Beruflich Dokumente

Kultur Dokumente

Determinant of Income Smoothing at Manufacturing Firms Listed On Indonesia Stock Exchange

Hochgeladen von

inventionjournalsOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Determinant of Income Smoothing at Manufacturing Firms Listed On Indonesia Stock Exchange

Hochgeladen von

inventionjournalsCopyright:

Verfügbare Formate

International Journal of Business and Management Invention

ISSN (Online): 2319 8028, ISSN (Print): 2319 801X

www.ijbmi.org || Volume 5 Issue 9 || September. 2016 || PP01-04

Determinant of Income Smoothing At Manufacturing Firms

Listed On Indonesia Stock Exchange

Husaini1, Sayunita2

1,2

Department Management, Faculty of Economic and Business of Universitas Malikussaleh, Indonesia

ABSTRACT: This research conducted to analyze the influence of profitability, financial risk (leverage), value

of firm, institutional ownership and public ownership on the Income smoothing at Manufacturing firms listed in

Indonesia stock exchange (IDX). The data used in this research was secondary data and there was 68 samples

taken through purposive sampling technique. The method used in analyzing the relationship between the

independent variables and dependent variables was multiple linear regression methods and classical

assumption test. These findings simultaneously indicated that profitability, leverage, the value of the firm,

institutional ownership and public ownership influence on the income smoothing. The partially results

performed that leverage and value of firm influenced positively on income smoothing, while the profitability,

institutional ownership, and public ownership influenced negatively on the income smoothing of manufacturing

firms listed on the Indonesia Stock Exchange.

Keywords: Profitability, Leverage, Value of Firm, Institutional Ownership, Public Ownership, and Income

Smoothing.

I.

INTRODUCTION

Financial statements will provide the information about the improvement of firms financial statements used in

decision making by stakeholders. One of the important information needed in making decision is profit.

Earnings management tends to show the stability of profit of company in each period. The achievement of stable

and low variance profits in each period is considered as a good achievement of firm. Stabilizing profit is called

Income Smoothing [6,]. Income Smoothing or profit flattening is one of the patterns of profit manipulation by

controlling profits based on the fluctuation.

There are related studies about Income smoothing and perform various results one another. [1] Indicated that

financial risk and the value of the firm influenced positively on Income smoothing, while profitability and

ownership structure did not influence on Income smoothing of firms on Indonesia Stock Exchange, but [10] find

the profitability have a positive relationship and significant on income smoothing. [2] Indicated that there were

positive and significant influences between profitability and Income smoothing. [10,13] Stated that firm size, the

value of the firm, profitability and Financial Leverage partially and significantly influenced on the Income

smoothing of manufacturing firms of Sub-sector automotive & components listed in Indonesia Stock Exchange

in 2009-2012).

[7] Based on the result performed that public ownership structure, Audit quality, Independent Board

Commissioner proportion, Audit committee, type of industry, firms size, profitability influenced significantly.

While financial risk did not influence on Income smoothing. [4] Found that firm size, Profitability, and

Dividend Payout Ratio (DPR) influenced positively and significantly on Income smoothing.

In other side, institutional ownership is the ownership of firm stock by institutions or organizations such as

insurance companies, bank, investment companies and the other institutions also impact to income smoothing.

The higher institutional ownership, the more efficient of firm assets usage. The institutional can be the barrier to

certain parties in carrying out variance because the supervision of firm management committed by the owners of

institutional stock. Therefore, the institutional ownership portion functions as a prevention of wasting conducted

by management [12].

Besides that, Public ownership represents the number of stock in society. The higher percentage of public

ownership of stock, the lower possibility of firms in carrying out Income smoothing. The higher public

ownership, the more information known by society about the firms. Those case will prevent manager in

manipulating earning. However, public ownership does not frequently become a threat to some party in carrying

out deviation because of the few stock proportion owned by the public. Sometimes, the information obtained by

the public is also limited. Because the public is regarded as the minority shareholders where they only have

stock below 5% so that it makes them only able to be followers of the majority shareholders [11].

Based on the phenomenon above appear a research gap on the research results so that motivates the researchers

to find the consistency of the results of the research, then the researchers limit the study on the influencing

factors of Income smoothing at Manufacturing firms Listed on Indonesia Stock Exchange (IDX).

www.ijbmi.org

1 | Page

Determinant Of Income Smoothing At Manufacturing Firms Listed On Indonesia Stock Exchange

II.

METHODS

The data used in this study were taken from 68 manufacturing firms selected from141 firms listed in Indonesia

Stock Exchange (BEI) during 2013-2014. The sample was selected by using Purposive sampling method. The

object of observations was profitability, financial risk, the value of the firm, institutional ownership, and public

ownership.

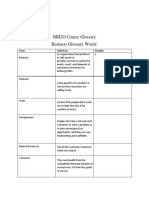

Table 1. Definition operational variable

Variable

Income

smoothing

Definition

Fluctuation in reported earnings that is considered

normal for the firms.

Profitability

The ability of firms in obtaining profits in a certain

period

Risks for the ordinary shareholders to get funding

through debt.

The price is willing to pay by a potential buyer if the

firm sold out which is represented by the stock price

Financial

Risk

Value of Firm

Institutional

Ownerships

Institutional ownership is a proportion of stock

ownership by an institution

Public

Ownerships

Public ownership reflects the number of outstanding

stock in society

III.

Measurements

Indeks Eckel (1981), [5]

IPL = [CV

/

]

I = income

S = Sales

I or S = [( t t-1) / t-1]

STATISTICAL ANALYSIS

The data was analyzed by using multiple linear regressions with the help of SPSS after having classical

assumption tests such as normality, multicolinearity and autocorrelation test. This analysis aimed to know the

influence of profitability, financial risk, the value of firm, ownership structure, (institutional and public

ownership) on Income smoothing at manufacturing firms listed in Indonesia Stock Exchange from 2013 and

2014.

IV.

RESULTS AND

DISCUSSIONS

This research was conducted in 2013 until 2014 and the total sample was 68 firms listed in Indonesia Stock

Exchange. The Independent variables used in this study were profitability, financial risk, firm Value,

Institutional Stocks and public stock. While the dependent variables was income smoothing. Before the data

were analyzed, first testing the classical assumption of normality, autocorrelation and multicolinerairty tests, as

presented below. Before analyzing the data, the classical assumption test should be done, they are normality test,

autocorrelation and multicolinerairty tests such as served below:

Table 2. One-Sample Kolmogorov-Smirnov Test

N

Normal Parametersa,b

Most Extreme Differences

Standardized Residual

136

.0000000

.98130676

.107

.107

-.068

1.248

.089

Mean

Std. Deviation

Absolute

Positive

Negative

Kolmogorov-Smirnov Z

Asymp. Sig. (2-tailed)

Table 3. Multicolinearity Test

Coefficientsa

Model

1

Collinearity Statistics

Tolerance

VIF

(Constant)

Return On Asset

Leverage

Value of Firm

Institutional Ownership

,969

,994

,996

,993

www.ijbmi.org

1,032

1006

1,004

1,007

2 | Page

Determinant Of Income Smoothing At Manufacturing Firms Listed On Indonesia Stock Exchange

Public Ownership

a. Dependent Variable: Income Smoothing

,969

1,031

Table 4. Autocorrelation Test

Model

1

R

.460a

R Square

.212

Adjusted R Square

.182

Std. Error of the Estimate

2.27870

Durbin-Watson

2.118

After conducted normality test, multicolinearity and autocorrelation test, it could be inferred that the data of this

research was categorized free from violation of classical assumption and was proper to be analyzed further.

After the data was analyzed using SPSS and multiple linear regressions, the results can be seen in the following

table:

Table 5. Multiple Linear Regression

Model

(Constant)

Return On Asset

Leverage

Firm Value

Institusional Ownership

Public Ownership

Coefficient Correlation ( R )

Coefficient Determination (R2)

Adjusted (R2)

B

3.936

-.149

.171

.006

-.042

-.232

,460

,212

,182

TCount

8.136

-2.393

3.351

2.704

-1.987

-2.260

Fcount

6.991

ttable

1,656

Ftable

3,062

Sig (t)

.000

.018

.001

.008

.049

.025

Sig (F)

.000

The table above performs that Coefficient Determination (adjusted R2) is 0,212 or 21,2%. This result indicated

that Return On Asset, Leverage, Firm value, Institutional ownership and Public ownership can influence Income

smoothing about 21,2%. While the rest of 78.8% was influenced by the other variables beyond of this model.

The simultaneous test performed that all the independent variables influenced significantly on income

smoothing at manufacturing firms listed in Indonesia Stock Exchange. The partial test obtained that Leverage,

the value of the firm influenced positively and significantly on Income smoothing. While the Return on Asset,

Institutional ownership and Public ownership influenced simultaneously on the Income smoothing at

manufacturing firms listed in Indonesia Stock Exchange.

V.

CONCLUSSIONS

The results performed that profitability, financial risk, the value of the firm, public ownership and institutional

ownership simultaneously influenced on Income smoothing positively and significantly. Partially, Profitability,

Public ownership and Institutional ownership influenced negatively and significantly on Income smoothing. The

results of this study supported by research [2,4,7,8,9,10,13], while leverage and the value of firm influenced

positively and significantly on Income smoothing at manufacturing firms listed in Indonesia Stock Exchange.

The results also consistent with research [10, 13].

This research provided the implication in which the management of manufacturing firms listed in Indonesia

Stock Exchange (BEI) should be able to generate and maintain the consistent profits so that the investors are

interested to invest in the firms. If the profits fluctuate relatively, the income smoothing can be carried out to

gain the trust of investors.

Hopefully, the further researchers could increase the other variables such as ownership managerial and

concentrate on the stock ownership proportion so that it can provide more varying results regarding the theory of

Income smoothing.

REFERENCES

[1].

[2].

[3].

[4].

[5].

[6].

[7].

[8].

Aji, Dhamar Yudho dan Aria Farah Mita. (2010). Pengaruh Profitabilitas, Risiko Keuangan, Nilai Perusahaan dan Struktur

Kepemilikan terhadap Praktik Perataan Laba : Studi Empiris Perusahaan Manufaktur Yang Terdaftar Di Bursa Efek Indonesia

Periode 20022008. Simposium Nasional Akuntansi XIU, Purwokerto.

Ashari, N., Koh, H.C., Tan, S.L. dan Wang. W.H. 1994. Factor Affecting Income Smoothing Among Listed Companies in

Singapore. Accounting Business Research, Vol 24 (96). Hal 291-301.

Belkaoui, A., The Smoothing Of Income Numbers : Some Empirical Evidence of Systematic Differences between Core and

Periphery Industrial Sector, Journal of Business Finance and Accounting, Winter 1984.

Budiasih, Igan, 2009. Faktor-Faktor Yang Mempengaruhi Praktik Perataan Laba, Jurnal Akuntansi dan Bisnis, Vol. 4, No. 1: 1

14.

Eckel, N. 1981. The Income Smooting Hypothesis Revisited. Abacus, Juni: 28- 40.

Harahap, Sofyan Syafri. 2007. Teori Akuntansi. Edisi Revisi. Jakarta: PT.Raja Grafindo Persada.

Herni dan Yulius Susanto, (2008). Pengaruh Struktur Kepemilikan Publik, Praktek Pengelolaan Perusahaan, Jenis Industri, Ukuran

Perusahaan, Profitabilitas, dan Risiko Keuangan terhadap Tindakan Perataan Laba (Studi Empiris pada Industri yang Listing di

Bursa Efek Jakarta). Jurnal Ekonomi dan Bisnis Indonesia, Vol. 23, No.3. p. 302-314.

Parijan, Khadijeh Parijan (2013), Income Smoothing Practices: An Empirical Investigation Of Listed Firms In Tehran Stock

Exchange (TSE), Indian Streams Research Journal, Indian Streams Research Journal, ISSN:-2230-7850.

www.ijbmi.org

3 | Page

Determinant Of Income Smoothing At Manufacturing Firms Listed On Indonesia Stock Exchange

[9].

[10].

[11].

[12].

[13].

Michelson, S.E., Jordan-Wagner, J. & Wootton, C.W. J Econ Finan (2000), The relationship between the smoothing of reported

income and risk-adjusted returns, Journal of Economics and Finance, June 2000, Volume 24, Issue 2, pp 141159.

DOI:10.1007/BF02752709.

Moh. Benny Alexandri and Winny Karina Anjani (2014), Income Smoothing: Impact Factors, Evidence In Indonesia, International

Journal of Small Business and Entrepreneurship Research Vol.3, No.1, pp. 21-27, January 2014, Published by European Centre

for Research Training and Development UK (www.eajournals.org).

Tarjo dan IA. Sulistyowati. (2005). Pengaruh Leverage dan Kepemilikan Saham terhadap Earning Manajemen pada Perusahaan Go

Public di Bursa Efek Jakarta. Makalah simposium Nasional Mahasiswa dan Alumni Pascasarjana Ilmu-ilmu Ekonomi, Yogyakarta.

Tarjo. (2008). Pengaruh Konsentrasi Kepemilikan Institusional dan Leverage Te rhadap Manajemen Laba, Nilai Pemegang saham

serta Cost of Equity Capital. Simposium Nasional Akuntansi XI, Pontianak.

Yasinta. (2012). Pengaruh Ukuran Perusahaan, Nilai Perusahaan, Profitabilitas dan Financial Leverage Terhadap Tindakan

Perataan Laba (Pada Perusahaan Manufaktur Sub Sektor Otomotif & Komponen Yang Terdaftar di BEI Periode 2009-2012).

Jurnal, Semarang.

www.ijbmi.org

4 | Page

Das könnte Ihnen auch gefallen

- The Effect of Transformational Leadership, Organizational Commitment and Empowerment On Managerial Performance Through Organizational Citizenship Behavior at PT. Cobra Direct Sale IndonesiaDokument9 SeitenThe Effect of Transformational Leadership, Organizational Commitment and Empowerment On Managerial Performance Through Organizational Citizenship Behavior at PT. Cobra Direct Sale Indonesiainventionjournals100% (1)

- Effects of Online Marketing On The Behaviour of Consumers in Selected Online Companies in Owerri, Imo State - NigeriaDokument12 SeitenEffects of Online Marketing On The Behaviour of Consumers in Selected Online Companies in Owerri, Imo State - Nigeriainventionjournals100% (1)

- Effects of Online Marketing On The Behaviour of Consumers in Selected Online Companies in Owerri, Imo State - Nigeria.Dokument12 SeitenEffects of Online Marketing On The Behaviour of Consumers in Selected Online Companies in Owerri, Imo State - Nigeria.inventionjournalsNoch keine Bewertungen

- The Impact of Leadership On Creativity and InnovationDokument8 SeitenThe Impact of Leadership On Creativity and InnovationinventionjournalsNoch keine Bewertungen

- The Usage and Understanding of Information and Communication Technology On Housewife in Family Welfare Empowerment Organization in Manado CityDokument10 SeitenThe Usage and Understanding of Information and Communication Technology On Housewife in Family Welfare Empowerment Organization in Manado CityinventionjournalsNoch keine Bewertungen

- Islamic Insurance in The Global EconomyDokument3 SeitenIslamic Insurance in The Global EconomyinventionjournalsNoch keine Bewertungen

- The Network Governance in Kasongan Industrial ClusterDokument7 SeitenThe Network Governance in Kasongan Industrial ClusterinventionjournalsNoch keine Bewertungen

- An Appraisal of The Current State of Affairs in Nigerian Party PoliticsDokument7 SeitenAn Appraisal of The Current State of Affairs in Nigerian Party PoliticsinventionjournalsNoch keine Bewertungen

- A Discourse On Modern Civilization: The Cinema of Hayao Miyazaki and GandhiDokument6 SeitenA Discourse On Modern Civilization: The Cinema of Hayao Miyazaki and GandhiinventionjournalsNoch keine Bewertungen

- Negotiated Masculinities in Contemporary American FictionDokument5 SeitenNegotiated Masculinities in Contemporary American FictioninventionjournalsNoch keine Bewertungen

- Inter-Caste or Inter-Religious Marriages and Honour Related Violence in IndiaDokument5 SeitenInter-Caste or Inter-Religious Marriages and Honour Related Violence in IndiainventionjournalsNoch keine Bewertungen

- The Social Composition of Megaliths in Telangana and Andhra: An Artefactual AnalysisDokument7 SeitenThe Social Composition of Megaliths in Telangana and Andhra: An Artefactual AnalysisinventionjournalsNoch keine Bewertungen

- Effect of P-Delta Due To Different Eccentricities in Tall StructuresDokument8 SeitenEffect of P-Delta Due To Different Eccentricities in Tall StructuresinventionjournalsNoch keine Bewertungen

- Literary Conviviality and Aesthetic Appreciation of Qasa'id Ashriyyah (Decaodes)Dokument5 SeitenLiterary Conviviality and Aesthetic Appreciation of Qasa'id Ashriyyah (Decaodes)inventionjournalsNoch keine Bewertungen

- Student Engagement: A Comparative Analysis of Traditional and Nontradional Students Attending Historically Black Colleges and UniversitiesDokument12 SeitenStudent Engagement: A Comparative Analysis of Traditional and Nontradional Students Attending Historically Black Colleges and Universitiesinventionjournals100% (1)

- H0606016570 PDFDokument6 SeitenH0606016570 PDFinventionjournalsNoch keine Bewertungen

- Muslims On The Margin: A Study of Muslims OBCs in West BengalDokument6 SeitenMuslims On The Margin: A Study of Muslims OBCs in West BengalinventionjournalsNoch keine Bewertungen

- A Critical Survey of The MahabhartaDokument2 SeitenA Critical Survey of The MahabhartainventionjournalsNoch keine Bewertungen

- E0606012850 PDFDokument23 SeitenE0606012850 PDFinventionjournalsNoch keine Bewertungen

- Non-Linear Analysis of Steel Frames Subjected To Seismic ForceDokument12 SeitenNon-Linear Analysis of Steel Frames Subjected To Seismic ForceinventionjournalsNoch keine Bewertungen

- F0606015153 PDFDokument3 SeitenF0606015153 PDFinventionjournalsNoch keine Bewertungen

- E0606012850 PDFDokument23 SeitenE0606012850 PDFinventionjournalsNoch keine Bewertungen

- H0606016570 PDFDokument6 SeitenH0606016570 PDFinventionjournalsNoch keine Bewertungen

- Non-Linear Analysis of Steel Frames Subjected To Seismic ForceDokument12 SeitenNon-Linear Analysis of Steel Frames Subjected To Seismic ForceinventionjournalsNoch keine Bewertungen

- C0606011419 PDFDokument6 SeitenC0606011419 PDFinventionjournalsNoch keine Bewertungen

- C0606011419 PDFDokument6 SeitenC0606011419 PDFinventionjournalsNoch keine Bewertungen

- D0606012027 PDFDokument8 SeitenD0606012027 PDFinventionjournalsNoch keine Bewertungen

- D0606012027 PDFDokument8 SeitenD0606012027 PDFinventionjournalsNoch keine Bewertungen

- F0606015153 PDFDokument3 SeitenF0606015153 PDFinventionjournalsNoch keine Bewertungen

- Development of Nighttime Visibility Assessment System For Road Using A Low Light CameraDokument5 SeitenDevelopment of Nighttime Visibility Assessment System For Road Using A Low Light CamerainventionjournalsNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Nir Code, 1997Dokument64 SeitenNir Code, 1997benzylicNoch keine Bewertungen

- A Short Review On Basic FinanceDokument4 SeitenA Short Review On Basic FinanceJed AoananNoch keine Bewertungen

- BFC 018 Key AnswerDokument6 SeitenBFC 018 Key AnswerMariphie OsianNoch keine Bewertungen

- Rohit ProjectDokument82 SeitenRohit Projectsourav kumar dasNoch keine Bewertungen

- A4 9131 Doing Business Saudi ArabiaDokument50 SeitenA4 9131 Doing Business Saudi ArabiameetnaushadNoch keine Bewertungen

- Irving Picard Vs Richard M. Glantz and FamilyDokument73 SeitenIrving Picard Vs Richard M. Glantz and FamilyjpeppardNoch keine Bewertungen

- Chapter TwoDokument19 SeitenChapter TwoTemesgen LealemNoch keine Bewertungen

- SEBIDokument60 SeitenSEBIKinjal Rupani90% (10)

- CivRev2 - Delson Case Digests (Leonen) (4SBCDEF1920)Dokument113 SeitenCivRev2 - Delson Case Digests (Leonen) (4SBCDEF1920)Naethan Jhoe L. CiprianoNoch keine Bewertungen

- Practice Multiple Choice Questions For First Test PDFDokument10 SeitenPractice Multiple Choice Questions For First Test PDFBringinthehypeNoch keine Bewertungen

- PLDT v. NTCDokument7 SeitenPLDT v. NTCMarites regaliaNoch keine Bewertungen

- Ameriprise Financial Stock PitchDokument12 SeitenAmeriprise Financial Stock Pitchaashish91100% (1)

- Unit 4 HRM NotesDokument22 SeitenUnit 4 HRM Notessebaseg342Noch keine Bewertungen

- Investment AvenuesDokument103 SeitenInvestment AvenuesSuresh Gupta50% (2)

- ICICI Vehical LoanDokument49 SeitenICICI Vehical Loanjagdish80% (5)

- Mirae Asset Emerging Bluechip Fund overviewDokument1 SeiteMirae Asset Emerging Bluechip Fund overviewSaurabh KothariNoch keine Bewertungen

- Chapters 7 – 13 Essay QuestionsDokument26 SeitenChapters 7 – 13 Essay QuestionsKayla SheltonNoch keine Bewertungen

- Content Report1Dokument36 SeitenContent Report1Ayesha ShamimNoch keine Bewertungen

- Mark Scheme (Results) Summer 2008: GCE Accounting (6002) Paper 01Dokument19 SeitenMark Scheme (Results) Summer 2008: GCE Accounting (6002) Paper 01Faiz Mohammed ChowdhuryNoch keine Bewertungen

- Types of Money Market InstrumentsDokument6 SeitenTypes of Money Market Instrumentsrabia liaqatNoch keine Bewertungen

- Business Glossary TermsDokument26 SeitenBusiness Glossary TermsaaminahNoch keine Bewertungen

- Bove V. Community Hotel Corp.: Oslin UsticeDokument9 SeitenBove V. Community Hotel Corp.: Oslin UsticeKeenan SafadiNoch keine Bewertungen

- ALIF 2021-2022 Annual PDFDokument79 SeitenALIF 2021-2022 Annual PDFCAL ResearchNoch keine Bewertungen

- Dividend Under Companies Act 2013Dokument12 SeitenDividend Under Companies Act 2013Abhinay KumarNoch keine Bewertungen

- Business Finance Module 1.2Dokument18 SeitenBusiness Finance Module 1.2Jyrah RamosNoch keine Bewertungen

- Capital Market Assignment2Dokument2 SeitenCapital Market Assignment2Benjamen KamzaNoch keine Bewertungen

- Bayantel Digested G R Nos 175418 20Dokument4 SeitenBayantel Digested G R Nos 175418 20Shane Fernandez JardinicoNoch keine Bewertungen

- Management AccountingDokument237 SeitenManagement Accountingtirupati100100% (13)

- Four Year Financial Performance ReviewDokument15 SeitenFour Year Financial Performance ReviewRahmati RahmatullahNoch keine Bewertungen

- Invest Now or Temporarily Hold Cash ?Dokument8 SeitenInvest Now or Temporarily Hold Cash ?vouzvouz7127100% (1)