Beruflich Dokumente

Kultur Dokumente

New Jeevan Anand Plan 815

Hochgeladen von

Anonymous YakppP3vAnCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

New Jeevan Anand Plan 815

Hochgeladen von

Anonymous YakppP3vAnCopyright:

Verfügbare Formate

LIC New Jeevan Anand (Plan No: 815)|| Detailed Benefit Illustration Premium calcul...

+91-9136419731, 9810563421

care@insurance21.in

Insurance21

Home

Page 1 of 6

About Us

LIC Plans

Premium Calculator

Maturity Calculators

Pension Calculator

Free Quote

Contact to Buy this Plan

Name

Advertisement

New Jeevan Anand (Plan No:815)

Mobile

Email

City

Jeevan Anand is one of the most sold endowment plans of LIC, which provides Risk Cover even after

Submit

maturity up to 100 years of age. LIC has launched New jeevan Anand (Plan No: 815) in new avatar.

This plan also provides double accidental benefit in case of accidental death up to 70 years of age.

This article gives comprehensive deatails of policy and various benefits associated with New Jeevan

Related Links

Anand Plan.

Jeevan Anand (149) Maturity Calculator

Plan Parameters

New Jeevan Anand Plan (815)

Age of Entry

18 to 50 years

Calculate your Age

Premium Paying Mode

Yearly, Half Yearly, Quarterly, Monthly (ECS Only)

Policy Term

15 to 35 Years

Basic Sum Assured

100000 and above ( in multiple of 5000)

Policy Revival

within 2 year

Rebate

2% on yearly, 1% on Half Yearly, Nil on Quarterly

Loan

After 3 years

Surrender

After 3 years of full premium payment

Advertisement

Benefit Illustrations

To Illustrate the benefits of New Jeevan Anand,

Lets

take

an

example

of

person

who

Comparison between Jeevan Anand and

Bank's RD

Difference Between New Jeevan Anand

and Old Jeevan Anand

Premium Calculator for New Jeevan

Anand (815)

More Items

Comparison Endowment plan (814) vs

Jeevan Pragati (838)

is

purchasing New Jeevan Anand Plan with following

Maturity Calculator for Jeevan Pragati

(838)

details.

Sum Assured: Rs. 5,00,000

Premium Calculator for Jeevan Pragati

Plan (838)

Policy Term: 21 Years

Policy Purchase Year: 2015

Age: 26 Years

Premium Calculator for Jeevan Shikhar

Plan (837)

Yearly Premium: Rs. 27454 Calculate

To Calculate benefits with details other than

LIC Jeevan Pragati Plan (838) Details

above, go to Maturity Calculator.

Premium & Maturity Calculator for

Jeevan Shikhar (837)

LIC Jeevan Shikhar Plan (837) Details

Maturity Details

If policy holder survives the policy term ( i.e. 21 years ), Maturity will be as under.

Maturity Year

Age at Maturity

Maturity Amount(approx)

2036

47

1102000

Maturity Calculator for Jeevan Labh

(836)

Premium Calculator for Jeevan Labh

(836)

After Normal Risk Cover continues even after maturity. Following table provides details of yearLIC Jeevan Labh Plan (836) Details

wise risk cover.

Year

Age

Normal Life Cover

2036+

47+

500000

New Jeevan Anand Premium and

Maturity Calculator

Comparison between LICs Jeevan

Akshay VI and Banks FD

Year-wise Death Claims

Maturity Calculator for LICs New Money

Back Plan - 25 years (821)

If death happens during the policy term ( Before 21 years ), 125% of Sum Assured + Bonus +

Final Addition Bonus(FAB) will paid to nominee and it is indicated as Normal Life Cover.In case

Maturity Calculator for LICs New Money

Back Plan - 20 years (820)

of accidental death, additional amount equal to sum assured is also payable to nominee, the

calculation is indicated as Accidental Life Cover.Calculation of year-wise and age-wise death

benefit according to accumulated bonus and FAB is illustrated below.

Year

Age

Normal Life Cover(approx)

Accidental Life Cover

(approx)

(With Double Accidental

Benefit Rider)

2015

26

649500

1149500

2016

27

674000

1174000

2017

28

698500

1198500

2018

29

723000

1223000

2019

30

747500

1247500

2020

31

772000

1272000

2021

32

796500

1296500

2022

33

821000

1321000

2023

34

845500

1345500

2024

35

870000

1370000

Premium Calculator for Jeevan Lakshya

(833)

Premium Calculator for LICs Amulya

Jeevan 2 (823)

Maturity Calculator for LICs Jeevan

Tarun Child Plan (834)

Premium Calculator for LICs Jeevan

Tarun Child Plan (834)

Premium Calculator for LICs Money Back

Plan - 25 years (821)

Premium Calculator for LICs Money Back

Plan - 20 years (820)

Maturity Calculator for Jeevan Lakshya

(833)

LICs New Endowment Plus ( 835)

http://www.insurance21.in/new-jeevan-anand-plan-815.php

3/31/2016

LIC New Jeevan Anand (Plan No: 815)|| Detailed Benefit Illustration Premium calcul...

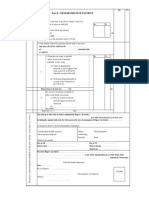

2025

36

894500

1394500

2026

37

919000

1419000

2027

38

943500

1443500

2028

39

968000

1468000

2029

40

1007500

1507500

2030

41

1034500

1534500

2031

42

1064000

1564000

2032

43

1093500

1593500

2033

44

1135500

1635500

2034

45

1187500

1687500

2035

46

1227000

1727000

Page 2 of 6

LICs Jeevan Akshay VI Pension Plan

(189)

LICs Jeevan Akshay Pension Calculator

LICs Jeevan Tarun (834)

LICs Amulya Jeevan II (823)

LICs Jeevan Lakshya (833)

Premium Calculator for New Endowment

Plan 814

LIC's Limited Premium Endowment (830)

LIC's New Endowment Plan (814)

Comments

Maturity Calculator for New Endowment

(814)

rajesh seth wrote:

24-03-2016 18:15:36

i am 26 and my wife also. we invest 30000 per year. which plan is suitable for us. in single or dute plan?

Ravi Replied:

LIC's Jeevan Shagun vs Bank's Fixed

Deposit

New Jeevan Anand (815) Maturity

Calculator

24-03-2016 20:27:29

Both of you can take jeevan lakshay.

Reply

Write Comment

Ram wrote:

21-03-2016 18:38:04

hi sir my father's age is 62 and mother's age is 48 i want to take 2 different policies of 5 lac for both please

suggest me best plan according to their age and please state reason also for opting specific policy

Ravi Replied:

21-03-2016 20:46:06

Age your fathers age is 62, so the premium to purchase a sum assured will be very high and return will be

according to sum assured purchased, I would not suggest any policy for him but he can have pension plan

with option 10.

For your mother your can take endonwent plan 814. It would better to take a regular premium paying

(Jeevan lakshay or Jeevan Labh) policy in your name instead of your father.

Reply

Write Comment

nanji k sagarka wrote:

09-03-2016 21:53:22

mera bima 2001 me jivan aand hai jiska priyam chhe mas me 2679 ata hai to meri bima kab pakega aur kitani rasi

muje milegi javab dijye sir

Ravi Replied:

10-03-2016 17:40:07

Bima rashi (sum assured) aur term kitna hai ?

Reply

Write Comment

santosh wrote:

06-03-2016 01:50:28

Lic plan no 815 returns guaranteed or not? And suppose if I pay annual premium of Rs 283000 for 17 years then

how much amount I can earn as pension annually?

Ravi Replied:

06-03-2016 10:09:04

The maturity amount equals to sum assured (guaranteed) + Bonus (variable). Bonus can also be considered

as guaranteed because, Bonus accumulates year-wise and become guaranteed to be paid at maturity. For

example, someone took policy of sum assured 10,00,000 with 21 year term in year 2013 then bonus rate

for 2013-14 was Rs. 48 per thousand of sum assured. so accumulated bonus amount will be 10,00,000 x

48/1000= 48,000 and for 2014-15 it was 49 then, accumulated bonus is 49,000, so 97,000 accumulated in

these 2 years becomes guaranteed to be paid after 21 years.

In Jeevan anand you will get entire maturity amount as a single amount as per product specification. It is up

to you to buy a pension plan available at the time of maturity or you can opt for maturity settlement option

where you can take your maturity as yearly equated amounts up to 10 years.

Reply

Write Comment

NARESH KUMAR YADU wrote:

05-03-2016 15:06:03

815 wali plan liya hu ...mera bhima dhan 1500000 lack ka hai ...21 sal ke bad mujhe kitna milega......mei sal me

81586 payment de raha hu...lekin bima dhan 21x81586=1713000 ho raha hai..

Ravi Replied:

05-03-2016 15:50:47

Bima dhan ( sum assured) total premium se jyada ho sakta h.

Reply

Write Comment

LOVELY wrote:

03-03-2016 23:59:00

My son will be 35 on march 21st of this year. He wish to take one of the policies ofnew jeevan anand and jeevan

labh .he wish to pay upto rs 35000 per month. Which policy will be best. Pl suggest

Ravi Replied:

04-03-2016 22:38:53

I would suggest Jeevan Labh.

http://www.insurance21.in/new-jeevan-anand-plan-815.php

3/31/2016

LIC New Jeevan Anand (Plan No: 815)|| Detailed Benefit Illustration Premium calcul...

Reply

Page 3 of 6

Write Comment

Sivaraman wrote:

25-02-2016 15:35:21

Vanakkam Sir, Whether it is possible to take the Jeevan Anand policy at two times. One policy this year and

another one policy after two years?

Ravi Replied:

26-02-2016 02:17:53

Yes, you can.

Reply

Write Comment

JAGADEESH wrote:

22-02-2016 20:32:08

Dear sir, if a person has a jeevan anand plan (s.a. five lakh) and matured at 56th age. He died at his 98th

age .then nominee get five lakhs ?

Ravi Replied:

22-02-2016 21:51:24

he will get 500000 bonuses at age 56 and in case of death at 98 his nominee will get another 500000.

Reply

Write Comment

Dipu wrote:

22-02-2016 17:01:13

Sir, I am looking new jeevan anand plan (815) for my wife. The S-A is 300000 for 16 years. Age is 26, so please

provide me regarding policy detail.

Ravi Replied:

23-02-2016 21:17:27

Please use maturity calculator for this plan.

Reply

Write Comment

M.RAMESH wrote:

22-02-2016 11:45:23

sir iam ramesh iam new policy jeevan anand firt premiume on 22/02/16 this policy changed in new endoment

policy(BONUS IN CREESED ) - YES OR NO

Ravi Replied:

23-02-2016 01:39:44

You can inform Lic branch in written that you are not satisfied with this plan and want to change to some

other plan.

Reply

Write Comment

R K Parida wrote:

22-02-2016 11:16:18

dear sir, i have taken two no. of policies i.e. one is LIC endowment plan (814) whose quarterly premium is Rs.

1360/-& Jeevan Anand(815) whose quarterly premium is Rs. 3049/- and both of the plan are for 20 years. Now I

am 28 years old and i have started the policy from 21.09.2015. so could u pls tell me how much return i could get?

Ravi Replied:

22-02-2016 20:54:30

please find sum assured and term of policy and use maturity calculator.

Reply

Write Comment

Gaurav Ojha wrote:

20-02-2016 15:25:05

Hiii sir, I m 33 year old and I want to invest aprox. 50,000 annualy for 21 year for my daughter which now only 6

month old. Which is the best plan for me from LIC , ICICI Ulip plan , mutual funds and many more

Ravi Replied:

20-02-2016 16:58:24

You may take jeevan lakshay plan (833) with term rider which will be suitable for daughter as it will provide

maturity or death claim amount only on completion of policy term (21 year in your case) can be used for

higher education and marriage goals. Apart from the above,I would also recommend to take SIP and PPF.

Reply

Write Comment

Ravinder Reddy wrote:

20-02-2016 11:54:18

Dear Ravi, Thanks for the details of the plans available. Am 32 years old with an monthly salary of 50k, thought of

investing around 50k per year for furture needs with risk cover and maximum returns, confused with so many

plans. please advice the best 2 plans which i can invest 25k each and get higher maturity and risk cover. and one

more thing in the maturity calculator which you shown its guaranteed or assumption. TIA Regards, Ravinder

Ravi Replied:

20-02-2016 16:52:18

I would suggest Jeevan Labh (836) and Jeevan lakshay(833), I also suggest to take term insurance such

that your minimum life cover becomes 50 Lakh. Maturity calculator shows maturity amount on the basis of

past trends (bonuses) and it it should not vary more than 5-6%.

Ravinder wrote:

20-02-2016 17:04:29

Thanks for your reply, am also in a thought of taking jeevan labh n jeevan anand instead of jeevan lakshya.N term

insurance will not give any returns apart from risk cover still should I take it for safety..please let me know n

should I take these from agent or online which one is cheaper. Thanks

Ravi Replied:

http://www.insurance21.in/new-jeevan-anand-plan-815.php

3/31/2016

LIC New Jeevan Anand (Plan No: 815)|| Detailed Benefit Illustration Premium calcul...

Page 4 of 6

20-02-2016 21:09:27

I suggested term insurance to have adequate risk cover on your life. It is very cheap, so you can have.

Regarding purchasing, Labh, anand or lakshay you can take through agent as these are not available online.

term insurance you can have online. in case you want assistance in buying please let us know.

Reply

Write Comment

Tharun wrote:

18-02-2016 11:33:00

Hi Ravi, Thanks for your detailed analysis on new Jeevan Aanand plan. I have 2 questions. 1.) I'm an NRI, I took

Jeevan Aanand plan on my last visit to India. After that I checked in LIC India website, saying that Green Card

holders are not eligible for NRI service. (I will get my Green card in next 5 years) 2.) My Plan is 10,00,000 16

years term. So that means after 16 years I will get 20,00,000 and Bonuses and After my death my nominy will get

10,00,000 ?

Ravi Replied:

18-02-2016 11:40:48

1. You should not be green card holder at the time of buying policy.

2. Please use maturity calculator for this plan to get complete details of your plan.

Reply

Write Comment

prasad wrote:

17-02-2016 06:03:59

i took jeevan anand pension plan two days back can i switch to another policy

Ravi Replied:

17-02-2016 08:19:01

No, you cannot change but you can ask your agent or branch that you want are not satisfied with this plan

and want to change to other plan. they will close it and give another plan of your choice.

Reply

Write Comment

Ganesh Kamankar wrote:

17-02-2016 03:43:34

Dear Sir , 815 New Jeevan Aanand - in which it has mentioned that I will be covered of sum assured after 21 years

of maturity period . If I don't want my Life to be secured after maturity then is there any provision to withdraw

that amount after I get maturity amount - In my case - 5 lacs is sum assured So shall I withdraw rs . 5 lacs

( which will be my life cover after maturity ) from LIC ?

Ravi Replied:

17-02-2016 12:09:31

You can surrender it after maturity, but it will be not full amount if you you will surrender at the time of

maturity then you will get around 30% of SA and it will increase as times increases after maturity.

Reply

Write Comment

Mohit yadav wrote:

13-02-2016 14:53:41

Sir, want to know is long term is beneficial or short term ? for respect of maturity benefited. & risk cover

Ravi Replied:

13-02-2016 15:12:12

Long term, because in long term, premiums will be less and return will be high and long risk cover as well.

Reply

Write Comment

Harshil Dave wrote:

13-02-2016 11:51:00

Dear Sir, I just purchased New Jeevan Anada 815 policies. Total SA is 13.6 lacs. My query is that agent has shown

returns from the 15th Policy year, is this true that jeevan anand policy provides annual returns?? Also Can I avail

maturity amount before the 101th year. For example my policy matures at 60th year of my age.

Ravi Replied:

13-02-2016 12:23:58

I guess you have more than one policy, what are the sum assured and terms of your policies.

Harshil Dave wrote:

13-02-2016 12:40:30

Yes. I have three policies. Details are as under: 1. SA 5 lacs term: 35 yrs 2. SA 4.5 lacs term: 28 yrs 3. SA 5.75

lacs term: 18 yrs.

Ravi Replied:

13-02-2016 12:53:02

Jeevan Anand provides maturity amount on completion of policy term. for example your sum assured 5.75L

will mature in 2033 and your will get maturity amount (11L) approx), however you may opt for maturity

settlement option and take 1.4L each year from 2033 to 2043. and then next plan will mature in 2044 which

will give similar option..

Reply

Write Comment

Anand Veerubhotla wrote:

11-02-2016 21:06:16

Dear Sir, good afternoon. My D.O.B. - 30/06/1974. In the year 2006, I took LIC - Jeevan Anand policy (Table 149

& Term 68-40) ; Sum Assured 10,00,000/- I have been paying premiums in last 10 years consistently without any

delay and got vested bonus double the amount of premiums I have paid. Now I realized that I was mislead by

agent with regard Tenure. According to Schedule, Date of Last payment 23/10/2045 - I will be 72 years old; Date

of Maturity 23/01/2074 - I will be 101 years. This seems to be ridiculous. May I kindly seek your advise about the

possibility of reducing the tenure (I mean date of maturity) with a possibility to pay more premium for the same

sum assured, i.e. Rs.10,00,000/- ? Any wise advise on this topic would be sincerely appreciated.

Ravi Replied:

http://www.insurance21.in/new-jeevan-anand-plan-815.php

3/31/2016

LIC New Jeevan Anand (Plan No: 815)|| Detailed Benefit Illustration Premium calcul...

Page 5 of 6

11-02-2016 23:46:16

No, Maturity will be on 23-10-2046 and from 2046 to 2074 you have life cover of 1000000.

Reply

Write Comment

Vineet Kumar wrote:

11-02-2016 12:50:45

My Details... My Sum Assured: is 700000 Term: 15 Maturity Benefit 1,134,000 Life Long Insurance Coverage After

Maturity 700,000 Sir, i want to know that after complete maturity can I get Life Long Insurance Coverage After

Maturity amount ??

Ravi Replied:

11-02-2016 19:41:40

yes..

Reply

Write Comment

sai tarun wrote:

10-02-2016 19:49:34

After the maturity period, is the risk cover only for an accidental death or for any natural death or for anykind of

death

Ravi Replied:

10-02-2016 20:51:58

Any kind of death.

Reply

Write Comment

Venkat wrote:

10-02-2016 17:10:07

Dear Ravi sir, My Brother opened Jeevan Anand and Jeevan Saral each 500000 in Aug25 and Sep 25 in 2013 year

Respectively. Half-yearly premium basis. in Jan 2016 he died. Aug 25 and Sep 25 2015 is not paid. then how much

amount our family got?? Thanks in Advance, Venkat.

Ravi Replied:

13-02-2016 08:27:15

it seems that he has paid premium for 3 year and eligible for surrender amount as at the time of death risk

cover was not available because of non-payment of premium within time. please mail your policy nos at

care@insurance21.in so that i can provide exact details.

Reply

Write Comment

udayasri wrote:

09-02-2016 12:23:21

Hi, I have taken this policy for a yearly premium of 26,641 + taxes SA 5lacs policy term 21 yrs Plz let me know

whether Accidental benefit rider is included in my plan or not

Ravi Replied:

09-02-2016 21:53:01

What was your age at the time of taking policy?

Reply

Write Comment

raj wrote:

08-02-2016 20:14:54

Sir, I have taken a plan under (815). The S-A is 300000. My Age is 20 & my yearly premium is 13341 rs. Sir, I just

want to know. what should my last D.L.P?

Ravi Replied:

09-02-2016 16:47:25

suppose you have taken policy for 16 years on 12-05-2015, then date of last payment (DLP) will be 12-052030 in case of yeaely mode and 12-11-2030 in case of half yearly mode.

Reply

Write Comment

anu wrote:

08-02-2016 14:10:01

Hello Do LIC pay back yearly in jeevan anand or we get total amount in one go. Thanks!

Ravi Replied:

08-02-2016 18:35:59

You will get maturity amount one time. Though there is option of maturity settlement where you will get

equated amounts on yearly basis or half yearly basis.

Reply

Write Comment

Suraj Shetty wrote:

04-02-2016 18:41:57

I have Jeevan Aanand T No. 815, wherein premium am paying is Rs.61363 which i need to pay for 16 years means

the total i will be paying is Rs. 9,81,808 and still assured sum is Rs, 8,000,00/- how come the sum assured will be

less than am paying can you please explain and let me know the maturity amount i will getting by doing all your

vested bonus ,etc calculations. Also can i close this policy or divert these where i can have better future plan for

my daughter who is 4 year old

Ravi Replied:

04-02-2016 23:34:21

It insurance plan and 800000 is sum assured that means in case of unfortunate event your nominee will be

paid at least 80000 even you have paid a single premium. and after maturity will be 8L plus bonuses ,

please user maturity calculator for approx values.

Reply

Write Comment

http://www.insurance21.in/new-jeevan-anand-plan-815.php

3/31/2016

LIC New Jeevan Anand (Plan No: 815)|| Detailed Benefit Illustration Premium calcul...

Page 6 of 6

T.Praneeth wrote:

04-02-2016 16:32:28

Sir, I have come to know that the normal life cover at maturity is arrived at by adding the sum assured and the

bonuses accrued over the term of the policy and the same would be paid at the time of claim settlement to the

policy holder.I would like to know if the after normal life cover equal to the sum assured at maturity could be

claimed as a lump sum payment at the time of maturity by waiving the life time cover guaranteed by the insurer?

Ravi Replied:

04-02-2016 23:50:38

yes, you may surrender your life cover after maturity.

Reply

Write Comment

T.Praneeth wrote:

03-02-2016 19:52:35

Sir, I have taken a Jeevan anand policy on 01/02/16 and I paid the premium on the same day.But the policy

document s have not yet been issued and I wish to know if it is possible to return the policy and apply for a refund

of the premium.If so what are the penalties or charges that I can be levied for such a premature termination of the

policy?

Ravi Replied:

03-02-2016 20:28:09

Yes, You can terminate, kindly visit your policy issuing branch.

Reply

Write Comment

Aarti wrote:

25-01-2016 23:29:37

Hello sir I am 32 years single mother I'm state government employ I want to secure the future of myself and my

daughter so want your opinion.

Ravi Replied:

26-01-2016 11:42:58

You can have Jeevan Lakshay with term rider or a pure term insurance.

PRAKASH wrote:

09-03-2016 14:52:18

mrs aarti my persnall opinion is that please open an child account in any of your near bank & buy a piggy bank at

your home and explain to make your child that put the money in the piggy bank daily & in the end of the month all

the money collected in the piggy bank show to ur child he/she will b quit happy after seeing the money & make

them to understand that dis will make ur futher bright and wen u r going to bank show it dat dis is the safe value

locker for ur child this will be benefit in two way ur child will understand the value of money and they will never

missuse of it.

Reply

Write Comment

brijendra singh wrote:

25-01-2016 14:28:58

this is just to confirm that do LIC's agents tell the same premium as to what we see in your premium calculator. I

don't think so. Kindly revert

Ravi Replied:

26-01-2016 11:59:10

I cannot say about your agent, but this will be the premium will be charged by LIC and will be indicated on

premium payment receipt. please note premium are inclusive of accidental benefit rider and service tax.

Reply

Write Comment

Write A Comment

Name

Email (This will not be made Public)

Mobile (This will not be made Public)

Message

Submit

Copyright 2014 - www.Insurance21.in

http://www.insurance21.in/new-jeevan-anand-plan-815.php

About Us

Privacy Policy

Disclaimer

3/31/2016

Das könnte Ihnen auch gefallen

- Retirement Strategies For Millennials: A Simple and Practical Plan for Retiring EarlyVon EverandRetirement Strategies For Millennials: A Simple and Practical Plan for Retiring EarlyNoch keine Bewertungen

- A Haven on Earth: Singapore Economy Without Duties and TaxesVon EverandA Haven on Earth: Singapore Economy Without Duties and TaxesNoch keine Bewertungen

- LIC New Jeevan Anand Plan DetailsDokument3 SeitenLIC New Jeevan Anand Plan DetailsVandana SharmaNoch keine Bewertungen

- LIC Jeevan Labh Plan (836) DetailsDokument12 SeitenLIC Jeevan Labh Plan (836) DetailsMuthukrishnan SankaranNoch keine Bewertungen

- Mr. Sandeep: Insurance Proposal ForDokument6 SeitenMr. Sandeep: Insurance Proposal ForHarish ChandNoch keine Bewertungen

- Why Loyalty Additions Not Conventional Regular Bonus in Lic Jeevan Saral Policy?Dokument1 SeiteWhy Loyalty Additions Not Conventional Regular Bonus in Lic Jeevan Saral Policy?uketechNoch keine Bewertungen

- LIC Jeevan Anand 149 in DepthDokument4 SeitenLIC Jeevan Anand 149 in Depthabdulyunus_amirNoch keine Bewertungen

- FAQ PMVVY RevisedDokument4 SeitenFAQ PMVVY Revisednikhil bhosaleNoch keine Bewertungen

- Compare Old Jeevan Anand Plan No 149 To New Jeevan Anand Plan No 815 - New LIC Plans in 2014 - LIC Plans & PoliciesDokument3 SeitenCompare Old Jeevan Anand Plan No 149 To New Jeevan Anand Plan No 815 - New LIC Plans in 2014 - LIC Plans & Policiesu4rishiNoch keine Bewertungen

- MMIP 7payDokument6 SeitenMMIP 7paykarthikrajan123Noch keine Bewertungen

- Product DetailsDokument13 SeitenProduct Detailskannakumar1983Noch keine Bewertungen

- How "Guaranteed or Assured ReturnDokument10 SeitenHow "Guaranteed or Assured ReturnDilip RajiwadeNoch keine Bewertungen

- New Jeevan Anand: Benefits Illustration SummaryDokument4 SeitenNew Jeevan Anand: Benefits Illustration SummaryVuppala RavitejaNoch keine Bewertungen

- Jeevan Surabhi - 106 - 107 - 108Dokument3 SeitenJeevan Surabhi - 106 - 107 - 108Vinay KumarNoch keine Bewertungen

- LICDokument14 SeitenLICGaurav AnandNoch keine Bewertungen

- New Creating Life Insurance PlansDokument1 SeiteNew Creating Life Insurance PlansarulkumarNoch keine Bewertungen

- An in-depth review of HDFC Life Sanchay Par Advantage plan and its suitabilityDokument11 SeitenAn in-depth review of HDFC Life Sanchay Par Advantage plan and its suitabilitySanjay S RayNoch keine Bewertungen

- Httplicjeevansaral - in 7Dokument6 SeitenHttplicjeevansaral - in 7abdulyunus_amirNoch keine Bewertungen

- Mr. Pankaj L: Insurance Proposal ForDokument6 SeitenMr. Pankaj L: Insurance Proposal ForHarish ChandNoch keine Bewertungen

- Basic Excel Functions - ProblemsDokument31 SeitenBasic Excel Functions - ProblemsSushma Jeswani TalrejaNoch keine Bewertungen

- CFP Mock Test Retirement PlanningDokument9 SeitenCFP Mock Test Retirement PlanningDeep Shikha100% (4)

- 16 Year at 41 AgeDokument4 Seiten16 Year at 41 AgeHarish ChandNoch keine Bewertungen

- Mr. Pankaj L: Insurance Proposal ForDokument6 SeitenMr. Pankaj L: Insurance Proposal ForHarish ChandNoch keine Bewertungen

- Saral 15 LakhsDokument7 SeitenSaral 15 LakhsPrashant TetaliNoch keine Bewertungen

- RTPBDokument87 SeitenRTPBKr PrajapatNoch keine Bewertungen

- How LIC Policies Work ?Dokument5 SeitenHow LIC Policies Work ?Inder Dhaliwal KangarhNoch keine Bewertungen

- This Is From FPSB India Sample Paper of RaipDokument25 SeitenThis Is From FPSB India Sample Paper of RaipsinhapushpanjaliNoch keine Bewertungen

- Jeevan Lakshya Plan FeaturesDokument2 SeitenJeevan Lakshya Plan FeaturesAvis KwtNoch keine Bewertungen

- New Children's Money Back: Benefits Illustration SummaryDokument2 SeitenNew Children's Money Back: Benefits Illustration SummaryPolireddi Gopala KrishnaNoch keine Bewertungen

- Jeevan Anand: Harish ChandDokument4 SeitenJeevan Anand: Harish ChandHarish ChandNoch keine Bewertungen

- Rad 1 Be 79Dokument6 SeitenRad 1 Be 79Harish ChandNoch keine Bewertungen

- New Moneyback 25 Years: Benefits Illustration SummaryDokument2 SeitenNew Moneyback 25 Years: Benefits Illustration Summarysamir249Noch keine Bewertungen

- Receive Payouts Once Every 5 YearsDokument6 SeitenReceive Payouts Once Every 5 YearsSheetal IyerNoch keine Bewertungen

- TVM: Time Value of Money Concepts and Retirement Planning ExamplesDokument8 SeitenTVM: Time Value of Money Concepts and Retirement Planning ExamplesSocio Fact'sNoch keine Bewertungen

- Lic Jeevan Saral Plan 165 ChartDokument3 SeitenLic Jeevan Saral Plan 165 Chartkhushbu patelNoch keine Bewertungen

- Insurance and retirement plan overview for Mr. Sai KumarDokument3 SeitenInsurance and retirement plan overview for Mr. Sai KumarSaikumar SelaNoch keine Bewertungen

- Have A Look at Its Amazing Benefits: Mr. XyzDokument3 SeitenHave A Look at Its Amazing Benefits: Mr. XyzHarish ChandNoch keine Bewertungen

- Jeevan Anand: Harish ChandDokument4 SeitenJeevan Anand: Harish ChandHarish ChandNoch keine Bewertungen

- Birla Sun Life Insurance Vision Your Policy IllustrationDokument1 SeiteBirla Sun Life Insurance Vision Your Policy IllustrationmiteshsuneriyaNoch keine Bewertungen

- Atal Pension Yojana (APY)Dokument75 SeitenAtal Pension Yojana (APY)prasenjit_gayen100% (2)

- Jeevan Anand: Harish ChandDokument4 SeitenJeevan Anand: Harish ChandHarish ChandNoch keine Bewertungen

- Lic of India LTDDokument4 SeitenLic of India LTDAnish PenmahaleNoch keine Bewertungen

- Retirement Planning TipsDokument91 SeitenRetirement Planning TipsSachin BhoirNoch keine Bewertungen

- Aam Admi Bima Yojana Lic PolicyDokument13 SeitenAam Admi Bima Yojana Lic PolicyNarendra KumarNoch keine Bewertungen

- Astha Life Insurance Company LimitedDokument8 SeitenAstha Life Insurance Company Limitedanisulislam asifNoch keine Bewertungen

- Table No 165Dokument2 SeitenTable No 165ssfinservNoch keine Bewertungen

- Birla Sun Life Vision PlanDokument3 SeitenBirla Sun Life Vision Planshahtejas12Noch keine Bewertungen

- Jeevan AmritDokument11 SeitenJeevan Amritapi-3800339100% (1)

- TMB Navarathnamala RD: Get Attractive Returns on Monthly SavingsDokument3 SeitenTMB Navarathnamala RD: Get Attractive Returns on Monthly SavingsSelvaraj MurugesanNoch keine Bewertungen

- Kotak Mahindra Life Insurance LimitedDokument7 SeitenKotak Mahindra Life Insurance LimitedAjay PawarNoch keine Bewertungen

- GSIP BrochureDokument2 SeitenGSIP Brochureabdul.nm4064Noch keine Bewertungen

- CFP Retirement Planning and Employee Benefits Monk Test.Dokument27 SeitenCFP Retirement Planning and Employee Benefits Monk Test.Vandana ReddyNoch keine Bewertungen

- Ravi Retire and Enjoy 48y To 75yDokument4 SeitenRavi Retire and Enjoy 48y To 75yRavindranath TgNoch keine Bewertungen

- Pension Planning: Top 5 Regular Income Options After RetirementDokument2 SeitenPension Planning: Top 5 Regular Income Options After RetirementPSNoch keine Bewertungen

- GIP Sales BrochureDokument15 SeitenGIP Sales BrochureSiva NandNoch keine Bewertungen

- 3 Most Important Personal Finance Formula's You Should KnowDokument15 Seiten3 Most Important Personal Finance Formula's You Should KnowajujkNoch keine Bewertungen

- FM AnswersDokument4 SeitenFM AnswersGamer zoneNoch keine Bewertungen

- Value & ReturnDokument1 SeiteValue & ReturnShihad Panoor N KNoch keine Bewertungen

- Calculate future and present value of investments at different interest ratesDokument48 SeitenCalculate future and present value of investments at different interest ratesavivaindiaNoch keine Bewertungen

- Kerala Public Service Commission: E-PaymentDokument5 SeitenKerala Public Service Commission: E-PaymentAnonymous YakppP3vAnNoch keine Bewertungen

- Bridge Manual PDF Complete v3.4Dokument374 SeitenBridge Manual PDF Complete v3.4Anonymous YakppP3vAnNoch keine Bewertungen

- Sale ProceedingsDokument1 SeiteSale ProceedingsAnonymous YakppP3vAnNoch keine Bewertungen

- Coconut Pile BridgeDokument1 SeiteCoconut Pile BridgeAnonymous YakppP3vAnNoch keine Bewertungen

- Thach 05Dokument1 SeiteThach 05Anonymous YakppP3vAnNoch keine Bewertungen

- 004 ShearBending PDFDokument1 Seite004 ShearBending PDFAnonymous YakppP3vAnNoch keine Bewertungen

- Final Answer KeyDokument13 SeitenFinal Answer KeyAnonymous YakppP3vAnNoch keine Bewertungen

- Important: Candidates Are Required To Apply Only Through Online ModeDokument31 SeitenImportant: Candidates Are Required To Apply Only Through Online ModeRakheeb BashaNoch keine Bewertungen

- Part Ii - Memorandum of Payment: Rs PsDokument1 SeitePart Ii - Memorandum of Payment: Rs PsAnonymous YakppP3vAnNoch keine Bewertungen

- Kerala Service Rules Part 1Dokument18 SeitenKerala Service Rules Part 1sinoshNoch keine Bewertungen

- Local Holiday 10-09-2021Dokument1 SeiteLocal Holiday 10-09-2021Anonymous YakppP3vAnNoch keine Bewertungen

- LinksDokument1 SeiteLinksAnonymous YakppP3vAnNoch keine Bewertungen

- Design of Deck Slab ReinforcementDokument1 SeiteDesign of Deck Slab ReinforcementAnonymous YakppP3vAnNoch keine Bewertungen

- Flexure Check For Bridges PDFDokument1 SeiteFlexure Check For Bridges PDFAnonymous YakppP3vAnNoch keine Bewertungen

- 004 IRC Deck Slab DesignDokument1 Seite004 IRC Deck Slab DesignAnonymous YakppP3vAnNoch keine Bewertungen

- 005 DiagramDokument1 Seite005 DiagramAnonymous YakppP3vAnNoch keine Bewertungen

- 002 - Estimate FormatDokument1 Seite002 - Estimate FormatAnonymous YakppP3vAnNoch keine Bewertungen

- Design of Deck Slab ReinforcementDokument1 SeiteDesign of Deck Slab ReinforcementAnonymous YakppP3vAnNoch keine Bewertungen

- 003 Bridge Pier PDFDokument4 Seiten003 Bridge Pier PDFAnonymous YakppP3vAnNoch keine Bewertungen

- Ring Bund, Water Pumping, Earthwork & Demolition EstimatesDokument1 SeiteRing Bund, Water Pumping, Earthwork & Demolition EstimatesAnonymous YakppP3vAnNoch keine Bewertungen

- Retaining Wall Over PDFDokument1 SeiteRetaining Wall Over PDFAnonymous YakppP3vAnNoch keine Bewertungen

- Retaining Wall Sli PDFDokument1 SeiteRetaining Wall Sli PDFAnonymous YakppP3vAnNoch keine Bewertungen

- MC CulvertDokument1 SeiteMC CulvertAnonymous YakppP3vAnNoch keine Bewertungen

- Retaining Wall Shear Key PDFDokument1 SeiteRetaining Wall Shear Key PDFAnonymous YakppP3vAnNoch keine Bewertungen

- Retaining Wall Sli PDFDokument1 SeiteRetaining Wall Sli PDFAnonymous YakppP3vAnNoch keine Bewertungen

- Culvert Quantity CalculationDokument2 SeitenCulvert Quantity CalculationAnonymous YakppP3vAnNoch keine Bewertungen

- Retaining Wall Over PDFDokument1 SeiteRetaining Wall Over PDFAnonymous YakppP3vAnNoch keine Bewertungen

- Retaining Wall Shear Key PDFDokument1 SeiteRetaining Wall Shear Key PDFAnonymous YakppP3vAnNoch keine Bewertungen

- Structural DetailsDokument1 SeiteStructural DetailsAnonymous YakppP3vAnNoch keine Bewertungen

- FB CH 2535 To 2770Dokument2 SeitenFB CH 2535 To 2770Anonymous YakppP3vAnNoch keine Bewertungen

- Cigna SmartCare Helpful GuideDokument42 SeitenCigna SmartCare Helpful GuideFasihNoch keine Bewertungen

- Aditya Retirement PlanningDokument49 SeitenAditya Retirement PlanningAditya TiwariNoch keine Bewertungen

- LC Issuance Request LetterDokument4 SeitenLC Issuance Request LetterAakay EnterprisesNoch keine Bewertungen

- Cuvva Case Analysis PDFDokument6 SeitenCuvva Case Analysis PDFAbhishekk TiwariNoch keine Bewertungen

- Health Insurance Activity Sheet - Spring 2022 1Dokument4 SeitenHealth Insurance Activity Sheet - Spring 2022 1api-632711577Noch keine Bewertungen

- PolicySchedule 22300031200160077963 178044227 PDFDokument1 SeitePolicySchedule 22300031200160077963 178044227 PDFVimal RathinasamyNoch keine Bewertungen

- Updated List of Insurance Entities in Good Standing As at November 20, 2020Dokument5 SeitenUpdated List of Insurance Entities in Good Standing As at November 20, 2020Fuaad DodooNoch keine Bewertungen

- SC Rules P&I Club Needs License as Insurer, Agent Requires Separate LicenseDokument1 SeiteSC Rules P&I Club Needs License as Insurer, Agent Requires Separate LicenseApril Gem BalucanagNoch keine Bewertungen

- Edelweiss Tokio Life - Cashflow ProtectionDokument10 SeitenEdelweiss Tokio Life - Cashflow ProtectionRohan R TamhaneNoch keine Bewertungen

- BS BuzzDokument8 SeitenBS BuzzBS Central, Inc. "The Buzz"Noch keine Bewertungen

- Result (Phase-I) To Be Displayed On WebsiteDokument14 SeitenResult (Phase-I) To Be Displayed On Websiteneekuj malikNoch keine Bewertungen

- Business Vocabulary PDFDokument18 SeitenBusiness Vocabulary PDFClaudia Catalan PennaNoch keine Bewertungen

- Agriculture DirectivesDokument38 SeitenAgriculture DirectivesLaxmi Bir MathemaNoch keine Bewertungen

- AKPA PolicyDokument10 SeitenAKPA PolicyRatheeshkumar Almurshed TravelNoch keine Bewertungen

- Maximizing Retirement Income Through Lifetime AnnuityDokument16 SeitenMaximizing Retirement Income Through Lifetime AnnuityK SNoch keine Bewertungen

- Mahler STAM Practice ExamsDokument390 SeitenMahler STAM Practice ExamsEmmanuelNoch keine Bewertungen

- Contract of IndemnityDokument3 SeitenContract of IndemnityAdan HoodaNoch keine Bewertungen

- Dominion Insurance Corp. v. Court of Appeals ruling on agent's authorityDokument4 SeitenDominion Insurance Corp. v. Court of Appeals ruling on agent's authoritywuplawschoolNoch keine Bewertungen

- Acko All-Round Protection PlanDokument3 SeitenAcko All-Round Protection PlanR YogaeshwerNoch keine Bewertungen

- Final Expense Lead ScriptDokument1 SeiteFinal Expense Lead Scriptallrounder fightNoch keine Bewertungen

- Po 2301 10060375 0 UsDokument6 SeitenPo 2301 10060375 0 UsAli MohamedNoch keine Bewertungen

- Understanding the Key Elements of Succession Law in the PhilippinesDokument5 SeitenUnderstanding the Key Elements of Succession Law in the PhilippinesMaia RegiafalceNoch keine Bewertungen

- AnnexG eKAS&ePresSDokument2 SeitenAnnexG eKAS&ePresSLaish Christle CapiendoNoch keine Bewertungen

- Family BudgetDokument3 SeitenFamily BudgetThuoNoch keine Bewertungen

- Harley Davidson InsuranceDokument4 SeitenHarley Davidson InsuranceDJ CherryNoch keine Bewertungen

- Master Service AgreementDokument8 SeitenMaster Service AgreementswarnaNoch keine Bewertungen

- Juxt Indian Urbanites Study 2010Dokument15 SeitenJuxt Indian Urbanites Study 2010JuxtConsult Pvt. Ltd.Noch keine Bewertungen

- Account Opening FormDokument14 SeitenAccount Opening FormAbdirahman mohamed100% (1)

- Usage-Based Insurance: Practical for Motor Policies in ZimbabweDokument7 SeitenUsage-Based Insurance: Practical for Motor Policies in ZimbabweKurauone MuswereNoch keine Bewertungen

- Conjunctions-YT Vid LT+BTDokument7 SeitenConjunctions-YT Vid LT+BTHồng Đức LêNoch keine Bewertungen