Beruflich Dokumente

Kultur Dokumente

Deductions Under Chapter VI Calculator

Hochgeladen von

Ajay Pratap0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

37 Ansichten2 SeitenThis document lists various tax deductions available under Chapter VI of the Indian Income Tax Act. It provides the section number, brief description and maximum deduction amount for sections 80C, 80CCC, 80CCD(1), 80CCD(1B), 80CCD(2), 80CCG, 80D, 80DD, 80DDB, 80E, 80G, 80GG, 80GGA, 80GGC, 80RRB, 80QQB, 80TTA, and 80U. The total amount of eligible deductions under Chapter VI is calculated.

Originalbeschreibung:

desductionsss

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document lists various tax deductions available under Chapter VI of the Indian Income Tax Act. It provides the section number, brief description and maximum deduction amount for sections 80C, 80CCC, 80CCD(1), 80CCD(1B), 80CCD(2), 80CCG, 80D, 80DD, 80DDB, 80E, 80G, 80GG, 80GGA, 80GGC, 80RRB, 80QQB, 80TTA, and 80U. The total amount of eligible deductions under Chapter VI is calculated.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

37 Ansichten2 SeitenDeductions Under Chapter VI Calculator

Hochgeladen von

Ajay PratapThis document lists various tax deductions available under Chapter VI of the Indian Income Tax Act. It provides the section number, brief description and maximum deduction amount for sections 80C, 80CCC, 80CCD(1), 80CCD(1B), 80CCD(2), 80CCG, 80D, 80DD, 80DDB, 80E, 80G, 80GG, 80GGA, 80GGC, 80RRB, 80QQB, 80TTA, and 80U. The total amount of eligible deductions under Chapter VI is calculated.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

11/11/2016

DeductionsunderChapterVICalculator

Calculate Deductions Available under Chapter VI

Section

Brief Information about the Section

80C

Amount paid or deposited towards life insurance,

contribution to Provident Fund set up by the

Government, recognized Provident Fund,

contribution by the assessee to an approved

superannuation fund, subscription to National

Savings Certicates, tuition fees, payment/

repayment for purposes of purchase or

construction of a residential house and many

other investments. For full list, please refer to

section 80C of the Income-tax Act.( The aggregate

Amount

amount of deduction under section 80C, 80CCC and

80CCD(1) shall not exceed Rs. 1,50,000/- )

80CCC

Deduction in respect of Payment of premium for

annuity plan of LIC or any other insurer. Deduction

is available upto a maximum of Rs. 150,000/-.

The premium must be deposited to keep in force a contract

for an annuity plan of the LIC or any other insurer for

receiving pension from the fund.

80CCD(1)

Deduction for contribution in pension scheme

notied by the Government to the extent of 10% of

salary in case of employees and 10% of total

income in case of others.

80CCD(1B) Maximum Deduction of Rs. 50,000/- for

contribution in National Pension Scheme. The

deduction is in addition to the maximum

deduction of Rs. 1,50,000/- available under 80C,

80CCC and 80CCD(1).

80CCD(2)

Contribution by employer in pension scheme

notied by the Government to the extent of 10% of

salary.

80CCG

Deduction is available upto 50% of the amount

invested.

( Maximum Deduction available Rs. 25,000/- )

80D

Deduction in respect of Medical Insurance

Premium for Self and family members.

( Maximum Deduction available Rs. 30,000/- for Senior

Citizens and Rs. 25,000/- for others. )

Deduction in respect of Medical Insurance

Premium for Parents (Father or mother or both).

( Maximum Deduction available Rs. 30,000/- for Senior

Citizens parents and Rs. 25,000/- in other cases. )

80DD

Deduction in respect of maintenance including

medical treatment of dependent who is a person

with disability.

http://finotax.com/incometax/incded

1/2

11/11/2016

DeductionsunderChapterVICalculator

( Maximum deduction Rs. 100,000/- in case of severe

disability (more than 80%) and Rs. 50,000/- in other cases. )

80DDB

Deduction to the extent of Rs. 40,000/- or the

amount actually paid, whichever is less for

expenditure actually incurred on self or dependent

relative for medical treatment of specied disease

or ailment.

80E

Deduction in respect of interest on loan taken for

pursuing higher education. The deduction is also

available for the purpose of higher education of a

relative.

80G

Deduction in respect of donations to certain funds,

charitable institutions, etc. The various donations

specied in Sec. 80G are eligible for deduction

upto either 100% or 50% with or without

restriction as provided in Sec. 80G

80GG

Deduction in respect of House Rent Paid.( Maximum

80GGA

Deduction in respect of certain donations for

scientic research or rural development

80GGC

Deduction in respect of contributions given by any

person to political parties

80RRB

Deduction in respect of royalty on patents.(

80QQB

Deduction in respect of royalty on Books.(

80TTA

Deduction in respect interest on Saving accounts.(

80U

Deduction in case of a person with disability.(

Deduction Rs. 24000/- )

Maximum Deduction Rs. 3,00,000/- )

Maximum Deduction Rs. 3,00,000/- )

Maximum Deduction Rs. 10,000/- )

Maximum Deduction: General disability - Rs. 50,000/-,

Severe disability - Rs. 1,00,000/-. )

Total Amount of Eligible Deductions under Chapter VI

http://finotax.com/incometax/incded

2/2

Das könnte Ihnen auch gefallen

- DeductionsDokument7 SeitenDeductionsManjeet KaurNoch keine Bewertungen

- Income Tax Section 80Dokument19 SeitenIncome Tax Section 80DEV HUGENNoch keine Bewertungen

- Income Tax Deductions Under Section 80C To 80UDokument12 SeitenIncome Tax Deductions Under Section 80C To 80UKrish GoelNoch keine Bewertungen

- Income TaxDokument8 SeitenIncome Taxved prakash raoNoch keine Bewertungen

- deduction 80c to 80 uDokument12 Seitendeduction 80c to 80 uPRO FilmmakerNoch keine Bewertungen

- Deductions On Section 80CDokument12 SeitenDeductions On Section 80CViraja GuruNoch keine Bewertungen

- net income how to calculate net income in income taxDokument34 Seitennet income how to calculate net income in income taxSeetha SenthilNoch keine Bewertungen

- On Deductions Under Section 80C To 80U (Unit - 4) Bcom 6 SEMDokument11 SeitenOn Deductions Under Section 80C To 80U (Unit - 4) Bcom 6 SEMMudasir LoneNoch keine Bewertungen

- Deductions From Gross Total Income: Deductions Allowable Under Various Sections of Chapter VIA of Income Tax ActDokument8 SeitenDeductions From Gross Total Income: Deductions Allowable Under Various Sections of Chapter VIA of Income Tax ActalisagasaNoch keine Bewertungen

- Section 80C To 80U 1Dokument41 SeitenSection 80C To 80U 1karanmasharNoch keine Bewertungen

- Taxation Ce2Dokument10 SeitenTaxation Ce2Ratnesh PalNoch keine Bewertungen

- Deductions Available Under Chapter VI of Income TaxDokument4 SeitenDeductions Available Under Chapter VI of Income TaxDeepanjali NigamNoch keine Bewertungen

- L-24, DeductionsDokument22 SeitenL-24, DeductionsSonu yadavNoch keine Bewertungen

- Tax Deductions Under Sections 80C, 80D, 80EE, 80G and MoreDokument5 SeitenTax Deductions Under Sections 80C, 80D, 80EE, 80G and MoreAjay MagarNoch keine Bewertungen

- Income Tax ConsultationDokument15 SeitenIncome Tax Consultation21BCO058 Tharun B KNoch keine Bewertungen

- Tax Deductions under Sections 80C to 80U from Gross Total IncomeDokument19 SeitenTax Deductions under Sections 80C to 80U from Gross Total IncomeShamrao GhodakeNoch keine Bewertungen

- Deductions To Be Made in Computing Total IncomeDokument15 SeitenDeductions To Be Made in Computing Total IncomeAbey FrancisNoch keine Bewertungen

- Investments Considered Under This Section Are: 1. Maximum Limit Rs.150000/-2. Available For Self, Spouse and ChildrenDokument8 SeitenInvestments Considered Under This Section Are: 1. Maximum Limit Rs.150000/-2. Available For Self, Spouse and ChildrenGourav BathejaNoch keine Bewertungen

- Income Tax Deductions.Dokument22 SeitenIncome Tax Deductions.Dhruv BrahmbhattNoch keine Bewertungen

- Best ELSS funds for tax saving in 2019Dokument13 SeitenBest ELSS funds for tax saving in 2019jsaideep23Noch keine Bewertungen

- Taxation Law ProjectDokument15 SeitenTaxation Law Projectraj vardhan agarwalNoch keine Bewertungen

- Section 80cDokument4 SeitenSection 80cKarthick BalajiNoch keine Bewertungen

- Amity University RajasthanDokument8 SeitenAmity University RajasthanHarshit TiwariNoch keine Bewertungen

- DeductionsDokument11 SeitenDeductionsguest1Noch keine Bewertungen

- Chapter ViaDokument4 SeitenChapter ViaCA Gourav JashnaniNoch keine Bewertungen

- Unit 5Dokument9 SeitenUnit 5piyush.birru25Noch keine Bewertungen

- Deductions: Basic Rule The Aggregate Amount of Deductions Under Sections 80C To 80U Cannot Exceed The Gross Total IncomeDokument28 SeitenDeductions: Basic Rule The Aggregate Amount of Deductions Under Sections 80C To 80U Cannot Exceed The Gross Total IncomeAmar ItagiNoch keine Bewertungen

- Exemptions Under Various Sections of The Income Tax, India: 1) Section 80 C (Limit: Rs. 1,00,000)Dokument5 SeitenExemptions Under Various Sections of The Income Tax, India: 1) Section 80 C (Limit: Rs. 1,00,000)Ramakoteswar NampalliNoch keine Bewertungen

- Tax ExemptionDokument3 SeitenTax ExemptionShubhangi Dhawale0% (1)

- DeductionsDokument7 SeitenDeductionsAnurag BishtNoch keine Bewertungen

- Income Tax Guide FY 2023-24Dokument11 SeitenIncome Tax Guide FY 2023-24akshay yadavNoch keine Bewertungen

- Chapter 12 TaxdeductionsDokument16 SeitenChapter 12 TaxdeductionsRiya SharmaNoch keine Bewertungen

- Income Tax Exemptions For The Year 2010Dokument4 SeitenIncome Tax Exemptions For The Year 2010Homework PingNoch keine Bewertungen

- Income Tax Savings SectionsDokument2 SeitenIncome Tax Savings Sectionsharvinder thukralNoch keine Bewertungen

- How To Save Tax Legally With Income Tax Deductions From 80C To 80G?Dokument3 SeitenHow To Save Tax Legally With Income Tax Deductions From 80C To 80G?facedoneNoch keine Bewertungen

- Deductions under Chapter VI-A of the Income Tax ActDokument13 SeitenDeductions under Chapter VI-A of the Income Tax ActAnfal MoidinNoch keine Bewertungen

- Various Sections For Tax SavingsDokument3 SeitenVarious Sections For Tax SavingsJayakrishnan MarangattNoch keine Bewertungen

- Deductions U/S 80C TO 80U: By: Sumit BediDokument69 SeitenDeductions U/S 80C TO 80U: By: Sumit BediKittu NemaniNoch keine Bewertungen

- Deductions: Basic Rule The Aggregate Amount of Deductions Under Sections 80C To 80U Cannot Exceed The Gross Total IncomeDokument29 SeitenDeductions: Basic Rule The Aggregate Amount of Deductions Under Sections 80C To 80U Cannot Exceed The Gross Total IncomeashpakkhatikNoch keine Bewertungen

- GIT - Total Income Exam QP - 18-3-2020Dokument18 SeitenGIT - Total Income Exam QP - 18-3-2020geddadaarunNoch keine Bewertungen

- Tax Deductions ExplainedDokument16 SeitenTax Deductions ExplainedArpit VermaNoch keine Bewertungen

- Deductions U/S 80C TO 80UDokument55 SeitenDeductions U/S 80C TO 80UAnshu kumarNoch keine Bewertungen

- ItfjfygjDokument3 SeitenItfjfygjKrishna GNoch keine Bewertungen

- Tax Deductions under Sections 80C to 80UDokument41 SeitenTax Deductions under Sections 80C to 80UanupchicheNoch keine Bewertungen

- Auto Income Tax Calculator Version 5.1 2010-11Dokument19 SeitenAuto Income Tax Calculator Version 5.1 2010-11Bijender Pal ChoudharyNoch keine Bewertungen

- Presented By: Dhruv Singh Priya Puri Nikhil Singhal Shantanu SaritaDokument22 SeitenPresented By: Dhruv Singh Priya Puri Nikhil Singhal Shantanu SaritaDhruv singhNoch keine Bewertungen

- Shreha Shah (Ba LLB Vii)Dokument7 SeitenShreha Shah (Ba LLB Vii)Shreha VlogsNoch keine Bewertungen

- NMIMS Global Access School For Continuing Education (NGA-SCE) Course: Taxation-Direct and Indirect Internal Assignment Applicable For June 2020 ExaminationDokument10 SeitenNMIMS Global Access School For Continuing Education (NGA-SCE) Course: Taxation-Direct and Indirect Internal Assignment Applicable For June 2020 ExaminationAnkit SharmaNoch keine Bewertungen

- Atc AtuDokument9 SeitenAtc AtuKeshav SagarNoch keine Bewertungen

- Some of The Tax Saving SavingsDokument3 SeitenSome of The Tax Saving SavingsNira SinhaNoch keine Bewertungen

- Shubham Saha Income TaxDokument17 SeitenShubham Saha Income TaxGautam KumarNoch keine Bewertungen

- Incometax Sections PDFDokument13 SeitenIncometax Sections PDFmohanNoch keine Bewertungen

- IT Assignment 2Dokument7 SeitenIT Assignment 2Srinivasulu Reddy PNoch keine Bewertungen

- CLUBBING OF INCOME AND DEDUCTIONS UNDER CHAPTER VI-ADokument8 SeitenCLUBBING OF INCOME AND DEDUCTIONS UNDER CHAPTER VI-ASiddharth VaswaniNoch keine Bewertungen

- Income Tax Rate 2010Dokument6 SeitenIncome Tax Rate 2010Vishal JwellNoch keine Bewertungen

- Section 80 Deduction TableDokument6 SeitenSection 80 Deduction TablevineyNoch keine Bewertungen

- Income Tax Rates (For Individuals, Hufs, Association of Persons, Body of Individuals) Assessment Year 2011-2012 Relevant To Financial Year 2010-2011Dokument6 SeitenIncome Tax Rates (For Individuals, Hufs, Association of Persons, Body of Individuals) Assessment Year 2011-2012 Relevant To Financial Year 2010-2011jhancyNoch keine Bewertungen

- Tax Planning Through Permissible DeductionsDokument33 SeitenTax Planning Through Permissible DeductionsNuhman.MNoch keine Bewertungen

- 1040 Exam Prep Module VI: Standard and Itemized DeductionsVon Everand1040 Exam Prep Module VI: Standard and Itemized DeductionsNoch keine Bewertungen

- 1040 Exam Prep Module IV: Items Excluded from Gross IncomeVon Everand1040 Exam Prep Module IV: Items Excluded from Gross IncomeNoch keine Bewertungen

- No Objection Letter To Whomsoever It May ConcernDokument1 SeiteNo Objection Letter To Whomsoever It May ConcernAjay Pratap0% (1)

- Subject - G.K. Class-5th: Write One Word AnswerDokument8 SeitenSubject - G.K. Class-5th: Write One Word AnswerAjay PratapNoch keine Bewertungen

- Ats of Easter Up On 19-07-2019Dokument4 SeitenAts of Easter Up On 19-07-2019Ajay PratapNoch keine Bewertungen

- Obc CertificateDokument1 SeiteObc CertificateAjay PratapNoch keine Bewertungen

- O Level Project SubmissionDokument1 SeiteO Level Project SubmissionAjay PratapNoch keine Bewertungen

- Reaction of Aluminium With AirDokument1 SeiteReaction of Aluminium With AirAjay PratapNoch keine Bewertungen

- ContentsDokument1 SeiteContentsAjay PratapNoch keine Bewertungen

- PMC AcknowldgeDokument1 SeitePMC AcknowldgeAjay PratapNoch keine Bewertungen

- ComputerDokument69 SeitenComputermanyascribda2Noch keine Bewertungen

- Banking Terms PARTDokument28 SeitenBanking Terms PARTAjay PratapNoch keine Bewertungen

- How: For JoiningDokument4 SeitenHow: For JoiningAjay PratapNoch keine Bewertungen

- Master's exam guide on export-import proceduresDokument4 SeitenMaster's exam guide on export-import proceduresAjay PratapNoch keine Bewertungen

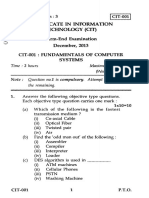

- Cit-001 3Dokument3 SeitenCit-001 3Ajay PratapNoch keine Bewertungen

- Kanoongo Syllabus PDFDokument2 SeitenKanoongo Syllabus PDFAjay PratapNoch keine Bewertungen

- CIT-002 Introduction to Information Technology ExamDokument2 SeitenCIT-002 Introduction to Information Technology ExamAjay PratapNoch keine Bewertungen

- National Insurance AO Exam Preparation Materials For Quantitative AptitudeDokument39 SeitenNational Insurance AO Exam Preparation Materials For Quantitative AptitudeSaurabh PandeyNoch keine Bewertungen

- IBO - English Assign.2013-14tDokument8 SeitenIBO - English Assign.2013-14tzargarsafwatNoch keine Bewertungen

- IGNOU Examination FormDokument2 SeitenIGNOU Examination FormShashank VashisthaNoch keine Bewertungen

- Understanding the key components of a balance sheetDokument4 SeitenUnderstanding the key components of a balance sheetAjay PratapNoch keine Bewertungen

- Ibps Clerk III - General Awareness - ..Dokument10 SeitenIbps Clerk III - General Awareness - ..Ajay PratapNoch keine Bewertungen

- ComputerDokument69 SeitenComputermanyascribda2Noch keine Bewertungen

- Understanding Bills of ExchangeDokument52 SeitenUnderstanding Bills of ExchangeParesh Vaviya91% (11)

- Depreciation and ProvisionsDokument52 SeitenDepreciation and ProvisionsSaurabh GhoneNoch keine Bewertungen

- National Insurance AO Exam Preparation Materials For Quantitative AptitudeDokument39 SeitenNational Insurance AO Exam Preparation Materials For Quantitative AptitudeSaurabh PandeyNoch keine Bewertungen

- 26b.xls Download Form15G.pdf DownloadDokument2 Seiten26b.xls Download Form15G.pdf DownloadAjay PratapNoch keine Bewertungen

- Receipt and Payment AccountDokument3 SeitenReceipt and Payment AccountAjay PratapNoch keine Bewertungen

- Understanding Bills of ExchangeDokument52 SeitenUnderstanding Bills of ExchangeParesh Vaviya91% (11)

- Secondary AssessmentsDokument12 SeitenSecondary Assessmentsapi-338389967Noch keine Bewertungen

- Buhos SummaryDokument1 SeiteBuhos Summaryclarissa abigail mandocdocNoch keine Bewertungen

- ABS Part4 - Vessel Systems & Machinery - 2001Dokument710 SeitenABS Part4 - Vessel Systems & Machinery - 2001AndréMenezesNoch keine Bewertungen

- Platinum Gazette 29 November 2013Dokument12 SeitenPlatinum Gazette 29 November 2013Anonymous w8NEyXNoch keine Bewertungen

- Chambal Cable Stayed Bridge Connecting ShoresDokument6 SeitenChambal Cable Stayed Bridge Connecting Shoresafzal taiNoch keine Bewertungen

- Steps of Repertorization - 5e097dab9ad98Dokument18 SeitenSteps of Repertorization - 5e097dab9ad98Sowjanya JyothsnaNoch keine Bewertungen

- Grade 9 P.EDokument16 SeitenGrade 9 P.EBrige SimeonNoch keine Bewertungen

- Age Discrimination PDFDokument20 SeitenAge Discrimination PDFMd. Rezoan ShoranNoch keine Bewertungen

- Bespoke Fabrication Systems for Unique Site SolutionsDokument13 SeitenBespoke Fabrication Systems for Unique Site Solutionswish uNoch keine Bewertungen

- Chin Cup Therapy An Effective Tool For The Correction of Class III Malocclusion in Mixed and Late Deciduous DentitionsDokument6 SeitenChin Cup Therapy An Effective Tool For The Correction of Class III Malocclusion in Mixed and Late Deciduous Dentitionschic organizerNoch keine Bewertungen

- 21 - Effective Pages: Beechcraft CorporationDokument166 Seiten21 - Effective Pages: Beechcraft CorporationCristian PugaNoch keine Bewertungen

- Indian Boyhood PDFDokument316 SeitenIndian Boyhood PDFHasanNoch keine Bewertungen

- Berman Et Al-2019-Nature Human BehaviourDokument5 SeitenBerman Et Al-2019-Nature Human BehaviourMira mNoch keine Bewertungen

- Human Diseases A Systemic Approach 8th Edition-Páginas-15-26Dokument12 SeitenHuman Diseases A Systemic Approach 8th Edition-Páginas-15-26Karime LopezNoch keine Bewertungen

- Build Size and Aesthetics with the 6-Week Hype Gains Hypertrophy ProgramDokument21 SeitenBuild Size and Aesthetics with the 6-Week Hype Gains Hypertrophy ProgramDanCurtis100% (1)

- Concept PaperDokument6 SeitenConcept Paperapple amanteNoch keine Bewertungen

- SEXUALABUSEDokument12 SeitenSEXUALABUSERyoman EchozenNoch keine Bewertungen

- How to Calculate PayrollDokument87 SeitenHow to Calculate PayrollMichael John D. Natabla100% (1)

- Module 4 q2 Smaw-9-10Dokument15 SeitenModule 4 q2 Smaw-9-10Louvre Ferris Salabao TangbawanNoch keine Bewertungen

- ZP Series Silicon Rectifier: Standard Recovery DiodesDokument1 SeiteZP Series Silicon Rectifier: Standard Recovery DiodesJocemar ParizziNoch keine Bewertungen

- Ficha Tecnica StyrofoamDokument2 SeitenFicha Tecnica StyrofoamAceroMart - Tu Mejor Opcion en AceroNoch keine Bewertungen

- Understanding Anxiety Disorders and Abnormal PsychologyDokument7 SeitenUnderstanding Anxiety Disorders and Abnormal PsychologyLeonardo YsaiahNoch keine Bewertungen

- EDSP Quantitative and Qualitative FormDokument2 SeitenEDSP Quantitative and Qualitative FormTalal SultanNoch keine Bewertungen

- Ficha Tecnica Emeral 8C PDFDokument11 SeitenFicha Tecnica Emeral 8C PDFLeticia KoerichNoch keine Bewertungen

- Myofascial Release for Piriformis MyalgiaDokument14 SeitenMyofascial Release for Piriformis MyalgiaApoorvNoch keine Bewertungen

- Chemicals Zetag DATA Powder Magnafloc 351 - 0410Dokument2 SeitenChemicals Zetag DATA Powder Magnafloc 351 - 0410PromagEnviro.comNoch keine Bewertungen

- Handbook For Magnaflux L10 CoilDokument4 SeitenHandbook For Magnaflux L10 CoilmgmqroNoch keine Bewertungen

- Heal Yourself in Ten Minutes AJDokument9 SeitenHeal Yourself in Ten Minutes AJJason Mangrum100% (1)

- MPQ2908 - 48V Buck Converter Automotive Reference DesignDokument4 SeitenMPQ2908 - 48V Buck Converter Automotive Reference DesignShubham KaklijNoch keine Bewertungen

- Pakistan List of Approved Panel PhysicianssDokument5 SeitenPakistan List of Approved Panel PhysicianssGulzar Ahmad RawnNoch keine Bewertungen