Beruflich Dokumente

Kultur Dokumente

MAC - APP.No.596-2008

Hochgeladen von

daljitsodhiOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

MAC - APP.No.596-2008

Hochgeladen von

daljitsodhiCopyright:

Verfügbare Formate

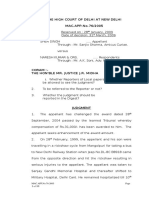

IN THE HIGH COURT OF DELHI AT NEW DELHI

MAC. APP. No.596/2008

Date of Decision: 26th March, 2009

NATIONAL INSURANCE CO. LTD.

Appellant.

Through: Mr. Pradeep Gaur and Mr. Amit

Kumar Pandey, Advocates for

the appellant.

Versus

KANIKA SABOO & ORS.

Respondents.

Through: Mr. Arvind Dhingra and

Mr.Pardeep Kumar,

Advocates for the Respondent.

CORAM:HONBLE MR. JUSTICE J.R. MIDHA

1.

Whether Reporters of Local papers may

Be allowed to see the judgment?

2.

To be referred to the Reporters or not?

3.

Whether the judgment should be

reported in the Digest?

ORDER (Oral)

CMs No.17078/2008 and 1303/2009 in

MAC APP.No.596/2008

1.

The appellant has challenged the award of the learned

Tribunal whereby the compensation has been awarded to

claimants/respondents. The challenge is on the ground that

the driver was not holding a valid driving licence at the time

of the accident and, therefore, the Insurance Company is

not liable.

2.

The appeal is pending for hearing. By an interlocutory

order, this Court has directed the Insurance Company to

deposit the entire award amount along with interest with

the learned Tribunal.

MAC APP.No.596/2008

3.

page 1 of 6

The appellant has raised an issue of deduction of TDS

from the interest amount.

4.

It is submitted by the learned counsel for the appellant

that in all cases of deposit of interest amount exceeding

Rs.50,000/- with learned Tribunal or with this Court in

pursuance to an interim order in pending appeals, the

appellant is deducting the TDS and is depositing the

remaining amount with the learned Tribunal or with this

Court, as the case may be, and the TDS certificate is issued

in the name of the learned Tribunal /Registrar General of

this Court.

5.

The learned counsel for the claimants/respondents

No.1 to 9 has strongly opposed the deduction of the TDS on

the ground that the deposit of interest with the Court under

an interim order is not payment of income by way of

interest within the meaning of Section 194A of the IncomeTax Act, 1961 and, therefore, Section 194A would not apply.

6.

Section 194A (1) and (3) (ix) of the Income-Tax Act are

reproduced hereunder:SECTION 194A. (1)

Any

person,

not

being an individual or a Hindu

undivided family, who is responsible

for paying to a resident any income by

way of interest other than income by

way of Interest on securities, shall

at the time of credit of such income to

the account of the payee or at the

time of payment thereof in cash or by

issue of a cheque or draft or by any

other mode, whichever is earlier,

deduct income-tax thereon at the

rates in force.

MAC APP.No.596/2008

page 2 of 6

SECTION

194A (3) - The provisions

of sub-section (1) shall not apply

(ix) to such income credited or paid

by

way

of

interest

on

the

compensation amount awarded by the

Motor Accidents Claims Tribunal where

the amount of such income or, as the

case may, the aggregate of the

amounts of such income credited or

paid during the financial year does not

exceed fifty thousand rupees.

7.

Section 194A (1) has three ingredients which are as

under:(i)

There is payment of income by way of interest

exceeding Rs.50,000/-.

(ii)

The person making payment is responsible to

make the payment.

(iii)

The person receiving the payment is entitled to

receive payment of income by way of interest.

8.

None of the essential requirements of the Section

194A of the Income-Tax Act are satisfied in the present case.

The reasons are as under:(i)

The deposit of interest amount under the order of

this Court pending hearing/decision of the appeal

is not payment of income.

(ii)

The

appellant

is

not

responsible

to

make

payment of income by way of interest to the

Court.

MAC APP.No.596/2008

page 3 of 6

(iii)

The Court is not entitled to any payment of

income by way of interest from the Appellant.

9.

Section 194A(3)(ix) is attracted only to cases where

Section 194A(1) is applicable. Since Section 194A(1) is not

applicable to the present case, Section 194A(3)(ix) shall also

not be attracted.

10.

There is another aspect of this matter. The purpose of

deduction of TDS is to deduct the tax at source is to identify

the income of interest above Rs.50,000/- and also deduct

tax at source and a TDS certificate is issued to the recipient

to enable him to either take adjustment of TDS against his

tax liability or to seek refund if his income is below taxable

limit.

However, the Court is not entitled to receive any

payment of income from the appellant and, therefore, if the

TDS certificate is issued to the Court, the Court can neither

adjust the TDS certificate nor seek the refund against any

head. Rather there is no head for deposit of TDS in favour

of the Court. At a later stage, if the appeal is decided in

favour of the appellant and the money is to be refunded

back to the appellant, the appellant cannot even get the

refund of the TDS amount. On the other hand, if the appeal

is dismissed and the interest amount is released to the

claimants, they also cannot get the credit of the TDS. This

clearly demonstrates that deduction of TDS by the appellant

in the name of the Court and issuance of TDS certificate to

MAC APP.No.596/2008

page 4 of 6

the Court is not within the ambit of Section 194A of the

Income-Tax Act, 1961. It is well settled that if two

interpretations are possible then the one interpretation

which leads to achieving the object of the provision should

be applied.

11.

Since the issue involved in this case pertains to the

Income-tax, it was considered appropriate to seek the

opinion

of

the

Standing

Counsel

of

the

Income-Tax

Department. This court, therefore, requested the learned

Standing Counsel, Mr. Sanjiv Sabharwal to assist this Court.

12.

Mr. Sabharwal, the learned Standing Counsel of the

Income-Tax

Department

has

been

apprised

of

the

controversy and he is present in the Court. Mr. Sabharwal

submits that the appellant is liable to deduct the TDS under

Section 194A of the Income-Tax Act in cases where the

payment of any income by way of interest exceeding

Rs.50,000/- is made directly by the appellant to the

claimant. The learned Standing Counsel submits that the

deposit of interest amount with the Court under the interim

direction of the Court pending final determination of the

rights in appeal is only a inchoate right and, therefore,

Section 194A does not apply and no TDS can be deducted.

The learned Standing Counsel refers and relies upon the

judgment of Apex Court in the case of Commissioner of

Income Tax, West Bengal Vs. Hindustan Housing and Land

MAC APP.No.596/2008

page 5 of 6

Development Trust, 161 (ITR) 425 (1986).

The learned

Standing Counsel further submits that upon the final

decision of the appeal, if the appeal is allowed, then

appellant would be entitled to refund of the deposit amount.

On the other hand if the appeal is dismissed, the interest

amount lying deposited with the Court, would be treated as

income and the claimants will be liable to pay the IncomeTax and, therefore, in order to protect the interest of the

Revenue Department, the Court may send notice to the

Income-Tax Department before release of the amount and

may call for Income Tax Clearance Certificate or deposit of

the Income Tax by the claimant with the Income-Tax

Department.

13.

I agree with the opinion of the learned Standing

Counsel of the Income-Tax Department.

I, therefore, hold

that Section 194A of the Income-Tax Act does not apply to

the

cases

of

deposit

of

interest

amount

exceeding

Rs.50,000/- by the appellant under interim direction of the

Court pending the final determination of the appeal.

MARCH 26, 2009

aj

MAC APP.No.596/2008

J.R. MIDHA, J.

page 6 of 6

Das könnte Ihnen auch gefallen

- Less: Payments Already Made Rs. 2,30,000/-Balance Payable 8,70,000Dokument2 SeitenLess: Payments Already Made Rs. 2,30,000/-Balance Payable 8,70,000daljitsodhiNoch keine Bewertungen

- Memorandum of UnderstandingDokument11 SeitenMemorandum of UnderstandingdaljitsodhiNoch keine Bewertungen

- Muslim MarriageDokument23 SeitenMuslim MarriagedaljitsodhiNoch keine Bewertungen

- Chapter 3 Fibre To FabricDokument2 SeitenChapter 3 Fibre To FabricdaljitsodhiNoch keine Bewertungen

- Memorandum of UnderstandingDokument11 SeitenMemorandum of UnderstandingdaljitsodhiNoch keine Bewertungen

- Chapter 2 Globe Latitudes and LongitudesDokument3 SeitenChapter 2 Globe Latitudes and LongitudesdaljitsodhiNoch keine Bewertungen

- This Article Is Written by Nipasha MahantaDokument15 SeitenThis Article Is Written by Nipasha MahantadaljitsodhiNoch keine Bewertungen

- Memorandum of UnderstandingDokument11 SeitenMemorandum of UnderstandingdaljitsodhiNoch keine Bewertungen

- Memorandum of UnderstandingDokument10 SeitenMemorandum of UnderstandingdaljitsodhiNoch keine Bewertungen

- Reply 125 CRPCDokument15 SeitenReply 125 CRPCdaljitsodhi100% (11)

- Chapter 4 Maps-Social ScienceDokument3 SeitenChapter 4 Maps-Social SciencedaljitsodhiNoch keine Bewertungen

- SUBJECT: Appointment As Enquiry OfficerDokument2 SeitenSUBJECT: Appointment As Enquiry OfficerdaljitsodhiNoch keine Bewertungen

- Earth in Solar System Class 6 Chapter 1 Social ScienceDokument3 SeitenEarth in Solar System Class 6 Chapter 1 Social SciencedaljitsodhiNoch keine Bewertungen

- Chapter 2 Components of FoodDokument2 SeitenChapter 2 Components of FooddaljitsodhiNoch keine Bewertungen

- Delhi High Court compensation case for child's deathDokument15 SeitenDelhi High Court compensation case for child's deathdaljitsodhiNoch keine Bewertungen

- In The High Court of Delhi at New Delhi FAO No. 884/2003Dokument12 SeitenIn The High Court of Delhi at New Delhi FAO No. 884/2003daljitsodhiNoch keine Bewertungen

- In The High Court of Delhi at New DelhiDokument13 SeitenIn The High Court of Delhi at New DelhidaljitsodhiNoch keine Bewertungen

- Chapter 1 Food - Where Does It Come FromDokument2 SeitenChapter 1 Food - Where Does It Come FromdaljitsodhiNoch keine Bewertungen

- FAO - No.842-2003Dokument5 SeitenFAO - No.842-2003daljitsodhiNoch keine Bewertungen

- In The High Court of Delhi at New DelhiDokument13 SeitenIn The High Court of Delhi at New DelhidaljitsodhiNoch keine Bewertungen

- Insurance Company Ordered to Pay Compensation in 12-Year-Old Accident CaseDokument19 SeitenInsurance Company Ordered to Pay Compensation in 12-Year-Old Accident CasedaljitsodhiNoch keine Bewertungen

- FAO - No.842-2003Dokument20 SeitenFAO - No.842-2003daljitsodhiNoch keine Bewertungen

- Insurance Company Ordered to Pay Compensation in 12-Year-Old Accident CaseDokument19 SeitenInsurance Company Ordered to Pay Compensation in 12-Year-Old Accident CasedaljitsodhiNoch keine Bewertungen

- SALE LETTER AFFIDAVITDokument5 SeitenSALE LETTER AFFIDAVITRadhey Paliwal74% (76)

- Delhi High Court Judgment on Motor Accident Compensation CaseDokument10 SeitenDelhi High Court Judgment on Motor Accident Compensation CasedaljitsodhiNoch keine Bewertungen

- In The High Court of Delhi at New DelhiDokument6 SeitenIn The High Court of Delhi at New DelhidaljitsodhiNoch keine Bewertungen

- In The High Court of Delhi at New Delhi: MAC - APP.Nos.135/2008 & 359/2008Dokument8 SeitenIn The High Court of Delhi at New Delhi: MAC - APP.Nos.135/2008 & 359/2008daljitsodhiNoch keine Bewertungen

- In The High Court of Delhi at New Delhi FAO 116/1998: RD STDokument10 SeitenIn The High Court of Delhi at New Delhi FAO 116/1998: RD STdaljitsodhiNoch keine Bewertungen

- Delhi High Court increases maintenance in matrimonial caseDokument4 SeitenDelhi High Court increases maintenance in matrimonial casedaljitsodhiNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Obligations and Contracts TestDokument28 SeitenObligations and Contracts TestHazel Marie De GuzmanNoch keine Bewertungen

- NIT SpecificationsDokument28 SeitenNIT SpecificationsUniversal MinconNoch keine Bewertungen

- BillDokument14 SeitenBillvikramNoch keine Bewertungen

- Your July Bank StatementDokument2 SeitenYour July Bank StatementA VNoch keine Bewertungen

- Banking Domain KnowledgeDokument15 SeitenBanking Domain KnowledgeanraomcaNoch keine Bewertungen

- Cash BudgetDokument10 SeitenCash BudgetShrinivasan IyengarNoch keine Bewertungen

- I General: Internal Audit ChecklistDokument33 SeitenI General: Internal Audit ChecklistHimanshu GaurNoch keine Bewertungen

- Moot Problem First YearsDokument10 SeitenMoot Problem First YearsudishaNoch keine Bewertungen

- Fixedline and Broadband Services: Your Account Summary This Month'S ChargesDokument2 SeitenFixedline and Broadband Services: Your Account Summary This Month'S ChargesVinay MohanNoch keine Bewertungen

- Us So You Want To Be A Crypto BankDokument18 SeitenUs So You Want To Be A Crypto BankTingNoch keine Bewertungen

- Reservation Confirmation: Your BookingDokument2 SeitenReservation Confirmation: Your Booking王梓乔Noch keine Bewertungen

- CrossCompany InterCompany TransactionsDokument8 SeitenCrossCompany InterCompany TransactionspaiashokNoch keine Bewertungen

- Electronic Payment Systems: 20-751 ECOMMERCE Technology SUMMER 2002 Michael I. ShamosDokument24 SeitenElectronic Payment Systems: 20-751 ECOMMERCE Technology SUMMER 2002 Michael I. ShamosPriyanka GautamNoch keine Bewertungen

- Understand Joint and Solidary ObligationsDokument85 SeitenUnderstand Joint and Solidary Obligationslena cpaNoch keine Bewertungen

- BKAL1013 A201 Tutorial 3 333Dokument6 SeitenBKAL1013 A201 Tutorial 3 333yussuf mohamedNoch keine Bewertungen

- VoucherDokument11 SeitenVoucherRoger Cabarles IIINoch keine Bewertungen

- Chapter 22 CPWD ACCOUNTS CODEDokument26 SeitenChapter 22 CPWD ACCOUNTS CODEarulraj1971Noch keine Bewertungen

- EBS ConfigurationDokument15 SeitenEBS ConfigurationPrateek100% (2)

- Carding Vocabulary and Understanding TermsDokument4 SeitenCarding Vocabulary and Understanding TermsTrex InfernoNoch keine Bewertungen

- Disbursement Voucher: Department of The Interior and Local GovernmentDokument35 SeitenDisbursement Voucher: Department of The Interior and Local GovernmentRobert Dela Cruz LamelaNoch keine Bewertungen

- Sage Accounting Software PDFDokument32 SeitenSage Accounting Software PDFvaall4me410% (1)

- RMG Inc. ClaimDokument2 SeitenRMG Inc. ClaimCarl AKA Imhotep Heru ElNoch keine Bewertungen

- Pgm2017 ProsDokument76 SeitenPgm2017 ProsAnto PaulNoch keine Bewertungen

- Project Report On Everest Bank LTDDokument28 SeitenProject Report On Everest Bank LTDdt_rock4463% (24)

- Telangana: Gramin Rojgar Kaylan SansthanDokument3 SeitenTelangana: Gramin Rojgar Kaylan Sansthanjhoganpallisanthosh goudNoch keine Bewertungen

- People vs. Sindiong and Pastor (77 Phil. 1000)Dokument2 SeitenPeople vs. Sindiong and Pastor (77 Phil. 1000)Cherry Ann Cubelo NamocNoch keine Bewertungen

- First Division Engr. Jose E. Cayanan, G.R. No. 172954: ChairpersonDokument4 SeitenFirst Division Engr. Jose E. Cayanan, G.R. No. 172954: ChairpersonJaysieMicabaloNoch keine Bewertungen

- MT103Dokument6 SeitenMT103wisnu ipasarNoch keine Bewertungen

- WellsFargoDokument12 SeitenWellsFargoqazimoeez191Noch keine Bewertungen

- AGS Irrigation Raingun QuotationDokument1 SeiteAGS Irrigation Raingun QuotationAnonymous HdscNyJNoch keine Bewertungen