Beruflich Dokumente

Kultur Dokumente

Republic V Security Credit and Acceptance Corp. Et. Al (Directors)

Hochgeladen von

brendamanganaanOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Republic V Security Credit and Acceptance Corp. Et. Al (Directors)

Hochgeladen von

brendamanganaanCopyright:

Verfügbare Formate

Republic v Security Credit and Acceptance Corp. et.

al (directors)

19 SCRA 58 (1967)

Doctrine: An investment company which loans out the money of its

customers, collects the interest and charges a commission to both lender

and borrower, is a bank. It is conceded that a total of 59,463 savings account

deposits have been made by the public with the corporation and its 74

branches, with an aggregate deposit of P1,689,136.74, which has been lent

out to such persons as the corporation deemed suitable therefore. It is clear

that these transactions partake of the nature of banking, as the term is used

in Section 2 of the General Banking Act.

Facts:

The Solicitor General filed a petition for quo warranto to dissolve the

Security and Acceptance Corporation, alleging that the latter was

engaging in banking operations without the authority required therefor

by the General Banking Act (Republic Act No. 337).

o Pursuant to a search warrant issued by MTC Manila, members of

Central Bank intelligence division and Manila police seized

documents and records relative to the business operations of the

corporation.

After examination of the same, the intelligence division of

the Central Bank submitted a memorandum to the then

Acting Deputy Governor of Central Bank finding that the

corporation is engaged in banking operations.

It was found that Security and Acceptance Corporation

established 74 branches in principal cities and towns

throughout the Philippines;

that through a systematic and vigorous campaign

undertaken by the corporation, the same had

managed to induce the public to open 59,463

savings deposit accounts with an aggregate deposit

of P1,689,136.74;

o Accordingly, the Solicitor General commenced this quo warranto

proceedings for the dissolution of the corporation, with a prayer

that, meanwhile, a writ of preliminary injunction be issued ex

parte, enjoining the corporation and its branches, as well as its

officers and agents, from performing the banking operations

complained of, and that a receiver be appointed pendente lite.

o Superintendent of Banks of the Central Bank was then appointed

by the Supreme Court as receiver pendente lite of defendant

corporation.

In their defense, Security and Acceptance Corporation averred that the

the corporation had filed with the Superintendent of Banks an

application for conversion into a Security Savings and Mortgage

Bank, with defendants Zapa, Balatbat, Tanjutco (Pablo and

Vito, Jr.), Soriano, Beltran and Sebastian as proposed directors.

Issue:

Whether or not defendant corporation was engaged in banking

operations.

Held: YES.

An investment company which loans out the money of its customers,

collects the interest and charges a commission to both lender and

borrower, is a bank.

o It is conceded that a total of 59,463 savings account deposits

have been made by the public with the corporation and its 74

branches, with an aggregate deposit of P1,689,136.74, which has

been lent out to such persons as the corporation deemed

suitable therefore. It is clear that these transactions partake of

the nature of banking, as the term is used in Section 2 1 of the

General Banking Act.

o Hence, defendant corporation has violated the law by

engaging in banking without securing the administrative

authority required in Republic Act No. 337.

1 Sec. 2. Only duly authorized persons and entities may engage in the lending of funds obtained

from the public through the receipts of deposits or the sale of bonds, securities, or obligations of

any kind, and all entities regularly conducting such operations shall be considered as banking

institutions and shall be subject to the provisions of this Act, of the General Bank Act, and of other

pertinent laws. The terms 'banking institution and 'bank', as used in this Act, are synonymous and

interchangeable and specially include banks, banking institutions, commercial banks, savings

banks, mortgage banks, trust companies, building and loan associations, branches and agencies

in the Philippines of foreign banks, hereinafter called Philippine branches, and all other

corporations, companies, partnerships, and associations performing banking functions in the

Philippines."Persons and entities which receive deposits only occasionally shall not be

considered as banks, but such persons and entities shall be subject to regulation by the Monetary

Board of the Central Bank; nevertheless in no case may the Central Bank authorize the drawing

of checks against deposits not maintained in banks, or branches or agencies thereof.

"The Monetary Board may similarly regulate the activities of persons and entities which act as

agents of banks.

That the illegal transactions thus undertaken by defendant corporation

warrant its dissolution is apparent from the fact that the foregoing

misuser of the corporate funds and franchise affects the essence of its

business, that it is willful and has been repeated 59,463 times, and

that its continuance inflicts injury upon the public, owing to the number

of persons affected thereby.

"Sec. 6. No person, association or corporation not conducting the business of a commercial

banking corporation, trust corporation, savings and mortgage banks, or building and loan

association, as defined in this Act, shall advertise or hold itself out as being engaged in the

business of such bank, corporation or association, or use in connection with its business title the

word or words, 'bank', 'banking,' 'banker,' 'building and loan association,' 'trust corporation,' 'trust

company,' or words of similar import, or solicit or receive deposits of money for deposit,

disbursement, safekeeping, or otherwise, or transact in any manner the business of any such

bank, corporation or association without having first complied with the provisions of this Act in so

far as it relates to commercial banking corporations, trust corporations, savings and mortgage

banks, or building and loan association as the case may be. For any violation of the provisions of

this section by a corporation, the officers and directors thereof shall be jointly and severally liable.

Any violation of the provisions of this section shall be punished by a fine of five hundred pesos for

each day during which such violation is continued or repeated, and, in default of the payment

thereof, subsidiary imprisonment as prescribed by law."

Das könnte Ihnen auch gefallen

- Government Vs Philippine Sugar EstatesDokument2 SeitenGovernment Vs Philippine Sugar Estatesjay ugayNoch keine Bewertungen

- "Broken Things" Nehemiah SermonDokument7 Seiten"Broken Things" Nehemiah SermonSarah Collins PrinceNoch keine Bewertungen

- 02a - Rdg-1796 Treaty of TripoliDokument4 Seiten02a - Rdg-1796 Treaty of TripoliAnthony ValentinNoch keine Bewertungen

- Phil Trust Co Vs Rivera Case DigestDokument1 SeitePhil Trust Co Vs Rivera Case DigestRaje Paul Artuz100% (1)

- Republic of The Philippines vs. Security CreditDokument1 SeiteRepublic of The Philippines vs. Security CreditMylesNoch keine Bewertungen

- PDIC Vs Philippine Countryside Rural BankDokument2 SeitenPDIC Vs Philippine Countryside Rural BankLiliaAzcarraga100% (1)

- NIL - Associated Bank V CADokument1 SeiteNIL - Associated Bank V CAFoxtrot AlphaNoch keine Bewertungen

- RA 337 The General Banking Act of 1948Dokument20 SeitenRA 337 The General Banking Act of 1948Juan Luis LusongNoch keine Bewertungen

- Abacus Real Estate Development Center, Inc. v. Manila Banking CorporationDokument1 SeiteAbacus Real Estate Development Center, Inc. v. Manila Banking CorporationCheCheNoch keine Bewertungen

- San Fernando Rural Bank, Inc. V. Pampanga Omnibus Development Corporation and Dominic G. Aquino FactsDokument2 SeitenSan Fernando Rural Bank, Inc. V. Pampanga Omnibus Development Corporation and Dominic G. Aquino FactsRamon Khalil Erum IVNoch keine Bewertungen

- ROXAS Vs DE LA ROSADokument1 SeiteROXAS Vs DE LA ROSALiaa AquinoNoch keine Bewertungen

- Note Payable: D. DiscountDokument13 SeitenNote Payable: D. DiscountANDI TE'A MARI SIMBALA100% (3)

- M.E. Grey Vs Insular LumberDokument5 SeitenM.E. Grey Vs Insular LumberDexter CircaNoch keine Bewertungen

- Ocampo V EnriquezDokument3 SeitenOcampo V EnriquezbrendamanganaanNoch keine Bewertungen

- Razon vs. IAC DigestDokument2 SeitenRazon vs. IAC DigestMae Navarra100% (1)

- 2 Republic Vs Security Credit and Acceptance Corp.Dokument3 Seiten2 Republic Vs Security Credit and Acceptance Corp.BOEN YATOR100% (1)

- A Critical Analysis of Arguments (Most Recent)Dokument3 SeitenA Critical Analysis of Arguments (Most Recent)diddy_8514Noch keine Bewertungen

- Case Digest Republic of The Philippines, vs. Security Credit and Acceptance CorporationDokument3 SeitenCase Digest Republic of The Philippines, vs. Security Credit and Acceptance Corporationdbaratbateladot100% (2)

- 1 Republic v. Security Credit and Acceptance Corp.Dokument2 Seiten1 Republic v. Security Credit and Acceptance Corp.Word MavenNoch keine Bewertungen

- Villamor JR V UmaleDokument2 SeitenVillamor JR V UmaleSocNoch keine Bewertungen

- National Abaca V PoreDokument2 SeitenNational Abaca V PoreYlmir_1989Noch keine Bewertungen

- Bank File FormatDokument2 SeitenBank File Formatpmenocha8799100% (1)

- National Exchange vs. DexterDokument1 SeiteNational Exchange vs. DexterCindee YuNoch keine Bewertungen

- Mock Bar Examination Questions inDokument28 SeitenMock Bar Examination Questions inbrendamanganaan100% (1)

- People Vs MangalinoDokument1 SeitePeople Vs MangalinobrendamanganaanNoch keine Bewertungen

- Santiago v. Garchitorena (G.R. No. 109266)Dokument2 SeitenSantiago v. Garchitorena (G.R. No. 109266)brendamanganaan100% (2)

- Rural Bank of Lucena VS Arca DigestDokument2 SeitenRural Bank of Lucena VS Arca DigestRechel FernandezNoch keine Bewertungen

- Batong Buhay v. CADokument2 SeitenBatong Buhay v. CAmyc0_wheNoch keine Bewertungen

- ROGELIO Florete Vs MARCELINO FloreteDokument4 SeitenROGELIO Florete Vs MARCELINO FloreteMaeNoch keine Bewertungen

- Antam v. CA DigestDokument3 SeitenAntam v. CA DigestkathrynmaydevezaNoch keine Bewertungen

- Money Management For Forex Traders1Dokument11 SeitenMoney Management For Forex Traders1Aurélio Moreira100% (1)

- MWSS V DawayDokument2 SeitenMWSS V DawayPerry Rubio100% (1)

- Strong Vs Repide Case DigestDokument3 SeitenStrong Vs Repide Case Digestmacmac12345Noch keine Bewertungen

- BPI vs. de RenyDokument1 SeiteBPI vs. de RenyVanya Klarika NuqueNoch keine Bewertungen

- M.E GRAY v. INSULARDokument2 SeitenM.E GRAY v. INSULARdingNoch keine Bewertungen

- Datu Tagorana VS SecDokument2 SeitenDatu Tagorana VS SecallynNoch keine Bewertungen

- Go vs. BSP G.R. No. 178429, Oct. 23, 2009 (604 SCRA 322)Dokument5 SeitenGo vs. BSP G.R. No. 178429, Oct. 23, 2009 (604 SCRA 322)Carlos JamesNoch keine Bewertungen

- CommRev CaseDokument4 SeitenCommRev CaseJoan PabloNoch keine Bewertungen

- BANKING - IBL-ReviewerDokument240 SeitenBANKING - IBL-Reviewerviva_33Noch keine Bewertungen

- BSP and Chuchi Fonacier vs. Hon. Nina G. ValenzuelaDokument2 SeitenBSP and Chuchi Fonacier vs. Hon. Nina G. ValenzuelaKelsey Olivar MendozaNoch keine Bewertungen

- 2 Westmont Investment v. Francia, Jr.Dokument2 Seiten2 Westmont Investment v. Francia, Jr.MlaNoch keine Bewertungen

- Banking Laws Case DigestDokument6 SeitenBanking Laws Case Digestjancelmido1Noch keine Bewertungen

- National Exchange V DexterDokument1 SeiteNational Exchange V DexterReghz De Guzman PamatianNoch keine Bewertungen

- People v. GarciaDokument2 SeitenPeople v. GarciajanpepotNoch keine Bewertungen

- Clemente vs. CADokument1 SeiteClemente vs. CAReghz De Guzman PamatianNoch keine Bewertungen

- Edward Nell Co. v. Pacific Farms, Inc. DigestDokument1 SeiteEdward Nell Co. v. Pacific Farms, Inc. DigestBinkee VillaramaNoch keine Bewertungen

- Mentholatum v. MangalimanDokument2 SeitenMentholatum v. MangalimanAgz Macalalad100% (2)

- Vivas vs. Monetary BoardDokument2 SeitenVivas vs. Monetary BoardCaroline A. LegaspinoNoch keine Bewertungen

- Gonzales Vs PNBDokument3 SeitenGonzales Vs PNBKacel CastroNoch keine Bewertungen

- Legal FormsDokument3 SeitenLegal FormsbrendamanganaanNoch keine Bewertungen

- Marshall Wells Vs ElserDokument1 SeiteMarshall Wells Vs ElserEM RGNoch keine Bewertungen

- PAL v. Spouses Sadic and Aisha Kurangking, Et Al.Dokument2 SeitenPAL v. Spouses Sadic and Aisha Kurangking, Et Al.Danielle Dacuan100% (4)

- National Abaca Vs Pore DigestDokument3 SeitenNational Abaca Vs Pore DigestcrapshoxNoch keine Bewertungen

- Edward A. Keller & Co., Ltd. V. COB Group Marketing Inc. GR No. L-68907, 16 January 1986 Case DoctrineDokument11 SeitenEdward A. Keller & Co., Ltd. V. COB Group Marketing Inc. GR No. L-68907, 16 January 1986 Case DoctrineGrey WolffeNoch keine Bewertungen

- AETNA Casualty and Surety Co Vs Pacific Star Line DigestDokument2 SeitenAETNA Casualty and Surety Co Vs Pacific Star Line DigestKlaire EsdenNoch keine Bewertungen

- Pan Malayan Insurance Corp. vs. Court of AppealsDokument3 SeitenPan Malayan Insurance Corp. vs. Court of AppealsbrendamanganaanNoch keine Bewertungen

- Santiago v. Garchitorena (G.R. No. 109266) FactsDokument2 SeitenSantiago v. Garchitorena (G.R. No. 109266) Factsbrendamanganaan100% (1)

- Leticia Miranda v. PDIC, BSP and Prime Savings BankDokument1 SeiteLeticia Miranda v. PDIC, BSP and Prime Savings BankCheCheNoch keine Bewertungen

- Philippine Commercial and Industrial Bank, and Henares v. The Hon. Court of Appeals and Marinduque Mining and Industrial CorporationDokument1 SeitePhilippine Commercial and Industrial Bank, and Henares v. The Hon. Court of Appeals and Marinduque Mining and Industrial CorporationCheCheNoch keine Bewertungen

- General Principles Schools of Thought in Criminal Law (1996)Dokument53 SeitenGeneral Principles Schools of Thought in Criminal Law (1996)brendamanganaanNoch keine Bewertungen

- Lipana vs. Development Bank of The Philippines DigestDokument1 SeiteLipana vs. Development Bank of The Philippines DigestJoseph Macalintal100% (1)

- National Abaca Vs Pore DigestDokument3 SeitenNational Abaca Vs Pore DigestmarezaNoch keine Bewertungen

- BANCO FILIPINO SAVINGS AND MORTGAGE BANK vs. HON. FIDEL PURISIMA, Etc., and HON. VICENTE ERICTA and JOSE DEL FIERO, Etc.Dokument2 SeitenBANCO FILIPINO SAVINGS AND MORTGAGE BANK vs. HON. FIDEL PURISIMA, Etc., and HON. VICENTE ERICTA and JOSE DEL FIERO, Etc.Dave Lumasag CanumhayNoch keine Bewertungen

- Lozano vs. de Los Santos: 274 SCRA 452 - Business Organization - Corporation Law - Jurisdiction of The SECDokument16 SeitenLozano vs. de Los Santos: 274 SCRA 452 - Business Organization - Corporation Law - Jurisdiction of The SECGrace Lacia Delos Reyes100% (1)

- Central Bank vs. CADokument2 SeitenCentral Bank vs. CAxx_stripped52Noch keine Bewertungen

- 92 - San Miguel Corporation v. KhanDokument1 Seite92 - San Miguel Corporation v. KhanJoshua RiveraNoch keine Bewertungen

- Eleria Government Service Insurance System vs. Court of AppealsDokument3 SeitenEleria Government Service Insurance System vs. Court of AppealsbrendamanganaanNoch keine Bewertungen

- Prudential Bank vs. Court of Appeals CASE DIGESTDokument2 SeitenPrudential Bank vs. Court of Appeals CASE DIGESTVince LeidoNoch keine Bewertungen

- Avon vs. Court of Appeals Et. AlDokument3 SeitenAvon vs. Court of Appeals Et. AlWhere Did Macky GallegoNoch keine Bewertungen

- Expert Travel vs. CA DigestDokument4 SeitenExpert Travel vs. CA DigestPaolo Adalem100% (1)

- BelmanDokument2 SeitenBelmanBethany MangahasNoch keine Bewertungen

- Onapal V CADokument10 SeitenOnapal V CAMp CasNoch keine Bewertungen

- A Commission To Both Lender and Borrower, Is A Bank. It Is Conceded That A Total of 59,463 SavingsDokument45 SeitenA Commission To Both Lender and Borrower, Is A Bank. It Is Conceded That A Total of 59,463 SavingsJustice PajarilloNoch keine Bewertungen

- Banking Laws Week 1Dokument7 SeitenBanking Laws Week 1Keshlyn KellyNoch keine Bewertungen

- Republic Act No. 337Dokument38 SeitenRepublic Act No. 337mfspongebobNoch keine Bewertungen

- People vs. SalarzaDokument6 SeitenPeople vs. SalarzabrendamanganaanNoch keine Bewertungen

- BSP Group Vs Sally Go (2010)Dokument7 SeitenBSP Group Vs Sally Go (2010)brendamanganaanNoch keine Bewertungen

- G.R. No. 88724 April 3, 1990 THE PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, CEILITO ORITA Alias "Lito," Defendant-Appellant. TheDokument20 SeitenG.R. No. 88724 April 3, 1990 THE PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, CEILITO ORITA Alias "Lito," Defendant-Appellant. ThebrendamanganaanNoch keine Bewertungen

- 2017 Commercial Law Bar ExamDokument24 Seiten2017 Commercial Law Bar ExambrendamanganaanNoch keine Bewertungen

- Banking Law On Secrecy of Bank DepositsDokument29 SeitenBanking Law On Secrecy of Bank DepositsbrendamanganaanNoch keine Bewertungen

- Insurance Case DigestDokument6 SeitenInsurance Case DigestbrendamanganaanNoch keine Bewertungen

- Sps. Espiritu V Sps. SazonDokument3 SeitenSps. Espiritu V Sps. SazonbrendamanganaanNoch keine Bewertungen

- Dev't Bank of The Philippines V Arcilla Jr.Dokument1 SeiteDev't Bank of The Philippines V Arcilla Jr.brendamanganaanNoch keine Bewertungen

- AC No. 6332Dokument19 SeitenAC No. 6332brendamanganaanNoch keine Bewertungen

- LEgform 3 (Long)Dokument3 SeitenLEgform 3 (Long)brendamanganaanNoch keine Bewertungen

- Book I Part 2Dokument23 SeitenBook I Part 2brendamanganaanNoch keine Bewertungen

- AC No. 6332Dokument19 SeitenAC No. 6332brendamanganaanNoch keine Bewertungen

- Republic of The Philippines National Capital Judicial Region Regional Trial Court Manila, Branch 1Dokument4 SeitenRepublic of The Philippines National Capital Judicial Region Regional Trial Court Manila, Branch 1brendamanganaanNoch keine Bewertungen

- People V NunezDokument10 SeitenPeople V NunezbrendamanganaanNoch keine Bewertungen

- People V NunezDokument10 SeitenPeople V NunezbrendamanganaanNoch keine Bewertungen

- International Negotiations On Climate Change:: Key Questions & AnswersDokument3 SeitenInternational Negotiations On Climate Change:: Key Questions & AnswersbrendamanganaanNoch keine Bewertungen

- People V GuillenDokument3 SeitenPeople V GuillenbrendamanganaanNoch keine Bewertungen

- Truck Parking Areas in Europe 2007Dokument91 SeitenTruck Parking Areas in Europe 2007daddy4dcNoch keine Bewertungen

- ScriptDokument2 SeitenScriptKenneth FloresNoch keine Bewertungen

- Agael Et - Al vs. Mega-Matrix (Motion For Reconsideration)Dokument5 SeitenAgael Et - Al vs. Mega-Matrix (Motion For Reconsideration)John TorreNoch keine Bewertungen

- Profitfleet Incorporated: MG MarilaoDokument2 SeitenProfitfleet Incorporated: MG MarilaoBusico DorisNoch keine Bewertungen

- Quiz 2 - Prof 3Dokument5 SeitenQuiz 2 - Prof 3Tifanny MallariNoch keine Bewertungen

- Statement of Protest by DR D Narasimha ReddyDokument3 SeitenStatement of Protest by DR D Narasimha ReddyFirstpostNoch keine Bewertungen

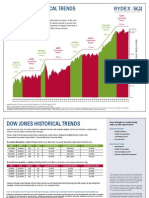

- Rydex Historical TrendsDokument2 SeitenRydex Historical TrendsVinayak PatilNoch keine Bewertungen

- PROBLEM 1: How Should The 100,000 Be Distributed To The Following CreditorsDokument2 SeitenPROBLEM 1: How Should The 100,000 Be Distributed To The Following CreditorsMitch Tokong MinglanaNoch keine Bewertungen

- Simulation 7 - Payroll Spring-2020Dokument13 SeitenSimulation 7 - Payroll Spring-2020api-519066587Noch keine Bewertungen

- Jurisprudence Syllabus - NAAC - NewDokument8 SeitenJurisprudence Syllabus - NAAC - Newmohd sakibNoch keine Bewertungen

- Peoria County Jail Booking Sheet For Oct. 4, 2016Dokument7 SeitenPeoria County Jail Booking Sheet For Oct. 4, 2016Journal Star police documents0% (1)

- BCPC Sample Executive OrderDokument3 SeitenBCPC Sample Executive OrderBarangay Ditucalan100% (2)

- Acctg 16a - Midterm Exam PDFDokument5 SeitenAcctg 16a - Midterm Exam PDFMary Grace Castillo AlmonedaNoch keine Bewertungen

- Governor-General of IndiaDokument15 SeitenGovernor-General of IndiaveersainikNoch keine Bewertungen

- Credit Manager or Regional Credit Manager or Credit and CollectiDokument3 SeitenCredit Manager or Regional Credit Manager or Credit and Collectiapi-77291601Noch keine Bewertungen

- PDS (PNP) - 2Dokument5 SeitenPDS (PNP) - 2Deng HarborNoch keine Bewertungen

- Pcd!3aportal Content!2fcom - Sap.portal - Migrated!2ftest!2fcom - ril.RelianceCard!2fcom - RilDokument16 SeitenPcd!3aportal Content!2fcom - Sap.portal - Migrated!2ftest!2fcom - ril.RelianceCard!2fcom - Rildynamic2004Noch keine Bewertungen

- Application For Judicial ReviewDokument8 SeitenApplication For Judicial ReviewWilliam SilwimbaNoch keine Bewertungen

- Laurel Training Non IndDokument27 SeitenLaurel Training Non Indmadhukar sahayNoch keine Bewertungen

- Asset Based ValuationDokument11 SeitenAsset Based ValuationShubham ThakurNoch keine Bewertungen

- Application of ATCCDokument3 SeitenApplication of ATCCmayur_lanjewarNoch keine Bewertungen

- Deen Is NaseehaDokument3 SeitenDeen Is NaseehaSobia QasimNoch keine Bewertungen

- Gentileschi's Judith Slaying HolofernesDokument2 SeitenGentileschi's Judith Slaying Holofernesplanet2o100% (3)

- Lemon v. KurtzmanDokument82 SeitenLemon v. Kurtzman0419lucasNoch keine Bewertungen