Beruflich Dokumente

Kultur Dokumente

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Hochgeladen von

Shyam SunderOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Hochgeladen von

Shyam SunderCopyright:

Verfügbare Formate

LEAD FINANCIAL SERVICES LTD.

101 S'la Ram Mansion, 71 8/21, Joshi Rood,

,I

Karol Bagh, New Delhi-11 0005

Phone: 23549822, 23

Fax: 23623829

e-mail: lead financial@rediffm~il:~om

(for grievance redressal dIvIsion)

CIN : L74140DL1993PLC053485

14th

November, 2016

To

The Stock Exchange, Mumbai

Corporate Relationship Department

1st Floor, New Trading Ring.

Rotunda Building

PJ Towers, Dalal Street Fort

Mumbai -400001

Sub. ; Unaudited Financial Results for the quarter and half year ended on 30th September, 2016 u/r

33 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015

Dear Sir,

Please find enclosed herewith a copy of the Unaudited Financial Results (Provisional) for the quarter

and half year ended on 30th September, 2016, which have been approved and taken on record by

the Board of Directors at the Board Meeting of the Company held on Monday, the 14th day of

November, 2016.

The Limited Review Report by the Auditors of the Company is also annexed herewith.

Kindly take the above on record and oblige.

Thanking you

Yours faithfully

For LEAD FINANCIAL SERVICES LIMITED

[Chairman]

101, Sita Ram Mansion, 718/21, Joshi Road,

Karol Bagh, New Delhi-11 0005

Phone: 23549822, 23

Fax: 23623829

e-mail : leadfinancial@rediffmail.com

LEAD FINANCIAL SERVICES LTD.

(for grievance redressal division)

ClN : L74140DL 1993PLC053485

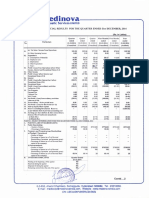

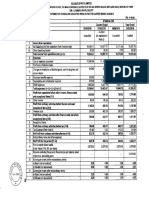

UNAUDITED FINANCIAL RESULTS FOR THE QUARTER & HALF-YEAR ENDED 30 SEPTEMBER, 2016

Statement of Standalone Unaudited Results for the Quarter & Half-Year Ended 3010912016

S.

No.

Particulars

Quarter Ended

Income from operations

(a) Net Sales/Income from Operations

Quarter Ended

30109/2016

30/0612016

(Unaudited)

(Unaudited)

Quarter Ended Half Year Ended Half Year Ended

30/0912015

3010912016

30/09/2015

(Unaudited)

(Unaudited)

(Unaudited!

IRs. in Lacs)

Year Ended

31/0312016

(Audited!

16.03

130.97

2S.82

147.00

45.38

91.99

16.03

130.97

26.82

147.00

45.38

91.99

1.00

117.14

(Net of excise duty)

(b) Other Operating Incomes

Total Income from Operations (Net)

Expenses

(a) Cost 01 materials consumed

(b) Purchases of stock-in-trade

3.36

(e) Changes in inventories of finished goods,

work-in-progress and

118.14

3.36

176.66

(S.91)

(117.87)

stock~n-trade

(d) Employee benefits expense

0.94

1.05

1.83

1.99

3.66

5.61

(e) Depreciation and amortisation expense

0.10

0.09

4.26

0.19

(I) Other expenses

1.66

3.90

2.10

120.38

3.53

12.49

3.96

124.28

8.59

5.96

14.66

9.47

11.11

84.98

12.13

10.59

14.33

22.72

30.72

7.01

0.02

0.04

0.15

0.06

0.18

1.32

12.15

10.63

14.48

22.78

30.90

8.33

0.00

0.75

0.75

0.75

1.50

3.01

12.15

9.88

13.73

22.03

29.40

5.32

12.15

9.88

13.73

22.03

29.40

5.32

(1.33)

2.95

3.39

1.62

8.23

0.57

13.48

6.93

10.34

20.41

21.17

4.75

Total Expenses

Proflll (Loss) from operations before other

Income, finance costs and exceptional ttems (1-2)

Other Income

Profrtl (Loss) from ordinary activities before

finance costs and exceptional Items (3

4)

Finance Costs

Profit! (Loss) from ordinary activities after finance

costs but before exceptional items (5 - 6)

Exceptional Items

(0.49)

Profit! (Loss) from ordinary activities before tax

(7~8)

10 Tax Expense

11

Net

prom I (Loss) from ordinary activities .ftel' ux

(9 -10)

12

Extraordinary items (net of tax expense)

13

Net Proflll(Loss) for the period (11-12)

14

Paid-up Equity Share Capital

2.02

13.48

6.93

10.34

20.41

21.17

6.77

330.00

330.00

330.00

330.00

330.00

330.00

(Face Value of Rs 101- each)

15

Reserves exduding Revaluation Reserves as

121.55

per balance sheet of previous accounting year

16.1 Earnings per ahare (bafore extraordinary

Ilems) (of Rs. 10/- each) (nolannuallsed):

(a) Basic

0.41

0.21

0.31

0.62

0.64

0.14

(b) Diluted

0.41

0.21

0.31

0.62

0.64

0.14

0.41

0.41

0.21

0.31

0.31

0.62

0.62

0.64

0.21

0.64

0.21

16.ii Earnings per share (after extraordinary

Items) (of Ra. 101- each) (not annualised):

(a) Basic

(b) Diluted

0.21

For Lead ~nCial Services Ltc

Chalnftan

LEAD FINANCIAL SERVICES LIMITED

BALANCE SHEET AS AT 30 September, 2016

Particulars

I.

EQUITY AND LIABILITIES

(1 )

Shareholder's Funds

(a) Share Capital

(b) Reserves and Surplus

(2)

(3)

330

142

330

122

Non-Current Liabilities

Deferred Tax Liabilities (Net)

Current Liabilities

(a) Short-Term Borrowings

(b) Other Current Liabilities

(c) Short-Term Provisions

38

453

5

73

525

1

Total Liabilities

968

1,053

2

533

6

212

323

4

57

II.

ASSETS

(1 )

Non-Current Assets

(a) Fixed Assets

Tangible Assets

(b) Non-Current Investments

(c) Long Term Loans And Advances

(d) Deferred Tax Assets (Net)

(2)

(Amount in Rs. Lakhs)

As at

As at

31st March, 2016

30th September, 2016

Current Assets

(a) Inventories

(b) Cash and Cash Equivalents

(e) Short-Term Loans and Advances

354

176

4

334

Total Assets

968

1,053

15

ForLea~rVices

Ltd.

Chairman

NOTES:

1. These results have been reviewed by the Audit Committee and approved by the Board of

Directors at their Meeting held on 14th November, 2016.

r

2. The Company operates in one segment only. Accordingly, Segment Reporting as defined in

Accounting Standard (AS-17) is not applicable.

3. The figures for the corresponding periods have been restated, wherever necessary, to make

them comparable.

4. Tax Expense comprises current tax expense net of Deferred Tax chargel credit.

5. The above Results have been reviewed by the Statutory Auditors of the Company.

For and on behalf of the Board

For Lead Financial Services Ltd.

~.~

Place: New Delhi

Date : 14th November, 2016

P.C Bindal

( Chairman)

G. C. Sharda & Co.

CHARTERED ACCOUNTANTS

Limited Review Report on Standalone financial Results for the

QUgrter end Six Months Ended 30/09/2016

To the Board of Directors

Lead Financial Services Limited

We have reviewed the accompanying Statement of Standalone Unaudited Financial

Results of lead Financial Services limited ("the Company") for the Quarter and Six

Months Ended 30/09/2016. This statement is the responsibility of the Company's

Management and has been approved by the Board of Directors. Our responsibility is to

issue a report on these financial STatements based on our review.

We conducted our review in accordance with the Standard on Review Engagement

(SRE) 2400, Engagements to Review Financial Statements issued by the Institute of

Chartered Accountants of India. This standard requires that we plan and perform the

review to obtain moderate assurance as to whether the financial statements are free of

material misstatement. A review is limited primarily to inquiries of company personnel

and analytical procedures applied to financial data and thus provides less assurance

than on audit. We have not performed an audit and accordingly. we do not express an

audit opinion.

Based on OUf review conducted as above, nothing has come to our attention that

causes us to believe that the accompanying statement of unaudited financial results

prepared in accordance with applicable accounting standards and other recognized

accounting practices and policies has not disclosed the information required to be

disclosed in terms of Regulation 33 of the SEBI (Listing Obligations and Disclosure

Requirements) Regulations, 2015 including the manner in which it is to be disclosed, or

that it contains any material misstatement.

For G.C. Sharda & Co.

Chartered Accountants

IFi,m

Re~"1ra~:r; 500041 Ni

CA. Gopat Chandra Sharda

Portner

Membership No. 071920

New Delhi

Date: 14/11/2016

A: D 34, LGF, East of Kailash, New Delhi

110 065. India T: +91 1: 26234388, 26234999 W: gcshdfda com E: offlce@gcsharda.com

Das könnte Ihnen auch gefallen

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNoch keine Bewertungen

- Office Style Manual, in Section 11.7 It Says, "Names of Vessels Are Quoted in MattersDokument9 SeitenOffice Style Manual, in Section 11.7 It Says, "Names of Vessels Are Quoted in MattersFreeman Lawyer100% (1)

- JPM Private BankDokument31 SeitenJPM Private BankZerohedge100% (2)

- On Buy Back of ShareDokument30 SeitenOn Buy Back of Shareranjay260Noch keine Bewertungen

- Working Capital Management of PEPSICO Sudhir ProjectDokument85 SeitenWorking Capital Management of PEPSICO Sudhir Projectsudhir_86kumar83% (24)

- Mutual Fund Holdings in DHFLDokument7 SeitenMutual Fund Holdings in DHFLShyam SunderNoch keine Bewertungen

- A Study On Factors Influencing Investment Decision Regarding Various Financial ProductsDokument4 SeitenA Study On Factors Influencing Investment Decision Regarding Various Financial ProductsEditor IJTSRDNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument8 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument8 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokument15 SeitenStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Dokument4 SeitenAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument6 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review For June 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument3 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument3 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Dokument6 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Revised Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenRevised Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Dokument3 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- HINDUNILVR: Hindustan Unilever LimitedDokument1 SeiteHINDUNILVR: Hindustan Unilever LimitedShyam SunderNoch keine Bewertungen

- Financial Results For Dec 31, 2013 (Result)Dokument4 SeitenFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- JUSTDIAL Mutual Fund HoldingsDokument2 SeitenJUSTDIAL Mutual Fund HoldingsShyam SunderNoch keine Bewertungen

- Financial Results For September 30, 2013 (Result)Dokument2 SeitenFinancial Results For September 30, 2013 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDokument2 SeitenSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNoch keine Bewertungen

- Order of Hon'ble Supreme Court in The Matter of The SaharasDokument6 SeitenOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNoch keine Bewertungen

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Dokument1 SeitePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Settlement Order in Respect of R.R. Corporate Securities LimitedDokument2 SeitenSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNoch keine Bewertungen

- Financial Results For June 30, 2013 (Audited) (Result)Dokument2 SeitenFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNoch keine Bewertungen

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDokument5 SeitenExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For June 30, 2014 (Audited) (Result)Dokument3 SeitenFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For March 31, 2016 (Result)Dokument11 SeitenStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For Mar 31, 2014 (Result)Dokument2 SeitenFinancial Results For Mar 31, 2014 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For September 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- PDF Processed With Cutepdf Evaluation EditionDokument3 SeitenPDF Processed With Cutepdf Evaluation EditionShyam SunderNoch keine Bewertungen

- Standalone Financial Results For June 30, 2016 (Result)Dokument2 SeitenStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Investor Presentation For December 31, 2016 (Company Update)Dokument27 SeitenInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNoch keine Bewertungen

- Transcript of The Investors / Analysts Con Call (Company Update)Dokument15 SeitenTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- BCML Annual Report 2016-17-1 PDFDokument300 SeitenBCML Annual Report 2016-17-1 PDFKeyur DesaiNoch keine Bewertungen

- Via E-Mail To Rule-Comments@sec - Gov: ASSOCIATION YEAR 2010-2011 ChairDokument7 SeitenVia E-Mail To Rule-Comments@sec - Gov: ASSOCIATION YEAR 2010-2011 ChairMarketsWikiNoch keine Bewertungen

- Inggris Chapter 2Dokument4 SeitenInggris Chapter 2Alam MahardikaNoch keine Bewertungen

- Book BuildingDokument19 SeitenBook Buildingmonilsonaiya_91Noch keine Bewertungen

- The Autobiography of William Henry Donner (CS)Dokument166 SeitenThe Autobiography of William Henry Donner (CS)Ben DencklaNoch keine Bewertungen

- Ibm Cognos ProspectingDokument3 SeitenIbm Cognos ProspectingtasvirkhaliliNoch keine Bewertungen

- Bikol Reporter January 4 - 10 IssueDokument8 SeitenBikol Reporter January 4 - 10 IssueBikol ReporterNoch keine Bewertungen

- The Bank and The Mundhra AffairDokument14 SeitenThe Bank and The Mundhra AffairAmbika MehrotraNoch keine Bewertungen

- Maharashtra Scooter Limited-FinalDokument87 SeitenMaharashtra Scooter Limited-Finalchopra_rishabh12Noch keine Bewertungen

- Financial Analysis of HABIB BANK 2006-2008Dokument17 SeitenFinancial Analysis of HABIB BANK 2006-2008Waqas Ur RehmanNoch keine Bewertungen

- Business PlanDokument43 SeitenBusiness PlanVimithraNoch keine Bewertungen

- JKH On The Recent MMR-MMT DebatesDokument41 SeitenJKH On The Recent MMR-MMT Debateskmp897862Noch keine Bewertungen

- Gift Certificates Available!Dokument32 SeitenGift Certificates Available!todaysshopperNoch keine Bewertungen

- Anand ProjectDokument75 SeitenAnand Projectsrinidhiprabhu_koteshwaraNoch keine Bewertungen

- Assignment Chapter: 04 & 05: Submitted ToDokument3 SeitenAssignment Chapter: 04 & 05: Submitted ToSha D ManNoch keine Bewertungen

- ProspectusOfBSC FinalDokument99 SeitenProspectusOfBSC FinalcrazyfaisalNoch keine Bewertungen

- Weakness and Gaps in SGSYDokument2 SeitenWeakness and Gaps in SGSYVikram JeetNoch keine Bewertungen

- The Time Value Of Money ExplainedDokument40 SeitenThe Time Value Of Money Explainedeshkhan100% (1)

- Steven Guerra ResumeDokument1 SeiteSteven Guerra Resumeapi-281084241Noch keine Bewertungen

- BFC5935 - Tutorial 3 Solutions PDFDokument6 SeitenBFC5935 - Tutorial 3 Solutions PDFXue XuNoch keine Bewertungen

- Triggering Event at UnileverDokument3 SeitenTriggering Event at UnileverUzmaCharaniaNoch keine Bewertungen

- Kotak Assured Income PlanDokument9 SeitenKotak Assured Income Plandinesh2u85Noch keine Bewertungen

- Guillermo and Sons Automotive Repair Shop Business Plan 1Dokument19 SeitenGuillermo and Sons Automotive Repair Shop Business Plan 1api-241466802Noch keine Bewertungen

- TVM Exercises in Cash Flow Mapping 1Dokument2 SeitenTVM Exercises in Cash Flow Mapping 1Cherry Anne TolentinoNoch keine Bewertungen

- FIN 534 GENIUS Teaching Effectively Fin534geniusdotcomDokument31 SeitenFIN 534 GENIUS Teaching Effectively Fin534geniusdotcomyaswanthkanikNoch keine Bewertungen