Beruflich Dokumente

Kultur Dokumente

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Hochgeladen von

Shyam SunderOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Hochgeladen von

Shyam SunderCopyright:

Verfügbare Formate

RAJ AGRO AJIITLS LTD.

CIN: [I 51 49D11 990PtC0 40532

B, Neor Modhubon Chowk. Rohini. New Delhi- 1 l0 085

Sector

C-B/419,

Office:

Regisiered

Ctipor"t. Office & Works:Villoge Powo, G. T. Rood, Neor Civil Airport, Ludhiono -141 12o

Ph : +9

RAM L/QTLY/U

FR

-I

61 -251 2264 F oxi +9 1 -1 61 -2845085 Emoil :

I 76-T7 /SM-2

rojogromills@gmoil'com

Dated: 09.LL.2OL6

ND

The Secretary

Bombay Stock Exchange Ltd.

25th Floor, Phiroze Jeejee Bhoy

Dalal Street, Fort, Mumbai

Towers,

400 00L

Subject: Unaudited Financial Results for Quarter f nOia 30.09.2016

Dear Sir,

ln compliance with clause 41 of the Listing Agreement, we are pleased to enclose herewith the

Unaudited Financial Results for the Quarter ended 30.09.2016; which have been considered,

approved and taken on the record by the Board of Directors of the Company in their meeting

held on 09.L1.2O!6 at their Corporate Office of the Company along with Review Report on

Quarterly Financial Results and Year to Date Result. The statement of Assets and Liabilities for

the half year ending 30.09.2016 is also attached herewith.

The results have been released for the publication in the Newspapers.

This is for your information and record purpose.

Thanking you,

Yours Faithfully,

For Raj Agro Mills Limited

\,-ut+

AGt\ Signatory

Encl: h/a

F,C,Goyal & Co,,

l

CHARTERED ACCOUNTANTS

Pakhowal Road,

LUDHIANA _ 141001

Off: +91161-2406716

Fax: +91 161-2403546

Resi. +91161-2406342

Email: capcqoval@qmail.com

To,

1

The Board of Directors,

Raj Agro Mitts Ltd. ,

C-8/419, Sector-8,

Near Madhuban Chowk,

Rohini, New Delhi-110 085

Sirs,

Subject:

Review Report

We have reviewed thd accompanyjng statement of Un-audited Financiat Resutts of M/s RAJ

AGRO MILLS LTD., for the quarter Jnded 30.09.2016 except for the disctosures regarding

'Pubtic Sharehol.ding' and 'Promoter and Promoter Group Sharehotding'which have been

from disctosures made by the management and have not been auditeO Uy us. This statement is

irui"j

lhe responsibitity of the Company's management and has been approved by the Board of

Directors. Oun responsibitity is to issue a report on these financiat'statemenis based on our

reuew.

We conducted our review in accordance with the Standa'rd on Review Engagement (SRE) Z4OO,

Engagements to Review Financiat Statements issued by the lnstitute of Chartered Accountants

of lndia. This standard requires that we ptan and perform the review to obtain moderate

assurance as to whether the financia[ statements are free of material misstatement. A review

is limited.primarity to inquiries of company personnel and anal,yticat procedures appl,ied to

financial data rand thus provide [ess assurance than an audit. We have not performed an audit

and accordingty, we do not express an audit opinion.

Based on our review conducted as above, nothing has come

to our attention that causes us to

betieve that the accompanying statement of un-audited financiaI resutts prepared in

accordance with Accounting Standards and other recognized accounting practices and policies

has not disctosed the information required to be disctosed in terms of ctause 41 of the r-isting

Agreement inqtuding the manner in which it is to be disctosed, or that it contains any materiat

misstatement.

For P. C. Goyat &

'o\

t;

(cA

Pa

M.No: 08037

FRN:002368N

Ptace: Ludhiana

Date:09.11.2016

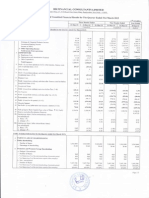

RAJ AGRO FJ'IILLS LTD.

REGD.OFFICE : C-8/419 SECTOR-8, NEAR MADHUBAN CHOWK, ROHlNl, NEW DELHI - '1 10 085

CORPORATE OFFICE & WORKS : VILL.PAWA,G.T.ROAD,LUDHIANA - 141 120

UNAUDITED FINANEIALEEStJ!T{] FOR THE QUARTER ENDED 30.09.2016

( Rs. ln Lacs

Particulars

S/No.

Corresponding Year to Date

3 months

figures for

months ended

ended in Prv current period

Year i.e.

ended

30.06.20 16

3 months

e

Previous 3

nded

30.09.2016

30.09.2015

(U

7

8

o

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

b. Consumption of raw materials

c. Employee Cost

d. Financial Cost

e. Depreciation

f. Other Expenditure

g.Total

0.00

0.00

0.00

0.00

0.00

0.00

7.12

2.O1

4.76

3.41

8.61

0.00

0.00

0.00

0.00

0.88

285.93

0,49

u.50

1-.21

0.99

r.16

L.16

0.60

2.14

2.1,4

5.25

8.69

Net Profit (+)/Loss (-) from Ordinary Activities after

tax (9 - 10)

Extraordinary item (net of tax expense Rs .. . . . )

Net Profit (+)/Loss (-) for the period (1 1 - 1 2)

Paid-up equity share capitai

(FaceValue per share. Rs.10/-)

Reserve excluding Revaluation Reserves as per

balance sheet of previous accounting year

0,00

3.63

(3.63

4.96

(4.e

c.00

(3.63

(3.63

0.00

(3,63

19 24.48

304.99

(304.ee)

(9.34)

{301.32

0.c0

0.00

(s.34)

(301.32

0.00

0.00

'

0.00

0.00

0.00

0.00

(1.s 6)

(4.e6)

0.110

0.00

6 )

(8.se

0.00

0.0(-)

(4.96)

(8.s9

0.00

0.c0

0.c0

{4.e 6)

(4.e6)

(8.se

6 )

{1924.4

8 )

10.36

(9.34

(9 34)

11.924.48)

(1924.48)

310.3 6

Place: Ludhiana

,6

0.00

(301.3 2)

3

10.36

(0.16)

(0.28)

(0.30)

(9.71)

(0.12

(0.16

(0 16)

(0.2

8 )

(0.30)

(-o.71)

1093 600

1093 600

109 3600

1093600

1093600

35.24%

35.24%

1093600

35.24%

Nil

35.74%

Nil

Nit

Nil

Nil

Nil

10000

2010000

201000n

241 0000

2010000

2010000

64.76%

64.7 6%

64.16'/"

64.76%

64.76%

64.76%

20

o(\',

(0.16

By order of

the Board

For Ra.j Agro N4iils Limited

ANr.

09.1"1 .20

(30 1.32

(L924.48)

No investo(s) / shareholders(s) complaint is pending during tne said quarter

The above financial results have been reviewed by the Siatulory Audi

(0 12)

UN

l*

Date

1924.48)

The above financial resuits of the company has been considered approved and taken on record by the Board of Direciors in their meeting

held on 09.11.20.16 at the Corporate Office of the Company

iJ.00

310,36

0.00

NOTES:

The previous year figures have been regrouped / recasied wlrerever r.tecessary.

(301.32

0.00

share equity capital of the company)

1

2

3.67

(e.34)

(4,e

(4.e6)

6 )

310.3 6

2.42

0.00

310.3 6

11.36

(11.36)

0.48

0.00

0.00

(3.63

8.s9

(8.se

(8.se

(4.e

5.44

(s.44)

(4.e6)

(4.e

0.00

(3.63

6 )

0.00

0.00

Earnings Per Share (EPS) (Rs.)

a) Basic and diluted EPS before Extraordinary itmes,

for the year to date and for the previous year (not to be

annualised)

b) Basic and diluted EPS after Extraordinary rtems for

the period, for the year to date and for the previous year

(not to be annual sed)

Public Shareholding

- Number of Shares

- Percentage of Shareholding

Promoters and Prornoter gror-rp shareholding

a) Pledged/Encumbered

- Number of Shares

-Percentage of Shares (as a % of the total

shareholding of promoter and promoter group)

-Percentage of Shares (as a % of the total

share equity capital of the company)

b) Non-encumbered

- Number of Shares

-Percentage of Shares (as a % of the total

shareholding of promoter and promoter group)

-Percentage of Shares (as a % of the total

18

1.03.2016

(Audited)

0.00

11

17

30.09.2015

n-Audited'l

0.00

Tax Expense

(lncl. of Current, Deterred & Fringe Beneflt Tax)

to

0.00

10

15

30.09.2016

{Un-Audited)

0.00

Profit (+)/Loss (-) from Ordinary Activities before tax

14

year ended

period ended

0.00

(7+8)

12

Accou nting

0.00

lnterest

Profit after Interest but before Exceptional items (5-6)

Exceptional items

lUn-Audited)

Previous

figures for

perivous

(a) Nei Sales/lncome from Operations

(b) Other Operating lncome

Expenditure

a. (lncrease)/decrease in stock in trade and work in

progress

Profit from Operations before Other lncome, lnterest

and Exceptional items (1-2)

Other lncome

Profit before Interest & Exceptionai items (3+4)

(Audited)

n-Aud ited)

Year to Date

(Sanjeev Bansal)

Managing Director

DIN:00057485

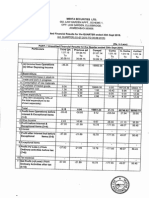

RAJ AGRO iitlLLS LTD.

REGD.OFFICE

: C-8/419 SECTOR-8,

NEAR MADHUBAN CHOWK,

RoHlNl, NEW DELHI - 1 10 085

- 141 120

CORPORATE OFFICE & WORKS : VILL.PAWA,G.T.ROA,D,LUDHIANA

ANNEXURE IX

(Rs. In Lakhs)

PARTICULARS

FOR CURRENT HALF

YEAR ENDING ON

30.09.2016

(UN.AUDITED)

SHAREHOLDERS' FUNDS

(a) Capitat

(b) Reserve & Surptus

60.36

161.98

922.34

LOAN FUNDS

0.00

Secured Loans

Unecured Loans

1213.54

1213.54

0.00

DEFERRED TAX LIABILITY

2135.87

TOTAL

13.11

FIXED ASSETS

0.00

INVESMENTS

tJ.40

LONG TERM LOANS & ADVANCES

CURRENT ASSETS, LOANS & ADVANCES

(a) lnventories

(b) Sundry Debtors

0.00

(c) Cash and Bank Balances

(d) Other Current Assets

4.00

0.00

11

(e) Loans and Advances

.00

0.00

15.00

LISS CURRENT LIABILITITS AND PROVISIONS

(a) Current Liabitiljes

(b) Provlsions

0.67

TOTAL

0.7

0.08

5

14.75

NET CURRENT A55ETS

0.00

MISCELLANEOUS EXPENDJTURES

(NOT WRITTEN OFF OR ADJUSTED)

2095.05

PROFIT AND LOSS ACCOUNT

2135.87

rOTAL

By Order

of the Board

For Raj Agro Milts Limited

DaLe : 09 I 11 /7016

Place : Ludhiana

Das könnte Ihnen auch gefallen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument6 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument8 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokument7 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Dokument8 SeitenFinancial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokument2 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument8 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Dokument2 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review For March 31, 2015 (Result)Dokument5 SeitenFinancial Results & Limited Review For March 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNoch keine Bewertungen

- JUSTDIAL Mutual Fund HoldingsDokument2 SeitenJUSTDIAL Mutual Fund HoldingsShyam SunderNoch keine Bewertungen

- Order of Hon'ble Supreme Court in The Matter of The SaharasDokument6 SeitenOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNoch keine Bewertungen

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDokument5 SeitenExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNoch keine Bewertungen

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Dokument1 SeitePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNoch keine Bewertungen

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDokument2 SeitenSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNoch keine Bewertungen

- HINDUNILVR: Hindustan Unilever LimitedDokument1 SeiteHINDUNILVR: Hindustan Unilever LimitedShyam SunderNoch keine Bewertungen

- Mutual Fund Holdings in DHFLDokument7 SeitenMutual Fund Holdings in DHFLShyam SunderNoch keine Bewertungen

- Settlement Order in Respect of R.R. Corporate Securities LimitedDokument2 SeitenSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For June 30, 2014 (Audited) (Result)Dokument3 SeitenFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For Dec 31, 2013 (Result)Dokument4 SeitenFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Standalone Financial Results For March 31, 2016 (Result)Dokument11 SeitenStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For Mar 31, 2014 (Result)Dokument2 SeitenFinancial Results For Mar 31, 2014 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For June 30, 2013 (Audited) (Result)Dokument2 SeitenFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNoch keine Bewertungen

- PDF Processed With Cutepdf Evaluation EditionDokument3 SeitenPDF Processed With Cutepdf Evaluation EditionShyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For September 30, 2013 (Result)Dokument2 SeitenFinancial Results For September 30, 2013 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For September 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For June 30, 2016 (Result)Dokument2 SeitenStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Investor Presentation For December 31, 2016 (Company Update)Dokument27 SeitenInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Transcript of The Investors / Analysts Con Call (Company Update)Dokument15 SeitenTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Bilaspur 28042017Dokument25 SeitenBilaspur 28042017mahanth gowdaNoch keine Bewertungen

- The Family AdvantageDokument94 SeitenThe Family AdvantageBusiness Families FoundationNoch keine Bewertungen

- The Smart Farm ProjectDokument17 SeitenThe Smart Farm ProjectThe Art Farm100% (2)

- Lessons From The JapaneseDokument3 SeitenLessons From The JapaneseibnmosawiNoch keine Bewertungen

- Project Profile-Manufacturing of Rusk CokkiesDokument15 SeitenProject Profile-Manufacturing of Rusk CokkiesSannat JainNoch keine Bewertungen

- Preface - 2010 - Private Equity and Venture Capital in EuropeDokument4 SeitenPreface - 2010 - Private Equity and Venture Capital in EuropeHbNoch keine Bewertungen

- Foreign Direct InvestmentDokument5 SeitenForeign Direct InvestmentUdit SethiNoch keine Bewertungen

- Second Term Exam-2070 Particulars Debit (RS.) Credit (RS.)Dokument8 SeitenSecond Term Exam-2070 Particulars Debit (RS.) Credit (RS.)ragedskullNoch keine Bewertungen

- Better Business, 2e (Solomon) Chapter 6 Forms of Business OwnershipDokument40 SeitenBetter Business, 2e (Solomon) Chapter 6 Forms of Business OwnershipAngelita Dela cruzNoch keine Bewertungen

- Liquified Natural Gas BasicsDokument24 SeitenLiquified Natural Gas BasicsMichael SmithNoch keine Bewertungen

- Chapter 3: Theories of International Relations: Realism and LiberalismDokument44 SeitenChapter 3: Theories of International Relations: Realism and LiberalismAniket kawadeNoch keine Bewertungen

- Lucid Fourth Quarter and Full Year 2022 Financial ResultsDokument6 SeitenLucid Fourth Quarter and Full Year 2022 Financial ResultsMaria MeranoNoch keine Bewertungen

- Baker Mckenzie Global M&A Index Q2 2017Dokument7 SeitenBaker Mckenzie Global M&A Index Q2 2017Arnaud DumourierNoch keine Bewertungen

- Bs 1000 03 - 2016Dokument5 SeitenBs 1000 03 - 2016rashidnyouNoch keine Bewertungen

- TeamLease Services Private LTD GR SDokument16 SeitenTeamLease Services Private LTD GR SSk.Abdul NaveedNoch keine Bewertungen

- Digest - Phil Asset Growth Two, Inc. vs. Fastech GR No 206528 June 28, 2016 PDFDokument5 SeitenDigest - Phil Asset Growth Two, Inc. vs. Fastech GR No 206528 June 28, 2016 PDFNathalie PattugalanNoch keine Bewertungen

- Family Law FMR 120Dokument17 SeitenFamily Law FMR 120Iram YousufNoch keine Bewertungen

- Fundamental Analysis of ACCDokument10 SeitenFundamental Analysis of ACCmandeep_hs7698100% (2)

- Financial Performance Analysis of SCBDokument24 SeitenFinancial Performance Analysis of SCBprabeena neupaneNoch keine Bewertungen

- 2nd Year EnglishDokument2 Seiten2nd Year EnglishUmair100% (2)

- Chapter 12 Capital Marketing ResearchDokument11 SeitenChapter 12 Capital Marketing ResearchThomas HWNoch keine Bewertungen

- BTEC Business Unit 2 Finance For BusinessDokument14 SeitenBTEC Business Unit 2 Finance For BusinessArgiris VlastosNoch keine Bewertungen

- Answer Key Assignment in Equity Investments - VALIX 2017Dokument3 SeitenAnswer Key Assignment in Equity Investments - VALIX 2017Shinny Jewel VingnoNoch keine Bewertungen

- Full Report PDFDokument274 SeitenFull Report PDFJosafat Jade ColendresNoch keine Bewertungen

- ECM 3670 Assign 1 (v2)Dokument10 SeitenECM 3670 Assign 1 (v2)Huei ChunNoch keine Bewertungen

- Statement 1579849221565Dokument3 SeitenStatement 1579849221565DILLINoch keine Bewertungen

- Forms of-WPS OfficeDokument22 SeitenForms of-WPS OfficeKyla SanchezNoch keine Bewertungen

- Revista MatLabDokument40 SeitenRevista MatLabboribertoNoch keine Bewertungen

- Ford Investment ThesisDokument7 SeitenFord Investment Thesispatricialeatherbyelgin100% (1)

- Term Paper of Product and Brand ManagementDokument19 SeitenTerm Paper of Product and Brand Management9956272017100% (1)