Beruflich Dokumente

Kultur Dokumente

Uscudar 02

Hochgeladen von

Akhil1101Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Uscudar 02

Hochgeladen von

Akhil1101Copyright:

Verfügbare Formate

Recent Researches in Urban Sustainability and Green Development

Consumer decision making in the area of

insurance products in the Czech Republic

compared with other countries

Petra Mareov, Josef Drahokoupil

Abstract - One of the basic prerequisites for competitiveness are

innovations and speed of businesses in innovation processes. This

also applies to all products in financial services and insurance. One

of the important pieces of knowledge, is the knowledge of customer

needs and their motives within the decision making process. This

paper aims to familiarize with consumer decisions within insurance

products in the Czech Republic and with selected studies of similar

interests abroad. Everything is analyzed with regard to the

availability of information on the supply side (insurance companies)

as well as on demand side (a client).

The factors determining the choice of most clients will be

specified, in both the Czech Republic and other countries.

Within the research project implemented in the Czech

Republic, it was investigated whether the elimination

of asymmetric information on the supply side leads to a

rational decision of consumer.

II. THEORETICAL BASES OF CONSUMER BEHAVIOUR AND

ASYMMETRIC INFORMATION

Key words insurance, consumer, decision, research.

Consumer decision making has long been of interest to

researchers. Beginning about 300 years ago early economists,

led by Nicholas Bernoulli, John von Neumann and Oskar

Morgenstern, started to examine the basis of consumer

decision making [9]. This early work approached the topic

from an economic perspective, and focused solely on the act of

purchase [7]. The most prevalent model from this perspective

is Utility Theory which proposes that consumers make

choices based on the expected outcomes of their decisions.

Consumers are viewed as rational decision makers who are

only concerned with self interest [10,13].

Where utility theory views the consumer as a rational

economic man [13], contemporary research on Consumer

Behaviour considers a wide range of factors influencing the

consumer, and acknowledges a broad range of consumption

activities beyond purchasing. These activities commonly

include; need recognition, information search, evaluation of

alternatives, the building of purchase intention, the act of

purchasing, consumption and finally disposal. This more

complete view of consumer behaviour has evolved through a

number of discernable stages over the past century in light of

new research methodologies and paradigmatic approaches

being adopted.

While this evolution has been continuous, it is only since the

1950s that the notion of consumer behaviour has responded to

the conception and growth of modern marketing to encompass

the more holistic range of activities that impact upon the

consumer decision [1]. This is evident in contemporary

definitions of consumer behaviour:

consumer behaviour is the study of the processes

involved when individuals or groups select, purchase, use or

I. INTRODUCTION

The high degree of globalization of markets, increasing

competition and asymmetric information, all means new

challenges for the participants of markets and the insurance

market is no exception. Insurance, as a specific type of

industry, consisting of providing and administration of

insurance, brings with it many specifics, compared to other

economic sectors. The basic principle of insurance is financial

risk elimination, when an entity exposed to some risk, transfer

this risk to another entity (the insurance company), which in

case the risk becomes a reality, provides insurance coverage,

generally financing, thereby it is financial elimination of the

risk. In the Czech Republic, the insurance market on supply

side is exposed to pressure from a lower margin calculated on

the product. On the demand side, demands for quality and

service level increase. With these new trends, to understand

the behaviour and decision-making of consumer is of growing

importance.

Many insurers in the creation and innovation are based on

the modernist mindset of the world, which assumes that the

autonomous systems behave according to rational economic

models. Rational people should behave effectively in order to

target, what they pursue at the time of choice. [12]. The

assumption of rational behaviour could be challenged on the

grounds of asymmetric information and advertising.

Furthermore, in connection with reference group, gender, age,

education and income group.

Given the aforementioned potential for distortion of rational

behaviour of clients deciding on insurance will be examined.

ISBN: 978-1-61804-037-4

25

Recent Researches in Urban Sustainability and Green Development

dispose of products, services, ideas or experiences to satisfy

needs and desires.

[11].

In a further development of this issue, models of consumer

behaviour have been created. For example a model of rational,

sociological, or frame model.

Within consumer decision-making, what information is

available for them is crucial. This area counts that on the

supply and demand sides is influencing the decision, due to the

so-called asymmetric information".

The asymmetric information represents a situation where

economic entities on one side of the market, have better

information than entities on the other side. The entities can use

or abuse the better information, which may cause damage to

other market participants. Thanks to this, the so-called market

failures occur, when in theory, an effective market mechanism

will behave inefficiently, distorted prices and other market

parameters will occur. Thanks to the above-mentioned work

with the risk, in insurances the asymmetric information has a

significant impact on the functioning of the insurance market.

On one hand, it is obvious that entities having an interest in

concluding insurance are better aware of their situation than an

insurance company and might even intentionally place false

information on the situation, on the other hand, the insurance

company may have better information thanks to the large

number of clients and claims which they deal with. Also, the

insurance company usually has better information about the

self-constructed product.

The advantage of the demand side is the advantage of the

client of the insurance company. The advantage lies in the fact

that nobody knows their own situation, health condition,

technical condition of assets, financial situation, etc. better

than the clients themselves who want to be insured. Such a

client should therefore logically conclude insurance whenever

they think its worthy, i.e. the rate of their future benefit will be

higher than if they did not conclude insurance. The client uses

their dominance in the information, assuming that the

insurance company will pay them more than they pay to

insurance company.

Analogy of an individual economic decision-making entity,

whether to get insured or not, is the decision-making of the

insurance company regarding the insurance premium.

However, while for an individual economic entity, as it has

been said, this is a subjective matter, in the case of insurance

company, given the large number of clients and claims, it is

rather a mathematical problem solving through exploration of

the collective phenomena. In this, an informational advantage

can be seen on the insurance company side, when the

insurance company may in its deliberations use the historic

statistical ensemble of clients, insurance claims and events and

from that, they can guess the future development of currently

concluded insurances. Due to the size of the statistical

ensemble, it is obvious and possible to use the law of averages

for the mutual balancing of risks, as well as other work with

risk. Insurance companies on the basis of historical data and

other obtained information, create a calculating model of

insurance premium, which they adjust at the time. According

to Dahel [3], thanks to the above-mentioned, there is clear

information prevalence on the insurance company side.

A. Rational models

These models look at consumer especially as at a rationally

considering being, acting on the basis of economic advantage.

Consumer behaviour is interpreted as a result of consumer

rational consideration. Nevertheless some preconditions must

be kept, e.g.: consumer is wholly informed about all options

parameters and is able to make decision-making algorithm that

he deliberately complies. Bindings among income, prices,

facilities, budget limit, marginal behoof, cross-elasticity,

indifferent curves and others are controlled.

Creating of consumer behaviour rational model from

questionnaire survey results with a view to indifferent curves is

also a goal of a specific research.

For consumer decision-making analysis is not the behoof

measurability necessary. Sufficient precondition is consumer

ability to compare behoof of different goods combination. In

this case indifferent analysis is used to deduce demand curve.

Consumer chooses from various combinations of consumed

goods and is able to compare these combinations behoof. The

base for indifference analysis is indifference set. Indifference

set is a set of consumer combinations, every of which has the

same behoof and no set element is preferred to others.

Everything can be graphically demonstrated per indifferent

curve.

For every pair of goods can be drawn a run of indifferent

curves. Individual indifferent curves differ from each other by

combinations of both goods that bring different behoof to

consumer. Indifferent curves with increasing behoof depart

from axis zero and do not cross each other [5].

B. Sociological models

Sociologic approaches to consumer behaviour study how

consumer behaviour is influenced by social aspects and social

groups. One of central ideas that has already been expressed at

the beginning of the twentieth century by sociologist and

economist T. Velen is: People have got, on usual terms, very

strong tendency to follow social standards. Fashion influence

is a very obvious example.

C. General view of consumer behaviour

Concrete form of purchase decision-making process is

conditioned by every consumer individuality, his consumer

predisposition. The binding of predisposition and decisionmaking takes place inside every human, it is about internal

processes and in a manner it expresses consumer blackbox.

Consumer blackbox is more or less some kind of consumer

behaviour predisposition and purchase decision-making

interaction [5].

ISBN: 978-1-61804-037-4

26

Recent Researches in Urban Sustainability and Green Development

III. THE CURRENT SITUATION IN THE FIELD OF CONSUMER

BEHAVIOUR, FOCUSING ON THE INSURANCE MARKET

modern looking equipments, bank understand the specific

needs of customer, banks frontline employees are neat

appearing. On an average if the modern looking buildings and

amenities change by 1 unit, there will be 0.135 units increase

in the overall behavioral intention when other variables are

kept constant. Moreover the result of the t-test confirms that

the calculated partial regression coefficient such as (0.135),

(.288), (.170), (.147) and (.100) are highly significant at 1

percent level and 5 percent level. Similarly the multiple R of

0.665 shows there exist a relationship of 66.5 percent between

variables of service quality aspects and overall behavioral

Intention. The R Square value of 0.443, exhibits that the

variables of service quality explained a variation of 44.3

percent in overall behavioral intention. Finally, the result of Ftest signifies that the explained variation by the above said

variables in the SERVQUAL was highly significant at one

percent level. From the above analysis it is concluded that the

variables of service quality namely Modern looking

equipments and employees understands customers specific

needs were the dominant variables that increase the overall

behavior intention among customers of public retail banks [4].

A similar analysis of consumer behaviour, focusing on

financial services, has been implemented in Portugal. There

have also been investigated and identified the factors

determining the choice of a product.

Portuguese users reveal higher repurchase intention,

propensity to complain and a higher sensibility at price. It was

not possible to achieve a significant statistically relationship

between the SST (self-service Technologies) use and

satisfaction, propensity to change of bank and positive wordof-mouth. From the six formulated hypothesis, solely, two are

confirmed and remained obvious:

1) the relationship between the SST use and the higher

sensibility of consumer at price,

2) the SST use is not sufficient to satisfy and keep clients,

in order, to originate a positive word-ofmouth effect.

The research also shows a positive relationship among the

word-of-mouth and the intention to repurchase and a negative

relationship between the word-of-mouth and the sensibility at

price and the propensity to change of bank (p<0,01). A

negative correlation was found between the intention to

repurchase and sensibility at price and the propensity to

change of bank (p<0,01), the opposite (positive relationship) is

verified between the intention to repurchase and the propensity

to complain (p<0,05). The research, shows a positive

relationship between the sensibility at price and the propensity

to change of bank, in other words, clients more price sensitive

display a higher propensity to change of bank (p<0,01).

Finally, the results corroborate part of the study proposal, i.e.,

SST users reveal a higher propensity to repurchase (p<0,05)

and a higher propensity to complain, when something does not

run well (p<0,05). Relatively to the positive word-of-mouth

and the satisfaction, the results of the study are consistent with

the proposal, that associates the SST users to a positive wordof-mouth and a higher satisfaction, i.e., the correlation

coefficient has the correct signal, however, it is not statistically

In the decision-making field, a large number of studies have

been implemented. These include, for example, consumer

behaviour in the selection of banking products in Pakistan.

Table 5 shows the results of research objective two and three

with the help of Marginal effect of sensitivity analysis. The

seven influencing factors are rank from the factor analysis and

the logistic regression model is ranked as follows:

TABLE 1.

MARGINAL EFFECTS OF CUSTOMERS SWITCHING BEHAVIOUR

Ranking Factors Name

Marginal effect

1 Price

0.16398341

2 Distance

0.10936621

3 Switching Cost

-0.10567336

4 Service Quality

0.07095342

5 Reputation

0.06339969

6 Involuntary Switching

-0.05280674

7 Effective Advertising

0.04025589

Competition

Source: [4]

The marginal effects table illustrates that price factor

making the maximum impact on customers bank switching

behaviour in retail banking of Pakistan. The results show that a

unit increase in price results 16.4% probability that a customer

will switch banks. Price has the second highest impact maker

on customers bank switching behaviour. A unit increase in the

Distance factor (e.g. branch close) results in 10.93%

probability of customers switching banks. 10.56% is

probability of customer switching in retail banking industry of

Karachi, if one unit of Switching Cost decreases. Similarly,

Service Quality, Reputation, Involuntary Switching and

Effective Advertising Competition are the fourth, fifth, sixth

and seventh important factors that impact customers retail

bank switching behaviour of Pakistan (see Table 1).

Further research in the field of banking analyzed the

decision-making of clients with regard to the quality of

services provided (see Table 2).

TABLE 2.

CONTRIBUTION OF BEST SET OF SERVICE QUALITY VARIABLES

TOWARDS CUSTOMERS OVERALL BEHAVIOUR INTENTION

Source: [6]

The above equation shows the impact of the variables of

service quality aspects such as convenient operating hours,

ISBN: 978-1-61804-037-4

27

Recent Researches in Urban Sustainability and Green Development

significant (p<0,05). Results reveal the existence of a positive

correlation, but not statistically significant between the SST

use and the propensity to change of bank. In other words, this

study shows that the SST use is not sufficient for getting

satisfied and loyal clients, which therefore, can express

positive word-of-mouth. Conversely to Mols (1998), this

investigation shows that the Portuguese SST users are more

price sensitive (p<0,01). The highest sensibility of the

Portuguese consumer at price may be related to the biggest

difficult of banks in differentiating their services, given that

currently, every banks place at disposal SST, which in

consequence, is not anymore a differentiating source, has

happened before [8].

offer of one insurer and the consumer had a choice of

three possible variants of this offer. Price does not have

any effect in the case of rational behaviour).

4) voted for the option C, which offered the widest range

of insurance coverage,

5) would not vote for option B, which offered twice of the

performance compared to variant C, since the scope of

insurance coverage would be significantly reduced and

insurance would not fulfil its intended fiction.

IV. CONSUMER DECISION-MAKING IN THE FIELD OF INSURANCE

PRODUCTS IN THE CZECH REPUBLIC

In 2010, at the University of Hradec Kralove a research was

conducted, focusing on the issue of consumer decision-making

in life insurance. The research was conducted in collaboration

with one of the most important entities in the Czech insurance

market. The aim of the research project was to explore

consumer behaviour if there is offer of one type of insurance

coverage (insurance in the event of death) in three variants.

Life insurance was selected because for most insurers in the

product portfolio it is one of the key insurance coverage. The

main issue on which the research sought an answer, is whether

in the absence of asymmetric information, the consumer

behaves rationally or not, and what factors have a significant

influence on their decisions. It was backed up from the rational

model of consumer behaviour.

Within the researched project were defined circumstances

by co-insurance, defining rational and irrational behaviour of

consumers in their choice of the three options offered. It

implies that consumer in the transfer of risks to the insurer may

consider the offer by three parameters:

1) the extent of insurance coverage (for what is insured

and what not = exclusions from insurance),

2) the amount of insurance coverage (the maximum

monetary amount provided by the insurer when the insured

event),

3) price (the amount of cash given by consumer to insurer

to create insurance technical reserves).

A. insurance against accidental death (In the event that an insured

event occurs due to an accident, the insurer shall pay indemnity.)

B. insurance against accidental death with double performance in

the event of a traffic accident and insurance against sudden

death (heart attack, stroke). (In case the insured event (death)

occurs due to accident, the insurer shall pay indemnity, if the

insured event (death) occurs in a traffic accident, the insurer

pays twice more. In case the insured event (death) occurs on the

leading causes of death, therefore heart attack and stroke, the

insurer pays the agreed amount.)

C. insurance against death ( In case the insured event (death)

occurs from any cause, the insurer pays the agreed amount.)

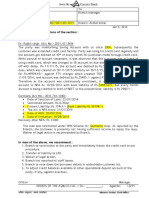

Fig. 1 Client's decision on the choice of options

The amount of offered insurance coverage and the cost of

various options were calculated by actuaries of the cooperating organization for age groups and gender. The graph

shows that regardless of any further breakdown of clients,

answer C predominates, which is insurance against death from

any cause. This option is specified as a rational choice. We can

say that in the first stage of the decision-making process, most

clients behaved rationally. Irrational choices, i.e. option A and

B, were voted by 240 respondents, which isnt a negligible

number. Also examined were the factors influencing the choice

of insurance.

Rationally behaving consumer:

1) chooses a bid which ensures the transfer of full range

risk to insurer, i.e. the extent of insurance coverage closely

resembles a surety against risk. Option C provides 100%

coverage range for both men and women. Option B offers

a range of 34% coverage for men and 17% for women.

Option A offers a range of 32% coverage for men and 15%

for women,

2) chooses a level of insurance performance, which is

sufficient to eliminate results from the realized risk,

3) takes into account cost factors for comparison of the

advantages of offers from various insurers. (In this

research, which offered insurance against death, it was the

ISBN: 978-1-61804-037-4

28

Recent Researches in Urban Sustainability and Green Development

the service. Within the research conducted in the Czech

Republic it was found, that in the specific choice on product,

the price did not play a dominant role, but the dominant role

had the actual knowledge of content of the products. The

research was conducted under conditions of the provision

complete information on the product. However, despite the

provision of complete information, a relatively large number

of clients decided irrationally, namely that in product

selection, the supply side would implement higher gains at the

expense of the client. Among these clients for supply, the

possibility is opened to attract new customers, not actually due

to a better product, but also through the right utilization of

marketing devices.

Fig. 2 Decisive factor in the choice of insurance due to the selected

variant.

Report arose within specific research following grant project

GAR Decision making in autonomous systems No.

402/09/0662

REFERENCES

The question about the factor affecting the choice of

insurance is shown in the chart. Clients, who have opted for

insurance only against accidental death, took the prize as the

main criteria. Clients requiring a double payment in the event

of an accident (option B) took a substantial range of insurance,

just as those who want to insure against death from any cause

(option C). At the same time the amount of insurance coverage

was the most important for those who voted for twice of the

performance in case of an accident (option B). Therefore it can

be concluded that option C, which is regarded as the best for

clients, was voted most often with regard to the scope of

insurance. Clients in most cases were able to utilize the full

information provided to them for making the right decision.

Within the researched project, other circumstances that could

affect the selection (age, gender, education level, income

group, etc.) were investigated in detail. This is mainly because

there were also a large number of the clients with irrational

choice. There is the space for the offering institution to use this

knowledge and pull the clients to their side through for

example, a better offer than that of the competition.

[1] R. Blackwell, et al., Consumer Behavior. 9th ed. Orlando: Harcourt,

2001,

[2] J. Bray, Consumer Behaviour Theory: Approaches and Models, 2008,

available:

http://eprints.bournemouth.ac.uk/10107/1/Consumer_Behaviour_Theory__Approaches_%26_Models.pdf

[3] J. Dahel, et al., Pojistn teorie, Professional publishing. 2006,

[4] N. U. R. Khan, A. M. Ghouri, U. A, Siddqui, A. Shaikh, I. Ala,

Determinants Analysis of Customer Switching Behavior in Private Banking

Sector of Pakistan , Interdisciplinary journal of contemporary research in

business, Vol. 2, No. 7, 2010,

[5] Koudelka, J.: Spotebn chovn a sementace trhu, VE, Praha, pp. 225,

2006,

[6] K. Ravichandran,. K.Bhargavi, S. A. Kumar, Influence of Service Quality

on Banking Customers, International Journal of Economics and Finance,

Vol. 2, No. 4, 2010,

[7] Loudon, D. L., et al., Consumer Behaviour Concepts and Applications. 4th

ed.: McGraw Hill, 1993,

[8] M. A. Rodrigues, R. J. L. Amorim, J. F. Proena, SST and the consumer

behaviour in portuguese financial services, International Journal on

www/Internet, Vol. 5, N. 2, pp. 181-192, 2009,

[9] M. Richarme, Consumer Decision-Making Models, Strategies, and

Theories,

[online].

Available:

www.decisionanalyst.com/Downloads/ConsumerDecisionMaking.pdf

[Accessed: 2-6-7].

[10] Schiffman, L. G., et al., Consumer Behavior. 9th ed. New Jersey:

Prentice Hall, 2007,

[11] Solomon, M., et al., Consumer Behaviour: A European Perspective,

3rd ed. Harlow: Prentice Hall, 2006,

[12] Thaler, Richard H.: From Homo Economicus to Homo Sapiens,

Journal of Economics Perspectives 14,, pp.133-141, 2000,

[13] G.M. Zinkhan, Human Nature and Models of Consumer Decision

Making. Journal of Advertising, 21, (4) II-III, 1992.

V. CONCLUSION

For today's business environment characteristic is increasing

competition, which globalization and the associated expansion

of the free market contributes to. The life cycle of products

and services shortens, thereby, the demands on the ability of

firms to adapt to the increasingly rapid changes in the

competitive environment are increasing. One of the

prerequisites for competitiveness is innovation and speed of

businesses in innovation processes. This also applies to

products in the field of financial services. Knowledge is

becoming the most important form of capital, the knowledge

needs of organizations grow, become an indispensable

strategic resource to achieve success.

One of the most important forms of knowledge is the

knowledge of customer needs and their motives in the decision

making process. Factors influencing the choice of financial

product were the subject of this analysis.

In terms of foreign studies, devoted to the issue of consumer

decision making in the field of financial products, clearly the

leading factor is price and the entity behaviour, which provides

ISBN: 978-1-61804-037-4

29

Das könnte Ihnen auch gefallen

- SM CFAsolutions Reilly1ceDokument58 SeitenSM CFAsolutions Reilly1cesky_6129250% (2)

- Health Club Business PlanDokument47 SeitenHealth Club Business PlanjonesclintonNoch keine Bewertungen

- NF 817-Asthal BoharDokument2 SeitenNF 817-Asthal BoharAkhil1101Noch keine Bewertungen

- 607 PunhanaDokument1 Seite607 PunhanaAkhil1101Noch keine Bewertungen

- Professional Resume FormatDokument3 SeitenProfessional Resume FormatsankalpadixitNoch keine Bewertungen

- Integrating Total Quality PDFDokument10 SeitenIntegrating Total Quality PDFAkhil1101Noch keine Bewertungen

- Bharat Sanchar Nigam Limited (Website:) Application Form For Closure /surrender of TelephoneDokument2 SeitenBharat Sanchar Nigam Limited (Website:) Application Form For Closure /surrender of TelephoneAbhinavNoch keine Bewertungen

- अगगगग्रिम अननभभाग Advances Section ददग्रिभभाष कगग्रिरंमभाक - 0124-2657513 अरंचल कभारभार्यालर Circle Office फफैक्स/fax-0124-2657503Dokument1 Seiteअगगगग्रिम अननभभाग Advances Section ददग्रिभभाष कगग्रिरंमभाक - 0124-2657513 अरंचल कभारभार्यालर Circle Office फफैक्स/fax-0124-2657503Akhil1101Noch keine Bewertungen

- Designing Pay Levels Mix and Pay StructuresDokument0 SeitenDesigning Pay Levels Mix and Pay StructuresMootoosamy Diany100% (1)

- Energy 1. GeneralDokument19 SeitenEnergy 1. GeneralAkhil1101Noch keine Bewertungen

- SM CFAsolutions Reilly1ceDokument58 SeitenSM CFAsolutions Reilly1cesky_6129250% (2)

- Security AnalysisDokument305 SeitenSecurity AnalysisAoc HyderporaNoch keine Bewertungen

- Satish CVDokument2 SeitenSatish CVAkhil1101Noch keine Bewertungen

- 817 Alwar Road - 7 CasesDokument1 Seite817 Alwar Road - 7 CasesAkhil1101Noch keine Bewertungen

- Readme 7Dokument2 SeitenReadme 7Akhil1101Noch keine Bewertungen

- E-Commerce Syllabus and FrameworkDokument91 SeitenE-Commerce Syllabus and Frameworkpavanjammula100% (5)

- Corporate Governance and The Quality of Financial DisclosuresDokument8 SeitenCorporate Governance and The Quality of Financial DisclosuresAkhil1101Noch keine Bewertungen

- Corporate Governance and The Quality of Financial DisclosuresDokument8 SeitenCorporate Governance and The Quality of Financial DisclosuresAkhil1101Noch keine Bewertungen

- SM CFAsolutions Reilly1ceDokument58 SeitenSM CFAsolutions Reilly1cesky_6129250% (2)

- Bharat Sanchar Nigam Limited (Website:) Application Form For Closure /surrender of TelephoneDokument2 SeitenBharat Sanchar Nigam Limited (Website:) Application Form For Closure /surrender of TelephoneAbhinavNoch keine Bewertungen

- Board of Directors Composition, Structure, Duties & PowersDokument29 SeitenBoard of Directors Composition, Structure, Duties & PowersbrijeshbhaiNoch keine Bewertungen

- CSR LifeDokument5 SeitenCSR LifeAkhil1101Noch keine Bewertungen

- Annual Report 2014 15Dokument137 SeitenAnnual Report 2014 15Akhil1101Noch keine Bewertungen

- Health Club Business PlanDokument47 SeitenHealth Club Business PlanjonesclintonNoch keine Bewertungen

- Security AnalysisDokument305 SeitenSecurity AnalysisAoc HyderporaNoch keine Bewertungen

- CG and FDDokument12 SeitenCG and FDAkhil1101Noch keine Bewertungen

- Study Material Enterpreneurship Development: UNIT-1 Concept of Entrepreneur, EntrepreneurshipDokument44 SeitenStudy Material Enterpreneurship Development: UNIT-1 Concept of Entrepreneur, EntrepreneurshipAkhil1101100% (2)

- Claim and SettlemenmtDokument14 SeitenClaim and SettlemenmtThanga DuraiNoch keine Bewertungen

- Understanding Corporate Taxation: Leandra LedermanDokument21 SeitenUnderstanding Corporate Taxation: Leandra LedermanAkhil1101Noch keine Bewertungen

- Corporate Governance Financial Information Disclosure: and The Quality ofDokument7 SeitenCorporate Governance Financial Information Disclosure: and The Quality ofAkhil1101Noch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Starbucks Marketing Plan Group 3 Analyzes Consumer BehaviorDokument8 SeitenStarbucks Marketing Plan Group 3 Analyzes Consumer BehaviorSHUBHAM PRASADNoch keine Bewertungen

- American ValuesDokument20 SeitenAmerican ValuesTarak Bach-Hamba100% (1)

- K. J. Somaiya College of Arts and Commerce (Autonomous)Dokument8 SeitenK. J. Somaiya College of Arts and Commerce (Autonomous)Anvayi ArchanaNoch keine Bewertungen

- Analysis of Brand Loyalty of Cosmetics in Thanjavur DistrictDokument7 SeitenAnalysis of Brand Loyalty of Cosmetics in Thanjavur Districtkavita_nNoch keine Bewertungen

- STP of Successful BrandDokument7 SeitenSTP of Successful BrandVatsal GadhiaNoch keine Bewertungen

- Thesis On Customer Satisfaction in TelecomDokument7 SeitenThesis On Customer Satisfaction in Telecompavopeikd100% (2)

- Mba ProjectDokument77 SeitenMba ProjectManonmani ANoch keine Bewertungen

- Consumer Trend CanvasDokument14 SeitenConsumer Trend CanvasKool Adam100% (1)

- Introduction To Behavioural SciencesDokument3 SeitenIntroduction To Behavioural SciencesBusiness Developer & Marketer100% (7)

- F-Trend: Fashion Forecast 2020 Emotional Well-BeingDokument16 SeitenF-Trend: Fashion Forecast 2020 Emotional Well-Beingdhruva7Noch keine Bewertungen

- Consumer Behaviour and Utility MaximizationDokument8 SeitenConsumer Behaviour and Utility MaximizationJagmohan KalsiNoch keine Bewertungen

- Total Quality Management Practices in Islami Bank Bangladesh Ltd.Dokument10 SeitenTotal Quality Management Practices in Islami Bank Bangladesh Ltd.Piash AhmedNoch keine Bewertungen

- Marketing of Banking Services: A Historical PerspectiveDokument40 SeitenMarketing of Banking Services: A Historical PerspectiveAashika Shah100% (1)

- Date JuiceDokument40 SeitenDate JuiceasifonikNoch keine Bewertungen

- Towards - An PDFDokument33 SeitenTowards - An PDFlestari daswanNoch keine Bewertungen

- A Study On Customer Satisfaction Towards Departmental Stored in Raipur City Satyajit SarkarDokument55 SeitenA Study On Customer Satisfaction Towards Departmental Stored in Raipur City Satyajit SarkarSATYA07100% (1)

- MBSDokument11 SeitenMBSShakthi RaghaviNoch keine Bewertungen

- A Study On Consumer Buying Behavior While Purchasing Maruti Suzuki Cars Undertaken at "T.R. Sawhney Motors PVT LTD."Dokument60 SeitenA Study On Consumer Buying Behavior While Purchasing Maruti Suzuki Cars Undertaken at "T.R. Sawhney Motors PVT LTD."Hardik MadanNoch keine Bewertungen

- Consumer Buying Behavior Towards ICICI Prudential Life Insurance ProductsDokument5 SeitenConsumer Buying Behavior Towards ICICI Prudential Life Insurance ProductsVijay100% (1)

- Sustaining An Ethnic Soft Drink - Paper Boat: Brand Positioning and Consumer BehaviorDokument15 SeitenSustaining An Ethnic Soft Drink - Paper Boat: Brand Positioning and Consumer BehaviorSaloni PatilNoch keine Bewertungen

- Advances in Tourism Destination MarketingDokument280 SeitenAdvances in Tourism Destination Marketingadelineo vlog ONoch keine Bewertungen

- New Economics ProjectDokument21 SeitenNew Economics ProjectAshvika JM100% (1)

- A Study On Customer Behavour With Respect To Insurance CompanyDokument40 SeitenA Study On Customer Behavour With Respect To Insurance CompanyJahnavi BopudiNoch keine Bewertungen

- Project Report Submitted ToDokument74 SeitenProject Report Submitted ToAkshaya PavarattyNoch keine Bewertungen

- 19th International Economic Conference ProgramDokument44 Seiten19th International Economic Conference ProgramCristian DitoiuNoch keine Bewertungen

- Possibilities, Preferences ChoicesDokument20 SeitenPossibilities, Preferences ChoicesRazia AminNoch keine Bewertungen

- Emebet Bezabih - Sample Market ResearchDokument101 SeitenEmebet Bezabih - Sample Market Researchaprille altNoch keine Bewertungen

- Project Report On KurkureDokument23 SeitenProject Report On KurkureMrinal Sandbhor73% (45)

- 14 - Chapter 3 PDFDokument79 Seiten14 - Chapter 3 PDFjkNoch keine Bewertungen

- The Theory of Consumers Behavior and DemandDokument57 SeitenThe Theory of Consumers Behavior and DemandYonas AddamNoch keine Bewertungen