Beruflich Dokumente

Kultur Dokumente

IMT-59 Fin

Hochgeladen von

rranjan64Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

IMT-59 Fin

Hochgeladen von

rranjan64Copyright:

Verfügbare Formate

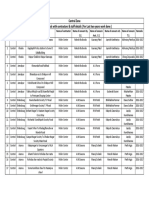

INSTITUTE OF MANAGEMENT TECHNOLOGY

CENTRE FOR DISTANCE LEARNING

GHAZIABAD

End-Term Examinations – June 2009

Subject Code : IMT-59 Time Allowed : 3 Hours

Subject Name: Financial Management Max. Marks : 50

Notes: (a) Answer any FOUR questions from SECTION-A and CASE STUDY as given in SECTION-B.

Each Question (SECTION-A) carries 9 MARKS and (SECTION-B) Case Study carries 14 MARKS.

(b) No doubts/clarifications shall be entertained. In case of doubts/clarifications, make reasonable assumptions and proceed.

(c) For students enrolled in January 2008, July 2008 and January 2009 batches, the Question Paper would be treated for

70 marks instead of 50 marks.

SECTION-A MARKS : 36

Q.1 Explain the need for financial analysis. How does the use of ratios help in financial analysis?

Q.2 Discuss any three of the following:

a) Yield to maturity

b) Relevance of MM approach in capital structure

c) Bonus shares

d) Cash conversion cycle

Q.3 (a) A finance company advertises that it will pay a lump sum of Rs44650 at the end of 5 years to investors who deposit

annually Rs 6000 for 5 years. What is the interest rate implicit in this offer?

(b) A company’s bonds have a par value of Rs 100, maturity in seven years, and carry a coupon rate of 12% payable

semi-annually. If the appropriate discount rate is 16%, what price should the bond command in the market place?

Q.4 Differentiate between:

a) Mutually Exclusive and Independent Investment

b) Basic and diluted earning per share

c) Aggressive & matching approach of financing working capital

Q.5 Current market price of share of A Ltd. is Rs 134/- . Company is currently paying the dividened of Rs 3.5 per share ,

dividend is expected to grow at 15 % over the next six years and then at the rate of 8 % perpetually. Calculate the cost of

equity capital.

Q.6 What issue arises when the firm is deciding how to partition profits between dividend and retained earning?

Q.7 Strong Enterprises Ltd. is a manufacturer of high quality running shoes. Ms Dazlling, President, is considering

computerizing the company’s ordering, inventory and billing procedures. She estimates that the annual savings from

computerization include a reduction of ten clerical employees with annual salaries of Rs 15000 each, Rs 8000 from

reduced production delays caused by raw materials inventory problems, Rs 12000 from lost sales due to inventory

stockouts, and Rs 3000 associated with timely billing procedures. The purchase price of system is Rs 2,00,000 and

installation costs are Rs 50000. These outlays will be depreciated on straight line basis to a zero book salvage value

which is also its market value at the end of five years. Operation of the new system requires two computer specialists with

annual salaries of Rs 40000 per person. Also annual maintenance and operating cash expenses of Rs 12000 are

estimated to be required. The company’s tax rate is 40 % and its required rate of return for this project is 12%.

You are required to:

a) Find the projects initial cash outlay

b) Find the projects operating and terminal value cash flows over its 5 year life

c) Evaluate the project using NPV method

d) Evaluate the project using PI method

e) Calculate the projects pay back period

SECTION-B (Case Study) MARKS : 14

Metcalf Engineers is considering a proposal to replace one of its hammers. The following information is available:

a) The existing hammer was bought 2 years ago for Rs 10 lakh. It has been depreciated at the rate 33.33 percent per

annum. It can be presently sold at its book value. It has remaining life of 5 years after which on disposal, it would fetch a

value equal to its the then book value.

b) The new hammer costs Rs 16 lakhs , it will subject to a depreciation rate of 33.33%. After 5 years it is expected to fetch a

value equal to its book value. The replacement of the old hammer would increase revenues by Rs 2 lakhs per year and

reduce operating cost ( excluding depreciation) by Rs 1.5 lakh per year.

Compute the incremental post tax cash flows associated with the replacement proposal, assuming the tax rate of 50%

23-6-2009 (E) Page 1 of 1 IMT-59

Das könnte Ihnen auch gefallen

- Dec 2008Dokument2 SeitenDec 2008tdewanjeeNoch keine Bewertungen

- Economic Insights from Input–Output Tables for Asia and the PacificVon EverandEconomic Insights from Input–Output Tables for Asia and the PacificNoch keine Bewertungen

- Institute of Management Technology: Centre For Distance LearningDokument2 SeitenInstitute of Management Technology: Centre For Distance Learningabhimani5472Noch keine Bewertungen

- Institute of Management Technology: Centre For Distance LearningDokument1 SeiteInstitute of Management Technology: Centre For Distance Learningmahendernayal007Noch keine Bewertungen

- Developing Airport Systems in Asian Cities: Spatial Characteristics, Economic Effects, and Policy ImplicationsVon EverandDeveloping Airport Systems in Asian Cities: Spatial Characteristics, Economic Effects, and Policy ImplicationsNoch keine Bewertungen

- PPAC AssignDokument13 SeitenPPAC AssignTs'epo MochekeleNoch keine Bewertungen

- Assessment 1 October 2021 POCFDokument2 SeitenAssessment 1 October 2021 POCFAakanksha ChughNoch keine Bewertungen

- Chemical Plant Design and Economics - R2009 - 29!05!2014Dokument2 SeitenChemical Plant Design and Economics - R2009 - 29!05!2014rahulNoch keine Bewertungen

- P3 Strategic Financial Management Question and Answer Dec 2014Dokument21 SeitenP3 Strategic Financial Management Question and Answer Dec 2014CLIVENoch keine Bewertungen

- Dfi 305 - DL Assg July 2012Dokument6 SeitenDfi 305 - DL Assg July 2012jhouvanNoch keine Bewertungen

- Questions For Group 1: S.B.Khatri-FM-AIMDokument6 SeitenQuestions For Group 1: S.B.Khatri-FM-AIMAbhishek singhNoch keine Bewertungen

- Questions For Group 1: S.B.Khatri-FM-AIMDokument6 SeitenQuestions For Group 1: S.B.Khatri-FM-AIMAbhishek singhNoch keine Bewertungen

- MB0029Dokument3 SeitenMB0029Tenzin KunchokNoch keine Bewertungen

- Ininstitute of Management Technology: Centre For Distance LearningDokument2 SeitenIninstitute of Management Technology: Centre For Distance Learningabhimani5472Noch keine Bewertungen

- Project Appraisal MBA-IVDokument11 SeitenProject Appraisal MBA-IVnareshbansal130Noch keine Bewertungen

- Spring 2009 Mgt201 3 VuabidDokument5 SeitenSpring 2009 Mgt201 3 Vuabidsaeedsjaan100% (3)

- FM MITSoB Capital - Budgeting Exercises)Dokument3 SeitenFM MITSoB Capital - Budgeting Exercises)Saket SumanNoch keine Bewertungen

- ACC208 Sem 2 2021Dokument3 SeitenACC208 Sem 2 202120220354Noch keine Bewertungen

- Question Paper of FMDokument3 SeitenQuestion Paper of FMsrijana pathakNoch keine Bewertungen

- Ex.C.BudgetDokument3 SeitenEx.C.BudgetGeethika NayanaprabhaNoch keine Bewertungen

- Capital BudgetingDokument75 SeitenCapital Budgetingsubroshakar gamerNoch keine Bewertungen

- Capital Budgeting TechniquesDokument2 SeitenCapital Budgeting TechniquesmananipratikNoch keine Bewertungen

- Project Appraisal 1Dokument23 SeitenProject Appraisal 1Fareha RiazNoch keine Bewertungen

- Project Appraisal-1 PDFDokument23 SeitenProject Appraisal-1 PDFFareha RiazNoch keine Bewertungen

- sFikv8tLO3DuTOB3I8bY 4762Dokument2 SeitensFikv8tLO3DuTOB3I8bY 4762dipusharma4200Noch keine Bewertungen

- CA Inter FM SM Q MTP 2 May 2024 Castudynotes ComDokument12 SeitenCA Inter FM SM Q MTP 2 May 2024 Castudynotes ComsaurabhNoch keine Bewertungen

- ECON F411 - MidTerm Paper - 2019-20Dokument2 SeitenECON F411 - MidTerm Paper - 2019-20AdityaNoch keine Bewertungen

- 18ME51 Model Question Paper - With Effect From 2020-21 (CBCS Scheme) Fifth Semester B.E. Degree Examination Management and EconomicsDokument10 Seiten18ME51 Model Question Paper - With Effect From 2020-21 (CBCS Scheme) Fifth Semester B.E. Degree Examination Management and EconomicsSunilkumar M SNoch keine Bewertungen

- Assignment Drive WINTER 2013 Program Mbads/ Mbaflex/ Mbahcsn3/ Mban2/ Pgdban2 Semester II Subject Code & Name MB0045 Financial Management BK Id B1628 Credit 4 Marks 60Dokument2 SeitenAssignment Drive WINTER 2013 Program Mbads/ Mbaflex/ Mbahcsn3/ Mban2/ Pgdban2 Semester II Subject Code & Name MB0045 Financial Management BK Id B1628 Credit 4 Marks 60Dhruvik PatelNoch keine Bewertungen

- Investment Appraisal TAE TESTDokument2 SeitenInvestment Appraisal TAE TESTJames MartinNoch keine Bewertungen

- Sem IV (Internal 2010)Dokument15 SeitenSem IV (Internal 2010)anandpatel2991Noch keine Bewertungen

- Investment Decisions Problems 2Dokument5 SeitenInvestment Decisions Problems 2MussaNoch keine Bewertungen

- Financial Management-Capital Budgeting:: Answer The Following QuestionsDokument2 SeitenFinancial Management-Capital Budgeting:: Answer The Following QuestionsMitali JulkaNoch keine Bewertungen

- Indian Institute of Technology Kharagpur: (Treat Multiplier As The Reciprocal of Marginal Demand Propensities)Dokument2 SeitenIndian Institute of Technology Kharagpur: (Treat Multiplier As The Reciprocal of Marginal Demand Propensities)maimslapNoch keine Bewertungen

- Tutorial 2Dokument5 SeitenTutorial 2Hirushika BandaraNoch keine Bewertungen

- P1 Question June 2019Dokument6 SeitenP1 Question June 2019S.M.A AwalNoch keine Bewertungen

- Use of Statistical Tables PermittedDokument2 SeitenUse of Statistical Tables PermittedPAVAN KUMARNoch keine Bewertungen

- Financial Management Assg-1Dokument6 SeitenFinancial Management Assg-1Udhay ShankarNoch keine Bewertungen

- Assignment For CB TechniquesDokument2 SeitenAssignment For CB TechniquesRahul TirmaleNoch keine Bewertungen

- BSF 1102 - Principles of Finance - November 2022Dokument6 SeitenBSF 1102 - Principles of Finance - November 2022JulianNoch keine Bewertungen

- BBMF2093 24octDokument4 SeitenBBMF2093 24octyvonneapj-wb22Noch keine Bewertungen

- CS Final - Financial Tresurs and Forex Management - June 2004Dokument4 SeitenCS Final - Financial Tresurs and Forex Management - June 2004Rushikesh DeshmukhNoch keine Bewertungen

- 4a. Capital BudgetingDokument6 Seiten4a. Capital BudgetingShubhrant ShuklaNoch keine Bewertungen

- Q and As-Corporate Financial Management - June 2010 Dec 2010 and June 2011Dokument71 SeitenQ and As-Corporate Financial Management - June 2010 Dec 2010 and June 2011chisomo_phiri72290% (2)

- MFE 10 - Project Planning and AppraisalDokument4 SeitenMFE 10 - Project Planning and AppraisalKushan Chanaka AmarasingheNoch keine Bewertungen

- Engineering Economics and Finacial Management (HUM 3051)Dokument5 SeitenEngineering Economics and Finacial Management (HUM 3051)uday KiranNoch keine Bewertungen

- 05 Exercises On Capital BudgetingDokument4 Seiten05 Exercises On Capital BudgetingAnshuman AggarwalNoch keine Bewertungen

- MTP 19 53 Questions 1713430127Dokument12 SeitenMTP 19 53 Questions 1713430127Murugesh MuruNoch keine Bewertungen

- 7ACCN018W - Exam July 2020 (MODIFIED 19 MAY 2020)Dokument11 Seiten7ACCN018W - Exam July 2020 (MODIFIED 19 MAY 2020)hazyhazy9977Noch keine Bewertungen

- MAF603-QUESTION TEST 2 - Dec 2018Dokument4 SeitenMAF603-QUESTION TEST 2 - Dec 2018fareen faridNoch keine Bewertungen

- Activity - Capital Investment AnalysisDokument5 SeitenActivity - Capital Investment AnalysisKATHRYN CLAUDETTE RESENTENoch keine Bewertungen

- Capital Budgeting SumsDokument6 SeitenCapital Budgeting SumsDeep DebnathNoch keine Bewertungen

- F 9Dokument32 SeitenF 9billyryan1100% (2)

- Break-Even Analysis and New Design Economics - Ii: (Draw Profit Volume Diagram)Dokument7 SeitenBreak-Even Analysis and New Design Economics - Ii: (Draw Profit Volume Diagram)Garima PalNoch keine Bewertungen

- UntitledDokument5 SeitenUntitledbetty KemNoch keine Bewertungen

- BComDokument3 SeitenBComChristy jamesNoch keine Bewertungen

- Capital Expenditure DecisionDokument10 SeitenCapital Expenditure DecisionRakesh GuptaNoch keine Bewertungen

- Motion Exhibit 4 - Declaration of Kelley Lynch - 03.16.15 FINALDokument157 SeitenMotion Exhibit 4 - Declaration of Kelley Lynch - 03.16.15 FINALOdzer ChenmaNoch keine Bewertungen

- Contoh RPH Ts 25 Engish (Ppki)Dokument1 SeiteContoh RPH Ts 25 Engish (Ppki)muhariz78Noch keine Bewertungen

- Morocco Top ScientistsDokument358 SeitenMorocco Top Scientistsa.drioicheNoch keine Bewertungen

- Xavier High SchoolDokument1 SeiteXavier High SchoolHelen BennettNoch keine Bewertungen

- Field Assignment On Feacal Sludge ManagementDokument10 SeitenField Assignment On Feacal Sludge ManagementSarah NamyaloNoch keine Bewertungen

- Discrete Probability Distribution UpdatedDokument44 SeitenDiscrete Probability Distribution UpdatedWaylonNoch keine Bewertungen

- National Bank Act A/k/a Currency Act, Public Law 38, Volume 13 Stat 99-118Dokument21 SeitenNational Bank Act A/k/a Currency Act, Public Law 38, Volume 13 Stat 99-118glaxayiii100% (1)

- My Parenting DnaDokument4 SeitenMy Parenting Dnaapi-468161460Noch keine Bewertungen

- IBM Unit 3 - The Entrepreneur by Kulbhushan (Krazy Kaksha & KK World)Dokument4 SeitenIBM Unit 3 - The Entrepreneur by Kulbhushan (Krazy Kaksha & KK World)Sunny VarshneyNoch keine Bewertungen

- Medicidefamilie 2011Dokument6 SeitenMedicidefamilie 2011Mesaros AlexandruNoch keine Bewertungen

- (Methods in Molecular Biology 1496) William J. Brown - The Golgi Complex - Methods and Protocols-Humana Press (2016)Dokument233 Seiten(Methods in Molecular Biology 1496) William J. Brown - The Golgi Complex - Methods and Protocols-Humana Press (2016)monomonkisidaNoch keine Bewertungen

- DMSCO Log Book Vol.25 1947Dokument49 SeitenDMSCO Log Book Vol.25 1947Des Moines University Archives and Rare Book RoomNoch keine Bewertungen

- Science Project FOLIO About Density KSSM Form 1Dokument22 SeitenScience Project FOLIO About Density KSSM Form 1SarveesshNoch keine Bewertungen

- ICONS+Character+Creator+2007+v0 73Dokument214 SeitenICONS+Character+Creator+2007+v0 73C.M. LewisNoch keine Bewertungen

- TestDokument56 SeitenTestFajri Love PeaceNoch keine Bewertungen

- Water and Wastewater For Fruit JuiceDokument18 SeitenWater and Wastewater For Fruit JuiceJoyce Marian BelonguelNoch keine Bewertungen

- Jaimini Astrology and MarriageDokument3 SeitenJaimini Astrology and MarriageTushar Kumar Bhowmik100% (1)

- Economies of Scale in European Manufacturing Revisited: July 2001Dokument31 SeitenEconomies of Scale in European Manufacturing Revisited: July 2001vladut_stan_5Noch keine Bewertungen

- Magnetism 1Dokument4 SeitenMagnetism 1krichenkyandex.ruNoch keine Bewertungen

- Q3 Grade 8 Week 4Dokument15 SeitenQ3 Grade 8 Week 4aniejeonNoch keine Bewertungen

- Transfer Pricing 8Dokument34 SeitenTransfer Pricing 8nigam_miniNoch keine Bewertungen

- All Zone Road ListDokument46 SeitenAll Zone Road ListMegha ZalaNoch keine Bewertungen

- GemDokument135 SeitenGemZelia GregoriouNoch keine Bewertungen

- Feuerhahn Funeral Bullet 17 March 2015Dokument12 SeitenFeuerhahn Funeral Bullet 17 March 2015brandy99Noch keine Bewertungen

- Final Module in Human BehaviorDokument60 SeitenFinal Module in Human BehaviorNarag Krizza50% (2)

- Labor Rules English Noi Quy Bang Tieng Anh PDFDokument27 SeitenLabor Rules English Noi Quy Bang Tieng Anh PDFNga NguyenNoch keine Bewertungen

- BirdLife South Africa Checklist of Birds 2023 ExcelDokument96 SeitenBirdLife South Africa Checklist of Birds 2023 ExcelAkash AnandrajNoch keine Bewertungen

- Project Report On ICICI BankDokument106 SeitenProject Report On ICICI BankRohan MishraNoch keine Bewertungen

- Custom Belt Buckles: Custom Brass Belt Buckles - Hand Made in The USA - Lifetime Guarantee of QualityDokument1 SeiteCustom Belt Buckles: Custom Brass Belt Buckles - Hand Made in The USA - Lifetime Guarantee of QualityAndrew HunterNoch keine Bewertungen

- Mooting ExampleDokument35 SeitenMooting Exampleluziro tenNoch keine Bewertungen

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyVon EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyBewertung: 4.5 von 5 Sternen4.5/5 (37)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Von EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Bewertung: 4.5 von 5 Sternen4.5/5 (13)

- Getting to Yes: How to Negotiate Agreement Without Giving InVon EverandGetting to Yes: How to Negotiate Agreement Without Giving InBewertung: 4 von 5 Sternen4/5 (652)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Von EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Bewertung: 4.5 von 5 Sternen4.5/5 (5)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindVon EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindBewertung: 5 von 5 Sternen5/5 (231)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyVon EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyBewertung: 5 von 5 Sternen5/5 (1)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingVon EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingBewertung: 4.5 von 5 Sternen4.5/5 (17)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNVon Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNBewertung: 4.5 von 5 Sternen4.5/5 (3)

- Finance Basics (HBR 20-Minute Manager Series)Von EverandFinance Basics (HBR 20-Minute Manager Series)Bewertung: 4.5 von 5 Sternen4.5/5 (32)

- Value: The Four Cornerstones of Corporate FinanceVon EverandValue: The Four Cornerstones of Corporate FinanceBewertung: 4.5 von 5 Sternen4.5/5 (18)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaVon EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaBewertung: 4.5 von 5 Sternen4.5/5 (14)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceVon EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNoch keine Bewertungen

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursVon EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursBewertung: 4.5 von 5 Sternen4.5/5 (8)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditVon EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditBewertung: 5 von 5 Sternen5/5 (1)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successVon EverandReady, Set, Growth hack:: A beginners guide to growth hacking successBewertung: 4.5 von 5 Sternen4.5/5 (93)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelVon Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNoch keine Bewertungen

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialVon EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialBewertung: 4.5 von 5 Sternen4.5/5 (32)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisVon EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisBewertung: 5 von 5 Sternen5/5 (6)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantVon EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantBewertung: 4.5 von 5 Sternen4.5/5 (146)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetVon EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetBewertung: 5 von 5 Sternen5/5 (2)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Von EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Bewertung: 4 von 5 Sternen4/5 (33)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsVon EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsBewertung: 5 von 5 Sternen5/5 (1)