Beruflich Dokumente

Kultur Dokumente

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Hochgeladen von

Shyam SunderOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Hochgeladen von

Shyam SunderCopyright:

Verfügbare Formate

ri>

{l=

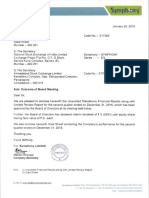

rNDtn INFR^SP^CE Lmnl ED

Regi6tered office: 7lh Floor "A' wing, Ashoka Cnamoers Rasala Marg' Ahmedi

Phone : 079-65450463 Email : info@indiainfiaspace.com Wcbsile:

CIN: 145201 GJ1995P1C024895

November 14,2016

Io,

Depanment of Corporate Services

Bombay Stock Exchange Limited

25th Floor, P.l. Tower,

DalalStreet

Fort, Mumbai- 400 001.

Dear Sir/Madam,

Sub: Outcome of Board Meeting

This is to inform you that the Board of Directors of the Companv in its meet

held

i.e. on Monday, November 14, 2016 at the Registered Office of the CompanV inter alia

considered and approved the Unaudited Financial Results for the euarter end

Septem

30, 2016 along with Limited Review Report thereon.

Please take

the above on your records.

Thanking You,

Yours faithfully,

For,India Inf

sl3

,&,

DIN: 01955762

PAIIIGJ I(. SHAH ASSOGIATES

CHARTERED ACCOUNTANTS

ct

PA| 0J silAtl

B.Corn.. FC.A.. A.C.S.

701-4, Niman,

Navrangp!ra,Ah

.llavemore

PhonE:26

E-mall: ps

Mobile:98254

66303452

abad-380

@rediffrnail

CERTIFICATD

We have reviewed the accompanying statement of unaudited financi results

M/s. India Infraspace Limited for the period ended 30t! September 2016. Thi

statement is the responsibility of the Company's Management

has bee

approved by the Board of Directols. Our responsibility is to issue a r

n on Ine

l-nancial slatemenLs based on our re!ie,,\.

We conducted our review ir1 accordance with the Sta4dard on Review

institute

{SRE) 2400, Engagements to Review FinanciEl Statements issued by

Chartered Accountants of India. This standard reollires that we Dlan

rl e rF\iew to ootarn modera'e dssuranc^.s ro wh(incr the Finan;ial S tement a

free of marerial misstatement. A review is limited primajilv to inouiries of com

personnel arld anal].tical procedures applied to financiai data aIId us provid

less assurance than an audit. We have not perlormed an audit and a

rdingly,

do not exDress an audit oDinion.

Based on our review conducted as above. nothins has came tO OUr a

uon,

causcs us to beiieve that the accompanying starement of unaudil d financi

results prepared in accordance with Accounring Standaids and othe recognlse

accounting practices and policies has not disclosed the inlormation

uired to b

disclosed in terms of Regulation 33 of the SEBI (Listing Obligalions an Disclosu

Rcquirenents) Regulations, 2015 including the manner in which tisto

disclosed. or that iL contains anv material misstatement.

FOR PANKAJ I{. SHAH

SOCIA

Firm Registration N .10735

CI{ARTARED

UNTAN

Vt $..14,11.2016

{PANKAJ K.

PROPRIDTOR

M. No. 034603

tttotl ttWnesPnCe LtUtteO

r'nti'oaO- 380 00

FLoor. A'wing, Ashoka chamo"," n"""ta tvl"'g,

ClNr 145201GJ1995P1C024895

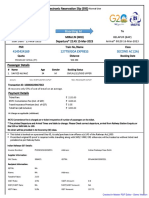

,,lauorreo eru,,,r.rcrt nesurrs ron rHE ouARrER ENpEo sEip#l*EE;3;0;;10*

Six

rctor/rol6

30/09/2015

30/06/2016

lncome from operations

1164.36

0.00

1164.36

Todl lncome t.om operations (ne!)

2

(d) Emolovee benelits

itern9]Stll

1648.44

0.0(

0.00

000

144133

164641

0.00

000

408.56

00(

,408.56

000

000

0.00

000

0.0(

0.00

0.00

0.00

000

0.00

0.38

00(

000

3.71

276

000

527

1651.68

1163.95

1375.09

872.44

2539.0,

1035.s3

0.41

-2.20

0.00

-0,1'l

1_7

"1,22

000

0.01

000

381

-2.20

0.02

-0,11

0.00

0.0

0.57

0.04

0.39

0.00

,2.22

-0.11

-1.8

-1.22

0.53

0.00

0.00

0.0

0.00

000

0,39

0.00

-2,22

0_11

"1.8

-1.22

0.53

000

0.00

00

000

0,39

-0.11

-1.8

0,43

0.00

00

000

Fiorit / (Loss)from ordinary activities before

rinance costs and exceptional

000

1034-31

2535 2t

{'1-

0.00

000

000

tt71

0.31

Profit/ (Loss)ffom operations before other

income, finance costs and exceptional items

1648.44

1034.31

2537.25

0.00

2537.21

1281.02

1163.1i4

e4ense

'1372,89

a72 73

0.00

872.73

6.1

0.00

b) Purchase of slock-in irade

tcttncreaseloecrease in nvenlories oIFG. WIP and

1372.49

0.00

31i 03/2016

30/09/2015

30/09/2016

0,41

002

Profii/ (Loss)fiom ordinary activities atter

finance costs bui before exceptional items

(5:!L

Profit/ (Loss) from ordinary activities before

tal

t0

Net Pront/ (Loss) from ordinary aftertax {9-10)

Exlraord nafr' tems (nei otiax expenses)

Net Prorit / (rosslfor the period (11_12)

000

-2.22

0.00

0,39

-2.22

-0.11

-1,8

1.22

0.00

-1,22

Sha ot Plofil / (Loss) of associaies'

0.00

0.00

0.00

0,0

0,00

0.00

0.00

1l

2

3

14+15r

Pad up equty share capital(Face value

of

0-00

0.00

0.0

0.39

"2,22

-0.11

-1.4

1.22

0.43

2ea

1000

1000

28

100(

1000

10/_

17

Resetue ercluding Revalailon Resetues as per

balance sheet oi prcvious accoLnt fg year

Eafnings Per share {before extraordinary iteds)

t8

19

0.00

0.0c

Net Profit / ( Loss ) after taxes , minority interest

and share ol p.orit / ( loss ) or associates ( 13 +

16

000

(27 2l

0 001

002

-0.001

02

0.001

-0 02

-0.001

0.001

0 001

-Q

0 001

0 001

(58.86)

460.51

-00

-00

-0.01

-0.01

0.004

0.004

-0.0

-0.01

-00

,0.01

0.004

0.004

Eaminss Per share (after extraordinary items)

19

1.

aa2

The abov unaudited finarcialresults were reviewed by ihe slatuiory Audrtors recorimm

aiihermeet ng held on Monday'lz

Comrnit(ee and iaken on record byihe Boad ofDireciors

2 Company operates n nfrastructure, lT & Sieel Segment

3 The Statutory Auditors have carried oul a lmited reviewoithe finafciaisuLts fofthe

qua 1er efding Seplember 30, 2016.

The prevous quarteas/yeais fgures have been regrcuped/rearranged whrever fecessar) io make t comparable

with the c!trent quanetyear

5 Scheme of a (argemenl of ihe Company became effectlve on Jlly 1 8, 201 6. Pursuafi lo I ie Scheme lhe inirastruct

ihe Company has been vesled into Vernes Infolech Prvate Limiied and ihe capiia of the Cor .nanv lPrdnn*n td Rq 2

or23 00.000 eqrrty shares oi Rs

APT

it;.1

10 each

:/.

\.)0"

0ir)i/

}'1E!A

E'li

/,7//

\r-\

(t,//

\\e,

),00 000 compr

rg

)o". r,*,.uo

I

DIRE( IOR

sIATEMENT QF ASSETS AND LIAAILITIES

{Rs.in Lacs

Particulars

1

EQUIIYAND LIABILITIES

Shareholders Funds

(a) Share Cap,tal

(b) Resetues aid Surcl!s

Sub{otal

2

280.00

(27 20)

- S ha

reholders Funds

1,000.00

(58.86

252.80

941.14

2,423.63

1830.33

221.38

664 33

2.77

0.T0

2,497.53

3.438.67

Non-current Liabilities

la) Lonq lem boffowinos

lb) Deieffed Tax Liabiliiies (Net)

Sub-total - Non-currenr tiabiiities

Current Liabilities

a) Short - lerm boffowrnqs

c) Oihe. Cunent Liabl tes

(d) shorilerm Provisions

Sub{otal

Curent Liabilities

TOTAL - EQUITY AND LIABILTTIES

295

2.647.96

2.900.76

ASSETS

I

(b) Non-cuffent lnveslments

(c) Lons ierm loans and advances

Sub-total" Non,c u rrent Assets

'132.09

132.69

987.35

987.35

lb) Trade RecervabLes

c) Cash and Cash Equlvalenls

ld) Shori - temr oans and advances

e) Other curent assets

Sub-total - Cuffent Assets

TOTAL,ASSETS

2l

574 65

3.58

1.839.89

33.20

2,764.07

2.900.76

2,451.32

3,438.67

339 15

1,98014

33

{

t+t

z\\$

vb

U\\ 1"1

'91

INDIA INFRASPACE LIMITED

Audited segment -Wise Revenue, Results and CapitalEmployed

s, ln Lacs

Quarter Ended

30/09/2016

Unaudited

30/06/2016

Unaudited

Sax

Month I nded

30/09/2015

30/09/2015

v09/2015

Unaudited

Unaudited

naudited

1t0312016

1. Segment Revenue

a) SteelTradino

lb) Informaton Technooqv SeMces

:c)Tradino of Goods

ld) Infrastructure I Allied Seruices

e) Olherc

Less: Inter Seoment Revenue

Net sales/lncome From ODerations

2.Seqment Results

a) SteelTradino

lb) Information Technoloov Services

fd) nfrastructure

& ALlied Services

le) Others

Total

Less: {il Other LJn-allocable

Expenditurc net off

Total Profit Before Tax

0.00

0.00

1164.36

0.00

0.0c

0.0c

1312.8.,

0.0c

0.0c

0.00

872.73

0.00

0.0c

0.0c

0.0c

2537.24

0.0c

0.0c

161.58

0.00

872.73

0.00

0.00

367.07

0.0c

1281.3i

000

00c

1164_36

1372.49

0.0c

1372.89

872_73

0.0c

872.73

0.0c

2537.25

1034.31

0.0c

0.00

1644.44

0.0c

1648.44

0.00

0.00

o.72

0.0c

00c

0.0c

0.0c

0.0c

0.0c

1.27

0.0c

0.00

1.24

o.2i

1.91

021

034

000

000

0.0c

0.0c

0.0c

0.0c

0.0c

0.0c

0.0c

0.00

00t

3.81

0.72

-0.33

1.24

0.21

-0.3

1.97

1.54

-3.4i

-3.8C

-2.76

5.84

-5.31

-0.1'1

-'1.8:

-5.09

0.10

4.77

0.00

1'164.36

0.39

1034.31

000

1.69

0.5:

3.CapitalEnployed

(Segnrent asseis

Sesmenl

Liabililies)

(a) Steel Ooefation

b) lnformation Technoloqv Services

c)Tfadinq of Goods

d) nfrastructure & Allied Seruices

e ) Other Unallocable

Total

0.1

204.30

00c

53.16

252.80

4.77

0.10

552.25

686.51

290.74

943.36

460.83

686.51

-202.47

939.49

0.10

204.34

0

53.16

252.40

//r

l4

lq-

lz

-5.0s

0.1c

-202.81

0.1c

0.9

686.51

258 2i

939.4

941.14

460.8:

686.51

Das könnte Ihnen auch gefallen

- Criminal Law Notes First YearDokument12 SeitenCriminal Law Notes First YearShella Hannah Salih100% (3)

- Short Term Financial Management 3rd Edition Maness Test BankDokument5 SeitenShort Term Financial Management 3rd Edition Maness Test Bankjuanlucerofdqegwntai100% (16)

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1Von EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1Noch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument6 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Statement of Assets & Liabilities As On September 30, 2016 (Result)Dokument4 SeitenStatement of Assets & Liabilities As On September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument7 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument7 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument7 SeitenStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokument8 SeitenStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument9 SeitenStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument7 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument9 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Statement of Assets & Liabilites As On March 31, 2016 (Result)Dokument11 SeitenStatement of Assets & Liabilites As On March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument13 SeitenStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument10 SeitenStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Dokument6 SeitenStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Announces Q3 Results & Limited Review Report For The Quarter Ended December 31, 2015 (Result)Dokument5 SeitenAnnounces Q3 Results & Limited Review Report For The Quarter Ended December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument7 SeitenStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument9 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Statement of Assets & Liabilities (Result)Dokument10 SeitenStatement of Assets & Liabilities (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Dokument5 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Mutual Fund Holdings in DHFLDokument7 SeitenMutual Fund Holdings in DHFLShyam SunderNoch keine Bewertungen

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDokument5 SeitenExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNoch keine Bewertungen

- JUSTDIAL Mutual Fund HoldingsDokument2 SeitenJUSTDIAL Mutual Fund HoldingsShyam SunderNoch keine Bewertungen

- HINDUNILVR: Hindustan Unilever LimitedDokument1 SeiteHINDUNILVR: Hindustan Unilever LimitedShyam SunderNoch keine Bewertungen

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDokument2 SeitenSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNoch keine Bewertungen

- Settlement Order in Respect of R.R. Corporate Securities LimitedDokument2 SeitenSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNoch keine Bewertungen

- Order of Hon'ble Supreme Court in The Matter of The SaharasDokument6 SeitenOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNoch keine Bewertungen

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Dokument1 SeitePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For Mar 31, 2014 (Result)Dokument2 SeitenFinancial Results For Mar 31, 2014 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For June 30, 2014 (Audited) (Result)Dokument3 SeitenFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For September 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For June 30, 2016 (Result)Dokument2 SeitenStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For June 30, 2013 (Audited) (Result)Dokument2 SeitenFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For Dec 31, 2013 (Result)Dokument4 SeitenFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results For September 30, 2013 (Result)Dokument2 SeitenFinancial Results For September 30, 2013 (Result)Shyam SunderNoch keine Bewertungen

- PDF Processed With Cutepdf Evaluation EditionDokument3 SeitenPDF Processed With Cutepdf Evaluation EditionShyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For March 31, 2016 (Result)Dokument11 SeitenStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Transcript of The Investors / Analysts Con Call (Company Update)Dokument15 SeitenTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Investor Presentation For December 31, 2016 (Company Update)Dokument27 SeitenInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- NHA V BasaDokument3 SeitenNHA V BasaKayeNoch keine Bewertungen

- Yayen, Michael - MEM601Dokument85 SeitenYayen, Michael - MEM601MICHAEL YAYENNoch keine Bewertungen

- SAP Project System - A Ready Reference (Part 1) - SAP BlogsDokument17 SeitenSAP Project System - A Ready Reference (Part 1) - SAP BlogsSUNIL palNoch keine Bewertungen

- RMS - UHS - Misch Metal Steel - 19x2.49mm - 24MAR22 - SignedDokument3 SeitenRMS - UHS - Misch Metal Steel - 19x2.49mm - 24MAR22 - SignedNirmal WiresNoch keine Bewertungen

- 12779/GOA EXPRESS Second Ac (2A)Dokument2 Seiten12779/GOA EXPRESS Second Ac (2A)Altamash ShaikhNoch keine Bewertungen

- Thomas W. McArthur v. Clark Clifford, Secretary of Defense, 393 U.S. 1002 (1969)Dokument2 SeitenThomas W. McArthur v. Clark Clifford, Secretary of Defense, 393 U.S. 1002 (1969)Scribd Government DocsNoch keine Bewertungen

- Loss or CRDokument4 SeitenLoss or CRJRMSU Finance OfficeNoch keine Bewertungen

- KMPDU Private Practice CBA EldoretDokument57 SeitenKMPDU Private Practice CBA Eldoretapi-175531574Noch keine Bewertungen

- Subercaseaux, GuillermoDokument416 SeitenSubercaseaux, GuillermoMarco Cabesour Hernandez RomanNoch keine Bewertungen

- Lista de Intrebari Pentru Examen Disciplina: Limba EnglezaDokument22 SeitenLista de Intrebari Pentru Examen Disciplina: Limba EnglezaAdrianNoch keine Bewertungen

- 01 Manual's WorksheetsDokument39 Seiten01 Manual's WorksheetsMaria KhanNoch keine Bewertungen

- Financial System in PakistanDokument13 SeitenFinancial System in PakistanMuhammad IrfanNoch keine Bewertungen

- Payroll in Tally Erp 9Dokument13 SeitenPayroll in Tally Erp 9Deepak SolankiNoch keine Bewertungen

- Analysis of The Novel Trafficked by Akachi Adimora Ezeigbo 1 PDFDokument2 SeitenAnalysis of The Novel Trafficked by Akachi Adimora Ezeigbo 1 PDFlord somtonwajide100% (1)

- Making Money On Autopilot V3 PDFDokument6 SeitenMaking Money On Autopilot V3 PDFGatis IvanansNoch keine Bewertungen

- En Banc G.R. No. L-16439 July 20, 1961 ANTONIO GELUZ, Petitioner, vs. The Hon. Court of Appeals and Oscar Lazo, RespondentsDokument6 SeitenEn Banc G.R. No. L-16439 July 20, 1961 ANTONIO GELUZ, Petitioner, vs. The Hon. Court of Appeals and Oscar Lazo, Respondentsdoc dacuscosNoch keine Bewertungen

- Moovo Press ReleaseDokument1 SeiteMoovo Press ReleaseAditya PrakashNoch keine Bewertungen

- Radio CodesDokument1 SeiteRadio CodeshelpmeguruNoch keine Bewertungen

- Bantolo V CastillonDokument3 SeitenBantolo V Castillongoma21Noch keine Bewertungen

- Position Paper in Purposive CommunicationDokument2 SeitenPosition Paper in Purposive CommunicationKhynjoan AlfilerNoch keine Bewertungen

- Certificate Programme: Unit 2: Legal Requirements in Setting Up Ngos: India &south Asia 1Dokument48 SeitenCertificate Programme: Unit 2: Legal Requirements in Setting Up Ngos: India &south Asia 1Deepak Gupta100% (1)

- Gun Control and Genocide - Mercyseat - Net-16Dokument16 SeitenGun Control and Genocide - Mercyseat - Net-16Keith Knight100% (2)

- Menasco HSE Training-Role of HSE ProfessionalDokument10 SeitenMenasco HSE Training-Role of HSE ProfessionalHardesinah Habdulwaheed HoluwasegunNoch keine Bewertungen

- Ang vs. TeodoroDokument2 SeitenAng vs. TeodoroDonna DumaliangNoch keine Bewertungen

- Presentation 2Dokument35 SeitenPresentation 2Ma. Elene MagdaraogNoch keine Bewertungen

- Interconnect 2017 2110: What'S New in Ibm Integration Bus?: Ben Thompson Iib Chief ArchitectDokument30 SeitenInterconnect 2017 2110: What'S New in Ibm Integration Bus?: Ben Thompson Iib Chief Architectsansajjan9604Noch keine Bewertungen

- Lesson 4the Retraction Controversy of RizalDokument4 SeitenLesson 4the Retraction Controversy of RizalJayrico ArguellesNoch keine Bewertungen

- 2022-01-07 Market - Mantra - 070122Dokument9 Seiten2022-01-07 Market - Mantra - 070122vikalp123123Noch keine Bewertungen