Beruflich Dokumente

Kultur Dokumente

CNMC Reports 47% Rise in Net Profit For First 9 Months of 2016 Marginal Profit Drop in 3Q2016 With Lower Revenue and Higher Costs Arising From Stop-Work Order

Hochgeladen von

WeR1 Consultants Pte LtdOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CNMC Reports 47% Rise in Net Profit For First 9 Months of 2016 Marginal Profit Drop in 3Q2016 With Lower Revenue and Higher Costs Arising From Stop-Work Order

Hochgeladen von

WeR1 Consultants Pte LtdCopyright:

Verfügbare Formate

Company Registration No.

: 201119104K

CNMC Reports 47% Rise in Net Profit for First 9 Months of 2016;

Marginal Profit Drop in 3Q2016 with Lower Revenue and Higher

Costs Arising from Stop-Work Order

Strong net cash balance of US$33.37M as at 30 September 2016

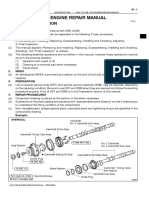

US$ (million)

Revenue

Results from operating

activities

Earnings before interest,

taxation, depreciation,

amortisation

Net profit

Net profit attributable to

owners of the Company

3Q2016

3Q2015

9M2016

9M2015

9.95

Change

(%)

(15.0)

29.48

27.17

Change

(%)

8.5

8.45

2.24

2.33

(3.9)

13.62

9.38

45.1

3.45

3.29

4.9

17.17

12.19

40.9

2.25

2.38

(5.6)

13.70

9.35

46.6

1.76

1.83

(3.6)

11.02

7.40

49.0

SINGAPORE, 7 November 2016 A temporary stop-work order issued by authorities

in Kelantan crimped output and drove up production costs for CNMC Goldmine

Holdings Limited (CNMC or the Company) in the third quarter of 2016 (3Q2016),

but the gold miner said today it still managed to make a profit and bolster its cash

holdings during those three months.

CNMC had to halt operations at its flagship Sokor gold field (Sokor) for seven days

after regulators issued the stop-work order on 19 July 2016 to review its application for

large-scale operation status and the extension of Sokors mining lease.

The Company took another 14 days to restart the entire production process after the

stop-order order was lifted on 25 July 2016. The application was approved in August

2016, allowing CNMC to mine for unlimited amounts of ore at Sokor until 31

December 2034.

As a result of the temporary production halt, output fell 24.3% to 6,284.68 ounces of

fine gold in 3Q2016 from 8,304.67 ounces in the same period last year (3Q2015).

The decline was offset by a 12.3% rise in average selling price to US$1,345.31 per

ounce of gold and drove revenue down 15.0% to US$8.45 million.

The stop-work order also drove up production costs. The Companys all-in cost of

production climbed to US$728 per ounce of gold in 3Q2016 from US$564 an ounce in

3Q2015. The increase was mainly due to partial payment of a one-time processing fee

payable to the Kelantan state government for the extension of Sokors mining lease.

Company Registration No.: 201119104K

Total operating expenses rose 20.5% to US$5.76 million in 3Q2016, driven mainly by

increases in amortisation and depreciation, marketing and publicity, and staff

remuneration. The higher amortisation costs relate mostly to the one-time processing

fee for Sokors mining lease extension. The one-time processing fee, which has been

capitalised, will be amortised over the course of the new lease.

With the lower revenue and higher expenses, CNMC turned in a net profit of US$2.25

million in 3Q2016, compared to US$2.38 million in 3Q2015. Net profit attributable to

shareholders slipped 3.6% to US$1.76 million.

Earnings per share for the quarter amounted to 0.43 US cent, compared to 0.45 US

cent for 3Q2015. Net asset value per share increased to 10.35 US cents as at 30

September 2016 from 8.22 US cents as at 31 December 2015.

The Company managed to generate net cash of US$3.50 million from operations in

3Q2016. It had US$33.49 million in cash and cash equivalents as at 30 September

2016, nearly double the US$18.31 million at the end of 3Q2015.

For the first nine months of 2016 (9M2016), CNMC made a net profit of US$13.70

million, up 46.6% from the same period last year (9M2015). The increase was driven

by the Groups strong performance in the first two quarters of 2016. Revenue for

9M2016 rose 8.5% to US$29.48 million.

Mr Chris Lim, CNMCs Chief Executive Officer, said: Operations are back to normal at

Sokor and we remain focused on production and managing costs. Still, all-in costs for

the final three months of this year are expected to go up further as we recognise the

rest of the one-time processing fee for the lease extension.

The proposed acquisition of a 51% stake in Pulai Mining Sdn Bhd (Pulai Mining),

which is authorised to mine for gold, iron ore and feldspar in an area in Kelantan

almost four times the size of Sokor, could underpin CNMCs long-term prospects, Mr

Lim added.

Pulai Mining, which signed a share subscription agreement with CNMC on 25 August

2016, has exploration and mining licences with a combined license area of

approximately 3,841.3 hectares (or 38.41 Square Kilometres) for gold, feldspar and

iron ore in the State of Kelantan, Malaysia.

### End ###

Media & Investor Contact Information

WeR1 Consultants Pte Ltd

3 Phillip Street, #12-01, Royal Group Building

Singapore 048693

Tel: (65) 6737 4944 | Fax: (65) 6737 4944

Company Registration No.: 201119104K

Frankie Ho - frankieho@wer1.net

Grace Yew - graceyew@wer1.net

About CNMC Goldmine Holdings Limited

(Bloomberg: CNMC:SP; Reuters: CNMC.SI)

CNMC Goldmine Holdings Limited (CNMC or the Company) is the first Catalistlisted gold mining company on the Singapore Exchange Securities Trading Limited

(the SGX-ST). Headquartered in Singapore, the Company and its subsidiaries (the

Group) started operations in 2006 and are principally engaged in the exploration and

mining of gold and the processing of mined ore into gold dors.

The Company is currently focused on developing the Sokor Gold Field Project,

located in the State of Kelantan, Malaysia. Spanning an area of 10km2, the project has

identified four gold deposit regions, namely Mansons Lode, New Discovery, Sg.

Ketubong and Rixen.

As of December 2015, the Sokor Gold Field Project had JORC-compliant gold

resources (inclusive of ore reserves) of 13.83 million tonnes at a grade of 1.4 g/t in the

Measured, Indicated and Inferred categories for a total of 618,000 ounces. The project

achieved its first gold pour on 21 July 2010.

For more information on the Company, please visit www.cnmc.com.hk

This press release has been prepared by CNMC Goldmine Holdings Limited (the

Company) and its contents have been reviewed by the Companys sponsor,

PrimePartners Corporate Finance Pte. Ltd. (the Sponsor) for compliance with the

Singapore Exchange Securities Trading Limited (the SGX-ST) Listing Manual

Section B: Rules of Catalist. The Sponsor has not verified the contents of this press

release.

This press release has not been examined or approved by the SGX-ST. The Sponsor

and the SGX-ST assume no responsibility for the contents of this press release,

including the accuracy, completeness or correctness of any of the information,

statements or opinions made or reports contained in this press release. The Sponsor

has also not drawn on any specific technical expertise in its review of this press

release.

The contact person for the Sponsor is Ms Keng Yeng Pheng, Associate Director,

Continuing Sponsorship, at 16 Collyer Quay, #10-00 Income at Raffles, Singapore

049318, telephone (65) 6229 8088.

Das könnte Ihnen auch gefallen

- Grand Banks Yachts Records S$1.1 Million NPAT in 1Q FY2023 Net Order Book Reaches All-Time High of S$191.8 MillionDokument2 SeitenGrand Banks Yachts Records S$1.1 Million NPAT in 1Q FY2023 Net Order Book Reaches All-Time High of S$191.8 MillionWeR1 Consultants Pte LtdNoch keine Bewertungen

- Grand Banks Yachts Records Net Profit Before Tax of S$2.9 Million For FY2022 Declares Dividend Amid Record High OrdersDokument3 SeitenGrand Banks Yachts Records Net Profit Before Tax of S$2.9 Million For FY2022 Declares Dividend Amid Record High OrdersWeR1 Consultants Pte LtdNoch keine Bewertungen

- SGX Chasen Secures S$26.6 Million Worth of New ProjectsDokument2 SeitenSGX Chasen Secures S$26.6 Million Worth of New ProjectsWeR1 Consultants Pte LtdNoch keine Bewertungen

- Grand Banks Yachts Reverses Shutdown LossesDokument2 SeitenGrand Banks Yachts Reverses Shutdown LossesWeR1 Consultants Pte LtdNoch keine Bewertungen

- Serial System FY2021 Net Profit Rises 4,168% To US$11.1 Million As Turnaround Strategies Gain Momentum Amid Global Chip Shortage Proposes Final Dividend of 0.45 Singapore Cent Per ShareDokument4 SeitenSerial System FY2021 Net Profit Rises 4,168% To US$11.1 Million As Turnaround Strategies Gain Momentum Amid Global Chip Shortage Proposes Final Dividend of 0.45 Singapore Cent Per ShareWeR1 Consultants Pte LtdNoch keine Bewertungen

- InnoTek Announces 1H'22 Stable Revenue Off S$84. Million, Despite Challenge of China's Zero-Covid PolicyDokument3 SeitenInnoTek Announces 1H'22 Stable Revenue Off S$84. Million, Despite Challenge of China's Zero-Covid PolicyWeR1 Consultants Pte LtdNoch keine Bewertungen

- Chasen Reports 1QFY2023 Net Profit Before Tax of S$0.3 Million On Revenue of S$37.3 MillionDokument3 SeitenChasen Reports 1QFY2023 Net Profit Before Tax of S$0.3 Million On Revenue of S$37.3 MillionWeR1 Consultants Pte LtdNoch keine Bewertungen

- Chasen's FY2022 Profit Before Income Tax Increases 40% To S$6.5 Million, Outpacing Revenue Growth Secures Fresh Projects From All Business Segments Worth S$14.5 MillionDokument4 SeitenChasen's FY2022 Profit Before Income Tax Increases 40% To S$6.5 Million, Outpacing Revenue Growth Secures Fresh Projects From All Business Segments Worth S$14.5 MillionWeR1 Consultants Pte LtdNoch keine Bewertungen

- Mooreast's 1H2022 Net Profit Rises 122% To S$0.9 Million On Revenue of S$13.0 Million Wins US$2.6 Million Project For Japan's First Commercial Floating Wind FarmDokument3 SeitenMooreast's 1H2022 Net Profit Rises 122% To S$0.9 Million On Revenue of S$13.0 Million Wins US$2.6 Million Project For Japan's First Commercial Floating Wind FarmWeR1 Consultants Pte LtdNoch keine Bewertungen

- Settlement Agreement With Two Shareholders/Directors of Fullerton Health Paves Way For Completion of Merger Involving S$350 Million Cash InjectionDokument1 SeiteSettlement Agreement With Two Shareholders/Directors of Fullerton Health Paves Way For Completion of Merger Involving S$350 Million Cash InjectionWeR1 Consultants Pte LtdNoch keine Bewertungen

- Livingstone Health and ASX-Listed Osteopore To Jointly Develop Regenerative 3D-Printed Product, Solutions, and Therapy For Bone and Tissue HealingDokument2 SeitenLivingstone Health and ASX-Listed Osteopore To Jointly Develop Regenerative 3D-Printed Product, Solutions, and Therapy For Bone and Tissue HealingWeR1 Consultants Pte LtdNoch keine Bewertungen

- InnoTek Posts FY2021 Net Profit of S$11.5 Million Dividend of 2.0 Singapore Cents Per Share Proposed For FY2021Dokument3 SeitenInnoTek Posts FY2021 Net Profit of S$11.5 Million Dividend of 2.0 Singapore Cents Per Share Proposed For FY2021WeR1 Consultants Pte LtdNoch keine Bewertungen

- Sasseur REIT Delivered Highest 3rd Quarter DPU of 1.831 Cents and Highest 9-Month 2021 DPU of 5.204 CentsDokument6 SeitenSasseur REIT Delivered Highest 3rd Quarter DPU of 1.831 Cents and Highest 9-Month 2021 DPU of 5.204 CentsWeR1 Consultants Pte LtdNoch keine Bewertungen

- SGX-Listed Camsing Healthcare Limited, Parent of Nature's Farm Supplements Distributor, Announces S$11.34 Million White Knight' Agreements With Founder of Qiren OrganisationDokument2 SeitenSGX-Listed Camsing Healthcare Limited, Parent of Nature's Farm Supplements Distributor, Announces S$11.34 Million White Knight' Agreements With Founder of Qiren OrganisationWeR1 Consultants Pte LtdNoch keine Bewertungen

- Newly-Listed Mooreast Holdings Ltd. Records FY2021 Revenue of S$14.2 Million Accelerates Renewable StrategyDokument3 SeitenNewly-Listed Mooreast Holdings Ltd. Records FY2021 Revenue of S$14.2 Million Accelerates Renewable StrategyWeR1 Consultants Pte LtdNoch keine Bewertungen

- Electricity Retailer Union Power Reorganises Customer Portfolio To Respond To Exceptional Sustained Rise in Singapore Wholesale Energy PricesDokument2 SeitenElectricity Retailer Union Power Reorganises Customer Portfolio To Respond To Exceptional Sustained Rise in Singapore Wholesale Energy PricesWeR1 Consultants Pte LtdNoch keine Bewertungen

- Grand Banks Yachts Announces Revenue of S$33.8 Million For 1H FY2022 Net Order Book Hits High of S$154.2 MillionDokument2 SeitenGrand Banks Yachts Announces Revenue of S$33.8 Million For 1H FY2022 Net Order Book Hits High of S$154.2 MillionWeR1 Consultants Pte LtdNoch keine Bewertungen

- Hatten Land Seeks Shareholder Approval To Diversify Business Model and Align Towards The Digital EconomyDokument3 SeitenHatten Land Seeks Shareholder Approval To Diversify Business Model and Align Towards The Digital EconomyWeR1 Consultants Pte LtdNoch keine Bewertungen

- Hatten Land Forms Joint Venture With Singapore Fintech Group Hydra XDokument4 SeitenHatten Land Forms Joint Venture With Singapore Fintech Group Hydra XWeR1 Consultants Pte LtdNoch keine Bewertungen

- Homegrown Mooring Solutions Provider, Mooreast Holdings LTD., To Raise Total Gross Proceeds of S$8.5M From SGX Catalist IPODokument5 SeitenHomegrown Mooring Solutions Provider, Mooreast Holdings LTD., To Raise Total Gross Proceeds of S$8.5M From SGX Catalist IPOWeR1 Consultants Pte LtdNoch keine Bewertungen

- Chasen 1HFY2022 Revenue Rises 44% To S$84.0 Million On Higher Contributions From All Business Segments Secures Fresh Contracts Worth S$19.9 MillionDokument3 SeitenChasen 1HFY2022 Revenue Rises 44% To S$84.0 Million On Higher Contributions From All Business Segments Secures Fresh Contracts Worth S$19.9 MillionWeR1 Consultants Pte LtdNoch keine Bewertungen

- Mooreast Holdings Ltd. Closes First Day Trading at S$0.250, 13.6% Higher Than IPO Issue Price, Marking Strong Listing DebutDokument4 SeitenMooreast Holdings Ltd. Closes First Day Trading at S$0.250, 13.6% Higher Than IPO Issue Price, Marking Strong Listing DebutWeR1 Consultants Pte LtdNoch keine Bewertungen

- Serial System Reports 9M2021 Net Profit of US$9.2M, Reversing Sharply From Loss of US$4.9M A Year Ago As Growth Strategies Gain MomentumDokument3 SeitenSerial System Reports 9M2021 Net Profit of US$9.2M, Reversing Sharply From Loss of US$4.9M A Year Ago As Growth Strategies Gain MomentumWeR1 Consultants Pte LtdNoch keine Bewertungen

- Tests Show Natshield™ Sanitiser Effective Up To 12 HoursDokument2 SeitenTests Show Natshield™ Sanitiser Effective Up To 12 HoursWeR1 Consultants Pte LtdNoch keine Bewertungen

- Lodgement of Preliminary Offer Document of Mooreast Holdings LTDDokument1 SeiteLodgement of Preliminary Offer Document of Mooreast Holdings LTDWeR1 Consultants Pte LtdNoch keine Bewertungen

- Press Release For Immediate Release: (Company Registration No.: 199301388D) (Incorporated in The Republic of Singapore)Dokument4 SeitenPress Release For Immediate Release: (Company Registration No.: 199301388D) (Incorporated in The Republic of Singapore)WeR1 Consultants Pte LtdNoch keine Bewertungen

- Livingstone Health HY2022 Revenue Nearly Doubles To S$16.0 Million Net Profit After Tax 62% Higher at S$2.1 Million PDFDokument3 SeitenLivingstone Health HY2022 Revenue Nearly Doubles To S$16.0 Million Net Profit After Tax 62% Higher at S$2.1 Million PDFWeR1 Consultants Pte LtdNoch keine Bewertungen

- Hatten Land's Subsidiary HTPL Signs Definitive Agreement With Frontier To Operate at Least 1,000 Cryptocurrency Mining Rigs in MalaysiaDokument3 SeitenHatten Land's Subsidiary HTPL Signs Definitive Agreement With Frontier To Operate at Least 1,000 Cryptocurrency Mining Rigs in MalaysiaWeR1 Consultants Pte LtdNoch keine Bewertungen

- Berjaya Partners Holista To Offer Healthy Breads and Foods in Starbucks Malaysia, 7 - Eleven and Other F&B OutletsDokument3 SeitenBerjaya Partners Holista To Offer Healthy Breads and Foods in Starbucks Malaysia, 7 - Eleven and Other F&B OutletsWeR1 Consultants Pte LtdNoch keine Bewertungen

- Press Release For Immediate Release: (Company Registration No.: 199301388D) (Incorporated in The Republic of Singapore)Dokument4 SeitenPress Release For Immediate Release: (Company Registration No.: 199301388D) (Incorporated in The Republic of Singapore)WeR1 Consultants Pte LtdNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Should Animals Be Banned From Circuses.Dokument2 SeitenShould Animals Be Banned From Circuses.Minh Nguyệt TrịnhNoch keine Bewertungen

- Search Inside Yourself PDFDokument20 SeitenSearch Inside Yourself PDFzeni modjo02Noch keine Bewertungen

- TAX & DUE PROCESSDokument2 SeitenTAX & DUE PROCESSMayra MerczNoch keine Bewertungen

- FCE Listening Test 1-5Dokument20 SeitenFCE Listening Test 1-5Nguyễn Tâm Như Ý100% (2)

- Contract Costing and Operating CostingDokument13 SeitenContract Costing and Operating CostingGaurav AggarwalNoch keine Bewertungen

- Sangam ReportDokument37 SeitenSangam ReportSagar ShriNoch keine Bewertungen

- Cost Allocation Methods & Activity-Based Costing ExplainedDokument53 SeitenCost Allocation Methods & Activity-Based Costing ExplainedNitish SharmaNoch keine Bewertungen

- Addendum Dokpil Patimban 2Dokument19 SeitenAddendum Dokpil Patimban 2HeriYantoNoch keine Bewertungen

- BICON Prysmian Cable Cleats Selection ChartDokument1 SeiteBICON Prysmian Cable Cleats Selection ChartMacobNoch keine Bewertungen

- Sergei Rachmaninoff Moment Musicaux Op No in E MinorDokument12 SeitenSergei Rachmaninoff Moment Musicaux Op No in E MinorMarkNoch keine Bewertungen

- Database Interview QuestionsDokument2 SeitenDatabase Interview QuestionsshivaNoch keine Bewertungen

- Corporate Law Scope and RegulationDokument21 SeitenCorporate Law Scope and RegulationBasit KhanNoch keine Bewertungen

- Neligence: Allows Standards of Acceptable Behavior To Be Set For SocietyDokument3 SeitenNeligence: Allows Standards of Acceptable Behavior To Be Set For SocietyransomNoch keine Bewertungen

- Bpoc Creation Ex-OrderDokument4 SeitenBpoc Creation Ex-OrderGalileo Tampus Roma Jr.100% (7)

- Opportunity, Not Threat: Crypto AssetsDokument9 SeitenOpportunity, Not Threat: Crypto AssetsTrophy NcNoch keine Bewertungen

- Hadden Public Financial Management in Government of KosovoDokument11 SeitenHadden Public Financial Management in Government of KosovoInternational Consortium on Governmental Financial ManagementNoch keine Bewertungen

- Maternity and Newborn MedicationsDokument38 SeitenMaternity and Newborn MedicationsJaypee Fabros EdraNoch keine Bewertungen

- EE-LEC-6 - Air PollutionDokument52 SeitenEE-LEC-6 - Air PollutionVijendraNoch keine Bewertungen

- 1 - Nature and Dev - Intl LawDokument20 Seiten1 - Nature and Dev - Intl Lawaditya singhNoch keine Bewertungen

- Episode 8Dokument11 SeitenEpisode 8annieguillermaNoch keine Bewertungen

- Detailed Lesson Plan School Grade Level Teacher Learning Areas Teaching Dates and Time QuarterDokument5 SeitenDetailed Lesson Plan School Grade Level Teacher Learning Areas Teaching Dates and Time QuarterKhesler RamosNoch keine Bewertungen

- Otto F. Kernberg - Transtornos Graves de PersonalidadeDokument58 SeitenOtto F. Kernberg - Transtornos Graves de PersonalidadePaulo F. F. Alves0% (2)

- How To Use This Engine Repair Manual: General InformationDokument3 SeitenHow To Use This Engine Repair Manual: General InformationHenry SilvaNoch keine Bewertungen

- IB Theatre: The Ilussion of InclusionDokument15 SeitenIB Theatre: The Ilussion of InclusionLazar LukacNoch keine Bewertungen

- List of Parts For Diy Dremel CNC by Nikodem Bartnik: Part Name Quantity BanggoodDokument6 SeitenList of Parts For Diy Dremel CNC by Nikodem Bartnik: Part Name Quantity Banggoodyogesh parmarNoch keine Bewertungen

- Research PhilosophyDokument4 SeitenResearch Philosophygdayanand4uNoch keine Bewertungen

- Important TemperatefruitsDokument33 SeitenImportant TemperatefruitsjosephinNoch keine Bewertungen

- Purposive Communication Module 1Dokument18 SeitenPurposive Communication Module 1daphne pejo100% (4)

- Jesus' Death on the Cross Explored Through Theological ModelsDokument13 SeitenJesus' Death on the Cross Explored Through Theological ModelsKhristian Joshua G. JuradoNoch keine Bewertungen

- As If/as Though/like: As If As Though Looks Sounds Feels As If As If As If As Though As Though Like LikeDokument23 SeitenAs If/as Though/like: As If As Though Looks Sounds Feels As If As If As If As Though As Though Like Likemyint phyoNoch keine Bewertungen