Beruflich Dokumente

Kultur Dokumente

Loma Mariposa v. Santa Cruz, Ariz. Ct. App. (2016)

Hochgeladen von

Scribd Government DocsCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Loma Mariposa v. Santa Cruz, Ariz. Ct. App. (2016)

Hochgeladen von

Scribd Government DocsCopyright:

Verfügbare Formate

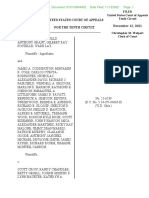

NOTICE: NOT FOR OFFICIAL PUBLICATION.

UNDER ARIZONA RULE OF THE SUPREME COURT 111(c), THIS DECISION IS NOT

PRECEDENTIAL AND MAY BE CITED ONLY AS AUTHORIZED BY RULE.

IN THE

ARIZONA COURT OF APPEALS

DIVISION ONE

LOMA MARIPOSA II, L.P., an Arizona limited partnership,

Plaintiff/Appellee,

v.

SANTA CRUZ COUNTY a political subdivision of the State

of Arizona, Defendant/Appellant.

No. 1 CA-TX 15-0007

FILED 11-22-2016

Appeal from the Arizona Tax Court

No. TX2013-000605

The Honorable Christopher T. Whitten, Judge

AFFIRMED

COUNSEL

Buchalter Nemer PC, Scottsdale

By Douglas S. John, Shaun T. Kuter

Counsel for Plaintiff/Appellee

Helm Livesay & Worthington Ltd., Tempe

By Roberta S. Livesay

Counsel for Defendant/Appellant

LOMA MARIPOSA v. SANTA CRUZ

Decision of the Court

MEMORANDUM DECISION

Judge Donn Kessler delivered the decision of the Court, in which Presiding

Judge Kenton D. Jones and Judge Randall M. Howe joined.

K E S S L E R, Judge:

1

Santa Cruz County (County) appeals from the tax courts

grant of summary judgment in favor of Loma Mariposa II, L.P.

(Taxpayer). We agree with the tax court that the County consented to the

error alleged in Taxpayers Notice of Claim (Claim). Accordingly, we

affirm.

FACTUAL AND PROCEDURAL HISTORY

2

Taxpayer owns an apartment complex in Nogales, Arizona

(Property), that is operated pursuant to the Federal Low Income Housing

Tax Credit (LIHTC) program.1 See 26 U.S.C. 42 (West 2013).2 Pursuant

to that program, the Property is subject to legal restrictions set forth in a

recorded Land Use Restriction Agreement (LURA).3

3

Taxpayer challenged its property taxes for tax years 2009

through 2012 by filing a Claim with the County Assessor (Assessor)

pursuant to Arizona Revised Statutes (A.R.S.) section 42-16254 (Supp.

The LIHTC program aims to provide an incentive for the

construction and rehabilitation of affordable housing by allowing owners

of qualified rental properties to claim tax credits annually over a ten-year

period. Sagit Leviner, Affordable Housing and the Role of the Low Income

Housing Tax Credit Program: A Contemporary Assessment, 57 Tax Law 869, 870

(2004).

1

We cite the current version of applicable statutes when no revisions

material to this decision have since occurred.

2

In this case, the LURA requires that eighty units be occupied by

households whose income is sixty percent or less of the area median gross

income and that rents conform to low income standards established by

the federal and state government. These restrictions last for thirty years

and run with the Property.

3

LOMA MARIPOSA v. SANTA CRUZ

Decision of the Court

2013). Taxpayers Claim asserted the Assessor had committed an error in

failing to account for the legal restrictions on the Subject Property.

4

Pursuant to A.R.S. 42-16254(C), the Assessor had sixty days

to provide a written response to the Claim, either consenting to or disputing

the error. See A.R.S. 42-16254(C). Although the Assessor prepared a

written response, he mistakenly mailed it to the wrong address, and

Taxpayer did not receive the response until after the sixty-day period had

expired.

5

Taxpayer then sent a written demand to the Assessor and the

County Board of Supervisors pointing out that [a] failure to file a written

response within sixty days constitutes consent to the error and asking

them to direct the County Treasurer to correct the tax roll pursuant to A.R.S.

42-16254(C). See id. The tax roll was not corrected.

6

After exhausting its administrative remedies, Taxpayer filed

a complaint in tax court. The parties filed cross-motions for summary

judgment. The tax court granted Taxpayers motion and denied the

Countys motion, concluding that A.R.S. 42-16254(C) is self-executing:

the failure to file a written response to the taxpayer within sixty days

constitutes consent to the error.

7

After entry of final judgment, the County timely appealed.

We have jurisdiction pursuant to A.R.S. 12-120.21(A)(1) (2016) and 12170(C) (2016).4

DISCUSSION

8

This Court reviews the tax courts grant of summary

judgment de novo. See Walgreen Ariz. Drug Co. v. Ariz. Dept of Revenue, 209

Ariz. 71, 72, 6 (App. 2004). If the material facts are undisputed, we must

determine whether the tax court correctly applied the substantive law to

Taxpayer challenged the valuation of its property for tax year 2013,

not as an error correction but rather pursuant to A.R.S. 42-16201(B) (2006).

See Loma Mariposa II, L.P. v. Santa Cruz County, TX 2012-000433 (filed Sept.

19, 2012). After a bench trial, the tax court entered judgment in favor of the

County, and Taxpayer appealed. See id.; Loma Mariposa II LP v. Stanta Cruz

County, CA-TX 16-0002 (appeal docketed April 28, 2016). Upon stipulation

of the parties, this Court stayed that appeal pending a final decision in this

case. See Order Staying Appeal at 1, Loma Mariposa II LP v. Stanta Cruz

County, CA-TX 16-0002 (entered July 14, 2016).

4

LOMA MARIPOSA v. SANTA CRUZ

Decision of the Court

those facts. Id. In so doing, we review issues of statutory interpretation

de novo. See id.

9

Taxpayer argues the Assessor failed to timely respond to the

Claim and therefore consented to the error. The tax court agreed. However,

the County argues Taxpayer: (1) waived any defect in the Countys

administration of A.R.S. 42-16254(C), and (2) did not suffer any

deprivation of due process rights. The relevant statute, A.R.S. 4216254(C), provides:

Within sixty days after receiving a notice of claim, the tax

officer may file a written response to the taxpayer to either

consent to or dispute the error and to state the grounds for

disputing the error. A failure to file a written response within

sixty days constitutes consent to the error, and the board of

supervisors shall direct the county treasurer to correct the tax

roll on the taxpayers written demand supported by proof of

the date of the notice of claim and the tax officers failure to

timely dispute the error.

A.R.S. 42-16254(C) (emphasis added). This Court will not venture

outside the language of an unambiguous statute to explore whether it might

be construed to provide something different from the meaning that clearly

appears on its face. Paging Network of Ariz., Inc. v. Ariz. Dept of Revenue,

193 Ariz. 96, 98, 13 (App. 1998).

10

An administrative pleading mailed within the statutory time

period to the wrong address is not timely filed. See Salt River Project Agric.

Improvement & Power Dist. v. Ariz. Dept of Econ. Sec. (SRP), 156 Ariz. 155,

157 (App. 1988). In SRP, plaintiff mistakenly mailed a petition for review

to the wrong address. Id. at 15556. This Court held that even though

[plaintiff] acted within the fifteen-day appeal period, its actions did not

constitute a timely filing. Id. at 156; see also Stapert v. Ariz. Bd. of Psychologist

Examrs, 210 Ariz. 177, 182-83, 25 (App. 2005) (holding that a plaintiffs

motion for reconsideration, delivered by messenger service to the wrong

agency, was untimely).

11

Like the plaintiff in SRP, the Assessor here admittedly mailed

his response to the wrong address. Thus, although the response was mailed

within the statutory time period, it was not timely filed. Accordingly,

LOMA MARIPOSA v. SANTA CRUZ

Decision of the Court

pursuant to the plain language of 42-16254, the Assessor consented to the

error alleged in Taxpayers Claim.5

I.

Waiver

12

The County argues that Taxpayer waived any defect in the

Countys administration of A.R.S. 42-16254(C) by appealing from the

Assessors decision on its Claim to the County Board of Equalization.

Waiver is either the express, voluntary, intentional relinquishment of a

known right or such conduct as warrants an inference of such an intentional

relinquishment. Am. Contl Life Ins. Co. v. Ranier Constr. Co., 125 Ariz. 53,

55 (1980).

13

Taxpayers actions do not indicate waiver. After receiving no

response from the Assessor within the sixty-day statutory period, Taxpayer

sent a letter to the Assessor and the Board of Supervisors demanding they

direct the County Treasurer to correct the tax roll pursuant to A.R.S. 4216254(C). See A.R.S. 42-16254(C) (providing the board of supervisors

shall direct the county treasurer to correct the tax roll on the taxpayers

written demand supported by proof of the date of the notice of claim and

the tax officers failure to timely dispute the error.) (emphasis added).

However, after receiving the Assessors late response to its Claim, Taxpayer

pursued review before the Board of Equalization and the tax court pursuant

to A.R.S. 42-16254(F)-(G), and expressly argued consent in both

proceedings. Taxpayers actions in no way convey an express, voluntary,

and intentional relinquishment of its right to challenge the Countys

Courts apply filing deadlines strictly in tax cases. See Ringier Am. v.

State Dept of Revenue, 184 Ariz. 250, 254 (App. 1995) (We therefore hold

that the tax court correctly held that [taxpayers] failure to timely pursue

the appropriate appellate procedures required dismissal of its action.); see

also Pesqueira v. Pima Cty. Assessor, 133 Ariz. 255, 257 (App. 1982) (The filing

deadline . . . is a jurisdictional condition.).

5

LOMA MARIPOSA v. SANTA CRUZ

Decision of the Court

administration of A.R.S. 42-16254(C). Accordingly, the Countys waiver

argument fails.6

II.

Due Process

14

Next, the County argues the tax court erred in failing to

consider whether Plaintiff suffered any deprivation of due process rights.

It contends that [w]hen the Assessor provided and [Taxpayer] received a

second response to its [Claim], and [Taxpayer] attended the subsequent

hearing, it obtained all the benefits of due process.

15

The fact that Taxpayer received a hearing before the Board of

Equalization does not alter the legal conclusion that the County consented

to the error by failing to file a timely written response to Taxpayers Claim

as required by the statute. Accordingly, the Countys due process

argument fails.

III.

Excusable Neglect

16

Finally, the County argues its mailing mistake was purely

one of excusable neglect. Arizona, however, does not recognize a goodcause exception for administrative filings absent explicit statutory

authority. See Stapert, 210 Ariz. at 180, 10.

17

In Stapert, a messenger service delivered plaintiffs motion for

reconsideration to the wrong agency. See id. at 179, 3. The Arizona Board

The County also cites to Hormel v. Maricopa County, 224 Ariz. 454,

459, 21-22 (App. 2010). The County contends Hormel supports its

argument that if an agreement was reached on the dispute, the County had

an unconditional obligation to issue the refund and if it failed to do so, the

appropriate remedy was for the taxpayer to take the matter to the Board to

review the merits. The County claims that given that remedy, Taxpayer

had the duty to prove its claim on the merits. We disagree. Hormel involved

a meeting between the taxing authority and the taxpayer under A.R.S. 4216254(D)-(F), which provides that when the taxing authority disputes the

error, a meeting is held and the parties can agree to a full or partial

resolution of the dispute. At that point, the taxpayer can file a petition with

the board on any remaining dispute. A.R.S. 42-16254(F). Here, the

Countys consent occurred under 42-16254(C), dealing with failure of the

County to timely object to the claim. Moreover, the fact Taxpayer sought

judicial relief while also asking the Board to determine whether there was

a consent or to decide the merits of the claim does not mean that Taxpayers

only remedy is to then prove the error itself rather than rely on consent.

6

LOMA MARIPOSA v. SANTA CRUZ

Decision of the Court

of Psychologist Examiners refused the motion finding it was untimely filed.

See id. at 180, 10. In upholding that decision, this Court noted it was

undisputed that Dr. Staperts motion for reconsideration was not filed

with the Board within the time allowed by law and concluded [t]his court

has specifically rejected the contention that a good-cause exception existed

when there was no statutory authority for such an exception. Id. at 180,

11, 13 (citing SRP, 156 Ariz. at 157). Accordingly, the Countys argument

that the Assessors failure to timely respond was the result of excusable

neglect also fails.

CONCLUSION

18

For the foregoing reasons, we affirm the decision of the tax

court. In the exercise of our discretion, we grant Taxpayers request for an

award of attorneys fees on appeal pursuant to A.R.S. 12348(B) (Supp.

2013), subject to the limitation imposed by 12348(E)(5). Taxpayer is also

entitled to costs on appeal upon compliance with Arizona Rule of Civil

Appellate Procedure 21. See A.R.S. 12-341 (2016); ARCAP 21.

AMY M. WOOD Clerk of the Court

FILED: AA

Das könnte Ihnen auch gefallen

- Albert E. Robinson and Rose M. Robinson v. United States, 920 F.2d 1157, 3rd Cir. (1991)Dokument8 SeitenAlbert E. Robinson and Rose M. Robinson v. United States, 920 F.2d 1157, 3rd Cir. (1991)Scribd Government DocsNoch keine Bewertungen

- United States Court of Appeals, Ninth CircuitDokument7 SeitenUnited States Court of Appeals, Ninth CircuitScribd Government DocsNoch keine Bewertungen

- First Natl. Bank v. Weld County, 264 U.S. 450 (1924)Dokument5 SeitenFirst Natl. Bank v. Weld County, 264 U.S. 450 (1924)Scribd Government DocsNoch keine Bewertungen

- Rizona Ourt of Ppeals: Plaintiff/Appellant, VDokument12 SeitenRizona Ourt of Ppeals: Plaintiff/Appellant, VScribd Government DocsNoch keine Bewertungen

- McConkey Et Ux. v. Commissioner of Internal Revenue, 199 F.2d 892, 4th Cir. (1952)Dokument4 SeitenMcConkey Et Ux. v. Commissioner of Internal Revenue, 199 F.2d 892, 4th Cir. (1952)Scribd Government DocsNoch keine Bewertungen

- David Kaufman v. Roscoe Egger, Commissioner of Internal Revenue, 758 F.2d 1, 1st Cir. (1985)Dokument6 SeitenDavid Kaufman v. Roscoe Egger, Commissioner of Internal Revenue, 758 F.2d 1, 1st Cir. (1985)Scribd Government DocsNoch keine Bewertungen

- Herbert Weiss and Estate of Roberta Weiss, Deceased, Herbert Weiss, Personal Representative v. Commissioner of Internal Revenue, 850 F.2d 111, 2d Cir. (1988)Dokument9 SeitenHerbert Weiss and Estate of Roberta Weiss, Deceased, Herbert Weiss, Personal Representative v. Commissioner of Internal Revenue, 850 F.2d 111, 2d Cir. (1988)Scribd Government DocsNoch keine Bewertungen

- United States Court of Appeals, Fourth CircuitDokument3 SeitenUnited States Court of Appeals, Fourth CircuitScribd Government DocsNoch keine Bewertungen

- Feb 16 Cases OriginalsDokument53 SeitenFeb 16 Cases OriginalsMsIc GabrielNoch keine Bewertungen

- Publish United States Court of Appeals For The Tenth CircuitDokument17 SeitenPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNoch keine Bewertungen

- Flora v. United States, 357 U.S. 63 (1958)Dokument10 SeitenFlora v. United States, 357 U.S. 63 (1958)Scribd Government DocsNoch keine Bewertungen

- Goldstein, Baron & Lewis, Chartered v. United States, 995 F.2d 35, 4th Cir. (1993)Dokument5 SeitenGoldstein, Baron & Lewis, Chartered v. United States, 995 F.2d 35, 4th Cir. (1993)Scribd Government DocsNoch keine Bewertungen

- United States Court of Appeals Third Circuit.: No. 16597. No. 16598Dokument3 SeitenUnited States Court of Appeals Third Circuit.: No. 16597. No. 16598Scribd Government DocsNoch keine Bewertungen

- Chandler v. CIR, 10th Cir. (2009)Dokument8 SeitenChandler v. CIR, 10th Cir. (2009)Scribd Government DocsNoch keine Bewertungen

- Betty W. STEELE, Appellant, v. Secretary of The Treasury, Donald REGAN Charles E. Roddy, District Director Internal Revenue Service, AppelleesDokument5 SeitenBetty W. STEELE, Appellant, v. Secretary of The Treasury, Donald REGAN Charles E. Roddy, District Director Internal Revenue Service, AppelleesScribd Government DocsNoch keine Bewertungen

- Claire W. Glendening Boryan Lee Glendening Koss Alicia B. Glendening Tennent v. United States, 884 F.2d 767, 4th Cir. (1989)Dokument8 SeitenClaire W. Glendening Boryan Lee Glendening Koss Alicia B. Glendening Tennent v. United States, 884 F.2d 767, 4th Cir. (1989)Scribd Government DocsNoch keine Bewertungen

- United States Court of Appeals, Eleventh CircuitDokument8 SeitenUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNoch keine Bewertungen

- John M. Casper v. Commissioner of Internal Revenue, 805 F.2d 902, 10th Cir. (1986)Dokument6 SeitenJohn M. Casper v. Commissioner of Internal Revenue, 805 F.2d 902, 10th Cir. (1986)Scribd Government DocsNoch keine Bewertungen

- Algodon Manufacturing Company, Inc. v. Edwin Gill, Formerly Collector of Internal Revenue, 243 F.2d 160, 4th Cir. (1957)Dokument4 SeitenAlgodon Manufacturing Company, Inc. v. Edwin Gill, Formerly Collector of Internal Revenue, 243 F.2d 160, 4th Cir. (1957)Scribd Government DocsNoch keine Bewertungen

- Robert E. Selman and Pauline Selman v. United States, 941 F.2d 1060, 10th Cir. (1991)Dokument9 SeitenRobert E. Selman and Pauline Selman v. United States, 941 F.2d 1060, 10th Cir. (1991)Scribd Government DocsNoch keine Bewertungen

- Superior Court of The State of California For The County ofDokument8 SeitenSuperior Court of The State of California For The County ofAnonymous FmoV5PNoch keine Bewertungen

- Published United States Court of Appeals For The Fourth CircuitDokument10 SeitenPublished United States Court of Appeals For The Fourth CircuitScribd Government DocsNoch keine Bewertungen

- Humberto Reyes v. Aqua Life Corp, 11th Cir. (2015)Dokument12 SeitenHumberto Reyes v. Aqua Life Corp, 11th Cir. (2015)Scribd Government DocsNoch keine Bewertungen

- United States v. Robert K. Michaels and Margaret P. Michaels, 840 F.2d 901, 11th Cir. (1988)Dokument3 SeitenUnited States v. Robert K. Michaels and Margaret P. Michaels, 840 F.2d 901, 11th Cir. (1988)Scribd Government DocsNoch keine Bewertungen

- Wheeler v. CIR, 521 F.3d 1289, 10th Cir. (2008)Dokument6 SeitenWheeler v. CIR, 521 F.3d 1289, 10th Cir. (2008)Scribd Government DocsNoch keine Bewertungen

- Charles v. Clement, Jr. v. United States of America, Charles v. Clement, Jr. v. United States, 472 F.2d 776, 1st Cir. (1973)Dokument7 SeitenCharles v. Clement, Jr. v. United States of America, Charles v. Clement, Jr. v. United States, 472 F.2d 776, 1st Cir. (1973)Scribd Government DocsNoch keine Bewertungen

- Not PrecedentialDokument6 SeitenNot PrecedentialScribd Government DocsNoch keine Bewertungen

- Howard S. Long v. United States of America, Internal Revenue Service, and Colorado Department of Revenue, 972 F.2d 1174, 10th Cir. (1993)Dokument14 SeitenHoward S. Long v. United States of America, Internal Revenue Service, and Colorado Department of Revenue, 972 F.2d 1174, 10th Cir. (1993)Scribd Government DocsNoch keine Bewertungen

- Commissioner of Internal Revenue v. Smith Paper, Inc., 222 F.2d 126, 1st Cir. (1955)Dokument7 SeitenCommissioner of Internal Revenue v. Smith Paper, Inc., 222 F.2d 126, 1st Cir. (1955)Scribd Government DocsNoch keine Bewertungen

- Gilliam v. CIR, 10th Cir. (2003)Dokument8 SeitenGilliam v. CIR, 10th Cir. (2003)Scribd Government DocsNoch keine Bewertungen

- FLYNN, M. Rutledge, v. UNITED STATES of America by and Through EGGERS, Roscoe Commissioner of Internal Revenue. Appeal of M. Rutledge FLYNNDokument9 SeitenFLYNN, M. Rutledge, v. UNITED STATES of America by and Through EGGERS, Roscoe Commissioner of Internal Revenue. Appeal of M. Rutledge FLYNNScribd Government DocsNoch keine Bewertungen

- United States Court of Appeals, Seventh CircuitDokument6 SeitenUnited States Court of Appeals, Seventh CircuitScribd Government DocsNoch keine Bewertungen

- Adamson vs. CIRDokument2 SeitenAdamson vs. CIRJoshua OuanoNoch keine Bewertungen

- Demurrer To Unlawful Detainer Complaint For California SAMPLEDokument8 SeitenDemurrer To Unlawful Detainer Complaint For California SAMPLERaquel Quiñonez100% (5)

- Ronald P. Muck, Plaintiff-Counter-Defendant-Appellant v. United States of America, Defendant-Counter-Claimant-Appellee v. Duane Kiskadden, Counter-Defendant, 3 F.3d 1378, 10th Cir. (1993)Dokument6 SeitenRonald P. Muck, Plaintiff-Counter-Defendant-Appellant v. United States of America, Defendant-Counter-Claimant-Appellee v. Duane Kiskadden, Counter-Defendant, 3 F.3d 1378, 10th Cir. (1993)Scribd Government DocsNoch keine Bewertungen

- Cta 1D CV 09420 M 2021feb03 AssDokument6 SeitenCta 1D CV 09420 M 2021feb03 AssFirenze PHNoch keine Bewertungen

- New Mexico Citizens For Clean Air and Water Pueblo of San Juan v. Espanola Mercantile Company, Inc., Doing Business As Espanola Transit Mix Co., 72 F.3d 830, 10th Cir. (1996)Dokument8 SeitenNew Mexico Citizens For Clean Air and Water Pueblo of San Juan v. Espanola Mercantile Company, Inc., Doing Business As Espanola Transit Mix Co., 72 F.3d 830, 10th Cir. (1996)Scribd Government DocsNoch keine Bewertungen

- James J. Randazzo v. United States of America, Department of The Treasury, Internal Revenue Service, 751 F.2d 145, 3rd Cir. (1984)Dokument3 SeitenJames J. Randazzo v. United States of America, Department of The Treasury, Internal Revenue Service, 751 F.2d 145, 3rd Cir. (1984)Scribd Government DocsNoch keine Bewertungen

- Charles R. Sicker v. Commissioner of Internal Revenue, 815 F.2d 1400, 11th Cir. (1987)Dokument3 SeitenCharles R. Sicker v. Commissioner of Internal Revenue, 815 F.2d 1400, 11th Cir. (1987)Scribd Government DocsNoch keine Bewertungen

- Estate of Mansy Y. Michael, by David Michael v. M.J. Lullo, District Director of Internal Revenue Service, 173 F.3d 503, 4th Cir. (1999)Dokument21 SeitenEstate of Mansy Y. Michael, by David Michael v. M.J. Lullo, District Director of Internal Revenue Service, 173 F.3d 503, 4th Cir. (1999)Scribd Government DocsNoch keine Bewertungen

- United States Court of Appeals, Third CircuitDokument3 SeitenUnited States Court of Appeals, Third CircuitScribd Government DocsNoch keine Bewertungen

- Dizon Vs People G.R. No. 227577, January 24, 2018 Facts:: SandiganbayanDokument2 SeitenDizon Vs People G.R. No. 227577, January 24, 2018 Facts:: SandiganbayanShella Hannah Salih100% (1)

- David W. Woods v. Internal Revenue Service, 3 F.3d 403, 11th Cir. (1993)Dokument2 SeitenDavid W. Woods v. Internal Revenue Service, 3 F.3d 403, 11th Cir. (1993)Scribd Government DocsNoch keine Bewertungen

- Ballard's Service Center, Inc. v. William Transue, 865 F.2d 447, 1st Cir. (1989)Dokument5 SeitenBallard's Service Center, Inc. v. William Transue, 865 F.2d 447, 1st Cir. (1989)Scribd Government DocsNoch keine Bewertungen

- Richards v. CIR, 10th Cir. (2008)Dokument9 SeitenRichards v. CIR, 10th Cir. (2008)Scribd Government DocsNoch keine Bewertungen

- Andrzej Madura v. Lakebridge Condominium Associationi, 11th Cir. (2010)Dokument8 SeitenAndrzej Madura v. Lakebridge Condominium Associationi, 11th Cir. (2010)Scribd Government DocsNoch keine Bewertungen

- Cox v. CIR, 514 F.3d 1119, 10th Cir. (2008)Dokument21 SeitenCox v. CIR, 514 F.3d 1119, 10th Cir. (2008)Scribd Government DocsNoch keine Bewertungen

- United States v. Richard L. Steck and June D. Steck, 295 F.2d 682, 10th Cir. (1961)Dokument5 SeitenUnited States v. Richard L. Steck and June D. Steck, 295 F.2d 682, 10th Cir. (1961)Scribd Government DocsNoch keine Bewertungen

- In Re Tanaka Brothers Farms, Inc., Debtor, United States of America, and Its Agency The Internal Revenue Service v. Andrea S. Berger, Trustee Boulder Creek Farms, Inc., 36 F.3d 996, 10th Cir. (1994)Dokument9 SeitenIn Re Tanaka Brothers Farms, Inc., Debtor, United States of America, and Its Agency The Internal Revenue Service v. Andrea S. Berger, Trustee Boulder Creek Farms, Inc., 36 F.3d 996, 10th Cir. (1994)Scribd Government DocsNoch keine Bewertungen

- $ - Upreme Ltourt: 3republic of TbeDokument9 Seiten$ - Upreme Ltourt: 3republic of Tbeανατολή και πετύχετεNoch keine Bewertungen

- United States v. National Bank of Commerce, 472 U.S. 713 (1985)Dokument31 SeitenUnited States v. National Bank of Commerce, 472 U.S. 713 (1985)Scribd Government Docs100% (1)

- Filed: Patrick FisherDokument5 SeitenFiled: Patrick FisherScribd Government DocsNoch keine Bewertungen

- Arthur C. Ewing A/K/A A. Clifford Ewing Maxine H. Ewing v. United States, 914 F.2d 499, 4th Cir. (1990)Dokument11 SeitenArthur C. Ewing A/K/A A. Clifford Ewing Maxine H. Ewing v. United States, 914 F.2d 499, 4th Cir. (1990)Scribd Government DocsNoch keine Bewertungen

- Feb 17 Spec Pro OabcDokument6 SeitenFeb 17 Spec Pro OabcMsIc GabrielNoch keine Bewertungen

- Frank Miskovsky v. United States, 414 F.2d 954, 3rd Cir. (1969)Dokument5 SeitenFrank Miskovsky v. United States, 414 F.2d 954, 3rd Cir. (1969)Scribd Government DocsNoch keine Bewertungen

- Adamson vs. Court of ApepalsDokument15 SeitenAdamson vs. Court of ApepalsMaria Nicole VaneeteeNoch keine Bewertungen

- David A. Koss Freya B. Koss v. United States, 69 F.3d 705, 3rd Cir. (1995)Dokument11 SeitenDavid A. Koss Freya B. Koss v. United States, 69 F.3d 705, 3rd Cir. (1995)Scribd Government DocsNoch keine Bewertungen

- Keller Tank Services v. CIR, 10th Cir. (2017)Dokument39 SeitenKeller Tank Services v. CIR, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- Keller Tank Services v. CIR, 10th Cir. (2017)Dokument39 SeitenKeller Tank Services v. CIR, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- City of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Dokument21 SeitenCity of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- United States v. Garcia-Damian, 10th Cir. (2017)Dokument9 SeitenUnited States v. Garcia-Damian, 10th Cir. (2017)Scribd Government Docs100% (1)

- Coyle v. Jackson, 10th Cir. (2017)Dokument7 SeitenCoyle v. Jackson, 10th Cir. (2017)Scribd Government Docs100% (1)

- Payn v. Kelley, 10th Cir. (2017)Dokument8 SeitenPayn v. Kelley, 10th Cir. (2017)Scribd Government Docs50% (2)

- United States v. Olden, 10th Cir. (2017)Dokument4 SeitenUnited States v. Olden, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- United States v. Kieffer, 10th Cir. (2017)Dokument20 SeitenUnited States v. Kieffer, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- Harte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Dokument100 SeitenHarte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- Brown v. Shoe, 10th Cir. (2017)Dokument6 SeitenBrown v. Shoe, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- Greene v. Tennessee Board, 10th Cir. (2017)Dokument2 SeitenGreene v. Tennessee Board, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- Apodaca v. Raemisch, 10th Cir. (2017)Dokument15 SeitenApodaca v. Raemisch, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- Wilson v. Dowling, 10th Cir. (2017)Dokument5 SeitenWilson v. Dowling, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- United States v. Henderson, 10th Cir. (2017)Dokument2 SeitenUnited States v. Henderson, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- Consolidation Coal Company v. OWCP, 10th Cir. (2017)Dokument22 SeitenConsolidation Coal Company v. OWCP, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- Pecha v. Lake, 10th Cir. (2017)Dokument25 SeitenPecha v. Lake, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- United States v. Windom, 10th Cir. (2017)Dokument25 SeitenUnited States v. Windom, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- United States v. Roberson, 10th Cir. (2017)Dokument50 SeitenUnited States v. Roberson, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- Publish United States Court of Appeals For The Tenth CircuitDokument10 SeitenPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNoch keine Bewertungen

- United States v. Kearn, 10th Cir. (2017)Dokument25 SeitenUnited States v. Kearn, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- United States v. Voog, 10th Cir. (2017)Dokument5 SeitenUnited States v. Voog, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- Publish United States Court of Appeals For The Tenth CircuitDokument14 SeitenPublish United States Court of Appeals For The Tenth CircuitScribd Government Docs100% (1)

- Northglenn Gunther Toody's v. HQ8-10410-10450, 10th Cir. (2017)Dokument10 SeitenNorthglenn Gunther Toody's v. HQ8-10410-10450, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- United States v. Muhtorov, 10th Cir. (2017)Dokument15 SeitenUnited States v. Muhtorov, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- NM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Dokument9 SeitenNM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- Publish United States Court of Appeals For The Tenth CircuitDokument24 SeitenPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNoch keine Bewertungen

- Webb v. Allbaugh, 10th Cir. (2017)Dokument18 SeitenWebb v. Allbaugh, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- Publish United States Court of Appeals For The Tenth CircuitDokument17 SeitenPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNoch keine Bewertungen

- United States v. Magnan, 10th Cir. (2017)Dokument27 SeitenUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- Pledger v. Russell, 10th Cir. (2017)Dokument5 SeitenPledger v. Russell, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- United States v. Kundo, 10th Cir. (2017)Dokument7 SeitenUnited States v. Kundo, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- United States v. Magnan, 10th Cir. (2017)Dokument4 SeitenUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- Freedom Kerkula v. City of MoorheadDokument17 SeitenFreedom Kerkula v. City of MoorheadinforumdocsNoch keine Bewertungen

- Judicial Recusal Reform: Toward Independent Consideration of DisqualificationDokument34 SeitenJudicial Recusal Reform: Toward Independent Consideration of DisqualificationThe Brennan Center for JusticeNoch keine Bewertungen

- UNITED STATES of America v. Joseph CUSUMANO, AppellantDokument16 SeitenUNITED STATES of America v. Joseph CUSUMANO, AppellantScribd Government DocsNoch keine Bewertungen

- Trinity Augmentation DecisionDokument19 SeitenTrinity Augmentation DecisionCannon MichaelNoch keine Bewertungen

- Tech Systems, Inc. v. Lovelen Pyles, 4th Cir. (2015)Dokument9 SeitenTech Systems, Inc. v. Lovelen Pyles, 4th Cir. (2015)Scribd Government DocsNoch keine Bewertungen

- Arizona Appeals Court Reply Brief of Appellant Kari Lake - November 14, 2023Dokument43 SeitenArizona Appeals Court Reply Brief of Appellant Kari Lake - November 14, 2023Jordan ConradsonNoch keine Bewertungen

- Bruner-McMahon v. County of Sedgwick, 10th Cir. (2014)Dokument17 SeitenBruner-McMahon v. County of Sedgwick, 10th Cir. (2014)Scribd Government DocsNoch keine Bewertungen

- United States Court of Appeals, Second CircuitDokument5 SeitenUnited States Court of Appeals, Second CircuitScribd Government Docs100% (1)

- UnpublishedDokument5 SeitenUnpublishedScribd Government DocsNoch keine Bewertungen

- The Personnel Board of Jefferson County's ResponseDokument15 SeitenThe Personnel Board of Jefferson County's ResponsegaylegearNoch keine Bewertungen

- Order and Judgment - Ca10 - 21-6139Dokument25 SeitenOrder and Judgment - Ca10 - 21-6139Dillon JamesNoch keine Bewertungen

- Baffinland Iron Mines Corporation Et Alia. v. The Territorial Board of Revision, Government of NunavutDokument42 SeitenBaffinland Iron Mines Corporation Et Alia. v. The Territorial Board of Revision, Government of NunavutNunatsiaqNewsNoch keine Bewertungen

- In Re Maatita (Fed. Cir.) - Opening BriefDokument49 SeitenIn Re Maatita (Fed. Cir.) - Opening BriefSarah BursteinNoch keine Bewertungen

- The Notice Provisions of The Alabama Fair Dismissal and Teacher Tenure ActsDokument49 SeitenThe Notice Provisions of The Alabama Fair Dismissal and Teacher Tenure ActsE Frank CorneliusNoch keine Bewertungen

- United States v. Oscar Leonardo Hernandez, 693 F.2d 996, 10th Cir. (1982)Dokument5 SeitenUnited States v. Oscar Leonardo Hernandez, 693 F.2d 996, 10th Cir. (1982)Scribd Government DocsNoch keine Bewertungen

- Leonard Pignatello v. Attorney General of The United States, 350 F.2d 719, 2d Cir. (1965)Dokument9 SeitenLeonard Pignatello v. Attorney General of The United States, 350 F.2d 719, 2d Cir. (1965)Scribd Government DocsNoch keine Bewertungen

- Sections 14 17Dokument239 SeitenSections 14 17Dianne Esidera RosalesNoch keine Bewertungen

- Miriam Awuku, A206 266 819 (BIA Sept. 20, 2017)Dokument7 SeitenMiriam Awuku, A206 266 819 (BIA Sept. 20, 2017)Immigrant & Refugee Appellate Center, LLCNoch keine Bewertungen

- United States Court of Appeals, Third CircuitDokument9 SeitenUnited States Court of Appeals, Third CircuitScribd Government DocsNoch keine Bewertungen

- Property Cases (Public and Private) (Art 419-426)Dokument54 SeitenProperty Cases (Public and Private) (Art 419-426)Strawber RyNoch keine Bewertungen

- How To Prepare A Supreme Court Appeal BriefDokument52 SeitenHow To Prepare A Supreme Court Appeal BriefJoshua J. IsraelNoch keine Bewertungen

- Appellant Stegeman Brief Georgia Court of Appeals11/03/2009Dokument30 SeitenAppellant Stegeman Brief Georgia Court of Appeals11/03/2009Janet and JamesNoch keine Bewertungen

- Immiigration Law Outline, Selected Topics - 9th Circuit 590 PagesDokument590 SeitenImmiigration Law Outline, Selected Topics - 9th Circuit 590 PagesUmesh HeendeniyaNoch keine Bewertungen

- Ana Guadalupe Landaverde-Morales, A206 722 187 (BIA Oct. 17, 2017)Dokument3 SeitenAna Guadalupe Landaverde-Morales, A206 722 187 (BIA Oct. 17, 2017)Immigrant & Refugee Appellate Center, LLCNoch keine Bewertungen

- Ellsworth PetitionDokument26 SeitenEllsworth PetitionJustin FentonNoch keine Bewertungen

- JH, A Minor, by and Through His Parents and Next Friends, JD and Ss JD Ss v. Henrico County School Board, 326 F.3d 560, 4th Cir. (2003)Dokument11 SeitenJH, A Minor, by and Through His Parents and Next Friends, JD and Ss JD Ss v. Henrico County School Board, 326 F.3d 560, 4th Cir. (2003)Scribd Government DocsNoch keine Bewertungen

- Arthur McDorn Williams v. Jennings McAbee Herbert B. Long Julius H. Baggett Frank Harrison McAbee Building Supply, Incorporated, 85 F.3d 618, 4th Cir. (1996)Dokument2 SeitenArthur McDorn Williams v. Jennings McAbee Herbert B. Long Julius H. Baggett Frank Harrison McAbee Building Supply, Incorporated, 85 F.3d 618, 4th Cir. (1996)Scribd Government DocsNoch keine Bewertungen

- Rizal Light v. Municipality of MorongDokument31 SeitenRizal Light v. Municipality of Morongangelica_tan_12Noch keine Bewertungen

- United States v. John D. Copanos & Sons, Inc., A Corporation John D. Copanos E. Gaye McGraw Norman v. Ellerton, Individuals, 857 F.2d 1469, 4th Cir. (1988)Dokument9 SeitenUnited States v. John D. Copanos & Sons, Inc., A Corporation John D. Copanos E. Gaye McGraw Norman v. Ellerton, Individuals, 857 F.2d 1469, 4th Cir. (1988)Scribd Government DocsNoch keine Bewertungen

- John Witkowski v. Intl Brotherhood of Boilermake, 3rd Cir. (2010)Dokument9 SeitenJohn Witkowski v. Intl Brotherhood of Boilermake, 3rd Cir. (2010)Scribd Government DocsNoch keine Bewertungen

- Summary of Atomic Habits: An Easy and Proven Way to Build Good Habits and Break Bad Ones by James ClearVon EverandSummary of Atomic Habits: An Easy and Proven Way to Build Good Habits and Break Bad Ones by James ClearBewertung: 4.5 von 5 Sternen4.5/5 (558)

- The Stoic Mindset: Living the Ten Principles of StoicismVon EverandThe Stoic Mindset: Living the Ten Principles of StoicismBewertung: 5 von 5 Sternen5/5 (5)

- The 7 Habits of Highly Effective People: The Infographics EditionVon EverandThe 7 Habits of Highly Effective People: The Infographics EditionBewertung: 4 von 5 Sternen4/5 (2475)

- Summary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesVon EverandSummary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesBewertung: 5 von 5 Sternen5/5 (1635)

- The Age of Magical Overthinking: Notes on Modern IrrationalityVon EverandThe Age of Magical Overthinking: Notes on Modern IrrationalityBewertung: 4 von 5 Sternen4/5 (24)

- Summary of Dan Martell's Buy Back Your TimeVon EverandSummary of Dan Martell's Buy Back Your TimeBewertung: 5 von 5 Sternen5/5 (1)

- The Mountain is You: Transforming Self-Sabotage Into Self-MasteryVon EverandThe Mountain is You: Transforming Self-Sabotage Into Self-MasteryBewertung: 4.5 von 5 Sternen4.5/5 (880)

- Power Moves: Ignite Your Confidence and Become a ForceVon EverandPower Moves: Ignite Your Confidence and Become a ForceNoch keine Bewertungen

- The Power of Now: A Guide to Spiritual EnlightenmentVon EverandThe Power of Now: A Guide to Spiritual EnlightenmentBewertung: 4.5 von 5 Sternen4.5/5 (4125)

- Summary: The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel: Key Takeaways, Summary & Analysis IncludedVon EverandSummary: The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel: Key Takeaways, Summary & Analysis IncludedBewertung: 5 von 5 Sternen5/5 (80)

- Think This, Not That: 12 Mindshifts to Breakthrough Limiting Beliefs and Become Who You Were Born to BeVon EverandThink This, Not That: 12 Mindshifts to Breakthrough Limiting Beliefs and Become Who You Were Born to BeBewertung: 2 von 5 Sternen2/5 (1)

- No Bad Parts: Healing Trauma and Restoring Wholeness with the Internal Family Systems ModelVon EverandNo Bad Parts: Healing Trauma and Restoring Wholeness with the Internal Family Systems ModelBewertung: 5 von 5 Sternen5/5 (4)

- Maktub: An Inspirational Companion to The AlchemistVon EverandMaktub: An Inspirational Companion to The AlchemistBewertung: 4.5 von 5 Sternen4.5/5 (3)

- Breaking the Habit of Being YourselfVon EverandBreaking the Habit of Being YourselfBewertung: 4.5 von 5 Sternen4.5/5 (1458)

- By the Time You Read This: The Space between Cheslie's Smile and Mental Illness—Her Story in Her Own WordsVon EverandBy the Time You Read This: The Space between Cheslie's Smile and Mental Illness—Her Story in Her Own WordsNoch keine Bewertungen

- Briefly Perfectly Human: Making an Authentic Life by Getting Real About the EndVon EverandBriefly Perfectly Human: Making an Authentic Life by Getting Real About the EndNoch keine Bewertungen

- Summary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessVon EverandSummary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessNoch keine Bewertungen

- Summary: Outlive: The Science and Art of Longevity by Peter Attia MD, With Bill Gifford: Key Takeaways, Summary & AnalysisVon EverandSummary: Outlive: The Science and Art of Longevity by Peter Attia MD, With Bill Gifford: Key Takeaways, Summary & AnalysisBewertung: 4.5 von 5 Sternen4.5/5 (42)

- Out of the Dark: My Journey Through the Shadows to Find God's JoyVon EverandOut of the Dark: My Journey Through the Shadows to Find God's JoyBewertung: 4.5 von 5 Sternen4.5/5 (13)

- Becoming Supernatural: How Common People Are Doing The UncommonVon EverandBecoming Supernatural: How Common People Are Doing The UncommonBewertung: 5 von 5 Sternen5/5 (1478)

- The Bridesmaid: The addictive psychological thriller that everyone is talking aboutVon EverandThe Bridesmaid: The addictive psychological thriller that everyone is talking aboutBewertung: 4 von 5 Sternen4/5 (131)

- Eat That Frog!: 21 Great Ways to Stop Procrastinating and Get More Done in Less TimeVon EverandEat That Frog!: 21 Great Ways to Stop Procrastinating and Get More Done in Less TimeBewertung: 4.5 von 5 Sternen4.5/5 (3225)

- Summary of The 48 Laws of Power: by Robert GreeneVon EverandSummary of The 48 Laws of Power: by Robert GreeneBewertung: 4.5 von 5 Sternen4.5/5 (233)