Beruflich Dokumente

Kultur Dokumente

Home Office Integ

Hochgeladen von

Reshielyn Vee Entrampas LopezCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Home Office Integ

Hochgeladen von

Reshielyn Vee Entrampas LopezCopyright:

Verfügbare Formate

ADVANCE ACCOUNTING PART 1 & 2 (ACCTG 10 & 11)

HOME OFFICE AND BRANCHES

Agencies and branches are established to decentralize operations or to expand into new markets. Agencies

are simple extensions of the home office; branches, generally, are with regulated autonomy to operate as

an independent entity.

Because agencies do not maintain its own set of accounting records, all its transactions are recorded in the

books of the home office. If the home office would like to determine viabilities of the agencies, real and

nominal accounts for the agency are identified in the home office books to facilitate such determination.

Otherwise, the agency items are merged without identification with those of the home office.

The branch has its own complete set of accounting records, therefore all its transactions, including those

with the home office, are recorded in its books. It also presents its own set of financial statements; the

income statement, the balance sheet, and the statement of cash flows. But because the branch is a part of

the home office, therefore, these set of financial statements are not capable for general purposes. And

since the home office is just also part of the whole organization, its own set of financial statements: the

income statement, the balance sheet and the statement of cash flows are also not acceptable for general

purposes. These two different sets of financial statements are internal to of the reporting entities,

combined financial statements must be prepared for the combined entities (taken as one and the same) to

meet the requirements of general-purpose statements.

A branch and its home office represent two accounting systems but just one accounting and reporting

entity. All entries in the accounting records of the branch are also entered, at least in summary form, in the

accounting records of the home office. The records of the home office and the branch are linked by two

reciprocal accounts; the Home Office Equity account in the books of the branch and the Investment in

Branch account in the books of the home office. Because they are always reciprocal, it means that the two

accounts always have the same balance although the Investment in Branch is a debit account (as an asset

in the books of the home office) and the Home Office is a credit account (as an equity in the books of the

branch). The two accounts frequently show different balances on a temporary basis due to errors and

items in transit. A very important aspect of the study of home office and branches is the reconciliation of

the reciprocal balances.

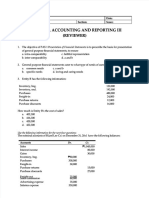

An illustration of journal entries recorded for interoffice transactions follow:

Transactions

-Transfer of Cash form the home

office

-Transfer of Cash from the branch

-Transfer of mdse from HO at cost

-Transfer of mdse form HO at

above cost

-Payment

expenses

by

HO

of

branch

-Allocation of prev. paid branch

expenses

-Transfer of Fixed asset

home office to branch

from

Home Office Books

Inv. In Branch

x

Cash

Inv.

In

x

Inv. In Branch

Shipment to

x

Inv. In Branch

Shipment to

x

Allowance for OV

Inv. In Branch

x

Inv. In Branch

x

Memo entry

Branch Books

x

Cash

x

Branch

x

Branch

x

Branch

x

x

Cash

x

Expenses

Cash

Home

Office

x

Home Office Equity

x

Equity

x

Cash

x

Shipment form HO

Home Office

x

Shipment form HO

Home Office

x

Expenses

x

Equity

x

Equity

Home

Office

x

Equity

Home

Office

x

Equity

x

Expenses

x

Memo Entry

(Note: There will be no entry if all fixed assets are accounted in the

books of the home office); otherwise:

Inv. In Branch

x

Fixed Assets

x

Accumulated Depn

x

Home Office Equity

Fixed Assets

x x

1 | Page

ADVANCE ACCOUNTING PART 1 & 2 (ACCTG 10 & 11)

-To take-up branch Profit/(loss)

Inv. In Branch

Branch

x

Income

x

Branch Loss

Inv.

-To adjust the reported branch NI/

(NL) for realized allowance

In

Branch

Accumulated Depn

x

Income summary

x

Home Office Equity

x

Home Office Equity

x

Income summary

x

No Entry

x

Allowance for OV

Branch

Income

x

Note: The adjusting entry to reflect the true net income or loss of the

branch form the standpoint of the home office is always favorable and

only necessary when billing is above cost.

Problem 1

YYY Corporation operates a number of branches in Metro Manila. On June 30 2014 its Makati branch

showed a home office account balance of P17,504 and the Home office books showed a branch account

balance of P16,352. The following information may help in reconciling both accounts:

1. A P7,680 shipment charged by home office to Makati branch was actually sent to Cubao branch and

retained by the latter.

2. A P9,600 shipment, intended and charged to Marikina branch was shipped to and retained by Makati

branch.

3. A P1,280 emergency cash transfer from Cubao branch was not taken up in the home office books.

4. Home office collects a Makati branch accounts receivable of P2,304 and fails to notify the branch.

5. Home office was charged for P768 for mdse returned by Makati branch on June 28 , but it is still in

transit.

6. Home office erroneously recorded Makati branch net income for may 2014 at P10,416. The branch

reported a net income of P8,112.

Required:

Compute for the reconciled amount of the Home office and Makati branch.

Problem 2

The following were found in your examination of the interplant accounts between Bulacan Home office and

Laguna branch.

1. Transfer of fixed assets from home office amounting to P67,450 was not booked by the branch.

2. P12,500 covering marketing expenses of another branch was charged by the Home office to Laguna.

3. Laguna recorded a debit note on inventory transfers from home office of P93,750 twice.

4. Home office recorded cash transfer of P82, 125 from Laguna branch as coming from Tagum City Branch.

5. Laguna reversed a previous debit memo from Cagayan de Oro branch amounting to P13,125. Home

Office decided that this charge is appropriately Tagum city branch cost.

6. Laguna recorded a debit memo from home office of P5,812.50 as P5,700.

Required:

How much is the net adjustment in the Home office books related to the Laguna branch account?

Problem 3

The pre-closing trial balances of DDF Corporation and its Tarlac Branch for the year ended 12-31-14, prior

to adjusting and closing entries are as follows:

HOME OFFICE

BRANCH

Accounts

CASH

A Receivable net.

Inventory beg., from vendors

Inventory

from Home Office

Deferred profit

Fixed Assets, net

Debit

P35,840

81,920

235,520

Credit

Debit

P10,240

51,200

51,200

20,840

Credit

25,600

890,880

92,160

2 | Page

ADVANCE ACCOUNTING PART 1 & 2 (ACCTG 10 & 11)

Investment in branch

Accounts payable

Long-term Debt

Common stocks

Retained Earnings, beg

Home Office equity

Sales

Purchases

Shipment from Home Office

Shipment to branch

Operating Expenses

Totals

158,720

226,304

409,600

307,200

358,400

46,080

117,760

327,680

983040

819,200

122,880

92,160

86,016

174,080

P2,396,16

0

P2,396,160

51,200

P491,520

P491,520

Inventory per physical count on 12-31-14

From vendors

P184,320

P20, 480

From Home Office

30,720

Additional information:

1. Inventory transferred to the branch from the home office is billed at 125% of cost

2. The home office billed the branch P15,360 for inventory is shipped to the branch on 12-28-14; the

branch received and recorded this shipment on January 2, 2015.

3. The branch remitted P25,600 cash to the Home Office on 12-31-14; the home Office received and

recorded this remittance on January 4, 2015.

Requirements:

1. Prepare the year end adjusting entries to bring the intercompany accounts into agreement.

2. Complete the following analysis of the Branch Inventory

Transfer

Above Cost

Transfer at

Cost

Mark-up

Beg., Inventory:

Acquired from vendors

Acquired from Home Office

Add; Purchases

Shipment from Home Office

Total goods Available for sale

Less :Ending Inventory:

From vendors

SFHO

COST OF GOOD SOLD

3. Prepare the following year-end adjusting entries to:

a. Record the BRANCH income on the HOME OFFICE books.

b. Adjust the Deferred profit account to the proper balance.

4. Prepare the year-end closing entries for the HOME OFFICE and the BRANCH.

5. Prepare the following for 2014:

a. In come statement and Balance sheet for BRANCH AND HOME OFFICE

b. Combined FS.

Problem 4

On 12-31-14 the investment in branch account on the Home Office books of AAA Company shows a

balance of P192,000. The following facts are ascertained:

1. Merchandise billed at P6,400 is in transit on 12-31-14 from Home office to the branch.

2. The branch collected a Home Office account receivable for P2,560. The branch did not notify the

Home

office of the cash collection.

3. On December 30, the Home office mailed a check of P12,800 to the branch but the bookkeeper

charged

the check to General expenses; the branch has not received the check as of 12-31-14.

4. Branch profit for December was recorded by the Home office at P11,392 instead of P12,544

5. Branch returned supplies of P1,280 to the home office but the home office has not yet recorded

the receipts of supplies.

3 | Page

ADVANCE ACCOUNTING PART 1 & 2 (ACCTG 10 & 11)

Required:

a. compute the balance of the Home office account on the Branch book as of 12-31 before its

adjustments.

b. Prepare a reconciliation statement to compute the adjusted balances on 12-31-14.

Problem 5

UKL Corporation bills its branch for merchandise shipment at 25% above cost. The following are some of

the account balances appearing on the books of the Home office and its branch as of 12-31-14.

Inventory, January 1

Shipment from Home Office

Purchases

Shipment to Branch

Allowance

for

overvaluation

inventory

Sales

Operating expenses

Home Office Books

P36,000

Branch

1,080,000

288,000

79,200

1,440,000

348,000

Branchs Books

P57,600

336,000

360,000

864,000

132,000

The ending inventory of the branch of P86,400 includes goods from outside purchases of P19,200; the

ending inventory of the Home office is P180,000.

Calculate:

1. The amount of shipments in transit at cost at the end of 2014.

2. The overstatement of branch cost of sales during 2014.

3. The combined net income for the year 2014.

Problem 6

HOO Corporation has one branch office, named BOO branch. HOO is performing the end-of-the-period

reconciliation of its BOO branch account whose current balance is P? and BOOs Home office account

whose current balance is P? the following items are unsettled at the end of the accounting period (you may

assume that the item has been reflected in the accounts of the underlined entity):

1. HOO has agreed to remove P480 of excess freight charges charged to BOO when HOO shipped twice as

much inventory as BOO requested.

2. BOO mailed a check for P7,040 to HOO as a payment for merchandise shipped from HOO to BOO. HOO

has not yet received the check.

3. BOO returned defective merchandise to HOO. The merchandise was billed to BOO at P2,560 when its

actual cost was P1,920.

4. Advertising expenses attributable to the BOO office were paid for by the HOO in the amount of P3,200.

Required:

What is the unadjusted balance of HOOs Branch account and BOOs home office account if, the

adjusted balances for the BOOs branch account and HOO home office account is P320,000?

Problem 7

DDD company is engaged in merchandising both at its Head Office in Makati and its Branch in Cebu.

Selected accounts in the trial balances of DDD company and its Cebu Branch at 12-31-14 follows:

Debit

Home Office

Branch

Inventory January

P14,720

P7,392

Branch

37,312

Purchases

121,600

Shipment from Home office

67,200

Freight in From Home Office

3,520

Sundry expenses

32,000

16,000

Credit

Home office

34,112

Sales

99,200

89,600

Shipment to branch

64,000

Allowance for overvaluation of branch inventory

7,040

4 | Page

ADVANCE ACCOUNTING PART 1 & 2 (ACCTG 10 & 11)

Additional Info:

a. Cebu branch receives all its merchandise from head Office. The Head Office bills the goods at

cost plus 10% mark-up. At 12-31-14 a shipment with a billing price of P3,200 was in transit to the branch

Freight on this shipment was P160 which is to be treated as part of inventory.

b. December 31, 2014 inventories, excluding the shipment in transit was:

Head Office, at cost

P19,200

Cebu branch, at billed value (excluding freight of P333)

6,656

Required:

What is the net income of the Head office, and the True income of Cebu branch?

Problem 8

Home office transfers inventory to its branch at a 20% mark-up on cost. During 2014, inventory costing the

home office P51,200 was transferred to the branch. At year end, the home office adjusted its unrealized

intercompany inventory profit account downward by P11,648. The Branchs year-end balance sheet shows

P3,072 of inventory acquired from the Home office.

Required: How much is the beginning inventory of the branch at cost?

Problem 9

On 12-31-14, the branch current account on the home offices books has a balance of P405,000. In

analyzing the activity in each of these accounts for Dec., you find the following differences:

Inventory costing P14,500 was returned by the branch to the home office on 12-19-14. The billing

was at cost, but the home office recorded the transaction at P1,450.

A home office customer remitted P41,000 to the branch. The branch recorded this cash collection

on 12-23-14. Meanwhile, back at the home office, no entry has been made yet.

The home office accountant had recorded a branch remittance initiated on 12-28-14 for P64,000

twice.

Inventories costing P89,000 was received by the branch from home office on 01-02-13. However,

the home office accountant informed the branch accountant about the shipment on 12-19-14 and

the latter had recorded the inventory shipment at P98,000. The home office ships goods to its

branches at cost.

The Home office incurred P12,000 of advertising expenses and allocated 1/8 of this amount to the

branch on 12-21-14. The branch inadvertently recorded half of the advertising expenses incurred by

the home office during the year.

How much is the unadjusted balance of the Home Office Current account?

Problem 10

The trial balances of the Home office and the branch office ABC Company as follows:

The ABC Company

Trial Balance

December 31, 2013

Debits

Cash

Accounts Receivables

Inventory- 12-31-13

Plant Assets (net)

Branch

Cost of Goods Sold

Expenses

Total

Credits

Accounts Payable

Mortgage

Capital Stock

Retained Earnings-January 1,

2013

Sales

Accrued Expenses

Home

15,000

20,000

30,000

150,000

44,000

220,000

70,000

549,000

Branch

2,000

17,000

8,000

93,000

41,000

161,000

23,000

50,000

100,000

26,000

350,000

150,000

2,000

5 | Page

ADVANCE ACCOUNTING PART 1 & 2 (ACCTG 10 & 11)

Home Office

Total

549,000

9,000

161,000

The following additional information is to be considered:

a. The branch receives all of its merchandise from home office. The home office bills goods to the branch

at 125% of cost. During 2013 the branch was billed for 105,000 on shipments from the home office.

b. the home office credit sales for the invoice price of goods shipped to the branch.

c. on January 1, 2013, the inventory of the home office was P25,000. The branch books showed a P6,000

inventory.

d. On December 30, 2013, the home office billed the branch for P12,000, representing the branchs share

of expenses paid at the home office. The branch has not yet recorded this billing.

e. All cash collections made by the branch are deposited in a local bank to the account of the home office.

Deposits of this nature included the following:

Amount

Date Deposited by branch

P5,000

3,000

7,000

2,000

December 28, 2013

December 29, 2013

December 30, 2013

January 2, 2014

Date Recorded by

office

December 30, 2013

January 2, 2014

January 3 2014

January 5 2014

Home

f. Expenses incurred locally by the branch are paid from an impress bank account that is reimbursed

periodically by the home office. Just prior to the end of the year, the home office forwarded a reimbursed

check in the amount of P3,000, which was not received by the branch office until January, 2014.

Required:

1. Prepare a reconciliation of the branch accounts and the Home Office account, showing the

corrected book balances.

2. Prepare combined income statement.

Problem 11

The following transactions were entered in the branch current account of Makati Head Office for the year

2014

Beg. Balance

Shipment to branch, 4/1/14

Cash forwarded, 6/1/14

Collection of AR, 9/1/14

Operating expenses charged to the

Branch12/31/14

DEBIT

459,258

212,400

15,000

CREDIT

33,300

2,880

Shipment to the branch during the year were made at 20% above cost

The balance of the allowance for overvaluation of branch inventory account was P21,300 at the

beginning, and the allowance was written down to P14,700 at year-end.

On 12-10-14, the home office purchased a piece of equipment amounting to P36,000 for its branch

in Ortigas. The said equipment has a useful life of the five years and will be carried in the books of

the branch, but the home office recorded the purchased by debiting Equipment

The branch recorded the depreciation of the equipment by debiting the Home Office current

account and crediting Accumulated Depreciation.

Debit memo regarding the allocation of operating expenses to the Ortigas branch was received by

the branch on January 2, 2015.

The Ortigas branch reported net income of P197,730

It also remitted cash to the home office on 12-31-14 amounting to P33,000, which the home office

received and recorded on January 1, 2015

The interoffice accounts were in agreement at the beginning of the year.

Compute for the following

1. How much is the unadjusted balance of the branch current account on 12-31-14 before

necessary closing entries were made?

2. What is the amount of adjustment in the allowance for overvaluation of Branch inventory

account?

3. How much is the net income of Ortigas branch that will be reported in the combined income

statement of The Makati Company.

6 | Page

ADVANCE ACCOUNTING PART 1 & 2 (ACCTG 10 & 11)

4. What is the amount of the Home Office Current account that will be reported in the books of

Ortigas Branch after closing entries are made?

Problem 12

The Batangas Branch of M Corporation is billed for merchandise by the Home Office at 120% of cost. The

branch in turn bills its customers at 1255 of cost. On January 17 all of the branch merchandise were

destroyed by fire except some goods priced to sell for P6,000. No insurance was maintained. A branch

book shows the following information:

Merchandise Inventory, January 1 (at billed price)

Shipments from Home Office (January 1-17)

Sales

Sales Returns

Sales Allowances

P26,400

20,000

15,000

2,000

1,000

Required:

a. What was the cost of the merchandise destroyed by fire?

b. How much is fire loss in so far as the Home Office is concerned?

Problem 13

The income statement submitted by Tarlac Branch to the Home Office for the month of December 2014, is

shown below. After effecting the necessary adjustments the true net income of the branch was ascertained

to be P156,000.

Sales

Cost of sales:

Inventory, December 1

Shipments from Home Office

Local purchases

Total available for sale

Inventory, December 31

Gross Margin

Operating Expenses

Net Income for December, 2014

The branch inventories were:

Merchandise from home Office

Local purchases

P600,000

P80,000

350,000

30,000

P460,000

100,000

P360,000

P240,000

180,000

P60,000

12/01/14

12/31/14

P70,000

P84,000

10,000

16,000

Required:

a. The billing price based on cost imposed by the Home office to the branch,

b. The balance of allowance for overvaluation of branch December 31, 2014 after adjustment.

Problem 14

FINC opened an agency in Manila. The following are transactions for July 2015. Samples worth P10,000,

advertising materials of P5,000 and checks for P50,000 were sent to the agency. Agency sales amounted

to P220,000 (cost P150,000). The collection for agency amounted to P176,400 net of 2% discount. The

agencys working fund was replenished for the following expenses incurred: rent for 2 months P10,000;

delivery expenses P2,500 and miscellaneous expenses of P2,000. Home office charges the following to the

agency, after analysis of accounts recorded on the books; salaries and wages P15,000 and commission

which is 5% sales. The agency sample inventory at the end of December is 25% of the quantity shipped.

The agency has used 20% of the advertising materials sent by the Home office.

How much is the agency net income for the month of July 2015?

Problem 15

On 12-31-14 the home office current account on the books of the Manila branch has a balance of

P325,000. In analyzing the activity in each of these accounts for December, you find the following

differences:

a. A P12,000 branch remittance to the home office initiated on December 28, 2014 was recorded twice by

the home office on 12-29 and on 12-30.

b. The home office incurred P18,000 of advertising expenses and allocated 1/3 of this amount to the

branch on 12-17-14. The branch recorded this transaction on 12-19-14 amounting to P9,000.

7 | Page

ADVANCE ACCOUNTING PART 1 & 2 (ACCTG 10 & 11)

c. A branch customer remitted P8,000 to the home office. The home office recorded this cash collection on

12-22-14. Upon notification on the same year, the branch debited the amount to Accounts Receivable and

credited to Home office Current.

d. Inventory costing P121,900 was sent to the branch by the Home office on 12-12-14. The billing was at

cost, but the branch recorded the transaction at P129,100.

e. A P32,000 shipment, charged by home office to Manila branch, was actually sent to and retained by

Alabang branch.

f. The branch collected a home office accounts receivable of P9,200 and fails to notify the home office

g. Home office erroneously recorded the branchs net income at P34,725. He branch reported a net income

of P37,425.

h. the branch writes off uncollectible accounts of P7,500. The allowance for doubtful accounts is

maintained on the books of the home office. The home office is not yet notified about the write off.

Required:

How much is the unadjusted balance of the branch current account as of 12-31-14?

Problem 16

QRS Trading Co. operates a branch in Baguio City. At close of the business on December 31, 2014 Baguio

Branch account in the home office books showed a debit balance of P184, 750. The interoffice accounts

were in agreement at the beginning of the year. For purposes of reconciling the interoffice accounts, the

following facts were ascertained:

a. Furniture and fixtures costing the home office P19,000 was picked up by the branch as P1,900. The

branch will maintain the records of the asset used.

b. Freight charge on merchandise made by the home office for P1,350 was recorded in the branch books as

P3,150.

c. Home office credit memo for P2,400 was recorded twice by the branch.

d. The branch failed to take up a P3,000 debit memo from the home office.

e. The home office inadvertently recorded a remittance for P11,000 from its Bicol branch as a remittance

from its Baguio branch.

f. On December 30, 2014 the branch sent a check for P27,000 to the home office to settle its account. The

check was not delivered to the home office until January 3, 2015.

g. On December 27, 2014 the branch returned P11,000 of seasonal merchandise to the home office for the

January clearance sale. The merchandise was not received by the home office until January 4.

h. The home office allocated general expenses of P5,000 to the branch. The branch had not entered the

allocation at the year-end.

i. Branch store insurance premiums of P3,200 were paid by the home office. The branch recorded the

amount of P32,000.

Required:

Determine the balance in the branch books of the home office account before adjustments as of

12-31-14

Problem 17

MMM Company has established a branch in Tacloban be sending goods costing P184,900 and P80,000 in

cash on July 1, 2014. Home office initiated transactions for the remainders of the year are found below. At

the end of the year, the companys controller has found out that the accounting staff assigned in recording

the transactions between the home office and the branches had failed to record all the transactions

initiated by the branch. Because of this, there is a significant discrepancy between the balances of the

reciprocal accounts.

The home office acquired computer equipment amounting to P420,000 for the branch on August 1,

2014. As per agreement, the branch will keep all the property, plant and equipment records.

Goods costing P320,000 were shipped from the home office to branch on November 9,2014

Additional cash amounting to P53,000was transferred to the branch on 12-2-14

A branch customer has incorrectly paid P25,000 cash to the home office on 12-16-14

The home office incurred P65,000 of advertising cost and P96,000 of salaries. Tacloban branch is to

shoulder 30% and 20% of these expenses respectively

8 | Page

ADVANCE ACCOUNTING PART 1 & 2 (ACCTG 10 & 11)

For the purpose of reconciling the reciprocal accounts, the controller has instructed the branch accountant

to send a copy of the Home office current general ledger to the home office

HOME OFFICE CURRENT

8/3

11/5

12/20

Equip. acquisition

Cash remittance

Returns of good to

HO

420,000

78,000

49,000

7/1

7/1

8/15

11/10

12/4

Goods from HO

Cash

Collection of HOs

AR

Goods from HO

Cash

184,900

80,000

113,600

230,000

50,300

Compute for the unadjusted balance of investment in Tacloban account

a. P1,142,800

b. P1,044,800

c. P1,071,600

d. P1,058,200

The net adjustment balance in the Home Office Current account

a. P946,400 net debit

b. P946,400 net credit

c. P996,400 net debitd.

credit

P996,400

net

9 | Page

Das könnte Ihnen auch gefallen

- HO, B & A AcctgDokument15 SeitenHO, B & A AcctgCarolina Fortez Dacanay71% (7)

- Practical Accounting Problems II SolutionsDokument9 SeitenPractical Accounting Problems II SolutionsEunice BernalNoch keine Bewertungen

- Home Office, Branch and Agency AccountingDokument15 SeitenHome Office, Branch and Agency AccountingErwin Labayog MedinaNoch keine Bewertungen

- Chapter 13 Multiple Choice QuestionsDokument8 SeitenChapter 13 Multiple Choice QuestionsMel ChuaNoch keine Bewertungen

- P2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Dokument12 SeitenP2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Kate Alvarez100% (2)

- Home Office and Branch Accounting PDFDokument3 SeitenHome Office and Branch Accounting PDFJisselle Marie Custodio0% (1)

- C Par First Pre Board 2008 ADokument17 SeitenC Par First Pre Board 2008 AJaylord Pido100% (1)

- Aa2e Hal Testbank Ch04Dokument26 SeitenAa2e Hal Testbank Ch04jayNoch keine Bewertungen

- AainvtyDokument4 SeitenAainvtyRodolfo SayangNoch keine Bewertungen

- AFAR 01 Partnership AccountingDokument6 SeitenAFAR 01 Partnership AccountingAriel DimalantaNoch keine Bewertungen

- ADV2 Chapter12 QADokument4 SeitenADV2 Chapter12 QAMa Alyssa DelmiguezNoch keine Bewertungen

- Advanced Accounting Home Office, Branch and Agency TransactionsDokument7 SeitenAdvanced Accounting Home Office, Branch and Agency TransactionsMajoy Bantoc100% (1)

- NFJPIA Mockboard 2011 P2Dokument13 SeitenNFJPIA Mockboard 2011 P2Regie Sharry Alutang PanisNoch keine Bewertungen

- Use The Fact Pattern Below For The Next Three Independent CasesDokument5 SeitenUse The Fact Pattern Below For The Next Three Independent CasesMichael Bongalonta0% (1)

- MidtermQ2 - Home Office Branch Accounting Billing Above CostDokument7 SeitenMidtermQ2 - Home Office Branch Accounting Billing Above Costsarahbee33% (3)

- Auditing Appplications PrelimsDokument5 SeitenAuditing Appplications Prelimsnicole bancoroNoch keine Bewertungen

- Cost To CostDokument1 SeiteCost To CostAnirban Roy ChowdhuryNoch keine Bewertungen

- Installment Sales Multiple QuestionsDokument36 SeitenInstallment Sales Multiple QuestionsTrixie CapisosNoch keine Bewertungen

- LTCC - ExamDokument5 SeitenLTCC - ExamLouise Anciano100% (1)

- Rmbe Afar For PrintingDokument18 SeitenRmbe Afar For PrintingjxnNoch keine Bewertungen

- Activity 1 Home Office and Branch Accounting - General ProceduresDokument4 SeitenActivity 1 Home Office and Branch Accounting - General ProceduresDaenielle EspinozaNoch keine Bewertungen

- Practice Problems AcctgDokument10 SeitenPractice Problems AcctgRichard ColeNoch keine Bewertungen

- AA2Q1Dokument1 SeiteAA2Q1Sweet EmmeNoch keine Bewertungen

- Afar 12 Franchise Accounting: Straight ProblemsDokument2 SeitenAfar 12 Franchise Accounting: Straight ProblemsJem Valmonte100% (1)

- Problem 11 AFARDokument4 SeitenProblem 11 AFARNorman Delirio0% (1)

- Nuvali Sales Agency Net IncomeDokument4 SeitenNuvali Sales Agency Net IncomeDivine CuasayNoch keine Bewertungen

- P2 Branch Accounting M2020Dokument6 SeitenP2 Branch Accounting M2020Charla SuanNoch keine Bewertungen

- Prelim Exam - Doc2Dokument16 SeitenPrelim Exam - Doc2alellie100% (1)

- Revenue Recognition for Consignment SalesDokument2 SeitenRevenue Recognition for Consignment SalesPau SantosNoch keine Bewertungen

- REVENUE RECOGNITION LONG TERM CONSTRUCTIONDokument4 SeitenREVENUE RECOGNITION LONG TERM CONSTRUCTIONCee Gee BeeNoch keine Bewertungen

- Business Combinations ExplainedDokument8 SeitenBusiness Combinations ExplainedLabLab ChattoNoch keine Bewertungen

- BAC 318 Final Examination With AnswersDokument10 SeitenBAC 318 Final Examination With Answersjanus lopez100% (1)

- CMPC Quiz 2Dokument5 SeitenCMPC Quiz 2Mae-shane Sagayo50% (2)

- Audit Risk Model and MaterialityDokument14 SeitenAudit Risk Model and Materialityedrick LouiseNoch keine Bewertungen

- Home Office and Branch Accounting ProblemsDokument6 SeitenHome Office and Branch Accounting ProblemsMary Dale Joie Bocala100% (1)

- PFRS 15 Revenue Recognition ProblemsDokument2 SeitenPFRS 15 Revenue Recognition ProblemsArlyn A. Zuniega0% (1)

- Ac8dccd2 1613019594275Dokument7 SeitenAc8dccd2 1613019594275Emey CalbayNoch keine Bewertungen

- Auditing Cup - 19 Rmyc Answer Key Final Round House StarkDokument13 SeitenAuditing Cup - 19 Rmyc Answer Key Final Round House StarkCarl John PlacidoNoch keine Bewertungen

- ACC16 - HO 2 Installment Sales 11172014Dokument7 SeitenACC16 - HO 2 Installment Sales 11172014Marvin James Cho0% (2)

- D. All of ThemDokument6 SeitenD. All of ThemRyan CapistranoNoch keine Bewertungen

- (Solved) Galaxy Corporation Acquired 80% of The Outstanding Shares of United... - Course HeroDokument6 Seiten(Solved) Galaxy Corporation Acquired 80% of The Outstanding Shares of United... - Course Heroadulusman501Noch keine Bewertungen

- Audit of Investments - Equity Securities Supplementary ProblemsDokument2 SeitenAudit of Investments - Equity Securities Supplementary ProblemsNIMOTHI LASE0% (1)

- Home Office and Branch Accounting: Trial Balances, Adjustments, and Financial StatementsDokument4 SeitenHome Office and Branch Accounting: Trial Balances, Adjustments, and Financial StatementsMaurice AgbayaniNoch keine Bewertungen

- Hoba 2019 QuizDokument10 SeitenHoba 2019 QuizJo Montes0% (1)

- Long-Term Construction Contracts (Pfrs 15) : Start of DiscussionDokument3 SeitenLong-Term Construction Contracts (Pfrs 15) : Start of DiscussionErica DaprosaNoch keine Bewertungen

- Drill Problems - ConsolidationDokument6 SeitenDrill Problems - Consolidationgun attaphanNoch keine Bewertungen

- Vdocuments - MX - Advanced Financial Accounting 1Dokument11 SeitenVdocuments - MX - Advanced Financial Accounting 1Sweet EmmeNoch keine Bewertungen

- Advanced Acounting QizDokument3 SeitenAdvanced Acounting QizJamhel MarquezNoch keine Bewertungen

- Multiple Choice - ConceptualDokument22 SeitenMultiple Choice - Conceptualjustinng191Noch keine Bewertungen

- Advanced Financial Accounting and Reporting 14 - NGAS: Straight Problems Problem 1Dokument6 SeitenAdvanced Financial Accounting and Reporting 14 - NGAS: Straight Problems Problem 1Jem ValmonteNoch keine Bewertungen

- NFJPIA Mockboard 2011 P2Dokument6 SeitenNFJPIA Mockboard 2011 P2ELAIZA BASHNoch keine Bewertungen

- AP.2906 InvestmentsDokument6 SeitenAP.2906 InvestmentsmoNoch keine Bewertungen

- Comprehensive Examinations 2 (Part II)Dokument4 SeitenComprehensive Examinations 2 (Part II)Yander Marl BautistaNoch keine Bewertungen

- Long-Term Construction Contracts (Special Revenue Recognition) JLM Illustrative Problems Problem 1Dokument5 SeitenLong-Term Construction Contracts (Special Revenue Recognition) JLM Illustrative Problems Problem 1Divine Cuasay100% (1)

- Identify The Choice That Best Completes The Statement or Answers The QuestionDokument13 SeitenIdentify The Choice That Best Completes The Statement or Answers The QuestionErwin Labayog MedinaNoch keine Bewertungen

- P2 105 Agency Home Office and Branch Accounting Key AnswersDokument6 SeitenP2 105 Agency Home Office and Branch Accounting Key AnswersHikari100% (1)

- Accounting For Home Office and BranchDokument12 SeitenAccounting For Home Office and BranchJohn Rey LabasanNoch keine Bewertungen

- Branches and AgenciesDokument10 SeitenBranches and AgenciesSol Guimary0% (1)

- Accounting For Business Combinations - Prelims Quiz No. 1Dokument7 SeitenAccounting For Business Combinations - Prelims Quiz No. 1Karl KiwisNoch keine Bewertungen

- Home Office and Branch Accounting Theories and Problems SolutionsDokument18 SeitenHome Office and Branch Accounting Theories and Problems Solutionskris mNoch keine Bewertungen

- Group 5 HandoutsDokument19 SeitenGroup 5 HandoutsReshielyn Vee Entrampas LopezNoch keine Bewertungen

- Gelinas-Dull 8e Chapter 06 Revised SeptemberDokument37 SeitenGelinas-Dull 8e Chapter 06 Revised SeptemberReshielyn Vee Entrampas LopezNoch keine Bewertungen

- History and Achievements of Ballet PhilippinesDokument3 SeitenHistory and Achievements of Ballet PhilippinesReshielyn Vee Entrampas LopezNoch keine Bewertungen

- Flowchart For Process of Laundry 1Dokument6 SeitenFlowchart For Process of Laundry 1Reshielyn Vee Entrampas LopezNoch keine Bewertungen

- FINAL - Ballet Philippines CoverDokument2 SeitenFINAL - Ballet Philippines CoverReshielyn Vee Entrampas LopezNoch keine Bewertungen

- Business Permit AND Licensing DivisionDokument11 SeitenBusiness Permit AND Licensing DivisionReshielyn Vee Entrampas LopezNoch keine Bewertungen

- Ballet Philippines Case Study on Turnover and SalaryDokument5 SeitenBallet Philippines Case Study on Turnover and SalaryMarjhie SoriagaNoch keine Bewertungen

- Revised 06 FinalDokument33 SeitenRevised 06 FinalReshielyn Vee Entrampas LopezNoch keine Bewertungen

- Lease accounting guideDokument2 SeitenLease accounting guideReshielyn Vee Entrampas LopezNoch keine Bewertungen

- CH 06Dokument46 SeitenCH 06Reshielyn Vee Entrampas LopezNoch keine Bewertungen

- PPT ch02Dokument47 SeitenPPT ch02JeemCarloFagelaPulaNoch keine Bewertungen

- Depreciation Expense, Rp. 25.000.000Dokument12 SeitenDepreciation Expense, Rp. 25.000.000Roni SinagaNoch keine Bewertungen

- Lecture Notes 2 Formation of A PartnershipDokument14 SeitenLecture Notes 2 Formation of A PartnershipMegapoplocker MegapoplockerNoch keine Bewertungen

- Comprehensive IncomeDokument8 SeitenComprehensive IncomepavankirNoch keine Bewertungen

- P-M-I Chart guides loan decisionDokument2 SeitenP-M-I Chart guides loan decisionLorielyn Arnaiz CaringalNoch keine Bewertungen

- Financial Accounting and Reporting Iii Financial Accounting and Reporting Iii (Reviewer) (Reviewer)Dokument18 SeitenFinancial Accounting and Reporting Iii Financial Accounting and Reporting Iii (Reviewer) (Reviewer)Jhaan Key Losita�oNoch keine Bewertungen

- Income Statement: Financial StatementsDokument5 SeitenIncome Statement: Financial StatementsKen DiNoch keine Bewertungen

- Fundamentals of Accounting AssignmentDokument5 SeitenFundamentals of Accounting AssignmentFiromsa Ahmednur Tesfaye100% (1)

- Revenue Recognition Over TimeDokument11 SeitenRevenue Recognition Over TimeFAEETNoch keine Bewertungen

- FS Mapping FLE02-1Dokument29 SeitenFS Mapping FLE02-1Lenielyn UbaldoNoch keine Bewertungen

- Preparing a bank reconciliation and journal entries (20鈥�25 min) P7 ...Dokument5 SeitenPreparing a bank reconciliation and journal entries (20鈥�25 min) P7 ...ehab_ghazallaNoch keine Bewertungen

- Financial Accounting & ReportingDokument4 SeitenFinancial Accounting & Reportingkulpreet_20080% (1)

- Consolidated Accounts QuestionsDokument10 SeitenConsolidated Accounts QuestionsGiedrius SatkauskasNoch keine Bewertungen

- Business Finance - Horizontal AnalysisDokument2 SeitenBusiness Finance - Horizontal AnalysisAnon0% (1)

- Chapter 1 OperationsDokument9 SeitenChapter 1 Operationsrietzhel22100% (1)

- Sanguine Company Trial Balance and Financial StatementsDokument1 SeiteSanguine Company Trial Balance and Financial StatementsJohn Paul Cristobal0% (1)

- Asset MisappropriationsDokument25 SeitenAsset MisappropriationsIrwan JanuarNoch keine Bewertungen

- Case: Ravi Bose, An NSU Business Graduate With Few Years' Experience As An Equities Analyst, Was Recently Brought in As Assistant To TheDokument13 SeitenCase: Ravi Bose, An NSU Business Graduate With Few Years' Experience As An Equities Analyst, Was Recently Brought in As Assistant To TheAtik MahbubNoch keine Bewertungen

- ch03 SolDokument12 Seitench03 SolJohn Nigz PayeeNoch keine Bewertungen

- U.S. Composite Corporation Financial StatementsDokument28 SeitenU.S. Composite Corporation Financial StatementsMercedes Figueroa HilarioNoch keine Bewertungen

- OutcomeofBoardMeeting10082023 10082023173019Dokument5 SeitenOutcomeofBoardMeeting10082023 10082023173019PM LOgsNoch keine Bewertungen

- 2023 1Q DMAS Financial Statements 31 Mar 2023Dokument85 Seiten2023 1Q DMAS Financial Statements 31 Mar 2023Yudha AryazNoch keine Bewertungen

- Thesis Ias 16Dokument4 SeitenThesis Ias 16aflobjhcbakaiu100% (2)

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Dokument8 SeitenStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Name of Company Worksheet for the period endedDokument11 SeitenName of Company Worksheet for the period endedRaymond RocoNoch keine Bewertungen

- Problem 7 Worksheet and Reversing EntriesDokument14 SeitenProblem 7 Worksheet and Reversing Entrieskrisayatsumi100% (1)

- 06 JUNE AnswersDokument13 Seiten06 JUNE AnswerskhengmaiNoch keine Bewertungen

- P7 - IAS's Summary (June 2015)Dokument12 SeitenP7 - IAS's Summary (June 2015)Hamza Abdul Haq83% (6)

- Aa 3Dokument4 SeitenAa 3Unknown 01Noch keine Bewertungen

- Jeizel Concepcion PR 4-1 To 4-5Dokument7 SeitenJeizel Concepcion PR 4-1 To 4-5Concepcion Family100% (2)

- Chapter6 - Trial balance and Preparation of Final Accounts яDokument13 SeitenChapter6 - Trial balance and Preparation of Final Accounts яshreya taluja100% (1)