Beruflich Dokumente

Kultur Dokumente

Crosscurrents: Alan M. Newman's Stock Market

Hochgeladen von

sdonthy_gmailOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Crosscurrents: Alan M. Newman's Stock Market

Hochgeladen von

sdonthy_gmailCopyright:

Verfügbare Formate

Alan M.

Newmans Stock Market

CROSSCURRENTS

U.S. STOCK MARKET OUTLOOK for SEPTEMBER 13, 2010

DJIA 10,462 - SPX 1109 - NASDAQ 2242

UNCERTAINTY STILL TRUMPS STOCKS IN THE COMPARISON BETWEEN EQUITIES

AND BULLION. HIGH FREQUENCY TRADING NOW ACCOUNTS FOR 56% OF ALL

TRANSACTIONS, FAIR VALUATIONS NOT POSSIBLE. - NEXT ISSUE - OCTOBER 4, 2010 -

Grim Reminders.

Nine years ago, on the day

terror took down the Twin Towers

and ended the lives of 2977 innocent human beings, the world became a far more dangerous place.

The attack was the most successful

peacetime targeted attack on innocent civilians in history and as such,

made a statement that

still reverberates with

the announcement of

each new episode of

terror on the evening

news. The most recent

in Uganda (see http://

tinyurl.com/37k7q7s)

only two months ago

was a startling reminder that virtually no

one is safe. Given the

evidence of the last

decade, those who are

responsible are sufficiently financed and

organized to continue

their heinous and inhuman criminal acts and

have no incentive to

end their reign of terror. The news is not all

bad. Not all terror attempts succeed and in

fact, the U.S. has had excellent success in thwarting potential attacks.

A report by U.S. Senator James Inhofe, detailing many of these failed

attempts can be viewed at http://

tinyurl.com/2clrhbs. While we are

gratified that these particular plans

failed, their scope and the dogged

persistence of the operatives is mind

blowing and frightening. The implications are that the battle against

terror is nowhere near an end.

The tragedy of 911 catalyzed

a 180 degree shift in our views on

the precious metals market and at

the same time, served as a reminder

of the risks inherent in paper assets.

In recent years, we have covered the

potential for bullion, presenting our

case every few months, most often

with the same three charts shown in

todays issue. Our last report on

June 7th can be viewed at http://

www.cross-currents.net/k060710q.

pdf. At that time, we focused on

uncertainty and dismally broken

market mechanics as two primary

reasons to distrust stocks and trust

gold. As new evidence of the effects

of high frequency trading (HFT) come

to light, those reasons are at least as

valid today as they have ever been.

Uncertainty rules.

Ironically, our

featured chart today

again portrays a modestly improved environment for equity

investors. For several

years we had maintained an eventual

target of 5:1 for the

Dow/Gold ratio but

have since pushed

our target upwards to

6:1 as a response to

the nations ability to

monitor terrorist efforts and thereby reduce these risks to

some extent. We believe that before the

super bull market for

gold ends, the Dow

will trade at only six

times the price of bullion. As of the end of August, the

Dow/Gold ratio was 8.03. With the

exception of February 2009, this was

the lowest ratio since June 1991. Of

course, a 6:1 target for the Dow/

Gold ratio does not mean opposite

directions in price. For instance, if

golds bull market were to end at the

(Continued on page 2)

Please note: Information contained herein has been obtained from sources believed reliable but is not necessarily complete and accuracy is not

guaranteed. Any securities mentioned in this issue are not to be construed as investment or trading recommendations specifically for you. You

must consult your own advisor for investment or trading advice. This report is for informational and entertainment purposes only.

CROSSCURRENTS - Commentary - September 13, 2010 - Page 2

(Continued from page 1)

current level of $1250 per ounce, we

would expect the Dow to trade at

7500. However, if gold were to eventually trade as high as $3000 per

ounce, a 6:1 ratio would equate to

the Dow at 18,000. Either 6:1 parameter would satisfy our target. And

interestingly, although gold has almost quintupled from the lows of

April 2001, if the 6:1 target is valid,

gold remains the better play. In the

case of our first example (gold @

$1250 gold, Dow 7500), gold would

go sideways but the Dow would fall

by nearly 28%. In the case of our

second example (gold @ $3000,

Dow 18,000), gold would trade

140% higher but the Dow would

trade up by a lesser amount, 73%.

In fact, every in-between computation of a 6:1 Dow/gold ratio places

gold with the advantage.

we expected they would. The bear

market lasted more than 21 years

and we see no reason why the bull

market for gold cannot last at least

another few years. Paper assets are

definitely not what they used to be.

The grim reminders we focus on today are sufficient reasons for gold to

continue moving higher. While the

1980 peak equates to $1901 per

ounce in inflation adjusted terms, we

believe the final high for bullion will

turn out to be much higher.

THE ODDS HAVE IT

Deflation = 20%

Recession Worsens = 30%

Terrorist Event = 10%

Derivative Event = 10%

Armed Conflict = 15%

(will hurt stock prices)

the federal reserve, our theme of uncertainty and higher prices for gold

would appear to be a lock. However,

there was one glaring omission in Peseks report, that of the effects of

high frequency trading (HFT) on the

equity markets, one of the most significant reasons for stocks to remain

a second best alternative for investors.

Another article about how

Nanex analysts are taking apart the

data appeared in the NY Times a few

weeks ago (see http://tinyurl.

com/25kwju2) and the most relevant posit was that of the founder of

Nanex, who hypothesized .the

bizarre patterns might have been the

result of a Wall Street version of cyberwarfare.

Clearly, as another

Nanex spokesperson

something is not right.

posited,

Although the SEC is somewhat cognizant of abusive market

Comparisons after the ef-Odds that none of the above will occur = 39%

mechanics, they are anything but

fects of inflation also place gold in a

fleet of foot in their response to

far better light than stocks. Below

changing conditions and are notoriOdds that at least one will occur = 61%

left, since the great gold bull market

ously glacier like in their ability to

Odds that at least two will occur = 28%protect U.S. investors. Bob Pisanis

commenced, gold is up 288%, a rate

of over 15% annualized gains AFTER

piece for CNBC mentioned SEC chief

Inflation Surge = 40%

the effects of inflation. By compariMary Shapiros recent comments

son, the Dow is down 24% after in- (will tend to support stock prices)

which left zero confidence that any

flation. The wonder is that golds

substantive action will be taken. If it

bull market is not more widely recis true (and we have no doubts on

ognized and why, after two manias

that score) that internalized trading

involving stocks and housing, gold

and dark pools now represent 26%

seems just an also run in the public

of all trading in a market where HFT

eye. Advertisements continue to run

now encompassing 56% of all transin local newspapers for the public to

actions, then clearly, we have

[Ed note:] Wikipedia maintains a list of

terrorist incidents dating far back in hissell their gold jewelry and there is no

usurped the capital formation system

tory with details of hundreds of inciclamor to buy the precious metal.

to benefit those do not INVEST in our

dents since 911 (see http://tinyurl.com/

Given the lack of public enthusiasm,

equity markets. Our principal thesis

hlu8d).

there would seem to be ample room

is that fair valuations cannot be prefor bullion to run on the upside.

sent (except by chance alone) when a

market is overwhelmed by short term

Something Is Not Right.

At bottom right, another intrading. The best example of the psyflation adjusted perspective, which

chological proof of our posit is the

Bill Peseks opinion piece

we have shown for several years

casino, where even low payout slot

(see http://tinyurl.com/29766qq) for

punctuated by resistance levels.

machines are in demand simply beBloomberg not too long ago was an

Note, only one more resistance level

cause the gratification can be instaneye opener. If bullions surge is inremains, the others have all fallen as

deed a puzzlement for the chief of

(Continued on page 3)

CROSSCURRENTS - Commentary - September 13, 2010 - Page 3

(Continued from page 2)

taneous. While we admit there must

be profitable algorithms currently utilized and in vogue amongst quants,

we are also certain they change with

the winds. We have established an

environment in which it no longer

may pay to own equity for the long

term because there is no long term

anymore. Something is definitely not

right.

Looking Far Ahead.

Although we still expect considerable downside potential into an

October low for equities, we have

maintained the odds for a new secular bull market are growing as the

lost decade for stocks comes to an

end. To be more precise, although

we are unwilling to commit 100% to

the bull thesis after our downside targets are met, we do believe stocks

will rebound quite nicely and rally

strongly in 2011. Our caveat is the

next secular bull market for stocks

will in no way resemble the last secular bull market for stocks and beyond

2011, progress for years to come is

likely to be dull, uninspiring, boring

and plodding.

Below left, we present a

really long term perspective, one

which clearly implies a far more modest future is in store than the glory

years from 1982 to 2000. The 20year annualized rate of gain is now

7.5%, the highest since November

2008 and well in excess of what history has shown to be sustainable. As

seen below, 20-year returns have

been below 5% more than half the

time and have averaged only 5.1%,

despite the tremendous bull market

from 1982 to 2000. Moreover, during a vast history of 78 years from

1917 to 1995, the 20-year return was

only 4% annualized and this long history implies that we should expect a

return to at least the 5% level, proba-

bly the 4% level and perhaps even an

eventual return to the 0.7% level

achieved back in 1982. Impossible?

Remember, the Dow has actually lost

ground over the last ten years. A

glance at the circled bottoms in the

1920s, 1930s and the 1940s clearly

suggests the 0.7% level is possible.

If our thesis is correct, investors will require a great deal of patience and will have to accept that

the last secular bull market was an

aberration, not to be repeated in our

lifetimes. For instance, let us assume

three targets in which either the

5%, 4% or 0.7% levels are eventually

Dow

8400

10,500

12,000

5%

Nov. 11 Jan. 15

May. 15

4%

Dec. 13

0.7% Apr. 17

Aug. 15 Jan. 16

Dec. 18

Apr. 17

achieved for 20-year annualized returns. Furthermore, let us assume

four scenarios in which these

targets are fulfilled at either Dow

8400, Dow 10,500 or Dow 12,000.

Dow 8400 represents the top of the

range for our October low forecast.

Dow 10,500 is roughly the current

level. Dow 12,000 represents the

assumption of a relatively bullish target. Unfortunately, no matter how we

slice and dice the possibilities, it will

likely require extraordinary patience

for investors if any of the scenarios

are to occur. Clearly, the Dow 8400

scenario represents a negative return

for investors.

Dow 10,500 represents a zero return. Unfortunately,

even our Dow 12,000 scenario does

not represent anything more than

modest gains. For instance, the scenario representing 20-year annualized

gains at the 5% level in May 2015 at

Dow 12,000 results in an annualized

rate of gain from today of only 2.9%.

While we cannot deny the

possibility of much higher prices

eventually in the next secular bull

market, there seems little likelihood

that 20-year annualized returns can

be sustained anywhere near current

levels and will fall, perhaps rapidly, to

more reasonable levels. The twin

manias have come and gone and if

history is any guide at all, we should

be on the track towards normal.

One Last Grim Reminder

Many months ago, we stated

that weekly initial unemployment

claims would present the best picture

we have for recovery prospects and

dutifully, we have shown the chart in

almost every issue to accentuate that

an economic recovery was still far

away. In recent weeks, the picture

has actually worsened. As of August

21st, the four-week average was as

high as it has been since November

of last year and is currently 42%

higher than at the end of 2007, when

we first might have begun to suspect

that all was not well. While continuing claims seem to be trending down

slowly, the truth of the matter is that

many of those previously collecting

are no longer eligible to collect and

are thus, off the roster. Given the

paucity of job creation this year, they

are either still unemployed, or as the

U-6 rate of employment illustrates,

are underemployed (http://tinyurl.

com/2cev7vl). Clearly, 2008 was a

bum year. As long as weekly claims

and continuing claims remain at the

same levels as the 2008 average

highlighted below, it is highly unlikely

that the economy is making any real

progress. Were still looking for close

to 8 million jobs to replace those

lost. At the current pace of job creation, this will take a very long time,

another good reason why 20-year annualized returns for stocks should

decline to more reasonable levels.

CROSSCURRENTS - Market Indicators - September 13, 2010 - Page 4

the 21-day incarnation of our Emotional Intensity indicator never wound up

issuing a buy signal but it

may be on the verge of issuing a new sell signal by late

this week, if activity is even

modestly retrained. It would

take fairly large expansion in

optimism to prevent the new

signal. The recent sell signal

was registered on August

10th, the day after the Dow

and S&P peak and we note

with great interest that all major indexes are still trading

lower, despite enormous media play on the rally. As we

suggested in the last issue,

we still expect the levels of

late May to be exceeded as

we turn into a really rough

patch in October.

While Speculative intensity certainly backed off,

this indicator has crept up

again and is at levels consistent with a significant peak in

prices. Although well shy of

the peak seen earlier in the

year, the resurgence to current high levels strongly implies there is excessive enthusiasm for stocks and in particular, Nasdaq stocks. Ironically, Nasdaq finally shows

signs of under performance

and we believe that mode will

not only continue but will be

accentuated in the weeks

ahead.

Alan M. Newmans Stock Market

CROSSCURRENTS

entire contents 2010 Crosscurrents Publishing, LLC

3280 Sunrise Highway #125

Wantagh, NY 11793

(516) 557-7171

Alan M. Newman, Editor

Information contained herein has been obtained from sources

believed reliable but is not necessarily complete and accuracy is not guaranteed. Any securities that are mentioned in this issue are not to be

construed as investment or trading recommendations specifically for you.

You must consult your own advisor for investment or trading advice.

The entire contents of CROSSCURRENTS are protected by

federal copyright laws. The federal Copyright Act imposes liability for

violations of this law, including any unauthorized reproduction of this

issue, in part or in whole.

You cant have a bull

market without participation

by the players playing the

game to the hilt and despite

the speculation desire shown

in our second indicator for

Nasdaq, too many players

have simply gone home to

nap while HFT rules the

arena. Who can compete?

The exchanges are killing the

golden goose. In any event,

low volume like you see at

bottom left, is the kiss of

death for bulls.

A Larger Perspective

Sentiment, as measured by the Investors Intelligence tally of investment advisers, turned quite negative

in March of 2008. At one

point, there were close to

three bears for every two

bulls and bears exceeded

bulls for six straight weeks.

Although

pessimism

may

have been the catalyst for

much of the nine week rally

that took the Dow up 7.4%,

those who had turned pessimistic turned out to be quite

correct, just a bit ahead of

the mark.

Within another

four weeks, they were proved

insightful and before another

five months had elapsed the

Dow was down over 4000

points and 33% lower. Thus,

we believe the recent turn of

events in which this indicator

has taken a turn towards pessimism, should be viewed in

a larger perspective.

As well, in the 2008

timeframe, investment advisers were consistently more

negative about the markets

prospects than now. Both the

26 and 52-week moving average of the bull to bear ratio

hovered around 1. We seem

to remember comments how

the consistently

somewhat

pessimistic sentiment would

play out well for the bulls. It

did not. However, given the

economic background, the 26

and 52 week ratio are currently rather optimistic at 1.5

and 1.8 (bulls to bears) respectively. For a long time,

bulls have been far more in

evidence than bears. It will

take more than the current

blip to create a bottom based

on sentiment. More importantly, with mutual funds now

at an all-time low of only

3.4% cash-to-assets, the larger perspective shows excessive, perhaps even euphoria.

THANKS TO:

ALAN ABELSON

BARRONS

FOR COVERAGE

OF OUR COMMENTARY

CROSSCURRENTS

POWERFUL COMMENTARY

UNIQUE PERSPECTIVES

ONE YEAR$189

SIX MONTHS$100

WWW.CROSSCURRENTS.NET/

SUBSCRIBE.HTM

NOW IN OUR 21st YEAR!

CROSSCURRENTS - The Three Weeks Ahead - September 13, 2010

- Rationales & Targets -

We were correct in our assumption of a respite, were wrong

about the duration of the respite but thus far, were also correct in our

gauge of strong resistance at Dow 10,500. However, time is beginning to

run out on both a bear outcome for stocks and a continued rally in bullion.

Long term, we are still ridiculously bullish on gold but a pullback from the

recent record highs is a growing possibility. If our expected correction for

stocks is going to occur, it needs to get started in earnest soon. Seasonal

effects will begin to turn positive in another month. The August lows at

Dow 9900 now appear to have taken on more significance as an important

support and given the environment of mechanically driven trading and low

volume, potential for a very rapid downside remains. The odds for our

most bearish scenario are clearly dwindling and we are too close in time to

the bottom, thus Dow 8400 is now our worst case scenario and Dow 91009200 now looms larger as an eventual reversal point. Bank stocks are

needed for any bull push but the entire group looks barely alive.

Last issues comments on pharmaceuticals is a lot more relevant

now with the recent activity and new high in Bristol Myers (BMY) and last

weeks breakout in Pfizer (PFE). Even Merck (MRK) is on the verge of a

breakout, so the group may finally be ready for a much larger push. Another that looks quite promising is Allergan (AGN).

On the other hand, the semi-conductor group looks awful and we

wonder how an economic recovery can be posited if this important group is

under performing. Advanced Micro (AMD), Applied Materials (AMAT) and

even giant Intel (INTC) are in the dumps and appear poised for a breakdown. Below, PFE and AMAT are presented as samples for their peers.

PFE

FAIR WARNING & DISCLAIMER:

The publisher of this newsletter and one or more of its affiliated

persons and entities may have positions in the securities or sectors

recommended in this newsletter and may therefore have a conflict

of interest in making the recommendations herein. For example, if

an affiliate has an existing long position in a security that this newsletter recommends for a long position, the buying activity that recommendation generates may cause the price of such securities to

rise, potentially allowing the affiliate to exit the position at a profit.

Any securities mentioned in this issue are not to be construed as

investment or trading recommendations specifically for you. You

must consult your own advisor for investment or trading advice.

The Psychology of the Market

Invest. Intel.: 3 Wk. Bull/Bear Ratio 1.0 Skeptical

AAII: 3 Week Bull/Bear Ratio: 0.8 Skeptical

Mutual Funds: 3.4% cash: Euphoric

Crosscurrents Emotion-Based Indicators:

ANOTHER SELL SIGNAL POSSIBLE

LATE THIS WEEK

Short Term Forecast

RALLY NEARING END

WE STILL EXPECT DOWNSIDE

TO RESUME WITH UNEXPECTED FORCE

STRONG RESISTANCE AT DOW 10,500-10,600

IMPORTANT SUPPORT: DOW 9900

Intermediate Term Forecast

THROUGH OCTOBER 2010

REWARD/RISK RATIO: AWFUL

UPSIDE POTENTIAL = 1 to 2%

EXPECTED DOWNSIDE RISK = 13%

MAXIMUM DOWNSIDE RISK = 20%

Crosscurrents 10 Investment Stance

RETAINED FROM PREVIOUS YEAR OR EARLIER

Newmont Mining (NEM) 10% LONG +46.7%

China Medical Tech. (CMED) 5% LONG 3582%

Goldcorp (GG) 5% LONG +5.7%

Newmont Mining (NEM-closed) +51.4%

AVERAGE GAIN +23.0%

Vs. DJIA +0.3% SPX 0.6% Nasdaq 1.3%

AMAT

Retained ideas priced from inception

Percentage gains (losses) include dividends

AVERAGE GAIN IS WEIGHTED

POSSIBLE FUTURE ADDITIONS

Mindray Medical (MR) - forward P/E 18

Pfizer Inc. (PFE) 4.3% dividend yield

Altria Group (MO) 6.5% dividend yield

AT&T Inc. (T) 6.1% dividend yield

ShengaTech Inc. (SDTH) - China/Speculative

TRADING STANCESTILL OPEN

Powershares QQQ Trust (QQQQ) 10% SHORT 37.9%

This hedge will be eliminated before the end of October.

Pictures of a Stock Market Mania

http://www.cross-currents.net/charts.htm

NEW UPDATE - SEPTEMBER 4th

Das könnte Ihnen auch gefallen

- 2Q 2016 Tocqueville Gold Strategy Letter FinalDokument15 Seiten2Q 2016 Tocqueville Gold Strategy Letter Finalredcorolla95573Noch keine Bewertungen

- 10/20/14 Global-Macro Trading SimulationDokument20 Seiten10/20/14 Global-Macro Trading SimulationPaul KimNoch keine Bewertungen

- 10/15/14 Global-Macro Trading SimulationDokument22 Seiten10/15/14 Global-Macro Trading SimulationPaul KimNoch keine Bewertungen

- 10/21/14 Global-Macro Trading SimulationDokument20 Seiten10/21/14 Global-Macro Trading SimulationPaul KimNoch keine Bewertungen

- 10/17/14 Global-Macro Trading SimulationDokument20 Seiten10/17/14 Global-Macro Trading SimulationPaul KimNoch keine Bewertungen

- April 082010 Post SDokument8 SeitenApril 082010 Post SAlbert L. PeiaNoch keine Bewertungen

- On Gold Swings and Cluelessness Galore: Ctober SsueDokument13 SeitenOn Gold Swings and Cluelessness Galore: Ctober SsueChad Thayer VNoch keine Bewertungen

- 10/29/14 Global-Macro Trading SimulationDokument21 Seiten10/29/14 Global-Macro Trading SimulationPaul KimNoch keine Bewertungen

- Gold Ex Plainer September 19 2010Dokument6 SeitenGold Ex Plainer September 19 2010Radu LucaNoch keine Bewertungen

- 10/8/14 Global-Macro Trading SimulationDokument19 Seiten10/8/14 Global-Macro Trading SimulationPaul KimNoch keine Bewertungen

- Stocks: Once More Up, Then The Big Down: NY Times' Krugman: We Are Entering The Third DepressionDokument36 SeitenStocks: Once More Up, Then The Big Down: NY Times' Krugman: We Are Entering The Third DepressionAlbert L. PeiaNoch keine Bewertungen

- Debunking The Gold Bubble Myth: By: Eric Sprott & Andrew MorrisDokument4 SeitenDebunking The Gold Bubble Myth: By: Eric Sprott & Andrew Morrisscribd_tsan100% (1)

- T MKC G R: HE Loba L EportDokument3 SeitenT MKC G R: HE Loba L EportMKC GlobalNoch keine Bewertungen

- 1-23-12 More QE On The WayDokument3 Seiten1-23-12 More QE On The WayThe Gold SpeculatorNoch keine Bewertungen

- Elliot Wave Theorist June 10Dokument10 SeitenElliot Wave Theorist June 10Mk S Kumar0% (1)

- RJ StoutDokument7 SeitenRJ StoutacegacegnikNoch keine Bewertungen

- Investment Strategy: Turning Point?Dokument5 SeitenInvestment Strategy: Turning Point?marketfolly.comNoch keine Bewertungen

- 10/14/14 Global-Macro Trading SimulationDokument22 Seiten10/14/14 Global-Macro Trading SimulationPaul KimNoch keine Bewertungen

- Strategic Value: Value Analysis as a Business WeaponVon EverandStrategic Value: Value Analysis as a Business WeaponNoch keine Bewertungen

- Thunder Road Report 26Dokument57 SeitenThunder Road Report 26TFMetalsNoch keine Bewertungen

- Lane Asset Management Stock Market Commentary October 2011Dokument9 SeitenLane Asset Management Stock Market Commentary October 2011Edward C LaneNoch keine Bewertungen

- The Golden Mean: NterviewDokument6 SeitenThe Golden Mean: NterviewvagierayNoch keine Bewertungen

- The Years 1999/2000 Were A Time of ExtremesDokument9 SeitenThe Years 1999/2000 Were A Time of ExtremesAlbert L. PeiaNoch keine Bewertungen

- 10/31/14 Global-Macro Trading SimulationDokument18 Seiten10/31/14 Global-Macro Trading SimulationPaul KimNoch keine Bewertungen

- Bonfire of The CurrenciesDokument5 SeitenBonfire of The CurrenciesNolan AndersonNoch keine Bewertungen

- August 022010 PostsDokument150 SeitenAugust 022010 PostsAlbert L. PeiaNoch keine Bewertungen

- March 152010 PostsDokument11 SeitenMarch 152010 PostsAlbert L. PeiaNoch keine Bewertungen

- 10/10/14 Global-Macro Trading SimulationDokument21 Seiten10/10/14 Global-Macro Trading SimulationPaul KimNoch keine Bewertungen

- March 112010 PostsDokument10 SeitenMarch 112010 PostsAlbert L. PeiaNoch keine Bewertungen

- A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationVon EverandA History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationBewertung: 4 von 5 Sternen4/5 (11)

- Lane Asset Management Stock Market Commentary September 2011Dokument10 SeitenLane Asset Management Stock Market Commentary September 2011eclaneNoch keine Bewertungen

- Sprott - GoldDokument4 SeitenSprott - Goldvariantperception100% (1)

- Dow Nasdaq S&P 500: Stocks/Gold ComparisonDokument5 SeitenDow Nasdaq S&P 500: Stocks/Gold ComparisonAlbert L. PeiaNoch keine Bewertungen

- 10/23/14 Global-Macro Trading SimulationDokument20 Seiten10/23/14 Global-Macro Trading SimulationPaul KimNoch keine Bewertungen

- Transforming Monetary LandscapesDokument7 SeitenTransforming Monetary Landscapesakshat madhogariaNoch keine Bewertungen

- March 292010 PostsDokument12 SeitenMarch 292010 PostsAlbert L. PeiaNoch keine Bewertungen

- Gold Forecast 2010Dokument12 SeitenGold Forecast 2010Mohamed Said Al-QabbaniNoch keine Bewertungen

- Insiders Power Oct 2015Dokument14 SeitenInsiders Power Oct 2015InterAnalyst, LLCNoch keine Bewertungen

- 10/9/14 Global-Macro Trading SimulationDokument21 Seiten10/9/14 Global-Macro Trading SimulationPaul KimNoch keine Bewertungen

- Calm Before Another Global Market Storm Cooper ' and Given Just HowDokument12 SeitenCalm Before Another Global Market Storm Cooper ' and Given Just HowAlbert L. PeiaNoch keine Bewertungen

- ILL THE Curse OF Below Growth Leave Ndia: Reserve Bank of IndiaDokument12 SeitenILL THE Curse OF Below Growth Leave Ndia: Reserve Bank of IndiaVinayraj TenkaleNoch keine Bewertungen

- Week Summary: Macro StrategyDokument10 SeitenWeek Summary: Macro StrategyNoel AndreottiNoch keine Bewertungen

- GoldDokument4 SeitenGoldchivotrader100% (1)

- GloomBoomDoom Jan2011Dokument15 SeitenGloomBoomDoom Jan2011MikeGMNoch keine Bewertungen

- Investor'S Guide: by Jeff Clark, Editor of Big GoldDokument12 SeitenInvestor'S Guide: by Jeff Clark, Editor of Big GoldaldilnojinjaloNoch keine Bewertungen

- MSJ 11316Dokument10 SeitenMSJ 11316Anonymous OHTcTQNoch keine Bewertungen

- Housing Sales and Inflation Surge: That Is ExactlyDokument11 SeitenHousing Sales and Inflation Surge: That Is ExactlyAlbert L. PeiaNoch keine Bewertungen

- May 122010 PostsDokument13 SeitenMay 122010 PostsAlbert L. PeiaNoch keine Bewertungen

- 6-26-12 Greed Is Good.Dokument4 Seiten6-26-12 Greed Is Good.The Gold SpeculatorNoch keine Bewertungen

- How Long Is The Subprime TunnelDokument6 SeitenHow Long Is The Subprime TunnelAlampilli BaburajNoch keine Bewertungen

- Framework For Understanding The Market: Page 1 of 7 @alphacharts (Stocktwits, Twitter, Substack) Dec 30, 2020Dokument7 SeitenFramework For Understanding The Market: Page 1 of 7 @alphacharts (Stocktwits, Twitter, Substack) Dec 30, 2020sreenivas puttaNoch keine Bewertungen

- Silver Producers A Call To ActionDokument5 SeitenSilver Producers A Call To Actionrichardck61Noch keine Bewertungen

- The Money Bubble - Turk, JamesDokument128 SeitenThe Money Bubble - Turk, Jamesmuppettheater100% (1)

- August 172010 PostsDokument269 SeitenAugust 172010 PostsAlbert L. PeiaNoch keine Bewertungen

- The Great Super Cycle: Profit from the Coming Inflation Tidal Wave and Dollar DevaluationVon EverandThe Great Super Cycle: Profit from the Coming Inflation Tidal Wave and Dollar DevaluationNoch keine Bewertungen

- 10/13/14 Global-Macro Trading SimulationDokument21 Seiten10/13/14 Global-Macro Trading SimulationPaul KimNoch keine Bewertungen

- The Shadow Market: How a Group of Wealthy Nations and Powerful Investors Secretly Dominate the WorldVon EverandThe Shadow Market: How a Group of Wealthy Nations and Powerful Investors Secretly Dominate the WorldBewertung: 4 von 5 Sternen4/5 (2)

- 2011 Omgeo CTM Prod Rel Info Docs x4 PDFDokument28 Seiten2011 Omgeo CTM Prod Rel Info Docs x4 PDFsdonthy_gmailNoch keine Bewertungen

- AWS Data-Lake EbookDokument9 SeitenAWS Data-Lake Ebooksdonthy_gmailNoch keine Bewertungen

- Adiyogi The First YogiDokument8 SeitenAdiyogi The First Yogisdonthy_gmailNoch keine Bewertungen

- Dhirendra Brahmachari Sukshma Vyayama Subtle YogaDokument29 SeitenDhirendra Brahmachari Sukshma Vyayama Subtle Yogadryashtokas93% (15)

- Collection of Some Articles by SadhguruDokument60 SeitenCollection of Some Articles by Sadhgurusdonthy_gmail100% (1)

- IAM20 Mediation StepsDokument4 SeitenIAM20 Mediation Stepssdonthy_gmailNoch keine Bewertungen

- Mother As Revealed To Me by Ganga Charan DasguptaDokument98 SeitenMother As Revealed To Me by Ganga Charan Dasguptasdonthy_gmailNoch keine Bewertungen

- Jll-Capital Markets BrochureDokument12 SeitenJll-Capital Markets BrochurechloeheNoch keine Bewertungen

- CH 9 Lecture NotesDokument14 SeitenCH 9 Lecture NotesraveenaatNoch keine Bewertungen

- Equity Valuation-1Dokument37 SeitenEquity Valuation-1Disha BakshiNoch keine Bewertungen

- Term SheetDokument9 SeitenTerm SheetDongare RahulNoch keine Bewertungen

- Fischer 2017Dokument28 SeitenFischer 2017YNoch keine Bewertungen

- Retirement Option Form: Declaration and Specimen Signature of Accont Holder (S)Dokument1 SeiteRetirement Option Form: Declaration and Specimen Signature of Accont Holder (S)Salman ArshadNoch keine Bewertungen

- CFA PresentationDokument47 SeitenCFA PresentationBen Carlson100% (8)

- Greed IS Back: Business With PersonalityDokument36 SeitenGreed IS Back: Business With PersonalityCity A.M.Noch keine Bewertungen

- What Is Return Driven StrategyDokument3 SeitenWhat Is Return Driven Strategycolleenf-1Noch keine Bewertungen

- PFRS Vs PFRS For SMEsDokument31 SeitenPFRS Vs PFRS For SMEsxdoubledutchessNoch keine Bewertungen

- Chana Short Term ReportDokument4 SeitenChana Short Term ReportLeela SareesNoch keine Bewertungen

- Strama of Gonzales Auto RepairDokument16 SeitenStrama of Gonzales Auto RepairChelot Aguilar Bautista100% (1)

- FI 515 Week 1 QuizDokument4 SeitenFI 515 Week 1 QuizBella DavidovaNoch keine Bewertungen

- Presentation On Stock MarketDokument25 SeitenPresentation On Stock Marketsunil pancholi85% (47)

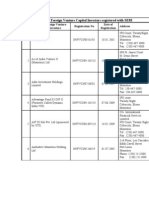

- A-List of Foreign Venture Capital Investors Registered With SEBIDokument24 SeitenA-List of Foreign Venture Capital Investors Registered With SEBIVipul ParekhNoch keine Bewertungen

- Directives Unified Directives, 2066Dokument231 SeitenDirectives Unified Directives, 2066arjun kafleNoch keine Bewertungen

- How Would You Characterize Your Trading Style?: Tony Oz: Short-Term Trading, Part IDokument8 SeitenHow Would You Characterize Your Trading Style?: Tony Oz: Short-Term Trading, Part ItonerangerNoch keine Bewertungen

- IL&FS Crisis Impact On Indian EconomyDokument4 SeitenIL&FS Crisis Impact On Indian EconomyBhavesh Rockers GargNoch keine Bewertungen

- Shares and Share CapitalDokument16 SeitenShares and Share Capitalvamsibu100% (2)

- Sunanda Jha & Dinabandhu BagDokument4 SeitenSunanda Jha & Dinabandhu Bagdinabandhu_bagNoch keine Bewertungen

- Chapter 5 - Multiple Choice ProblemsDokument22 SeitenChapter 5 - Multiple Choice Problemssol lunaNoch keine Bewertungen

- Assignment Accounting Chapter 1Dokument7 SeitenAssignment Accounting Chapter 1Aarya Aust100% (1)

- BKM Chapter 7Dokument43 SeitenBKM Chapter 7Isha0% (1)

- Financial Management Project BbaDokument54 SeitenFinancial Management Project BbaMukul Somgade100% (6)

- IAPM Selected NumericalsDokument18 SeitenIAPM Selected NumericalsPareen DesaiNoch keine Bewertungen

- Finance For The Non Financial Manager IIDokument121 SeitenFinance For The Non Financial Manager IIAamirNoch keine Bewertungen

- 2015 Corporate - Veil - Piercing - and - Al PDFDokument34 Seiten2015 Corporate - Veil - Piercing - and - Al PDFbdsrlNoch keine Bewertungen

- Topics: Break-Even Analysis, Operating and Financial Leverage, and Optimal Capital StructureDokument5 SeitenTopics: Break-Even Analysis, Operating and Financial Leverage, and Optimal Capital StructuremagoimoiNoch keine Bewertungen

- Half Yearly - ST IgnatiusDokument16 SeitenHalf Yearly - ST IgnatiusuhhwotNoch keine Bewertungen

- Natixis Graduate ProgramDokument3 SeitenNatixis Graduate ProgramganadorfNoch keine Bewertungen