsomanyfundsinexistence,itislesssurprisingthatsomefundwould

appeartobeconsistentlysuperiorafterthefact.Exceptionalpastperformanceofasmallnumberof

managersispossiblebychanceeveninanefficientmarket.Abettertestisprovidedincontinuation

studies.Arebetterperformersinoneperiodmorelikelytorepeatthatperformanceinlaterperiods?

Miller'srecordinthelastthreeyearsfailsthecontinuationorconsistencycriterion.

http://textflow.mheducation.com/parser.php?secload=8.f&fake&print

12/12

Das könnte Ihnen auch gefallen

- IA&M-Module 3 EMHDokument17 SeitenIA&M-Module 3 EMHShalini HSNoch keine Bewertungen

- Portfolio & Investment Analysis Efficient-Market HypothesisDokument137 SeitenPortfolio & Investment Analysis Efficient-Market HypothesisVicky GoweNoch keine Bewertungen

- The Efficient Markets HypothesisDokument4 SeitenThe Efficient Markets HypothesisTran Ha LinhNoch keine Bewertungen

- Lecture 1 Effecient Market HypothesisDokument10 SeitenLecture 1 Effecient Market HypothesisInformation should be FREENoch keine Bewertungen

- New DOC DocumentDokument3 SeitenNew DOC DocumentlaalsurfeeNoch keine Bewertungen

- 1615050798_efficient market hypothesisDokument5 Seiten1615050798_efficient market hypothesisAdarsh KumarNoch keine Bewertungen

- Market EfficiencyDokument9 SeitenMarket Efficiencyiqra sarfarazNoch keine Bewertungen

- The Efficient Market Hypothesis: An Overview of Key Concepts and ImplicationsDokument17 SeitenThe Efficient Market Hypothesis: An Overview of Key Concepts and Implicationsmuzamil BhuttaNoch keine Bewertungen

- Efficient Markets Theory, 03Dokument4 SeitenEfficient Markets Theory, 03Smoky RubbishNoch keine Bewertungen

- Efficient Market TheoryDokument6 SeitenEfficient Market TheoryRahul BisenNoch keine Bewertungen

- Stock Exchange Efficiency: Weak, Semi-Strong & Strong FormsDokument6 SeitenStock Exchange Efficiency: Weak, Semi-Strong & Strong FormsMihaelaNoch keine Bewertungen

- EMH Corporate FinanceDokument38 SeitenEMH Corporate FinanceIsma NizamNoch keine Bewertungen

- Efficient Market HypothesisDokument7 SeitenEfficient Market HypothesisAdedapo AdeluyiNoch keine Bewertungen

- Portfolio Managment ProjectDokument11 SeitenPortfolio Managment Projectmayuri mundadaNoch keine Bewertungen

- Market EfficiencyDokument14 SeitenMarket EfficiencyMrMoney ManNoch keine Bewertungen

- EMH Implications for Optimal Investment StrategiesDokument3 SeitenEMH Implications for Optimal Investment Strategiesharsh_vineet4Noch keine Bewertungen

- Rational and Irrational Market BehaviorDokument13 SeitenRational and Irrational Market BehaviorOwen Changgeun KwonNoch keine Bewertungen

- Overview of Financial MarketsDokument15 SeitenOverview of Financial MarketsDavidNoch keine Bewertungen

- MPPA EFFICIENT MARKET PORTFOLIODokument5 SeitenMPPA EFFICIENT MARKET PORTFOLIOzaphneathpeneahNoch keine Bewertungen

- Efficient MKT HypothesisDokument20 SeitenEfficient MKT HypothesisSamrat MazumderNoch keine Bewertungen

- Efficient Markets: A Testable Hypothesis To Answer The Question: How Are Securities Market Prices Determined?Dokument26 SeitenEfficient Markets: A Testable Hypothesis To Answer The Question: How Are Securities Market Prices Determined?james4819Noch keine Bewertungen

- Financial Regulation 01 Introduction Notes 20170818 Parab PDFDokument15 SeitenFinancial Regulation 01 Introduction Notes 20170818 Parab PDFNisarg SavlaNoch keine Bewertungen

- What Is Market Efficiency?Dokument3 SeitenWhat Is Market Efficiency?CelestiaNoch keine Bewertungen

- Trends and TA in StocksDokument5 SeitenTrends and TA in StocksUzair UmairNoch keine Bewertungen

- The Efficient Market HypothesisDokument4 SeitenThe Efficient Market HypothesisSalma Khalid100% (1)

- EMH Assignment 1Dokument8 SeitenEMH Assignment 1khusbuNoch keine Bewertungen

- BFC5935 - Tutorial 4 SolutionsDokument6 SeitenBFC5935 - Tutorial 4 SolutionsXue XuNoch keine Bewertungen

- Moving Average Signals & Efficient Market Theory ExplainedDokument15 SeitenMoving Average Signals & Efficient Market Theory ExplainedjeroagriNoch keine Bewertungen

- Market EfficiencyDokument12 SeitenMarket Efficiencyhira nazNoch keine Bewertungen

- Piotroski Original PaperValue Investing: The Use of Historical Financial Statement Information To Separate Winners From LosersDokument42 SeitenPiotroski Original PaperValue Investing: The Use of Historical Financial Statement Information To Separate Winners From LosersStockopedia100% (1)

- Efficient Market HypothesisDokument8 SeitenEfficient Market HypothesisGaara165100% (1)

- Investment Management UMAD5X-15-3: Efficient Market Hypothesis 1Dokument33 SeitenInvestment Management UMAD5X-15-3: Efficient Market Hypothesis 1Te TeNoch keine Bewertungen

- Question 2 - The Issue of Central Bank Independence Has Been The Subject of Important Academic WorkDokument16 SeitenQuestion 2 - The Issue of Central Bank Independence Has Been The Subject of Important Academic WorkMing NgọhNoch keine Bewertungen

- Efficient Market HypothesisDokument6 SeitenEfficient Market HypothesisAndrie Andycesc Amstrong LeeNoch keine Bewertungen

- New DOC DocumentDokument1 SeiteNew DOC DocumentlaalsurfeeNoch keine Bewertungen

- 1 PBDokument12 Seiten1 PBvNoch keine Bewertungen

- Efficient Market Hypothesis NotesDokument7 SeitenEfficient Market Hypothesis NotesAryan AroraNoch keine Bewertungen

- 463-Article Text-463-1-10-20160308Dokument10 Seiten463-Article Text-463-1-10-20160308Luciene MariaNoch keine Bewertungen

- Efficient Market Hypothesis: Weak-Form EfficiencyDokument2 SeitenEfficient Market Hypothesis: Weak-Form EfficiencyAbdullah ShahNoch keine Bewertungen

- Financial StatementDokument4 SeitenFinancial StatementVictoriaHuangNoch keine Bewertungen

- Notes On Efficient Market HypothesisDokument4 SeitenNotes On Efficient Market HypothesiskokkokkokokkNoch keine Bewertungen

- Efficient Market HypothesisDokument13 SeitenEfficient Market Hypothesiskunalacharya5Noch keine Bewertungen

- Efficient MarketDokument9 SeitenEfficient MarketDorah KahiseNoch keine Bewertungen

- EMH by SaleemDokument4 SeitenEMH by SaleemMuhammad Saleem SattarNoch keine Bewertungen

- Arbitrage Pricing TheoryDokument5 SeitenArbitrage Pricing TheoryNouman MujahidNoch keine Bewertungen

- Efficient Market TheoryDokument17 SeitenEfficient Market Theorysahiwalgurnoor100% (1)

- Investors Determine Equilibrium Stock Prices Through Supply and DemandDokument9 SeitenInvestors Determine Equilibrium Stock Prices Through Supply and DemandAnika VarkeyNoch keine Bewertungen

- APOTHEOSIS: Study on Random Walk Hypothesis of Indian StocksDokument10 SeitenAPOTHEOSIS: Study on Random Walk Hypothesis of Indian Stockshk_scribdNoch keine Bewertungen

- Discuss factors affecting market efficiency and roles of portfolio managersDokument3 SeitenDiscuss factors affecting market efficiency and roles of portfolio managersAhmed WaqasNoch keine Bewertungen

- Market efficien-WPS OfficeDokument2 SeitenMarket efficien-WPS OfficeWalton Jr Kobe TZNoch keine Bewertungen

- ArchDokument47 SeitenArchHitesh MittalNoch keine Bewertungen

- Efficient Market Theory PresentationDokument15 SeitenEfficient Market Theory Presentationshruti.shindeNoch keine Bewertungen

- Chapter 6Dokument4 SeitenChapter 6aseosuari aseoNoch keine Bewertungen

- Efficient MarketDokument15 SeitenEfficient MarketSitansu Sekhar MohantyNoch keine Bewertungen

- Efficient Market HypothesisDokument3 SeitenEfficient Market Hypothesismeetwithsanjay100% (1)

- 1285228572zse and EmhDokument6 Seiten1285228572zse and EmhAhyyaNoch keine Bewertungen

- What Is Market EfficiencyDokument8 SeitenWhat Is Market EfficiencyFrankGabiaNoch keine Bewertungen

- The Ascent of Market Efficiency: Finance That Cannot Be ProvenVon EverandThe Ascent of Market Efficiency: Finance That Cannot Be ProvenNoch keine Bewertungen

- Internet Stock Trading and Market Research for the Small InvestorVon EverandInternet Stock Trading and Market Research for the Small InvestorNoch keine Bewertungen

- Mis-S17 DBMS 9-12 20170418Dokument65 SeitenMis-S17 DBMS 9-12 20170418swangNoch keine Bewertungen

- Laundry Board ImagesDokument2 SeitenLaundry Board ImagesswangNoch keine Bewertungen

- Laundry Board ImagesDokument2 SeitenLaundry Board ImagesswangNoch keine Bewertungen

- JCrewGroupInc DEFA14A 20101123Dokument46 SeitenJCrewGroupInc DEFA14A 20101123swangNoch keine Bewertungen

- How To Solve A Chemistry Word ProblemDokument10 SeitenHow To Solve A Chemistry Word ProblemswangNoch keine Bewertungen

- Marketing Chapter 4Dokument58 SeitenMarketing Chapter 4swangNoch keine Bewertungen

- Difference Between Global Co., International Co., Multinational Co., Transnational Co. and Multidomestic CoDokument4 SeitenDifference Between Global Co., International Co., Multinational Co., Transnational Co. and Multidomestic CoNina HooperNoch keine Bewertungen

- Questions On International Trade & Finance (With Answers)Dokument4 SeitenQuestions On International Trade & Finance (With Answers)Timothy Tay0% (1)

- Module 13 Cost Accounting ManufacturingDokument23 SeitenModule 13 Cost Accounting Manufacturingnomvulapetunia460Noch keine Bewertungen

- Cathay PacificDokument3 SeitenCathay PacificSachin SuryavanshiNoch keine Bewertungen

- Ch4 - Designing Distribution Networks and Applications To Omni-Channel Retailing (Student)Dokument45 SeitenCh4 - Designing Distribution Networks and Applications To Omni-Channel Retailing (Student)Wenhui TuNoch keine Bewertungen

- Forward Rates - March 25 2021Dokument2 SeitenForward Rates - March 25 2021Lisle Daverin BlythNoch keine Bewertungen

- Module Guide: Module BM3309 International Business Semester: October 2015Dokument40 SeitenModule Guide: Module BM3309 International Business Semester: October 2015Nor Ashikin IsmailNoch keine Bewertungen

- Certificate in Islamic Finance SyllabusDokument4 SeitenCertificate in Islamic Finance SyllabusJMF2020Noch keine Bewertungen

- DS112 Development Perspectives I Course OverviewDokument68 SeitenDS112 Development Perspectives I Course OverviewDanford DanfordNoch keine Bewertungen

- Chapter 02 National Differences in Political EconomyDokument38 SeitenChapter 02 National Differences in Political EconomyNiladri RaianNoch keine Bewertungen

- Bus Continuity 1Dokument24 SeitenBus Continuity 1api-3733759Noch keine Bewertungen

- THESISDokument62 SeitenTHESISBetelhem EjigsemahuNoch keine Bewertungen

- Audit 2023Dokument18 SeitenAudit 2023queenmutheu01Noch keine Bewertungen

- Affidavit - SampleDokument3 SeitenAffidavit - Sampleqandaadvisory2Noch keine Bewertungen

- How communities changed before, during, and after the pandemicDokument3 SeitenHow communities changed before, during, and after the pandemicMJ San PedroNoch keine Bewertungen

- Skill Development Is Key To Economic Growth - Role of Higher Education in IndiaDokument34 SeitenSkill Development Is Key To Economic Growth - Role of Higher Education in IndiaAmit Singh100% (1)

- MO QuestionDokument2 SeitenMO Questionlingly justNoch keine Bewertungen

- Assign. Acct 101Dokument16 SeitenAssign. Acct 101Carlos Vicente E. Torralba100% (1)

- Class XI QPDokument100 SeitenClass XI QPDevansh DwivediNoch keine Bewertungen

- Salary StructureDokument1 SeiteSalary Structureomer farooqNoch keine Bewertungen

- Session 2 - Deductions From Gross Income, Part 1Dokument10 SeitenSession 2 - Deductions From Gross Income, Part 1ABBIE GRACE DELA CRUZNoch keine Bewertungen

- Money laundering stages and detection methodsDokument4 SeitenMoney laundering stages and detection methodsSrishtikumawat20% (5)

- MOSP Final Project - ITC - Group7 - SectionCDokument29 SeitenMOSP Final Project - ITC - Group7 - SectionCArjun JainNoch keine Bewertungen

- Option 1 Billing: SustainabilityDokument4 SeitenOption 1 Billing: SustainabilityArnie Tron NoblezaNoch keine Bewertungen

- BCG - ACC3 - 28 June 2021 - S1Dokument5 SeitenBCG - ACC3 - 28 June 2021 - S1Ntokozo Siphiwo Collin DlaminiNoch keine Bewertungen

- Marketing CommunicationDokument8 SeitenMarketing CommunicationAruna EkanayakaNoch keine Bewertungen

- AIS Reviewer PDFDokument20 SeitenAIS Reviewer PDFMayNoch keine Bewertungen

- ProdmixDokument10 SeitenProdmixLuisAlfonsoFernándezMorenoNoch keine Bewertungen

- GAAP: Generally Accepted Accounting PrinciplesDokument7 SeitenGAAP: Generally Accepted Accounting PrinciplesTAI LONGNoch keine Bewertungen

- Test Bank For Financial Reporting Financial Statement Analysis and Valuation 8th EditionDokument23 SeitenTest Bank For Financial Reporting Financial Statement Analysis and Valuation 8th Editionbriansmithmwgrebcstd100% (25)