Beruflich Dokumente

Kultur Dokumente

Group Project Asignment

Hochgeladen von

Azizi MustafaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Group Project Asignment

Hochgeladen von

Azizi MustafaCopyright:

Verfügbare Formate

BUSINESS ACCOUNTING | BKAL1013

TABLE OF CONTENTS

CONTENTS

PAGE

1.0 INTRODUCTION

2.0 COMPANYS BACKGROUND AND STRATEGIES

2.1 ECONOMIC LANDSCAPE

2.2 DIVIDENDS

2.3 OPERATIONS REVIEW

2.4 ENVIRONMENTAL PERFORMANCE

2.5 MARKETING

2.6 HUMAN CAPITAL

2.7 OUTLOOK

2.8 ACKNOWLEDGEMENT

3.0 RATIO ANALYSIS

3.1 CURRENT RATIO

3.2 RATIO OF FIXED- ASSETS TO LONG-TERM

LIABILITIES

3.3 RATIO OF NET SALES TO ASSETS

3.4 RATE EARNED ON TOTAL ASSETS

3.5 RATE EARNED ON STOCKHOLDERS EQUITY

3.6 EARNINGS PER SHARE ON COMMON STOCK

4.0 DISCUSSION

4.1 CURRENT RATIO

4.2 RATIO OF FIXED-ASSETS TO LONG-TERM

10

LIABILITIES

4.3 RATIO OF NET SALES TO ASSETS

4.4 RATE EARNED ON TOTAL ASSETS

4.5 RATE EARNED ON STOCKHOLDERS EQUITY

4.6 EARNINGS PER SHARE ON COMMON STOCK

5.0 CONCLUSION

4

4

5

5

6

7

8

9

12

12

12

13

13

14

14

15

15

16

16

16

18

18

19

1.0

INTRODUCTION

BUSINESS ACCOUNTING | BKAL1013

Hartalega was the inventor of the worlds first lightweight Nitrile glove in 2002,

which caused a demand shift from latex to nitrile gloves all over the globe. Needless

to say, Hartalega are now the largest producer of nitrile gloves in the world, capable of

manufacturing 22 billion gloves a year and will progressively expand to 42 billion

gloves in 2020.

Hartalegas continued technological innovations help ensure gloves are manufactured

with equal emphasis on efficiency and quality; a key reason why they are trusted as

the OEM manufacturer for some of the worlds biggest brands.Their workforce of

5,500 people across 7 dedicated manufacturing facilities has also done them proud.

Hartalega has gone on to win many prestigious accolades, including recognitions from

Forbes Asia, KPMG and Asia Money.As they expand globally, Hartalega will

continue to be coveted as the preferred choice in gloves.

In this assignment, the background of the company will be discussed in general to

further illustrate the business nature of the company. This will provide the basis for

the further discussion of Hartalega's business strategies. Besides, the chairmans

report is used for reference in order to figure out some of the strategies or major

course of actions that Hartalega Holdings Berhad has taken over the financial year

period.

Furthermore, a two subsequent years ratio analysis which is in 2014 and 2015 of

Hartalega is prepared based on the information given in financial statements. The ratio

analysis includes of current ratio, ratio of fixed assets to long-term liabilities, ratio of

net sales to assets and so on. After that, these ratios are calculated and compared. The

report discusses the possible conditions or factors, supported by statements in various

sections of the companys annual reports. This helps to explain and summarizes the

results of the analysis.

Reports are used in business, finance, education, government, and manufacturing.

Why are the business reports important in any company? This is because the report

2

BUSINESS ACCOUNTING | BKAL1013

provides the interpretation and explanation of information which can be easily

understand by the readers. A report is not only the basic management tool for making

decisions but also recommend natural actions or solutions to solve problem.

Moreover, annual reports provide information on the companys mission and history

and summarize the companys achievements in the past year.

2.0

COMPANYS BACKGROUND AND STRATEGIES

BUSINESS ACCOUNTING | BKAL1013

2.1

ECONOMIC LANDSCAPE

Global economic growth was moderate in 2014. Although the

US was on the road to recovery, the European Union was still

gripped by the effects of the financial crisis, while emerging

markets, including Asian economies, saw subdued growth.

Malaysias glove manufacturing sector bore the brunt of

external market factors which affected all industry players.

This included softening raw material costs due to global

rubber supply surplus, which drove down average selling

prices, as well as higher operating costs due to increased

electricity and gas tariffs. Despite the tough economic climate,

global demand for rubber gloves saw robust growth during the

year. Demand growth was consistent in both developed and

emerging markets, buoyed by increasing healthcare standards

as well as healthcare reforms, particularly in developing

countries. Malaysia commanded approximately 62% of the

global export market in 2014, with total exports of rubber

gloves expanding 8.6% year-on-year to 48.9 billion pairs.

Nitrile rubber gloves took the lead once again, amounting to

51% of Malaysias total rubber glove exports. Exports of

synthetic rubber gloves rose by 9.7% to 24.9 billion pairs in

2014 compared with 22.7 billion pairs in the previous year,

and increased by 7.2% in value terms. In comparison, total

exports of natural rubber gloveshad a growth rate of 7.4% in

quantity terms and a 1.5% decline in value terms.

The US was the chief export region for Malaysian nitrile rubber

gloves, commanding over 30% of exports. The southern

regions of Europe and other emerging markets including China

and Brazil also registered growth in exports of nitrile rubber

gloves. Clearly, the industry is ripe with potential, and

BUSINESS ACCOUNTING | BKAL1013

Hartalega is well-positioned to tap into these prospects over

the long-term.

For the financial year ended 31 March 2015, the Group

registered a profit after tax of RM210.21 million, compared

with RM233.29 million in the previous fiscal year. Profit before

tax came in at RM276.9 million. This drop was primarily

attributable to higher start-up costs for the NGC. Other factors

which also had an impact were lower average selling prices as

a result of declining raw material costs and more competitive

selling prices, as well as higher electricity and natural gas

tariffs driving up operational costs, which put pressure on

operating profit margins. However, due to the Groups high

level of productivity and manufacturing efficiency, Hartalega

profit margins remained well above the industry average.

Furthermore, the Group continued to record solid topline

growth on a year-on-year basis. Revenue for the year grew by

3.5% to RM1.145 billion compared with RM1.107 billion last

year due to higher sales volume. In line with Hartalega

commitment to sustaining profitability and strengthening

balance sheet,

Hartalega

earnings

before

interest,

tax,

depreciation and amortisation (EBITDA) came in at RM323

million. The cash balance for the Group was RM70.5 million.

Meanwhile, earnings per share for the year stood at 27.01 sen,

and net assets per share attributable to the owners of the

company was 158 sen. Although market conditions remain

challenging, what is important is that Hartalega are a resilient

Group, with an agile and capable talent pool leading us

forward.

2.2

DIVIDENDS

BUSINESS ACCOUNTING | BKAL1013

The Group is firmly dedicated to enhancing value for

Hartalega shareholders Via consistent dividend yields. This is

demonstrated by Hartalega dividend policy, which commits a

minimum payout of 45% of the Groups annual net profit.

Towards this end, they have successfully paid out a total

dividend of 9 sen per share to date. The Board expects to

announce a final dividend at the Ninth Annual General

Meeting.

2.3

OPERATIONS REVIEW

Research and Development:Passion for innovation has always

been the driving

force behind Hartalega growth and success. As they move

forward, Hartalega

research and development (R&D) efforts are a key pillar of the

Group. A clear

reflection of this is Hartalega state-of-the-art Next Generation

Integrated Glove Manufacturing Complex (NGC). The NGC is

set to raise the bar even higher for the industry, as an iconic

glove

complex

that

incorporates

the

most

advanced

production technologies, attractive workplace design, and a

Centre of Excellence comprising Research and Development

and Learning Centres to inspire more innovation. Hartalega

commissioned the first three production lines of Plant 1 and 2

of the NGC during the year under review, with a production

line speed of 45,000 piecesper hour, the highest in the

industry

due

to

Hartalega

superior

manufacturing

technologies and automation.

All production technologies within the Group are inhouse

engineered and proprietary to Hartalega, giving their an edge

over our competitors in terms of quality and productivity. In

6

BUSINESS ACCOUNTING | BKAL1013

fact, the NGC production lines are even outperforming some of

their existing plants. As a result of this, they decommissioned

Plant 1 of their Bestari Jaya operations due to lower efficiency.

With the onset of the NGC, they have been able to set new

industry benchmarks as they improve overall efficiency and

workflow, boosting their total installed capacity to 16 billion

pieces of gloves per annum to date. Along with productivity

improvements, they also cognisant of the importance of

keeping abreast with ever-evolving markets.

2.4

ENVIRONMENTAL PERFORMANCE

In tandem with Hartalega growth over the years, they have

always taken conscious steps to protect the environment in

the areas in which they have a presence. Towards this end,

they have implemented various sustainable measures with a

view towards actively preserving and safeguarding their ecosystem.

This

includes

their

biomass

and

waste

water

treatment plants, to preserve water supply and air quality by

ensuring effluent water discharge and air emission levels are

in compliance with the standards of Jabatan Alam Sekitar

(JAS).

Moreover, Hartalega was one of only four manufacturing

companies and the only rubber glove manufacturer listed in

the Index. This clearly demonstrates the Groups unwavering

commitment

towards

establishing

throughout our operations.

2.5

MARKETING

sustainable

practices

BUSINESS ACCOUNTING | BKAL1013

Their marketing strategy is a fundamental component of their

growth plans, as they strive to expand their brand presence in

key markets. Their efforts have certainly borne fruit, as

Hartalega is the only glove company with sustained sales

growth on a year-on-year basis, due to their strong client base

coupled with their reputation as an industry pioneer and our

top-of the-line products. The Groups total sales volume forthe

year increased to 12.5 billion pieces, compared with 11.5

billion pieces in the previous year. The US remained their

primary market with 48% of their nitrile glove exports,

followed by Europe which rose to 30%. Meanwhile, sales to the

Asia-Pacific region grew to 14%, largely attributable to

increased sales to Japan and China.

Additionally, in another milestone for the Group, they officially

launched their new global distribution arm, MUN, integrating

their operations throughout Australia, China, India and the US.

With the tagline, From the heart of many for many, MUN

epitomizes a mind-set of products from the heart, which

stems from Hartalegas passion for caring and innovation,

creating a global company that will touch live with our

innovative, high quality gloves. Complementing our long-term

expansion strategy, the establishment of MUN will allow us to

enhance our distribution channels in an integrated manner

and

standardise

operations,

building

an

even

stronger

foundation to extend our current reach. This will also open up

opportunities for the Group to tap into new markets in the

future. In conjunction with the launch of MUN, they also

unveiled GloveOn, a new umbrella brand representing their

existing glove business. The GloveOn brand will enable to

standardise their glove products worldwide.

BUSINESS ACCOUNTING | BKAL1013

2.6

HUMAN CAPITAL

The calibre of their human capital is integral to their success,

as their workforce is the backbone of the Group. As part of

their aim to enhance efficiencies across the board, they are

focused on creating a highly productive organisational culture

that incorporates lean management principles. As a result of

this, they were able to reduce their manual labour workforce

by 12% during the year. They are also actively engaged in

promoting

development

of skills

in

order

to scale

up

capabilities. Towards this end, they have established a number

of talent development programmes, workshops and other

initiatives. Along with their Human Resources Development

Programme, in the year under review we embarked on the

Aon-Hewitt

Leadership

management

addition,

they

team

have

to

Programme

enhance

for

core

implemented

the

the

Groups

competencies.

proven

In

Japanese

methodologies of 5S and Kaizen on a Group-wide basis. This

facilitates

organisational

environment,

encourages

efficiency

teamwork

within

and

the

workplace

discipline,

and

utilises a structured approach forcontinuous improvement.

They also rolled out a campaign to inculcate their core values

in thei employees, which are known as SHIELD: Synergy,

Honesty, Innovativeness, Excellence in Quality, Learning and

Dedication. Moreover, in order to attract and retain a highly

skilled workforce, they have introduced a second Executive

Share Option Scheme. This is in line with their objectives to

instil a sense of ownership as well as to incentivise and drive

performance in their employees. Further to this, their highperforming employees also had the opportunity to experience

international trade exhibitions in Europe, the Middle-East and

BUSINESS ACCOUNTING | BKAL1013

Asia. This provided them with valuable industry exposure and

enabled them to gain keen insights on global markets.

2.7

OUTLOOK

Despite contending with challenging market forces during the

year, Hartalega was able to weather through this by

leveraging on our solid foundation, established track record

and strong margins. The inherent prospects of the glove

industry bode well for your Group over the long-term,

particularly given the resilient demand growth for nitrile

gloves. They are poised to capture this growth with the NGC,

which is proceeding on track. Once completed, the NGC will

comprise a total of six state-ofthe- art manufacturing plants

housing 72 technologically advanced production lines. This will

significantly expand their installed capacity to over 42 billion

per annum and increase productivity by 33% compared to

their existing facilities. As the first production lines of the NGC

were commissioned in the fourth quarter of the year under

review, this did not contribute substantially to profitability.

However, with new lines being commissioned progressively,

the significant boost in capacity will certainly have a positive

impact in the coming years ahead. The NGC also has an

improved

structured

maintenance

schedule

to

ensure

optimum efficiency. In the long-run, they are confident that

the NGC will enable they to defend their margins and maintain

their dominance in the nitrile glove market. Although some

10

BUSINESS ACCOUNTING | BKAL1013

industry analysts cite concerns of oversupply, they firmly

believe that this is unlikely given robust demand. As

testament to this, Hartalega is operating at full capacity, with

a high utilisation rate of 80% to 90% for their production lines,

in order to meet the heightened demand for our quality

gloves. Glove makers are also building capacities at a

moderate pace on a staggered basis, which should cater to

steady demand growth year-on-year.

At this juncture, they do not anticipate a significant upsurge in

demand for gloves due to this, as these diseases have not had

a substantial overall impact; however they are wellprepared

with the new capacities set to come on-stream. As they

pursue opportunities for growth, their distribution platform

MUN is set to see greater penetration in emerging markets.

Particularly in countries such as China, where per capita

consumption of gloves is significantly lower than developed

markets such as Europe and theUS, there lies much untapped

potential that they can capitalise on. Moving forward, market

conditions are expected to ease as raw material costs

stabilise, with concerted efforts by the member countries of

the International Tripartite Rubber Council, including Malaysia,

to stem the fall of rubber prices.

In 2015, Malaysia also rolled out the Goods and Services Tax

which was a cause for concern for many industries. However,

this is expected to have negligible impact on the glove

industry which is predominantly export-driven. They are

cognisant of the importance of building a strong talent pool to

ensure

the

long-term

success

of

the

Group.

Talent

development continues to be a key focus area as they strive

to uphold a sustainable competitive advantage. In a rapidly

growing

market

and

increasingly

11

competitive

business

BUSINESS ACCOUNTING | BKAL1013

environment, Hartalega continues to maintain our leading

edge at the forefront of the industry, leveraging on their

passion for innovation and first-mover advantage in the nitrile

segment.

2.8

ACKNOWLEDGEMENT

Hartalega sincere appreciation to their Board members, as

well as their management team and employees, for their

steadfast dedication in guiding the Group forward. On a

personal note, Kuan Kam Hon @ Kwan Kam Onn would like

to thank Chuah Phaik Sim, who has decided to leave their

Board. Having been with they since their IPO, she has played a

vital role on the Board and her contributions have been

invaluable. On behalf of the Group, he would like to extend a

warm welcome to their newest Board member, Razman Hafidz

bin Abu Zarim, who was appointed as an Independent and

Non- Executive Director on 2 March 2015. Their gratitude also

goes

to

shareholders,

financiers,

business

partners,

consultants and relevant approving authorities for their

support.

The year under review certainly had its share of challenges, as

various pressures weighed down the glove manufacturing

sector. As a result of our forward-thinking strategy to sustain

our pole position in the nitrile glove segment, during the

financial year we officially commissioned the first production

lines of the Next Generation Integrated Glove Manufacturing

Complex (NGC). This is indeed a significant milestone for the

Group, in line with our drive to forge ahead and set new

benchmarks as a leader in the industry. We will continue to

12

BUSINESS ACCOUNTING | BKAL1013

shape the growth of the Group by leveraging on and

accelerating our strengths.

Over the long-term, we are confident of bright prospects

ahead.

3.0

RATIO ANALYSIS

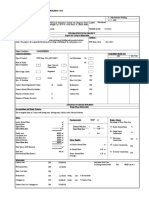

3.1

CURRENT RATIO

13

BUSINESS ACCOUNTING | BKAL1013

Current Assets

Current Liabilities

2015

2016

388,443,301

126,983,875

3.06

539,060,2

70

190,654,1

02

2.85

The current ratio of Hartalega in 2015 is 3.06 but in 2016 is only 2.85.

This means that a company has a amount of time in order to raise the funds to

pay for these liabilities.

3.2

RATIO OF FIXED- ASSETS TO LONG-TERM LIABILITIES

Fixed Assets(Net)

Long-Term Liabilities

2015

1,069,008,575

59,806,949

17.87

2016

1,422,039,

277

266,420,11

3

5.38

The Ratio of fixed- assets to long term in 2015 is 17.87 and its very different

in 2016 is only 5.38

3.3

RATIO OF NET SALES TO ASSETS

14

BUSINESS ACCOUNTING | BKAL1013

Net

Sales

Average Total Assets(Exclude long-term

investment)

2015

2016

276,990,069

1,961,099,54

7

317,254,565

1,457,451,87

6

0.14

0.21

Ratio of net sales to assets in 2015 is 0.14 and in 2016 is 0.21.

This ratio measures how efficiently a firm uses its assets to generate sales.

3.4

RATE EARNED ON TOTAL ASSETS

Net Income + Interest

Expense

Average Total Stockholder Equity

2015

2016

209,498,202 + 108,544

1,457,451,876

0.14

258,259,393 +

376,585

1,961,099,

547

0.13

The total asset turnover ratio calculates net sales as a percentage of assets to

show how many sales are generated from each dollar of company assets.

In 2015 it is 0.14 but in 2016 is 0.13

3.5

RATE EARNED ON STOCKHOLDERS EQUITY

15

BUSINESS ACCOUNTING | BKAL1013

Net

Income

Average Total Stockholder's

Equity

2015

2016

209,498,202

1,268,999,503

0.16

258,259,39

3

1,501,942,

273

0.17

Rate earned on stockholder's equity on 2015 is 0.16 and 2016 is 0.17.

Depending on the economy, this can be a healthy return rate no matter what

the investment is.

3.6

EARNINGS PER SHARE ON COMMON STOCK

Net income- Preffered Dividens

Shares of Common Stock

Outstanding

2015

2016

209498202-0

400,779,017

258,259,393-0

820,514,607

0.52

0.31

Earning per share on common stock in 2015 is 0.52 but in 2016 earning

decerease to 0.31.

Higher earnings per share is always better than a lower ratio because this

means shareholders.

The company is more profitable and the company has more profits to

distribute to its.

16

BUSINESS ACCOUNTING | BKAL1013

4.0

DISCUSSION

4.1

CURRENT RATIO

Current ratio function in this case is used to indicate the ability to meet

currently mature obligations. In other words, its used to measure companys

ability to pay short-term and long-term obligations. From the analysis

provided, the current ratio shows a decrease trends from 3.06 in 2015 to 2.85

in 2016. In this case, it shows that Hartalega Bhd has a amount of time in

order to raise the funds to pay for its debt.

This current ratio helps investors and creditors understand the liquidity of a

company and how easily that Hartalega will be able to pay off its current

liabilities. They have RM 388,443,301 in 2015 and RM 539,060,270 in 2016

for their current assets. Their current liabilities in 2015 is RM 126,983,875 and

2016 is RM 190,654,102. To find working capital current assets must be

subtract with current liabilities. When subtracted, Hartalega Bhd working

capital is RM 261,459,426 for 2015 and RM 348,406,168 for 2016.

This ratio expresses a firm's current debt in terms of current assets. So a

current ratio of 4 would mean that the company has 4 times more current

assets than current liabilities. A higher current ratio is always more favorable

than a lower current ratio because it shows that Hartalega Bhd can more easily

make current debt payments.

If a company has to sell of fixed assets to pay for its current liabilities, this

usually means the company isn't making enough from operations to support

activities. In other words, the company is losing money. If a company is

weighted down with a current debt, its cash flow will suffer.

17

BUSINESS ACCOUNTING | BKAL1013

4.2

RATIO OF FIXED-ASSETS TO LONG-TERM LIABILITIES

Ratio of fixed assets to long-term liabilities is a solvency measures that

indicates the margin of safety of the noteholders or bondholders. Based on

analysis, the ratio of fixed- assets to long term in 2015 is 17.87 and its very

different in 2016 is only 5.3.

The major decrease in this ratio at the end of 2015 is mainly due to liquidating

three-half of Hartalega Bhds long-term liabilities. If the company needs to

borrow additional funds on a long-term basis in the future, it is not in safe

position to make any debt or liabilities.

4.3

RATIO OF NET SALES TO ASSETS

The ratio of net sales to assets is a profitability measure that shows how

effectively a firm utilizes its assets. From the analysis, Hartalega Bhds ratio of

net sales to assets in 2015 is 0.14 and it raise up to 0.21 in 2016. If the sales of

one are twice the sales of the other, the business with the higher sales is

making better use of its assets. A comparison with similar company averages

would be helpful in assessting the effectiveness of Hartalega Bhds use of its

assets.

The total asset turnover ratio is an indicator of a companys profitability. A

company that has a high profit margin generally has high asset turnover. This

means Hartalega Bhd is able to make more sales with fewer assets than others

in the industry.

4.4

RATE EARNED ON TOTAL ASSETS

The rate earned on total assets are uses to measure the profritability of total

assets, without considering how the assets are financed. The total asset

turnover ratio calculates net sales as a percentage of assets to show how many

sales are generated from each dollar of company assets. Based on analysis,

18

BUSINESS ACCOUNTING | BKAL1013

Hartalega Bhd, rate earned in 2015 is 0.14 but in 2016 is 0.13. This shows that

this rate are not affected by whether the assets are financed primarily by

creditors or stockholders.

The rate earned on total assets of Hartalega Bhd during 2015 improved over

that of 2016. A comparison with similar companies and industry averages

would be useful in evaluating Hartalega Bhds profitability on total assets.

4.5

RATE EARNED ON STOCKHOLDERS EQUITY

Rate earned on stockholders equity or return on equity (ROE) are used to

assess the profitability of the investment by stockholders. Return on equity

measures how efficiently a firm can use the money from shareholders to

generate profits and grow the company. Unlike other return on investment

ratios, ROE is a profitability ratio from the investor's point of view this does

not the company. In other words, this ratio calculates how much money is

made based on the investors' investment in the company, not the company's

investment in assets or something else. In this analysis, the rate earned on

stockholder's equity that Hartalega Bhd gain on 2015 is 0.16 and 2016 is 0.17.

Investors want to see a high return on equity ratio because this indicates that

Hartalega Bhd

is using its investors' funds effectively. Higher ratios are

almost always better than lower ratios, but have to be compared to other

companies' ratios in the industry. Since every industry has different levels of

investors and income, ROE can't be used to compare companies outside of

their industries very effectively.

Many investors also choose to calculate the return on equity at the beginning

of a period and the end of a period to see the change in return. This helps track

a company's progress and ability to maintain a positive earnings trend.

19

BUSINESS ACCOUNTING | BKAL1013

4.6

EARNINGS PER SHARE ON COMMON STOCK

Earnings per share on common stock are used to assess the profitability of the

investment by common stockholders. Earning per share is the same as any

profitability or market prospect ratio. In analysis provided, Hartalega Bhds

earning per share on common stock in 2015 is 0.52 but in 2016 earning

decrease to 0.31.

Higher earnings per share is always better than a lower ratio because this

means the company is more profitable and the company has more profits to

distribute to its shareholders. But in this case Hartalega Bhd does not have an

ability to distribute to its shareholders.

20

BUSINESS ACCOUNTING | BKAL1013

21

BUSINESS ACCOUNTING | BKAL1013

5.0

CONCLUSION

From our eveluation of the performance of Hartalega Holding Berhad, we has found

that this company show a good performance in year 2015 and 2016. The ratio analysis

also showed that this company perform very well and almost all ratio analysis is

positive. However compare to previous year that is 2015, the company performance is

decreasing in several aspects but still acceptable because the economic pressure is

very high in current year.

Last but not least, we suggest that company to take several defensive strategies to

make sure their performance is not effected too much with the enviromental pressure.

They should make sure they can survive and maintain their performance.

We think that Hartalega Holding Berhad has high potential business in Malaysia

however the economic may give negative effect and investor should hold their

investment as we think they can overcome the pressure and increase their

performance in the future.

22

Das könnte Ihnen auch gefallen

- Guide to Good Practice in the Management of Time in Complex ProjectsVon EverandGuide to Good Practice in the Management of Time in Complex ProjectsNoch keine Bewertungen

- CUACA Troubleshooting GuideDokument38 SeitenCUACA Troubleshooting GuideYomiSadikuNoch keine Bewertungen

- A Cost Control System Development - A Collaborative Approach For Small and Medium-Sized ContractorsDokument8 SeitenA Cost Control System Development - A Collaborative Approach For Small and Medium-Sized Contractorsntl9630Noch keine Bewertungen

- Dayang Sabriah Safri MFKA2009Dokument114 SeitenDayang Sabriah Safri MFKA2009Muhammad AmirNoch keine Bewertungen

- The Accuracy of Pre-Tender Building Cost Estimates in Australia.Dokument14 SeitenThe Accuracy of Pre-Tender Building Cost Estimates in Australia.Barbara Kruzic0% (1)

- Planning EngineerDokument7 SeitenPlanning EngineerAnonymous qg3W2rsRcG100% (1)

- DQS360 Tutorial 5 Constraints & Basic Features of Project SoftwareDokument3 SeitenDQS360 Tutorial 5 Constraints & Basic Features of Project Softwarelily0% (1)

- Topic 2 - Cost IndexDokument26 SeitenTopic 2 - Cost IndexAlwin ChgNoch keine Bewertungen

- ECM 566 Construction Project Management Course OverviewDokument9 SeitenECM 566 Construction Project Management Course OverviewiskandarNoch keine Bewertungen

- Eco MinionDokument45 SeitenEco MinionAidi RedzaNoch keine Bewertungen

- Sarawak Digital Economy Strategy: An Overview BookletDokument36 SeitenSarawak Digital Economy Strategy: An Overview BookletGiovanna AdlimNoch keine Bewertungen

- 06 Emcm5203 T2Dokument23 Seiten06 Emcm5203 T2HASMANIRA100% (1)

- Project Plan: AcceptanceDokument5 SeitenProject Plan: AcceptanceSFGovNoch keine Bewertungen

- Prepared By: Amrita Chatterjee Swarnendu Bhattacharjee: Adamas Institute of Technology, Civil Engineering, 3 YearDokument79 SeitenPrepared By: Amrita Chatterjee Swarnendu Bhattacharjee: Adamas Institute of Technology, Civil Engineering, 3 YearMonjit RoyNoch keine Bewertungen

- Costing For Civil Engineering ProjectDokument26 SeitenCosting For Civil Engineering ProjectArchangelmc50% (2)

- Material resource planning and ABC analysis techniquesDokument15 SeitenMaterial resource planning and ABC analysis techniquesAmila Thiwanka Nawarathna GedaraNoch keine Bewertungen

- LCC SoftwareDokument2 SeitenLCC SoftwareKu Azriesha Ku AzmiNoch keine Bewertungen

- Logbook QsDokument4 SeitenLogbook QsAlang ZulkefliNoch keine Bewertungen

- Role of Project ManagersDokument10 SeitenRole of Project Managersapi-3860630100% (1)

- Materials Management Optimization for Healthcare FacilitiesDokument30 SeitenMaterials Management Optimization for Healthcare FacilitiesAshutosh Kumar0% (1)

- Self-Assessment Site Set-Up ChecklistDokument2 SeitenSelf-Assessment Site Set-Up ChecklistArunKumar GNoch keine Bewertungen

- NOTE DCE3408 2 LeadersipDokument26 SeitenNOTE DCE3408 2 LeadersipTaufik AkieNoch keine Bewertungen

- Factors Affecting Construction Project Overhead ExpensesDokument13 SeitenFactors Affecting Construction Project Overhead ExpensesbuddikalrNoch keine Bewertungen

- Subject: Management Civil Ii: Lecture Notes HandoutDokument6 SeitenSubject: Management Civil Ii: Lecture Notes Handoutabstickle100% (1)

- Method Statement For Pile Loading Test - Rev.01 As Per CommentDokument4 SeitenMethod Statement For Pile Loading Test - Rev.01 As Per CommentAnija RamleeNoch keine Bewertungen

- Demolition and excavation worksDokument30 SeitenDemolition and excavation worksHafizan Hanafiah100% (3)

- CADANGAN MEMBINA DEWAN SERBAGUNA UUMDokument9 SeitenCADANGAN MEMBINA DEWAN SERBAGUNA UUMYiong Chin LiongNoch keine Bewertungen

- Eca FormsDokument7 SeitenEca Forms刘会卿Noch keine Bewertungen

- Ankit Balyan U06CE065 B.Tech IV CED, SVNIT, SuratDokument20 SeitenAnkit Balyan U06CE065 B.Tech IV CED, SVNIT, SuratankitbalyanNoch keine Bewertungen

- Moura Et Al. 2014 - Line of Balance Is It A Synthesis of Lean Production Principles As Applied To Site Programming of WorksDokument12 SeitenMoura Et Al. 2014 - Line of Balance Is It A Synthesis of Lean Production Principles As Applied To Site Programming of WorksReyLeonNoch keine Bewertungen

- Management and Principles For Quantity SurveyorDokument73 SeitenManagement and Principles For Quantity SurveyorMadhusudhanan VijayanNoch keine Bewertungen

- Supply Chain AuditDokument4 SeitenSupply Chain AuditMuhammad WaqarNoch keine Bewertungen

- AQS 2230 Department of Quantity Surveying International Islamic University Malaysia Coursework 1 Award of MarksDokument9 SeitenAQS 2230 Department of Quantity Surveying International Islamic University Malaysia Coursework 1 Award of MarksABDUL RAZINoch keine Bewertungen

- 16 Cost EstimatingDokument5 Seiten16 Cost EstimatinganasameranaNoch keine Bewertungen

- Case Studies in Project Management Semester September 2020Dokument8 SeitenCase Studies in Project Management Semester September 2020faroukalias100% (1)

- QS Presentation SlidesDokument33 SeitenQS Presentation SlidesNazrul KamsolNoch keine Bewertungen

- De Assignment (FINAL)Dokument21 SeitenDe Assignment (FINAL)ChungHuiPing100% (1)

- Report Part 2Dokument36 SeitenReport Part 2Seth NurulNoch keine Bewertungen

- Study of Factors Affecting Construction Cost Performance in Nigerian Construction Sites. Amusan.L.M E-Mail: Worldalternativeamusan@yahoo AbstractDokument18 SeitenStudy of Factors Affecting Construction Cost Performance in Nigerian Construction Sites. Amusan.L.M E-Mail: Worldalternativeamusan@yahoo AbstractAfeez MayowaNoch keine Bewertungen

- ESTIMATING & CONTRACT MEASUREMENT PRINCIPLESDokument228 SeitenESTIMATING & CONTRACT MEASUREMENT PRINCIPLESNg Zhe ShengNoch keine Bewertungen

- Mini Project SampleDokument7 SeitenMini Project Samplevishal100% (1)

- Effect of Organizational Culture On Delay in Construction PDFDokument12 SeitenEffect of Organizational Culture On Delay in Construction PDFashikNoch keine Bewertungen

- Eca KosongDokument3 SeitenEca KosongWN MHNoch keine Bewertungen

- Ponding On The Flat RoofsDokument4 SeitenPonding On The Flat RoofsthirumalaichettiarNoch keine Bewertungen

- The Strategic Role of Project Portfolio Management: Evidence From The NetherlandsDokument13 SeitenThe Strategic Role of Project Portfolio Management: Evidence From The NetherlandsPrakash SinghNoch keine Bewertungen

- Construction Price IndexDokument3 SeitenConstruction Price IndexRanjith EkanayakeNoch keine Bewertungen

- National Infrastructure Plan 251010Dokument52 SeitenNational Infrastructure Plan 251010himanshu_nigamNoch keine Bewertungen

- Estimation and CostingDokument46 SeitenEstimation and CostingBALAMURUGAN R100% (1)

- Contract Doc AnalysisDokument47 SeitenContract Doc AnalysisHazirah ZieraNoch keine Bewertungen

- Schedule of RatesDokument42 SeitenSchedule of RatesShaukat Ali KhanNoch keine Bewertungen

- A2 1StrategicCorporatefinanceDokument187 SeitenA2 1StrategicCorporatefinanceMANIRAGABA Alphonse100% (1)

- Manual for Consultant Quantity SurveyorsDokument44 SeitenManual for Consultant Quantity SurveyorsGani Osal TyNoch keine Bewertungen

- Productivity Rate AnalysisDokument6 SeitenProductivity Rate AnalysismhdfhmNoch keine Bewertungen

- SR (1) .Quantity SurveyorDokument4 SeitenSR (1) .Quantity SurveyorpoplinuiytNoch keine Bewertungen

- Project Control Stages A Complete Guide - 2019 EditionVon EverandProject Control Stages A Complete Guide - 2019 EditionNoch keine Bewertungen

- Highway Engineer: Passbooks Study GuideVon EverandHighway Engineer: Passbooks Study GuideNoch keine Bewertungen

- A8Dokument15 SeitenA8Chaitanya AbhishekNoch keine Bewertungen

- Gordon (1963)Dokument10 SeitenGordon (1963)Claudio PilarNoch keine Bewertungen

- MS11 Decentralization Segment Reporting Responsibility Accounting Performance Evaluation and Transfer PricingDokument4 SeitenMS11 Decentralization Segment Reporting Responsibility Accounting Performance Evaluation and Transfer PricingMarchelle CaelNoch keine Bewertungen

- How To Analyse Profitability: Dupont System, Ebitda and Earnings QualityDokument11 SeitenHow To Analyse Profitability: Dupont System, Ebitda and Earnings QualityNam Duy VuNoch keine Bewertungen

- 2.4 Time Series Analysis of Historical ReturnsDokument55 Seiten2.4 Time Series Analysis of Historical ReturnsL SNoch keine Bewertungen

- EntrepreneurshipDokument22 SeitenEntrepreneurshipHercel Louise HernandezNoch keine Bewertungen

- A Comparative Study of The Public and Private Sector Bank Withspecial Reference To Punjab National Bank and HDFC Bank 2167 0234 1000155Dokument4 SeitenA Comparative Study of The Public and Private Sector Bank Withspecial Reference To Punjab National Bank and HDFC Bank 2167 0234 1000155kshemaNoch keine Bewertungen

- Hris System in MCB Bank PakistanDokument20 SeitenHris System in MCB Bank PakistanMuhammad Ahsan DildarNoch keine Bewertungen

- Understanding Venture Capital Term SheetsDokument56 SeitenUnderstanding Venture Capital Term SheetsninjaGuiden100% (17)

- DSKP KSSM Mathematics Form 3 EditedDokument31 SeitenDSKP KSSM Mathematics Form 3 EditedMtpa Mashoor100% (1)

- Advanced Accounting NotesDokument19 SeitenAdvanced Accounting NotesTajammul M'd TakiNoch keine Bewertungen

- Capital Asset Pricing ModelDokument4 SeitenCapital Asset Pricing ModelGeorge Ayesa Sembereka Jr.Noch keine Bewertungen

- Laundry T Theory Introduction 1997Dokument12 SeitenLaundry T Theory Introduction 1997Longterm YeungNoch keine Bewertungen

- Chapter 1 The Investment Environment: Fundamentals of Investing, 13e, Global Edition (Smart)Dokument166 SeitenChapter 1 The Investment Environment: Fundamentals of Investing, 13e, Global Edition (Smart)MackaZbewNoch keine Bewertungen

- Calculating Rate Return - GuideDokument6 SeitenCalculating Rate Return - GuideAbdullah ShaikhNoch keine Bewertungen

- UBL Internship ReportDokument43 SeitenUBL Internship ReportWasif JamalNoch keine Bewertungen

- Introduction To: Corporate FinanceDokument85 SeitenIntroduction To: Corporate FinanceCephas PanguisaNoch keine Bewertungen

- Investments (Theories)Dokument41 SeitenInvestments (Theories)Iris Mnemosyne100% (1)

- Pearls MonographDokument32 SeitenPearls MonographArch Henry Delantar CarboNoch keine Bewertungen

- Laporan Guest LectureDokument4 SeitenLaporan Guest LecturemaritaputriNoch keine Bewertungen

- How Money WorksDokument32 SeitenHow Money Worksapi-284998491100% (6)

- Time Value of Money True/False QuestionsDokument10 SeitenTime Value of Money True/False QuestionsKenjiNoch keine Bewertungen

- Capital investment decisions analysisDokument62 SeitenCapital investment decisions analysisVijay GandhiNoch keine Bewertungen

- CH 10Dokument38 SeitenCH 10Syed Atiq TurabiNoch keine Bewertungen

- Working Capital ManagementDokument52 SeitenWorking Capital Managementforevers2218Noch keine Bewertungen

- Chapter 2Dokument78 SeitenChapter 2BhumitNoch keine Bewertungen

- Final Exam (6th Set) 54 QuestionsDokument9 SeitenFinal Exam (6th Set) 54 QuestionsShoniqua JohnsonNoch keine Bewertungen

- Adapt (FM1)Dokument28 SeitenAdapt (FM1)SumaiyyahRoshidiNoch keine Bewertungen

- MBA CapitalBudgetingDokument34 SeitenMBA CapitalBudgetinganvita raoNoch keine Bewertungen

- Engineering and SourcingDokument22 SeitenEngineering and SourcingMJ SapiterNoch keine Bewertungen