Beruflich Dokumente

Kultur Dokumente

Bizmanualz Banking Management Policies and Procedures Sample

Hochgeladen von

Ye PhoneCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bizmanualz Banking Management Policies and Procedures Sample

Hochgeladen von

Ye PhoneCopyright:

Verfügbare Formate

Bizmanualz Sample from the Banking Management Policies and Procedures Manual

includes

an example policy, procedure, a list of topics, forms and job descriptions

Banking Management Policies and Procedures Manual

US$ 89.95

How to Order:

Online:

www.bizmanualz.com

By Phone: 314-384-4183

866-711-5837

Email: sales@bizmanualz.com

These Banking Procedures will assist retail banking facilities in preparing

a Standard Operating Procedures (SOP) Manual for their small to

medium-size banks. It can be customized to fit your bank staff and

operations. The content also supplements Bizmanualz core procedures

manuals for Accounting and Human Resources. The Banking

Procedures cover the key functions of retail banking including demand

deposit transactions, credit card ATM processing, teller operations and

wire transfers

Instant download

What is included?

Available immediately

Over 90 pages of

(no shipping required)

documentation

10 Banking Policies and

Procedures

10 Corresponding Forms

How To Manual Preparation

Guide

Fully editable content in MS

Word Files

Sample Policy from Banking Management Policies and

Procedures

Document ID

BNK 103

Revision

0.0

Effective Date

mm/dd/yyyy

Title

FUNDS AVAILABILITY AND STOP

PAYMENTS

Prepared By

Preparers Name/Title

Reviewed By

Reviewers Name/Title

Approved By

Final Approvers Name/Title

Print Date

mm/dd/yyyy

Date Prepared

mm/dd/yyyy

Date Reviewed

mm/dd/yyyy

Date Approved

mm/dd/yyyy

Title:BNK103 FUNDS AVAILABILITY AND STOP PAYMENTS

Policy:

To provide funds in the form of cash deposits, wires, and ABC Bank checks to the

customer in a timely manner, and to provide the customer the option of stopping

payment of a check at the customers request.

Purpose:

To outline the guidelines for determining the availability of funds, and explain the

procedures for stopping payment of a check.

Scope:

Funds Availability guidelines apply only to basic checking and savings accounts

and only to check deposits or items payable as cash items. Other accounts such as

Money Market Accounts, Certificates of Deposit, Individual Retirement

Accounts, etc., may have more specific guidelines, which are to be provided to

Bizmanualz Sample from the Banking Management Policies and Procedures Manual

includes

an example policy, procedure, a list of topics, forms and job descriptions

the customer at the time of opening an account. Stop payments apply to checking

accounts.

Definition:

Business days include each day the bank is open for business. Saturdays,

Sundays, and holidays are not considered business days.

Procedure:

1.0 FUNDS AVAILABILITY

1.1

The first business day after the day funds in the form of cash, wires, ABC Bank checks,

and most other checks are deposited, they will be made available to the customer for

withdrawal in most instances. Automatic or direct deposits will be available the day they

are received.

1.2

The date of deposit will be the same day of a deposit received at the bank before closing,

at an Automated Teller Machine owned or operated by ABC Bank prior to 3:00 p.m., or

in the night depository before the posted cut-off time. If, in any circumstances, the

deposit is other than these, the date of deposit will be the following business day.

1.3

In some circumstances (see below) the customers deposit may not be available until a

later date. This will necessitate a hold being placed on the funds. The customer should

be immediately notified if the funds are not available. If the customer has already left the

bank, he or she will need to be mailed a notice stating the reason the funds are being

delayed, the amount of funds not available, and the date the delay will be released.

Examples of when the funds may not be immediately available include:

The bank has reasonable cause to believe a check deposited by the customer will

not be paid

The total amount of checks deposited to a customers account is more than $3,500

A check returned unpaid is redeposited

The account has a history of excessive overdrafts

1.4

Unexpected emergencies, such as temporary communication or computer failures, may

also delay the availability of funds.

1.5

Complete BNK103 Ex1 Hold Card, if a hold needs to be placed on the account.

2.0 STOP PAYMENTS

2.1

Stop payments are a service provided to the customer in the event the customer does not

want a check he or she has written to be paid. It is important to place the stop payment

information on the account as quickly as possible to prevent losses.

2.2

Inform the customer that his or account will be charged $15.00 for this service.

2.4

The following information must be obtained from the customer and placed on BNK103

Ex 2 Stop Payment Form:

Bizmanualz Sample from the Banking Management Policies and Procedures Manual

includes

an example policy, procedure, a list of topics, forms and job descriptions

Customers name, address, and a telephone number where the customer can be

reached during banking hours.

Account number

Check number

Date of the check

Who the check is made payable to

Amount of the check

Reason for the stop payment

2.5

This information needs to be placed on the account and given to the bookkeepers.

2.6

The customer will need to sign the stop payment form within ten business days. The stop

payment will be placed on the account for six months.

2.7

If the customer would like to release the stop payment, they need to come in the bank and

sign a release. It is important that the customer understands that by signing the release,

he or she has agreed to allow the check to be paid.

Revision History:

Revision

0

Date

Description of changes

mm/dd/yy Initial Release

yy

Requested By

Bizmanualz Sample from the Banking Management Policies and Procedures Manual

includes

an example policy, procedure, a list of topics, forms and job descriptions

]BNK103 Ex1 HOLD CARD

Account Name:

Account Number:

Amount of hold:$

Release Date:

Reason for hold:

Other Information:

Employees Signature

Date

Approving Supervisors Signature

Time

NOTE: Your account will be charged $15.00 for this service.

Bizmanualz Sample from the Banking Management Policies and Procedures Manual

includes

an example policy, procedure, a list of topics, forms and job descriptions

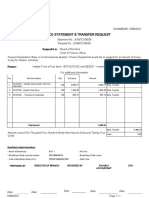

BNK103 Ex2 STOP PAYMENT FORM

Customers Name:

Account Number:

Amount:$

Check Number:

Check made payable to:

Check date:

Release date:

Reason for stop payment:

Reissued? r YES r NO

If so, check number and date:

Other Information:

Customers Signature

Date

Information placed on customers account? r YES r NO

Employees signature

Date

Approving Supervisors Signature

Time

Bizmanualz Sample from the Banking Management Policies and Procedures Manual

includes

an example policy, procedure, a list of topics, forms and job descriptions

Banking Management Policies and Procedures Manual:

10 Prewritten Policies and Procedures

1. ATM Card or VISA Debit CardLine of Credit

2. Foreign Currency

3. Funds Availability

4. Incoming and Outgoing Collections

5. Lost Stolen Checks, ATM Cards and

NS Funds

6. Opening and Closing Accounts

7. Teller Transactions

8. Wire Transfers

9. Bank Security

10. Guard Force Management

10 Prewritten Forms and Records

1.

2.

3.

4.

5.

Hold Card

Stop Payment Form

Lost/Stolen Form

Closing Form

Photocopy Request Form

6. Change of Address Form

7. Wire Transfer Form

8. Recurring Wire Transfer Form

9. Key Issue Policy

10. Special Incident Report Form

Das könnte Ihnen auch gefallen

- Financial Policy and Procedure Manual TemplateDokument31 SeitenFinancial Policy and Procedure Manual TemplatevanausabNoch keine Bewertungen

- APES 310 Audit ProgramDokument13 SeitenAPES 310 Audit ProgramShamir Gupta100% (1)

- PGL Payor Draft NSJ - 6Dokument15 SeitenPGL Payor Draft NSJ - 6Kicki Andersson100% (1)

- PPP and Dry Port - Cambodian PresentationDokument13 SeitenPPP and Dry Port - Cambodian PresentationYe PhoneNoch keine Bewertungen

- Account Closure/ Fixed Deposit Premature Withdrawal FormDokument1 SeiteAccount Closure/ Fixed Deposit Premature Withdrawal Formrony1346100% (1)

- Systematizing The Debt Collection ProcessDokument7 SeitenSystematizing The Debt Collection ProcessNigel A.L. BrooksNoch keine Bewertungen

- Loan Agreement: Pty LimitedDokument15 SeitenLoan Agreement: Pty LimitedoutmaticNoch keine Bewertungen

- Financial Policy and Procedures ManualDokument18 SeitenFinancial Policy and Procedures ManualAahna Mittal100% (1)

- Ncnda+Imfpa en Blanco 3333.auDokument9 SeitenNcnda+Imfpa en Blanco 3333.auflint1967100% (1)

- Bizmanualz CEO Policies and Procedures Series 2Dokument20 SeitenBizmanualz CEO Policies and Procedures Series 2Ye PhoneNoch keine Bewertungen

- Audit of The Sales and Receipt Cycle: Tests of Controls and Substantive Tests of TransactionsDokument56 SeitenAudit of The Sales and Receipt Cycle: Tests of Controls and Substantive Tests of TransactionsErica Mae ZuluetaNoch keine Bewertungen

- DCB NRE Account OpeningDokument8 SeitenDCB NRE Account OpeningAbhay AgrawalNoch keine Bewertungen

- Amended Branch Less Banking Regulations - 6!20!2011Dokument37 SeitenAmended Branch Less Banking Regulations - 6!20!2011syedjanNoch keine Bewertungen

- DepositpolicyDokument21 SeitenDepositpolicyBalaji Jagalpure100% (1)

- Sterling Bank PLC - 2008 Annual ReportDokument100 SeitenSterling Bank PLC - 2008 Annual ReportSterling Bank PLC100% (3)

- Non Face To Face Account Opening FormDokument10 SeitenNon Face To Face Account Opening FormAlvin Samuel PandianNoch keine Bewertungen

- Sources and Utilization of Funds of OSCBDokument12 SeitenSources and Utilization of Funds of OSCBpapa1988Noch keine Bewertungen

- Part 3Dokument29 SeitenPart 3Rajib DattaNoch keine Bewertungen

- Policy On Bank Deposits: PreambleDokument6 SeitenPolicy On Bank Deposits: PreambleLukumoni GogoiNoch keine Bewertungen

- Credit Appraisal of Term Loans by Financial Institutions Like BanksDokument4 SeitenCredit Appraisal of Term Loans by Financial Institutions Like BanksKunal GoldmedalistNoch keine Bewertungen

- Banking Products Assignment FINAL 2Dokument19 SeitenBanking Products Assignment FINAL 2satyabhagatNoch keine Bewertungen

- Remittance Activity of Janata BankDokument90 SeitenRemittance Activity of Janata BankJajabor Shuhan100% (4)

- Alteration of ChequeDokument5 SeitenAlteration of ChequefatinNoch keine Bewertungen

- Guide Handling Transporting Cash May 2013Dokument18 SeitenGuide Handling Transporting Cash May 2013Gabriela ArismendiNoch keine Bewertungen

- 3branch Teller Training Manual 1. 6Dokument31 Seiten3branch Teller Training Manual 1. 6Ashenafi GirmaNoch keine Bewertungen

- SAT Remittance Form For BRAC BankDokument1 SeiteSAT Remittance Form For BRAC BankArman HossainNoch keine Bewertungen

- Overdraft Facility - Bajaj FinserveDokument9 SeitenOverdraft Facility - Bajaj FinserveDilip KumarNoch keine Bewertungen

- Indusind Bank LTDDokument76 SeitenIndusind Bank LTDRavindra Sharma0% (1)

- EcoBank Training Manual-V1-11-DEC-2015 PDFDokument126 SeitenEcoBank Training Manual-V1-11-DEC-2015 PDFMohamed Musthafa100% (1)

- TnCs Platinum 1105 Clean VersionDokument6 SeitenTnCs Platinum 1105 Clean Versionbibekananda87Noch keine Bewertungen

- Bank Alfalah Marketing Plan: Presented To: Presented By: Reg#Dokument24 SeitenBank Alfalah Marketing Plan: Presented To: Presented By: Reg#Jibran GhaniNoch keine Bewertungen

- Account Closure and Term Deposit Premature Withdrawal FormDokument2 SeitenAccount Closure and Term Deposit Premature Withdrawal FormSonali SarkarNoch keine Bewertungen

- Team ID: SYN-09-011 Team Name: Trail Blazers Plan: Waste-to-Energy Sector: EnergyDokument35 SeitenTeam ID: SYN-09-011 Team Name: Trail Blazers Plan: Waste-to-Energy Sector: EnergyHamzaEjazNoch keine Bewertungen

- Banking Practice and Procedure Chapter TwoDokument27 SeitenBanking Practice and Procedure Chapter TwoDEREJENoch keine Bewertungen

- Account Tariff Structure Basic Savings AccountDokument1 SeiteAccount Tariff Structure Basic Savings Accountgaddipati_ramuNoch keine Bewertungen

- Bank Sales PracticesDokument26 SeitenBank Sales Practicesmarlane ava laurenNoch keine Bewertungen

- Credit and CollectionsDokument3 SeitenCredit and CollectionsConrad RodricksNoch keine Bewertungen

- Policies and Procedures 0526 PDFDokument12 SeitenPolicies and Procedures 0526 PDFpunyaNoch keine Bewertungen

- Account OperationsDokument24 SeitenAccount Operationsmohil kashyapNoch keine Bewertungen

- Mse Lending PolicyDokument10 SeitenMse Lending PolicytanweerwarsiNoch keine Bewertungen

- Types of Bank Accounts in IndiaDokument18 SeitenTypes of Bank Accounts in IndiaPriya SharmaNoch keine Bewertungen

- Final-General Banking .Dokument27 SeitenFinal-General Banking .Salman AhmedNoch keine Bewertungen

- Chart of AccountsDokument6 SeitenChart of Accountssundar kaveetaNoch keine Bewertungen

- Blue Book PDFDokument151 SeitenBlue Book PDFdhruv KhandelwalNoch keine Bewertungen

- Trust ModarabaDokument56 SeitenTrust ModarabaZubair MirzaNoch keine Bewertungen

- Seeds... : The Business Planning ProcessDokument4 SeitenSeeds... : The Business Planning ProcessRajetha GunturNoch keine Bewertungen

- Growthink's 2009 Business Plan Guide: 6033 W. Century Blvd. - Los Angeles, CA 90045 - 800-506-5728Dokument33 SeitenGrowthink's 2009 Business Plan Guide: 6033 W. Century Blvd. - Los Angeles, CA 90045 - 800-506-5728highgrainNoch keine Bewertungen

- Portfolio Risk AnalysisDokument30 SeitenPortfolio Risk Analysismentor_muhaxheriNoch keine Bewertungen

- Certified Credit Union Financial Counselor Training Program: The Vermont StoryDokument9 SeitenCertified Credit Union Financial Counselor Training Program: The Vermont StoryREAL SolutionsNoch keine Bewertungen

- Accountancy ModelDokument124 SeitenAccountancy ModelJose' YesoNoch keine Bewertungen

- Unit 3. Procedure For Opening & Operating of Deposit AccountDokument11 SeitenUnit 3. Procedure For Opening & Operating of Deposit AccountBhagyesh ThakurNoch keine Bewertungen

- Receivables ManagementDokument11 SeitenReceivables ManagementPuneet JindalNoch keine Bewertungen

- TDS Declaration FormDokument2 SeitenTDS Declaration FormA M P KumarNoch keine Bewertungen

- Banker Customer RelationshipDokument13 SeitenBanker Customer RelationshipFahimAnwarNoch keine Bewertungen

- Banking Services: Presented By:-Ratnesh WaghmareDokument32 SeitenBanking Services: Presented By:-Ratnesh WaghmareRatnesh WaghmareNoch keine Bewertungen

- A) Introduce Your Company and Its Products/services Capture InterestDokument8 SeitenA) Introduce Your Company and Its Products/services Capture InterestGetachew MuluNoch keine Bewertungen

- Credit Insurance MarketDokument107 SeitenCredit Insurance MarketManjunath Reddy100% (2)

- Credit Risk ManualDokument39 SeitenCredit Risk ManualMehedi HasanNoch keine Bewertungen

- EPISD Bond Program Management Audit - 08.09.19Dokument15 SeitenEPISD Bond Program Management Audit - 08.09.19El Paso TimesNoch keine Bewertungen

- COP Cash in TransitDokument30 SeitenCOP Cash in TransitFrancisco SaraivaNoch keine Bewertungen

- Generally Accepted Auditing Standards A Complete Guide - 2020 EditionVon EverandGenerally Accepted Auditing Standards A Complete Guide - 2020 EditionNoch keine Bewertungen

- Tool Kit for Tax Administration Management Information SystemVon EverandTool Kit for Tax Administration Management Information SystemBewertung: 1 von 5 Sternen1/5 (1)

- Green Cities GGP3Dokument35 SeitenGreen Cities GGP3Ye PhoneNoch keine Bewertungen

- Solid Waste ManagementDokument2 SeitenSolid Waste ManagementYe PhoneNoch keine Bewertungen

- Your Phone Is Your Phone IsDokument30 SeitenYour Phone Is Your Phone IsYe PhoneNoch keine Bewertungen

- Introduction To Public Private PartnershipsDokument25 SeitenIntroduction To Public Private PartnershipsYe PhoneNoch keine Bewertungen

- Ukuku Lodge Feasibility Study-2Dokument32 SeitenUkuku Lodge Feasibility Study-2Ye PhoneNoch keine Bewertungen

- 4est B1G502Dokument38 Seiten4est B1G502Ye PhoneNoch keine Bewertungen

- Uiwang ICD - Republic of KoreaDokument29 SeitenUiwang ICD - Republic of KoreaYe PhoneNoch keine Bewertungen

- Yangon Land Use Building Height Zoning Plan1Dokument47 SeitenYangon Land Use Building Height Zoning Plan1Ye PhoneNoch keine Bewertungen

- PVTM SEA - Post-Show Report 1.1Dokument13 SeitenPVTM SEA - Post-Show Report 1.1Ye PhoneNoch keine Bewertungen

- Presentation - ASEAN Economic Community - ImplicatiDokument30 SeitenPresentation - ASEAN Economic Community - ImplicatiYe PhoneNoch keine Bewertungen

- Building A Network of Mobile Money AgentsDokument11 SeitenBuilding A Network of Mobile Money AgentsYe PhoneNoch keine Bewertungen

- Nielsen VN - Personal Finance Monitor Mid-Year 2010Dokument42 SeitenNielsen VN - Personal Finance Monitor Mid-Year 2010OscarKhuongNoch keine Bewertungen

- Cross River Bank Checking Deposit Account AgreementDokument17 SeitenCross River Bank Checking Deposit Account AgreementguedatheloveNoch keine Bewertungen

- FXPrimus EuropeDokument3 SeitenFXPrimus EuropeEmil TangNoch keine Bewertungen

- Marketing AssignmentDokument23 SeitenMarketing AssignmentGUTA HAILE TEMESGENNoch keine Bewertungen

- Western Union Money Transfer Service Terms and ConditionsDokument3 SeitenWestern Union Money Transfer Service Terms and ConditionsDaryll Anne LagtaponNoch keine Bewertungen

- 1 Offer LetterDokument5 Seiten1 Offer LettersandeepNoch keine Bewertungen

- Party-A:: Agreement On Delivery of Cash Funds For Investments Transfer Via Ip/Ip - /IPIP/XXXX-20Dokument15 SeitenParty-A:: Agreement On Delivery of Cash Funds For Investments Transfer Via Ip/Ip - /IPIP/XXXX-20Elizabeth LukitoNoch keine Bewertungen

- Registration - Accommodation FormDokument4 SeitenRegistration - Accommodation FormNadjo NadjobezNoch keine Bewertungen

- Junst2106036-Statement Huc0102 ContruccionDokument8 SeitenJunst2106036-Statement Huc0102 Contruccioncarmen canturin cabreraNoch keine Bewertungen

- Day Student Fees For The 2020-2021 Academic YearDokument2 SeitenDay Student Fees For The 2020-2021 Academic YearRafaelNoch keine Bewertungen

- Fi AP Config Guide Apps VBDokument51 SeitenFi AP Config Guide Apps VBwindsor2004Noch keine Bewertungen

- Compensation Plan: The Simplest, Most Generous and Fair Compensation Program in The IndustryDokument28 SeitenCompensation Plan: The Simplest, Most Generous and Fair Compensation Program in The IndustryRonald RxNoch keine Bewertungen

- Electronic Payment Authorization FormDokument1 SeiteElectronic Payment Authorization FormFatir FatihNoch keine Bewertungen

- AC - UVWIENUVWIE AUSTIN EDIRIN - MAY, 2023 - 203329650 - FullStmtDokument9 SeitenAC - UVWIENUVWIE AUSTIN EDIRIN - MAY, 2023 - 203329650 - FullStmtAustin EdirinNoch keine Bewertungen

- BIC Flyer Program DetailsDokument6 SeitenBIC Flyer Program DetailsWincy PaezNoch keine Bewertungen

- BIC CodeDokument23 SeitenBIC CodevenkatanagasatyaNoch keine Bewertungen

- Transparency Documentation EN 2019Dokument23 SeitenTransparency Documentation EN 2019shani ChahalNoch keine Bewertungen

- Personal Banking: What Is It?Dokument25 SeitenPersonal Banking: What Is It?chala meseretNoch keine Bewertungen

- ICMGP 2015 - Registration Form, International Conference On Mercury As Global PollutantDokument3 SeitenICMGP 2015 - Registration Form, International Conference On Mercury As Global PollutantAulia QisthiNoch keine Bewertungen

- Citibank ElenaDokument8 SeitenCitibank ElenaAndre BarrazaNoch keine Bewertungen

- Visanet - Treyas - PGLDokument5 SeitenVisanet - Treyas - PGLreyben454Noch keine Bewertungen

- Romelo Online101 - 6 Digits - 2022 - EricDokument15 SeitenRomelo Online101 - 6 Digits - 2022 - EricFredrick GordonNoch keine Bewertungen

- Application Form For CSWIP 5 Year Renewal (Overseas) With LogbookDokument4 SeitenApplication Form For CSWIP 5 Year Renewal (Overseas) With LogbookAustin. MNoch keine Bewertungen

- Funding Instructions - AMP FuturesDokument1 SeiteFunding Instructions - AMP Futuressuon ongbakNoch keine Bewertungen

- Us Kaplan Medical ApplicationDokument6 SeitenUs Kaplan Medical ApplicationJos LCNoch keine Bewertungen

- FIN435 ReportDokument29 SeitenFIN435 Reportfarah aliNoch keine Bewertungen

- Project Report ON "Study of Cash Management AT Standard Chartered Bank"Dokument112 SeitenProject Report ON "Study of Cash Management AT Standard Chartered Bank"Ajit JainNoch keine Bewertungen

- Form 31640929Dokument5 SeitenForm 31640929Sanjyot KolekarNoch keine Bewertungen