Beruflich Dokumente

Kultur Dokumente

Financial Intelligence

Hochgeladen von

Vicky Ze SeVenCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Financial Intelligence

Hochgeladen von

Vicky Ze SeVenCopyright:

Verfügbare Formate

The Financial Intelligence by Berman and Knight

Page 1

Table of Contents

PART I. Art of Finance and Why it Matters

Chapter 1: What is FI? 2

Chapter 2: Art of Finance 2

P1: Toolbox

2

PART II. Income statement

Chapter 3: Profit is an estimate

2

Chapters 3-7: Income Statement 2

PART III. The Balance SHeet 4

PART IV. The Cash Flow Statement

PART V. Ratios 5

The 5 Profitability Ratios 5

1. Gross Profit Margin 5

2. Operating Profit Margin

6

3. Net Profit Margin Percentage 6

4. Return on Assets

6

5. Return on Equity (ROE)

6

The 2 Leverage Ratios 6

1. Debt to Equity

6

2. Interest Coverage

6

The 2 Liquidity Ratios 7

1. Current Ratio 7

2. Quick Ratio 7

The 6 Efficiency Ratios 7

1. Days in Inventory (DII)

7

2. Inventory Turns

7

3. Days Sales Outstanding (DSO) 7

4. Days Payable Outstanding

7

5. Property Plant and Equipment Turnover (PPE turnover) 8

6. Total Asset Turnover 8

PART VI. Return on investment

PART VII. Managing Working Capital 8

The Financial Intelligence by Berman and Knight

PART I. ART OF FINANCE AND WHY IT MATTERS

Chapter 1: What is FI?

Financial intelligence, or wisdom about the financial aspects of a business

involves the abilities to do three things

Interpret the three main financial statements (income statement, balance

sheet, cash flow statement)

Understanding the assumptions, the judgements, the possibilities of cooking the books.

Analyze the numbers; make decisions, interpret, ....

Chapter 2: Art of Finance

P1: Toolbox

Three generic sources of financing:

Owner financing

Getting others the invest equity

Debt financing

Financial Officers

Small Organizations

Bookkeeper: Record all financial transactions in an organized system

Accountant (outsourced). Taxes, financial reports, set up of accounting

system

Large Organizations

Financial Tech (bookkeeper). Record all financial transactions in an

organized system.

CFO. Chief Financial Officer. Oversee management and strategy from a

financial perspective.

Controller (Comptroller). Like a CFO but more focused on management

from a financial perspective

Treasurer. Financial person who communicates and relates with the

outside world.

PART II. INCOME STATEMENT

1. Accountancy

Accountancy is the profession (process) of managing financial information

about an business entity. This profession is concerned with:

Setting up financial record keeping systems

Decision making about how to record and interpret the resulting data

Organizing the data into reports

Communicating the reports and financial information

2. Cash-based and Accrual Accounting

Two kinds of accounting systems

Cash Based. Revenues are recognized when cash is received and expenses

are recorded when cash is paid. (same as a checkbook).

Accrual Based. Each item (sale, purchase,) is entered as it happens regardless of when actual payments are received or made.

Accrual based accounting is the system used by nearly all businesses because

this gives a more accurate picture of how the business is working.

Page 2

The Financial Intelligence by Berman and Knight

3. The Matching Principle

Matching Principle: Match the revenue earned during an accounting period

with the expenses incurred in generating the revenue.

4. Income Statement

An income statement shows how much profit a business entity has made

during a period of time based on the formula:

(sales) - (expenses) = (net profit)

The income statement is presented as a table of numbers as shown in Fig. xx

Fig. 1. Income statement (from Dummies book).

The overall purpose of the income statement is to show whether the company made or lost money during the period being reported. Notice that the

income statement (Fig. xx) shows 4 things

1. Sales made

2. Expenses and what these expenses are for

3. The bottom line profit

4. Various measures of how much money was made

The income statement goes by many different names:

Profit and loss statement (P&L)

Revenue statement

Statement of financial performance

Earnings statement

Operating statement

Statement of operations)

Facts

Way more detailed in practice

Often numbers need to be multiplied by 1,000 or 1,000,000

Footnotes describe details; look for these

Many different names are used for items; depends on the company. This

makes learning about the income statement and other financial statements

much more difficult.

Main Ideas of the Income Statement

Sales (Revenue). The $ value of all goods/services a company provides for its

customers.

Earnings Per Share (EPS). Total revenue divided by number of shares outstanding. A number that strongly effects the value of stock.

COGS (Costs of Goods Sold). All the costs directly involved in producing a

product.

Page 3

The Financial Intelligence by Berman and Knight

COS (Costs of Services). All the costs directly involved in providing a service.

Operating Expenses. Expenses of running a business (e.g. selling, administrative, staff, insurance, advertising, marketing, utilities) that are not part of

the COGS or COS.

GAAP (Generally Accepted Accounting Principles). Defines the standards

for preparing financial reports.

Depreciation. A reduction in the value of an asset with the passage of time,

due in particular to wear and tear. Example: Cost of a milling machine is

spread out over the predicted life of the machine, with a portion of the cost

being expensed each accounting year.

Amortization. The reduction of the value of an asset by prorating its cost

over a period of years. Example, cost of gaining a patent is spread out over

the life of the patent, with each portion being recorded as an expense on the

companys income statement.

Amortization versus Depreciation:

Amortization usually refers to spreading an intangible assets cost over that

assets useful life.

Depreciation, on the other hand, refers to prorating a tangible assets cost

over that assets life.

Profit (earnings, earned income, income, net income, net, net profit):

Amount left over after all the expenses are subtracted from revenue.

Three basics types of profit:

Gross Profit. (Revenue) - (COGS); Making your product in a cost effective

way.

Operating Profit: (Revenue) - (COGS) - (Operating Expenses) ==> Making

your product + running your operation profitably.

Net Profit: (Revenue) - (COGS) - (Operating Expenses) - (Interest) (Taxes) ==> Bottom line amount.

PART III. THE BALANCE SHEET

5. The Balance Sheet

The balance sheet is a financial document that essential describes

The $ value of a company (in accounting terms) at a specific instant in time

Who these $s belong to (the owner) or (others)

Fig. 2. An example of a balance statement

Page 4

The Financial Intelligence by Berman and Knight

6. The Accounting Balance Equation

The accounting balance equation defines and relates three concepts

(owners equity in the business) = (assets of the business) -(liabilities of the business)

7. Owner Equity

Owners Equity is the owners (shareholders) stake in the company as measured by accounting rules.

8. Assets

Assets are what the company owns that can be turned into cash. Examples:

Cash, bonds, stock

Machinery and equipment

Patents, trade secrets

Inventory

9. Current Assets and Long Term Assets

Current assets: an asset on the balance sheet which is expected to be sold,

turned over, or used up in the near future, usually within one year. A current asset is liquid (it is easy to convert to cash). A current asset can be used

to meet existing liabilities.

Money in the bank

Petty cash

Money received but not yet banked (see cash in hand)

Money owed to the business by its customers

Raw materials for manufacturing

Stock bought for re-sale.

Long term assets: Those things with a useful life of more than one year.

May be difficult to turn into cash in one year or less.

PPE (plant, property, equipment)

Vehicles

Furniture

Office equipment, computers, fixtures and fittings, and plant and machinery

PART IV. THE CASH FLOW STATEMENT

10. Cash is King

Cash keeps a company alive. Cash flow is a critical measure of its financial

health.

You need people to run the businessany business. You need a place of business, telephones, electricity, computers, supplies, and so on.

And you cant pay for all these things with profits because profits arent real

money. Cash is. Cash is king.

11. The Burn Rate

Burn rate (negative cash flow measured in $/time as in $/month) measures

how fast a company will use up its shareholder capital. If the shareholder

capital is exhausted, the company will either have to start making a profit,

find additional funding, or close down.

12. The Warren Buffet Rules

Page 5

The Financial Intelligence by Berman and Knight

Warren Buffett is generally considered to be the worlds most successful

investor.

1. WB evaluates a business based on its long-term rather than its short-term

prospects.

2. WB looks for businesses he understands.

3. WB places the greatest emphasis on a measure of cash flow that he calls

owner earnings.

Owner Earnings:

Money an owner could take out of his business and spend, say, at the grocery store for his own benefit.

The value of a company is the total of the net cash flows (owner earnings)

expected to occur over the life of the business, discounted by an appropriate

interest rate

Reported earnings + depreciation, amortization, other non-cash items average annual amount of capitalized spending on plant, machinery, equipment (and presumably research and development).

13. The Cash Flow Statement

A financial statement that shows the changes in amount of cash (or cash

equivalent) on hand.

Fig. 3. An example of a Cash Flow Statement

PART V. RATIOS

Four categories to analyze performance:

Profitability ratios:

Leverage ratios:

Liquidity ratios:

Efficiency Ratios

The 5 Profitability Ratios

14. Gross Profit Margin

GM = (gross profit)/(revenue)

gross profit = (sales) - (GOGS)

Shows the basic profitability of your product or service; if you cannot make

this # good ==> little chance of success; perhaps the most important ratio for

the entrepreneur.

downward trends reveal problems (discounting to get sales, COGS rising)

Page 6

The Financial Intelligence by Berman and Knight

Page 7

15. Operating Profit Margin

OM = (operating profit = EBIT)/(revenue)

operating profit = (sales) - (COGS) - (operating expenses)

EBIT = earnings before income and taxes

shows how well business is being run

16. Net Profit Margin Percentage

Bottom line: how many dollars do you get to keep for every sales dollar

ROS = Return on Sales = Net Margin

(net profit/revenue)

17. Return on Assets

ROA shows how effective the company is in terms of using assets to generate

profits

(net profits)/(total assets)

18. Return on Equity (ROE)

ROE = (net profits)/(shareholders equity)

Really important to investors ==> should be 10% or higher (versus bank)

The 2 Leverage Ratios

Leverage = ability to use a small force to generate a large force.

Operating leverage = (fixed costs)/(variable costs);

The extent to which fixed costs are part of a companys cost structure

The higher the proportion of fixed costs, the faster income increases or

decreases with sales volumes.

Financial leverage = extent to which a companies asset base is financed by

debt

Leverage

Increases ability to make money

Increases risk

1. Debt to Equity

1 Debt to Equity Ratio 2 5

1 Total liabilities 2

1 Shareholder's equity 2

Best value is a function of what industry

Used by bankers to determine what company to loan to

2. Interest Coverage

How much interest a company has to pay relative to how much it is making.

Shows how easy it is for a company to pay its interest

1 Operating profit 2

1 Interest Coverage 2 5

1 Annual interest charges 2

Used by banks

The Financial Intelligence by Berman and Knight

Page 8

Tricks (like operating leases used by airlines) used to make this ratio lookgood.

1 Debt to Equity Ratio 2 5

The 2 Liquidity Ratios

1 Total liabilities 2

1 Shareholder's equity 2

Liquidity means being in cash or easily convertible to cash; debt paying ability.

In accounting current assets means assets that can be converted into cash in

1 year or less.

1. Current Ratio

Too low when this gets near 1; barely able to pay bills.

If this ratio gets too high, means you are holding onto too much cash

1 current assets 2

1 Current Ratio 2 5

1 current liabilities 2

2. Quick Ratio

a.k.a. acid test

should be above 1

1 quick ratio 2 5

The 6 Efficiency Ratios

1 current assets 2 2 1 inventory 2

1 current liabilities 2

How well you are managing the balance statement

Inventory is like frozen cash; the quicker you can get it out of your business,

the better off you are.

1. Days in Inventory (DII)

Measures how many days your inventory stays in your system

1 1 $s of inventory @ start 2 1 1 $s of inventory @ end 2 2 /2

1 Days in Inventory 2 5

1 inventory sold per day measured in COGs/day 2

2. Inventory Turns

Measures how many times your inventory turns over per year

1 360 days 2

1 Inventory Turns 2 5

1 DII 2

3. Days Sales Outstanding (DSO)

Measures how fast your customers pay their bills

1 ending accounts receivable 1 A/R 2 2

1 Days sales outstanding 2 5

5 54.4 day

1 revenue/day 2

This means that on average it takes your customers 54.4 days to pay their

bills.

4. Days Payable Outstanding

The Financial Intelligence by Berman and Knight

Measures how fast my company pays its outstanding invoices to suppliers.

Important for keeping suppliers happy.

1 ending accounts payable 1 A/P 2 2

1 Days payable outstanding 2 5

5 24.4 day

1 COGs/day 2

5. Property Plant and Equipment Turnover (PPE turnover)

A measure of how many $s of sales your company gets for each $ invested in

PPE

1 Revenue 2

1 PPE turnover 2 5

5 3.9

1 PPE 1 from balance statement 2 2

6. Total Asset Turnover

A measure of how many $s of sales your company gets for each $ invested in

(all assets). How efficiently is company using all assets to generate revenue. /

1 Revenue 2

1 Total asset turnover 2 5

5 1.7

1 Total assets 1 from balance statement 2 2

PART VI. RETURN ON INVESTMENT

Resources for capital expenditures are limited but there are an infinite # of

choices. ROI is how decisions are made

1. How to Calculate ROI

Step 1. Determine how much cash is needed.

Step 2. Estimate future cash flows from the investment

Step 3. Calculate the ROI, using 1 of 3 methods

Simple Payback Method

Net Present Value Method: Recommended Method

Internal Rate of Return Method

PART VII. MANAGING WORKING CAPITAL

Page 9

The Financial Intelligence by Berman and Knight

Page 10

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Download Geometry (Veritas Prep GMAT SeriesDokument2 SeitenDownload Geometry (Veritas Prep GMAT SeriesVicky Ze SeVenNoch keine Bewertungen

- ConsultingDokument40 SeitenConsultingVicky Ze SeVenNoch keine Bewertungen

- 689140894Dokument7 Seiten689140894HATEMNoch keine Bewertungen

- Sustainable Insight May 2011 - KPMGDokument20 SeitenSustainable Insight May 2011 - KPMGVicky Ze SeVenNoch keine Bewertungen

- How movie budgets impact audience ratingsDokument1 SeiteHow movie budgets impact audience ratingsVicky Ze SeVenNoch keine Bewertungen

- Macro Session 11ADokument23 SeitenMacro Session 11AVicky Ze SeVenNoch keine Bewertungen

- Nts2 Ximb Ac in Users Off Dean DeansOffPlanBM2015 NSF 504ca2Dokument1 SeiteNts2 Ximb Ac in Users Off Dean DeansOffPlanBM2015 NSF 504ca2Vicky Ze SeVenNoch keine Bewertungen

- Impact Report Deloitte DK 17 18Dokument51 SeitenImpact Report Deloitte DK 17 18Vicky Ze SeVenNoch keine Bewertungen

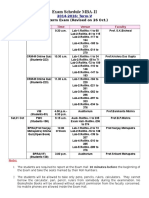

- Exam Schedule MBA-II: Mid-Term Exam (Revised On 26 Oct.)Dokument2 SeitenExam Schedule MBA-II: Mid-Term Exam (Revised On 26 Oct.)Vicky Ze SeVenNoch keine Bewertungen

- Aditya Viswanathan Resume PDFDokument1 SeiteAditya Viswanathan Resume PDFVicky Ze SeVenNoch keine Bewertungen

- Quantitative Methods PDFDokument42 SeitenQuantitative Methods PDFVicky Ze SeVenNoch keine Bewertungen

- Place Stats 2013-14Dokument31 SeitenPlace Stats 2013-14ShashikantLodhiNoch keine Bewertungen

- Shapiro - CH 12 Missing PG 244Dokument1 SeiteShapiro - CH 12 Missing PG 244Vicky Ze SeVenNoch keine Bewertungen

- Session 1Dokument20 SeitenSession 1Tarun Sai KrishnaNoch keine Bewertungen

- DetinDokument4 SeitenDetinVicky Ze SeVenNoch keine Bewertungen

- BIS 05 1 Foundation of BIDokument16 SeitenBIS 05 1 Foundation of BIVicky Ze SeVenNoch keine Bewertungen

- Supply Chain Management Compendium 2014 Edition FinalDokument7 SeitenSupply Chain Management Compendium 2014 Edition FinalVicky Ze SeVenNoch keine Bewertungen

- BIS 06 1 Business Process Mapping ActivityModelingDokument30 SeitenBIS 06 1 Business Process Mapping ActivityModelingVicky Ze SeVenNoch keine Bewertungen

- Glossary May 02Dokument20 SeitenGlossary May 02Vikas SuryavanshiNoch keine Bewertungen

- Formulas and concepts for profit, loss, time, distance, speed, partnership and moreDokument9 SeitenFormulas and concepts for profit, loss, time, distance, speed, partnership and morePrashanth MohanNoch keine Bewertungen

- PGP Summers 2015-16 AuditedDokument10 SeitenPGP Summers 2015-16 AuditedVicky Ze SeVenNoch keine Bewertungen

- GST Xaam - inDokument4 SeitenGST Xaam - inrravat111Noch keine Bewertungen

- Imagining India Ideas For The New CenturyDokument5 SeitenImagining India Ideas For The New CenturyVicky Ze SeVenNoch keine Bewertungen

- ORGB OB Motivation at WorkDokument48 SeitenORGB OB Motivation at WorkVicky Ze SeVenNoch keine Bewertungen

- Ejkm Volume8 Issue1 Article218 PDFDokument10 SeitenEjkm Volume8 Issue1 Article218 PDFVicky Ze SeVenNoch keine Bewertungen

- DetinDokument4 SeitenDetinVicky Ze SeVenNoch keine Bewertungen

- 689140894Dokument7 Seiten689140894HATEMNoch keine Bewertungen

- Financial Markets: A Beginner's ModuleDokument2 SeitenFinancial Markets: A Beginner's Moduledavidd121Noch keine Bewertungen

- PGP Summers 2015-16 AuditedDokument10 SeitenPGP Summers 2015-16 AuditedVicky Ze SeVenNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- VP Finance Controller in Philadelphia PA Resume William SteeleDokument2 SeitenVP Finance Controller in Philadelphia PA Resume William SteeleWilliamSteeleNoch keine Bewertungen

- CorporateLiquidation ProblemswithAnswerKeyDokument5 SeitenCorporateLiquidation ProblemswithAnswerKeyJayPee BasiñoNoch keine Bewertungen

- Assign 4Dokument3 SeitenAssign 4Guangjun OuNoch keine Bewertungen

- Financing Health Care: Concepts, Challenges and Practices: April 28 - May 9, 2014Dokument2 SeitenFinancing Health Care: Concepts, Challenges and Practices: April 28 - May 9, 2014J.V. Siritt ChangNoch keine Bewertungen

- CreditCard Transfer 918919310895Dokument2 SeitenCreditCard Transfer 918919310895habibullahshekh620Noch keine Bewertungen

- Supreme Court: Gullas, Lopez, Tuaño and Leuterio For Plaintiff-Appellant. Jose Delgado For Defendant-AppellantDokument47 SeitenSupreme Court: Gullas, Lopez, Tuaño and Leuterio For Plaintiff-Appellant. Jose Delgado For Defendant-AppellantArzaga Dessa BCNoch keine Bewertungen

- McKnight's Pub Brew ConnoisseurDokument45 SeitenMcKnight's Pub Brew ConnoisseurLesh GaleonneNoch keine Bewertungen

- Income Tax Rates: For AY 2021-22 (New) & A.Y. 2020-21 (Old)Dokument2 SeitenIncome Tax Rates: For AY 2021-22 (New) & A.Y. 2020-21 (Old)pankaj goyalNoch keine Bewertungen

- TM BseDokument4 SeitenTM BseVansh GoelNoch keine Bewertungen

- BCTC Case 2Dokument10 SeitenBCTC Case 2Trâm Nguyễn QuỳnhNoch keine Bewertungen

- 57 Marketing Tips For Financial Advisors by James Pollard - The Advisor Coach LLCDokument85 Seiten57 Marketing Tips For Financial Advisors by James Pollard - The Advisor Coach LLCAravamudhan Srinivasan100% (4)

- HDFC Bank's 1st Annual ReportDokument20 SeitenHDFC Bank's 1st Annual ReportTotmolNoch keine Bewertungen

- Accounting Notes On LedgersDokument3 SeitenAccounting Notes On LedgersAlisha shenazNoch keine Bewertungen

- Accountancy QP 3 (A) 2023Dokument5 SeitenAccountancy QP 3 (A) 2023mohammedsubhan6651Noch keine Bewertungen

- BSBFIM601 - Assessment 2 ProjectDokument8 SeitenBSBFIM601 - Assessment 2 ProjectSaanjit KcNoch keine Bewertungen

- Financial Statement AnalysisDokument4 SeitenFinancial Statement AnalysisLea AndreleiNoch keine Bewertungen

- Annual Report KIJA 2015 56 - 63Dokument210 SeitenAnnual Report KIJA 2015 56 - 63David Susilo NugrohoNoch keine Bewertungen

- Portugal Citizenship ProgramsDokument6 SeitenPortugal Citizenship ProgramsKenan Goja100% (1)

- Cost To CostDokument1 SeiteCost To CostAnirban Roy ChowdhuryNoch keine Bewertungen

- Valuing Rent-Controlled Residential PropertiesDokument14 SeitenValuing Rent-Controlled Residential PropertiesiugjkacNoch keine Bewertungen

- Entrep TemplateDokument18 SeitenEntrep TemplateVinjason Cabugason100% (1)

- Income Tax Payment Challan: PSID #: 34336315Dokument1 SeiteIncome Tax Payment Challan: PSID #: 34336315kashif shahzadNoch keine Bewertungen

- Presentation-Accounting StandardsDokument24 SeitenPresentation-Accounting StandardsJose Bradford100% (2)

- Smart ConsensusDokument1 SeiteSmart ConsensusKarthikKrishnanNoch keine Bewertungen

- Payday Lending Traps Borrowers in Long-Term Debt CyclesDokument33 SeitenPayday Lending Traps Borrowers in Long-Term Debt CyclesRyan HayesNoch keine Bewertungen

- Section ADokument9 SeitenSection AForeclosure Fraud75% (4)

- Employment Vs Independent Contractor AnalysisDokument4 SeitenEmployment Vs Independent Contractor AnalysisLarry HaberNoch keine Bewertungen

- 4) TaxationDokument25 Seiten4) TaxationvgbhNoch keine Bewertungen

- MUTUAL FUNDS GUIDEDokument31 SeitenMUTUAL FUNDS GUIDEAshi KhatriNoch keine Bewertungen

- Understanding Yield Curves and How They Impact InvestingDokument8 SeitenUnderstanding Yield Curves and How They Impact InvestingThúy LêNoch keine Bewertungen