Beruflich Dokumente

Kultur Dokumente

Tax II 1st Exam TSN Short

Hochgeladen von

gerfz_116Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Tax II 1st Exam TSN Short

Hochgeladen von

gerfz_116Copyright:

Verfügbare Formate

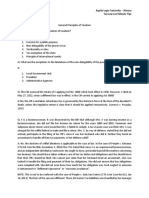

TAXATION LAW 2 TRANSCRIPT

From the lectures of Atty. Percy Donalvo, CPA

Ateneo de Davao College of Law | Tres Manresa SY 2015 2016

November 17, 2015 (EAE)

TITLE III

ESTATE AND DONORS TAX

the essence of donation mortis causa. Thats why when you

talk of donation mortis causa, its not about the time of the

execution of the deed, but rather, the tacit donation will arise

only upon the death of the donor.

What is this transfer tax all about? How do we define

transfer tax? What are transfer taxes?

Estate Tax

TRANSFER TAX A tax imposed upon the privilege of

passing ownership of a property without any valuable

consideration.

What is an estate?

So pagsinabi mong transfer tax it would always pertain to a

gratuitous transfer.

obligations which are transferrable obligations which are

not extinguished upon death.

Paano yan pag may valuable consideration? What is the tax

What happens to the estate when the person dies? The

properties that he had will be transferred to the heirs, either

by will or by law. Pag may will, testate siya. Pag walang will,

intestate of course.

consequence for that?

It would entirely depend if the transfer of property

is for business purposes; probably you will be

imposed business taxes.

If the property passed on to another person is not

for business, what do you call that property? What

is that classification of an asset that is not used for

business? Capital asset. So capital asset diba, by

now dapat alam niyo na anong takbo niyan.

But right now we are not concerned about that anymore. We

are concerned about transfer taxes.

What is the nature of a transfer tax? Its pretty much the

same with income tax because it is a privilege tax. It is

not a tax on the property but its a tax on the privilege of

passing the property from one person to another without any

valuable consideration. Because the imposition of transfer

taxes does not rest upon the ownership. Its not about the

ownership but its about the act of passing the thing or the

property from one person to another.

What are the kinds of transfer taxes that we have under our

tax laws? Currently we have two:

1.

Estate tax

2.

Donors tax

So dalawa yan siya. This is actually the coverage of your first

exam.

Lets go to governing laws. With respect to governing laws

you have to remember the basic principle: Transfer taxes are

governed by the law existing at the time when the transfer

took place. Kung kailan siya dinonate, you apply the existing

law during that time. Kung kailan namatay diba. Because

when you talk about succession, the passing of property

happens upon death.

If the property is given gratuitously and is effective during

the lifetime of the giver, we call that donation inter vivos

diba? Or donation lang. Donations inter vivos are governed

by the law at the time of its effectivity. But if its considered

a donation mortis causa, of course, if the transfer will

happen only during that time, the donor will die diba. Thats

Pagsinabi niyo kasing estate guys, its synonymous with

inheritance. Diba, it comprises of all your properties, rights or

It is the act of transferring that is being taxed by our current

estate tax law. What is being taxed by the NIRC is the

privilege of the decedent to control the distribution of his

property even though he is already dead. So that is the

privilege that is being taxed by the government. The nature

of course is it is an excise tax because what is taxed is the

privilege; it is not a tax on the property.

What are the purposes of levying the estate tax?

Most authors would only say two.

Its for more equitable distribution of wealth, lalo na

kung madami masyadong pag-aari yung namatay,

syempre a portion of it must go to the government

to equalize the wealth. Social justice.

It is the most effective and appropriate method for

taxing the privilege which the decedent enjoys of

controlling the disposition upon his death of the

properties he accumulated during the lifetime.

Other purposes are:

To get revenues.

It is also the only method of collecting the share

which is properly due to the state as a partner in

the accumulation of the property on account of the

protection given by the state.

If you go back to our Tax 1 diba, what are the underlying

considerations why the government taxes a particular

transaction or particular person or action? Its because of the

protection that the government affords to that constituent or

property. Diba kung resident ka ditto sa Pilipinas, the

government will protect you. If you are a citizen of course

the government will protect you.

What about inheritance tax? Is this term the same with

estate tax?

Inheritance tax is still a privilege tax. It is a tax on the

right to receive an inheritance. Currently, under Philippine

laws, walatayong inheritance tax dito. Datimerontayo, before

[Page 1 of 29]

First Exam Coverage | To God be the Glory

TAXATION LAW 2 TRANSCRIPT

From the lectures of Atty. Percy Donalvo, CPA

Ateneo de Davao College of Law | Tres Manresa SY 2015 2016

NIRC meron tayong inheritance tax pero wala na yan siya

ngayon.

What about the term net estate? Compare this to gross

estate.

When you talk about the net estate, this is actually the tax

base of your estate tax. Of course, before you will be able to

get your net estate, you will have your gross estate. So

pretty much the same with your income taxation. Now in

determining your estate tax, you are guided by this basic

formula:

Gross Estate

Net Estate

Its pretty simple. Kumbaga, if you remember your income

taxation, diba almost the same?

Gross Income

(Less) Deductions

=

Of course you will determine those figures. The gross estate,

the deductions, etc., and apply it accordingly, and then when

you reach the net estate, you will have a table, which is your

tax for the estate taxation. Gaya lang sa income tax on

individuals. The concept is the same.

Of course finally, kung late ka nagfile ng ETR mo, or late ka

nagbayad ng estate tax mo, there will be surcharges and

penalties that you will have to take into account later on.

Next question: When will the estate tax accrue? Is it the

same with the time of payment of estate tax?

The estate tax ACCRUES as of the death of the

decedent, and the accrual of the tax is distinct from the

obligation to pay the same. Lets try to understand that.

(Less) Deductions

=

Next, know the location of the property.

Net Taxable Income

If you will spread it out, meron pa yang personal

exemptions, additional personal exemptions, diba. So marami

siya.

Now for our entire discussion here, we will present what is

the composition of gross estate. Yan man ang mahirap. What

composes this? What is the composition of deductions? And

what is the net estate? What are the considerations that you

have to take to account before you reach the net estate,

which would be your tax base for your estate tax.

If you will expand the formula on gross estate further:

Gross Estate

Does that mean if the person dies his estate tax should be

paid immediately? Not really. Because what happens after

the person dies? The first thing that you are going to do is to

collate everything. Ipunin mo lahat ng properties ng

decedent as of the time of his death. Why? Because the

estate tax will accrue on the date of death, you will have to

determine the value of the property at the time of his death,

because that will be the basis of the estate tax later on.

It is different from the OBLIGATION TO PAY the

estate tax.

Why? Because the obligation to pay the estate tax will come

later on. Imposible man yan, mamatay ka tapos bayaran mo

kaagad, hindi man yan, unless kung konte lang estate mo.

This is actually the concept given in the case of Lorenzo vs.

Posadas.

If the estate tax accrues at the time of the decedents death,

when does the obligation to pay the tax arise? Kelan mo siya

bayaran?

This is answered in Section 91 and Section 90 of your NIRC.

(Less) Deductions

SEC. 90. Estate Tax Returns.

Ordinary

xxx

Special

Share of the Surviving Spouse

=

Net Estate

Again, spread out natin yan. What composes the ordinary,

what composes the special, what composes the share of the

surviving spouse. Everything is in the codal.

What are the basic steps for you to determine your estate

tax?

First thing, determine the nationality and the residence

of the decedent. Para lang general principles of income

taxation. You have to know the nationality of the income

earner. You also have to know the residence of the person

who is earning. Pretty much the same with your income

taxation.

(B) Time for Filing. For the purpose of determining the

estate tax provided for in Section 84 of this Code, the estate

tax return required under the preceding Subsection (A) shall

be filed within 6 months from the decedent's death.

A certified copy of the schedule of partition and the order of

the court approving the same shall be furnished the

Commissioner within 30 after the promulgation of such

order.

(C) Extension of Time. The Commissioner shall have

authority to grant, in meritorious cases, a reasonable

extension not exceeding 30 days for filing the return.

xxx

Sec. 91. Payment of Tax.

[Page 2 of 29]

First Exam Coverage | To God be the Glory

TAXATION LAW 2 TRANSCRIPT

From the lectures of Atty. Percy Donalvo, CPA

Ateneo de Davao College of Law | Tres Manresa SY 2015 2016

(A) Time of Payment. The estate tax imposed by Section

84 shall be paid at the time the return is filed by the

executor, administrator or the heirs.

Next, situs of the properties this is similar to income

taxation.

(B) Extension of Time. When the Commissioner finds that

the payment on the due date of the estate tax or of any part

thereof would impose undue hardship upon the estate or any

of the heirs, he may extend the time for payment of such tax

or any part thereof not to exceed 5 years, in case the estate

is settled through the courts, or 2 years in case the estate is

settled extrajudicially.

What about for tangibles? The general rule is movables

follow the owner or the person.

In such case, the amount in respect of which the extension is

granted shall be paid on or before the date of the expiration

of the period of the extension, and the running of the Statute

of Limitations for assessment as provided in Section 203 of

this Code shall be suspended for the period of any such

extension.

Provided, further, That franchise which must be exercised in

Where the taxes are assessed by reason of negligence,

intentional disregard of rules and regulations, or fraud on the

part of the taxpayer, no extension will be granted by the

Commissioner.

If an extension is granted, the Commissioner may require the

executor, or administrator, or beneficiary, as the case may

be, to furnish a bond in such amount, not exceeding double

the amount of the tax and with such sureties as the

Commissioner deems necessary, conditioned upon the

payment of the said tax in accordance with the terms of the

extension.

xxx

Real property, the situs is where the property is located.

For intangibles, the NIRC itself has specific rules that must

be followed. You can look at Section 104 of the NIRC.

SEC. 104. Definitions. x x x

the Philippines; shares, obligations or bonds issued by any

corporation or sociedad anonima organized or constituted in

the Philippines in accordance with its laws; shares,

obligations or bonds by any foreign corporation 85% of the

business of which is located in the Philippines; shares,

obligations or bonds issued by any foreign corporation if such

shares, obligations or bonds have acquired a business situs

in the Philippines; shares or rights in any partnership,

business or industry established in the Philippines, shall be

considered as situated in the Philippines x x x

Under this clause in Section 104, these intangibles are

considered as located in the Philippines.

1.

Franchises to be exercised within the Philippines

2.

Shares, obligations or bonds issued by Philippine

corporations

3.

Even if the shares or bonds are from a foreign

corporation, but 85% of its business is situated in

the Philippines

4.

Also pertains to foreign corporations, but the

obligations or the shares or the bonds acquired in

the Philippines

5.

Of course you have any rights in any partnership,

business or industry established in the Philippines

So its pretty much the same thing, pay as you file as a

general rule.

Now, we have said earlier that one of the considerations that

should be taken into account in determining your estate tax

is the nationality and the residence of the decedent.

Lets go back to income taxation. Ano bang rule natin? What

is the simple rule that we have to follow when we talk about

the general principles of income taxation? Only the resident

citizens are taxable on their income within and without the

Philippines. The rest of the individuals are taxable only on

their income earned within the Philippines, right?

What about here in estate taxation? What is the rule that we

have to follow?

Do you notice the difference between taxation of income and

estate? Diba pag income, resident citizen lang. But when you

talk about estate taxation, the rule is:

GR All types of individuals or decedents are taxable

on properties wherever located as part of the gross

estate.

EXC When you are considered as a nonresident

decedent. Because if you are considered a nonresident

decedent, only your properties which are found in the

Philippines are to form part of your gross estate. That

is the importance there.

What about the intangibles which are not listed here in the

NIRC, Section 104? Then you follow the general rule.

Movables follow the person.

If you go back to BPI vs. Posadas, I think this is a different

ruling. The issue here revolves on insurance proceeds. The

decedent here is actually a nonresident alien. Hes a German,

who met a Filipina. Eventually, nonresident siya, but then he

died here in the Philippines. So what happened was that the

insurance proceeds were immediately delivered to BPI.

Ang question dito, WON the insurance policy and its

proceeds were subject to inheritance tax. Inheritance to kasi

at that time meron pa tayong inheritance tax.

The Supreme Court said here that the insurance proceeds

were delivered here in the Philippines sa BPI for purposes of

administration. So since gideliver siya ditto sa Pilipinas, the

movable follows the person, therefore, it is subject to

[Page 3 of 29]

First Exam Coverage | To God be the Glory

TAXATION LAW 2 TRANSCRIPT

From the lectures of Atty. Percy Donalvo, CPA

Ateneo de Davao College of Law | Tres Manresa SY 2015 2016

inheritance tax. That is one application of that. Intangible

man siya kaya nga insurance proceeds.

November 19, 2015 (AL)

REVIEW:

Last meeting we discussed the general concept of transfer

taxes. As of now we only have two: Estate Tax and Donors

Tax.

We dont have inheritance tax as of the moment. We also

defined what Estate is. And we had a few basic

considerations:

1.

2.

The approval of the Governing law, when does the

estate tax accrue? Of course it is during that time

that the decedent died.

The accrual of the Estate tax is different from the

obligation to pay. Because the obligation to pay the

Estate tax will be provided for by law.

I think I discussed to you Articles 90 and 91, the time of

payment of Estate Tax. And we discussed a little bit about

Lorenzo vs. Posadas. Its a very old case which deals with

inheritance tax.

We also discuss about the importance of nationality and

residence, this has something to do with the composition of

your gross estate later on. We also start discussing about the

situs of the property that can be included in the Gross Estate.

For Real Properties, it is where the property is

located

For Tangible Personal Properties you use the usual

rule, the movables follow the person

For Intangibles, we have discussed Section 104 of

the NIRC which talks about specific intangibles

which has situs here in the PH therefore includable

in the Gross Estate.

Also, what about those intangibles which are not

listed under Section 104, you go back to the general

rule on tangible properties.

DISCUSSION PROPER:

Lets go now to the valuation of properties.

How do you value your properties when you include it in

your Gross Estate? What is the rule that you have to follow?

Read Section 88.

SEC. 88. Determination of the Value of the Estate.

(A) Usufruct. To determine the value of the right of

usufruct, use or habitation, as well as that of annuity, there

shall be taken into account the probable life of the

beneficiary in accordance with the latest Basic Standard

Mortality Table, to be approved by the Secretary of Finance,

upon recommendation of the Insurance Commissioner.

xxx

We have said earlier you also have to include your intangible

properties, also rights as part of your Gross Estate. There are

some rights that you have to include in your gross estate like

Usufruct specifically. But the problem usually with rights

when you include them in your Gross Estate - buti sana kung

intellectual property because there is some certain value that

you can think of. How much cost did you incur for you to

develop that products which are patentable, etc?

But what about rights like Usufruct, how do you value them?

According to the law you have to take into account the

probable life of the beneficiary in accordance with the

[latest] Mortality Table.

In the end it will be the BIR who will determine the value of

that Usufruct.

As to how it is applied in actuality, I do not know. I have no

idea.

xxx

(B) Properties. - The estate shall be appraised at its fair

market value as of the time of death. However, the

appraised value of real property as of the time of death shall

be, whichever is higher of

(1) The fair market

Commissioner, or

value

as

determined

by

the

(2) The fair market value as shown in the schedule of values

fixed by the Provincial and City Assessors.

Section 88 (b) is the more important provision in this section.

It pertains to properties in general.

What is the valuation that you are going to use? You use the

FMV of the Property.

Where do you reckon the value? Is it at the time of the

payment of the Estate Tax?

NO. It should be at the time of death. Basically Section 88

already states the date of [death] valuation rule when it

comes to properties that should be included in the Gross

Estate. The value is the fair market value and then it must be

the value at the time of death of the decedent. Yan ang

sinasabi ng Section 88.

With respect to FMV, how do you determine the FMV of such

property? We will have no problem if its real properties

because you take into account the:

1.

The FMV as per the BIR (zonal value), OR

2.

You take into account the FMV as shown in the

schedule of values fixed by the Provincial and City

Assessors.(Assessed Value)

Are you familiar with those terms?

Its almost similar with the capital gains taxation concept.

When you sell Real properties classified as capital assets.

[Page 4 of 29]

First Exam Coverage | To God be the Glory

TAXATION LAW 2 TRANSCRIPT

From the lectures of Atty. Percy Donalvo, CPA

Ateneo de Davao College of Law | Tres Manresa SY 2015 2016

Where do you base your 6% CGT? Selling Price, and these

two values (Zonal value, Assessed Value) whichever is

higher. So its pretty much the same here in Estate Taxation.

ISSUE: Whether or not the CA erred in affirming the CTA in

the latter's determination of the deficiency estate tax

imposed against the Estate.

The problem now is what about the Personal property like

cars, paintings. How do you determine the FMV of that?

RULING: It is admitted that the claims of the Estate's

aforementioned creditors have been condoned. As a mode of

extinguishing an obligation, condonation or remission of

debt is defined as:

Normally, this is from the accountants perspective ha.

According to what my friend said, when it comes to Personal

Properties they would have to get an appraiser. Sometimes

hindi na sila nagakuha ng appraiser, they just put an

amount. For example like cars they would peg it at 20%

depreciation rate per year. So yong car mo 2 years pa lang,

40% less of the cost of that car yun yung value ng Estate.

G.R. No. 140944

April 30, 2008

RAFAEL ARSENIO S. DIZON, in his capacity as the

Judicial Administrator of the Estate of the deceased

JOSE P. FERNANDEZ, petitioner,

vs.

COURT OF TAX APPEALS and COMMISSIONER OF

INTERNAL REVENUE, respondents.

FACTS: On November 7, 1987, Jose P. Fernandez died.

Thereafter, a petition for the probate of his will was

filed. The probate court then appointed retired Supreme

Court Justice Arsenio P. Dizon and petitioner, Atty. Rafael

Arsenio P. Dizon as Special and Assistant Special

Administrator, respectively, of the Estate of Jose.

On November 26, 1991, the Assistant Commissioner for

Collection of the BIR, Themistocles Montalban, issued Estate

Tax

Assessment

Notice

demanding the

payment

of P66,973,985.40 as deficiency estate tax. Petitioner thru

Atty. Gonzales moved for the reconsideration of the said

estate tax assessment. However, the BIR Commissioner

denied the request and reiterated that the estate is liable for

the payment of P66,973,985.40 as deficiency estate tax.

Petitioner filed a petition for review before respondent CTA.

The CTA denied the said petition for review. Nevertheless,

the CTA did not fully adopt the assessment made by the BIR

and it came up with its own computation of the deficiency

estate tax in the amount of P37,419,493.71 plus 20%

interest from the due date of its payment until full payment

thereof. CA affirmed the CTA's ruling.

Hence this petition. The Petitioner claims that:

xxx the BIR failed to consider that although the actual

payments made to the Estate creditors were lower than their

respective claims, such were compromise agreements

reached long after the Estate's liability had been settled by

the filing of its estate tax return and the issuance of BIR

Certification Nos. 2052 and 2053; and that the reckoning

date of the claims against the Estate and the settlement of

the estate tax due should be at the time the estate tax return

was filed by the judicial administrator and the issuance of

said BIR Certifications and not at the time the

aforementioned Compromise Agreements were entered into

with the Estate's creditors. xxx

An act of liberality, by virtue of which, without receiving any

equivalent, the creditor renounces the enforcement of the

obligation, which is extinguished in its entirety or in that part

or aspect of the same to which the remission refers. It is an

essential characteristic of remission that it be gratuitous, that

there is no equivalent received for the benefit given; once

such equivalent exists, the nature of the act changes. It may

become dation in payment when the creditor receives a thing

different from that stipulated; or novation, when the object

or principal conditions of the obligation should be changed;

or compromise, when the matter renounced is in litigation or

dispute and in exchange of some concession which the

creditor receives.

Verily, the second issue in this case involves the construction

of Section 79 of the National Internal Revenue Code (Tax

Code) which provides for the allowable deductions from the

gross estate of the decedent. The specific question is

whether the actual claims of the aforementioned creditors

may be fully allowed as deductions from the gross estate of

Jose despite the fact that the said claims were reduced or

condoned through compromise agreements entered into by

the Estate with its creditors.

"Claims against the estate," as allowable deductions from the

gross estate under Section 79 of the Tax Code, are basically

a reproduction of the deductions allowed under Section 89

(a) (1) (C) and (E) of Commonwealth Act No. 466 (CA 466),

otherwise known as the National Internal Revenue Code of

1939, and which was the first codification of Philippine tax

laws. Philippine tax laws were, in turn, based on the federal

tax laws of the United States. Thus, pursuant to established

rules of statutory construction, the decisions of American

courts construing the federal tax code are entitled to great

weight in the interpretation of our own tax laws.

It is noteworthy that even in the United States, there is some

dispute as to whether the deductible amount for a claim

against the estate is fixed as of the decedent's death which is

the general rule, or the same should be adjusted to reflect

post-death developments, such as where a settlement

between the parties results in the reduction of the amount

actually paid.

On one hand, the U.S. court ruled that the appropriate

deduction is the "value" that the claim had at the date of the

decedent's death. Also, as held in Propstra v. U.S., where a

lien claimed against the estate was certain and enforceable

on the date of the decedent's death, the fact that the

claimant subsequently settled for lesser amount did not

preclude the estate from deducting the entire amount of the

claim for estate tax purposes. These pronouncements

essentially confirm the general principle that post-death

[Page 5 of 29]

First Exam Coverage | To God be the Glory

TAXATION LAW 2 TRANSCRIPT

From the lectures of Atty. Percy Donalvo, CPA

Ateneo de Davao College of Law | Tres Manresa SY 2015 2016

developments are not material in determining the amount of

the deduction.

On the other hand, the Internal Revenue Service (Service)

opines that post-death settlement should be taken into

consideration and the claim should be allowed as a deduction

only to the extent of the amount actually paid. Recognizing

the dispute, the Service released Proposed Regulations in

2007 mandating that the deduction would be limited to the

actual amount paid.

In announcing its agreement

5th Circuit Court of Appeals held:

with Propstra, the

U.S.

We

are

persuaded

that

the

Ninth

Circuit's

decision...in Propstra correctly apply the Ithaca Trust dateof-death valuation principle to enforceable claims against the

estate. As we interpret Ithaca Trust, when the Supreme

Court announced the date-of-death valuation principle, it was

making a judgment about the nature of the federal estate

tax specifically, that it is a tax imposed on the act of

transferring property by will or intestacy and, because the

act on which the tax is levied occurs at a discrete time, i.e.,

the instance of death, the net value of the property

transferred should be ascertained, as nearly as possible, as

of that time. This analysis supports broad application of the

date-of-death valuation rule.

We express our agreement with the date-of-death

valuation rule, made pursuant to the ruling of the U.S.

Supreme Court in Ithaca Trust Co. v. United States.

First. There is no law, nor do we discern any legislative intent

in our tax laws, which disregards the date-of-death valuation

principle and particularly provides that post-death

developments must be considered in determining the net

value of the estate. It bears emphasis that tax burdens are

not to be imposed, nor presumed to be imposed, beyond

what the statute expressly and clearly imports, tax statutes

being

construed strictissimi

juris against

the

government. Any doubt on whether a person, article or

activity is taxable is generally resolved against taxation.

Second. Such construction finds relevance and consistency in

our Rules on Special Proceedings wherein the term "claims"

required to be presented against a decedent's estate is

generally construed to mean debts or demands of a

pecuniary nature which could have been enforced against

the deceased in his lifetime, or liability contracted by the

deceased before his death.

What did the BIR say regarding the valuation of that

indebtedness of the estate which has been condone or

compromise? Diba yong namatay meron siyang utang, dapat

bayaran niya ang utang. But what the BIR did is to have the

liabilities of the estate condone, bawasan ang mga utang or

subject to compromise?

From the FT of the case: On the other hand, the Internal

Revenue Service (Service) opines that post-death settlement

should be taken into consideration and the claim should be

allowed as a deduction only to the extent of the amount

actually paid.

Practically what the BIR is trying to say is this; the amount of

the indebtedness of the Estate is deductible from the Gross

estate. Utang yan ng Estate, babayaran niya so deduction

siya sa Gross estate mo. What the BIR is trying to say here is

this; since later on na-condone na pala ang utang ng Estate

then you should either:

1.

Do not (?) claim it as a deduction since wala na

palang utang to deduct to begin with, OR

2.

iI na-compromise mo siya the amount is smaller

you use that compromise amount. So kung maliit

ang deduction niyo, maglaki ang Gross Estate.

Siyempre maglaki ang Net Estate niyo, malaki ang

babayaran na tax. There will be a tax deficiency.

Ano ang sabi ng SC regarding that contention of the BIR?

The post death development is not material in determining

the deductions.

Applying it sa contention ng BIR, bakit mali ang BIR? If it is

reckoned from the date of death of decedent what is the

effect of the remission/condonation of whatever liabilities of

the estate? What is the effect of that? Later on what will

happen if there is condonation of debt after the death of

decedent?

Any post developments already will become immaterial

because what matters is that the value of the Estate at the

time of death, the value of deductions at the time of death,

because sabi ng batas the generating source of the power of

the State to tax the estate of the deceased is the death of

decedent.

G.R. No. L-43082

June 18, 1937

Therefore, the claims existing at the time of death are

significant to, and should be made the basis of, the

determination of allowable deductions.

PABLO LORENZO, as trustee of the estate of Thomas

Hanley, deceased, plaintiff-appellant,

vs.

JUAN POSADAS, JR., Collector of Internal

Revenue, defendant-appellant.

What was the issue regarding the valuation of property? To

be more specific, what about deductions? Ano ang sabi ng

BIR dito specifically with respect to the amount of

indebtedness that were condone? Ang sabi niya dito meron

daw utang ang Estate tapos na-compromise.

FACTS: On May 27, 1922, Thomas Hanley died, leaving a

will and considerable amount of real and personal properties.

The will was admitted to probate. Said will provides, among

other things, as follows:

5. I direct that all real estate owned by me at the time of my

death be not sold or otherwise disposed of for a period of ten

[Page 6 of 29]

First Exam Coverage | To God be the Glory

TAXATION LAW 2 TRANSCRIPT

From the lectures of Atty. Percy Donalvo, CPA

Ateneo de Davao College of Law | Tres Manresa SY 2015 2016

(10) years after my death, and that the same be handled

and managed by the executors, and proceeds thereof to be

given to my nephew, Matthew Hanley, at Castlemore,

Ballaghaderine, County of Rosecommon, Ireland, and that he

be directed that the same be used only for the education of

my brother's children and their descendants.

6. I direct that ten (10) years after my death my property be

given to the above mentioned Matthew Hanley to be

disposed of in the way he thinks most advantageous.

The defendant Collector of Internal Revenue, assessed

against the estate an inheritance tax in the total amount of

P2,052.74. The plaintiff paid said amount under protest,

notifying the defendant at the same time that unless the

amount was promptly refunded suit would be brought for its

recovery. The defendant overruled the plaintiff's protest and

refused to refund the said amount, plaintiff went to court.

ISSUES: (b) Should the inheritance tax be computed on the

basis of the value of the estate at the time of the testator's

death, or on its value ten years later?

HELD: (b) The plaintiff contends that the estate of Thomas

Hanley, in so far as the real properties are concerned, did

not and could not legally pass to the instituted heir, Matthew

Hanley, until after the expiration of ten years from the death

of the testator on May 27, 1922 and, that the inheritance tax

should be based on the value of the estate in 1932, or ten

years after the testator's death. The plaintiff introduced

evidence tending to show that in 1932 the real properties in

question had a reasonable value of only P5,787. This amount

added to the value of the personal property left by the

deceased, which the plaintiff admits is P1,465, would

generate an inheritance tax which, excluding deductions,

interest and surcharge, would amount only to about P169.52.

If death is the generating source from which the power of

the estate to impose inheritance taxes takes its being and if,

upon the death of the decedent, succession takes place and

the right of the estate to tax vests instantly, the tax should

be measured by the vlaue of the estate as it stood at the

time of the decedent's death, regardless of any subsequent

contingency value of any subsequent increase or decrease in

value.

"The right of the state to an inheritance tax accrues at the

moment of death, and hence is ordinarily measured as to

any beneficiary by the value at that time of such property as

passes to him. Subsequent appreciation or depriciation is

immaterial."

Our attention is directed to the statement of the rule in

Cyclopedia of Law of and Procedure (vol. 37, pp. 1574,

1575) that, in the case of contingent remainders, taxation is

postponed until the estate vests in possession or the

contingency is settled. This rule was formerly followed in

New York and has been adopted in Illinois, Minnesota,

Massachusetts, Ohio, Pennsylvania and Wisconsin. This rule,

horever, is by no means entirely satisfactory either to the

estate or to those interested in the property. Realizing,

perhaps, the defects of its anterior system, we find upon

examination of cases and authorities that New York has

varied and now requires the immediate appraisal of the

postponed estate at its clear market value and the payment

forthwith of the tax on its out of the corpus of the estate

transferred.

But whatever may be the rule in other jurisdictions, we hold

that a transmission by inheritance is taxable at the time of

the predecessor's death, notwithstanding the postponement

of the actual possession or enjoyment of the estate by the

beneficiary, and the tax measured by the value of the

property transmitted at that time regardless of its

appreciation or depreciation.

Ano sabi ng will regarding sa real properties? Ano sabi ng

BIR? Diba may inheritance tax? Ano sabi ng Government?

The way I understood the case there is an issue here

regarding the value of the property. What is the valuation

that we are going to use? Is it during the time that the

decedent died OR 10 years after during that time that the

heir will receive the money or property? Because ano ang

contention ng gobyerno dito? Medyo mahihirap siya

intindihin pero the way I understood it, when did the transfer

take effect? Sabi ng BIR dapat 10 years after dyan pa

ibibigay ang property eh, because there is a specific

stipulation sa will that it would be *** for 10 years before

you are going to distribute it.

What did the SC say about this matter? Again its date of

[death] valuation rule.

Also take note that the right of the decedent over the

properties are also taken into consideration. Because as we

will find later on when we will discuss about Gross Estate

proper that there will be some properties which seemingly

already transferred to some other person and yet you will

still include them in your Gross Estate.

GROSS ESTATE

Based on Section 85 what are the classifications of

decedents? It is important for you to classify the decedent

because this will have an impact on your Gross Estate.

SEC. 85. Gross Estate. The value of the gross estate of the

decedent shall be determined by including the value at the

time of his death of all property, real or personal, tangible or

intangible, wherever situated: Provided, however, that in the

case of a nonresident decedent who at the time of his death

was not a citizen of the Philippines, only that part of the

entire gross estate which is situated in the Philippines shall

be included in his taxable estate.

xxx

To be more precise you have:

1.

citizens;

2.

residents decedent; and

[Page 7 of 29]

First Exam Coverage | To God be the Glory

TAXATION LAW 2 TRANSCRIPT

From the lectures of Atty. Percy Donalvo, CPA

Ateneo de Davao College of Law | Tres Manresa SY 2015 2016

3.

Non-resident alien decedents

Why do you have to classify it that way? Because Under

Section 85 the rule is like this: the estate of residents and

citizens pag residents its either resident citizens or resident

aliens or kung citizens shall comprise all the value of all

your properties (real or personal, tangible or intangible)

wherever situated.

Even if you are an alien and you are residing here in the PH

you have to include the entirety of your property. With

respect to nonresident citizen decedents, you will only

include in the estate those properties which are situated here

in the PH.

What do you understand Residence here in the context of

Estate taxation?

2014 TSN: The term residence is synonymous with

domicile and are used interchangeably without distinction.

It refers to the permanent home, the place to which

whenever absent, for business or pleasure, one intends to

return, and depends on facts and circumstances, in the

sense that disclose intent. It is, therefore, not necessarily the

actual place of residence.

Gross Estate You think of the entirety of the property of

the decedent at the time of his death. Of course you have to

take into consideration his nationality and residence because

that will have an impact on his Gross Estate.

What composes your Gross Estate?

Generally, it is all the properties of the decedent.

(2) the right, either alone or in conjunction with any person,

to designate the person who shall possess or enjoy the

property or the income therefrom;

except in case of a bonafide sale for an adequate and full

consideration in money or money's worth.

Lets dissect.

There are 2 types of transfers in contemplation of death:

1.

The decedent has at any time made a

transfer,

by

trust

or

otherwise,

in

contemplation of or intended to take effect in

possession or enjoyment at or after death.

Strictly speaking this is Transfer in contemplation of

death per se. You transfer it now later on pa mag

take effect pag namatay ang tao. I will transfer

four months from now, so I am going to make a will

and of course donate this property sa anak ko. The

transfer will take effect after the death of the

decedent. Dito papasok ang donation mortis causa.

That is why you always have to take note of the

case of Ganuelas vs. Cawed (succession case).

How do you determine whether its a donation intervivos or donation mortis causa aside from the fact

that the formalities will be different. Iba man ang

formalities yan, number one you follow the

formalities donation kung donation intervivos siya.

Once it falls under donation mortis causa then you

have to follow the formalities of will. Take note of

the distinguishing characteristics of a donation

mortis causa.

Specifically you have seven considerations to think of:

Ganuelas vs. Cawed

xxx

(A) Decedent's Interest. - To the extent of the interest

therein of the decedent at the time of his death;

The decedent must have an interest over the property. What

if nabenta niya beforehand? Normally if he has already sold it

prior to his death even if the actual delivery of the property

is already subsequent to his death but there is already a

transfer of ownership even before his death, so Ok lang yan.

Hindi na siya kasali sa Estate. What matters is that the

decedent will have an interest over that property to be

included in the Gross Estate

(B) Transfer in Contemplation of Death. - To the extent

of any interest therein of which the decedent has at any time

made a transfer, by trust or otherwise, in contemplation of or

intended to take effect in possession or enjoyment at or after

death, or of which he has at any time made a transfer, by

trust or otherwise, under which he has retained for his life or

for any period which does not in fact end before his death

(1) the possession or enjoyment of, or the right to the

income from the property, or

The

distinguishing

characteristics

donation mortis causa are the following:

of

1. It conveys no title or ownership to the transferee

before the death of the transferor; or, what

amounts to the same thing, that the transferor

should retain the ownership (full or naked) and

control of the property while alive;

2. That before his death, the transfer should be

revocable by the transferor at will, ad nutum; but

revocability may be provided for indirectly by means

of a reserved power in the donor to dispose of the

properties conveyed;

So it may be possible during the interim period

there is already transfer of ownership but at

anytime before the death the decedent will be able

to revoke it later on if he wants to.

3. That the transfer should be void if the transferor

should survive the transferee.

So think of those characteristics.

[Page 8 of 29]

First Exam Coverage | To God be the Glory

TAXATION LAW 2 TRANSCRIPT

From the lectures of Atty. Percy Donalvo, CPA

Ateneo de Davao College of Law | Tres Manresa SY 2015 2016

2.

The decedent has at any time made a

transfer, by trust or otherwise, under which

he has retained for his life or for any period

which does not in fact end before his death;

(1) the possession or enjoyment of, or the

right to the income from the property, or

(2) the right, either alone or in conjunction

with any person, to designate the person who

shall possess or enjoy the property or the

income therefrom;

It basically means like this:

During his lifetime I will transfer this property to

you but I will remain as the beneficial owner.

Kumbaga legal title ba yan kung transfer lang? Ako

yong beneficial owner although you are already the

title owner as of now. If that is the set-up, it is

considered as transfers in contemplation of death.

Even if the properties are already transferred to

some other person, still you have to include that in

your Gross Estate.

So number one, the possession or enjoyment of, or

the right to the income ang mabilin na lang

beneficial owner[ship]. Or it may be possible the

remaining right is, the decedent either alone or

together with some other person will have right to

choose sino makatanggap ng property or who will

receive the income of this property after I die.

Thats about it. You may simply call this as

Transfers with retention of right.

CAVEAT: But I would suggest pag isulat nyo yan sa

notebook wag niyo sabihin transfers with retention

of right kasi gawa-gawa ko lang nong law student

pa ako. Just to make me remember the things.

What do you mean by contemplation of death?

The thought of death is the impending cause of the transfer.

Mamatay nako ugma ihatag nalang nako sa imoha.

(C) Revocable Transfer. -

(1) To the extent of any interest therein, of which the

decedent has at any time made a transfer (except in case of

a bona fide sale for an adequate and full consideration in

money or money's worth) by trust or otherwise, where the

enjoyment thereof was subject at the date of his death to

any change through the exercise of a power (in whatever

capacity exerciseable) by the decedent alone or by the

decedent in conjunction with any other person (without

regard to when or from what source the decedent acquired

such power), to alter, amend, revoke, or terminate, or where

any such power is relinquished in contemplation of the

decedent's death.

(2) For the purpose of this Subsection, the power to alter,

amend or revoke shall be considered to exist on the date of

the decedent's death even though the exercise of the power

is subject to a precedent giving of notice or even though the

alteration, amendment or revocation takes effect only on the

expiration of a stated period after the exercise of the power,

whether or not on or before the date of the decedent's death

notice has been given or the power has been exercised. In

such cases, proper adjustment shall be made representing

the interests which would have been excluded from the

power if the decedent had lived, and for such purpose if the

notice has not been given or the power has not been

exercised on or before the date of his death, such notice

shall be considered to have been given, or the power

exercised, on the date of his death.

This is just: The transferor reserves the right to alter,

revoke, or amend such transfer before he dies.

Why is it that you will have to include this in your Gross

Estate? Natransfer mo naman siya, it does not *** later on.

It will be subjected to, anong klaseng provision siya hindi

siya suspensive diba, ano siya, resolutory condition??? Hoy

OBLICON!!! (T_T)

You have the right to revoke or change or alter whatever

agreement that you have while you are still alive. You will

have to include that in your Gross Estate because there is no

genuine transfer of ownership. There is still control

remaining on the part of the decedent. That is why you have

to include that as a part of your Gross Estate even if

seemingly before the death you have already transferred its

ownership to some other person. Pretty much like the

situation we discussed earlier in transfer in contemplation of

death. Only that with respect to this revocable transfer you

have the right to revoke or change whatever agreement you

have for the meantime.

Take note also with respect to the Exemption to revocable

transfer, exemption to transfers in contemplation of death:

bona fide sale for an adequate and full consideration

in money or money's worth. If that happens ibaligya jud

nimo siya mudawat ka ug kwarta that will be taken out from

the context of includable properties in your Gross Estate.

(D) Property Passing Under General Power of

Appointment. - To the extent of any property passing

under a general power of appointment exercised by the

decedent:

(1) by will, or

(2) by deed executed in contemplation of, or intended to

take effect in possession or enjoyment at, or after his death,

or

(3) by deed under which he has retained for his life or any

period not ascertainable without reference to his death or for

any period which does not in fact end before his death

(a) the possession or enjoyment of, or the right to the

income from, the property, or

(b) the right, either alone or in conjunction with any person,

to designate the persons who shall possess or enjoy the

property or the income therefrom;

[Page 9 of 29]

First Exam Coverage | To God be the Glory

TAXATION LAW 2 TRANSCRIPT

From the lectures of Atty. Percy Donalvo, CPA

Ateneo de Davao College of Law | Tres Manresa SY 2015 2016

his death or for any period which does not in fact

end before his death death:

except in case of a bona fide sale for an adequate and full

consideration in money or money's worth.

What do you

Appointment?

understand

by

General

Powers

of

The power of appointment is the power given to that person

to appoint or designate someone who will receive that

property.

How do you distinguish this from Special Power of

Appointment? (From PM Reyes Reviewer)

(a) the possession or enjoyment of, or the right to the

income from, the property, or

(b) the right, either alone or in conjunction with any person,

to designate the persons who shall possess or enjoy the

property or the income therefrom;

Diba

sounds familiar.

contemplation of death.

Sounds

like

sa

transfers

in

General Power of

Appointment

Special Power of

Appointment

Take note again of the last clause of the paragraph as

exception, except in case of a bona fide sale for an

adequate and full consideration in money or money's worth.

Donor gives the donee the

power to appoint any

Donor gives the donee the

power to appoint a

Is this power of appointment allowed by law? Its found in

your Civil Code, fidiecommisary substitution. (nadiscuss niyo

ba yan? YESSIR) Check the Civil Code.

person as successor to enjoy

the property.

person within a limited group

to succeed in the

enjoyment of the property

Shall form part of the gross

estate

Shall not form part of the

gross estate

When you talk about the power of appointment it does not

really refer to the property of the decedent. Technically not

the property of the decedent. Ano mga situation dyan?

Sample situation:

Supposing si A died leaving a will in favor of B. He some sort

of designated B. Sabi niya, this property (5 has. land) will be

given to B but after 5 years this property will be given by B

to C.

Of these three, saan nagarefer ang power of appointment?

The power of appointment either by will or by deed, it is A

giving the power of Appointment to B.

Art. 863. A fideicommissary substitution by virtue of which

the fiduciary or first heir instituted is entrusted with the

obligation to preserve and to transmit to a second heir the

whole or part of the inheritance, shall be valid and shall take

effect, provided such substitution does not go beyond one

degree from the heir originally instituted, and provided

further, that the fiduciary or first heir and the second heir are

living at the time of the death of the testator.

(E) Proceeds of Life Insurance. - To the extent of the

amount receivable by the estate of the deceased, his

executor, or administrator, as insurance under policies taken

out by the decedent upon his own life, irrespective of

whether or not the insured retained the power of revocation,

or to the extent of the amount receivable by any beneficiary

designated in the policy of insurance, except when it is

expressly stipulated that the designation of the beneficiary is

irrevocable.

Now, in case B will die, will you include this property to his

Gross Estate? Its not much about A but its about B. Sa

kanya magrefer ang power of appointment. In this scenario

supposing B will die will you include this property in the

estate of B? NO. Because the power of appointment given to

B was specific it is as if the property is not really owned by B

the transfer is from A to C. Intermediary kasi,

What is the rule with respect to the proceeds of life

insurance? Will the proceeds of the life insurance received by

the decedents beneficiary be included in the Gross Estate of

the deceased? If the beneficiary is the Estate, what is the

effect?

What about if sabihin ni A I will give you this 5 has land and

you are free to give it to anyone else, as if owner na si B.

That is why you have to include this, yan yong sinasabi natin

ang general power of appointment.

Who should be the beneficiary of the insurance proceeds?

How should the property pass under this appointment?

1.

Its either by will example natin kanina, last will and

testament;

2.

Any deed executed in contemplation of death;

3.

by deed under which he has retained for his life or

any period not ascertainable without reference to

What are you referring when you talk about revocability? The

designation of the beneficiary.

Take note that the revocability of the insurance proceeds in

Income taxation is immaterial. Maalala niyo yan? Ano nga

ang rule natin with respect to the insurance proceeds?

Excluded from your Gross Income because that is a form of

indemnity. It doesnt really matter if revocable or irrevocable

basta di siya kasali sa Income.

But with respect to Estate Taxation the revocability becomes

material.

So what are the steps that you have to follow here when you

talk about proceeds of life insurance?

[Page 10 of 29]

First Exam Coverage | To God be the Glory

TAXATION LAW 2 TRANSCRIPT

From the lectures of Atty. Percy Donalvo, CPA

Ateneo de Davao College of Law | Tres Manresa SY 2015 2016

1.

The first thing that you have to put in mind is that it

should be a Life insurance.

2.

Life Insurance was procured by the decedent upon

his own life.

3.

After determining those two factors the next step is

you determine who receives the life insurance

proceeds.

4.

After determining it whether it is revocable or

irrevocable.

If the transaction is not actually a bona-fide sale, so kulang

ang kwarta. You sell a tract of land worth 5M but you sell it

for only 1m. What will happen? Contemplation of death pa

rin siya. You have to include the difference between the

actual amount and the FMV as part of your Gross

Estate, kasi contemplation of death. More so if the sale is

actually fictitious you have the intention to avoid estate tax

process. Baligya baligaya lang ka as if, no parting of money

whatsoever. This is actually to prevent the Tax evasion

scheme that may be committed by the heirs to *** the tax

liability.

Going to the first point, if the beneficiary is the Estate itself

or the decedent itself you dont think of the revocability

anymore because it will always be included in your Gross

Estate.

(H) Capital of the Surviving Spouse. - The capital of the

surviving spouse of a decedent shall not, for the purpose of

this Chapter, be deemed a part of his or her gross estate.

If it is some other persons or persons other than the

Estate then you include those proceeds to the Gross Estate

if the designation of such beneficiary is revocable.

Beneficiary is the Estate = Always include in the GE.

If beneficiary is not the Estate then:

If revocable = Include in the GE.

If irrevocable = DO NOT include in the GE.

(F) Prior Interests. - Except as otherwise specifically

provided therein, Subsections (B), (C) and (E) of this Section

shall apply to the transfers, trusts, estates, interests, rights,

powers and relinquishment of powers, as severally

enumerated and described therein, whether made, created,

arising, existing, exercised or relinquished before or after the

effectivity of this Code.

Just read this provision, not really that important. One thing

to consider pala itong prior interest provision one of the very

rare occasion Congress will opt to apply the tax measure

retroactively.

(G) Transfers of Insufficient Consideration. - If any one

of the transfers, trusts, interests, rights or powers

enumerated and described in Subsections (B), (C) and (D) of

this Section is made, created, exercised or relinquished for a

consideration in money or money's worth, but is not a bona

fide sale for an adequate and full consideration in money or

money's worth, there shall be included in the gross estate

only the excess of the fair market value, at the time of death,

of the property otherwise to be included on account of such

transaction, over the value of the consideration received

therefor by the decedent.

What does this subsections B, C, D provided for in the codal?

This refers to transfers in contemplation of death, revocable

transfers and property passing under General power of

Appointment. All of which should NOT be bona-fide sale for

good consideration.

If you come to think about it, if you will really apply this

provision regarding this Capital of the Surviving Spouse it is

not actually the property per se. Later on we will try to

compute to determine the Gross Estate. You will realize that

you will have to put the entire property even if it is conjugal

or absolute community property. You have to put it entirely

in your Gross Estate because later on you will realize that

there will be special deduction share of the surviving

spouse. You will also have to take into considerations the

deductions like expenses. Where do you put it? Is it

exclusive? Diba magsharing man ang spouses sa expenses.

Later on I will try to teach you how to compute. For now

wag muna. That is basically our discussion pertaining to

Gross Estate.

Nov. 26, 2015 (ZM)

EXEMPTIONS

Before we begin with deductions lets jump first to section 87.

These are the exemption of certain acquisition and

transmissions.

SEC. 87. Exemption of Certain Acquisitions and

Transmissions. The following shall not be taxed:

xxx

The first question we have to ask here is to what type of

decedents are these exceptions applicable? Basically these

exemptions are applicable to all types of decedents,

residents, citizens or nonresidents. They can have these

types of exceptions.

Under this provision, you can see that there are four

exemptions.

(A) The merger of usufruct in the owner of the naked title;

Number one is self-explanatory. So it is possible that the

property will be transferred to that person but the beneficial

ownership will remain in some other person. If the beneficial

ownership is transferred to the titled owner then there is no

transfer to speak of in the first place.

[Page 11 of 29]

First Exam Coverage | To God be the Glory

TAXATION LAW 2 TRANSCRIPT

From the lectures of Atty. Percy Donalvo, CPA

Ateneo de Davao College of Law | Tres Manresa SY 2015 2016

(B) The transmission or delivery of the inheritance or legacy

by the fiduciary heir or legatee to the fideicommissary;

Proceeds of life insurance policy. The beneficiaries

are persons other than the estate if irrevocable.

You have the transmission from the fiduciary to the

fideicomissary. It is under article 863.

Death benefits. (refer to Casasola for the listing)

Basically, the situation here is like this:

DEDUCTIONS

Decedent A executed a will and he transferred a

certain property in favor of B and then the transfer

is with the condition that B should preserve the

property in favor of C. Should B die, C will be the

owner of the property.

So the effects of the transaction are as follows:

For the transfer of A to B, the property will

be included in the gross estate of A.

For the transfer from B to C, the property

will be excluded from Bs gross estate.

Saan to na topic? Diba sa appointments?

(C) The transmission from the first heir, legatee or donee in

favor of another beneficiary, in accordance with the desire of

the predecessor; and

The third one is pretty much like number 2.

excluded from your gross estate.

This will be

In the first acquisition, the law deems it as if there is only

one transfer that is why you exclude this kind of transfer

from the gross estate of the deceased.

(D) All bequests, devises, legacies or transfers to social

welfare, cultural and charitable institutions, no part of the

net income of which insures to the benefit of any individual:

Provided, however, That not more than thirty percent (30%)

of the said bequests, devises, legacies or transfers shall be

used by such institutions for administration purposes.

Deductions here in estate taxation is pretty much easier to

remember because there is some sort of mnemonic.

There are two broad types of deductions from the gross

estate:

1.

Ordinary deductions

2.

Special deductions

Some books say that number 3 is the share of the surviving

spouse but I think this is more of an exclusion rather than a

deduction.

Under ordinary deductions you have (ELIT MTV) Expenses,

Losses, Indebtedness, Taxes, Mortgage unpaid, Transfers for

public use, Vanishing deductions

Special deductions is easier because you have (SMeRF)

Standard, Medical expenses, RA 4917 otherwise known as

the death benefits, Family home and then you have the

share of the surviving spouse.

SEC. 86. Computation of Net Estate. For the purpose of

the tax imposed in this Chapter, the value of the net estate

shall be determined:

(A) Deductions Allowed to the Estate of

Citizen or a Resident.

In the case of a citizen or resident of the

Philippines, by deducting from the value of the

gross estate

xxx

The fourth exclusion is pretty much the same as the

transfers in your income taxation if you remember.

But take note of the conditions or requirements so that these

transfers will be excluded from the gross estate.

Ordinary Deductions

1.

The institutions involved, social welfare, cultural and

charitable institutions

2.

No part of the institutions net income will inure to

the benefit of any individual

(1) Expenses, Losses, Indebtedness, and

taxes. Such amounts:

3.

Not more than 30% of the property transferred will

be part of the administration expenses of that

entity.

(a) For actual funeral expenses or in an amount

equal to 5% of the gross estate, whichever is lower,

but in no case to exceed P200,000;

Q: Is the listing in section 87 exclusive?

A: No because there are a lot of provisions scattered in the

NIRC. Example:

Share of the surviving spouse. It is not actually

deduction but you exclude that amount pertaining

to the spouse.

I. EXPENSES

(b) For judicial expenses of the testamentary or

intestate proceedings;

Regarding the AMOUNT. Sabi ng batas there are three

figures to think of for deduction. But to simplify things its

just:

[Page 12 of 29]

First Exam Coverage | To God be the Glory

TAXATION LAW 2 TRANSCRIPT

From the lectures of Atty. Percy Donalvo, CPA

Ateneo de Davao College of Law | Tres Manresa SY 2015 2016

The actual funeral expenses

Or 5% of the gross estate

Or the P200,000 limit whichever is lower.

Regarding SUBSTANTIATION REQUIREMENTS. If you have

substantiation requirements in your income taxation, it is the

same with estate taxation because funeral expenses must

always be supported with documentary requirements,

receipts etc. that would show that these expenses were

actually incurred by the estate.

What do you mean by actual funeral expenses? Because

when you come to think of the strict interpretation of funeral

expenses, katung paglubong lang. mubalit kag lubnganan,

moseleyo, lapida, where you would bury the dead and

probably the coffin.

1.

Mourning apparel of the surviving spouse

and unmarried minor children of the

deceased. Diba usually naka suot tayo ng puti.

Take note that this is for the surviving spouse

and unmarried minor children.

2.

Expenses for the wake of the deceased

including food and drinks. Diba naga siopao,

candy, coffee, Milo.

3.

Publication charges for death notices like

obituary.

6.

Interment

and/or

cremation

fees.

Expenses after interment, so after nalibing you

cannot claim it anymore as part of your funeral

expenses especially tayong mga Pinoy mahilig

tayo mag 9 days, 40 days tapos anniversary. So

All other expenses incurred for the performance

of rites and ceremonies incident to

interment. Example yung honorarium sa pari.

What about crying ladies? (not answered)

Hindi siya deductible because it is not spent by you or

the estate because it is a donation.

Another problem pag may namatay is banks. They will

not allow you to withdraw more than 10,000 so

kailangan ng extrajudicial settlement of estate para

maka withdraw kayo. So ginagawa ng mga lawyers naga

partial distribution of estate with respect to the cash

lang. [talking about corporation law]

Judicial Expenses

When you talk about judicial expenses for purposes of

estate taxation it includes:

1.

Inventory-taking of assets. So kailangan ng

runner na mag collate the mga titulo, mag kuha ng

certified true copy. So you can actually put that in

your judicial expenses because the definition of

judicial expenses here is not strict. Hindi siya limited

to court proceedings. What if naga extrajudicial

settlement ng estate? Ano nalang yung judicial

expense mo, notaryo?

2.

Expenses for the administration of the estate

pending the settlement. Of course you have to

spend something for the preservation of the estate

of the deceased. Yung mga bahay at lupa niya,

businesses niya so you have to spend for the

preservation. Administration man yan siya.

3.

Expenses for the distribution of the estate

among the heirs. Ipadala mo yung sasakyan sa

Manila diba may freight, so you can include that as

a judicial expense. The revenue regulation would

say that these deductible items are expenses

incurred during the settlement of the estate but not

beyond the last day prescribed by law or the

Funeral Expenses

Under the REVENUE REGULATIONS NO. 2-2003, Section

6, we have the expanded meaning of funeral

expenses. Like what?

Cost of the burial plot like mausoleum. But if

there is a family estate only that portion which

pertains to burial lot of the deceased.

What about the food and drinks your relatives would

give you?

There are two types of expenses:

5.

7.

Does this include the medical expenses of the deceased

while he was still alive? Of course no, it is not funeral kasi

hindi pa nga patay and it is considered as a special

deduction. It has a separate treatment as a deduction.

Take note of the P200,000 limit. If it will exceed P200,000

you are not allowed to deduct it anymore simply because the

ceiling is provided by law and this cannot be even adjusted

by the revenue regulation because it is provided by law and

walang nakalagay na as recommended by the secretary of

finance.

Telecommunication expenses in informing

relatives. I think this is already obsolete. Diba

wala ng naga telegram ngayon.

hindi na kasali.

The revenue regulation will say that actual funeral

expenses are the expenses which are actually incurred in

connection with the interment or burial of the deceased. It

includes expenses for the wake.

Is it necessary that the funeral expenses must be actually

paid? Not necessarily as long as it is incurred. Diba usually

pag sudden death hindi prepared so utang utang man yan.

So its okay as long as you are able to substantiate it with

the proper documentation that you have incurred that

expenses during the wake of the deceased.

4.

[Page 13 of 29]

First Exam Coverage | To God be the Glory

TAXATION LAW 2 TRANSCRIPT

From the lectures of Atty. Percy Donalvo, CPA

Ateneo de Davao College of Law | Tres Manresa SY 2015 2016

extension thereof so okay lang i-extend as long as

approved by the BIR.

The law says testamentary or intestate proceedings. As

Ive said even the law says it is just testamentary or

intestate proceeding, they are not really strict in the

interpretation of this because the principle is that the

judicial expenses are limited to such administration

expenses as are actually or necessarily incurred:

De Guzman vs. De Guzman-Carillo

GR No. L-29276 May 18 1978

Facts: This is more of an accounting case. Basically

someone died and his will was probated and then he left

behind a residential house. Sa accounting report may

sinabi kasi na expenses like construction of the fence

daw and then the bathroom renovation, the repair of the

terrace and also the interior.

1.

Administration of the assets of the estate

Issue: Are you allowed to deduct these expenses?

2.

Payment of debts

3.

Distribution of the remainder among those

entitled thereto.

Held: SC held yes of course because the administrator

has the duty to preserve the property. Prior to its

distribution to the heirs, the administrator has the duty

to preserve the property and theses expenses for

preservation are allowed as a deduction from the gross

estate.

What about attorneys fees?

CIR vs. CA et al GR No. 123206

March 22, 2000

Facts: This involves WWII veteran and then nabaliw

siya then kailangan niya ng guardianship tapos namatay

siya. Yung PNP nag apply sila accounting while the

decedents brother applied for guardianship pero wala

siyang na file na estate tax return. What the PNP did

was they advised the heirs na mag execute nalang ng

extrajudicial settlement of estate tapos kayo na bahala

magpatakbo ng bayad sa estate tax. Thereafter, sinunod

ng heirs, nag file na sila ng petition for the

administration of estate and then nagpadala na ng

notice si BIR calling for the assessment/ payment. One

of the heirs did not want to pay.

What are the other things allowed under judicial

expenses?

1.

Fees of the executor or administrator

2.

Attorneys fees

3.

Court fees

4.

Accountants fees

5.

Appraisers fees because there are times when

you need an appraiser

6.

Clerk hire

7.

Bookkeeper, probably kailangan mo ito to keep

track of all the businesses

8.

Technical distribution (?)

9.

Cost of storing and maintaining the property of

the estate

Issues:

1. Notarial fee na binayad for the extra judicial

settlement

2. Attorneys fees in the guardianship proceedings.

Held: SC said both expenses are allowed as part of

judicial expenses. With respect to the notarial fees, it is

sufficient that the expense be a necessary contribution

toward the settlement of the case. So even if hindi siya

dumaan sa korte, it falls under the definition of judicial

expenses.

What about brokers fees? Diba sometimes the deceased

has to many assets but hindi liquid meaning marami

siyang assets pero hindi siya cash. So paano mo bayaran

ang estate tax mo so ibenta mo yung ibang properties.

Mag benta ka kailangan mo ng broker bayaran mo yung

broker so that can be claimed as judicial expenses.

With respect to the guardianship proceedings, ito ang

mejo may problema ako sa court kasi the judicial

proceedings was done nung buhay pa siya. It was not

done nung patay na siya kasi bakit ka pa naman mag

ga-guardian. But the Sc said that the guardianship

proceedings was allowed as a judicial expense because

the guardianship proceeding was essential to the

distribution of the property.

What are the documentary requirements needed for the

judicial expenses?

The SC gave a good discussion about judicial expenses

as a deduction. Sabi dito the expenses must be essential

to the proper settlement of the estate, expenditures

incurred for the individual benefit of the heirs, devises

legatees are not deductible.

In general the revenue regulations would just require a

sworn statement of account issued and signed by the

creditor kumbaga. If there is a judicial proceeding you

have the submit the pertinent papers that were filed in

court kung meron ba talagang testate proceedings.

Probably statement of account from the lawyer or

accountant as long as it is a sworn statement. Its more

of a technical matter it is written in your book.

II. LOSSES

I divided the losses in to two:

[Page 14 of 29]

First Exam Coverage | To God be the Glory

TAXATION LAW 2 TRANSCRIPT

From the lectures of Atty. Percy Donalvo, CPA

Ateneo de Davao College of Law | Tres Manresa SY 2015 2016

thereof in your gross estate. I-add na nimo sa imong