Beruflich Dokumente

Kultur Dokumente

Hola Kola Case Study

Hochgeladen von

Abhinandan SinghCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Hola Kola Case Study

Hochgeladen von

Abhinandan SinghCopyright:

Verfügbare Formate

HOLA-KOLA THE CAPITAL

BUDGETING DECISION

ABHINANDAN SINGH

MP15003

XLRI PGDM 2015-18

Financial Management 2

Executive Summary

Mexico with an increasing fascination of Soft drinks among the people is

having the highest consumption of carbonated soft-drinks per capita in the

world. But this also lead to health problems such as obesity which forced the

government to impose a 20% tax on soft-drinks to reduce the consumption

and also generate revenue which may be used for fighting public health

problems. Major players in this segment were Coca-Cola, Pepsi-Cola, Dr.

Pepper Snapple and Grupo Penafiel who together accounted for more than

90% share. Bebida Sols being a local company provided a low price

carbonated soft-drink having similar taste at about half the price which was

sold mainly in small independent grocery stores and convenience stores.

The company products were mainly targeted for middle to low income

families and product promotion was mainly through incentives to the small

retailers. During the recession in 2008-09 the company benefited as demand

increased for low priced soda-business and sales increased by 60% from

2008 to 2009. Also return on sales had also seen an increasing trend in last

few years.

Antonio Ortega, owner of Bebida Sol was thinking of launching a zero-calorie

product line with the rising health problem such as Obesity in Mexico. Certain

consideration that he was supposed to take into account was the demand for

these types of products and also people who demanded these products. So

they hired a consultant to do market research and got the estimate that they

could sell a total of 600,000 liters of these zero-calorie carbonates a month.

Now the management had to take a final decision whether to invest in this

project.

Problem Identification

Hola Kola being a small company in the soft drinks business was launching a

new product line. Certain question that were to be answered are

Whether there will be demand for their product?

Who all will be the potential customers?

Will the low income group opt for these products as they might not be

much concern about health problems caused by soft-drinks?

What if the big players enter into the market?

1 | Page

Financial Management 2

Will the demand estimated by the consultant be the actual demand

and more importantly the sustenance of the demand?

The above problems are more of market related issues, now coming to the

finance related issues there were certain questions that were to be

answered.

What will be initial investment? Considering that market study is to be

done for the next 5 years what would be the return on this investment?

What would be the NPV of all these returns?

What would be the effective IRR during this tenure?

Cost analysis of producing a unit and final price that the company

would charge from its customer. What if inflation increases in the next

2-3 years?

How to calculate the depreciation of the new bottling plant that is to be

setup for these ranges of products?

Whether the initial consultant cost is to be taken into account when

analyzing the business decision?

Will the annexure be used for storing inventory and whether this cost is

to be taken as an opportunity cost in the financial analysis?

How to calculate the working capital for this venture?

What would be average cost of capital? The value at which the future

cash flows would be discounted to get NPV.

How to take into account the cannibalization of existing product lines

because of this new product?

These are some of the problems that have been identified and need to be

answered before deciding on the final decision to go ahead with the project.

Solutions

Initial investment for the project is assumed to be 50 million pesos

which was needed for a new fleet of semi-automated bottling and

kegging machines and this also include the cost of installation. This in

turn would help the company to reduce its labour cost by semiautomating the whole process. The ROI will be shown after the final

calculation

Net present values of all future cash flow will give a better picture

whether the project is worth taking or not as a high negative NPV

2 | Page

Financial Management 2

means that it is better to not invest than to suffer loss. The figures

have been shown in the final analysis.

IRR is that rate at which negative NPV becomes zero. For any company

there is an option to invest in a project or in the market. A high

IRR(greater than market rate) shows that it is better to invest in project

while a lower value in general suggest that investing in market is a

more lucrative option (but at its own risk).

Some costs that are to be taken into account are raw material costs

(1.8 pesos per liter) while labour costs and energy costs were

estimated to be 180,000 and 50,000 pesos per month (for production

of 600,000 units per month). Administrative and selling expenses were

estimated to be 300,000 a year as the product is to be sold by current

sales work force and also the existing distribution channels. Accounts

department in Bebida sol charged 1% of sales as overhead cost for any

project. As there has not been any mention of inflation in the next few

years, for simplicity we will assume that all costs are to remain in the

next 5 years and also the selling price for the product (5 pesos per

liter)

As the company expected that the new machinery will have a life of 5

years and after that it can be sold at a salvage value of 4 million pesos,

so we will use the straight line depreciation method to calculate the

depreciation per year which comes to be 9.2 million pesos per year.

Also the company though that if the product is a success then they can

introduce a fully automated bottling plant after 5 years and in case it is

a failure then they can close the plant and thus the project.

As the company has already paid for the consultation cost (5 million

pesos) and there was no way to recover this sunk cost so it will not be

taken into account. This cost has no bearing on the companys decision

to go ahead with the project.

The annexure was built the first owner of the company and it was

planned for storing inventory for mineral water business project that

was planned years ago. All these years it was vacant but a few days

back Antonio received an offer to lease out this space for 60,000 pesos

a year. With the starting of zero-calorie soft drinks this revenue would

not be added to be the company so this fall in the category of

3 | Page

Financial Management 2

opportunity cost. As with any opportunity costs this cost is to be taken

into account for any financial analysis.

The company had made huge financial gains in the last 2-3 years and

thus had a huge amount of cash to be invested into any new venture.

As the General manager estimated that they would require a loan of

20% of the initial investment (50 million pesos) which comes out to be

10 million pesos that the banker had agreed to pay at an interest rate

of 16%. With a 20-80 debt equity structure WACC for the project was

estimated to be 18.2%. This was the average cost of capital and also

the value at which future cash flows are to be discounted to get net

present value (NPV).

The company also realized that with the introduction of this new

product line their existing products might suffer as many of the

existing customers will switch between products of the same company.

It was estimated that it will cause a potential erosion of 800,000 pesos

(i.e. 0.8 million pesos) of after tax cash flow each year.

After taking into account the above facts and figures we will be doing a

financial analysis to find whether venturing into the new project would be

ideal for the company.

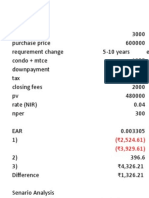

Calculation

4 | Page

Financial Management 2

5 | Page

Financial Management 2

From the above analysis we find that the NPV has a positive value of 3.10

million Pesos and the IRR for the corresponding period comes out to be 23%.

6 | Page

Financial Management 2

How Free Cash Flow has been calculated

Net Income for each year

NCC (Depreciation)

Interest*(1-t) where t is tax rate

WC (Investment) It is negative for 1st year and then 0 for other years

FC (Investment) It is 50 million Pesos for 1st year and 0 for other years

Now FCFF = NI + NCC + Interest*(1-t) WC (Investment) FC

(Investment)

Other data that has been used for calculation has been mentioned in Fig 1

Conclusion

On the basis of above analysis we can conclude that the project is a viable

one and Bebida Sol can go for the project.

The NPV for the next 5 years is a positive value which comes out to be 3.10

million Pesos. As NPV is greater than zero and also has a high positive value

i.e. 3.10 million, so the project will supposedly give a positive ROI even after

some approximation or estimation error.

Also if we find the discounted payback period then we find that the payback

period comes out to be (3 years and 5 months) which also indicates that the

project is a feasible one.

The Weighted Average Cost of Capital is estimated to be 18.2%. The IRR from

the calculation comes out to be 23%. So from that perspective also we find

that investment in this project looks a more lucrative option.

Apart from all these financial analysis considering the market situation where

major players have already suffered setbacks this is a good time to invest

and capture some share from the big players. The government has also

taken many initiatives to de-promote the consumption of carbonated soft

drinks. The market of high calorie soft-drinks is already going to be affected

with the increase in taxes and more people becoming health conscious. Thus

it is a good time to get the first mover advantage in the zero-calorie

carbonated drink market.

Thus I would recommend to go for the project as it look viable in market as

well as financial sense.

7 | Page

Das könnte Ihnen auch gefallen

- HOLA KOLA CAPITAL BUDGET DECISIONDokument8 SeitenHOLA KOLA CAPITAL BUDGET DECISIONAnushka0% (2)

- Hola Kola Case - Capital Budgeting - MP15030Dokument4 SeitenHola Kola Case - Capital Budgeting - MP15030raghav89% (19)

- Hola KolaDokument24 SeitenHola KolaNidhi Agarwal92% (12)

- Capital Budgeting Decision for Hola-Kola's Zero-Calorie Soft DrinkDokument7 SeitenCapital Budgeting Decision for Hola-Kola's Zero-Calorie Soft DrinkRivki MeitriyantoNoch keine Bewertungen

- Hola Kola Case StudyDokument3 SeitenHola Kola Case StudyRaenessa FranciscoNoch keine Bewertungen

- Hola Kola CaseDokument4 SeitenHola Kola CaseSwaraj Dhar25% (4)

- Hola Kola Case SolutionDokument8 SeitenHola Kola Case Solutionsathya50% (8)

- Hola KolaDokument3 SeitenHola KolaAmit BiswalNoch keine Bewertungen

- Hola Kola Case SolutionDokument5 SeitenHola Kola Case SolutionMary Meza RivasNoch keine Bewertungen

- Hola Kola Solution Base AbhinavDokument17 SeitenHola Kola Solution Base Abhinavnisha0% (2)

- Hola Kola - Docx 2Dokument3 SeitenHola Kola - Docx 2Gabriela PereiraNoch keine Bewertungen

- hOLA - kOLADokument3 SeitenhOLA - kOLAOm Prakash100% (1)

- Hola Cola 111Dokument261 SeitenHola Cola 111Neupane IshaNoch keine Bewertungen

- Hola Cola Case Financial AnalysisDokument6 SeitenHola Cola Case Financial AnalysisVishakha Chopra100% (3)

- Hola KolaDokument3 SeitenHola Kola17crushNoch keine Bewertungen

- Group 1 - Hola KolaDokument13 SeitenGroup 1 - Hola KolaIshtiaque AhmedNoch keine Bewertungen

- Hola-Kola Case NPV AnalysisDokument5 SeitenHola-Kola Case NPV AnalysisFuad Hasan Gazi100% (1)

- Monthly Sales and Cost AnalysisDokument3 SeitenMonthly Sales and Cost AnalysisGautam D50% (2)

- Hola-Kola-The Capital Budgeting DecisionDokument12 SeitenHola-Kola-The Capital Budgeting DecisionSachin Gupta25% (4)

- Hola Kola Case Capital BudgetingDokument4 SeitenHola Kola Case Capital BudgetingFrancisco RomanoNoch keine Bewertungen

- Relevant cash flows and investment analysis of zero calorie carbonates projectDokument2 SeitenRelevant cash flows and investment analysis of zero calorie carbonates projectShamsuzzaman Sun0% (1)

- Capital Budgeting Hola ColaDokument3 SeitenCapital Budgeting Hola ColaPrasoon Swaroop Jha33% (3)

- Sec2 - Group4 - Hola KolaDokument2 SeitenSec2 - Group4 - Hola KolaAmit BiswalNoch keine Bewertungen

- Hola Cola CaseDokument2 SeitenHola Cola CasePrithviraj Padgalwar50% (2)

- Working Capital Collection Period 30 DaysDokument12 SeitenWorking Capital Collection Period 30 DaysLinda Putri AsmaniaNoch keine Bewertungen

- Hola Kola CaseDokument5 SeitenHola Kola CaseAisha Almazrouee92Noch keine Bewertungen

- Hola Kola Case Capital Budgeting MP15030Dokument4 SeitenHola Kola Case Capital Budgeting MP15030Francisco RomanoNoch keine Bewertungen

- Sec-2 - Subgroup-9 (FM-Hola Kola)Dokument9 SeitenSec-2 - Subgroup-9 (FM-Hola Kola)Ankit VisputeNoch keine Bewertungen

- Answer To 5th Question (Bebida Sol)Dokument1 SeiteAnswer To 5th Question (Bebida Sol)malimojNoch keine Bewertungen

- Case Study of Hola KolaDokument5 SeitenCase Study of Hola KolaRuohui ChenNoch keine Bewertungen

- Hola-Kola-The Capital Budgeting Decision: Team 7 Prithviraj ChauhanDokument12 SeitenHola-Kola-The Capital Budgeting Decision: Team 7 Prithviraj ChauhanKaushik meridianNoch keine Bewertungen

- Hansson Private LabelDokument4 SeitenHansson Private Labelsd717Noch keine Bewertungen

- HPL's $170M Expansion ProjectDokument6 SeitenHPL's $170M Expansion ProjectKp Porter57% (7)

- Snap IPODokument16 SeitenSnap IPOKaran NainNoch keine Bewertungen

- Hansson Private Label Case SolutionDokument3 SeitenHansson Private Label Case SolutionTracy PhanNoch keine Bewertungen

- Sneaker 2013Dokument6 SeitenSneaker 2013Shivam Bose67% (3)

- HBR Hannson Final Case AnalysisDokument5 SeitenHBR Hannson Final Case AnalysisTexasSWO75% (4)

- Lockheed Tristar Case Study 11020241041Dokument19 SeitenLockheed Tristar Case Study 11020241041R Harika Reddy100% (7)

- AB Bank LimitedDokument4 SeitenAB Bank LimitedMd. Din Islam AsifNoch keine Bewertungen

- Saito Solar Teaching NoteDokument8 SeitenSaito Solar Teaching NoteANKIT AGARWAL100% (1)

- Lockeed 5 StarDokument6 SeitenLockeed 5 StarAjay SinghNoch keine Bewertungen

- Global Athletic Footwear Market AnalysisDokument7 SeitenGlobal Athletic Footwear Market AnalysisMNoch keine Bewertungen

- Sneaker 2013Dokument13 SeitenSneaker 2013Hirosha Vejian100% (2)

- PPTXDokument8 SeitenPPTXWriters Wing100% (2)

- Sneakers 2013Dokument5 SeitenSneakers 2013priyaa0364% (11)

- Midland Energy Case StudyDokument5 SeitenMidland Energy Case StudyLokesh GopalakrishnanNoch keine Bewertungen

- Time Value of Money The Buy Versus Rent Decision - SolutionDokument5 SeitenTime Value of Money The Buy Versus Rent Decision - Solutioncpsoni62% (13)

- Time Value of Money - The Buy Versus Rent Decision - StudentDokument1 SeiteTime Value of Money - The Buy Versus Rent Decision - StudentUmer Tahir17% (12)

- Case Solution-Liquid Chemical CompanyDokument2 SeitenCase Solution-Liquid Chemical CompanyDHRUV SONAGARANoch keine Bewertungen

- Case Study 20 - Target CorporationDokument13 SeitenCase Study 20 - Target CorporationPat Cunningham64% (11)

- Liquid Chemical CompanyDokument1 SeiteLiquid Chemical CompanyNavendu Rai67% (3)

- Science Technology Company Case Memo (TobyOdenheim)Dokument4 SeitenScience Technology Company Case Memo (TobyOdenheim)todenheim100% (1)

- New Balance Sneakers 2013 vs Persistence Project AnalysisDokument4 SeitenNew Balance Sneakers 2013 vs Persistence Project AnalysisMehwish Pervaiz100% (2)

- Woodyard Investment Analysis NPVDokument1 SeiteWoodyard Investment Analysis NPVEric Silvani100% (4)

- Lady M Confections case discussion questions and valuation analysisDokument11 SeitenLady M Confections case discussion questions and valuation analysisRahul Sinha40% (10)

- Organic Juice Project NPV & IRR AnalysisDokument1 SeiteOrganic Juice Project NPV & IRR AnalysisTaha ShahbazNoch keine Bewertungen

- PRQZ 2Dokument26 SeitenPRQZ 2Hoa Long ĐởmNoch keine Bewertungen

- PRQZ 2Dokument31 SeitenPRQZ 2Yashrajsing LuckkanaNoch keine Bewertungen

- Pisa Pizza healthier pizza sales projectionsDokument6 SeitenPisa Pizza healthier pizza sales projectionskarol nicole valero melo100% (1)

- LPPDokument28 SeitenLPPRahul PathrabeNoch keine Bewertungen

- Use More SoapsDokument9 SeitenUse More SoapsAbhinandan SinghNoch keine Bewertungen

- 13 Earned Value ManagementDokument9 Seiten13 Earned Value ManagementAbhinandan Singh100% (1)

- Positioning Book ReviewDokument35 SeitenPositioning Book ReviewSmat JacerNoch keine Bewertungen

- Stratergic Management Case Study On StarbucksDokument30 SeitenStratergic Management Case Study On StarbucksRahul Sttud50% (2)

- Merve BEKTAŞ Didem ŞAHİN Sara OsmanoğluDokument22 SeitenMerve BEKTAŞ Didem ŞAHİN Sara OsmanoğluAbhinandan SinghNoch keine Bewertungen

- G GeniusDokument26 SeitenG GeniusAbhinandan SinghNoch keine Bewertungen

- World CSR Congress: Integrating Sustainability Into A Global OrganizationDokument12 SeitenWorld CSR Congress: Integrating Sustainability Into A Global OrganizationAbhinandan SinghNoch keine Bewertungen

- Visualmerchandising 121126111353 Phpapp02Dokument145 SeitenVisualmerchandising 121126111353 Phpapp02Abhinandan SinghNoch keine Bewertungen

- Mortein Vaporizer Marketing StrategyDokument26 SeitenMortein Vaporizer Marketing Strategymukesh chavanNoch keine Bewertungen

- Category Management 2Dokument9 SeitenCategory Management 2Abhinandan SinghNoch keine Bewertungen

- Merchandise Presentation in Retail Store - Intro, Demo, Floor Layout and SignageDokument26 SeitenMerchandise Presentation in Retail Store - Intro, Demo, Floor Layout and SignageAbhinandan SinghNoch keine Bewertungen

- Starbucks Deliveringcustomerservice 160222181028Dokument11 SeitenStarbucks Deliveringcustomerservice 160222181028Abhinandan SinghNoch keine Bewertungen

- Product Palaning Refe1Dokument58 SeitenProduct Palaning Refe1rafiq5002Noch keine Bewertungen

- The Wonder of Mumbai Dabbawallas Inspiration of ManagementDokument23 SeitenThe Wonder of Mumbai Dabbawallas Inspiration of ManagementSeema Mehta SharmaNoch keine Bewertungen

- Starbucks: Delivering Customer ServiceDokument23 SeitenStarbucks: Delivering Customer ServiceVishakha Rl RanaNoch keine Bewertungen

- Saatchi&SaatchiDokument5 SeitenSaatchi&SaatchiAbhinandan SinghNoch keine Bewertungen

- 5 Fastest Frontend Web Dev Frameworks - Fonbell SolutionDokument13 Seiten5 Fastest Frontend Web Dev Frameworks - Fonbell SolutionAbhinandan SinghNoch keine Bewertungen

- Leading Supply Chain Without Suits and TiesDokument11 SeitenLeading Supply Chain Without Suits and TiesAnoop AgrawalNoch keine Bewertungen

- General Motors and Its SuppliersDokument8 SeitenGeneral Motors and Its SuppliersAbhinandan SinghNoch keine Bewertungen

- Batiste 2in1 Dry Shampoo & Conditioner: Refreshes Roots and Targets Dryness For Gorgeously Soft, Conditioned HairDokument11 SeitenBatiste 2in1 Dry Shampoo & Conditioner: Refreshes Roots and Targets Dryness For Gorgeously Soft, Conditioned HairAbhinandan SinghNoch keine Bewertungen

- FINAL - New Product Development and Feasibility PDFDokument7 SeitenFINAL - New Product Development and Feasibility PDFRenz PamintuanNoch keine Bewertungen

- Valuation of 5000 stock options using Black Scholes model over 5 yearsDokument4 SeitenValuation of 5000 stock options using Black Scholes model over 5 yearsAbhinandan Singh0% (2)

- Six Sigma - IDokument133 SeitenSix Sigma - INitin PatelNoch keine Bewertungen

- Teuer Furniture (A)Dokument14 SeitenTeuer Furniture (A)Abhinandan SinghNoch keine Bewertungen

- Freelancing ListDokument29 SeitenFreelancing ListAbhinandan SinghNoch keine Bewertungen

- Job Satisfaction and Employee Engagement Case StudyDokument11 SeitenJob Satisfaction and Employee Engagement Case StudyMuneeb Ur-Rehman0% (1)

- TR EB Data Breach ResponseDokument5 SeitenTR EB Data Breach ResponseAbhinandan SinghNoch keine Bewertungen

- Atlantic Computer - A Bundling of Pricing OptionsDokument15 SeitenAtlantic Computer - A Bundling of Pricing OptionsAbhinandan SinghNoch keine Bewertungen

- XLRI Strategic Management of Apple Inc. in 2015Dokument6 SeitenXLRI Strategic Management of Apple Inc. in 2015Abhinandan SinghNoch keine Bewertungen

- US Razor Market ParamountDokument17 SeitenUS Razor Market ParamountAbhinandan SinghNoch keine Bewertungen

- Havell's Group Company ProfileDokument94 SeitenHavell's Group Company ProfileMohit RawatNoch keine Bewertungen

- Assessment GuideDokument27 SeitenAssessment Guideirene hulkNoch keine Bewertungen

- Mandvi Ibibo Tax InvoiceDokument2 SeitenMandvi Ibibo Tax InvoiceSumit PatelNoch keine Bewertungen

- Assessment of Customer Satisfaction On Home Based Catering Business in Cabadbaran CityDokument7 SeitenAssessment of Customer Satisfaction On Home Based Catering Business in Cabadbaran CityIOER International Multidisciplinary Research Journal ( IIMRJ)Noch keine Bewertungen

- Article On Investors Awareness in Stock Market-1Dokument10 SeitenArticle On Investors Awareness in Stock Market-1archerselevatorsNoch keine Bewertungen

- Govt ch3Dokument21 SeitenGovt ch3Belay MekonenNoch keine Bewertungen

- Assignment Ishan SharmaDokument8 SeitenAssignment Ishan SharmaIshan SharmaNoch keine Bewertungen

- KnightFrank - India Real Estate H2 2020Dokument150 SeitenKnightFrank - India Real Estate H2 2020Swanand KulkarniNoch keine Bewertungen

- Accounting Standard As 1 PresentationDokument11 SeitenAccounting Standard As 1 Presentationcooldude690Noch keine Bewertungen

- Calculate Car Interest RatesDokument1 SeiteCalculate Car Interest RatesKevinNoch keine Bewertungen

- Social Entrepreneurship Success Story of Project SukanyaDokument4 SeitenSocial Entrepreneurship Success Story of Project SukanyaHimanshu sahuNoch keine Bewertungen

- SMMT Q3 - 30 Sept 2021Dokument98 SeitenSMMT Q3 - 30 Sept 2021Adi KrizzNoch keine Bewertungen

- Cambridge Igcse Enterprise CoursebookDokument10 SeitenCambridge Igcse Enterprise CoursebookAnsko 30010% (1)

- FMCG Sales Territory ReportDokument21 SeitenFMCG Sales Territory ReportSyed Rehan Ahmed100% (3)

- SOP Guidelines For AustraliaDokument1 SeiteSOP Guidelines For AustraliaShivam ChadhaNoch keine Bewertungen

- IAS 33 Earnings Per Share: ImportanceDokument8 SeitenIAS 33 Earnings Per Share: Importancemusic niNoch keine Bewertungen

- Energy CrisesDokument17 SeitenEnergy CrisesMuhammad MuzammalNoch keine Bewertungen

- Government AccountsDokument36 SeitenGovernment AccountskunalNoch keine Bewertungen

- Smith Company Statement of Realization and LiquidationDokument5 SeitenSmith Company Statement of Realization and LiquidationTRCLNNoch keine Bewertungen

- Balaji Wafers (FINAL)Dokument38 SeitenBalaji Wafers (FINAL)Urja BhavsarNoch keine Bewertungen

- Time Table CS Exams December 2023Dokument1 SeiteTime Table CS Exams December 2023Himanshu UpadhyayNoch keine Bewertungen

- The Green Register - Spring 2011Dokument11 SeitenThe Green Register - Spring 2011EcoBudNoch keine Bewertungen

- Principles of Economics - 1 - 2Dokument81 SeitenPrinciples of Economics - 1 - 2KENMOGNE TAMO MARTIALNoch keine Bewertungen

- Creating Value in Service EconomyDokument34 SeitenCreating Value in Service EconomyAzeem100% (1)

- Presented by Gaurav Pathak Nisheeth Pandey Prateek Goel Sagar Shah Shubhi Gupta SushantDokument17 SeitenPresented by Gaurav Pathak Nisheeth Pandey Prateek Goel Sagar Shah Shubhi Gupta SushantSagar ShahNoch keine Bewertungen

- Options Exposed PlayBookDokument118 SeitenOptions Exposed PlayBookMartin Jp100% (4)

- Mondrian Group Tax StrategyDokument2 SeitenMondrian Group Tax StrategyJuan Daniel Garcia VeigaNoch keine Bewertungen

- CH IndiaPost - Final Project ReportDokument14 SeitenCH IndiaPost - Final Project ReportKANIKA GORAYANoch keine Bewertungen

- Enhance Financial Reports with a Proper Chart of AccountsDokument16 SeitenEnhance Financial Reports with a Proper Chart of AccountsSaleem MaheenNoch keine Bewertungen

- UNIT 1 - Introduction To Entepreneurship Part 1 (Compatibility Mode)Dokument71 SeitenUNIT 1 - Introduction To Entepreneurship Part 1 (Compatibility Mode)kuddlykuddles100% (1)