Beruflich Dokumente

Kultur Dokumente

PA House Appropriations Committee - Chairman's Report

Hochgeladen von

prideandpromiseCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

PA House Appropriations Committee - Chairman's Report

Hochgeladen von

prideandpromiseCopyright:

Verfügbare Formate

House Republican Appropriaons Commiee

The Chairmans Report Rep. Bill Adolph

State Budget Update: June 14, 2010

House Bill 2497 proposes to make changes to the methodology to calculate the employer contribuon rates of the

states two pension systems -- the Public School Employees Rerement System (PSERS) and the State Employees

Rerement System (SERS). The bill would address the pending spike in the employer contribuon rates for the two

systems by incrementally increasing the rates to help lessen expenditures in the state budget and for school districts.

House Republicans have asserted that any pension-related legislaon must also contain necessary reforms to help

the state beer manage its future expenses. In turn, an amendment to House Bill 2497 has been draed (A07493)

that would cover several key reforms. This amendment was draed through biparsan eorts.

House Bill 2497

As introduced by Democrat Appropriaons Commiee Chairman Rep. Dwight Evans, this legislaon would make

the following changes to both SERS and PSERS:

- Re-amorze all unfunded liabilies over a 30-year period.

- Establish a nal contribuon rate for scal year 2010-11 at 5 Percent for SERS and 5.64 Percent for PSERS

(This includes the .64 Percent for premium assistance).

- Implement limits on the increases in the employer contribuon rates. Annual Increases would be collared

at the following rates in the coming scal years:

- 2011-12: 3 Percent growth over prior year.

- 2012-13: 3.5 Percent growth over 2011-12.

- 2013-14 and Thereaer: 4.5 Percent over prior year.

- Change the asset smoothing period to 10 years for PSERS. The SERS asset smoothing period will remain at

ve years.

Pension Reform Measures - Amendment A07493

The following is a summary of the amendment to HB 2497 to reect reform measures being proposed to the states

pension systems (SERS and PSERS). Changes will only impact new hires and will not eect the benets of current

SERS and PSERS members.

REFORM MEASURES

- Rescind Act 9 (2001): Benets provided to employees under Act 9 would be rescinded for all new members

beginning January 1, 2011 for SERS and July 1, 2011 for PSERS. Eecve date for new legislators would be

December 1, 2010. None of the changes would apply to the Judicial Branch.

SERS Members (Class A-3)

- Accrual Rate (Mulplier) for each year of service will be 2 Percent of nal average salary. This rate

will apply to both legislators and state employees. The current rate for legislators is 3 Percent; for state

employees the rate is 2.5 Percent.

- The employee contribuon rate will remain at 6.25 Percent for state employees. The rate for new

legislators will drop from 7.5 Percent to 6.25 Percent.

- These new members of SERS have a 45-day period where they may opt into a new Class A-4, which would

provide an accrual rate of 2.5 Percent with an employee contribuon rate of 9.3 Percent.

Connued

Budget Update: June 14, 2010

Pension Reform Measures - Amendment A07493

SERS Members (Class A-3)

- Vesng periods will increase from 5 to 10 years for all new SERS members.

- Rerement age increases by 5 years from the current rerement age for all new members.

- No Opon 4 (lump sum payout) will be permied for new members upon rerement.

PSERS Members (Class T-E)

- Accrual Rate (Mulplier) for each year of service will be 2 Percent of nal average salary. This rate

will apply to public school employees. The current rate for this group is 2.5 Percent.

- The employee contribuon rate will remain at 7.5 Percent.

- These new members of PSERS have a 45-day period where they may opt into a new Class T-F, which would

provide an accrual rate of 2.5 Percent with an employee contribuon rate of 10.3 Percent.

- Vesng periods will increase from 5 to 10 years for all new PSERS members.

- Rerement age increases to 65 with 3 years of service. The current provisions allow rerement at age 62 with

1 year of service. Keeps rerement ages consistent with SERS.

- No Opon 4 (lump sum payout) will be permied for new members upon rerement.

- House Bill 2497 calls for an employer contribuon rate of 5.64 Percent for PSERS. The actuarial rate cered by

PSERS is marked at 8.22 Percent. This amendment would includes a provision that provides a window for the

employer contribuon rates, nong that they cannot be less than 5.64 Percent, but also no more than 8.22 Percent.

The exact rate will be subject to the amount approved in the nal state budget (General Appropriaons Bill) for

Fiscal Year 2010-11.

- Note: Rate collars for the following scal years will not be eected by this amendment.

REFORM MEASURES

The following points are applicable to both SERS and PSERS in regards to the reform measures addressed on the

previous page:

- The opt-in Class A-4 (SERS) and Class T-F (PSERS) is viewed as being revenue neutral and would come at no

addional cost to the systems. The increased employee contribuon for each class would cover addional

expenses.

- Current employees in both systems are restricted from the new opt-in classes.

- Employees who have previously made rerement contribuons under one of the two systems and le, only

to later return, will not be eected by the new provisions. The excepon to this rule would be for those

employees who le one system to join the other aer the eecve dates. Those who would fall under this

rule would be subject to the changes of the new system they join.

- The vesng period for disability benets for PSERS and SERS members will remain at 5 years. State troopers

and enforcement ocers would be eligible for disability benets as soon as they begin their me of service.

- New employees subjected to the changes in this amendment would be eligible to withdraw their employee

contribuons plus 4 Percent statutory interest if they terminate their service prior to becoming vested.

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- AP Government NotesDokument101 SeitenAP Government NotesEyuelDagnchew0% (1)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- US Government Unit 1 PDFDokument381 SeitenUS Government Unit 1 PDFJeanJames KöningNoch keine Bewertungen

- PubCorp Finals ReviewerDokument8 SeitenPubCorp Finals ReviewerFlorence RoseteNoch keine Bewertungen

- Chapter 18 Quiz Corrections ADokument4 SeitenChapter 18 Quiz Corrections Aapi-244140508100% (2)

- Notes & Reviewer On Election Laws (For Final Exam)Dokument15 SeitenNotes & Reviewer On Election Laws (For Final Exam)Miguel Anas Jr.Noch keine Bewertungen

- Fernandez v. HretDokument2 SeitenFernandez v. HretZepht BadillaNoch keine Bewertungen

- Goh v. ComelecDokument2 SeitenGoh v. ComelecfranzadonNoch keine Bewertungen

- DIGEST Carlos v. AngelesDokument1 SeiteDIGEST Carlos v. AngelesCamille EspeletaNoch keine Bewertungen

- The Rise of Competitive AuthoritarianismDokument16 SeitenThe Rise of Competitive AuthoritarianismDavid Sforza100% (1)

- PASBO Fund Balance DesignationsDokument6 SeitenPASBO Fund Balance DesignationsprideandpromiseNoch keine Bewertungen

- GASB Statement 45Dokument2 SeitenGASB Statement 45prideandpromiseNoch keine Bewertungen

- PASBO Fund Balance DesignationsDokument6 SeitenPASBO Fund Balance DesignationsprideandpromiseNoch keine Bewertungen

- Speak Up 2009 Unleashing The FutureDokument19 SeitenSpeak Up 2009 Unleashing The FutureprideandpromiseNoch keine Bewertungen

- Agenda 9-15-10Dokument3 SeitenAgenda 9-15-10prideandpromiseNoch keine Bewertungen

- Students Speak Up About Their Vision For 21st Century LearningDokument27 SeitenStudents Speak Up About Their Vision For 21st Century LearningRobert Allen MoodyNoch keine Bewertungen

- Agenda 9-8-10Dokument3 SeitenAgenda 9-8-10prideandpromiseNoch keine Bewertungen

- HB2497 and The Pension Rate SpikeDokument22 SeitenHB2497 and The Pension Rate SpikeprideandpromiseNoch keine Bewertungen

- Empowerment Letter May 24 2010Dokument2 SeitenEmpowerment Letter May 24 2010prideandpromiseNoch keine Bewertungen

- Agenda 8-18-10Dokument3 SeitenAgenda 8-18-10prideandpromiseNoch keine Bewertungen

- Northwestern Lehigh School DistrictDokument4 SeitenNorthwestern Lehigh School DistrictprideandpromiseNoch keine Bewertungen

- Commencement ProgramDokument8 SeitenCommencement ProgramprideandpromiseNoch keine Bewertungen

- Board Members and BloggingDokument3 SeitenBoard Members and BloggingprideandpromiseNoch keine Bewertungen

- Agenda 8-11-10Dokument2 SeitenAgenda 8-11-10prideandpromiseNoch keine Bewertungen

- Proposed Recommendations From Curriculum CouncilDokument1 SeiteProposed Recommendations From Curriculum CouncilprideandpromiseNoch keine Bewertungen

- Seven Key Aspects of Governing During CrisisDokument4 SeitenSeven Key Aspects of Governing During CrisisprideandpromiseNoch keine Bewertungen

- PERC Actuarial NoteDokument15 SeitenPERC Actuarial NoteprideandpromiseNoch keine Bewertungen

- Senate Bill 1192Dokument77 SeitenSenate Bill 1192prideandpromiseNoch keine Bewertungen

- Agenda 6-9-10Dokument2 SeitenAgenda 6-9-10prideandpromiseNoch keine Bewertungen

- Act 93 AgreementDokument9 SeitenAct 93 AgreementprideandpromiseNoch keine Bewertungen

- Senate Bill 1192Dokument77 SeitenSenate Bill 1192prideandpromiseNoch keine Bewertungen

- Schools Affected by SB 1192Dokument56 SeitenSchools Affected by SB 1192prideandpromiseNoch keine Bewertungen

- Proposed Final Budget 2010-11Dokument42 SeitenProposed Final Budget 2010-11prideandpromiseNoch keine Bewertungen

- Right To Know Request Granted - Collective Bargaining ContractDokument1 SeiteRight To Know Request Granted - Collective Bargaining ContractprideandpromiseNoch keine Bewertungen

- Right To Know Request - Collective Bargaining AgreementDokument1 SeiteRight To Know Request - Collective Bargaining AgreementprideandpromiseNoch keine Bewertungen

- Superintendent ContractDokument10 SeitenSuperintendent ContractprideandpromiseNoch keine Bewertungen

- Superintendent ContractDokument10 SeitenSuperintendent ContractprideandpromiseNoch keine Bewertungen

- Right To Know Extension - Collective Bargaining AgreementDokument1 SeiteRight To Know Extension - Collective Bargaining AgreementprideandpromiseNoch keine Bewertungen

- Right To Know Request Granted - Collective Bargaining ContractDokument1 SeiteRight To Know Request Granted - Collective Bargaining ContractprideandpromiseNoch keine Bewertungen

- Testimony Before The Senate Committee On Rules & AdministrationDokument65 SeitenTestimony Before The Senate Committee On Rules & AdministrationThe Brennan Center for Justice100% (1)

- NSL Notes - Chapter 7Dokument7 SeitenNSL Notes - Chapter 7APNSL100% (2)

- Engelen - Why Compulsory Voting Can Enhance DemocracyDokument17 SeitenEngelen - Why Compulsory Voting Can Enhance DemocracyFelix TanNoch keine Bewertungen

- Anti-Semitic Jew Fred Newman Led His Cult-Like Followers To Independence Party Power in New York City - NY Daily NewsDokument3 SeitenAnti-Semitic Jew Fred Newman Led His Cult-Like Followers To Independence Party Power in New York City - NY Daily NewsgbabeufNoch keine Bewertungen

- Representation of People ActDokument17 SeitenRepresentation of People ActAnjaliNoch keine Bewertungen

- Rise of New Urban Middle ClassDokument37 SeitenRise of New Urban Middle ClassKo BaNoch keine Bewertungen

- DeccanChronicle BANG P 10-06-2018Dokument16 SeitenDeccanChronicle BANG P 10-06-2018SudheerKumarNoch keine Bewertungen

- Research ProposalDokument2 SeitenResearch Proposalapi-354312348100% (1)

- Judge Rules Man Justified in Shooting Intruder: Deadly StormDokument32 SeitenJudge Rules Man Justified in Shooting Intruder: Deadly StormSan Mateo Daily JournalNoch keine Bewertungen

- Guns and VotingDokument29 SeitenGuns and VotingThe Brennan Center for JusticeNoch keine Bewertungen

- U.S. Government Services and Information U.S. Government Services and InformationDokument17 SeitenU.S. Government Services and Information U.S. Government Services and InformationFia FakhitaNoch keine Bewertungen

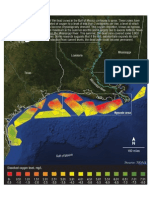

- Dead Zones in The Gulf of MexicoDokument1 SeiteDead Zones in The Gulf of MexicoSethNoch keine Bewertungen

- Manila Standard Today - May 5, 2012 IssueDokument12 SeitenManila Standard Today - May 5, 2012 IssueManila Standard TodayNoch keine Bewertungen

- From Votes To SeatsDokument62 SeitenFrom Votes To SeatsBoavida Simia PenicelaNoch keine Bewertungen

- Nelda Martinez ResumeDokument2 SeitenNelda Martinez ResumecallertimesNoch keine Bewertungen

- Naval v. COMELECDokument28 SeitenNaval v. COMELECMokeeCodillaNoch keine Bewertungen

- M5 Check in Activity 1 MMWDokument4 SeitenM5 Check in Activity 1 MMWDiana Joy MoranteNoch keine Bewertungen

- Stata C8Dokument21 SeitenStata C8Dumy NeguraNoch keine Bewertungen

- IYNF NC2010 Documents PDFDokument91 SeitenIYNF NC2010 Documents PDFcfergusson9007Noch keine Bewertungen

- Class Struggle UnionismDokument12 SeitenClass Struggle UnionismAlex HoganNoch keine Bewertungen

- Lebak, Sultan KudaratDokument3 SeitenLebak, Sultan KudaratSunStar Philippine NewsNoch keine Bewertungen