Beruflich Dokumente

Kultur Dokumente

RESERVE BANK OF INDIA - : Investment in Credit Information Companies

Hochgeladen von

rvaidya2000Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

RESERVE BANK OF INDIA - : Investment in Credit Information Companies

Hochgeladen von

rvaidya2000Copyright:

Verfügbare Formate

_____________RESERVE BANK OF INDIA_____________

www.rbi.org.in

DBOD.CID.BC.No.74/20.16.042/2013-14

November 29, 2013

All Credit Information Companies

Investment in Credit Information Companies

In exercise of the powers conferred by sub-section (1) of Section 11 of Credit Information

Companies (Regulation) Act, 2005, and in supersession of its direction on Investment in

Credit Information Companies dated November 20, 2008, Reserve Bank of India, being

satisfied that it is necessary and expedient in the public interest to do so, hereby directs

that investments directly or indirectly by any person, whether resident or otherwise, shall

not exceed ten per cent of the equity capital of the investee company.

2.

Notwithstanding the above, the Reserve Bank may consider allowing higher FDI

limits as under to entities which have an established track record of running a Credit

Information Bureau in a well regulated environment:

(a) up to 49% if their ownership is not well diversified (i.e., one or more shareholders

each hold more than 10% of voting rights in the company)

(b) up to 74% if their ownership is well diversified

or

If their ownership is not well diversified, at least 50% of the directors of the

investee CIC in India are Indian nationals/ Non-Resident Indians/ Persons of

Indian Origin subject to the condition that one third of the directors are Indian

nationals resident in India.

(c) The investor company should preferably be a listed company on a recognised

stock exchange.

3.

In case the investor in a Credit Information Company in India is a wholly owned

subsidiary (directly or indirectly) of an investment holding company, the conditions as at

(a), (b) and (c) of (2) above will be applied to the operating group company that is

engaged in credit information business and has undertaken to provide technical knowhow to the Credit Information Company in India.

(B. Mahapatra)

Executive Director

_____________________________________________________________________________________________________________________

___________________________

, , 13 , , . , - 400 001

Department of Banking Operations and Development, Central Office, 13th Floor, Central Office Building, S. Bhagat Singh Marg, Mumbai - 400 001

/Tel.No.:91-22-22601000, /Tel.No.(D):91-22-22701236,/Fax No. 91-22-22701239, email ID: cgmicdbodco@rbi.org.in

,

Das könnte Ihnen auch gefallen

- Cma Final - Banking LawDokument25 SeitenCma Final - Banking Lawray100% (1)

- Compliance Cert RBI Jan-Jun'23Dokument17 SeitenCompliance Cert RBI Jan-Jun'23vishwesheswaran1Noch keine Bewertungen

- 25.ecb & FdiDokument4 Seiten25.ecb & FdimercatuzNoch keine Bewertungen

- Para-Banking and ActivitiesDokument13 SeitenPara-Banking and ActivitiesKiran Kapoor100% (1)

- External Commercial BorrowingDokument27 SeitenExternal Commercial BorrowingNUPUR SAININoch keine Bewertungen

- Para Banking Activities PDFDokument17 SeitenPara Banking Activities PDFShailender SinghNoch keine Bewertungen

- Financial Regulations SummaryDokument4 SeitenFinancial Regulations SummarySaket BandeNoch keine Bewertungen

- Banking Regulation Act, 1949Dokument8 SeitenBanking Regulation Act, 1949Animesh BawejaNoch keine Bewertungen

- External Commercial Borrowings (Ecbs)Dokument5 SeitenExternal Commercial Borrowings (Ecbs)Prateek MallNoch keine Bewertungen

- Final Project 123.docx45Dokument45 SeitenFinal Project 123.docx45tarerakeshNoch keine Bewertungen

- Banking Regulation Act 1949: Key Provisions and RBI's Regulatory PowersDokument15 SeitenBanking Regulation Act 1949: Key Provisions and RBI's Regulatory PowersBhavya GuptaNoch keine Bewertungen

- RBI, thaneDokument26 SeitenRBI, thaneShailesh BapnaNoch keine Bewertungen

- Yes Bank Ltd. Scheme of ReconstructionDokument7 SeitenYes Bank Ltd. Scheme of ReconstructionBethany CaseyNoch keine Bewertungen

- Prohibition of Trading (Sec. 8)Dokument8 SeitenProhibition of Trading (Sec. 8)Onkar SinghNoch keine Bewertungen

- Para BankingDokument19 SeitenPara BankingNikhil FardeNoch keine Bewertungen

- Entry of Banks Into Insurance Business: All Scheduled Commercial Banks (Except RRBS)Dokument3 SeitenEntry of Banks Into Insurance Business: All Scheduled Commercial Banks (Except RRBS)cma_adpradhanNoch keine Bewertungen

- 'CC (CCC" CCC CCCCCCDokument14 Seiten'CC (CCC" CCC CCCCCCGopi KrishnaNoch keine Bewertungen

- RBI Directions On Foreign Banks and Acquisition and Amalgamation of BanksDokument8 SeitenRBI Directions On Foreign Banks and Acquisition and Amalgamation of Banksvijayadarshini vNoch keine Bewertungen

- Ce 25062012 EcDokument3 SeitenCe 25062012 EcprahladtripathiNoch keine Bewertungen

- ESOP Under FEMA RegulationDokument8 SeitenESOP Under FEMA RegulationDeeksha NCNoch keine Bewertungen

- Draft Guidelines For Issue of Commercial Paper (CP)Dokument9 SeitenDraft Guidelines For Issue of Commercial Paper (CP)extraterrestrial2024Noch keine Bewertungen

- Edelvise ProjectDokument21 SeitenEdelvise ProjectsunitaNoch keine Bewertungen

- Banking LawDokument8 SeitenBanking Lawharshkevadiya502Noch keine Bewertungen

- CA Empanelment-Application FormatDokument12 SeitenCA Empanelment-Application FormatJyothi GowdaNoch keine Bewertungen

- ODI May2011Dokument4 SeitenODI May2011Parul ShahNoch keine Bewertungen

- Bank Al Habib Director RemunerationDokument13 SeitenBank Al Habib Director RemunerationARquam JamaliNoch keine Bewertungen

- Constitution of Boards of Public Sector Banks in IndiaDokument6 SeitenConstitution of Boards of Public Sector Banks in IndiaGyan RanjanNoch keine Bewertungen

- UntitledDokument303 SeitenUntitledHarismithaNoch keine Bewertungen

- BANKING POLICY UPDATESDokument20 SeitenBANKING POLICY UPDATESGuruswami PrakashNoch keine Bewertungen

- BR CompaniesDokument3 SeitenBR CompaniesSagar DesaiNoch keine Bewertungen

- Britannia FY13 ARDokument121 SeitenBritannia FY13 ARnarayanan_rNoch keine Bewertungen

- What You Must Know About Incorporate a Company in IndiaVon EverandWhat You Must Know About Incorporate a Company in IndiaNoch keine Bewertungen

- In Case of Manufacturing Enterprises The Calculations of Original Cost ofDokument12 SeitenIn Case of Manufacturing Enterprises The Calculations of Original Cost ofVimal kumarNoch keine Bewertungen

- Audit of BanksDokument76 SeitenAudit of BankstilokiNoch keine Bewertungen

- Payment Bank LicenseDokument5 SeitenPayment Bank LicenseDr. Prafulla RanjanNoch keine Bewertungen

- P13Dokument14 SeitenP13sogoja2705Noch keine Bewertungen

- Persistent SebiDokument315 SeitenPersistent Sebirahul_viswanathan_1Noch keine Bewertungen

- Document 15Dokument5 SeitenDocument 15Tanya SinghNoch keine Bewertungen

- Banking & Economy PDF - March 2022 by AffairsCloud 1Dokument141 SeitenBanking & Economy PDF - March 2022 by AffairsCloud 1ASHUTOSH KUMARNoch keine Bewertungen

- RBI guidelines on foreign investment calculationDokument10 SeitenRBI guidelines on foreign investment calculationnalluriimpNoch keine Bewertungen

- Banking Regulation Act Made EasyDokument11 SeitenBanking Regulation Act Made EasywahilNoch keine Bewertungen

- Licensing of Financial Banks in IndiaDokument3 SeitenLicensing of Financial Banks in IndiaANOUSHKANoch keine Bewertungen

- Non Banking Financial Company (NBFC) Sector in India - Trends, Regulatory Issues and Way ForwardDokument13 SeitenNon Banking Financial Company (NBFC) Sector in India - Trends, Regulatory Issues and Way Forwardshubham moonNoch keine Bewertungen

- Investments by Co-Op SocietiesDokument16 SeitenInvestments by Co-Op SocietiesRajendra JoshiNoch keine Bewertungen

- Wilful DefaultersDokument41 SeitenWilful DefaultersNikhil Das SharmaNoch keine Bewertungen

- All you need to know about NBFCs in 38 charactersDokument30 SeitenAll you need to know about NBFCs in 38 charactersjeetNoch keine Bewertungen

- 20004ipcc Paper5 Cp6.CrackedDokument122 Seiten20004ipcc Paper5 Cp6.CrackedNitteshdas ChatergiNoch keine Bewertungen

- Reserve Bank of IndiaDokument47 SeitenReserve Bank of IndiaRitam PalNoch keine Bewertungen

- Enhanced Regulatory Power To Supersede Board of DirectorsDokument6 SeitenEnhanced Regulatory Power To Supersede Board of DirectorsAnonymous uurrtSaNoch keine Bewertungen

- Current Affairs: 01st Jan To 10th Jan 2022 CADokument76 SeitenCurrent Affairs: 01st Jan To 10th Jan 2022 CAShubhendu VermaNoch keine Bewertungen

- Banking Exams Based Upon Interview QuestionsDokument2 SeitenBanking Exams Based Upon Interview Questionsmathura4728Noch keine Bewertungen

- Raising Funds from Public in India under Companies Act and SEBI RegulationsDokument18 SeitenRaising Funds from Public in India under Companies Act and SEBI RegulationssatyajitNoch keine Bewertungen

- Original Prospectus of L&T Financial Holdings IPODokument547 SeitenOriginal Prospectus of L&T Financial Holdings IPO1106531Noch keine Bewertungen

- RajDokument376 SeitenRajrojabommalaNoch keine Bewertungen

- ECLGS Exhibit+I Self+Undertaking+by+the+BorrowerDokument2 SeitenECLGS Exhibit+I Self+Undertaking+by+the+BorrowerDevansh GuptaNoch keine Bewertungen

- Non Banking Financial Company (NBFC) Sector in India - Trends, Regulatory Issues and Way ForwardDokument13 SeitenNon Banking Financial Company (NBFC) Sector in India - Trends, Regulatory Issues and Way ForwardUbaid DarNoch keine Bewertungen

- Lrab Mod ADokument95 SeitenLrab Mod ABavya MohanNoch keine Bewertungen

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsVon EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNoch keine Bewertungen

- Regional Rural Banks of India: Evolution, Performance and ManagementVon EverandRegional Rural Banks of India: Evolution, Performance and ManagementNoch keine Bewertungen

- NOV 2008 India PR ApprovingInvestmentDokument6 SeitenNOV 2008 India PR ApprovingInvestmentrvaidya2000Noch keine Bewertungen

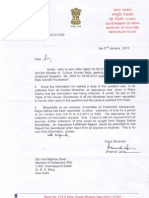

- Letter To Prof R VaidyanathanDokument2 SeitenLetter To Prof R Vaidyanathanrvaidya2000Noch keine Bewertungen

- Letter To PMDokument3 SeitenLetter To PMrvaidya2000Noch keine Bewertungen

- Ahmedabad Press Conference Nov 19 2015Dokument5 SeitenAhmedabad Press Conference Nov 19 2015PGurus100% (1)

- NGO's A Perspective 31-01-2015Dokument29 SeitenNGO's A Perspective 31-01-2015rvaidya2000Noch keine Bewertungen

- SGFX FinancialsDokument33 SeitenSGFX FinancialsPGurusNoch keine Bewertungen

- Vimarsha On Indian Economy - Myth and RealityDokument1 SeiteVimarsha On Indian Economy - Myth and Realityrvaidya2000Noch keine Bewertungen

- Subramanian Testimony 31313Dokument25 SeitenSubramanian Testimony 31313PGurusNoch keine Bewertungen

- National Herald NarrativeDokument2 SeitenNational Herald Narrativervaidya2000Noch keine Bewertungen

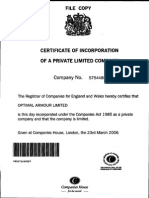

- Optimal Armour Corporate FilingsDokument198 SeitenOptimal Armour Corporate FilingsPGurusNoch keine Bewertungen

- Aranganin Pathaiyil ProfileDokument5 SeitenAranganin Pathaiyil Profilervaidya2000Noch keine Bewertungen

- How Did China Take Off US China Report 2012 "Uschinareport - Com-Wp-Con... Ds-2013!05!23290284.PDF" (1) .PDF - 1Dokument25 SeitenHow Did China Take Off US China Report 2012 "Uschinareport - Com-Wp-Con... Ds-2013!05!23290284.PDF" (1) .PDF - 1rvaidya2000Noch keine Bewertungen

- Composite Resin Corporate FilingsDokument115 SeitenComposite Resin Corporate FilingsPGurus100% (2)

- Brief Look at The History of Temples in IIT Madras Campus (Arun Ayyar, Harish Ganapathy, Hemanth C, 2014)Dokument17 SeitenBrief Look at The History of Temples in IIT Madras Campus (Arun Ayyar, Harish Ganapathy, Hemanth C, 2014)Srini KalyanaramanNoch keine Bewertungen

- Letter and Invitaion Give To Mr. r.v19!06!2015Dokument2 SeitenLetter and Invitaion Give To Mr. r.v19!06!2015rvaidya2000Noch keine Bewertungen

- Representation To PMDokument31 SeitenRepresentation To PMIrani SaroshNoch keine Bewertungen

- Timetable & AgendaDokument6 SeitenTimetable & Agendarvaidya2000Noch keine Bewertungen

- TVEs Growth Engines of China in 1980s - 1990s "WWW - Geoffrey-Hodgson - Inf... - Brakes-chinese-Dev - PDF"Dokument24 SeitenTVEs Growth Engines of China in 1980s - 1990s "WWW - Geoffrey-Hodgson - Inf... - Brakes-chinese-Dev - PDF"rvaidya2000Noch keine Bewertungen

- GrantsDokument1 SeiteGrantsrvaidya2000Noch keine Bewertungen

- FDI in Retail - Facts & MythsDokument128 SeitenFDI in Retail - Facts & Mythsrvaidya2000Noch keine Bewertungen

- Why India Needs To Prepare For The Decline of The WestDokument4 SeitenWhy India Needs To Prepare For The Decline of The Westrvaidya2000Noch keine Bewertungen

- Sec 66ADokument5 SeitenSec 66Arvaidya2000Noch keine Bewertungen

- Secular Assault On The SacredDokument3 SeitenSecular Assault On The Sacredrvaidya2000Noch keine Bewertungen

- Shamelessness Is Paraded As ModernDokument2 SeitenShamelessness Is Paraded As Modernrvaidya2000Noch keine Bewertungen

- Decline of The West Is Good For Us and Them - 11 Oct 2011Dokument4 SeitenDecline of The West Is Good For Us and Them - 11 Oct 2011rvaidya2000Noch keine Bewertungen

- Why The Indian Housewife Deserves Paeans of PraiseDokument3 SeitenWhy The Indian Housewife Deserves Paeans of Praiservaidya2000Noch keine Bewertungen

- Humbug Over KashmirDokument4 SeitenHumbug Over Kashmirrvaidya2000Noch keine Bewertungen

- Why The Retail Revolution Is Meeting Its NemesisDokument3 SeitenWhy The Retail Revolution Is Meeting Its Nemesisrvaidya2000Noch keine Bewertungen

- Why Sub-Prime Is Not A Crisis in IndiaDokument4 SeitenWhy Sub-Prime Is Not A Crisis in Indiarvaidya2000Noch keine Bewertungen