Beruflich Dokumente

Kultur Dokumente

Usefulness of Accounting Information System in Emerging Economy: Empirical Evidence of Iran

Hochgeladen von

Yusuf HusseinOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Usefulness of Accounting Information System in Emerging Economy: Empirical Evidence of Iran

Hochgeladen von

Yusuf HusseinCopyright:

Verfügbare Formate

International Journal of Economics and Finance

www.ccsenet.org/ijef

Usefulness of Accounting Information System in Emerging Economy:

Empirical Evidence of Iran

Mahdi Salehi (Corresponding author)

Assistant Prof. Accounting and Management Department, Zanjan University, Iran

Tel: 98-912-142-5323

E-mail: Salehimahdi_ir@yahoo.com

Vahab Rostami

Faculty Member of Pyame Noor University, Zanjan Branch, Iran

Abdolkarim Mogadam

Faculty member of Pyame Noor University, Gharmsar Branch

Accountancy at Allamehtababtabi University, Tehran, Iran

Abstract

The main objective of an accounting information system (AIS), a pre-eminently user-oriented system, is the

collection and recording of data and information regarding events that have an economic impact upon

organizations and the maintenance, processing and communication of information to internal and external

stakeholders. The results of this study show that although AIS is very useful to Iranian corporation, it is a gap

between what AIS is and what should be.

Keywords: Information system, Accounting Information System, Iran

Introduction

AIS of the past focused on the recording, summarizing and validating of data about business financial

transactions. Accounting systems that were previously performed manually can now be performed with the help

of computers. Therefore, improvements in the information technology have facilitated the use of cost and

management accounting procedures. Developments in IT have been paramount in recent decades, and they have

been leading developments in the globalization of markets and societies (Castells, 1996). In the view of the fact,

it is widely acknowledged that IT plays an important role in the field of accounting; IT can be strategic weapons

to support the object and strategy organizations. Some business organizations get competitive advantage by

equipping new information systems. Therefore organizations tend to increase the money for IT, which makes the

ratio of IT investment to their total budget higher.

In an era of global competition, the key to a firms survival is the continuous improvement of its performances.

AIS of the past focused on the recording, summarizing and validating of data about business financial

transactions. These functions were performed for the various groups within the organization that were concerned

about the respective decisions associated with financial accounting, managerial accounting, and tax compliance

issues (Hollander et al. 1996).

The need to integrate these often diverse systems led to the accountants appreciation of shared databases that

provide a cohesive picture of the organizations data, eliminating duplications and reducing data conflicts

(Moscoveet al. 1999).

The bold claims that technology has had the most important impact as accounting has been transformed into a

knowledge services profession have in general been poorly reflected in recent accounting research. Furthermore,

the research tradition in the AIS field, concentrating on, for example, transaction processing, data structure

modeling, computer fraud and security as well as system development methodologies, seems not to have

produced a useful understanding of the interplay between modern IT and accounting/management control

(Granlund & Mouritsen, 2003). According to Flynn (1992), the effectiveness of accounting information systems

can be received providing management information to assist concerned decisions. By Corner (1989) the

effectiveness of AIS can be evaluated as added value of benefits. Gelinas (1990) considers the effectiveness of

AIS as a measure of success to meet the established goals. The success of AIS implementation can be defined as

profitably applied to area of major concern to the organization, is widely used by one or more satisfied users, and

improves the quality of their performance. According to the above benefits which drives from AIS to corporate

186

International Journal of Economics and Finance

Vol. 2, No. 2; May 2010

sector, in this paper the authors try to illustrate this importance as well in developing country namely, Iran. Here

before explaining AIS, the authors briefly going to explain on information system.

Information Systems

An information system is an organized means of collecting, entering, and processing data and storing, managing,

controlling, and reporting information so that an organization can achieve its objectives and goals (Romney et al.,

1997:18). This definition of information system shows that an information system has following components.

Every information system is designed to accomplish one or more goals or objectives. For example, an

information system may be designed to collect and process data about employees to help managers prepare

payroll reports.

Inputs: Data must be entered into the information system to be processed.

Data are the facts that are collected and processed by the information system. Data are meaningless and useless,

which, therefore, should be processed and transformed to meaningful, organized, and useful form that is called

information.

Outputs: Output is the meaningful and useful information produced by the information system. For example,

weekly payroll report produced by the information system is an output.

Data storage: In addition to the external data entered into the information system, there should be internally

stored data used for processing.

Processors: In order to produce useful and meaningful information, data must be processed. Most companies

process data by using computers.

Instructions and Procedures: An information system produces data by the following instructions and

procedures. In computerized information systems, software includes procedures and instructions that direct

computers to process the data.

Users: Users are people who use the information produced by the system and who interacts with the system. For

example, managers who use financial statements that are produced by an accounting information system are the

users of the information system.

Control Measures: In order to make the information system produce correct, and error free information,

necessary measures should be taken to protect and control the information system.

Any system that includes the above components is known as an information system. The following section will

show how accounting systems are established using these components.

AIS

Accounting is the service function that seeks to provide the users with quantitative information. On the other

hand, AIS is an information system that is designed to make the accomplishment of accounting function possible.

AIS processes data and transactions to provide users with the information they need to plan, control, and operate

their businesses (Romney et al., 1997:2).

AIS can be a manual system, or a computerized system using computers. Regardless of the type, AIS is designed

to collect, enter, process, store, and report data and information.

Importance of AIS

Generally, information system is the whole of the related components that are working together to collect, store

and disseminate data for the purpose of planning, control, coordination, analysis and decision making.

On the other hand, an AIS is the whole of the related components that are put together to collect information,

raw data or ordinary data and transform them into financial data for the purpose of reporting them to decision

makers.

The most important and oldest of the present systems in businesses is certainly the Management Information

System. Management and information are two inseparable concepts and show the impossibility of the

rational execution of management activities without information. Management Information System consists of

many subsystems. Accounting Information System is one of these subsystems and the oldest one.

The accounting information system that is created in a business is directly related to the organizational culture,

level of strategic planning and the information technologies that this specific business has. It is possible to obtain

healthier information about the financial structures of the businesses that have set up a good accounting

information system. Some of the important functions that an accounting information system perform in a

187

International Journal of Economics and Finance

www.ccsenet.org/ijef

business are: collecting and recording data about the activities and transactions; planning; processing the data

and turning it into information to be used in decision-making for planning, application and control activities; and

carrying out the necessary controls in order to protect the business assets.

Accounting information plays an important role in the process of managing an enterprises activity. In the last

ten years, there has been an intensive process of implementing AIS in the world. These systems were

implemented in large industrial and small trade enterprises. Later, implementation of AIS started in other

enterprises and state institutions. The implementation of AIS is quite an expensive investment project for most

enterprises. However, in practice, the decision on which AIS to actually implement is, in most cases, based on

advertisement or the suggestions of associates. Flynn (1992) has found that only 20% information systems were

used successfully, while other installation effect was neutral or negative. These arguments show an importance

for evaluating the AIS effectiveness.

According to Flynn (1992), the effectiveness of AIS can be received providing management information to assist

concerned decisions with regard to the successfully managing of corporations. By Corner (1989) the

effectiveness of AIS can be evaluated as added value of benefits. Gelinas (1990) considers the effectiveness of

AIS as a measure of success to meet the established goals. The success of AIS implementation can be defined as

profitably applied to area of major concern to the organization, is widely used by one or more satisfied users, and

improves the quality of their performance. On the basis of made research authors come to conclusion, AIS

effectiveness can be considered as successful use of system, which ensures users needs.

The effectiveness of AIS can be evaluated using one or several models. Usage of several models increase

reliability of evaluation.

Features of AIS

Information system is perceived as an entirety of information processing system and resources of an enterprise

meant to form and disseminate information. Lucey (1991) has established that the system of information is a set

of unanimously operating people, data and procedures for the purpose of providing useful information.

Contemporary IS cannot function without computers and other technical means to measure primary information,

gather and register it in carriers, process and transmit it to consumers. For this reason computerized information

systems (CIS) are designed and implemented.

Some other researchers (Domeika, 2005) consider software an important element of computerized IS with which

technical equipment is able to arrange information in an automated way, create accounting CDB and is available

to users according to their needs. CIS of an enterprise accounting help to automate the processes of enterprise

performance accounting and arrangement of analytical information. Accounting, being a special information

system, should reveal the real picture of enterprise capital increase, sources of income and added value formation,

approaches for revenue and profit distribution, scope of consumption and storage.

Under the development of market economics the requirements for accounting information are changing and there

should be a significant step towards the improvement of methodology of its preparation, processing and issue to

users. When Lithuanian accounting is integrating into the system of European accounting it is not sufficient to

have good law regulating accounting, forms of financial reports, plan of accounts, standards of business

accounting. Other elements are also important for the system of accounting including profession of accounting

and code of its ethics, training and retraining of specialists of accounting, scientific research of accounting, etc.

(Mackevicius, 2007, Bruzauskas et al, 2005). The quality of accounting information is also determined by other

factors such as the level of primary information automation, functionality of computer software, integration of

accounting and other types of economic information, etc. Accounting information is closely related to other

types of economic information such as normative and target information and, especially, analytical information

(or results of analysis). Accounting in its broad sense includes not only accounting itself but also the analysis of

economic performance, management control and internal audit.

For a long time the analysis of an enterprise economic performance in western countries used to be restricted to

the analysis of the financial state, that is, the research of an enterprise cost-effectiveness, solvency. In the 2nd part

of the 20th century a contemporary system of accounting evolved whose core elements were as follows: financial

accounting and accountability, management accounting and control, financial analysis on the basis of financial

accountability. Economic analysis should definitely not limit itself to the analysis of financial performance

merely; rather, it should encompass all conjunctions of economic performance. The object of economic analysis

is economic performance of enterprises. Economic analysis occupies the intermediate position between the

selection of information and processing functions and the functions of decision making. Creating and

implementing the accounting IS the objectives of economic analysis and their solutions should become an

188

International Journal of Economics and Finance

Vol. 2, No. 2; May 2010

inseparable part of AIS. In sum, it arises to help managers at every position, according to Mitchell et al. (2000)

argued that accounting information could help manage short-term problems in areas such as costing, expenditure

and cash flow by providing information to support monitoring and control.

However, the existing literature provides little evidence of AIS development within corporations. Many studies

suggest that corporations have little management information and poor control, and that decision-making is

mostly ad hoc (Marriot & Marriot 2000). McMahon (2001), for example, suggested that financial accounting has

remained the principle source of information for internal management in corporations. Marriot & Marriot (2000)

also suggested that financial awareness among managers of corporations varies considerably and that the use of

computers for the preparation of management accounting information is not at its full potential.

Advantages of AIS

According to the several researchers, AIS have a lot of benefits to any company and corporation as follow:

1. Good cooperation

Any thing is always linked to certain environment, exists and develops third-party logistics enterprises in the

supply chain linking play a role of a bridge. Although the third-party logistics business as a separate entity exist

in the market, it and other enterprises still have to maintain a close relationship. This is because the consumers in

order to ensure normal operation of their production, they must understand and control the flow and the keeping

of materials timely, which calls that third-party logistics enterprises accounting information systems cooperate

with up-downstream enterprises, together control and manage the value-added activities occurred in the whole

supply chain, and achieve really supply chain competition. In addition, in the traditional enterprise organization

mode, the enterprise's business activities are divided in accordance with the functions and implement, so the lack

of co-ordination between departments the "islands of information" inevitably come into being. The new system

really record and reflect the economic business activities, do not require accountants note into the system

according to the pre-format, consequently avoid duplication of information collection and shortcomings; and

accountant no longer were limited to the accounting departments, but to participate in the enterprises operational

activities to coordinate other departments do well accounting information records and analytical work. In

addition, other companies could line on a third party logistics enterprises accounting information system through

the Internet, timely query and know the flow situation of logistics, do well their production plans.

2. To meet the needs of multi-users

With the change of the environment, the use objects of accounting information become expansion, including all

levels of enterprise management, all investment bodies outside, government agencies, intermediary organizations,

and so on, among them there are accountant and non-accountant. Traditional accounting information system can

only generate financial statements afforded to financial executive and fewer accounting information, which make

the use objects become narrow. But in the new system entity DB record all resources and economic business

activities, users through event-driven buttons on interactive interface can get the information they want.

According to the value chain management, any of the activities should be the value-added process, and account

is a measure means of the value of economic activity, therefore, any economic activity through the accounting

information system can be measured and reflected. However, as part of the current business activities can not be

measured by money, and we are currently unable to find suitable means of measuring the value, which caused

some economic activities not reflected through accounting information system.

3. To control afterwards, and control in advance and in concurrent

Account has the functions of supervision and control of the economic activities of the enterprise. And the

traditional manual account and of the computer accounting system for "accounting" can only do inspection

afterwards, the mistakes could not be avoided. New accounting information system integrate of real-time

processing, the standard cost, authorized the approval process control, budget management, and so on, so that

employees based on the standard budget, change from passive to active to manage their own activities, do

Real-time check, control, and timely identify problems, correct deviations and do truly Control afterwards, in

advance and in concurrent.

Brynjolfsson and Hitt (2003) estimated a production function for a panel of 600 large US firms, finding that the

contribution of IT investments to output growth significantly exceeds its factor share, implying a positive effect

of computers on productivity growth in the long-run. The results also suggest that IT capital deepening is

associated with far-reaching organizational changes within the firm.

OECD (2004) gathers a set of empirical papers that offers a comprehensive overview of the impacts of IT on

economic performance in advanced countries. The nine studies based on micro-data show significant impacts of

189

International Journal of Economics and Finance

www.ccsenet.org/ijef

digital technologies on firm-level performance. In most cases there is also evidence that IT investment is

associated with more rapid TFP growth and that this effect differs across industries. Firms in the financial sector

are among those that have benefited more from the new technologies.

Research Problem

The developments in information technologies, together with globalization and international legal arrangements,

have generated such notions as new economy, e-commerce and new accounting. In addition, these

developments have been useful in saving time and money and reducing the costs by accelerating transactions and

communication. The developments in information technologies have caused all or some of the financial

transactions in a business to be carried out in such different forms in electronic environments as electronic

commerce and electronic data exchange. This, as a result, caused the financial transactions to be removed from

the traditional paper-based activity environment to the electronic environment in the accounting information

system, which is described as the language of a business, and therefore, resulted in changes in all processes such

as recording, classification, reporting and analysis. At the same time, this change has also affected such

accounting applications as keeping the books, preparing financial statements and tax statements, auditing

activities and, therefore, the activities of the members of the accounting profession.

The above-mentioned developments in information technologies, which made the changes in accounting

information system, applications and profession inevitable, also created a change in the demands of the society

and an increase in the expectations from the members of accounting profession. So, in this paper the authors try

to shows the significance of accounting information system in developing country, namely Iran.

Related literature

Computers are now a key resource in accounting and financial information processing. Furthermore, major

advances in information technology (Seligman, 2000) as well as the existence of observable and tangible

economic benefits (Botosan, 1997 and Seligman, 2000) have driven traditional auditing and financial reporting

ever closer to being real-time tasks. Companies like Cisco Systems have made significant progress in making

real-time financial reporting a reality (Seligman, 2000). Seligman (2000, p.148) reports that Cisco Systems is

one of the rare companies today in which the boss can clap his hands and get the books closed within an hour.

Real-time financial reporting

Although real-time financial reporting provides benefits to investors and financial analysts, prior discussion

regarding the use of technologies that would bring the business community closer to real-time financial reporting

has raised several concerns. For instance, when Cushing (1989) wrote about the emergence of the Securities and

Exchange Commissions EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system (SEC, 2000 a), he

examined the feasibility and consequences of using a database approach to corporate financial reporting. The

database approach is a precursor to the current Internet client/server based portal approach. At the time of

Cushings work, the World Wide Web did not exist, and Bernard-Lees HTML (W3, 2000) was not yet invented.

Nonetheless, the issues addressed by Cushing are still relevant and point to a need for reexamination of the

content of accounting information systems education. In his work, Cushing found that the database approach

would be feasible for financial reporting. Yet, he also recognized that this approach would have varying

economic effects on several players in the economy. One of his observations dealt with which players might

support the database approach and which ones might oppose it. Cushing (1989) conjectured that the most likely

supporters of the database approach would be governmental agencies involved in regulatory enforcement,

accounting scholars, and the data processing industry. On the other hand, the most likely opponents might be

corporate management, corporate accountants, financial analysts, and investors with private access to inside

information. Cushing (1989) argued that corporate management might object to the database approach because it

would hinder their ability to manipulate financial information in a manner that best serves their self-interest.

Cushing believed that the database approach would enable meticulous monitoring and appraisal of

managements accounting choices. As a result, he reasoned that this approach would almost certainly lead to

restrictions in these choices, and that corporate management might experience a significant reduction in their

ability to manage earnings. Similar arguments could be made about real-time financial reporting in the context of

today's environment as it could lead to greater transparency in financial reporting and enable more efficient

monitoring of managements accounting method choices. Since 1989, technological advancements and the

World Wide Web have transformed the way users of financial reports seek financial information and how

corporations have supported (albeit selectively), through their web pages, users' demand for timely information.

The emergence of the World Wide Web has also made the nearly real-time financial reporting convenient and

economical for individual investors. Constantly updated World Wide Web pages have shown investors that they

190

International Journal of Economics and Finance

Vol. 2, No. 2; May 2010

may have the opportunity to acquire financial information on a real-time basis. It might be argued that the cost of

disclosing information real-time and/or the fear of passing on proprietary information to competitors might

discourage companies from disclosing their financial information in a real-time manner. However, these

disadvantages might be offset by the impact of timely disclosures on the cost of capital. Botosan (1997) found

that the cost of capital is lower for companies (particularly smaller entities) that provide more thorough and

timely financial disclosure than those companies that do not. Botosans findings provide some insight into the

potential benefits that might accrue from real-time financial reporting.

Assurance services for real-time reporting

The quality and effectiveness of real-time financial reporting is contingent upon the ability to provide real-time,

continuous financial auditing. Continuous auditing has been defined as "a methodology that enables independent

auditors to provide written assurance on a subject matter using a series of auditors' reports issued simultaneously

with, or a short period of time after, the occurrence of events underlying the subject matter" (CICA/AICPA,

1999). Continuous auditing requires a high degree of automation. It is also dependent upon (a) precise

definitions of the data underlying the items to be audited, (b) use of real-time controls to signal errors and

irregularities, and (c) automated integrated audit agents and other technologies that enable collection, analysis,

summarization, and reporting of audit evidence and opinions. Like real-time financial reporting, real-time,

continuous auditing also creates a need for a new breed of accounting information systems professionals, who

are not only well-versed in traditional audit and accounting methods, but also information technology (IT).

Changing nature of financial information systems and enabling technologies

The possibility of sharing very timely financial data and information on the Web has accelerated many new

developments in financial reporting that have the active support of the corporate community. One such

significant breakthrough is XBRL (Extensible Business Reporting Language, 2000), a variation of XML

(Extensible Markup Language), for financial reporting. XBRL is expected to make it easier to locate, retrieve,

and use financial data that are published on the Web. Moreover, by establishing penalties for private, preemptive

disclosure of financial information to exclusive groups such as financial analysts, the recent SEC fair disclosure

ruling provides additional impetus for advances in real-time reporting to the entire business and investing

community (Seligman, 2000). Corporations may now attempt to make timely (including real-time) information

available to all market participants rather than select groups of analysts and investment bankers. In order to reach

a distributed audience, real-time financial reporting and auditing require sophisticated network technology and

Web-based systems. As advances in real-time financial reporting and auditing continue, a new breed of

accounting practitioners and accounting scholars may question and subsequently reexamine some of the

fundamental assumptions made under the guise of manual systems usage during most of the last century. As

demonstrated by EDGAR (SEC, 2000 a) and other media available via the World Wide Web, the fundamental

assumptions underlying modern accounting may need to be thoroughly reexamined in this post-modern age in

which the media for financial communication is no longer confined to a linear time frame, but rather is capable

of accommodating spatial data points within dynamic financial transactions.

Hypotheses development

According to Huber (1990, p.65), use of advanced IT leads to more available and more quickly retrieved

information, including external information, internal information, and previously encountered information, and

thus leads to increased information accessibility. Firms with extensive resources may gain a competitive edge

by deploying IT in support of or to strengthen their business (King et al. 1989). Chan et al. (1997) and Hussin et

al. (2002) found that an appropriate level of IT sophistication was associated with the capability to align IT

strategy and business strategy. Hence, it is expected in well developed country used higher level IT and visa

versa.

According to the benefits and advantages of IT and research problem the below hypotheses is postulated to give

clear answer to the researchers:

First hypothesis: utilizing of accounting information counseling cause to increases accounting and financial

performance.

Second hypothesis: Accounting information system cause subtle predict of company future.

Third hypothesis: Accounting information system cause to more correctness of financial reporting.

Forth hypothesis: Accounting information software improves accounting standards in Iran.

Fifth hypothesis: Accounting information software confirms with other financial and managerial systems.

191

International Journal of Economics and Finance

www.ccsenet.org/ijef

Sixth hypothesis: Accounting information system covers all information needs of company.

Seventh hypothesis: Accounting information system covers all management levels information in Iran.

Research methodology

So far accurate answer to the research question, the authors design and developed a questionnaire which it is the

most suitable for this study. A survey questionnaire was completed by the financial managers of Iranian

corporations. The questionnaire contains two parts namely (A) bio-data and (B) this section includes several

deep questions related to AIS application and usefulness in Iranian corporations. The questionnaire was based on

Five-Point Likert,s Scale questionnaire. The Five-Point Likerts scale having the ratings of strongly disagree (1)

and strongly agree (5) were used. Totally 600 questionnaire were distributed among the financial managers in

Iran. Out of 600 questionnaires, 498 useable questionnaires were returned in first Feb to end of April 2009.

Table 1 shows more details of participants regarding gender, academic degree, experience, and background of

study of 498 participants. According to Table 1, 75.50% of participants were male and 24.10% were female. In

sum, majority of participants were male. Majority of participants had bachelor degree (240 numbers, 48.20%),

followed by 46.78% master degrees. Minority of participants had diploma degree (2.61%). The least number of

participants had PhD degrees (2.41%). To conclude, majority of Iranian financial managers in this study had

bachelor degrees.

Regarding to experience, 258 participants had more than 10 years experience, followed by 23.70% more than 15

years experience. Least number of participants had lee than 4 years experience (0.80%).

Regarding to the academicals background, 67.27% had accountancy background. More than 25% of participants

had management background.

Insert Table 1 Here

Testing of hypotheses

For the purposes of testing hypotheses the suitable test was adapted in this study. Chi Square Test was employed

in this study and the results of hypotheses are shown in Table 2.

First hypothesis: utilizing of accounting information counseling cause to increases accounting and financial

performance.

According to Table 2 the mean value, S.D, and D.f are 3.965, 1.434, and 2 respectively. The results of above

mentioned table shows that the first hypothesis is accepted. It means the utilizing of accounting information

counseling cause to increase accounting and financial performance. Hence null hypothesis is rejected. To

conclude, for improving accounting and financial performance sophisticate AIS should be adapt in Iranian

corporations.

Second hypothesis: Accounting information system cause subtle predict of company future.

With reference to Table 2, this hypothesis also accepted and null hypothesis rejected. In other words,

implementation of high AIS leads to better future prediction of corporations in Iran.

Insert Table 2 Here

Third hypothesis: Accounting information system cause to more correctness of financial reporting.

Table 2 shows that this hypothesis also strongly accepted in Iranian corporate sector. It means, any company

which adapted high AIS it has more correct financial statements as well as reliable financial reporting.

Forth hypothesis: Accounting information software improves accounting standards in Iran.

With regard to Table 2 this hypothesis rejected and null hypothesis accepted, in other words, accounting

information software does not harmonize with Iranian accounting standards.

Fifth hypothesis: Accounting information software confirms with other financial and managerial systems.

According to Table 2 this hypothesis also rejected and null hypothesis accepted, in other words Iranian AIS does

not confirms with other financial and managerial systems, so there is a gap between AIS and financial and

managerial systems. In reality it causes very weakness to Iranian corporations because if all systems fit each

others then company will take off to any target.

Sixth hypothesis: Accounting information system covers all information needs of company.

As Table 2 shows the sixth hypothesis also rejected and null hypothesis accepted, in other words, Iranian AIS

does not provide suitable information to company, so those companies can not make decision with reliable data.

192

International Journal of Economics and Finance

Vol. 2, No. 2; May 2010

According to the authors view points, the major weakness of Iranian corporations is that they are implementing

AIS but it is not very useful to corporations, so there is also gap so called AIS gap.

Seventh hypothesis: Accounting information system covers all management levels information in Iran.

The seventh hypothesis also rejected by Table 2. It means that AIS in Iran does not covers and provide

management levels information. It is another weakness of Iranian corporations which available AIS do not

provide managements information needs.

Conclusion

Accounting information systems of the past focused on the recording, summarizing and validating of data about

business financial transactions. These functions were performed for the various groups within the organization

that were concerned about the respective decisions associated with financial accounting, managerial accounting,

and tax compliance issues (Hollanderet al.1996). The need to integrate these often diverse systems led to the

accountants appreciation of shared databases that provide a cohesive picture of the organizations data,

eliminating duplications and reducing data conflicts (Moscove, et al. 1999). The results of this study showed that

AIS improve financial statements and reporting correctness in Iran. However, the results also revealed that there

is hug gap between what AIS and what should be. The major weakness of AIS in Iran as follow: in is not

affected to Iranian accounting standards, it is not confirms with other financial and managerial systems, it is not

covers all information needs have company and financial information and it is not covers all management levels

information in Iran. So, to this situation, the managers which are aware of AIS benefits should take more as well

as academicals action for reducing such gaps in Iranian corporate sectors.

References

Botosan, Christine A. (1997). Disclosure Level and the Cost of Equity Capital, The Accounting Review, Vol. 72

(July), pp. 323-349.

Bresnaham T., E. Brynjolfsson, L. Hitt (2002). Information Technology, Workplace Organization and the

Demand for Skilled Labor: Firm Level Evidence, Quarterly Journal of Economics, 17: 339-376.

Bresnahan et al. (2002). find a positive correlation between the accumulation of IT capital, innovation in

workplace organization and the use of more highly skilled workers.

Brynjolfsson E. L.M. Hitt (2003). Computing Productivity: Firm-Level Evidence, Review of Economics and

Statistics, Vol. 85, pp. 793-808.

Castells, M. (1996). The Information Age: Economy, Society and Culture. Volume I, The Rise of the Network

Society. Oxford: Blackwell.

Chan, Y.E., S.L Huff, D.W. Barclay, and D.G. Copeland (1997). Business strategic orientation, information

systems strategic orientation, and strategic alignment, Information Systems Research, vol. 8, no. 2, pp. 125-150.

CICA/AICPA, (1999). Continuous Auditing, Canadian Institute of Chartered

accountants, Toronto, Canada.

Cobb, I. (1993). JIT and the Management Accountant: A Study of Current UK Practice, CIMA, London.

Corner R. (1989). Systems Analysis for Profitable Business Applications, Prentice Hall.

Cushing, B. E. (1989). On the Feasibility and the Consequences of a Database Approach to Corporate Financial

Reporting, Journal of Information Systems, spring, pp. 29-52.

Extensible Business Reporting Language, Available online: http://www.xfrml.org/.

Fisher, J. (1992). Use of nonfinancial performance measures, Journal of Cost Management for the

Manufacturing Industry, Spring, pp. 31-8.

Flynn D. (1992). Information systems Requirements: Determination and Analysis. MCGRAW HILL Book

Company.

Foster, G. and C.T. Horngren, (1987). JIT: cost accounting and cost management issues, Management

Accounting (USA), Vol. 68 No. 12, pp. 19-25.

Gelinas U., A. Oram, W. Wriggins (1990). Accounting information systems, Pwskent Publishing Company:

Boston.

Granlund, M., and J. Mouritsen, (2003). Problematizing the relationship between management control and

information technology, Introduction to the Special section on Management control and new information

technologies, European Accounting Review, Vol. 12, No. 1, pp. 77-83.

193

International Journal of Economics and Finance

www.ccsenet.org/ijef

Green, F.B., F. Amenkhienan, and G. Johnson, (1991). Performance measures and JIT, Management Accounting

(USA), Vol. 72 No. 8, pp. 50-3.

Hollander, A., E, Denna and J.Cherrington (1996). Accounting, Information Technology, and Business Solutions,

Chicago, IL: Richard D. Irwin.

Hollander, A., E. Denna, and J. Cherrington, (1996). Accounting, Information Technology, and Business

Solutions. Chicago, IL: Richard D. Irwin.

Huber, G.P. (1990). A theory of the effects of advanced information technologies on organizational design,

intelligence, and decision making, Academy of Management Review, vol. 15, no. 1, pp. 47-71.

Hussin, H., M. King, and P.B. Cragg. (2002). IT alignment in small firms, European Journal of Information

Systems, vol. 11, pp. 108-127.

King, W.R., V. Grover, and E. Hufnagel. (1989). Using information and information technology for sustainable

competitive advantage: some empirical evidence, Information and Management, vol. 17, pp. 87-93.

Lucey, T. (1991). Management Information Systems, London: DP Publications Limited, 326 p. Domeika, P.

Secondary Economic Information of an Enterprise and its Computerized Arrangement//Engineering Economics,

ISSN 1392-2785. Kaunas: Technologija, 2005, No. 5(45), p. 1218.

Mackeviius, J. moni veiklos analiz (2007). Informacijos rinkimas, sisteminimas ir vertinimas. Monografija.

Antrasis pataisytas ir papildytas leidimas. Vilnius: TEV, pp. 306320.

Marriot, N. and P. Marriot (2000). Professional accountants and the development of a management accounting

service for the small firm: Barriers and possibilities, Management Accounting Research, vol. 11, pp. 475-492.

McIlhattan, R.D. (1987). How cost management systems can support the JIT philosophy, Management

Accounting (USA), Vol. 69 No. 3, pp. 20-6.

McMahon, R.G.P. (2001). Business growth and performance and financial reporting practices of Australian

manufacturing SMEs, Journal of Small Business Management, vol. 39, no. 2, pp. 152-164.

Mitchell, F., G. Reid, and J. Smith, (2000). Information system development in the small firm: The use of

management accounting, CIMA Publishing, United Kingdom.

Moscove, S., M. Simkin and N. Bagranoff (1999). Core Concepts of Accounting Information Systems, New York,

NY: John Wiley & Sons, Inc.

Moscove, S., M. Simkin, and N. Bagranoff (1999). Core Concepts of Accounting Information Systems, New

York, NY: John Wiley & Sons, Inc.

Romney, Marshall B., Steinbart, Paul John, Cushing, E. Barry (1997). Accounting Information System, Seventh

Edition, Addison-Wesley.

Securities and Exchange Commission, EDGAR Database of Corporate Information, Available online:

http://www.sec.gov/edgarhp.htm.

Securities and Exchange Commission, Selective Disclosure and Insider Trading, August 15, 2000, Effective date:

October 23, 2000. [Release Nos. 33-7881; 34-43154; IC-24599, File No. S7-31-99](File name: 33-7881.htm)

Available online: http://www.sec.gov/rules/final/33-7881.htm.

W3, Some early ideas for HTML, Available online: http://www.w3.org/MarkUp/#historical.

194

International Journal of Economics and Finance

Vol. 2, No. 2; May 2010

Table 1. General information of participants

Variable

Gender

Number

Percent

Male

378

75.90

Female

120

24.10

Diploma

13

2.61

Academic

B.S

240

48.20

degree

M.A

233

46.78

PhD

12

2.41

Experience

Less than 4

0.80

5-9

118

23.69

10-14

258

51.81

More than 15

118

23.70

Accountancy

335

67.27

Background of

Business management

128

25.70

the study

Financial management

22

4.42

Other

13

2.61

Table 2. Results of testing hypotheses

Hypotheses

Mean

S.D

d.f

Chi

Square

Asymp. Sig

Results

First hypothesis

3.965

1.434

8.600

0.014

Accepted

Second hypothesis

2.123

0.527

13.868

0.003

Accepted

Third hypothesis

2.297

0.786

10.140

0.017

Accepted

Fourth hypothesis

2.485

0.649

4.118

0.981

Rejected

Fifth hypothesis

2.316

0.635

3.972

0.624

Rejected

Sixth hypothesis

2.461

0.792

0.160

0.923

Rejected

Seventh hypothesis

2.438

0.758

1.920

0.383

Rejected

195

Das könnte Ihnen auch gefallen

- Information Funnel MethodDokument4 SeitenInformation Funnel Methodaeon blissNoch keine Bewertungen

- AKN4509 Accounting Information SystemsDokument57 SeitenAKN4509 Accounting Information SystemsAgnes Teoh Sook SianNoch keine Bewertungen

- Furniture For Interior Design PDFDokument192 SeitenFurniture For Interior Design PDFHOONG123100% (1)

- FedEx (Management Information Systems)Dokument12 SeitenFedEx (Management Information Systems)Nikita Uppal86% (7)

- VDA 6 Part 3 EN Rev3-2016-12-01 PrintDokument207 SeitenVDA 6 Part 3 EN Rev3-2016-12-01 PrintwalaNoch keine Bewertungen

- JAMES A. HALL - Accounting Information System Chapter 1Dokument41 SeitenJAMES A. HALL - Accounting Information System Chapter 1Joe VaTa75% (4)

- QNDokument6 SeitenQNdoctor andey1Noch keine Bewertungen

- Literature Review "Accounting Information System For Organizational"Dokument6 SeitenLiterature Review "Accounting Information System For Organizational"Yolanda WirawanNoch keine Bewertungen

- CBLM Work in A Team EnvironmentDokument73 SeitenCBLM Work in A Team EnvironmentRam-tech Jackolito Fernandez89% (18)

- Lec 1 - Introduction To Wireless CommunicationDokument60 SeitenLec 1 - Introduction To Wireless CommunicationYusuf HusseinNoch keine Bewertungen

- Media and Information Literacy TGDokument194 SeitenMedia and Information Literacy TGEverdina GiltendezNoch keine Bewertungen

- Launching A New ProductDokument22 SeitenLaunching A New ProductNayomi EkanayakeNoch keine Bewertungen

- Group7 Bsa 3L Importance of Accounting Information System Ais To The Management Decision MakingDokument34 SeitenGroup7 Bsa 3L Importance of Accounting Information System Ais To The Management Decision MakingCristy Martin YumulNoch keine Bewertungen

- CH 3 Accounting For Mudharabah Financing 1Dokument32 SeitenCH 3 Accounting For Mudharabah Financing 1Yusuf Hussein40% (5)

- Managing Information and TechnologyDokument7 SeitenManaging Information and Technologyjelyn bermudezNoch keine Bewertungen

- What Is The Data Privacy Act of 2012Dokument9 SeitenWhat Is The Data Privacy Act of 2012Dessa Ruth ReyesNoch keine Bewertungen

- Thesis PDFDokument65 SeitenThesis PDFApril Jane FabreNoch keine Bewertungen

- KSSMPK Scheme of Work English For Communication Form 5 Special Education Week Theme Learning Standard Listening and Speaking Reading WritingDokument4 SeitenKSSMPK Scheme of Work English For Communication Form 5 Special Education Week Theme Learning Standard Listening and Speaking Reading Writingmahesi magenNoch keine Bewertungen

- Role of Accounting Information Systems and Its Potential Contribution in Tax ComputationsDokument5 SeitenRole of Accounting Information Systems and Its Potential Contribution in Tax ComputationsCarrya LovatoNoch keine Bewertungen

- F2105073949 PDFDokument11 SeitenF2105073949 PDFshiferaw megisoNoch keine Bewertungen

- I Tool in OrganisationsDokument7 SeitenI Tool in OrganisationsDark ShadowNoch keine Bewertungen

- Assessment 3 A. Information Technology (It)Dokument6 SeitenAssessment 3 A. Information Technology (It)quratulainNoch keine Bewertungen

- Accounting Information SystemDokument22 SeitenAccounting Information SystemMickey KNoch keine Bewertungen

- Chapter22222 OuttDokument14 SeitenChapter22222 OuttAmrran AbdiNoch keine Bewertungen

- The Information System: An Accountant's PerspectiveDokument33 SeitenThe Information System: An Accountant's PerspectiveLUIS ALFONSO DELA CRUZNoch keine Bewertungen

- Prod CycleDokument8 SeitenProd CycleZenn Vanrim LopezNoch keine Bewertungen

- The Study of Accounting Information Systems:: Essential Concepts and ApplicationsDokument19 SeitenThe Study of Accounting Information Systems:: Essential Concepts and ApplicationsNhoel RsNoch keine Bewertungen

- James Hall IDokument8 SeitenJames Hall ITafadzwa Leon SemuNoch keine Bewertungen

- Research ProjectDokument8 SeitenResearch ProjectAriesNoch keine Bewertungen

- AIN1501 - Study Unit - 2Dokument4 SeitenAIN1501 - Study Unit - 2Hazel NyamukapaNoch keine Bewertungen

- NEOGYDokument19 SeitenNEOGYsoniaNoch keine Bewertungen

- Evaluation of Efficiency of Accounting Information Systems: A Study On Mobile Telecommunication Companies in BangladeshDokument16 SeitenEvaluation of Efficiency of Accounting Information Systems: A Study On Mobile Telecommunication Companies in BangladeshISRAEL MUGWENHINoch keine Bewertungen

- P. Accounting & F.M Assignment.Dokument11 SeitenP. Accounting & F.M Assignment.Oneof TNNoch keine Bewertungen

- Computerized Accounting System: Key On Establishing An Efficient Decision Making AND Business DevelopmentDokument36 SeitenComputerized Accounting System: Key On Establishing An Efficient Decision Making AND Business Developmentsheryl ann dizonNoch keine Bewertungen

- Impact of Accounting Information System As A Management Tool in OrganisationsDokument8 SeitenImpact of Accounting Information System As A Management Tool in OrganisationsJimmer CapeNoch keine Bewertungen

- Module 1 Introduction To AISDokument7 SeitenModule 1 Introduction To AISArn KylaNoch keine Bewertungen

- Ais lý thuyếtDokument13 SeitenAis lý thuyếtAnh Trần ViệtNoch keine Bewertungen

- Impact of Accounting InformationDokument4 SeitenImpact of Accounting InformationNisa IstafadNoch keine Bewertungen

- Effect of Management Information SystemDokument23 SeitenEffect of Management Information Systemsujata bhartiNoch keine Bewertungen

- Usefulness of Accounting Information SystemsDokument5 SeitenUsefulness of Accounting Information Systemsdiqyst33251Noch keine Bewertungen

- GOFWAHDokument4 SeitenGOFWAHsoniaNoch keine Bewertungen

- PlanningDokument11 SeitenPlanningSwati SinghNoch keine Bewertungen

- Impact of Top Management Support On Accounting Information System: A Case of Enterprise Resource Planning (ERP) SystemDokument8 SeitenImpact of Top Management Support On Accounting Information System: A Case of Enterprise Resource Planning (ERP) Systemzelalem shiferawNoch keine Bewertungen

- Mis & ErpDokument11 SeitenMis & Erpkar3kNoch keine Bewertungen

- The Role of Accounting Information System On Business PerformanceDokument9 SeitenThe Role of Accounting Information System On Business Performanceindex PubNoch keine Bewertungen

- A Review On Determinants of Accounting Information System AdoptionDokument6 SeitenA Review On Determinants of Accounting Information System AdoptionTah ape apeNoch keine Bewertungen

- Accounting Information System and ImprovDokument8 SeitenAccounting Information System and Improvgold.2000.dzNoch keine Bewertungen

- Accounting 1Dokument5 SeitenAccounting 1Dương Nguyễn ThuỳNoch keine Bewertungen

- Cost Accounting CoverDokument10 SeitenCost Accounting CoverRavi MogliNoch keine Bewertungen

- AIS C1 EdDokument12 SeitenAIS C1 Edhanan yishakNoch keine Bewertungen

- Assignment # 2Dokument21 SeitenAssignment # 2haroonsaeed12Noch keine Bewertungen

- Impact of Accounting Information Systems (AIS) On Organizational Performance A Case Study of TATA Consultancy Services (TCS) - IndiaDokument8 SeitenImpact of Accounting Information Systems (AIS) On Organizational Performance A Case Study of TATA Consultancy Services (TCS) - IndiaHerna TobingNoch keine Bewertungen

- 2 - AlnajjarDokument19 Seiten2 - AlnajjarWHILSA PUTRA MUTHINoch keine Bewertungen

- AIS-Chapter 1Dokument12 SeitenAIS-Chapter 1bisrattesfayeNoch keine Bewertungen

- Business Information Reflective EssayDokument5 SeitenBusiness Information Reflective EssayMalcolm TumanaNoch keine Bewertungen

- 89-Article Text-123-1-10-20181028Dokument8 Seiten89-Article Text-123-1-10-20181028Deus MalimaNoch keine Bewertungen

- 2 The Information EnvironmentDokument19 Seiten2 The Information Environment2205611Noch keine Bewertungen

- Computerized Accounting Systems and Financial Performance Among Firms in KenyaDokument8 SeitenComputerized Accounting Systems and Financial Performance Among Firms in Kenyakumpepertuazhia11Noch keine Bewertungen

- Computerised AccountingDokument9 SeitenComputerised AccountingDr.K.Baranidharan0% (1)

- 1 Chapter 1Dokument9 Seiten1 Chapter 1Shyne MonteverdNoch keine Bewertungen

- RRL 2023Dokument5 SeitenRRL 2023John Mark CleofasNoch keine Bewertungen

- AIS Chapter 1Dokument5 SeitenAIS Chapter 1Reyna Marie Labadan-LasacarNoch keine Bewertungen

- Effect of Accounting Information System On Financial Performance of Firms: A Review of LiteratureDokument12 SeitenEffect of Accounting Information System On Financial Performance of Firms: A Review of LiteratureWillowNoch keine Bewertungen

- Firm Size, Leverage and Profitability Overriding Impact of Accounting Information SystemDokument8 SeitenFirm Size, Leverage and Profitability Overriding Impact of Accounting Information SystemadillawaNoch keine Bewertungen

- Accounting Information SystemDokument79 SeitenAccounting Information Systemవెంకటరమణయ్య మాలెపాటిNoch keine Bewertungen

- Accounting Information Systems, 6: Edition James A. HallDokument41 SeitenAccounting Information Systems, 6: Edition James A. HallJc BuenaventuraNoch keine Bewertungen

- The Information System: An Accountant's PerspectiveDokument16 SeitenThe Information System: An Accountant's PerspectivevvNoch keine Bewertungen

- DefinitionDokument2 SeitenDefinitionKrisha TubogNoch keine Bewertungen

- Management Information systems - MIS: Business strategy books, #4Von EverandManagement Information systems - MIS: Business strategy books, #4Noch keine Bewertungen

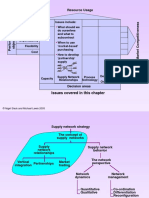

- Resource Usage: Issues Covered in This ChapterDokument21 SeitenResource Usage: Issues Covered in This ChapterYusuf HusseinNoch keine Bewertungen

- RSH - Qam11 - Excel and Excel QM Explsm2010Dokument153 SeitenRSH - Qam11 - Excel and Excel QM Explsm2010Yusuf HusseinNoch keine Bewertungen

- Except The: Income Sharing RatioDokument1 SeiteExcept The: Income Sharing RatioYusuf HusseinNoch keine Bewertungen

- Exam - Final - 11Dokument7 SeitenExam - Final - 11Yusuf HusseinNoch keine Bewertungen

- Data and Process Modeling: Husein OsmanDokument17 SeitenData and Process Modeling: Husein OsmanYusuf HusseinNoch keine Bewertungen

- Yaaqshiid: 1 Xaafadaha, Laamaha Iyo Waax-AhaDokument4 SeitenYaaqshiid: 1 Xaafadaha, Laamaha Iyo Waax-AhaYusuf HusseinNoch keine Bewertungen

- Lesson ThreeDokument14 SeitenLesson ThreeYusuf HusseinNoch keine Bewertungen

- Exam 2 Sample SolutionDokument6 SeitenExam 2 Sample SolutionYusuf HusseinNoch keine Bewertungen

- QuizzDokument1 SeiteQuizzYusuf HusseinNoch keine Bewertungen

- Binomial Distribution WorksheetDokument2 SeitenBinomial Distribution WorksheetYusuf Hussein100% (1)

- Capital BudgetDokument124 SeitenCapital BudgetYusuf HusseinNoch keine Bewertungen

- Example DVDDokument17 SeitenExample DVDYusuf HusseinNoch keine Bewertungen

- Chapter Four: Entering Beginning BalancesDokument4 SeitenChapter Four: Entering Beginning BalancesYusuf HusseinNoch keine Bewertungen

- Chapter 1Dokument29 SeitenChapter 1Yusuf Hussein100% (2)

- Chapter EightDokument11 SeitenChapter EightYusuf HusseinNoch keine Bewertungen

- Key Concepts: Week 5 Lesson 3: Economic Order Quantity (EOQ) ExtensionsDokument5 SeitenKey Concepts: Week 5 Lesson 3: Economic Order Quantity (EOQ) ExtensionsYusuf HusseinNoch keine Bewertungen

- Solution of Assignment Eco-04 Case: Mike (The Plumber) - A True StoryDokument5 SeitenSolution of Assignment Eco-04 Case: Mike (The Plumber) - A True StoryYusuf HusseinNoch keine Bewertungen

- MSci331 - Simplex and Big MDokument34 SeitenMSci331 - Simplex and Big MYusuf HusseinNoch keine Bewertungen

- COB291, Section - or Time of Class - Home Work Decision AnalysisDokument8 SeitenCOB291, Section - or Time of Class - Home Work Decision AnalysisYusuf HusseinNoch keine Bewertungen

- Sample Solution: Midterm Exam - 300 PointsDokument4 SeitenSample Solution: Midterm Exam - 300 PointsYusuf HusseinNoch keine Bewertungen

- Chapter 6 AnswersDokument8 SeitenChapter 6 AnswersYusuf HusseinNoch keine Bewertungen

- X P (X) XP (X) (X - E (X) ) P (X) : To See The Formulas, Hold Down The CTRL Key and Press The ' (Grave Accent) KeyDokument7 SeitenX P (X) XP (X) (X - E (X) ) P (X) : To See The Formulas, Hold Down The CTRL Key and Press The ' (Grave Accent) KeyYusuf HusseinNoch keine Bewertungen

- Chapter 6 Cost AccountingDokument12 SeitenChapter 6 Cost AccountingYusuf HusseinNoch keine Bewertungen

- CH I Introudction AISDokument11 SeitenCH I Introudction AISYusuf HusseinNoch keine Bewertungen

- Research Methods - STA630 Spring 2007 Assignment 05Dokument2 SeitenResearch Methods - STA630 Spring 2007 Assignment 05Yusuf HusseinNoch keine Bewertungen

- PeTa#1 InfomercialDokument12 SeitenPeTa#1 InfomercialMelvy EspanolNoch keine Bewertungen

- Ba 4242 Asi GB PDFDokument36 SeitenBa 4242 Asi GB PDFRenan SonciniNoch keine Bewertungen

- Buckland Information As Thing 2Dokument11 SeitenBuckland Information As Thing 2VJ MURALNoch keine Bewertungen

- Dlp-English 8 - March 02, 2023Dokument8 SeitenDlp-English 8 - March 02, 2023Kerwin Santiago ZamoraNoch keine Bewertungen

- Nature and Function of LanguageDokument11 SeitenNature and Function of LanguageCarthy Tang0% (1)

- Case StudyDokument5 SeitenCase Studyrohit utekarNoch keine Bewertungen

- Net ChakraDokument45 SeitenNet Chakracrashnburn4uNoch keine Bewertungen

- Teaching The WeatherDokument22 SeitenTeaching The WeatherNaylaNoch keine Bewertungen

- (Rishab Jain) Project Work PDFDokument79 Seiten(Rishab Jain) Project Work PDFRishabNoch keine Bewertungen

- How To Write A Conclusion For A Science Fair Research PaperDokument8 SeitenHow To Write A Conclusion For A Science Fair Research Paperc9sqf3keNoch keine Bewertungen

- 1.definition of A SystemDokument20 Seiten1.definition of A SystemGeethma RamanayakaNoch keine Bewertungen

- المحكمة الرقمية في إطار التقاضي الالكترونيDokument32 Seitenالمحكمة الرقمية في إطار التقاضي الالكترونيouchia hichamNoch keine Bewertungen

- NRTI Brochure AY 2022 23 1 - 2 - 2Dokument40 SeitenNRTI Brochure AY 2022 23 1 - 2 - 2sum ranjan patraNoch keine Bewertungen

- LESSON 1 Using ICT in Developing 21st Century SkillsDokument21 SeitenLESSON 1 Using ICT in Developing 21st Century SkillsJunelyn Gapuz VillarNoch keine Bewertungen

- 8 - Properties - of - Communication PURCOMM LESSON1Dokument4 Seiten8 - Properties - of - Communication PURCOMM LESSON1Jerico PitaNoch keine Bewertungen

- The Relativistic Brain by Ronald Cicurel and Miguel L. Nicolelis (2015)Dokument5 SeitenThe Relativistic Brain by Ronald Cicurel and Miguel L. Nicolelis (2015)Sinem SerapNoch keine Bewertungen

- Quarter-2 MPS Consolidated English Periodic-TestDokument15 SeitenQuarter-2 MPS Consolidated English Periodic-Testismael delosreyesNoch keine Bewertungen

- Udlg Graphicorganizer v2-2 Numbers-YesDokument1 SeiteUdlg Graphicorganizer v2-2 Numbers-YesIGNACIO MOREIRANoch keine Bewertungen

- Year 3 Mathematics Portfolio SatisfactoryDokument34 SeitenYear 3 Mathematics Portfolio SatisfactoryWooSeok ChoiNoch keine Bewertungen

- BattlespaceAwareness PDFDokument17 SeitenBattlespaceAwareness PDFYesika RamirezNoch keine Bewertungen