Beruflich Dokumente

Kultur Dokumente

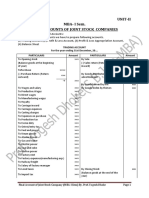

Financial Assets at Fair Value

Hochgeladen von

ariellemendozaOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Financial Assets at Fair Value

Hochgeladen von

ariellemendozaCopyright:

Verfügbare Formate

Financial assets at fair value

Financial assets that do not meet the criteria for classification at amortized cost

shall be measured at fair value. Financial assets measured at fair value are subclassified into the following:

1. Financial assets measured at fair value through profit or loss are financial

assets whose changes in fair values after initial recognition are recognized in

profit or loss. Financial assets at FVPL are further sub-classified into the

following:

a. Financial assets designated at FVPL

Notwithstanding the business model of the entity or contractual cash flow

characteristic of a financial asset, PFRS 9 gives entities the option, on

initial recognition, to designate a financial asset as measured at fair value

through profit or loss if doing so eliminates or significantly reduces a

measurement or recognition inconsistency that would otherwise arise

from measuring assets or liabilities or recognizing the gains and losses on

them on different bases.

The fair value option is available only on initial recognition. Once a

financial asset is designated as financial asset measured at FVPL, such

asset is recognized at fair value until the financial asset is derecognized.

b. Held for trading securities

Financial assets that are neither designated to be measured at FVPL nor

qualify for recognition at amortized cost are classified as held for trading

if:

i.

It is acquired principally for the purpose of selling it in the near

term;

ii.

On initial recognition it is part of a portfolio of identified financial

instruments that are managed together and for which there is

evidence or a recent actual pattern of short-term profit-taking; or

iii.

It is a derivative

2. Investments in equity securities measured at fair value through other

comprehensive income are financial assets whose changes in fair values

after initial recognition are recognized in other comprehensive income.

Das könnte Ihnen auch gefallen

- Module 5-InvestmentsDokument27 SeitenModule 5-InvestmentsJane Clarisse SantosNoch keine Bewertungen

- Week 05 - 01 - Module 10 - Financial Assets at Fair ValueDokument11 SeitenWeek 05 - 01 - Module 10 - Financial Assets at Fair Value지마리Noch keine Bewertungen

- IntAcc1.3LN Investments in Debt Equity InstrumentsDokument4 SeitenIntAcc1.3LN Investments in Debt Equity InstrumentsJohn AlbateraNoch keine Bewertungen

- Unit IV InvestmentsDokument16 SeitenUnit IV InvestmentsJonnacel TañadaNoch keine Bewertungen

- Lesson 1 (Week 1) - Financial Assets at Fair Value and Investment in BondsDokument14 SeitenLesson 1 (Week 1) - Financial Assets at Fair Value and Investment in BondsMonica MonicaNoch keine Bewertungen

- Financial Instrument Initial Recognition and MeasurementDokument1 SeiteFinancial Instrument Initial Recognition and MeasurementApriansahNoch keine Bewertungen

- ACCOUNTINGGDokument17 SeitenACCOUNTINGGAdah Micah PlarisanNoch keine Bewertungen

- Ia1 5a Investments 15 FVDokument55 SeitenIa1 5a Investments 15 FVJm SevallaNoch keine Bewertungen

- Ia1 5a Investments 15 FVDokument55 SeitenIa1 5a Investments 15 FVJm SevallaNoch keine Bewertungen

- Substantially Transferred The Risk and Rewards of Ownership or Has Not Retained Control of The Financial AssetsDokument3 SeitenSubstantially Transferred The Risk and Rewards of Ownership or Has Not Retained Control of The Financial Assetsdianne caballeroNoch keine Bewertungen

- LECTURE I InvestmentDokument5 SeitenLECTURE I Investmentrodell pabloNoch keine Bewertungen

- 06B Investment in Debt SecuritiesDokument4 Seiten06B Investment in Debt Securitiesrandomlungs121223Noch keine Bewertungen

- Financial InstrumentsDokument3 SeitenFinancial InstrumentsSHIENA TECSONNoch keine Bewertungen

- Intacc 1 Notes - Financial Assets StartDokument8 SeitenIntacc 1 Notes - Financial Assets StartKing BelicarioNoch keine Bewertungen

- References: Paragraph 11ADokument14 SeitenReferences: Paragraph 11AMariella AntonioNoch keine Bewertungen

- Overview of Philippine Financial Reporting Standards 9 (PFRS 9)Dokument4 SeitenOverview of Philippine Financial Reporting Standards 9 (PFRS 9)Earl John ROSALESNoch keine Bewertungen

- Accounting For InvestmentsDokument7 SeitenAccounting For InvestmentsPaolo Immanuel OlanoNoch keine Bewertungen

- PFRS 9 - Financial Instruments (NEW)Dokument20 SeitenPFRS 9 - Financial Instruments (NEW)eiraNoch keine Bewertungen

- Financial AssetsDokument6 SeitenFinancial AssetsJhen VillanuevaNoch keine Bewertungen

- 161 14 PFRS 9 Financial Instrument Investment in Financial AssetDokument5 Seiten161 14 PFRS 9 Financial Instrument Investment in Financial AssetRegina Gregoria SalasNoch keine Bewertungen

- Notes To Financial StatementsDokument17 SeitenNotes To Financial Statementsbadette Paningbatan100% (1)

- Iact-1 Rev FinalsDokument50 SeitenIact-1 Rev FinalsmickaNoch keine Bewertungen

- Financial Assets at Fair Value NotesDokument3 SeitenFinancial Assets at Fair Value NotesJames R JunioNoch keine Bewertungen

- Pas 32Dokument15 SeitenPas 32Cheska GalvezNoch keine Bewertungen

- 19331sm Finalnew cp6Dokument24 Seiten19331sm Finalnew cp6Naveen HRNoch keine Bewertungen

- Ifrs 9Dokument44 SeitenIfrs 9Rojohn ValenzuelaNoch keine Bewertungen

- Chapter 6 Accounting and Reporting of Financial InstrumentsDokument24 SeitenChapter 6 Accounting and Reporting of Financial InstrumentsMahendra Kumar B RNoch keine Bewertungen

- Ifrs 9 Financial at Fair Value - FVTPL and FvtociDokument2 SeitenIfrs 9 Financial at Fair Value - FVTPL and Fvtocironnelson pascual100% (2)

- Pas 32 PFRS 9Dokument110 SeitenPas 32 PFRS 9Katzkie Montemayor GodinezNoch keine Bewertungen

- Chap. 7-9 Summary For Written ReportDokument22 SeitenChap. 7-9 Summary For Written ReportMJNoch keine Bewertungen

- Financial Instrument - (NEW)Dokument11 SeitenFinancial Instrument - (NEW)AS Gaming100% (1)

- InvestmentDokument39 SeitenInvestmentJames R JunioNoch keine Bewertungen

- Financial Asset at Fair ValueDokument10 SeitenFinancial Asset at Fair ValuePgumballNoch keine Bewertungen

- Questions C15Dokument2 SeitenQuestions C15No NotreallyNoch keine Bewertungen

- Gtal - 2016 Ifrs9 Financial InstrumentsDokument11 SeitenGtal - 2016 Ifrs9 Financial InstrumentsErlanNoch keine Bewertungen

- 6 InvestmentsDokument219 Seiten6 InvestmentsKRISTINA DENISSE SAN JOSENoch keine Bewertungen

- PFRS 9Dokument7 SeitenPFRS 9MamabetNoch keine Bewertungen

- Categorizing Financial AssetsDokument3 SeitenCategorizing Financial AssetsAchmad ArdanuNoch keine Bewertungen

- Financial Asset: Non-Financial AssetDokument2 SeitenFinancial Asset: Non-Financial AssetNo NotreallyNoch keine Bewertungen

- Financial Instruments - IFRS 9Dokument3 SeitenFinancial Instruments - IFRS 9aubrey lomaadNoch keine Bewertungen

- Module 4Dokument20 SeitenModule 4Althea mary kate MorenoNoch keine Bewertungen

- AUDITING PROBLEM - From Audit of InvestmentDokument60 SeitenAUDITING PROBLEM - From Audit of InvestmentMa. Hazel Donita Diaz100% (1)

- CFAS Review QuestionsDokument3 SeitenCFAS Review QuestionsJay-B AngeloNoch keine Bewertungen

- NOTES On PFRS 9 Financial InstrumentsDokument11 SeitenNOTES On PFRS 9 Financial Instrumentsjsus22100% (1)

- Ifrs 9 Financial Instruments: Approach To Macro Hedging. Consequently, The Exception in IAS 39 For A Fair ValueDokument13 SeitenIfrs 9 Financial Instruments: Approach To Macro Hedging. Consequently, The Exception in IAS 39 For A Fair ValueAira Nhaira MecateNoch keine Bewertungen

- Ifrs 9Dokument42 SeitenIfrs 9tariqNoch keine Bewertungen

- ("Valstybės Žinios" (Official Gazette), 2004, No. 180-6699 2006, No. 37-1328 2007, No. 1-55)Dokument8 Seiten("Valstybės Žinios" (Official Gazette), 2004, No. 180-6699 2006, No. 37-1328 2007, No. 1-55)Jenus KhanNoch keine Bewertungen

- Module 4 - Financial Instruments (Assets)Dokument9 SeitenModule 4 - Financial Instruments (Assets)Luisito CorreaNoch keine Bewertungen

- IA Downloaded From GoogleDokument5 SeitenIA Downloaded From Googlearnold espiniliNoch keine Bewertungen

- Classification of Financial InstrumentsDokument18 SeitenClassification of Financial InstrumentsElena Hernandez100% (2)

- Non-Current Assets LessonDokument5 SeitenNon-Current Assets LessonNhel AlvaroNoch keine Bewertungen

- Actrev2 - InvestmentsDokument19 SeitenActrev2 - InvestmentsKenneth Bryan Tegerero Tegio100% (1)

- Intermediate Acc NotesDokument24 SeitenIntermediate Acc Notesyurineo losisNoch keine Bewertungen

- Financial AssetsDokument3 SeitenFinancial AssetsAshik Uz ZamanNoch keine Bewertungen

- FAR.111 - INVESTMENT IN EQUITY SECURITIES AND DEBT SECURITIES With AnswerDokument12 SeitenFAR.111 - INVESTMENT IN EQUITY SECURITIES AND DEBT SECURITIES With AnswerMae100% (1)

- Financial InstrumentsDokument3 SeitenFinancial InstrumentsAnna Marie BergadoNoch keine Bewertungen

- Financial Asset: TypesDokument2 SeitenFinancial Asset: TypesAngelie LapeNoch keine Bewertungen

- Ifrs 9Dokument2 SeitenIfrs 9MuhammadNoch keine Bewertungen

- Ifrs at A Glance: IAS 39 Financial InstrumentsDokument8 SeitenIfrs at A Glance: IAS 39 Financial InstrumentsvivekchokshiNoch keine Bewertungen

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideVon EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNoch keine Bewertungen

- UNIT II Final Account CollegeDokument36 SeitenUNIT II Final Account CollegeyogeshNoch keine Bewertungen

- Hero Motoco Elara ReportDokument7 SeitenHero Motoco Elara ReportBhagyashree Lotlikar100% (1)

- Eng 111 Sample Formula SheetDokument1 SeiteEng 111 Sample Formula Sheetjohn wickonsonNoch keine Bewertungen

- Equity JurisdictionDokument2 SeitenEquity JurisdictionAnthony J. Fejfar100% (1)

- Alcoa PDFDokument184 SeitenAlcoa PDFNADIA SABINA SUASTI GUDIÑONoch keine Bewertungen

- Financial Analysis of L&TDokument7 SeitenFinancial Analysis of L&TPallavi ChoudharyNoch keine Bewertungen

- Prataap SnacksDokument478 SeitenPrataap SnacksRicha P SinghalNoch keine Bewertungen

- StockTwits 50: Breadth, Trends, and TradesDokument6 SeitenStockTwits 50: Breadth, Trends, and TradesDanny JassyNoch keine Bewertungen

- Single Factor and CAPMDokument56 SeitenSingle Factor and CAPMpyaarelal100% (1)

- SSRN Id2317650 PDFDokument12 SeitenSSRN Id2317650 PDFOutage StoppedNoch keine Bewertungen

- Chapter 12 - : Cost of CapitalDokument32 SeitenChapter 12 - : Cost of CapitalRobinvarshney100% (1)

- A Study On Multi-Variate Financial Statement Analysis of Amazon and EbayDokument14 SeitenA Study On Multi-Variate Financial Statement Analysis of Amazon and EbayNisrine HafidNoch keine Bewertungen

- C+ F P N F+PDokument6 SeitenC+ F P N F+PIfka HassanNoch keine Bewertungen

- Singapore Millennials Waking Up To Retirement RealityDokument5 SeitenSingapore Millennials Waking Up To Retirement RealitysaccharineNoch keine Bewertungen

- Preqin Overview PDFDokument2 SeitenPreqin Overview PDFAmos AngNoch keine Bewertungen

- AMFIDokument290 SeitenAMFIsudishsingh8Noch keine Bewertungen

- Notes - Conso FS (Subsequent To Acquisition Date)Dokument35 SeitenNotes - Conso FS (Subsequent To Acquisition Date)Joana TrinidadNoch keine Bewertungen

- An Analysis of Panera Bread CompanyDokument4 SeitenAn Analysis of Panera Bread CompanyVânAnhĐào100% (1)

- Derivatives and Risk Management: What Does Forward Contract MeanDokument9 SeitenDerivatives and Risk Management: What Does Forward Contract MeanMd Hafizul HaqueNoch keine Bewertungen

- Commonly Used Multiples in IndustryDokument24 SeitenCommonly Used Multiples in IndustryRishabh GuptaNoch keine Bewertungen

- Capital Flow Into IndiaDokument19 SeitenCapital Flow Into IndiaVaibhav BanjanNoch keine Bewertungen

- 05 CAPM - ADokument73 Seiten05 CAPM - AHaoyang Pazzini YeNoch keine Bewertungen

- Caso 1Dokument7 SeitenCaso 1Carlos Rafael Angeles GuzmanNoch keine Bewertungen

- Persianas - Dubaishow - 210408 - BBDokument50 SeitenPersianas - Dubaishow - 210408 - BBoludave100% (1)

- Anastasia Guha Director, Northern Europe and MEA Principles For Responsible InvestmentDokument9 SeitenAnastasia Guha Director, Northern Europe and MEA Principles For Responsible InvestmentSid KaulNoch keine Bewertungen

- Bond Pricing Agency - MalaysiaDokument29 SeitenBond Pricing Agency - MalaysiaBenett MomoryNoch keine Bewertungen

- Titan Shoppers Stop Ratio Analysis - 2014Dokument25 SeitenTitan Shoppers Stop Ratio Analysis - 2014Jigyasu PritNoch keine Bewertungen

- Phil. Consolidated Coconut Industries V CIR (70 SCRA 22)Dokument15 SeitenPhil. Consolidated Coconut Industries V CIR (70 SCRA 22)Kaye Miranda LaurenteNoch keine Bewertungen

- Tiong Nam 2016 Annual ReportDokument156 SeitenTiong Nam 2016 Annual Reportnajihah radziNoch keine Bewertungen