Beruflich Dokumente

Kultur Dokumente

Pension Yojna

Hochgeladen von

Pranjal VarshneyCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Pension Yojna

Hochgeladen von

Pranjal VarshneyCopyright:

Verfügbare Formate

Atal Pension Yojana is a government-backed pension scheme in India targeted at

the unorganised sector. It was originally mentioned in the 2015 Budget speech by

Finance Minister Arun Jaitley in February 2015.[1] It was formally launched by

Prime Minister Narendra Modi on 9 May in Kolkata.[2] As of May 2015, only 11% of

India's population has any kind of pension scheme, this scheme aims to increase

the number.[3]

In Atal Pension Yojana, for every contribution made to the pension fund, The Cen

tral Government would also co-contribute 50% of the total contribution or ?1,000

(US$15) per annum, whichever is lower, to each eligible subscriber account, for

a period of 5 years. The minimum age of joining APY is 18 years and maximum age

is 40 years. The age of exit and start of pension would be 60 years. Therefore,

minimum period of contribution by the subscriber under APY would be 20 years or

more.

Aadhaar would be the primary KYC document for identification of beneficiaries, s

pouse and nominees to avoid pension rights and entitlement related disputes in t

he long-term. The subscribers are required to opt for a monthly pension from Rs.

1000

Rs. 5000 and ensure payment of stipulated monthly contribution regularly.

The subscribers can opt to decrease or increase pension amount during the course

of accumulation phase, as per the available monthly pension amounts. However, t

he switching option shall be provided once in year during the month of April.

This scheme will be linked to the bank accounts opened under the Pradhan Mantri

Jan Dhan Yojana scheme and the contributions will be deducted automatically. Mos

t of these accounts had zero balance initially. The government aims to reduce th

e number of such zero balance accounts by using this and related schemes.[3]

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Mohmmad Bin TuglakDokument3 SeitenMohmmad Bin TuglakPranjal VarshneyNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Jawaharlal Nehru (: HindustaniDokument1 SeiteJawaharlal Nehru (: HindustanisugupremNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- IAIS 2014 English8Dokument17 SeitenIAIS 2014 English8Pranjal VarshneyNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Jalaluddin KhiljiDokument1 SeiteJalaluddin KhiljiPranjal VarshneyNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Jantar MantarDokument1 SeiteJantar MantarPranjal VarshneyNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Chai TanyaDokument1 SeiteChai TanyaPranjal VarshneyNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Bhanu Pratap SinghDokument1 SeiteBhanu Pratap SinghPranjal VarshneyNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Alauddin Khilji's rise to power in 1296/TITLEDokument3 SeitenAlauddin Khilji's rise to power in 1296/TITLEPranjal VarshneyNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Aamir KhanDokument1 SeiteAamir KhanPranjal VarshneyNoch keine Bewertungen

- Meera BaiDokument2 SeitenMeera BaiPranjal Varshney100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- PoetryDokument2 SeitenPoetryPranjal VarshneyNoch keine Bewertungen

- Constructing An AngleDokument2 SeitenConstructing An AnglePranjal VarshneyNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Biography of Guru Teg BahadurDokument2 SeitenBiography of Guru Teg BahadurPranjal VarshneyNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Atal Bihari The Great PoatDokument1 SeiteAtal Bihari The Great PoatPranjal VarshneyNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Vipin Chandra PalDokument1 SeiteVipin Chandra PalPranjal VarshneyNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Lal Bahadur ShastriDokument1 SeiteLal Bahadur ShastriPranjal VarshneyNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- BalajiDokument1 SeiteBalajiPranjal VarshneyNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- FloodDokument1 SeiteFloodPranjal VarshneyNoch keine Bewertungen

- De For A StationDokument1 SeiteDe For A StationPranjal VarshneyNoch keine Bewertungen

- Radha KrishnaDokument1 SeiteRadha KrishnaPranjal VarshneyNoch keine Bewertungen

- Flood DisasterDokument1 SeiteFlood DisasterPranjal VarshneyNoch keine Bewertungen

- GovernmentDokument1 SeiteGovernmentPranjal VarshneyNoch keine Bewertungen

- Radha KrishnaDokument1 SeiteRadha KrishnaPranjal VarshneyNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Lord RamaDokument1 SeiteLord RamaPranjal VarshneyNoch keine Bewertungen

- KrishnaDokument1 SeiteKrishnaPranjal VarshneyNoch keine Bewertungen

- CoinsDokument1 SeiteCoinsPranjal VarshneyNoch keine Bewertungen

- Jawahar NehruDokument1 SeiteJawahar NehruPranjal VarshneyNoch keine Bewertungen

- Importance of Vedic MathsDokument2 SeitenImportance of Vedic MathsPranjal VarshneyNoch keine Bewertungen

- Importance of RelationshipDokument2 SeitenImportance of RelationshipPranjal VarshneyNoch keine Bewertungen

- Society in Pre-British India.Dokument18 SeitenSociety in Pre-British India.PřiýÂňshüNoch keine Bewertungen

- 6250 - D.Y. Patil College of Engineering and Technology, KolhapurDokument14 Seiten6250 - D.Y. Patil College of Engineering and Technology, KolhapurShivtej HatgineNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Tamil Nadu - WikipediaDokument25 SeitenTamil Nadu - WikipediaShivam KhandelwalNoch keine Bewertungen

- Vision Mission and Objectives of RelianceDokument3 SeitenVision Mission and Objectives of RelianceDipali Pawar0% (1)

- AA6 - MA - Lecture 14Dokument47 SeitenAA6 - MA - Lecture 14Ramisa FerdousiNoch keine Bewertungen

- Sectoral Snippets: India Industry InformationDokument18 SeitenSectoral Snippets: India Industry Informationpg10shivi_gNoch keine Bewertungen

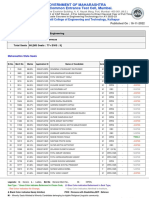

- Documents 77751 0 ResultsGATE22.pdfDokument53 SeitenDocuments 77751 0 ResultsGATE22.pdfOhol Rohan BhaskarNoch keine Bewertungen

- Regional - Teachers - of - Change ListDokument9 SeitenRegional - Teachers - of - Change ListGowrikumarNoch keine Bewertungen

- PolSc HonsDokument58 SeitenPolSc HonsRatnadip PaulNoch keine Bewertungen

- Khushwant SinghDokument1 SeiteKhushwant Singhnitinkp47100% (2)

- 6260 PDFDokument153 Seiten6260 PDFpravin awalkondeNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- All Parties Conference 1928 Summary of ProceedingsDokument12 SeitenAll Parties Conference 1928 Summary of ProceedingsĻost ÒneNoch keine Bewertungen

- Admitted Candidates List Upto Mop Up Round MBBS BD-MCC COUNCELLING 2022 PDFDokument3.197 SeitenAdmitted Candidates List Upto Mop Up Round MBBS BD-MCC COUNCELLING 2022 PDFrasdigdevNoch keine Bewertungen

- Scan Class IV 23032022Dokument2 SeitenScan Class IV 23032022RanbirNoch keine Bewertungen

- Chanakya's Chant Plot SummaryDokument1 SeiteChanakya's Chant Plot Summaryprnv99Noch keine Bewertungen

- 1000 General Knowledge (GK) Questions For SSC CGL 2017 Examination PDF (WWW - Thegkadda.com) PDFDokument23 Seiten1000 General Knowledge (GK) Questions For SSC CGL 2017 Examination PDF (WWW - Thegkadda.com) PDFAzeem MajeedNoch keine Bewertungen

- About Raja Bhoja: Aysha SadafDokument6 SeitenAbout Raja Bhoja: Aysha SadafmohamedNoch keine Bewertungen

- Allocation of Cadres To The Candidates Allocated To IAS On The Basis of CSE-2005Dokument3 SeitenAllocation of Cadres To The Candidates Allocated To IAS On The Basis of CSE-2005Roopesh PandeNoch keine Bewertungen

- India Foreign PolicyDokument72 SeitenIndia Foreign PolicyTanya ChaudharyNoch keine Bewertungen

- Books&Authors EbookDokument6 SeitenBooks&Authors EbookAnonymous ngY6NCuBNoch keine Bewertungen

- Apclist PDFDokument53 SeitenApclist PDFgbradvocateNoch keine Bewertungen

- Bangalore Companies ListDokument15 SeitenBangalore Companies ListKRA SCS IndiaNoch keine Bewertungen

- Ipc AbstractDokument32 SeitenIpc AbstractKusum Kali MitraNoch keine Bewertungen

- AHP DemandDokument60 SeitenAHP DemandRaahul RajaramanNoch keine Bewertungen

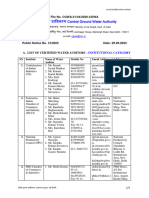

- Accredited Water AuditorsDokument3 SeitenAccredited Water AuditorsMithilesh KumarNoch keine Bewertungen

- Hotel Restaurant Data All IndiaDokument3 SeitenHotel Restaurant Data All IndiaNeha Bansal100% (1)

- Sare Jahan Se AcchaDokument9 SeitenSare Jahan Se AcchaSamrat PvNoch keine Bewertungen

- Minutes of 4th Meeting of Oversight Committee 1Dokument13 SeitenMinutes of 4th Meeting of Oversight Committee 1National HeraldNoch keine Bewertungen

- Important Current Affairs For SBI Clerk Mains 2023 Books & Authors - August To January 7Dokument6 SeitenImportant Current Affairs For SBI Clerk Mains 2023 Books & Authors - August To January 7Baba FakruddinNoch keine Bewertungen

- E Book DecemberDokument251 SeitenE Book DecemberAnonymous ABzZaSpcfNoch keine Bewertungen

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesVon EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesBewertung: 4.5 von 5 Sternen4.5/5 (30)

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyVon EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyBewertung: 5 von 5 Sternen5/5 (1)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassVon EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNoch keine Bewertungen

- How To Budget And Manage Your Money In 7 Simple StepsVon EverandHow To Budget And Manage Your Money In 7 Simple StepsBewertung: 5 von 5 Sternen5/5 (4)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsVon EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNoch keine Bewertungen

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantVon EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantBewertung: 4 von 5 Sternen4/5 (104)