Beruflich Dokumente

Kultur Dokumente

Accounting Day 6

Hochgeladen von

BenjaminCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Accounting Day 6

Hochgeladen von

BenjaminCopyright:

Verfügbare Formate

gar79611_ch06_233-278.

indd Page 268 12/15/08 11:33:41 PMuser-s176

268

/broker/MH-BURR/MHBR094/MHBR094-06/MHB R(

Chapter 6

Problems cowed:

T^PROBLEM 6-19 Basics of CVP Analysis (LOl. L03, L04. L06, L08]

Feather Friends, Inc., distributes a high-quality wooden birdhouse that sells for $20 per unit. Variable costs are $8 per unit, and fixed costs total $180,000 per year.

Required:

Answer the following independent questions:

1. What is the product's CM ratio?

2. Use the CM ratio to determine the break-even point in sales dollars.

3. Due to an increase in demand, the company estimates that sales will increase by $75,000 during the next year. By how much should net operating income increase (or net loss decrease)

assuming that fixed costs do not change?

4. Assume that the operating results for last year were:

Sales

Variable expenses

$400,000

160,000

Contribution margin

Fixed expenses

240,000

180,000

Net operating income

$ 60,000

a.

b.

Compute the degree of operating leverage at the current level of sales.

The president expects sales to increase by 20% next year. By what percentage should net

operating income increase?

Refer to the original data. Assume that the company sold 18,000 units last year. The sales

manager is convinced that a 10%reductionin the selling price, combined with a $30,000 increase in advertising, would cause annual sales in units to increase by one-third. Prepare two

contribution format income statements, one showing the results of last year's operations and

one showing the results of operations if these changes are made. Would you recommend that

the company do as die sales manager suggests?

Refer to the original data. Assume again that the company sold 18,000 units last year. The president does not want to change the selling price. Instead, he wants to increase the sales commission by $1 per unit. He thinks lhat this move, combined with some increase in advertising, would

increase annual sales by 25%. By how much could advertising be increased with profits remaining unchanged? Do not prepare an income statement, use die incremental analysis approach.

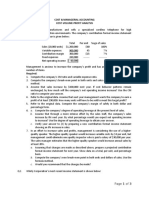

PROBLEM 6-20 Sales Mix; MuWproduct Break-Even Analysis (L09]

Gold Star Rice, Ltd., of Thailand exports Thai rice throughout Asia. The company grows three

varieties ofriceFragrant,White, and Loonzain. (The currency in Thailand is the baht, which is

denoted by B.) Budgeted sales by product and in total for the coming month are shown below:

Fragrant

Percentage of total sales

Sales

Variable expenses

20%

B150.000

108,000

100%

72%

52%

B390.000

78,000

100%

20%

28%

B210,000

84,000

100%

40%

Contribution margin

B 42,000

28%

B312,000

80%

B126,000

60%

100%

B750.00O

270,000

100%

36%

480,000

64%

Fixed expenses

449,280

Net operating income

B30.720

Dollar sales

breakeven

to

Fixed expenses

=

C M m i o

B449.280

"

0 M

= B702.000

As shown by these data, net operating income is budgeted at B30.720 for the month and

break-even sales at B702.000.

CONFIRMING PAGES

| aptara

gar79611_ch07_279-306.indd Page 300 12/17/08 10:41.42 PM user-s198

300

4-

/broker/MH-BURR/MHBR094/MHBR09i07__ .

I EQA

Chapter 7

Ms. Tyler is discouraged over die loss shown for the quarter, particularly because she had planned

to use the statement as support for a bank loan. Anolherfriend,a CPA, insists that die company should

be using absorption costing rather than variable costing and argues that if absorption costing had been

used die company would probably have reported at least some profit for the quarter.

At this point, Ms. Tyler is manufacturing only one product, a swimsuit. Production and cost

data relating to the swimsuit for the first quarter follow:

44

Units produced

Units sold

30,000

28,000

Variable costs per unit:

Direct materials

Direct labor

Variable manufacturing overhead

Variable selling and administrative

$3.50

$12.00

$1.00

$6.00

Required:

1. Complete the following:

a. Compute the unit product cost under absorption costing.

b. Redo the company's income statement for the quarter using absorption costing.

c. Reconcile the variable and absorption costing net operating income (loss) figures.

2. Was the CPA correct in suggesting that die company really earned a "profit" for the quarter?

Explain.

3. Dining the second quarter of operations, the company again produced 30,000 units but sold

32,000 units. (Assume no change in total fixed costs.)

a. Prepare a contribution format income statement for the quarter using variable costing.

b. Prepare an income statement for die quarter using absorption costing.

c. Reconcile the variable costing and absorption costing net operating incomes.

PROBLEM 7-14 Prepare and Reconcile Variable Costing Statements (L01. L02. L03. L041

Denton Company manufactures and sells a single product. Cost data for the product are given

below:

Variable costs per unit:

Direct materials

Direct labor

Variable manufacturing overhead

Variable selling and administrative

$7

10

5

3

Total variable cost per unit

$25

Fixed costs per month:

Fixed manufacturing overhead

Fixed selling and administrative

Total fixed cost per month

$315,000

245,000

$560,000

The product sells for $60 per unit. Production and sales data for July and August, the first two

months of operations, follow:

July

August

Units

Produced

Units

Sold

17,500

17,500

15,000

20,000

CONFIRMING PAGES

*($ aptara

gar79611_ch07_279-306.ind<i Page 301 12/17/08 10:41:43 PM user-s198

/broker/MH-BURR/MHBR094/MHBRO94-07

301

Variable Costing: A Tool for Management

The company's Accounting Department has prepared absorption costing income statements for

July and August as presented below:

Sales

Cost of goods sold

Gross margin

Selling and administrative expenses

Net operating income

July

August

$900,000

600,000

$1,200,000

800,000

300,000

290,000

400,000

305,000

$ 10,000

95,000

Required:

1. Determine the unit product cost under

a. Absorption costing.

b. Variable costing.

2. Prepare contributionformatvariable costing income statements for July and August.

3. Reconcile the variable costing and absorption costing net operating income figures.

4. The company's Accounting Department has determined the company's break-even point to be

16,000 units per month, computed as follows:

Fixed cost per month

$560,000

:

=

~ - 16,000 units

Unit contribution margin

$35 per unit

"I'm confused," said the president. "The accounting people say that our break-even point is

16,000 units per month, but we sold only 15,000 units in July, and the income statement they

prepared shows a $10,000 profit for that month. Either the income statement is wrong or the

break-even point is wrong ." Prepare a brief memo for the president, explaining what happened

on the July income statement.

PROBLEM 7-15 Comprehensive Problem with Labor Rxed [L01, L02, L03, L04]

Far North Telecom Ltd., of Ontario, has organized a new division to manufacture and sell specialty cellular telephones. The division's monthly costs are shown below:

*

Manufacturing costs:

Variable cpsts per unit:

Direct materials

Variable manufacturing overhead

Fixed manufacturing overhead costs (total)

Selling and administrative costs:

Variable

Fixed (total)

$48

$2

$360,000

12% of sales

$470,000

Far North Telecom regards all of its workers as full-time employees and the company has a

long-standing no layoff policy. Furthermore, production is highly automated. Accordingly, the

company includes its labor costs in its fixed manufacturing overhead. The cellular phones sell for

$ 150 each. During September, the first month of operations, the following activity was recorded:

Units produced

Units sold

12,000

10,000

Required:

1. Compute the unit product cost under:

a. Absorption costing.

b. Variable costing.

2. Prepare an absorption costing income statement for September.

3. Prepare a contribution format income statement for September using variable costing.

CONFIRMING PAGES

J aptara

Das könnte Ihnen auch gefallen

- Last Will and TestamentDokument6 SeitenLast Will and TestamentJonathan Gilham100% (1)

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersVon EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersBewertung: 5 von 5 Sternen5/5 (5)

- Bank Account TypesDokument1 SeiteBank Account TypesDoorga SatpathyNoch keine Bewertungen

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsVon EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNoch keine Bewertungen

- Day 11 Chap 6 Rev. FI5 Ex PRDokument8 SeitenDay 11 Chap 6 Rev. FI5 Ex PRChristian De Leon0% (2)

- UPDATES On Philippine Valuation Standards PDFDokument74 SeitenUPDATES On Philippine Valuation Standards PDFJoseph Cloyd LamberteNoch keine Bewertungen

- Finals SolutionsDokument9 SeitenFinals Solutionsi_dreambig100% (3)

- Accounting For Managers-Assignment MaterialsDokument4 SeitenAccounting For Managers-Assignment MaterialsYehualashet TeklemariamNoch keine Bewertungen

- Variable Costs:: Exercise 5-13: B/E Analysis and CVP GraphingDokument21 SeitenVariable Costs:: Exercise 5-13: B/E Analysis and CVP GraphingAshish BhallaNoch keine Bewertungen

- 8508 QuestionsDokument3 Seiten8508 QuestionsHassan MalikNoch keine Bewertungen

- A. Calculate The Break-Even Dollar Sales For The MonthDokument25 SeitenA. Calculate The Break-Even Dollar Sales For The MonthMohitNoch keine Bewertungen

- Managerial Accounting - WS4 Connect Homework GradedDokument9 SeitenManagerial Accounting - WS4 Connect Homework GradedJason HamiltonNoch keine Bewertungen

- Risk and Portfolio Management Similarities Between Joel Greenblatt and Stanley Druckenmiller - Base Hit InvestingDokument7 SeitenRisk and Portfolio Management Similarities Between Joel Greenblatt and Stanley Druckenmiller - Base Hit InvestingnabsNoch keine Bewertungen

- Chapter 3 - Cash Flow Analysis - SVDokument26 SeitenChapter 3 - Cash Flow Analysis - SVNguyen LienNoch keine Bewertungen

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionVon EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNoch keine Bewertungen

- MEMO FAX CVP Analysis SampleDokument26 SeitenMEMO FAX CVP Analysis SampleLita LinvilleNoch keine Bewertungen

- Income Taxation Rev 2Dokument22 SeitenIncome Taxation Rev 2Angel UrbanoNoch keine Bewertungen

- Given:: Problem 6 - 21: Prepare & Reconcile Variable Costing StatementsDokument13 SeitenGiven:: Problem 6 - 21: Prepare & Reconcile Variable Costing StatementsimjiyaNoch keine Bewertungen

- Business Finance Lesson-Exemplar - Module 3Dokument7 SeitenBusiness Finance Lesson-Exemplar - Module 3Divina Grace Rodriguez - LibreaNoch keine Bewertungen

- Bse Vs NasdaqDokument56 SeitenBse Vs NasdaqBhavesh Bajaj100% (2)

- 12 CVP Analysis SampleDokument12 Seiten12 CVP Analysis SampleMaziah Muhamad100% (1)

- 06 BasicAccTP1 SantosDokument3 Seiten06 BasicAccTP1 SantosJohn Santos100% (1)

- Cost Volume Profit Analysis - With KEYDokument8 SeitenCost Volume Profit Analysis - With KEYPatricia AtienzaNoch keine Bewertungen

- Bill French - Eve - Version 2Dokument28 SeitenBill French - Eve - Version 2Joanne LazaretoNoch keine Bewertungen

- Brewer Chapter 6Dokument8 SeitenBrewer Chapter 6Sivakumar KanchirajuNoch keine Bewertungen

- 6e Brewer CH05 B EOCDokument18 Seiten6e Brewer CH05 B EOCLiyanCenNoch keine Bewertungen

- 202E06Dokument21 Seiten202E06foxstupidfoxNoch keine Bewertungen

- Chapter # 8 Exercise & ProblemsDokument4 SeitenChapter # 8 Exercise & ProblemsZia Uddin0% (1)

- L Branch 8311652012 QuestionsDokument9 SeitenL Branch 8311652012 QuestionsMohitNoch keine Bewertungen

- HW 2.2 Afm SendDokument10 SeitenHW 2.2 Afm SendAbiodun OlokodanaNoch keine Bewertungen

- Chap 4 - ActivitiesDokument3 SeitenChap 4 - Activities31211022392Noch keine Bewertungen

- CVP Review Problem P 6.29 P 6.30Dokument4 SeitenCVP Review Problem P 6.29 P 6.30nehal hasnain refath0% (1)

- ACCT 505 Final ExamDokument4 SeitenACCT 505 Final Examjanymaxwell0% (1)

- CVP AssignmentDokument2 SeitenCVP AssignmentMichael CayabyabNoch keine Bewertungen

- Tutorial 1Dokument5 SeitenTutorial 1FEI FEINoch keine Bewertungen

- Break Even and CVPDokument2 SeitenBreak Even and CVPIshmael OneyaNoch keine Bewertungen

- FCES - Damanhour 3 Year - 2 Term: Management AccountingDokument11 SeitenFCES - Damanhour 3 Year - 2 Term: Management Accountingahmedgalalali497Noch keine Bewertungen

- Alpha University College Project Cost Accounting Group Assignment 1 (10marks) Submission Date: 23 April 2016 1Dokument3 SeitenAlpha University College Project Cost Accounting Group Assignment 1 (10marks) Submission Date: 23 April 2016 1AndinetNoch keine Bewertungen

- Cost AssignmentDokument4 SeitenCost AssignmentSYED MUHAMMAD MOOSA RAZANoch keine Bewertungen

- Question 3 - CVP AnalysisDokument13 SeitenQuestion 3 - CVP AnalysisMsKhan0078100% (1)

- Man Acc Qs 1Dokument6 SeitenMan Acc Qs 1Tehniat Zafar0% (1)

- Exam161 10Dokument7 SeitenExam161 10patelp4026Noch keine Bewertungen

- ExercisesDokument19 SeitenExercisesbajujuNoch keine Bewertungen

- Marginal Costing and Break-Even AnalysisDokument6 SeitenMarginal Costing and Break-Even AnalysisPrasanna SharmaNoch keine Bewertungen

- CVP Exercise Ref. Bautista, Cancino, Rada, SarmientoDokument5 SeitenCVP Exercise Ref. Bautista, Cancino, Rada, SarmientoRodolfo ManalacNoch keine Bewertungen

- Long Test 2 Set BDokument2 SeitenLong Test 2 Set BMonica ReyesNoch keine Bewertungen

- Ac102 Rev04-06Dokument25 SeitenAc102 Rev04-06Eric KnoflerNoch keine Bewertungen

- MGRL Practice 2 ModDokument20 SeitenMGRL Practice 2 ModAnn Kristine TrinidadNoch keine Bewertungen

- Problem 1: It Is Required To PrepareDokument7 SeitenProblem 1: It Is Required To PrepareGaurav ChauhanNoch keine Bewertungen

- DMMR CVP MathDokument2 SeitenDMMR CVP MathSabbir ZamanNoch keine Bewertungen

- Managerial Accounting Practice Problems2 PDFDokument9 SeitenManagerial Accounting Practice Problems2 PDFFrank Lovett100% (1)

- CVP H101Dokument4 SeitenCVP H101poppy2890Noch keine Bewertungen

- Contoh Soal Metode Harga Pokok VariabelDokument5 SeitenContoh Soal Metode Harga Pokok VariabelPrecious Vercaza Del RosarioNoch keine Bewertungen

- CAC Activity2Dokument3 SeitenCAC Activity2Jasper John NacuaNoch keine Bewertungen

- Managerial Accounting Exam CHDokument17 SeitenManagerial Accounting Exam CH808kailuaNoch keine Bewertungen

- Q4 CVPDokument2 SeitenQ4 CVPpdmallari12Noch keine Bewertungen

- MA 13.2 (No Solutions)Dokument2 SeitenMA 13.2 (No Solutions)Michael ComunelloNoch keine Bewertungen

- Cost & Managerial Accounting Cost-Volume-Profit Analysis: Page 1 of 3Dokument3 SeitenCost & Managerial Accounting Cost-Volume-Profit Analysis: Page 1 of 3mohammad bilal0% (1)

- Solving A CVP ProblemDokument11 SeitenSolving A CVP ProblemMahruf OpuNoch keine Bewertungen

- Managerial AccountingDokument1 SeiteManagerial Accountingacuna.alexNoch keine Bewertungen

- Managerial Accounting Exam 2 With SolutionsDokument13 SeitenManagerial Accounting Exam 2 With Solutionskwathom1Noch keine Bewertungen

- Strat Cost PAA1Dokument12 SeitenStrat Cost PAA1Katrina Jesrene DatoyNoch keine Bewertungen

- Kuis UTS Genap 21-22 ACCDokument3 SeitenKuis UTS Genap 21-22 ACCNatasya FlorenciaNoch keine Bewertungen

- Slo 02 Acc230 08 TestDokument5 SeitenSlo 02 Acc230 08 TestSammy Ben MenahemNoch keine Bewertungen

- Remodelers' Cost of Doing Business Study, 2020 EditionVon EverandRemodelers' Cost of Doing Business Study, 2020 EditionNoch keine Bewertungen

- Mercantile Reporting Agency Revenues World Summary: Market Values & Financials by CountryVon EverandMercantile Reporting Agency Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryVon EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Resume 1Dokument2 SeitenResume 1BenjaminNoch keine Bewertungen

- Bhopal SummaryDokument8 SeitenBhopal SummaryiamsosoNoch keine Bewertungen

- Waste Management of JapanDokument30 SeitenWaste Management of JapanBenjaminNoch keine Bewertungen

- Poisson TableDokument2 SeitenPoisson TableKharisma Agung Wahono0% (1)

- Accounting Day 5Dokument1 SeiteAccounting Day 5BenjaminNoch keine Bewertungen

- Bhopal SummaryDokument8 SeitenBhopal SummaryiamsosoNoch keine Bewertungen

- FORM Readers Club PRDokument1 SeiteFORM Readers Club PRBenjaminNoch keine Bewertungen

- The Investment Detective - Data OnlyDokument2 SeitenThe Investment Detective - Data OnlyBenjaminNoch keine Bewertungen

- Waste Management of JapanDokument30 SeitenWaste Management of JapanBenjaminNoch keine Bewertungen

- Tabel Kandungan MineralDokument1 SeiteTabel Kandungan MineralBenjaminNoch keine Bewertungen

- T Table PDFDokument1 SeiteT Table PDFgatototNoch keine Bewertungen

- Corporate Restructuring - Reconfiguring The FirmDokument10 SeitenCorporate Restructuring - Reconfiguring The FirmShashank VihariNoch keine Bewertungen

- Provide Answer To All Questions Below: 1. List Three Types of Financial Statement? Income StatementDokument19 SeitenProvide Answer To All Questions Below: 1. List Three Types of Financial Statement? Income Statementsamra azadNoch keine Bewertungen

- Introduction To Finance Zeeshan Notes Cost of CapitalDokument12 SeitenIntroduction To Finance Zeeshan Notes Cost of CapitalZeeshan SardarNoch keine Bewertungen

- Impact of Foreign Direct Investment On Indian EconomyDokument8 SeitenImpact of Foreign Direct Investment On Indian Economysatyendra raiNoch keine Bewertungen

- Russian Hostile Infiltration of The Western Financial System by Elements of Russian Government and KGBDokument33 SeitenRussian Hostile Infiltration of The Western Financial System by Elements of Russian Government and KGBkabud100% (2)

- Pooled Funds 2019 EditionDokument97 SeitenPooled Funds 2019 EditionPatrick CuraNoch keine Bewertungen

- 21 Financial Instruments s22 - FINALDokument95 Seiten21 Financial Instruments s22 - FINALAphelele GqadaNoch keine Bewertungen

- Proposal Form For LIC's Jeevan Akshay - II (Table No. 163) 1Dokument6 SeitenProposal Form For LIC's Jeevan Akshay - II (Table No. 163) 1Anonymous W9VINoTzaNoch keine Bewertungen

- RTIDokument10 SeitenRTIPriya AgarwalNoch keine Bewertungen

- Introduction Into "Local Correlation" Modelling: Alex LangnauDokument25 SeitenIntroduction Into "Local Correlation" Modelling: Alex LangnauAsmaBenSlimèneNoch keine Bewertungen

- Fin315 - Business Finance Chapter 10 and 11 NAME (PLEASE PRINT)Dokument8 SeitenFin315 - Business Finance Chapter 10 and 11 NAME (PLEASE PRINT)Ryan Xuan0% (1)

- Case Study On Sab Miller IndiaDokument163 SeitenCase Study On Sab Miller Indiaசக்தி தாசன்Noch keine Bewertungen

- REC Multiple Choice QuestionsDokument2 SeitenREC Multiple Choice QuestionsEnp Gus AgostoNoch keine Bewertungen

- OpacityDokument80 SeitenOpacityJoão Paulo Vaz100% (1)

- Mba-511 Bata Shoe Company LTDDokument11 SeitenMba-511 Bata Shoe Company LTDNasim HaidarNoch keine Bewertungen

- IBREL Annual Report2019Dokument276 SeitenIBREL Annual Report2019Anonymous 0BpXe7RMNoch keine Bewertungen

- Building A Value SystemDokument3 SeitenBuilding A Value SystemManpreet Singh JassalNoch keine Bewertungen

- As 20Dokument6 SeitenAs 20Rajiv JhaNoch keine Bewertungen

- QuoraDokument6 SeitenQuoraValleyWag100% (4)

- Depositary ReceiptsDokument40 SeitenDepositary Receiptsapeksha_6065320560% (1)

- NEXO Token TermsDokument7 SeitenNEXO Token TermsE. ANoch keine Bewertungen