Beruflich Dokumente

Kultur Dokumente

Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)

Hochgeladen von

Shyam SunderOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)

Hochgeladen von

Shyam SunderCopyright:

Verfügbare Formate

Upsurge Investment & Finance Ltd.

ary,2016

12th Janu

To,

The Manager - Department of Corporate Service

Bombay Stock Exchange Limited

Floor 25, P J Towers, Dalal Street

Mumbai

- 400 001

Sub: Unaudited Financial Results for the Quarter Ended

Ref:

3L't December. 20L5.

Code no. 531390

Dear Sir,

With reference to above, please find enclosed herewith Unaudited Financial Results for the

Quarter ended 31't December, 2015 considered and approved in the Board of Directors

Meeting held on today, l}tn January, 2Ol5 along with the Limited Reviewed Report for the

period of l't October, 2015 to 31't December,2015 under Regulation 33 of the Securities and

Exchange Board of India (Listing Obligation and Disclosure Requirements) Regulation,

2015.

Please find the details in order and acknowledge receipt of the same.

Thanking you,

Yours faithfully,

For Upsurge In

&

Finance Ltd

D.K. Goyal

Managing

Encl. ala

Regd. Officc: 303, Morya Landmark-I, Beliind Crystal Plaza, Off. New Link Road, Andlreri (W), Muqbai

]61!:9L-22-674254M.l Fax: 9l-22-6742544$ E-rnlil: info@upsurgeinvestrnent.com

CIN : I.67 L20lvffll994Pl,C07 9254

'400 053.

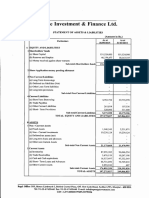

[Ipsurge Investment & Finance Ltd.

Quarter and Nine month ended 3111212015

corresponding 3

months ended in

the previous year

31t12t2014

a

b

Net Sales/lncome from Operations

Other operating lncome

(2O.43)

2,823.94

Total !ncome from operations (net)

Expenses

a

b

c

d

e

f

Cost of Material Consumed

Purchase of Stock- in- trade

Changes in inventories of Stock in trade

Employees Benefit ExPense

Depreciation and amortisation expenses

Other Expenses

Total Expenses

ProfiU(Loss) from Operations before other lncome, finance costs

and Exceptional ltems (1-2)

219.16

508.28

189.32

(131.e6)

189.32

(131.e6)

2,899.81

(1s4.86)

20.58

5.56

38.82

2,809.91

1,095.20

2,455.25

(67.18)

25.27

142.49

14.03

(67.18)

25.27

142.49

14.03

799.34

Other lncome

ProfiU(Loss) from ordinary activities before finance costs and

I

I

profiu(Loss) from ordinary activities after finance costs but before

14.37

4.87

0.54

Finance Costs

188.78

(136.83)

(67.18)

188.78

(136.83)

(67.18)

36 83)

(12.56)

(s4.62)

10.90

142.49

14.0s

10.90

142.49

14.03

10.90

23.85

118.64

12.53

118.64

1,515.24

12.53

1,515.24

Exceptional ltems

ProfiU(Loss) from Ordinary Activities before Tax (718)

{0

Tax Expenses

Net ProfiU(Loss) from Ordinary Activities after Tax (9t10)

Extraordinary item (Net of Tax expenses)

12

Net ProfiU(Loss) forthe period (1M21

13

14 Paid-up Equity Share Capital-[Face Value. Rs 10]

Reserve excluding revaluation reserve as per Balance sheet of

15

previous accounting year

15(i) Earning per share (before extraordinary items) (of Rs'10/- each) Not

annualised

a) Basic

b) Diluted

Earning per share (after extraordinary items) (of Rs.10/- each) Not

11

188.78

(1

I Aa.ZA

(136.83)

1515.24

1515.24

oi.azt

1,515.24

I O.SO

1,515.24

1.50

581.68

(0.e0)

(0.36)

(0.36)

(0.36)

(0.36)

.'

0.07

0.07

0.78

0.78

0.08

0.08

o.07

o.o7

0.78

0.78

0.08

0.08

note to the Financial Results

Notes

1

2

3

12th January 2016

The above financial results have been reveiwed by the Audit Committee and approved by the Board of Directors at the meeting held on

The Statutory Auditors of the company have conducted Limited Review of the the above financial results.

Previous year / quarters figures has been regroup / rearranged wherever necessary.

Place:Mumbai

Dale'. 1210112016

d.j

Regd. Office: 303, Morya Landmark-I, Behind Crystal Plaza, Off. New Link Road, Andheri (W),

Munlbai'400 053.

Tel: 9L-22-67425441Fax: 9t-22 -67425440 E-rn:ril: info@upsurgeinvestment.com

CIN : 1rt7 lz0lvltll994Pl,C0 79254

Bansal Bansal &

Co,

Chartered Accountants

Review Report to M/s Upsurge Investment & Finance Limited

We have reviewed the accompanying statement of unaudited financial results of M/s Upsurge

Investment & Finance Limited ('the company') for the period ended 31st December, 2G1,5. This

Board of

statement is the responsibility of the Company's Management and has been approved by the

Directors. Our responsibility is to issue a report on these financial statements based on our review.

We conducted our review in accordance with the Standard on Review Engagement (SRE) 2400,

,,Engagements to Review Financial Statements" issued by the Institute of Chartered Accountants of India'

whether

This standard requires that we plan and perform the review to obtain moderate assurance as to

inquiries of

the Financial Statements are free of material misstatement. A review is limited primarily to

less assurance

company personnel and analytical procedures applied to financial data and thus provides

opinion.

audit

an

express

than an audit. We have not performed an audit and accordingly, we do not

to believe that

Based on our review conducted as above, nothing has come to our attention that causes us

the accompanying statement of unaudited Financial results prepared in accordance with applicable

Accounting standards and other recognized accounting practices and policies has not disclosed the

and

information required to be disclosed in terms of Regulation 33 of the SEBI (Listing Obligations

it

or

that

Disclosure Requirements) Regulations, 2015 including the manner in which it is to be disclosed,

contains any material misstatement.

NIL

For Bansal Bansal & Co

Chartered Accountants

FRN:100986W

^f'-Yoy

]atin

Bansal

i''it

(Partner)

M. No.: 135399

Place: Mumbai

Date: January 12,2016

120, Building No.6, Mittal lndustrial Estate, Andheri Kurla Road, Andheri (East), Mumbai - 400 059.

Tel.: +91 22 6662 2444 o Fax:+91 2266622423. E-mail :mail@bansalbansal.com

Das könnte Ihnen auch gefallen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument2 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokument7 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Dokument3 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument3 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument3 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument3 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument8 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For December 31, 2015 (Result)Dokument3 SeitenFinancial Results For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument3 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument6 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Dokument5 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument10 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument3 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument3 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review For June 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument3 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument3 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument3 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryVon EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23Von EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23Noch keine Bewertungen

- PDF Processed With Cutepdf Evaluation EditionDokument3 SeitenPDF Processed With Cutepdf Evaluation EditionShyam SunderNoch keine Bewertungen

- Standalone Financial Results For March 31, 2016 (Result)Dokument11 SeitenStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For September 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Transcript of The Investors / Analysts Con Call (Company Update)Dokument15 SeitenTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNoch keine Bewertungen

- Investor Presentation For December 31, 2016 (Company Update)Dokument27 SeitenInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- GK Test-IiDokument11 SeitenGK Test-IiDr Chaman Lal PTNoch keine Bewertungen

- Daily Price Monitoring: Retail Prices of Selected Agri-Fishery Commodities in Selected Markets in Metro ManilaDokument3 SeitenDaily Price Monitoring: Retail Prices of Selected Agri-Fishery Commodities in Selected Markets in Metro ManilaRio CorralNoch keine Bewertungen

- Student ManualDokument19 SeitenStudent ManualCarl Jay TenajerosNoch keine Bewertungen

- Option - 1 Option - 2 Option - 3 Option - 4 Correct Answer MarksDokument4 SeitenOption - 1 Option - 2 Option - 3 Option - 4 Correct Answer MarksKISHORE BADANANoch keine Bewertungen

- Position PaperDokument9 SeitenPosition PaperRoel PalmairaNoch keine Bewertungen

- Gabuyer Oct13Dokument72 SeitenGabuyer Oct13William Rios0% (1)

- Exercises Service CostingDokument2 SeitenExercises Service Costingashikin dzulNoch keine Bewertungen

- Parts Price ListDokument5.325 SeitenParts Price ListAlva100% (1)

- AKROLEN® PP ICF 30 AM Black (8344) - Akro-PlasticDokument3 SeitenAKROLEN® PP ICF 30 AM Black (8344) - Akro-PlasticalkhalidibaiderNoch keine Bewertungen

- BroucherDokument2 SeitenBroucherVishal PoulNoch keine Bewertungen

- Account Statement From 1 Oct 2018 To 15 Mar 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument8 SeitenAccount Statement From 1 Oct 2018 To 15 Mar 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancerohantNoch keine Bewertungen

- White and Yellow Reflective Thermoplastic Striping Material (Solid Form)Dokument2 SeitenWhite and Yellow Reflective Thermoplastic Striping Material (Solid Form)FRANZ RICHARD SARDINAS MALLCONoch keine Bewertungen

- C.F.A.S. Hba1C: English System InformationDokument2 SeitenC.F.A.S. Hba1C: English System InformationtechlabNoch keine Bewertungen

- Facility Management SystemDokument6 SeitenFacility Management Systemshah007zaad100% (1)

- Why Is Inventory Turnover Important?: ... It Measures How Hard Your Inventory Investment Is WorkingDokument6 SeitenWhy Is Inventory Turnover Important?: ... It Measures How Hard Your Inventory Investment Is WorkingabhiNoch keine Bewertungen

- OCDI 2009 EnglishDokument1.025 SeitenOCDI 2009 EnglishCUONG DINHNoch keine Bewertungen

- DefinitionDokument6 SeitenDefinitionRatul HasanNoch keine Bewertungen

- MockboardexamDokument13 SeitenMockboardexamJayke TanNoch keine Bewertungen

- Gorlov Wind TurbineDokument3 SeitenGorlov Wind TurbineDwayneNoch keine Bewertungen

- DOLE Vacancies As of 01 - 10 - 13Dokument17 SeitenDOLE Vacancies As of 01 - 10 - 13sumaychengNoch keine Bewertungen

- The Application of 1,2,3-PropanetriolDokument2 SeitenThe Application of 1,2,3-PropanetriolAlisameimeiNoch keine Bewertungen

- Types of Foundation and Their Uses in Building ConstructionDokument4 SeitenTypes of Foundation and Their Uses in Building ConstructionCraig MNoch keine Bewertungen

- CSFP's Annual Executive Budget 2014Dokument169 SeitenCSFP's Annual Executive Budget 2014rizzelmangilitNoch keine Bewertungen

- Electric Baseboard StelproDokument4 SeitenElectric Baseboard StelprojrodNoch keine Bewertungen

- FLIPKART MayankDokument65 SeitenFLIPKART MayankNeeraj DwivediNoch keine Bewertungen

- Reliability EngineerDokument1 SeiteReliability EngineerBesuidenhout Engineering Solutions and ConsultingNoch keine Bewertungen

- Copyright IP Law Infringment of CopyrightDokument45 SeitenCopyright IP Law Infringment of Copyrightshree2485Noch keine Bewertungen

- Affidavit To Use The Surname of The FatherDokument2 SeitenAffidavit To Use The Surname of The FatherGlenn Lapitan Carpena100% (1)

- Challenges Faced by DMRCDokument2 SeitenChallenges Faced by DMRCSourabh Kr67% (3)

- 1 Conflict in NG - Report - 28FEB2018Dokument46 Seiten1 Conflict in NG - Report - 28FEB2018KrishnaNoch keine Bewertungen