Beruflich Dokumente

Kultur Dokumente

Oceanic Bank - Letter From John Aboh - CEO

Hochgeladen von

Oceanic Bank International PLCCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Oceanic Bank - Letter From John Aboh - CEO

Hochgeladen von

Oceanic Bank International PLCCopyright:

Verfügbare Formate

From the MD/CEO

Dear Customers & Shareholders,

I am writing this letter to you as the Chief Executive Officer of Oceanic Bank International Plc at a time of unprecedented financial sector

crisis in Nigeria and the rest of the world and following the intervention of the Central Bank of Nigeria in your bank.

The year 2009 for your bank has been extraordinary and our unaudited financial statements for the nine months to September 30, 2009

reflect the need to come clean about the true and fair state of affairs of the bank. In coming clean, we have examined the extent to which

the bank's accounts both in 2009 and prior year have reflected the true position of our non-performing loans and the recognition of

interest thereon.

In the unaudited accounts for the nine months to September 30th 2009, we have booked provisions of =N=311.8billion in respect of bad

and doubtful loans and , in line with Prudential Guidelines , accounting standards and best accounting practice , we have not booked

income on such non-performing loans, resulting in a loss before tax of =N=398.3billion. We are now confident that all known losses as at

September 30th 2009 have been properly accounted for. We also believe we have addressed the twin problems of 'ever greening' the loan

book and bad loans that were not properly accounted for.

To the extent that most of the loans we have now classified as bad in the 3rd Qtr 2009 unaudited accounts had already become delinquent

in 2008, but were not classified or accounted for as such in the 2008 audited accounts, we will in the coming months restate the 2008

accounts in order to correct these distortions. When this is done, it is expected that the Profit and Loss account for 2008 will show a

substantial loss vs. the profit after tax of =N=7.68billion currently shown, while the restated Profit and Loss account for nine months to

September 30th 2009 will show a correspondingly reduced loss. The restatement is not however expected to result in a change in the

Shareholders Funds position as at 30th September 2009 except to the extent of tax related adjustments.

Once this is done, we will be able to put behind us all the unfortunate events of the recent past and focus on the future of our great bank.

Our bank has a great brand. We are proud of our loyal and dependable customer base, a successful retail business, a network of 440

branches strategically located across Nigeria, world class transaction banking and retail banking product engines, rich holdings of real

estate, to name a few of elements we must continue to be proud of.

It is widely expected that the financial sector crisis in and outside Nigeria will persist in 2010. As we prepare to brace the macroeconomic

and external difficulties ahead, we are optimistic about the future of Oceanic Bank and we are poised to implement fully the recovery

strategy.

Your bank is taking action to streamline its cost base so as to align expenditure with revenue. To enable us focus on stabilising the bank's

Nigerian and core banking operations, our investment program has been postponed almost entirely. Unfortunately, since many of these

actions concern our employees, personnel adjustments cannot be avoided.

As I look forward to 2010, I am confident I have the right staff in the right positions to weather the financial storm, which may get worse

before it gets better. The nature of the economy is one we have never before experienced; however, I believe we can endure and tackle the

challenges that lie ahead.

To be successful in 2010 and beyond, we must:

1. Remain focused on our customers

2. Be committed to the enthronement of strong corporate governance

3. Sustain the momentum of the last two months that has resulted in deposit growth, loan recovery and improvements in efficiency;

4. Carefully monitor credit quality and proactively work with customers to remedy delinquencies and mitigate further deterioration of

their loans;

5. Use capital wisely.

6. Continue to review and control expenses.

In closing, I would like to reaffirm our commitment to a conservative corporate philosophy and strong corporate governance. I believe your

bank can rise above this and can be profitable even during these very difficult times. In fact, these difficult times may bring new growth

opportunities to Oceanic Bank.

Over the next days and weeks, the management team will be following through with stakeholders on this landmark bridge from the past

into the future of your bank, premised on the right foundation.

The Un-audited Accounts as at September 30, 2009 will be published on our website during the week and hardcopies will be available to

customers and investors.

Thank you for your continued support and investment in Oceanic Bank.

John O. Aboh

MD/CEO

www.oceanicbank.com experience peace...

Das könnte Ihnen auch gefallen

- ICBC Annual ReportDokument139 SeitenICBC Annual ReportmbabankingNoch keine Bewertungen

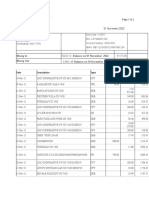

- Tax Invoice: TÜV Rheinland (India) Pvt. LTDDokument2 SeitenTax Invoice: TÜV Rheinland (India) Pvt. LTDHansraj GargNoch keine Bewertungen

- Receipt 25Dokument1 SeiteReceipt 25ASHIQ HUSSAINNoch keine Bewertungen

- Bank Reconciliation Format GuideDokument1 SeiteBank Reconciliation Format GuideMzee KodiaNoch keine Bewertungen

- HSBC Report On Two-Wheeler IndustryDokument64 SeitenHSBC Report On Two-Wheeler Industrymanishsharma33Noch keine Bewertungen

- Melitopol Oil Extraction PlantDokument14 SeitenMelitopol Oil Extraction PlantEvgeniy TruniakovNoch keine Bewertungen

- HMRC Plans For Northern Ireland Brexit ChecksDokument11 SeitenHMRC Plans For Northern Ireland Brexit Checkslisaoc100% (2)

- Westpac Pacific Internet Banking - Fiji - Make Immediate Payment ReceiptDokument1 SeiteWestpac Pacific Internet Banking - Fiji - Make Immediate Payment ReceiptViliameNoch keine Bewertungen

- Lol - 2019 09 06 Financial OpportunitiesDokument3 SeitenLol - 2019 09 06 Financial OpportunitiesOildeals Ng100% (1)

- Thank You for Banking with Us - Here is Your IBANDokument1 SeiteThank You for Banking with Us - Here is Your IBANZoya ShaikNoch keine Bewertungen

- Get A DSTV Explora + DSTV Premium + Access Fee For Only R849 Pmx24Dokument2 SeitenGet A DSTV Explora + DSTV Premium + Access Fee For Only R849 Pmx24Phumlani Zuma0% (1)

- Alrajhi-0 9248979251627416Dokument1 SeiteAlrajhi-0 9248979251627416MjdNoch keine Bewertungen

- Payment AdviceDokument1 SeitePayment AdviceAnonymous UdLAhtG6KBNoch keine Bewertungen

- SBP Amends Currency Management StrategyDokument1 SeiteSBP Amends Currency Management StrategySharjeel HussainNoch keine Bewertungen

- 27 January 2016: Your Master StatementDokument3 Seiten27 January 2016: Your Master StatementhanhNoch keine Bewertungen

- Instruction: Telegraphic TransferDokument4 SeitenInstruction: Telegraphic TransferBokulNoch keine Bewertungen

- Budget Insurance POLICY NUMBER 778754485Dokument13 SeitenBudget Insurance POLICY NUMBER 778754485suzan moeketsiNoch keine Bewertungen

- BankdetailsDokument5 SeitenBankdetailsAnupam DasNoch keine Bewertungen

- 18 Apr 2020 - (Free) ..cg11NTQKdgU - FXpwFhZhdQVyA3wCGXwCdhwEBxp-CHEOcw0DfBkIdgdzBQR1dgh2B3MDBn11DnECcgwHcQDokument1 Seite18 Apr 2020 - (Free) ..cg11NTQKdgU - FXpwFhZhdQVyA3wCGXwCdhwEBxp-CHEOcw0DfBkIdgdzBQR1dgh2B3MDBn11DnECcgwHcQLovemore Mutyambizi MuchenjeNoch keine Bewertungen

- 000011254894 (1)Dokument1 Seite000011254894 (1)Zuraida BashariNoch keine Bewertungen

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDokument1 SeiteE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsStephen NjeruNoch keine Bewertungen

- Payment Slip: Summary of Charges / Payments Current Bill AnalysisDokument8 SeitenPayment Slip: Summary of Charges / Payments Current Bill AnalysisElaine YingNoch keine Bewertungen

- Demand Draft Application FormDokument2 SeitenDemand Draft Application FormKamran Atif PechuhoNoch keine Bewertungen

- HSBC UK Bank PLCDokument4 SeitenHSBC UK Bank PLCndl_alex0608100% (1)

- Bank Guarantee (FormatDokument2 SeitenBank Guarantee (Formatmsadhanani3922Noch keine Bewertungen

- ING Bank StatementDokument2 SeitenING Bank StatementLand DowNoch keine Bewertungen

- Deutsche Bank FinalDokument26 SeitenDeutsche Bank FinalBoy NormanNoch keine Bewertungen

- Dispute Form FinalDokument2 SeitenDispute Form FinalFredNoch keine Bewertungen

- Nedbank Investment Statement - 28 Oct 2021Dokument2 SeitenNedbank Investment Statement - 28 Oct 2021Janice MkhizeNoch keine Bewertungen

- Absa Bank AccountDokument2 SeitenAbsa Bank AccountGRACIENNoch keine Bewertungen

- 2019-12 PDFDokument6 Seiten2019-12 PDFNur DanielNoch keine Bewertungen

- Transactions April 2022Dokument4 SeitenTransactions April 2022sree lochanaNoch keine Bewertungen

- Standard Checking Summary PDFDokument2 SeitenStandard Checking Summary PDFBobby BakerNoch keine Bewertungen

- Bill SturHubDokument4 SeitenBill SturHubBowor Oprek2Noch keine Bewertungen

- Preview PDFDokument7 SeitenPreview PDF13KARATNoch keine Bewertungen

- Bank Reconciliation Problems and SolutionsDokument3 SeitenBank Reconciliation Problems and SolutionsDev KumarNoch keine Bewertungen

- Manage bank account charges and transactionsDokument5 SeitenManage bank account charges and transactionsaethr juniorNoch keine Bewertungen

- Payment Slip: Summary of Charges / Payments Current Bill AnalysisDokument4 SeitenPayment Slip: Summary of Charges / Payments Current Bill AnalysisAizuddinNoch keine Bewertungen

- Nedbank Investment Statement - 28 Oct 2023Dokument2 SeitenNedbank Investment Statement - 28 Oct 2023mabuyisizakeleNoch keine Bewertungen

- Mr. Zarnigor Nurmamatova: Money in Money OutDokument2 SeitenMr. Zarnigor Nurmamatova: Money in Money OutsaNoch keine Bewertungen

- Statement of Account: Penyata AkaunDokument3 SeitenStatement of Account: Penyata AkaunWaNazren Wan KacangNoch keine Bewertungen

- Payment processing overview at HSBC GermanyDokument6 SeitenPayment processing overview at HSBC GermanyDiana GrajdanNoch keine Bewertungen

- Tax Invoice / Statement of Account: Invoice Cukai / Penyata AkaunDokument3 SeitenTax Invoice / Statement of Account: Invoice Cukai / Penyata Akaunqasihsuci82Noch keine Bewertungen

- HDFC Bank - Wire Transfer DetailsDokument2 SeitenHDFC Bank - Wire Transfer Detailsanon_193130758Noch keine Bewertungen

- Mts Bill Dec PDFDokument3 SeitenMts Bill Dec PDFAnkit KediaNoch keine Bewertungen

- Bank of ChinaDokument10 SeitenBank of ChinaAnuj MongaNoch keine Bewertungen

- Letter - Noor BankDokument1 SeiteLetter - Noor Bankrajkamal_eNoch keine Bewertungen

- Statement of HSBC Red Credit Card Account Red: Page 1 / 4Dokument4 SeitenStatement of HSBC Red Credit Card Account Red: Page 1 / 4Anson LukNoch keine Bewertungen

- DStv statement readyDokument2 SeitenDStv statement readyedsonNoch keine Bewertungen

- 2022 05 14 - StatementDokument1 Seite2022 05 14 - Statement樊瞳Noch keine Bewertungen

- NatWest Current Account Application Form Non UK EU ResDokument17 SeitenNatWest Current Account Application Form Non UK EU ResL mNoch keine Bewertungen

- Bank Islam IB Fund Transfer StatusDokument1 SeiteBank Islam IB Fund Transfer StatusMuhammad Khairul HafiziNoch keine Bewertungen

- Standard Chartered Bank Ghana PLC: Unaudited Financial Statements For The Period Ended 30 September 2021Dokument1 SeiteStandard Chartered Bank Ghana PLC: Unaudited Financial Statements For The Period Ended 30 September 2021Fuaad DodooNoch keine Bewertungen

- Complain Info - Funds Non ReceiptDokument1 SeiteComplain Info - Funds Non ReceiptVinod KumarNoch keine Bewertungen

- Central Testing Services Central Testing Services: Project Name: Punjab Police Phase IIDokument1 SeiteCentral Testing Services Central Testing Services: Project Name: Punjab Police Phase IIHamza Sheikh0% (1)

- Apply My Preferred Payment Plan DBS PromotionDokument1 SeiteApply My Preferred Payment Plan DBS PromotionOnaFajardoNoch keine Bewertungen

- Report On Dutch Bangla BankDokument22 SeitenReport On Dutch Bangla BankIshita Israt100% (1)

- Natwest Certificate of FundsDokument1 SeiteNatwest Certificate of Fundsruby caldeNoch keine Bewertungen

- Bank of Kigali Annual Report 2009Dokument80 SeitenBank of Kigali Annual Report 2009Bank of KigaliNoch keine Bewertungen

- Oceanic Bank Waxes Stronger, Gets Over N200 Billion From AMCONDokument3 SeitenOceanic Bank Waxes Stronger, Gets Over N200 Billion From AMCONOceanic Bank International PLC100% (1)

- Oyinkan Adewale, Oceanic Bank Executive Director and CFO, Interview On Q3 2010 ResultsDokument7 SeitenOyinkan Adewale, Oceanic Bank Executive Director and CFO, Interview On Q3 2010 ResultsOceanic Bank International PLCNoch keine Bewertungen

- Interview With Oyinkan Adewale, Executive Director - Chief Financial Officer, Oceanic Bank International PLC On Q2 2010 ResultsDokument9 SeitenInterview With Oyinkan Adewale, Executive Director - Chief Financial Officer, Oceanic Bank International PLC On Q2 2010 ResultsOceanic Bank International PLCNoch keine Bewertungen

- Oceanic Bank International PLC - Analyst Handout - FY 2008 Restatement, FY 2009, Q1 2010 ResultsDokument3 SeitenOceanic Bank International PLC - Analyst Handout - FY 2008 Restatement, FY 2009, Q1 2010 ResultsOceanic Bank International PLCNoch keine Bewertungen

- Oceanic Bank Unaudited Q3 2010 Results CommentaryDokument3 SeitenOceanic Bank Unaudited Q3 2010 Results CommentaryOceanic Bank International PLCNoch keine Bewertungen

- Oceanic Bank International PLC Unaudited Financial Statement For Period Ended March 31, 2010Dokument1 SeiteOceanic Bank International PLC Unaudited Financial Statement For Period Ended March 31, 2010Oceanic Bank International PLCNoch keine Bewertungen

- Oceanic Bank International PLC Q2 2010 Results ReviewDokument5 SeitenOceanic Bank International PLC Q2 2010 Results ReviewOceanic Bank International PLCNoch keine Bewertungen

- Press Release - Oceanic Bank International PLC Returns To Profitability, Grosses N28.7 Billion in Q1 2010 - June 22, 2010Dokument1 SeitePress Release - Oceanic Bank International PLC Returns To Profitability, Grosses N28.7 Billion in Q1 2010 - June 22, 2010Oceanic Bank International PLCNoch keine Bewertungen

- Oceanic Bank International PLC Audited Financial Statement For Period Ended December 31, 2009Dokument1 SeiteOceanic Bank International PLC Audited Financial Statement For Period Ended December 31, 2009Oceanic Bank International PLC100% (1)

- Press Release - Oceanic Bank International PLC Returns To Profitability, Grosses N28.7 Billion in Q1 2010 - June 22, 2010Dokument1 SeitePress Release - Oceanic Bank International PLC Returns To Profitability, Grosses N28.7 Billion in Q1 2010 - June 22, 2010Oceanic Bank International PLCNoch keine Bewertungen

- Oceanic Bank International PLC - Revised Financial Statement For The 15 Month Period Ended December 31, 2008Dokument1 SeiteOceanic Bank International PLC - Revised Financial Statement For The 15 Month Period Ended December 31, 2008Oceanic Bank International PLC50% (2)

- Settlement Rule in Cost Object Controlling (CO-PC-OBJ) - ERP Financials - SCN Wiki PDFDokument4 SeitenSettlement Rule in Cost Object Controlling (CO-PC-OBJ) - ERP Financials - SCN Wiki PDFkkka TtNoch keine Bewertungen

- Letter To Builder For VATDokument5 SeitenLetter To Builder For VATPrasadNoch keine Bewertungen

- Gestion de La Calidad HoqDokument8 SeitenGestion de La Calidad HoqLuisa AngelNoch keine Bewertungen

- Fundamentals of Accounting 3- Segment Reporting and Responsibility AccountingDokument25 SeitenFundamentals of Accounting 3- Segment Reporting and Responsibility AccountingAndrew MirandaNoch keine Bewertungen

- Mba-Cm Me Lecture 1Dokument17 SeitenMba-Cm Me Lecture 1api-3712367Noch keine Bewertungen

- Cash Flow Statement - QuestionDokument27 SeitenCash Flow Statement - Questionhamza khanNoch keine Bewertungen

- Multiple Choice QuestionsDokument9 SeitenMultiple Choice QuestionsReymark MutiaNoch keine Bewertungen

- Ghuirani Syabellail Shahiffa/170810301082/Class X document analysisDokument2 SeitenGhuirani Syabellail Shahiffa/170810301082/Class X document analysisghuirani syabellailNoch keine Bewertungen

- SAP PM Fiori AppsDokument16 SeitenSAP PM Fiori AppsVijayaw Vijji100% (1)

- 1 Deed of Absolute Sale Saldua - ComvalDokument3 Seiten1 Deed of Absolute Sale Saldua - ComvalAgsa ForceNoch keine Bewertungen

- Kasut You DistributionDokument9 SeitenKasut You DistributionNo Buddy100% (1)

- H4 Swing SetupDokument19 SeitenH4 Swing SetupEric Woon Kim ThakNoch keine Bewertungen

- CE462-CE562 Principles of Health and Safety-Birleştirildi PDFDokument663 SeitenCE462-CE562 Principles of Health and Safety-Birleştirildi PDFAnonymous MnNFIYB2Noch keine Bewertungen

- Manage Greenbelt Condo UnitDokument2 SeitenManage Greenbelt Condo UnitHarlyne CasimiroNoch keine Bewertungen

- ME-6501Computer Aided Design (CAD) WITH QB - by Civildatas - Com 12Dokument78 SeitenME-6501Computer Aided Design (CAD) WITH QB - by Civildatas - Com 12Charan KumarNoch keine Bewertungen

- NSU FALL 2012 FIN254.9 Term Paper On Aramit LimitedDokument24 SeitenNSU FALL 2012 FIN254.9 Term Paper On Aramit LimitedSamaan RishadNoch keine Bewertungen

- Banglalink (Final)Dokument42 SeitenBanglalink (Final)Zaki Ahmad100% (1)

- En (1119)Dokument1 SeiteEn (1119)reacharunkNoch keine Bewertungen

- Starting A Caf or Coffee Shop BusinessDokument11 SeitenStarting A Caf or Coffee Shop Businessastral05Noch keine Bewertungen

- Competitive Shopping AssignmentDokument5 SeitenCompetitive Shopping Assignmentapi-456889565Noch keine Bewertungen

- Money ClaimDokument1 SeiteMoney Claimalexander ongkiatcoNoch keine Bewertungen

- FLIPPING MARKETS TRADING PLAN 2.0.1 KEY CONCEPTSDokument60 SeitenFLIPPING MARKETS TRADING PLAN 2.0.1 KEY CONCEPTSLentera94% (18)

- Analisis Cost Volume Profit Sebagai Alat Perencanaan Laba (Studi Kasus Pada Umkm Dendeng Sapi Di Banda Aceh)Dokument25 SeitenAnalisis Cost Volume Profit Sebagai Alat Perencanaan Laba (Studi Kasus Pada Umkm Dendeng Sapi Di Banda Aceh)Fauzan C LahNoch keine Bewertungen

- Mem 720 - QBDokument10 SeitenMem 720 - QBJSW ENERGYNoch keine Bewertungen

- PEFINDO Key Success FactorsDokument2 SeitenPEFINDO Key Success Factorsanubhav saxenaNoch keine Bewertungen

- Corpo Bar QsDokument37 SeitenCorpo Bar QsDee LM100% (1)

- InventoryDokument53 SeitenInventoryVinoth KumarNoch keine Bewertungen

- My Project Report On Reliance FreshDokument67 SeitenMy Project Report On Reliance FreshRajkumar Sababathy0% (1)

- Supreme Court Dispute Over Liquidated DamagesDokument22 SeitenSupreme Court Dispute Over Liquidated DamagesShuva Guha ThakurtaNoch keine Bewertungen

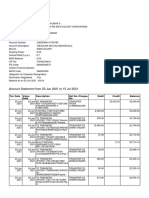

- Account Statement From 23 Jun 2021 To 15 Jul 2021Dokument8 SeitenAccount Statement From 23 Jun 2021 To 15 Jul 2021R S enterpriseNoch keine Bewertungen