Beruflich Dokumente

Kultur Dokumente

Using Bollinger Band® - Bands - To Gauge Trends

Hochgeladen von

fredsvOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Using Bollinger Band® - Bands - To Gauge Trends

Hochgeladen von

fredsvCopyright:

Verfügbare Formate

12/07/2015

UsingBollingerBand"Bands"ToGaugeTrends

Using Bollinger Band "Bands" To Gauge Trends

By Boris Schlossberg

Bollinger Bands are one of the most popular technical indicators for traders in any financial market, whether investors are

trading stocks, bonds or foreign exchange (FX). Many traders use Bollinger Bands to determine overbought and oversold

levels, selling when price touches the upper Bollinger Band and buying when it hits the lower Bollinger Band. In range-bound

markets, this technique works well, as prices travel between the two bands like balls bouncing off the walls of a racquetball court.

However, Bollinger Bands don't always give accurate buy and sell signals. This is where the more specific Bollinger Band

"bands" come in. Let's take a look.

Tutorial:: Analyzing Chart Patterns

Tutorial

The Problem With Bollinger Bands

As John Bollinger was first to acknowledge, "tags of the bands are just that - tags, not signals. A tag of the upper Bollinger Band

is not in and of itself a sell signal. A tag of the lower Bollinger Band is not in and of itself a buy signal". Price often can and does

"walk the band". In those markets, traders who continuously try to "sell the top" or "buy the bottom" are faced with an

excruciating series of stop-outs or worse, an ever-mounting floating loss as price moves further and further away from the

original entry.

Perhaps a more useful way to trade with Bollinger Bands is to use them to gauge trends. To understand why Bollinger Bands

may be a good tool for this task we first need to ask - what is a trend

trend??

Trend as Deviance

One standard clich in trading is that prices range 80% of the time. Like many clichs this one contains a good amount of truth

since markets mostly consolidate as bulls and bears battle for supremacy. Market trends are rare, which is why trading them is

not nearly as easy as it seems. Looking at price this way we can then define trend as deviation from the norm (range).

The Bollinger Band formula consists of the following:

BOLU = Upper Bollinger Band

BOLD = Lower Bollinger Band

n = Smoothing Period

m = Number of Standard Deviations (SD)

SD = Standard Deviation over Last n Periods Typical Price (TP) = (HI + LO + CL) / 3

BOLU = MA(TP, n) + m * SD[TP, n]

BOLD = MA(TP, n) - m * SD[TP, n]

At the core, Bollinger Bands measure deviation. This is the reason why they can be very helpful in diagnosing trend. By

generating two sets of Bollinger Bands - one set using the parameter of "1 standard deviation"

deviation" and the other using the typical

setting of "2 standard deviation" - we can look at price in a whole new way.

In the chart below we see that whenever price channels between the upper Bollinger Bands +1 SD and +2 SD away from mean

mean,,

the trend is up; therefore, we can define that channel as the "buy zone". Conversely, if price channels within Bollinger Bands 1

SD and 2 SD, it is in the "sell zone". Finally, if price meanders between +1 SD band and 1 SD band, it is essentially in a neutral

state, and we can say that it's in "no man's land".

One of the other great advantages of Bollinger Bands is that they adapt dynamically to price expanding and contracting as

volatility increases and decreases. Therefore, the bands naturally widen and narrow in sync with price action, creating a very

accurate trending envelope

envelope..

http://www.investopedia.com/articles/trading/05/022205.asp?view=print

1/3

12/07/2015

UsingBollingerBand"Bands"ToGaugeTrends

Figure 1: Bollinger Band channels show trends

Source: FXtrek Intellicharts

A Tool for Trend Traders and Faders

Having established the basic rules for Bollinger Band "bands", we can now demonstrate how this technical tool can be used by

both trend traders who seek to exploit momentum and fade traders who like to profit from trend exhaustion. Returning back to

the AUD/USD chart just above, we can see how trend traders would position long once price entered the "buy zone". They

would then be able to stay in trend as the Bollinger Band "bands" encapsulate most of the price action of the massive up-move.

What would the logical stop-out point be? The answer is different for each individual trader, but one reasonable possibility

would be to close the long trade if the candle turned red and more than 75% of its body were below the "buy zone". Using the

75% rule is obvious since at that point price clearly falls out of trend, but why insist that the candle be red? The reason for the

second condition is to prevent the trend trader from being "wiggled out" of a trend by a quick probative move to the downside

that snaps back to the "buy zone" at the end of the trading period. Note how in the following chart the trader is able to stay with

the move for most of the uptrend, exiting only when price starts to consolidate at the top of the new range.

Figure 2: Bollinger Band "bands" contain price action

Source: FXtrek Intellicharts

Bollinger Band "bands" can also be a valuable tool for traders who like to exploit trend exhaustion by picking the turn in price.

Note, however, that counter-trend trading requires far larger margins of error as trends will often make several attempts at

continuation before capitulating

capitulating..

http://www.investopedia.com/articles/trading/05/022205.asp?view=print

2/3

12/07/2015

UsingBollingerBand"Bands"ToGaugeTrends

In the chart below, we see that a fade trader using Bollinger Band "bands" will be able to quickly diagnose the first hint of trend

weakness. Having seen prices fall out of the trend channel, the fader may decide to make classic use of Bollinger Bands by

shorting the next tag of the upper Bollinger Band. But where to place the stop? Putting it just above the swing high will

practically assure the trader of a stop-out as price will often make many probative forays to the top of the range, with buyers

trying to extend the trend. Here is where the volatility property of Bollinger Bands becomes an enormous benefit to the trader.

By measuring the width of the "no man's land" area, which is simply the range of +1 to 1 SD from the mean, the trader can

create a quick and very effective projection zone, which will prevent him from being stopped out on market noise and yet

protect his capital if trend truly regains its momentum.

Figure 3: Fade trading using Bollinger Band "bands"

Source: FXtrek Intellicharts

The Bottom Line

As one the most popular technical analysis indicators, Bollinger Bands have become crucial for many technically oriented

traders. By extending their functionality through the use of Bollinger Band "bands", traders can achieve a greater level of

analytical sophistication using this simple and elegant tool for both trending and fading strategies.

2015, Investopedia, LLC.

http://www.investopedia.com/articles/trading/05/022205.asp?view=print

3/3

Das könnte Ihnen auch gefallen

- Bollinger Bands Explained - Best Settings & Strategy TestedDokument25 SeitenBollinger Bands Explained - Best Settings & Strategy TestedOPTIONS TRADING20Noch keine Bewertungen

- Bollinger Band (Part 2)Dokument5 SeitenBollinger Band (Part 2)Miguel Luz RosaNoch keine Bewertungen

- Bollinger Band® Definition: Standard Deviations Simple Moving AverageDokument3 SeitenBollinger Band® Definition: Standard Deviations Simple Moving AverageSandeep MishraNoch keine Bewertungen

- Using Bollinger Bands To Gauge Trends - InvestopediaDokument9 SeitenUsing Bollinger Bands To Gauge Trends - InvestopediarajritesNoch keine Bewertungen

- Bollinger Bands - What You Need To Know To Change Your TradingDokument18 SeitenBollinger Bands - What You Need To Know To Change Your TradingOPTIONS TRADING20Noch keine Bewertungen

- The Basics of Bollinger Bands® PDFDokument8 SeitenThe Basics of Bollinger Bands® PDFangkiongbohNoch keine Bewertungen

- Bollinger Bands RulesDokument2 SeitenBollinger Bands RulesBalajii RangarajuNoch keine Bewertungen

- (Trading) Stocks & Commodities - Using Bollinger Bands by John BollingerDokument11 Seiten(Trading) Stocks & Commodities - Using Bollinger Bands by John BollingeralvarocantarioNoch keine Bewertungen

- G5-T1 How To Use Bollinger BandsDokument9 SeitenG5-T1 How To Use Bollinger BandsThe ShitNoch keine Bewertungen

- Learn to Become Profitable Trader Using Smart Money Concept: Complete Guide to Trading Cryptocurrencies, Stocks Trading, and Forex TradingVon EverandLearn to Become Profitable Trader Using Smart Money Concept: Complete Guide to Trading Cryptocurrencies, Stocks Trading, and Forex TradingNoch keine Bewertungen

- Bollinger Bands: #1 Measuring Volatility #2 Identifying Bottoms and Tops #3 Signaling The Strength of A TrendDokument7 SeitenBollinger Bands: #1 Measuring Volatility #2 Identifying Bottoms and Tops #3 Signaling The Strength of A TrendJeremy NealNoch keine Bewertungen

- Eight Questions To Help You With Price Action Bar AnalysisDokument12 SeitenEight Questions To Help You With Price Action Bar Analysisaran singh100% (1)

- BootcampX Day 5Dokument67 SeitenBootcampX Day 5Vivek LasunaNoch keine Bewertungen

- Git Dos and Don'Ts: Hints and Common Pitfalls Matthias Männich, July 19 2011Dokument21 SeitenGit Dos and Don'Ts: Hints and Common Pitfalls Matthias Männich, July 19 2011puja_malh100% (1)

- Abcd NsepayDokument18 SeitenAbcd NsepayroughimNoch keine Bewertungen

- Breaks of StructureDokument3 SeitenBreaks of StructureDucog Jhory ANoch keine Bewertungen

- Oscillator Divergence and Fibonacci RetracementDokument14 SeitenOscillator Divergence and Fibonacci RetracementAlex ClaudiuNoch keine Bewertungen

- Swing Failure PatternDokument10 SeitenSwing Failure PatternsolomoneditasNoch keine Bewertungen

- Bearish Stop LossDokument3 SeitenBearish Stop LossSyam Sundar ReddyNoch keine Bewertungen

- ZulTheTrader HTF To Intraday Notes (Not For Sale)Dokument25 SeitenZulTheTrader HTF To Intraday Notes (Not For Sale)Spine StraightenerNoch keine Bewertungen

- The Empowered Forex Trader: Strategies to Transform Pains into GainsVon EverandThe Empowered Forex Trader: Strategies to Transform Pains into GainsNoch keine Bewertungen

- VSA Core PrinciplesDokument10 SeitenVSA Core Principlesswetha reddyNoch keine Bewertungen

- RSI CalcDokument2 SeitenRSI CalcregdddNoch keine Bewertungen

- 02 Demand and Supply AnalysisDokument33 Seiten02 Demand and Supply AnalysisRajeev SinghNoch keine Bewertungen

- Session 2 Notes (Part One)Dokument28 SeitenSession 2 Notes (Part One)CHIRAG JAINNoch keine Bewertungen

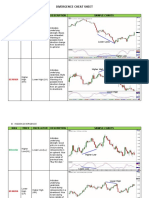

- Divergence Cheat Sheet: Bias Price Oscillator Description Sample ChartsDokument2 SeitenDivergence Cheat Sheet: Bias Price Oscillator Description Sample ChartsGab ByNoch keine Bewertungen

- The Selling Climax Has A Widening Spread and Increasing Volume. If It Does Not HaveDokument5 SeitenThe Selling Climax Has A Widening Spread and Increasing Volume. If It Does Not HaveUDAYAN SHAHNoch keine Bewertungen

- 55 Gold FeverDokument5 Seiten55 Gold FeverACasey101Noch keine Bewertungen

- Trading Plan EnglishDokument3 SeitenTrading Plan Englishهادی جهانیNoch keine Bewertungen

- 480 Bollinger BandsDokument5 Seiten480 Bollinger BandsUtkarsh DalmiaNoch keine Bewertungen

- Key Reference Areas Part 2 - Key TakeawaysDokument1 SeiteKey Reference Areas Part 2 - Key TakeawaysmarianoNoch keine Bewertungen

- Trading+With+MACD+ +a+Lesson+on+DivergenceDokument10 SeitenTrading+With+MACD+ +a+Lesson+on+DivergenceAndrea PedrottaNoch keine Bewertungen

- Indicator Soup: Enhance Your Technical Trading - September 2007 - by Darrell JobmanDokument5 SeitenIndicator Soup: Enhance Your Technical Trading - September 2007 - by Darrell JobmanLuisa HynesNoch keine Bewertungen

- The Dow Theory PrinciplesDokument9 SeitenThe Dow Theory Principlesjcfchee2804Noch keine Bewertungen

- How To Calculate and Trade Fibonacci Extension LevelsDokument2 SeitenHow To Calculate and Trade Fibonacci Extension LevelsPrakhyati RautNoch keine Bewertungen

- Pin Bars AdvancedDokument9 SeitenPin Bars AdvancedTrendzchaser SrdNoch keine Bewertungen

- BootcampX Day 2Dokument31 SeitenBootcampX Day 2Vivek LasunaNoch keine Bewertungen

- Al Brooks - Trading Price Action Ranges-7Dokument2 SeitenAl Brooks - Trading Price Action Ranges-7André Vitor Favaro Medes de Oliveira0% (2)

- Price Action Principles - Trading A Range Volume Profile & ToolsDokument37 SeitenPrice Action Principles - Trading A Range Volume Profile & Tools79JX DEVRİMNoch keine Bewertungen

- RSI UnlimitedDokument2 SeitenRSI UnlimitedjedilovagNoch keine Bewertungen

- SNR Supply DemandDokument10 SeitenSNR Supply DemandFitzNoch keine Bewertungen

- ElliottWaveManual+G P@FBDokument68 SeitenElliottWaveManual+G P@FBPranshu guptaNoch keine Bewertungen

- Swing AnalysisDokument3 SeitenSwing AnalysisRichard AsiimweNoch keine Bewertungen

- 30 Min Strategy PDFDokument14 Seiten30 Min Strategy PDFThe red RoseNoch keine Bewertungen

- James16 Part BDokument46 SeitenJames16 Part BAnonymous JrCVpuNoch keine Bewertungen

- Game Plan: Scenario 1 - Highs Made First Price Breaks Yesterday's Highs Unable To SustainDokument4 SeitenGame Plan: Scenario 1 - Highs Made First Price Breaks Yesterday's Highs Unable To SustainRICARDO100% (1)

- Volume Bar RulesDokument22 SeitenVolume Bar RulesHenry NgNoch keine Bewertungen

- Module VDokument30 SeitenModule VVarada RajaNoch keine Bewertungen

- Trading of GapsDokument3 SeitenTrading of GapsAnonymous 2HXuAeNoch keine Bewertungen

- VSA ExplorationsDokument1 SeiteVSA ExplorationsashlogicNoch keine Bewertungen

- Pinbar Trading Strategy: TradersguideDokument19 SeitenPinbar Trading Strategy: Tradersguidemanojmorye100% (1)

- True Support and ResistanceDokument12 SeitenTrue Support and ResistancechajimNoch keine Bewertungen

- Lifespan Investing: Building the Best Portfolio for Every Stage of Your LifeVon EverandLifespan Investing: Building the Best Portfolio for Every Stage of Your LifeNoch keine Bewertungen

- Rsi Divergence by Traders AcademyDokument2 SeitenRsi Divergence by Traders AcademyDemand SupplyNoch keine Bewertungen

- Decision Making-Stock TradingDokument17 SeitenDecision Making-Stock TradingGayathri BNoch keine Bewertungen

- Parabolic Capitulating MovesDokument7 SeitenParabolic Capitulating MovesChris Rodriguez SoloNoch keine Bewertungen

- AHOPEbook PDFDokument10 SeitenAHOPEbook PDFsabrinaNoch keine Bewertungen

- Downside RiskDokument53 SeitenDownside RiskfredsvNoch keine Bewertungen

- Volatility Decomposition and Estimation in Time-Changed Price ModelsDokument33 SeitenVolatility Decomposition and Estimation in Time-Changed Price ModelsfredsvNoch keine Bewertungen

- Parabolic SAR (Wilder)Dokument6 SeitenParabolic SAR (Wilder)anishghoshNoch keine Bewertungen

- Flyer - Empirical Studies On Volatility in International Stock MarketsDokument1 SeiteFlyer - Empirical Studies On Volatility in International Stock MarketsfredsvNoch keine Bewertungen

- Modern Portfolio Theory, 1950 To Date: Edwin J. Elton, Martin J. GruberDokument17 SeitenModern Portfolio Theory, 1950 To Date: Edwin J. Elton, Martin J. Gruberxai1lanroiboNoch keine Bewertungen

- CV Annen USLetterDokument2 SeitenCV Annen USLetterMarcoLesthrNoch keine Bewertungen

- FXTrader Interview April 2014Dokument4 SeitenFXTrader Interview April 2014Juliano BarbianNoch keine Bewertungen

- The Trader Business PlanDokument4 SeitenThe Trader Business Planmitesh100% (4)

- Bollinger Bands: Novice TraderDokument8 SeitenBollinger Bands: Novice TraderfredsvNoch keine Bewertungen

- Etd 2519Dokument72 SeitenEtd 2519FREDERICONoch keine Bewertungen

- Barro Ursua Stock MKT Crashes and Depressions 092909Dokument42 SeitenBarro Ursua Stock MKT Crashes and Depressions 092909fredsvNoch keine Bewertungen

- 1001 MOVIES You Must See Before You DieDokument19 Seiten1001 MOVIES You Must See Before You DieMayank100% (551)

- 6 Factors That Influence Exchange RatesDokument2 Seiten6 Factors That Influence Exchange RatesfredsvNoch keine Bewertungen

- Bollinger Bands: Novice TraderDokument8 SeitenBollinger Bands: Novice TraderfredsvNoch keine Bewertungen

- Calendar Effects On Stock Market Returns: Evidence From The Stock Exchange of MauritiusDokument35 SeitenCalendar Effects On Stock Market Returns: Evidence From The Stock Exchange of MauritiusfredsvNoch keine Bewertungen

- VIX Wikipedia enDokument6 SeitenVIX Wikipedia enfredsvNoch keine Bewertungen

- Etd 2519Dokument72 SeitenEtd 2519FREDERICONoch keine Bewertungen

- Calibration of Bollinger Bands ParametersDokument11 SeitenCalibration of Bollinger Bands ParametersfredsvNoch keine Bewertungen

- FXTrader Interview April 2014Dokument4 SeitenFXTrader Interview April 2014Juliano BarbianNoch keine Bewertungen

- (Trading) Stocks & Commodities - Using Bollinger Bands by John BollingerDokument11 Seiten(Trading) Stocks & Commodities - Using Bollinger Bands by John BollingeralvarocantarioNoch keine Bewertungen

- Bomar BandsDokument1 SeiteBomar BandsfredsvNoch keine Bewertungen

- AU Technical IndicatorsDokument11 SeitenAU Technical IndicatorsfredsvNoch keine Bewertungen

- The Basics of Bollinger Bands®Dokument2 SeitenThe Basics of Bollinger Bands®fredsvNoch keine Bewertungen

- Es2013 48Dokument6 SeitenEs2013 48fredsvNoch keine Bewertungen

- Stochastic Processes, It O Calculus, and Applications in EconomicsDokument18 SeitenStochastic Processes, It O Calculus, and Applications in EconomicsttlphuongNoch keine Bewertungen

- 1205 1002 PDFDokument20 Seiten1205 1002 PDFfredsvNoch keine Bewertungen

- 02 Bertrand M RoehnerDokument10 Seiten02 Bertrand M RoehnerfredsvNoch keine Bewertungen

- The Rise and Fall of S&P500 Variance FuturesDokument25 SeitenThe Rise and Fall of S&P500 Variance FuturesfredsvNoch keine Bewertungen

- Bootstrap Aggregating Multivariate Adaptive Regression Spline For Observational Studies in Diabetes CasesDokument8 SeitenBootstrap Aggregating Multivariate Adaptive Regression Spline For Observational Studies in Diabetes CasesTika MijayantiNoch keine Bewertungen

- Hussain Kapadawala 1Dokument56 SeitenHussain Kapadawala 1hussainkapda7276Noch keine Bewertungen

- Working With Regular Expressions: Prof. Mary Grace G. VenturaDokument26 SeitenWorking With Regular Expressions: Prof. Mary Grace G. VenturaAngela BeatriceNoch keine Bewertungen

- Analgesic ActivityDokument4 SeitenAnalgesic ActivitypranaliankitNoch keine Bewertungen

- Gullivers TravelDokument3 SeitenGullivers TravelRanen Das MishukNoch keine Bewertungen

- TestFunda - Puzzles 1Dokument39 SeitenTestFunda - Puzzles 1Gerald KohNoch keine Bewertungen

- Fraud Best PracticeDokument35 SeitenFraud Best PracticeIkhwanNoch keine Bewertungen

- Speakout Language BankDokument7 SeitenSpeakout Language BankСаша БулуєвNoch keine Bewertungen

- Worksheet For Mathematics For ManagementDokument3 SeitenWorksheet For Mathematics For Managementabel shimeles100% (1)

- Upload Emp Photo ConfigDokument14 SeitenUpload Emp Photo Configpaulantony143Noch keine Bewertungen

- Quality of Life After Functional Endoscopic Sinus Surgery in Patients With Chronic RhinosinusitisDokument15 SeitenQuality of Life After Functional Endoscopic Sinus Surgery in Patients With Chronic RhinosinusitisNarendraNoch keine Bewertungen

- Rulings On MarriageDokument17 SeitenRulings On MarriageMOHAMED HAFIZ VYNoch keine Bewertungen

- IC HDL Lab ManualDokument82 SeitenIC HDL Lab ManualRakshitha AngelNoch keine Bewertungen

- ElectionDokument127 SeitenElectionRaviKumar50% (2)

- FS 1 Activity 3.3Dokument6 SeitenFS 1 Activity 3.3HYACINTH GALLENERONoch keine Bewertungen

- Chuyen de GerundifninitiveDokument7 SeitenChuyen de GerundifninitiveThao TrinhNoch keine Bewertungen

- Nicolopoulou-Stamati - Reproductive Health and The EnvironmentDokument409 SeitenNicolopoulou-Stamati - Reproductive Health and The EnvironmentGiorgos PapasakelarisNoch keine Bewertungen

- MRA Project Milestone 2Dokument20 SeitenMRA Project Milestone 2Sandya Vb69% (16)

- Essay On Earth QuakeDokument7 SeitenEssay On Earth Quakexlgnhkaeg100% (2)

- PHNCDokument6 SeitenPHNCAmit MangaonkarNoch keine Bewertungen

- HF CharactersDokument5 SeitenHF CharactersAudri DebnathNoch keine Bewertungen

- Speech VP SaraDokument2 SeitenSpeech VP SaraStephanie Dawn MagallanesNoch keine Bewertungen

- CaseDokument2 SeitenCaseKimi Walia0% (2)

- Akhbar Al Fuqaha Narration - Non Raful Yadayn From Ibn Umar - Reply To Zubair Ali ZaiDokument15 SeitenAkhbar Al Fuqaha Narration - Non Raful Yadayn From Ibn Umar - Reply To Zubair Ali ZaiAbdullah YusufNoch keine Bewertungen

- CPN Project TopicsDokument1 SeiteCPN Project TopicsvirginNoch keine Bewertungen

- Accenture 172199U SAP S4HANA Conversion Brochure US Web PDFDokument8 SeitenAccenture 172199U SAP S4HANA Conversion Brochure US Web PDFrajesh2kakkasseryNoch keine Bewertungen

- Simple Past TenseDokument6 SeitenSimple Past Tenseanggun muslimahNoch keine Bewertungen

- COMPOSITION Analysis of A Jazz StandardDokument9 SeitenCOMPOSITION Analysis of A Jazz StandardAndresNoch keine Bewertungen

- The Concepts and Principles of Equity and HealthDokument18 SeitenThe Concepts and Principles of Equity and HealthPaulo César López BarrientosNoch keine Bewertungen

- Spelling Menu Days and MonthsDokument1 SeiteSpelling Menu Days and MonthsLisl WindhamNoch keine Bewertungen