Beruflich Dokumente

Kultur Dokumente

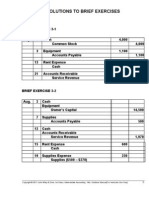

Chapter 11 Prepayments and Accruals Mix

Hochgeladen von

api-338561251Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chapter 11 Prepayments and Accruals Mix

Hochgeladen von

api-338561251Copyright:

Verfügbare Formate

Chapter 11 Prepayments and Accruals

11.3 Prepayments & Accruals (Mix)

Question 1

(a)

Date

2013

Jan 1

May 24

Sep 9

Dec 31

Utilities Expense Account

Particulars

Dr (+)

$

Accrued Utilities Expense

Cash at Bank

Cash at Bank

Profit and Loss

Accrued Utilities Expense

Cr (-) Balance

$

400

400 Cr

520

680

1 170

370

Insurance Expense Account

Date

2013

Jan 1

Apr 1

Dec 31

Dec 31

Particulars

Prepaid Insurance Expense

Cash at Bank

Profit and Loss

Prepaid Insurance Expense

(2 400 12 x 3)

Dr (+)

$

200

2 400

Cr (-)

$

Balance

200 Cr

2 000

600

Rent Income Account

Date

2013

Jan 1

Jun 15

Dec 15

Dec 31

Dec 31

(b)

Add:

Less:

Particulars

Rent Income Receivable

Cash at Bank

Cash at Bank

Profit and Loss

Rent Income Received in Advance

Dr (-)

$

300

Cr (+)

$

1 500

1 500

2 200

500

Balance

300

1 200

2 700

500

0

Income Statement for the year ended 31 December 2013 (extract)

Other Income

$

$

Rent Income

2 200

Expenses

Utilities Expense

Insurance Expense

(1 170)

(2 000)

(c)

Balance Sheet as at 31 December 2013 (extract)

$

Current Assets

Prepaid Insurance Expense

600

Current Liabilities

Accrued Utilities Expense

Rent Income Received in Advance

370

500

Dr

Cr

Cr

Cr

Chapter 11 Prepayments and Accruals

11.3 Prepayments & Accruals (Mix)

Question 2

(a)

Insurance Expense Account

Date

2014

Jan 1

Dec 31

Dec 31

Dec 31

Particulars

Prepaid Insurance Expense

Cash at Bank

Profit and Loss

Prepaid Insurance Expense

Dr (+)

Cr (-)

$

5 800

36 300

35 000

7 100

Balance

5 800 Dr

42 100 Dr

7 100 Dr

0

Rent Income Account

Date

2014

Jan 1

Dec 31

Dec 31

Dec 31

Particulars

Rent Income Receivable

Cash at Bank

Profit and Loss

Rent Income Received in Advance

(10 000 x 2/5)

Dr (-)

$

3 620

Cr (+)

$

Balance

3 620 Dr

24 890

17 270

4 000

(b)

Add:

Less:

Income Statement for the year ended 31 December 2014 (extract)

Other Income

$

$

Rent Income

17 270

Expenses

Insurance Expense

(35 000)

(c)

Balance Sheet as at 31 December 2014 (extract)

$

Current Assets

Prepaid Insurance Expense

7 100

Current Liabilities

Rent Income Received in Advance

4 000

(d)

If prepaid expenses $7100 was not adjusted, expense overstated by $7100

Profit understated by $7100, current Assets understated by $7100

Chapter 11 Prepayments and Accruals

11.3 Prepayments & Accruals (Mix)

Question 3

(a)

Accrued expense is expense incurred in the current financial

period that will be paid in the subsequent period.

The business has benefited from the service but has not paid for it yet.

Accrued expense is classified as current liabilities in the balance sheet.

Income received in advance / Uearned Income

Income received in advance or unearned income is money received in the

current financial period for which goods and services have not been provided to

customers yet.

Income received in advance or unearned income is classified as

current liabilities in the balance sheet.

(b)

Commission Income Account

Date

2013

Aug 1

Aug 4

Dec 31

Dec 31

Particulars

Commission Income Receivable

Cash at Bank

Commission Income Received in Advance

Profit and Loss

Dr (-)

$

180

Cr (+)

$

800

232

388

Balance

180 Dr

620 Cr

388 Cr

0

Education Tours Income Account

Date

2014

Aug 1

Aug 10

Aug 17

Aug 31

Dec 31

Particulars

Education Tours income received in advance

Cash in hand

Drawings

Education Tours income receivable

Profit and Loss

Dr (-)

$

4 028

Cr (+) Balance

$

700

700 Cr

1 200

1 900 Cr

1 278

3 178 Cr

850

4 028 Cr

0

(c)

Add:

Income Statement for the year ended 31 August 2014 (extract)

Other Income

$

Commission Income

388

Education Tours Income

4 028

4 416

(d)

Balance Sheet as at 31 August 2014 (extract)

$

Current Assets

Education Tours income receivable

850

Current Liabilities

Commission Income Received in Advance

232

(e)

If commission income received in advance $232 was not adjusted, income overstated by

$232 Current Liabilities understated by $232

Chapter 11 Prepayments and Accruals

11.3 Prepayments & Accruals (Mix)

Question 4(a)

Date

2014

Jun 1

2015

May 31

May 31

May 31

Date

2014

Jun 1

2015

May 31

May 31

May 31

(b)

Add:

Less:

Insurance Expense Account

Particulars

Dr (+)

Cr (-)

$

3 300

Accrued Insurance Expense

Profit and Loss

Prepaid Insurance Expense

Cash at Bank

28 880

Commission Income Account

Particulars

Commission Income Received in Advance

Dr (-)

$

23 180

2 400

Cr (+)

$

1 600

Balance

3 300 Cr

26 480 Cr

28 880 Cr

28 880 Dr

Balance

1 600 Cr

Cash at Bank

5 500

7 100 Cr

Commission Income Receivable

1 700

8 800 Cr

Profit and Loss

8 800

0

Income Statement for the year ended 31 December 2014 (extract)

Other Income

$

$

Commission Income

8 800

Expenses

Insurance Expense

(23 180)

(c)

Balance Sheet as at 31 December 2014 (extract)

$

Current Assets

Prepaid Insurance Expense

Commission Income Receivable

2 400

1 700

4 100

(d)If commission receivable $1 700 is not adjusted, income understated by $1 700.

Current Assets understated by $1 700.

(e)

General Journal

Date

Particulars

Dr ($)

Cr (S)

2014

Jun 1

2015

May 31

Commission Income Received in Advance

Commission Income

1 600

Cash at Bank

Commission Income

5 500

Commission Income Receivable

Commission Income

1 700

Commission Income

Profit and Loss

8 800

1 600

5 500

1 700

8 800

Das könnte Ihnen auch gefallen

- Exercise Chapter 3: Adjusting The AccountsDokument9 SeitenExercise Chapter 3: Adjusting The AccountsSeany Sukmawati100% (3)

- Accounting CH 3Dokument49 SeitenAccounting CH 3mad76857700Noch keine Bewertungen

- Self Study Solutions Chapter 3Dokument27 SeitenSelf Study Solutions Chapter 3flowerkmNoch keine Bewertungen

- ACCT101 2010-2011 TERM1 Sample Final ExamDokument12 SeitenACCT101 2010-2011 TERM1 Sample Final ExamhappystoneNoch keine Bewertungen

- Financial AccountingDokument9 SeitenFinancial AccountingAnonymous VmhXGNlFyNoch keine Bewertungen

- A A P F S: Djusting Ccounts AND Reparing Inancial TatementsDokument39 SeitenA A P F S: Djusting Ccounts AND Reparing Inancial TatementsBoo LeNoch keine Bewertungen

- Accounting Principles 10th Edition Weygandt Kimmel Chapter 3 PDFDokument139 SeitenAccounting Principles 10th Edition Weygandt Kimmel Chapter 3 PDFbeenie manNoch keine Bewertungen

- Multi Choice Questions For The Website For "Accounting 2" Disk Title A22Multichoice Chapter 1 - Balance Day AdjustmentsDokument2 SeitenMulti Choice Questions For The Website For "Accounting 2" Disk Title A22Multichoice Chapter 1 - Balance Day AdjustmentsAkhileshNoch keine Bewertungen

- Merger & Acquisition Accounting & Auditing Impact - Liquidation and Reorganisation - Jawaban Tugas Week 10Dokument10 SeitenMerger & Acquisition Accounting & Auditing Impact - Liquidation and Reorganisation - Jawaban Tugas Week 10Ragil Kuning ManikNoch keine Bewertungen

- CH 5 SolutionDokument21 SeitenCH 5 SolutionJoe MichaelsNoch keine Bewertungen

- 21S1 AC1103 Lesson 03 Discussion QuestionsDokument4 Seiten21S1 AC1103 Lesson 03 Discussion Questionsxiu yingNoch keine Bewertungen

- Workshop Solutions T1 2014Dokument78 SeitenWorkshop Solutions T1 2014sarah1379Noch keine Bewertungen

- Vol 2 CH 1Dokument20 SeitenVol 2 CH 1lee jong sukNoch keine Bewertungen

- Tutorial ACW 162 Chapter 3Dokument13 SeitenTutorial ACW 162 Chapter 3raye brahmNoch keine Bewertungen

- Cheat SheetDokument9 SeitenCheat SheetKhushi RaiNoch keine Bewertungen

- Basic Accounting Cup AnswerkeyDokument6 SeitenBasic Accounting Cup AnswerkeyChichiNoch keine Bewertungen

- Self Study Solutions Chapter 13Dokument11 SeitenSelf Study Solutions Chapter 13ggjjyy0% (1)

- Adjusting Entries Justin Park CASEDokument20 SeitenAdjusting Entries Justin Park CASEDKzNoch keine Bewertungen

- Homework Chapter 4Dokument17 SeitenHomework Chapter 4Trung Kiên Nguyễn100% (1)

- Warren Bab 4 Penyelesaian Siklus AkuntansiDokument69 SeitenWarren Bab 4 Penyelesaian Siklus AkuntansiCici SintamayaNoch keine Bewertungen

- Johnson - Cassandra - AC556 Assignment Unit 4Dokument9 SeitenJohnson - Cassandra - AC556 Assignment Unit 4ctp4950_552446766Noch keine Bewertungen

- Financial Accounting 2 Chapter 1 SolmanDokument17 SeitenFinancial Accounting 2 Chapter 1 SolmanElijah Lou ViloriaNoch keine Bewertungen

- Postemployment BenefitDokument2 SeitenPostemployment BenefitShaira BugayongNoch keine Bewertungen

- 2014 Volume 2 CH 1 Solution ManualDokument10 Seiten2014 Volume 2 CH 1 Solution ManualGabriel Dave AlamoNoch keine Bewertungen

- Week3 Homework AC557Dokument2 SeitenWeek3 Homework AC557seniorr001100% (1)

- Week 6 - Solutions (Some Revision Questions)Dokument13 SeitenWeek 6 - Solutions (Some Revision Questions)Jason0% (1)

- ACCT2542 Final Exam With SolutionsDokument16 SeitenACCT2542 Final Exam With SolutionsAnhPham100% (2)

- Solutions To Brief Exercises - Chapter 12Dokument12 SeitenSolutions To Brief Exercises - Chapter 12Anh KietNoch keine Bewertungen

- XII Accountancy CA - Expoected Questions & Answers - Live Revision 2022Dokument178 SeitenXII Accountancy CA - Expoected Questions & Answers - Live Revision 2022Sukhil KNoch keine Bewertungen

- AssignmentDokument8 SeitenAssignmentNitesh AgrawalNoch keine Bewertungen

- Ac557 W3 HW HBDokument2 SeitenAc557 W3 HW HBHasan Barakat100% (2)

- Midterm Answer KeyDokument10 SeitenMidterm Answer KeyRebecca ParisiNoch keine Bewertungen

- 2019 Mid-Semester Mock Exam QuestionsDokument20 Seiten2019 Mid-Semester Mock Exam QuestionsMichael BobNoch keine Bewertungen

- Answers - V2Chapter 1 2012Dokument10 SeitenAnswers - V2Chapter 1 2012Christopher Diaz0% (1)

- Accounting Assignmen3tDokument1 SeiteAccounting Assignmen3tRohit JindalNoch keine Bewertungen

- CH 03Dokument4 SeitenCH 03vivien50% (2)

- Examples Ch3 SolutionDokument7 SeitenExamples Ch3 SolutionNajwa Al-khateebNoch keine Bewertungen

- MT Principles of Accounting Fall 2023 UGDokument5 SeitenMT Principles of Accounting Fall 2023 UGwww.kazimarzanjsbmsc570Noch keine Bewertungen

- CH 04Dokument4 SeitenCH 04vivien33% (3)

- Assignment Questions - Suggested Answers (E4-8, E4-19, P4-2, P4-7) E4-8Dokument6 SeitenAssignment Questions - Suggested Answers (E4-8, E4-19, P4-2, P4-7) E4-8Ivy KwokNoch keine Bewertungen

- f2 Answers Nov14Dokument16 Seitenf2 Answers Nov14FahadNoch keine Bewertungen

- FA2 Spring 2011 Suggested SolutionDokument6 SeitenFA2 Spring 2011 Suggested Solutionaqsa_22inNoch keine Bewertungen

- Module 2 - Completing The Accounting Cycle DiscussionDokument62 SeitenModule 2 - Completing The Accounting Cycle Discussioncdlchristopher04100% (1)

- FNDB020 Practice Exam Paper 1 SolutionDokument10 SeitenFNDB020 Practice Exam Paper 1 SolutionThi Van Anh VUNoch keine Bewertungen

- Answer To Homework QuestionsDokument102 SeitenAnswer To Homework QuestionsDhanesh SharmaNoch keine Bewertungen

- G-1 Template NewDokument5 SeitenG-1 Template NewShucheng NieNoch keine Bewertungen

- 2020 Spring Midterm II A AnsKey PDFDokument12 Seiten2020 Spring Midterm II A AnsKey PDFEunice GuoNoch keine Bewertungen

- MT Test Review-Taxation 1-Win 2024Dokument4 SeitenMT Test Review-Taxation 1-Win 2024Mariola AlkuNoch keine Bewertungen

- P43ADokument5 SeitenP43AAquanetta OrtonNoch keine Bewertungen

- ACW1120-Week 5 Practice Q-Topic 5-Prepare FSDokument8 SeitenACW1120-Week 5 Practice Q-Topic 5-Prepare FSGan ZhengweiNoch keine Bewertungen

- Federal Income Tax: a QuickStudy Digital Law ReferenceVon EverandFederal Income Tax: a QuickStudy Digital Law ReferenceNoch keine Bewertungen

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryVon EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryVon EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Direct Property & Casualty Insurance Carrier Revenues World Summary: Market Values & Financials by CountryVon EverandDirect Property & Casualty Insurance Carrier Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Credit Union Revenues World Summary: Market Values & Financials by CountryVon EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Economic & Budget Forecast Workbook: Economic workbook with worksheetVon EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNoch keine Bewertungen

- Project Management Accounting: Budgeting, Tracking, and Reporting Costs and ProfitabilityVon EverandProject Management Accounting: Budgeting, Tracking, and Reporting Costs and ProfitabilityBewertung: 4 von 5 Sternen4/5 (2)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Von EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Bewertung: 5 von 5 Sternen5/5 (1)

- Fast-Track Tax Reform: Lessons from the MaldivesVon EverandFast-Track Tax Reform: Lessons from the MaldivesNoch keine Bewertungen

- Case 43Dokument6 SeitenCase 43Maria Danice AngelaNoch keine Bewertungen

- Isae 3400Dokument9 SeitenIsae 3400baabasaamNoch keine Bewertungen

- Insurance and Risk Management AssignmentDokument14 SeitenInsurance and Risk Management AssignmentKazi JunayadNoch keine Bewertungen

- Myanmar APGevaluationDokument207 SeitenMyanmar APGevaluationKashishBansalNoch keine Bewertungen

- Proposed Rule: Medical Benefits: Medical Care or Services Reasonable ChargesDokument4 SeitenProposed Rule: Medical Benefits: Medical Care or Services Reasonable ChargesJustia.comNoch keine Bewertungen

- Mutual Fund Management. Sybim-Sem-3 Faculty - Khyati Ma'am Co-Ordinator - Sheetal Ma'am Hinduja College of CommerceDokument24 SeitenMutual Fund Management. Sybim-Sem-3 Faculty - Khyati Ma'am Co-Ordinator - Sheetal Ma'am Hinduja College of CommerceMonish jainNoch keine Bewertungen

- Printable Conference Programme, Paris July 2012Dokument15 SeitenPrintable Conference Programme, Paris July 2012tprugNoch keine Bewertungen

- CH 12Dokument30 SeitenCH 12ReneeNoch keine Bewertungen

- Valuation Concepts and Methods Sample ProblemsDokument2 SeitenValuation Concepts and Methods Sample Problemswednesday addams100% (1)

- Public Policy Course Outline Prof. Tarun DasDokument32 SeitenPublic Policy Course Outline Prof. Tarun DasProfessor Tarun DasNoch keine Bewertungen

- CSR&SD 0118 l1 Intro To CSRDokument27 SeitenCSR&SD 0118 l1 Intro To CSRUditNoch keine Bewertungen

- Birla Sun Life - Garima - Group 3Dokument30 SeitenBirla Sun Life - Garima - Group 3mukesh chhotalaNoch keine Bewertungen

- Business Finance Final Çalışma ÖrneğiDokument8 SeitenBusiness Finance Final Çalışma ÖrneğiMustafa EyüboğluNoch keine Bewertungen

- MGT603 Spring 2013 QuizzesDokument42 SeitenMGT603 Spring 2013 QuizzesSayyed Muhammad Aftab ZaidiNoch keine Bewertungen

- Preference SharesDokument5 SeitenPreference ShareshasnaglowNoch keine Bewertungen

- The Standard Trade Model: Slides Prepared by Thomas BishopDokument56 SeitenThe Standard Trade Model: Slides Prepared by Thomas BishopNguyên BùiNoch keine Bewertungen

- Risk Management: Exchange RateDokument25 SeitenRisk Management: Exchange RateAjay Kumar TakiarNoch keine Bewertungen

- Petunjuk: Ujian Kompetensi Dasar I Program Pascasarjana Teknik Industri Universitas Sebelas MaretDokument4 SeitenPetunjuk: Ujian Kompetensi Dasar I Program Pascasarjana Teknik Industri Universitas Sebelas MaretriadNoch keine Bewertungen

- Duplichecker Plagiarism ReportDokument2 SeitenDuplichecker Plagiarism ReportErika DeboraNoch keine Bewertungen

- Ten Commandments of Commercial LendingDokument4 SeitenTen Commandments of Commercial LendingcapitalfinNoch keine Bewertungen

- Deloitte Vietnam - Tax Newsletter - May 2019Dokument27 SeitenDeloitte Vietnam - Tax Newsletter - May 2019Nguyen Hoang ThoNoch keine Bewertungen

- London Standard Platform Form 2009Dokument11 SeitenLondon Standard Platform Form 2009awjfernandez100% (1)

- Auditing & Assurance MAC005 Trimester 2 2020 ASSIGNMENTDokument8 SeitenAuditing & Assurance MAC005 Trimester 2 2020 ASSIGNMENTKarma SherpaNoch keine Bewertungen

- FBL3N - GL Account Line Item DisplayDokument4 SeitenFBL3N - GL Account Line Item DisplayP RajendraNoch keine Bewertungen

- Microfinance As A Poverty Reduction PolicyDokument12 SeitenMicrofinance As A Poverty Reduction PolicyCarlos105Noch keine Bewertungen

- Phil Mosley and Rolando Shannon Financial RatiosDokument12 SeitenPhil Mosley and Rolando Shannon Financial Ratiosapi-282888108Noch keine Bewertungen

- Quiz Conceptual Framework WITH ANSWERSDokument25 SeitenQuiz Conceptual Framework WITH ANSWERSasachdeva17100% (1)

- Victoria's Secret Annual ReportDokument13 SeitenVictoria's Secret Annual Reportapi-373843164% (28)

- CREDITS FinalsDokument6 SeitenCREDITS FinalsLara DelleNoch keine Bewertungen

- Staff Imprest FormDokument2 SeitenStaff Imprest FormSumeet MishraNoch keine Bewertungen