Beruflich Dokumente

Kultur Dokumente

International Gas Report March 2009

Hochgeladen von

Kim HedumCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

International Gas Report March 2009

Hochgeladen von

Kim HedumCopyright:

Verfügbare Formate

www.platts.

com

International Gas Report

Russia to sink $2.5bn in Nigeria Issue 618 / March 2, 2009

Russian gas giant Gazprom and Nigeria project. If built, the 4,300 km line will

aim this month to conclude an agreement transport 30 billion cubic meters/year Analysis

on domestic and export gas sales. from the Niger Delta into Europe by Israel insists on more than one supplier 3

Gazprom said February 25 that it way of Niger and Algeria (IGR 600/9). South Korea moves gas

hoped to tie up the $2.5 billion The project has been on the drawing down the agenda 4

investment plan in Nigerias gas sector board for at least 20 years. Iraq listens to the concerns of investors 6

in March (IGR 606/1). Its country head Ilyanin said the line gave Gazprom China starts small-scale

Vladimir Ilyanin said at a conference in enough opportunities to showcase its liquefaction plants 7

Abuja late February that a joint Russian- experience outside Nigeria. Saudi Arabia cuts associated gas output 8

Nigerian company would be formed. French Totals country boss Guy Netherlands faces up

We are looking at the domestic Maurice reportedly said during the to competitive future 9

market infrastructures, the gas gathering same event that his company was

systems and the new export projects in ready to join Gazprom the first time

News

gas. We are going to go into them a major has said as much. This could

immediately, he said. One project is bring more credibility to the project. BG outbids Arrow for Aussie Pure 12

the $20 billion trans-Sahara pipeline continued page 2 Thai PTTEP gives Clough contract 13

Indias Gujarat starts up Dahej line 14

Huskys Liwan 3-1 strikes gas 15

Sweden snaps up Dutch Nuon Foreigners top in Bangladesh

Norway slashes Troll work plan

16

17

UK supply needs $334bn spend 19

Soon two big Dutch utilities will likely be planned capacity; but not Nuons grid

UK LNG importers miss winter 20

in foreign hands, now that Swedens company Alliander. Dutch law requires

state-owned power generator Vattenfall legal unbundling of vertically integrated Dana finds more gas in Nile Delta 20

has bid 8.5 ($10.95) billion for Nuon utilities by separating infrastructure Gas producers build more storage 21

a deal that Nuons two boards have owners from energy suppliers. US plans to tax more from 2011 22

recommended to shareholders. Vattenfall has put its power grid in Senate approves $800bn spend 22

The price paid is close to the 9.3 Germany up for sale. ETP launches open season 23

billion that German utility RWE paid for Under the deal, Vattenfall would Ice keeps LNG offshore Algonquin 24

Essent, the other major regional Dutch initially acquire 49% of Nuons shares,

Argentina eyes gas-for-power swaps 24

utility, in January (IGR 615/21). with the remaining 51% to be bought in

Chevrons finds support two trains 26

The deal gives Vattenfall equity gas the coming six years under fixed terms.

production in the Dutch sector of the Following the initial acquisition of Indian Petronet doubles Dahej 27

North Sea, storage rights at Epe in 49%, Vattenfall will have operational Shells losses mount in Nigeria 29

Germany, 2.5 GW of gas-fired power control over Nuon, the company said Spains Repsol seeks YPF buyer 30

capacity and another 3.1 GW of continued page 2 Spains GN launches Fenosa bid 30

Thai PTTEP eyes acquisitions 31

M&A deals fall 59% in Q4 2008 32

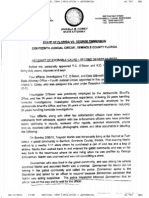

Zeebrugge Q4 gas vs Dated Brent Crude

Norways profits delight 32

($/bbl) ($/MMBtu)

46 7.6 BP gives Dudley the Americas, Asia 33

45 Zeebrugge Brent 7.5

Contracts and tenders 35

44 7.4

43 7.3

Events 36

42 7.2

41 7.1

Markets and prices

40 7.0

12-Feb 13-Feb 16-Feb 17-Feb 18-Feb 19-Feb 20-Feb 23-Feb 24-Feb 25-Feb Global gas market wallows in oversupply 37

Source: Platts Global Alert

The McGraw Hill Companies

LEADS

Russia to sink $2.5bn in Nigeria Sweden snaps up Dutch Nuon

continued from page 1 continued from page 1

Last September, Nigeria National Petroleum February 23. The transaction is expected to close by

Company signed an MOU with Gazprom the supplier the end of the second quarter of 2009 and is subject

of almost a quarter of Europes gas in a move which also to regulatory approval.

analysts said reflected its keen interest in Nigeria as it The takeovers by two foreign companies are positive

attempts to tighten its grip on Europes natural gas for competition, while a merger of the two, as was

supplies. Europe, on the other hand, is trying to considered last year, would just have been more of the

escape from Gazproms expansionist sales policy, and same and might also have posed problems with Brussels,

senior executives from the European Commission have according to a Dutch energy adviser, Floor Touber of

visited north African gas producers to see where Horatio Assurances M&A business in Amsterdam. He also

business can be done. said Vattenfall is seen as very green, unlike RWE.

Gazprom believes its experience of running similar There are still some independents left, such as

large-scale, long pipeline projects and maintenance Eneco, which is in merger talks, and Delta, which is

operations will stand it in good stead in its playing its own game and promoting itself as an

negotiations. We certainly want to help to continue independent, Touber said. But the politicians will be

expanding our reach in the global gas market, Ilyanin looking at ways of regulating the foreign owners, he said.

said. Most of Russias exports already come a vast By far the biggest Dutch gas supplier is GasTerra,

distance, although through very different terrain. which is half owned by the state and a quarter each by

Nigerias domestic gas industry has operated far Anglo-Dutch Shell and US ExxonMobil (see page 9).

below its full capacity because of a lack of funds and Nuon has a total installed capacity of 3.735 GW,

insecurity in the Niger delta. Nigerias president Umaru which will boost Vattenfalls generation capacity to

YarAdua has said he wants to raise $20 billion from 32.135 GW.

companies to invest in harnessing gas reserves to After losing out to German rival RWE in the race for

solve the countrys chronic power crisis. This would Essent, much speculation surrounded Vattenfalls next

include monetizing gas which is now flared in the target, with newspaper reports heavily associating the

absence of end-users. Western companies such as utility with a possible offer for UK energy company

Germanys E.ON and UK-based BG Group and Centrica Scottish & Southern Energy if its bid for Nuon had

are also keen to move into Nigeria. failed. Vattenfall was competing for Nuon with the likes

Gazprom signed a memorandum of understanding of Italys Eni and Danish Dong both of which would be

with state oil company NNPC and the next phase of this of strategic value, with their gas assets.

MOU is to begin detailed discussions on gas supply, Vattenfall CEO Lars Josefsson said: Nuons widely

both for domestic use as well as for exports, NNPC boss respected knowledge in renewables and clean energy

Mohammed Barkindo said. He, however, could not say technologies is a very valuable addition to our own,

when a deal would be signed even as the Nigerian power adding that it will accelerate the realization of

sector faces a gas-supply crisis. Gazprom is expected Vattenfalls strategy to make electricity clean. Although

to focus most of its initial investment on improving Vattenfall is seen as green in Sweden, in Germany it has

Nigerias domestic gas industry. Staff lignite mining operations for its power plants. Staff

] Editor

William Powell

International Gas Report

International Gas Report is published twice monthly by Platts, a division of The

McGraw-Hill Companies, registered office: 20 Canada Square, Canary Wharf,

London, England, E14 5LH.

Issue 618 / March 2, 2009

To reach Platts

(ISSN: 0266-9382)

william_powell@platts.com E-mail: support@platts.com

tel +44 (0)20 7176 6282 Officers of the Corporation: Harold McGraw III, Chairman, President and Chief

fax +44 (0)20 7176 6657 Executive Officer; Kenneth Vittor, Executive Vice President and General Counsel; North America

Robert J. Bahash, Executive Vice President and Chief Financial Officer; John Tel: 800-PLATTS-8 (toll-free)

Managing Editor Weisenseel, Senior Vice President, Treasurer.

+1-212-904-3070 (direct)

Paul Whitehead Prices, indexes, assessments and other price information published herein are

based on material collected from actual market participants. Platts makes no Latin America

Editorial Director, European Power warranties, express or implied, as to the accuracy, adequacy or completeness of Tel: + 54-11-4804-1890

Vera Blei the data and other information set forth in this publication (data) or as to the

merchantability or fitness for a particular use of the data. Platts assumes no Europe & Middle East

Editorial Director, Global Power liability in connection with any partys use of the data. Corporate policy prohibits Tel: +44-20-7176-6111

Larry Foster editorial personnel from holding any financial interest in companies they cover

and from disclosing information prior to the publication date of an issue. Asia Pacific

Vice President, Editorial

Dan Tanz

Copyright 2009 by Platts, The McGraw-Hill Companies, Inc. Tel: +65-6530-6430

Permission is granted for those registered with the Copyright Clearance Center

(CCC) to photocopy material herein for internal reference or personal use only,

Platts President provided that appropriate payment is made to the CCC, 222 Rosewood Drive, Advertising

Victoria Chu Pao Danvers, MA 01923, phone +1-978-750-8400. Reproduction in any other form, or Tel: +1-720-548-5479

for any other purpose, is forbidden without express permission of The McGraw-Hill

Manager, Advertising Sales Companies, Inc. Text-only archives available on Dialog, Factiva, and LexisNexis.

Ann Forte Platts is a trademark of the McGraw-Hill Companies, Inc.

The McGraw Hill Companies

2 INTERNATIONAL GAS REPORT / ISSUE 618 / MARCH 2, 2009

ANALYSIS

Israel insists on more than one supplier

While the Tamar-1 field appears to solve all Israels problems, there is no point in

counting the chickens yet. It will not be on stream for some years, and Israel wants a

diverse supply portfolio.

Israels national infrastructure ministry is warning that agreement with state-owned IEC, which is for 1.7 billion

the country will face a shortage of natural gas supplies cubic meters/year of gas at $2.75/MMBtu

in the coming years unless consumers reach

agreements with potential suppliers. The warning by the The Tamar-1 discovery gives us more flexibility in the

ministry comes just weeks after the announcement of a future but well still need several suppliers, Kugler

major discovery of natural gas at the Tamar-1 field off noted. Kugler has instructed the state-owned Israel

the countrys north Mediterranean coast (IGR 617/16). Electric Corp to guarantee supplies for the next few

years as a matter of urgency.

The gas from Tamar-1 will not reach Israel before

2014 at the earliest, predicted the ministrys As part of the effort, the IEC resumed talks with BG

director-general, Hezi Kulger, In an interview with about supplies from its Marine field, off the

Platts, Kugler said that the discovery was some way Mediterranean coast of the Palestinian-controlled Gaza

from the coast and the huge cost of developing it Strip. The Israeli ministries for infrastructure and

meant that the gas will not be available to meet finance revised an earlier decision and have now given

Israels short term needs. the utility the go ahead to commit for the entire

amount of gas in the Marine field.

However, his boss, the minister Benjamin Ben-Eliezer

has requested that Noble Energy speed up BG could start Marine field in 2012

development of the field in light of Israels energy BG has confirmed that talks have resumed but said that

shortage. Were interested in seeing the gas from serious negotiations were yet to begin. A senior IEC

Tamar-1 reach Israel as quickly as possible, the delegation was in Britain in mid-February for talks. An

minister said February 25. Tamar-1s operator, Noble, IEC source said that the company was very interested in

did not commit to a timetable but said that day the concluding a deal and that the Tamar discovery could

company and its Israeli partners were aware of the have a positive contribution to speeding up the talks.

countrys energy needs and would make every effort to

deliver the gas as quickly as possible. Kugler said that BG informed him that the Marine field

could be operational in 2012 if an agreement were

Demand in 2009 is expected to reach 4 billion cubic reached. The director general is also pressuring the

meters and rise to 6 Bcm next year. Long term countrys nascent private power industry to reach

projections are for demand to rise to 12 Bcm in 2015 agreements with suppliers in order to get their projects up

and as much as 15 Bcm in 2020. Even with potential and running in the coming years. He stressed that in the

reserves of 142 Bcm or possibly even 200 Bcm, the short term the IEC, the private power companies and

government is continuing with its policy of diversification industrial users should enter into urgent discussions with

of suppliers. Until recently Israel was concerned about East Mediterranean Gas for supplies from Egypt. They

over reliance on Egyptian supplies. But even with the must sit down seriously with EMG and reach agreements

latest windfall the government is opposed to dependence now or they will be to blame for the shortage in coming

on any one supplier, even it is a domestic company. years, he said.

Israel is supplied by the Yam Thetis consortium Israel is also proceeding with plans for an LNG terminal

Noble Energy, Delek Exploration and Avner Oil and Gas project. Kugler said that the preliminary tender would be

and by East Mediterranean Gas. The Yam Thetis issued within the next few weeks. The governments

Mary field, off of Israels southern Mediterranean economic cabinet will then give its final approval for the

coast, is expected to run dry within four to five years. tender. The plan is to issue the full scale international

EMG began supplying Israel with gas in May but tender by July of this year.

technical problems have led to reductions in the flow.

The situation is expected to improve in the coming LNG to come onstream by 2015

months and Israel is banking on increasing amounts of The target is for the LNG terminal to be operational by

Egyptian gas in the coming years (IGR 606/18). 2015 at the latest. The ministries for finance and for

infrastructure have stressed that Israel needs maximum

But any additional quantities will be at a higher price: diversification regarding suppliers of natural gas and

following talks late February, a new deal between the two therefore the LNG project is still critical. The

has doubled the price for additional supplies to $4.50- infrastructure ministry has reported substantial foreign

$5/MMBtu. The price applies to all new gas supplies to interest in the project including a number of leading

Israeli customers over and above the initial 15-year American and European energy companies.

3 INTERNATIONAL GAS REPORT / ISSUE 618 / MARCH 2, 2009

ANALYSIS

Last February the Israeli government approved the advisory council on oil and gas recommended granting

issuing of a tender for the supply of LNG and the 19 new licenses for gas exploration off of Israels

building of a terminal off the countrys Mediterranean Mediterranean coast.

coast to handle at least 4 Bcm/year of imports. The

government decision will require the IEC to purchase a The consortium led by Noble Energy and including Delek

minimum of 1 Bcm/year of LNG annually for a Exploration and Avner Gas and Oil was granted 12

minimum of ten years. The cost of the terminal is licenses. Six were approved for US-based Pelagic

estimated at $700 million. Exploration and one license to Energetic Corp.

Infrastructure minister Benjamin Ben-Eliezer is expected

The proposal calls for the terminal would be operated on to approve the councils recommendations in the coming

an open access basis with direct sales to customers. weeks. Ministry officials said that following the latest

Under the terms of the decision LNG will be supplied by round of recommendations 54% of Israels economic

a private gas company that would build and operate the waters would be licensed.

offshore terminal though other potential suppliers would

be allowed to use the terminal. There has been a marked increase in interest by local

and foreign companies in exploring for oil and gas

The infrastructure ministry is also continuing its following last months discovery of gas at Tamar-1, said,

efforts to encourage further exploration in Israels the director of the ministrys Natural Resources

economic waters. In mid-February the ministrys Licensing Department Yaakov Mimran.

South Korea moves gas down the agenda

South Korea is worried about energy security and the environment, so it has drawn up an

energy strategy that will reduce the need for natural gas, which it imports now solely as a

liquid, but will perhaps later import by pipeline.

The government of South Korea has unveiled a new 10% and 33% of power production respectively,

power sector strategy designed to increase energy leaving hydro and renewables to contribute the

security, cut carbon emissions and promote domestic remaining 7%. The ministry is planning 12 new

technology. The countrys already substantial nuclear reactors to be built by 2022, boosting the nuclear

sector is to be greatly expanded, with renewables industrys share of production to 48%, while a less

making an increasing contribution to the generation concrete goal of 60% has been set for 2035. A

mix. In thermal power production, fuel-oil will be combination of wind, solar and tidal power projects

almost eliminated as a feedstock, while the should see the proportion of electricity generated by

importance of coal will be somewhat downgraded. Yet renewables rise from 2.4% in 2007 to 6.1% in 2020

perhaps the biggest surprise in the new strategy is and 11% by 2030.

that the proportion of liquefied natural gas-fired

capacity in the generation mix is set to fall from 22% Focus on nuclear displaces gas

in 2008 to just 6% by 2022. This focus on nuclear power and to a lesser extent

renewables will see thermal power plants play a

Under the presidency of Lee Myung-bak, the new ministry decreasing role in the generation mix. All existing oil

of knowledge economy has been given the key role in fired plants are to be decommissioned, with just a single

determining long-term energy strategy. The ministry new facility built, largely for research and development,

formed a panel of 96 energy and environmental science while three coal-fired plants will be decommissioned and

experts last year to predict long term energy trends and seven built. Six gas fired plants are to be closed down

the panels findings have now been incorporated in the and eleven developed but the ministry expects many of

new strategy. Growth in electricity use is expected to be the new thermal plants to be relatively modest in terms

far lower in the future, at an average of 2.1%/year of generating capacity.

between now and 2022, in comparison with about 9% in

the 1990s. Nevertheless, this will still require a A ministry statement explained that the plan was to

substantial increase in generating capacity from the generate more low-carbon power while cutting back on

current level of 65.8 GW, particularly as the ministry has high-priced reserves such as LNG and coal. Under the

recommended a substantial increase in the gap between plan, the fuel cost will be about 56% lower [in 2022 in

power use and generation capacity. relative terms] than this year, the ministry said. Yet fuel

costs are only one explanation for the plans. South

At present, South Korea possesses 45 coal fired Korea possesses virtually no oil, gas or coal reserves of

plants, 40 gas fired facilities, 13 fuel oil fired plants its own and so has long been forced to rely on imports

and 20 nuclear reactors, which account for 25%, 25%, for most of its energy requirements. The increased focus

4 INTERNATIONAL GAS REPORT / ISSUE 618 / MARCH 2, 2009

ANALYSIS

on nuclear power and renewables will therefore customers and 4.8% to won 677/cu m for residential

strengthen its energy security, particularly as state consumers, but the new rates are still substantially

owned Korea Resources Corporation is seeking to lower than Kogas would like.

acquire its own overseas uranium mines.

Building the import pipeline could certainly help to hold

South Korea is classified as a Non-Annex 1 country gas prices down. The financial details of the project have

under the Kyoto Protocol and so is not required to not yet been concluded but Seoul believes that piped gas

reduce its carbon emissions by 2012. However, Seoul will be substantially cheaper than LNG. According to

recognizes that it will be regarded as an industrialized ministry figures, the average global price of LNG was

nation in whatever successor agreement to Kyoto is $499/mt in 2007, in comparison with an average price of

finally reached and so its energy strategy has the $410/mt equivalent for pipeline gas around the world.

benefit of focusing on low-carbon technologies. Under the September deal, Gazprom will transport 10

Finally, successive South Korean governments have Bcm/year from eastern Siberias Yakutsk fields to

consistently sought to promote domestic technology. Vladivostok and on to South Korea from 2015. It was

Foreign nuclear reactor technology was imported in originally hoped that the pipeline could be routed through

the 1970s and 1980s but government funding into North Korea, with Pyongyang expected to gain about $100

R&D meant that all reactors completed since 1998 billion in transit fees, but relations between North and

have employed largely Korean technology and Korea South Korea have deteriorated over the past few months.

Hydro & Nuclear Power Company is now seeking to As a result, a more expensive subsea route is being

export its reactor designs overseas. Similarly, Seoul considered, running 600 km across the Sea of Japan.

is providing R&D support for renewables in the hope

of encouraging the emergence of a new hi-tech, Subsea line avoids North Korea

export orientated industry. The subsea option became much more likely in February

when the ministry announced plans to develop a new

Gas plays baseload role in short-term gas storage project close to where the pipeline would

Nevertheless, thermal power plants are expected to reach South Koreas east coast. Reserves on the

provide some baseload generating capacity for the Donghae gas field are being depleted and the

foreseeable future. Gas-fired capacity may make a government plans to use the field to store up to 1.7

diminishing contribution to total power production but million mt equivalent of Russian gas (IGR 617/20). This

given that the number of gas fired plants is predicted to will boost national gas storage capacity as a proportion

increase from 40 to 45 over the next 13 years, the of annual consumption to 24.3% by 2017, up from just

dramatic fall in LNG-fed production cannot solely be 9.2% now, and so support Seouls energy security policy.

attributed to a realignment in the generation mix alone

but also to a new source of supply. Russias 10 Bcm/year of gas for South Korea is the

equivalent of just over 7 million mt/year of LNG, which

At present, virtually all South Korean gas demand is would comprise a significant proportion of the 27.26

satisfied by LNG imports but in September last year million mt that South Korea imported in 2008. The ministry

Seoul agreed to import 10 billion cubic meters/year has not released any projections on the total share of gas

from Russia via a new pipeline. The ministrys energy fired capacity in the generation mix in 2022 but a fall

strategy was unveiled in January, just four months after seems more than likely given the growing importance of

the pipeline deal and so the two do not appear in any nuclear energy and renewables. Yet even if gas does

way contradictory. Rather, the government of South become a less important power sector feedstock, this

Korea seems keen to secure an alternative source of need not translate into a decrease in total gas imports

gas and one that is less prone to price fluctuations. over the period in question, as 50% of all imported gas is

The countrys LNG imports may now have fallen from used in non-power sector industrial processes.

an average of $20/MMBtu in August last to $6.60/MM

Btu by this February but the wide price swings make it Recent research by Tokyo Gas concluded that large

difficult for Korea Gas Corporation, which holds a numbers of industrial consumers in East Asia will switch

monopoly on South Korean gas imports until 2010, from fuel oil to gas feedstock over the next decade and

and Korea Electric Power Corporation (Kepco) to plan the firm already supplies a greater proportion of its

for the long term. supplies to non-power sector customers in Japan than at

any other time in its history. A similar trend could be

Kogas made a net loss of won 30.3 billion ($20.18 emerging in South Korea given Kogas decision to

million) in the final quarter of 2008, in comparison with construct a new LNG terminal on the east coast at

a won 206.2 billion profit for the same period in 2007. Samcheok and the MKEs revelation that it will promote

Kepco fared even less well, recording a net loss of won the increased use of natural gas for heating by

2.95 trillion for the whole of 2008, largely because the residential customers and vehicles that run on liquefied

ministry of energy blocked its plans to increase petroleum gas. Even if the power sector is looking to

electricity tariffs to cover higher LNG costs. In other technologies, gas looks set to maintain a sizeable

November, the ministry finally granted gas tariff rises of presence in the energy mix of Asias fourth biggest

9.7% to won 598/cu m ($0.44/cu m) for industrial economy for a long time to come. Neil Ford

5 INTERNATIONAL GAS REPORT / ISSUE 618 / MARCH 2, 2009

ANALYSIS

Iraq listens to the concerns of investors

Iraqs oil ministry has eased the terms of its first post-war bidding round, bowing to

pressure from foreign would-be investors. The state will reduce its share drastically and

has made concessions regarding the data.

Iraqs oil ministry has eased the terms of its first post- declining baseline of production, and, an improved

war bidding round to make them more palatable to production target, a b/d production target to be reached

international oil companies, sources have told Platts. in the seventh year of the contract.

This includes reducing the share of state-owned Iraqi oil

companies in the joint ventures to 25% from 51%. The sources also said that the Iraqi delegation had

put on the table another parameter related to a fast-

The proposed changes to the Initial Tender Protocol track production target three years from start-up of

followed talks in Istanbul, Turkey, February 12-14 the contract but the idea is still under consideration

between representatives from 32 pre-qualified foreign oil by the oil ministry.

companies and an Iraqi delegation that included senior

oil ministry officials and affiliate upstream companies. A source at one of the foreign companies involved in

Oil minister Hussein al-Shahristani did not attend. the negotiations said that while the revised terms

were a welcome development, there were still some

The workshop represented a milestone in the first concerns over the issue of operatorship and the level

bidding round process to develop six oil fields and two of investment required by the mulinationals, which he

gas fields under long-term service contracts and was said would be financing the Iraqi share of the project

designed to hear the views of the qualified companies as well as their own.

on an initial tender protocol issued by the oil ministry.

The six oil fields on offer under a 20-year service

Sources close to the workshops participants told Platts contract are the major producing fields of Kirkuk and

that the oil ministry had received a large number of Bai Hassan in the north, and the two Rumaila fields,

comments from the foreign oil company with one source Zubair, West Qurna I and the three Meissan fields in

saying that the comments filled more than 100 pages. the south. The two gas fields are Akkas in the

As a result of the feedback, the Iraqi delegation western Anbar desert and Mansooriya northeast of

presented some modifications to previous terms in order Baghdad in Diyala province.

to ease some of the majors concerns.

The Iraqi oil ministry will use the feedback from the

The delegation told participants that it had decided to foreign oil companies to produce the Final Tender

reduce the required share of the state oil companies Protocol according to which the foreign majors will

in the joint operating entity that will be responsible present bids to develop the fields. Prior to the workshop,

for operating the fields to 25% from 51%. the ministrys consultants, Gaffney, Cline & Associates,

Furthermore, the operating entity of the fields will be classified the comments from the international oil

detached from the state oil companies, the North Oil companies into categories, enabling the participants to

Company and the South Oil Company. In the modified split into groups to discuss the responses.

version, operatorship of the joint venture will be put

under the direction of a joint management committee Investors had data issues

in which the international oil companies will hold One of the impressions obtained by the sources from

75%. However all decisions relating to development the workshop was that most of the foreign oil companies

will have to be unanimous. Under the previous plan, were not happy with the quality and the quantity of the

the national Iraqi oil companies would have had 51% data that was given to them for the fields. The

in the management company. multinationals reportedly expressed concern that they

could not carry out simulation runs on the basis of the

Iraq removes some of the charges data provided or make any accurate commercial and

The Iraqi delegation also took the initiative to ease technical evaluations based on assumptions and

the bidding parameters by removing the guesstimates, as one source put it.

maintenance remuneration fee, a $/b fee that was

supposed to be paid as a reward for maintaining a The sources said the Iraqi officials advised the foreign

pre-determined baseline level of production. The oil companies to make site visits to the fields to survey

baseline production level has also been changed local conditions, especially existing surface facilities.

from a horizontal line to a declining line that

reflects the true nature of the field. The consultants informed the companies on the sidelines

of the conference that US oil services companies Bechtel

The new parameters are: an improvement remuneration and KBR, a former division of Halliburton, were ready to

fee, a $/b fee as a reward for every barrel above the carry out the task of on site visits on their behalf. The

6 INTERNATIONAL GAS REPORT / ISSUE 618 / MARCH 2, 2009

ANALYSIS

sources said that around 10 of the companies present ease the pressure on the ministry to increase oil

took up the offer with Bechtels offer garnering the most production, the sources said.

interest. Both companies have been active in post-war

reconstruction work in Iraq. The Istanbul workshop was open to the 32 companies

which had purchased tender documents ahead of the

The Iraqi delegation told the qualified companies that Istanbul conference. A total of 35 international oil

they had until March 6 to submit further opinions and companies were pre-qualified for the first bidding round

comments on what was discussed in the workshop, launched in the middle of 2008.

after which the ministry would issue the final

protocol, expected around mid-April, taking their The new fields are expected to add 1.5 million b/d to

comments into consideration. Iraqs oil production capacity. Iraqs sustainable

production capacity is believed to be around 2.4

This schedule, which the foreign oil company million b/d currently, although the country had

representative believes is too tight, will enable the achieved production levels as high as 3 million b/d in

ministry to conduct the final bidding round by the middle the months before Saddam Husseins ouster in the

of June, a deadline the Iraqis are desperate to meet to US-led war of 2003. Faleh Al-Khayat

China starts small-scale liquefaction plants

China has brought onstream another two small-scale LNG production plants in Inner

Mongolia and Guangdong, adding to the countrys growing list of such niche liquefaction

facilities catering to the domestic market.

China has developed mini-liquefaction plants to solve operation on December 6, but is not yet running at full

transport difficulties in areas too remote for pipelines to capacity as it is suffering from a shortage of feed gas

be economic. It has just brought on stream two new from CNOOCs fields in the South China Sea, said Li.

liquefaction plants, one in Erdos, Inner Mongolia, and on

in Guangdongs Zhuhai city, said the deputy-president of However, LNG produced from the Zhuhai plant is not

Chemtex (China) Engineering Co, Weibin Li. intended for the Guangdong market, but mainly for

Shanghai. From Zhuhai, the LNG would be trucked to

US-based Chemtex is the engineering, procurement and Shanghais Wuhaogou peak-shaving plant, which was

construction contractor for both the Erdos and Zhuhai built around 1999 to store gas for emergency cover as

projects, which are based on the patented PRICO part of a project to pipe gas to Shanghai from the

technology by US firm Black & Veatch. offshore Pinghu field in the East China Sea. An

expansion of Wuhaogou was brought online in

The Erdos facility, owned by privately local firm Xingxing November, boosting its storage capacity to 100,000

Energy Co, has a 200,000-mt/year capacity. It began cubic meters, or equivalent to around 10 days of

commercial operation on November 30 and attained Shanghais gas consumption.

100% production capacity on December 10, said Li.

Besides from Zhuhai, Shanghai also buys

Feed gas for the Erdos plant is supplied by state- domestically produced LNG transported by trucks

controlled oil giant PetroChina from the Changqing oil from a small-scale liquefaction plant in the remote

field which spans the Shaanxi and Gansu provinces, northwestern Xinjiang Autonomous Region; as well as

and the Ningxia Autonomous Region, all of which border imports small LNG shipments on 19,000 cu m ships

Inner Monoglia, he said. from Malaysia. Shanghai would also start importing

conventional sized 120,000-150,000 cu m LNG

LNG produced from the Erdos plant is transported by cargoes from Malaysia later this year, when a 3

specially designed trucks, each with a capacity of 53 million mt/year LNG import terminal, which is now

cubic meters, to markets as far away as the southwestern being built by CNOOC, is ready.

Guizhou province, eastern Jiangsu province, northeastern

Shandong province and Shanghai city, Li said. Zhuhai is a mere 60 km southwest of Shenzhen,

where Chinas first LNG import facility, the

In Zhuhai city in the southern Guangdong province, Guangdong Dapeng terminal, is sited. Zhuhai is also

Chemtex also completed construction of a 600,000- where CNOOC has a proposal for another LNG import

cubic meters/day (around 438 mt/day) liquefaction plant terminal. In fact CNOOC also has plans to build an

on December 6, Li said. The Zhuhai plant, located on additional LNG import terminal at Shenzhen, bringing

Hengqin island, is owned by state-owned China National to three the number of existing and proposed terminal

Offshore Oil Corp. The plant entered commercial projects in Guangdong province.

7 INTERNATIONAL GAS REPORT / ISSUE 618 / MARCH 2, 2009

ANALYSIS

More domestic liquefaction plants planned By comparison, in Fujian province where Chinas second

While there were initial doubts about the economics of LNG import terminal is located, the government has

transporting LNG over long distances using trucks, a approved a price of Yuan 3.65/ cu m for regasified LNG

scarcity of gas in certain remote regions or cities still to be sold to residential users in the capital city of

awaiting connection to a pipeline grid has resulted in Fuzhou, the local media has reported.

demand for domestically produced LNG, enabling such

niche plants to be profitable. Before the Erdos and Zhuhai plants were completed,

China already had at least three operating liquefaction

Chinas gas pipeline network has improved but still plants a 400,000 mt/year unit by Chinese

cannot penetrate certain remote areas and some cites conglomerate Guanghui in the northwestern gas-rich

are not yet able to access pipeline gas, Li said. There Xinjiang region; a 150,000 cu meter/day unit owned by

is always a market for domestically produced LNG privately held Xinao Group at Beihai in the southwestern

transported by trucks, and this has always been a Guangxi region; and a pilot 40,000 mt/year plant by

sellers market, he added. state-owned Sinopec in the Zhongyuan oil field in the

northeastern Henan province.

Also, some city gas companies may find the volume of

gas allocated by PetroChina at state- controlled prices In addition to the Erdos and Zhuhai plants, Chemtex is

to be insufficient, so they supplement it with more also the EPC contractor for four more liquefaction

expensive, domestically produced LNG and aggregate projects in China, all to be based on Black & Veatchs

the costs, said Li. techonolgy, said Li.

For example, in the eastern Anhui province, the city gas The four new proposed plants would be sited at

company of Hefei city buys LNG from domestic Dazhou in the central Sichuan province (500,000

liquefaction plants at around Yuan 5/cu m ($0.73/ cu mt/year); Jingbian in the central Shaanxi province

m, or $20.30/MMBtu) to augment gas supplies from (500,000 cu m/day); Lanzhou in northwestern Gansu

PetroChinas West-East pipeline, and sells the mixture province (300,000 cu m/day); and in the far flung

to residential users at around Yuan 2.1/cu m, northwestern Xinjiang Autonomous Region (1.5 million

according to local media reports. cu m/day). KimFeng Wong

Saudi Arabia cuts associated gas output

Saudi Arabias gas production is bound up with crude output, and in todays climate of

cuts, it is left facing a shortage of gas. It is not expecting any non-associated gas for some

time, while Empty Quarter drilling has also disappointed.

Cuts in Saudi Arabias crude oil output to comply with February. The unilateral move by the worlds biggest

its OPEC target have reached a level where gas supply exporting nation would push output below 8 million b/d

is close to falling below demand. While the situation is in what appears a bid to help lift prices above

manageable in the near term, the kingdom will be $40/barrel for US light sweet crude oil futures. Bourland

unable to produce enough gas to meet demand if oil noted that around 60% of Saudi Arabias gas output is

production falls below 8 million b/d, Jadwa Research associated gas produced alongside crude oil.

said in a report February 17.

Reducing oil production therefore lowers the amount of

The report by chief economist Brad Bourland said the gas available ... It is estimated that if oil output falls

decision by OPEC to reduce its overall production by a below 8 million b/d the kingdom will not produce enough

total 4.2 million b/d from a September baseline meant gas to meet demand, he added.

group kingpin Saudi Arabia reducing output to 8.05

million b/d, a target achieved in January. A temporary dip in production from the January level

would not be a problem in the near term since power

With [oil] prices yet to show any sign of recovery, facilities can be run using alternative feedstock such as

the kingdom is planning to reduce production by an fuel oil. Liquids can also be used for petrochemicals

additional 300,000 b/d in February. Early indications though both are more costly than gas, Bourland said.

are that production will be maintained at this level,

Bourland said. Reliance on gas reduces the scope for sustained oil

production much below 8 million b/d and with some

Trading sources told Platts earlier in the month that other OPEC producers also heavily reliant on

they had been informed by Saudi Aramco that it associated gas, the chances of further large oil

intended to cut supply by a further 300,000 b/d in production cuts are limited, he said.

8 INTERNATIONAL GAS REPORT / ISSUE 618 / MARCH 2, 2009

ANALYSIS

The shortage of gas prompted Saudi Aramco recently Oil prices and $/ rate part company

to take the unusual step of securing imports of gasoil ($/barrel) ($/)

on long-term contracts, taking advantage of low 160 1.7

international prices, and in preparation for burning

134 1.6

more liquids for power generation, the report said.

108 1.5

Saudi Aramco last month issued a tender for 40,000

mt/month of 0.5% sulfur gasoil to cover the period 82 1.4

March-December 2009. Although the kingdom will

not be greatly affected by the temporary reduction in 56 1.3

the availability of gas, it highlights the long-term

30 1.2

supply issue, Jadwa said. Jan-08 Mar-08 May-08 Jul-08 Sep-08 Nov-08 Jan-09

Source: Platts

Gas demand is growing rapidly and many of the heavy

industrial projects and economic clusters planned in It estimated that Saudi oil revenues were $9.8 billion in

the kingdom are premised on the availability of cheap January, slightly above the figure for December but down

gas feedstock, it added. While more expensive from in excess of $30 billion/month between May and

feedstock can be used, this undermines the August last year. The peak was $38 billion in July, when

competitiveness of the end product. oil prices soared to a record of $147.27/b. The last

time oil revenues were below $10 billion for two

Saudi Aramco supplies gas feedstock to local industries consecutive months was in the first half of 2004, Jadwa

at a level believed to be below $1/MMBTu. said. Bourland also noted that the close relationship

between the US dollar and oil prices had broken down

Jadwa said some new non-associated gas fields would (see graph). There was a correlation between oil prices

soon be entering production, the largest being the and the US currency over the 11 months to November

offshore Karan field with a production capacity of 1.5 last year when investors bought oil, a dollar-denominated

Bcf/day which is set to come on stream in 2012. New asset, as a hedge against dollar weakness and vice

oil fields due to come on stream over the next few versa. The end of this linkage is the result of a shift in

years will also provide new sources of associated gas. investor sentiment, he said, and said there was no real

reason for the two to be linked in the first place.

However, the four consortia looking for non-

associated gas in the Empty Quarter have yet to Dollar strength is now being fueled by the return of

make any commercially viable discoveries. At the funds that had been invested abroad by US investors

same time, lower crude oil production and weaker oil and perceptions that the dollar is a relative safe haven,

prices have had a major impact on Saudi Arabias oil while the direction of oil prices reflects the prospects for

income, Jadwa said. the global economy. Kate Dourian

Netherlands faces up to competitive future

The Netherlands has always played an important role in the security of supply within

Europe, thanks to its giant Groningen field. But the field will not last for ever, and the

market needs to prepare for a future without it.

The Netherlands unique Groningen field has been a key It covers the structure of energy supply in the

supply source for northwest Europe. Most recently it was Netherlands, the countrys regulatory system and

able to supply some extra gas during the Russia-Ukraine the evolution of the Dutch trading hub, the title

crisis, owing to its reservoir characteristics. But it will transfer facility.

not last forever, and the Netherlands has been boosting

its infrastructure the so-called roundabout model While the state has been the most progressive in

in readiness for the massive influx of gas from Russia. continental Europe in terms of unbundling which has

enabled the two big utilities Nuon and Essent to be

This means more pipeline and more storage capacity bought the biggest supplier, GasTerra, remains half

and implies there will be room for more entrants and state-owned, and this presents the government with a

hence more competition, but the state is still intimately conflict of interests with regard to further liberalization.

involved with the biggest supplier, GasTerra. GasTerra manages the countrys supply portfolio and

its exports, and buys Groningen output and gas from

At the beginning of February the International Energy the small fields, giving it an unassailable position as

Agency published a report on Dutch reform policies. far as new entrants are concerned.

9 INTERNATIONAL GAS REPORT / ISSUE 618 / MARCH 2, 2009

ANALYSIS

According to Horatio Assurances energy expert Floor industry and the tackling of permits which are not

Touber, there is a big debate going on about how free is being worked on. These reforms in combination with

the market. What will happen with the small fields? Will a change of the Mining Act, for which a proposal was

they remain the first source of supply with Groningen submitted on May 28 2008 will boost gas production

used to balance? in the Netherlands, including the Dutch part of the

continental shelf, a spokesman for the economy

Small fields ministry told Platts.

Groningen operator NAM, a joint venture between Shell

and Exxon, expects the field to be able to produce gas The Dutch government is promoting active use of all

for the next 50 years, a spokesman said. The field now production licenses. In this context the industry and

produces gas at a maximum rate of of 350 million cubic government are working on a covenant to promote the

meters/day. In 2008 the Groningen field produced 41 active use, both by current license holders as well as

billion cubic meters. new ones, when the holders are not planning to be

active in those parts, the secretary-general of the

But this might be optimistic. Touber thinks the field Netherlands Oil and Gas Exploration and Production

will run out at around 2020. It could be another Association Bram van Mannekes told Platts. The

decade depending on developments, but there will be impact of [these] measures [is] difficult to predict, but

an end to Groningen gas. it is expected to add at least some 20 Bcm of gas.

Apart from the extra gas these measures will help to

The IEA report therefore urges the government to keep the offshore infrastructure in place for a longer

invest more money to further develop the countrys time, van Mannekes added.

small fields and keep Groningen for as long as

possible. The Dutch government in 1973 introduced However, the government has some harsh critics. In an

the small fields policy, which requires the incumbent interview with Platts a spokesman for the Environment

supplier to buy gas from smaller and more marginal Assessment Agency, an advisory body to the Dutch

wells. It has done so on terms and conditions that few government, expressed concerns about the continuing

if any other suppliers can match. emphasis on the small fields production and the

Dutch governments interest in increasing the small

The IEA observed that the policy of conserving fields gas output.

Groningen at the expense of the small fields has

helped to substantially increase gas reserves over the Joop Oude Lohuis acknowledged the swing capacity of

last decade. the Groningen field as an important aspect in the

Netherlands energy supply structure. He warned,

The report recommends that open access to these however, that the small fields were not as commercially

new resources be granted to interested parties, and attractive for the Dutch government.

welcomes the Dutch governments initiative to widen

out competition in the Dutch energy market. The IEA They are very expensive to develop, resulting in a loss

regards the Dutch governments initiative to enhance of profit for the state he said. Our view is that this

exploration and production activities in the natural gas does not run away. The government should

environmentally-sensitive Waddenzee area as a model encourage the development of these fields later when

for future policies. the price for gas has gone up again, he added.

[The government] has been quite successful in its Rather than further expanding the small fields for gas

approach to facilitate gas production in the sensitive production in the Netherlands, the agency would like to

Waddenzee area. After several years of negotiation with see the Groningen facilities used for accommodating

all parties involved, both permits to explore and to increased gas imports from outside Europe. We

produce could be given and the government itself support the idea of Groningen as the centre of the gas

created a fund to improve environmental quality in the roundabout, as such contributing to a sustained use of

area and to stimulate regional initiatives aimed at natural gas in Europe. Holland has the knowledge for

sustainability, the report said. such a gas roundabout and could even make a profit

out of it, he said.

Small fields made to work harder

On December 18 2008, the minister for economic The notion of the Netherlands using its geographic

affairs, Maria van der Hoeven, sent a letter to the location and expertise to serve as the centre of a gas

Dutch parliament, explaining what measures have roundabout for northwestern Europe has gained

been introduced and will still be taken to generally widespread support.

enhance the gas production from smaller fields.

Measures include the removal of obstacles in Dutch spot market liquidity growing

legislation and regulations and the introduction of The spot market in the Netherlands is organized around

more efficient procedures for the granting of permits; the Title Transfer Facility, a virtual market place set up in

the improvement of information services to the mining 2003 by the Dutch state-owned grid operator Gasunie.

10 INTERNATIONAL GAS REPORT / ISSUE 618 / MARCH 2, 2009

ANALYSIS

The TTF is operated by Gas Transport Services, a A well-functioning information service on the other

subsidiary of Dutch grid operator Gasunie. hand could help shippers adjust the gas supply in

time, the letter continues. The structure makes it very

At the beginning of February the TTF reported a new hard for new entrants to join the system and reform

trading record for gas trading in 2008 and is now the was needed to boost the role of the Dutch hub in

largest hub in continental Europe, the hub operator said. Europe, van der Hoeven said.

There were increasing numbers of gas traders and

suppliers registering to trade at the Dutch trading Energy traders have been ambivalent about the

platform and the operator experienced substantial duration of the balancing period, even though a

growth in 2008, GTS said. shorter period appears to disadvantage the shipper.

What matters is not a longer period, but better

Market participants supplied 20.3 Bcm at the TTF in information, they say, and access to the flexibility

2008, equal to almost half the total domestic gas needed to correct an imbalance.

consumption in the Netherlands.

Although TTF operator GTS does not consider the system

The volume of gas traded at the TTF also doubled year- punitive and favors cost reflectivity in order to avoid free

on-year to around 64 Bcm, representing a value of rider behaviour, as a spokesman for the company

around 15 billion ($19.12 billion). The number of TTF explained, Gasunie is planning to change the system. At

traders grew by 20% to a total of 60 trading the beginning of February the company had already

participants, making TTF the largest gas hub on the announced that it planned a reform of its balancing

continent in terms of supplied volume and trading system, but did not give any specific details as to

volume, the hub operator said. character of the reform.

This development has been widely welcomed by the The system has hourly balancing, and the argument is

Dutch government, industry as well as the IEA. Over the that with the massive flexibility afforded by the

years of its existence, however, the hubs balancing Groningen field, daily balancing would not work: the UK

system has come into focus and suggestions for its market is based on daily balancing, but beach

reform have been made. deliveries generally run at steady rates over the day.

In its report the IEA describes the system as potentially The way ahead

punitive to new entrants and smaller shippers and But if the speed at which the Dutch government has

would like to see a low-cost regime as well as a been able to implement recommendations and push

transparent and cost-reflective billing system created. reforms through is encouraging, it is at a crossroads

The Dutch governments critique is in line with with regard to its energy policy. It has to prepare for the

observations made by the IEA. end of Groningen

TTF balancing regime too stringent As Touber says, the Groningen field is one of the few in

In a letter to the Dutch parliament from February 18 the world which can be turned on and off daily but there

2008 obtained by Platts, van der Hoeven criticizes the is very little transparency about how it is used. The

narrow structure of the TTF balancing regime: ...GTS same is true of the transmission network and

places strict demands on network users. [Network underground storage. It is all in the hands of one or two

users] must be balanced every hour and every parties and it is not in their commercial interests to

deviation has a cost (imbalance charge), even if the provide transparency,

deviation is such that the transport network as a whole

remains in balance. Among these parties is the state, which, at the same

time, is keen to liberalize the market. But assuming it

In the UK, on whose gas hub the Dutch TTF is modelled is the desire of the Dutch government to liberalize the

commercially, the transporter is revenue-neutral, and is market, we need more transparency and regulation.

even incentivized by the regulator to pay a price as close This is a paradox.

to the market value as possible, if it needs to intervene

to balance the system. The worse that the monopoly For decades the Dutch society has benefited from the

transporter judges the market, which leads it to buy or Gasunie operation. It has been treated very well from

selling prematurely or at prices that are more than a the point of view of security of supply. Prices appeared

certain percentage off the average price paid on any given acceptable, if not to every industrial consumer. But, in a

day by market participants, the less money it can receive. supposedly liberalized market, large gas buyers and

distribution companies would like more flexibility in their

She also voices her concern over a lack of information purchasing arrangements and a better view of the

for shippers, which leads to a situation where competitive situation, Touber said. If the government

imbalance charges [are] an expense that they have really wants a liberalized market then it should strive for

little control over. It may also take years before the final transparency: in costs for capacity and in the available

invoice for imbalance is received. quantities of gas. Maria Yassin Jah, William Powell

11 INTERNATIONAL GAS REPORT / ISSUE 618 / MARCH 2, 2009

NEWS ASIA-PACIFIC

ASIA-PACIFIC

BG outbids Arrow for Aussie Pure areas of interest," the vice president for the company's

international business Nils Helge Sorgard, said.

UK major BG has raised the stakes in Australia: it upped "We could get involved in domestic pipeline gas

its bid for Australian coal seam gas player Pure Energy projects, but the focus will be on LNG," Sorgard said at

by another A$100 million, in the face of the improved the Asia Upstream conference in Singapore. In Australia,

offer from rival bidder Arrow Energy (IGR 617/1). Pure the company is more keen on projects offshore

has recommended that its shareholders accept UK gas northwest Australia rather than eastern Australia and

major BG Groups cash offer of February 26, which coal seam methane-based LNG projects, he said.

values the company at A$995 ($635) million. Sorgard did not specify which projects the company was

Arrow had last revised its offer February 11 to A$3 in interested in.

cash and 1.57 of its own shares for every one held in In Indonesia, StatoilHydro has expressed an interest

Pure Energy, which represented an implied total value of in joining Japan's Inpex in developing the Masela floating

A$7.18/share as of February 18. LNG project and helping state-run Pertamina develop the

Pure said its independent directors believed that technically challenging Natuna D-Alpha gas block in the

BGs revised offer was superior, as it carried an 11% South China Sea.

premium to Arrows implied value. StatoilHydro has a small presence in Asia. The

Pures independent directors, who hold a combined company has a 75% operating stake in China's Lufeng

stake of around 12% in the company, intend to accept 22-1 field in the South China Sea with China National

the increased BG Group offer within seven days if no Offshore Oil Company (25%).

superior offer emerges, the company said. It holds a 40% and 51% stake, respectively in the

In addition, two key Pure shareholders, Tom Fontaine deepwater Kuma and Karama blocks off Indonesia and

and Karl Meade, who hold interests of 5% and 3% has a 10% stake in deepwater block KG-DWN-98/2

respectively, also intend to take up BGs offer in the next offshore the east coast of India.

seven days, the Australian company said.

BG has been notified formally by Australias Foreign

Investment Review Board that there are no government

concerns over the takeover.

Martell-1 strikes Pluto LNG

Both BG and Arrow are eyeing Pures coal seam Woodside Petroleum has made a gas discovery with its

methane reserves in the northeastern Australian state of Martell-1 well in the Greater Pluto area off Western

Queensland to support their respective LNG project Australia, where it is drilling to find additional reserves

proposals in the port city of Gladstone. to underpin its LNG expansion plans. Wireline logs from

Pure announced February 18 a 32% rise in its proved Martell-1, in Carnarvon Basin permit WA-404-P, indicate a

and probable CSG reserves to 522 petajoules from the gross gas column of about 110 meters in good quality

394 PJ it had announced in December. reservoir sandstones, Woodside said February 24.

Eastern Australias extensive coal seam gas Woodside holds a 50% operating stake in the permit,

resources have attracted the attention of a number of with US-based Amerada Hess holding the remainder.

world oil and gas majors over the past 12 months and The well is located about 290 km (180 miles)

BG has played a prominent role in the merger and from Karratha and 100 km northwest of the Pluto gas

acquisition activity. BG launched a successful A$5.6 field. Woodside is drilling in the area as part of its

billion takeover of Queensland Gas Company last plans to secure gas to underpin a train two expansion

October, just two months after being thwarted in a hostile of its Pluto LNG project, the first train of which is

A$13.7 billion bid for larger local player Origin Energy. being built on the Burrup Peninsula. The A$12 ($7.7)

Arrow is also working to develop its resources to billion project will process gas from the Pluto and

supply a 1.5 million mt/year LNG project being Xena gas fields to produce 4.3 million mt/year of

planned by Liquefied Natural Gas Limited at LNG. The Martell-1 discovery is expected to be

Fishermans Landing in Gladstone. followed by further drilling on the structural trend later

in 2009, Woodside said.

Woodside is raising $1 billion via a corporate bond

Norway sees Asian LNG growth issue in the US to help it fund this project, it said

February 25. The bonds will be issued by Woodside

Norwegian energy giant StatoilHydro has pegged its Finance, which is a wholly owned subsidiary of Woodside

Asian expansion strategy on liquefied natural gas. It is Petroleum. It will consist of $400 million worth of five-

looking at the possibility of taking stakes in LNG year bonds with a coupon of 8.125% and $600 million

projects in Australia and Indonesia, a senior company of 1-year bonds with a coupon of 8.75%. The bonds will

official said February 26. be guaranteed by Woodside.

"We see LNG export opportunities as most Woodside had indicated it was looking to raise $1-

interesting and Australia and Indonesia are our main $1.7 billion above its existing undrawn credit line of

12 INTERNATIONAL GAS REPORT / ISSUE 618 / MARCH 2, 2009

NEWS ASIA-PACIFIC

$1.85 billion in 2009. The company needs funds to

refinance old debt and to fund the development of the

South Korea seeks own gas

4.3 million mt/year Pluto LNG project in which it has a South Korea plans spend a total of Won 1.1 trillion

90% stake. Sophia Rodrigues ($659 million) to exploit oil and gas reserves in its

continental shelf, with just under half that going on 20

exploratory wells over the next decade. It is hoping to

Thai PTTEP gives Clough contract find more than 100 million barrels of oil equivalent,

based on past assessments and updated data on

Thailands PTT Exploration & Production has awarded a underwater topography (see page 5).

$75 million contract to Clough, to install offshore South Korea discovered in 1998 a gas field off the

facilities for its Montara oil and gas development east coast, named Donghae-1, which has a total

scheme in northwest Australia. estimate deposit of 265 Bcf (IGR 615/13). The nearby

The Perth-based engineering and construction firm Gorae-8 structure discovered in 2005 and the Gorae-14

won the contract as PTTEP is moving strenuously to structure found in 2006 are estimated to hold 25 Bcf

develop its new Australian resources, barely two months and 10 Bcf, respectively. The country also plans to

after it acquired the unlisted Coogee Resources. It paid invest Won 400 billion to start commercial production of

$170 million for Coogees assets (IGR 615/34). gas hydrates off the east coast by 2015 (IGR 606/9).

The work involves transporting and installing the 750- South Korea has confirmed about 600 million mt of

mt Montara wellhead platform deck, the 285-mt mooring gas hydrate deposits off its east coast, which can meet

buoy with nine associated mooring legs, 26 km of infield the countrys natural gas needs for some 30 years.

pipelines, and the 100-mt Swift subsea manifold. Based on new assessments, we expect the deposit to

According to Clough, the installation is scheduled to reach up to 1 billion mt, a ministry official said.

start towards the end of the second quarter of 2009, and Gas hydrates, ice-like deposits of water and natural

it will keep the derrick pipelay barge Java Constructor gas, are located deep underwater where cold

engaged on the project for about four months in total. temperatures and extreme pressure causes the gas to

The development includes the Montara, Swift and condense into a semi-solid form. But they are bulky to

Skua fields which are located 690 km west of Darwin transport since much of the volume is just ice.

in the Ashmore Cartier permit area of the Timor Sea The government plans to spend additional Won 200

within the AC/L7 and AC/L8 production licences in 80 billion to develop technology and train engineers, which

metres of water. will be used to exploit the continental shelf region, the

The Thai state-controlled PTTEP expects the Montara ministry said. Energy-poor South Korea is the worlds

to start producing crude and gas in the fourth quarter of second-largest LNG buyer after Japan, and depends

this year. Estimated combined proved oil reserves at entirely imports for its supplies. Charles Lee

Montara, along with the two other fields lying in the

permits Jabiru and Challis are at 32 million barrels.

The Koreans suppose that Gazprom would have

Clough looks at expansion two partners KNOC and Kogas, the paper quoted

Clough is reviewing acquisition targets in the oil and Sechin as saying, adding that a format of cooperation

gas sector as it plans to strengthen its business in had not yet been finalized but talks on the matter

that area. It so far has an agreement with Indika would be brief.

Energy to collaborate on future ventures in offshore oil The West Kamchatka block in the Ohkotka Sea

and gas projects in Indonesia, through Tripatra, a covers 62,000 sq km and has resources estimated at

subsidiary of Indika Energy. 3.8 billion mt of hydrocarbons. The two state-energy

Clough has also sold its 82% stake in Indonesian giants are competing for the the right to develop Far

engineering, construction and mining company Petrosea Eastern offshore reserves, with Gazprom arguing the

to Indika Energy for $83.8 million. The sale is expected reserves in the area mainly contain gas.

to be completed in May. To date the Kamchatka reserves have been

developed by Rosneft and KNOC. The companies hold

60% and 40% stakes in the project respectively.

Russias Gazprom wins Kamchatka However, in 2008 the Russian government refused to

extend the five-year license that had expired in August,

Russian gas giant Gazprom will reportedly replace state- claiming Rosneft had failed to meet certain conditions.

owned oil major Rosneft in a joint venture with the Korea Gazprom immediately expressed interest in the block,

National Oil Corp to develop a far eastern field. Russian claiming its gas reserves amounted to 86%.

business daily Kommersant cited senior officials in the In January, Russias natural resources ministry

Russian government saying Gazprom would work with submitted to the government a list of 15 offshore oil and

KNOC on a block off Kamchatka. KNOC will remain gas fields that will be transferred to state companies

involved in the project, while other gas projects in the without auctions, including the license for the West

region may be developed by state-run Korea Gas Corp, Kamchatka shelf.

said Russian deputy prime minister Igor Sechin, who led Under Russian legislation, licenses for offshore fields

the Russian delegation to Korea. can only be granted to companies in which the state

13 INTERNATIONAL GAS REPORT / ISSUE 618 / MARCH 2, 2009

NEWS ASIA-PACIFIC

controls over 50% and which have at least five years of supply from Dahej through GAILs pipeline would

operating history in Russias offshore industry, leaving continue, the official said. GAIL transports RLNG, for

only Gazprom and Rosneft eligible. a fee, through a 24-inch pipeline from within the

Gazprom needs resources to fill the planned local Dahej terminal to GSPCs gas receiving station less

gas pipeline in Kamchatka, which under a government than 2 km away. The gas receiving station then

decision, is due to be commissioned in 2010. delivers the supply to GSPCs own customers through

Rosneft and KNOC have not yet given up the project a pipeline network. The new GSPC pipeline would

and in December signed a new deal on the joint enable RLNG from Dahej to be delivered directly to

development of the block in the expectation of being the gas receiving station.

granted a new license ahead of the signing of a final The new pipeline laid by GSPC has given us an

deal this year. KNOC officials have warned that if the alternative for uninterrupted transportation of RLNG in

Russian government does not issue a new license, the case GAILs pipeline is not functional for some reason,

company will pursue legal action for compensation for said Finance director of Petronet LNG, A Sengupta, which

losses incurred from the project, which it estimates at operates the Dahej terminal.

$212 million. Anna Shiryaevskaya GAILs pipeline also transports RLNG from Dahej

to the Dabhol power project managed by Ratnagiri

Gas and Power. As of the end of February, the

Indias Gujarat starts up Dahej line nameplate capacity of Dahej was due to double, from

5 million mt/year to 10 million mt/year, and actual

Indias Gujarat State Petroleum Corporation has achievable capacity to reach 11.5 million mt/year

commissioned a pipeline that gives it direct access very happily, according to the boss of LNG importer

to regasified LNG from the Dahej import terminal. Petronet Prosad Dasgupta. Petronet imports 5 million

Hitherto, only state-owned transporter GAIL had mt/year of LNG from RasGas at Dahej under a 25-

direct access, a senior GSPC official told Platts year contract with the Qatari supplier. Volumes under

February 16. We have commissioned a new pipeline this agreement will rise to 7.5 million mt/year from

and even started using it, said GSPC managing the fourth quarter of this year. The company also

director D J Pandian. imports spot cargoes to meet short-term supply

The new pipeline would be used mainly to import commitments to the Dabhol plant.

spot LNG, thus increasing the companys flexibility in its

spot transactions, said another GSPC official. GAIL signs deals with fertilizer companies

GSPC will use the new pipeline mostly to GAIL has signed a number of long-term gas supply

transport additional volume of gas that it would import agreements with two fertilizer producers, totalling

as spot LNG through the Dahej terminal, the GSPC 278.2 million cubic feet/d. The contracts will see GAIL

official said. The new pipeline would give us flexibility supply natural gas to the Barauni fertilizer plant of

in terms of changing our margins to accommodate Urvarak Videsh and to the National Fertilizers-owned

more customers, as we wont have to take into Bhatinda, Panipat and Nangal plants for a period of 15

account GAILs margin when we calculate our enduser years, said the company.

price for the customers, the official explained. GSPC Sales to UVLs Barauni plant will start between

has earlier stated its intentions of importing one to October 2012 and June 2013, while those to NFLs

two spot LNG cargoes a month, from March, through plants will begin some time between June and December

the Dahej terminal. 2012, it said February 26.

However, the existing arrangement under which For the fiscal year 2009-2010 (April-March), the

the company gets 3 million cu m/d of long-term Indian government will prioritize increased demand for

Australian Arrow to develop coal seam methane in Indonesia

Australias coal seam methane developer Arrow Energy in place, surrounds the Rambutan project area where

is going to explore and develop CSM in Indonesia, the Indonesian governments energy research

according to an agreement signed with asset owner institution Lemigas has been carrying out a trial CSM

Medco Energi Internasional. pilot project, Arrow said.

Arrow Energy said February 18 that its international In the statement, Medco Chairman Hilmi Panigoro

subsidiary Arrow Energy (Indonesia) Holdings and PT said he hoped the government would recognize the

Medco Energi CBM Indonesia would each have a 50% importance of this project as a major milestone in getting

interest in the deal, which will require approval from the the Indonesian CBM business moving and advancing the

Indonesian regulatory authorities before the exploration initial trial program carried out by Lemigas. The latest

operations begin. venture follows Arrows deal in January with Ephindo-

The SSE1 block, which covers an area of 1,889 sq Ilthabi CBM Holding, a subsidiary of Indonesias Ephindo

km in south Sumatra and has an active conventional group of companies for a farm-in to its Sangatta CSM

oil and gas producing area with existing infrastructure block in East Kalimantan.

14 INTERNATIONAL GAS REPORT / ISSUE 618 / MARCH 2, 2009

NEWS ASIA-PACIFIC

gas supplies from fertilizer plants which has come as a

result of the de-bottlenecking and expansion, conversion Panna-Mukta-Tapti under-perform

from naphtha and fuel oil feedstock to gas, and the A consortium of companies operating the Panna, Mukta

revival of mothballed units. and Tapti oil and gas fields offshore western India has

GAIL said it would source gas from upcoming fields declared partial force maje on gas supplies following

in the eastern offshore Krishna-Godavari basin, blocks problems in the subsea infrastructure, state-owned

elsewhere in the country, and from re-gasified LNG. offtaker GAIL said February 22.

GAIL is inviting expressions of interest for long-term Owing to a technical problem in the sub-sea

LNG supply into Dabhol on the countrys west coast. facilities, the PMT partners Oil and Natural Gas Corp.,

GAIL said the EOI should state the volume of LNG Reliance Industries Limited and British gas major BG

available for long-term supply to GAIL, the possible had reduced production from the PMT fields from 17.3

contract period, the LNG project from which the million cubic meters/day to 15 million cu m/day for the

cargoes will be shipped, and the role of the party past few weeks, GAIL said.

registering its interest. GAIL, which takes delivery of the entire natural gas

output of the PMT fields at the Hazira gas processing

complex in western Gujarat and sells it on to end-

Huskys Liwan 3-1 strikes gas users, said the reduction in supply had forced it to

declare force maje to its customer Gujarat Gas, a

The first appraisal well on the Liwan 3-1 prospect in the subsidiary of BG.

South China Sea encountered 36 feet of net gas pay, ONGC holds a 40% interest in the PMT consortium,

the field partners, Chinas CNOOC and Canadas Husky with RIL and BG holding a 30% stake each. BG has

Energy, said February 23 (IGR 717/3). Test results managed the technical operations of the fields for the

showed the well flowed at a restricted rate of 53 million past few years. Vandana Hari

cubic feet/d; at its peak, the well is expected to deliver

more than 150 million cubic feet/d, the partners said in

separate statements. The then operator, PetroChina, shut Du- 2 for