Beruflich Dokumente

Kultur Dokumente

Gross Profit Analysis: Multiple Choice

Hochgeladen von

Maryferd SisanteOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Gross Profit Analysis: Multiple Choice

Hochgeladen von

Maryferd SisanteCopyright:

Verfügbare Formate

Management Services by Luzviminda S.

Payongayong

Y2006 edition

CHAPTER 4

Gross Profit Analysis

Multiple Choice

1a

P150,000 F

120,000 UF

Price Current year's sales

volume

Adjusted Sales

Last Year's sales

2a

P56,000 F

TYP X TYTQ X TYM =

12.00

20,000

0.45

9.00

20,000

0.45

5.00

4,000

0.09

44,000

1.00

P28,000 UF

X

Y

Z

TYP x

9.00

7.50

4.00

GROSS PROFIT

QUANTITY

VARIANCE

x 150,000

P750,000.00

LYP x TYQ

P720000

180,000

x 150,000

600,000.00

LYP x LYQ

P720,000

180,000

x 180,000

720,000.00

Current year's sales

X

Y

Z

3c

TYP x TYQ

P750,000

150,000

Adjusted Sales I

TOTAL

SALES

240,000.00

180,000.00

20,000.00

440,000.00

Current year's cost of sales

TOTAL

TYTQ x TYM =

SALES

20,000

0.45

180,000.00

20,000

0.45

150,000.00

4,000

0.09

16,000.00

44,000

1.00

346,000.00

94,000.00

Adjusted Sales II

LYP X TYQ X

TYM =

10.00

20,000

0.45

8.00

20,000

0.45

6.00

4,000

0.09

44,000

1.00

ADJUSTED

SALES I

200,000.00

160,000.00

24,000.00

384,000.00

Adjusted Cost of Sales I

LYP x

8.00

7.00

4.50

TYQ x

TYM =

20,000

0.45

20,000

0.45

4,000

0.09

44,000

1.00

ADJUSTED

SALES I

160,000.00

140,000.00

18,000.00

318,000.00

66,000.00

Last year's sales

TOTAL

1 339447946.xlsx

TOTAL

Management Services by Luzviminda S. Payongayong

Y2006 edition

ADJ S I - ADJ. SA II

18,181.82

14,545.45

2,181.82

34,909.09

Quantity Variance

Adj. COS I Adj. COS I

14,545.45

12,727.27

1,636.36

28,909.09

F

F

F

F

X

Y

Z

LYP X LYTQ X TYM =

10.00

15,000

0.45

8.00

20,000

0.45

6.00

5,000

0.09

40,000

1.00

SALES

181,818.18

145,454.55

21,818.18

349,090.91

LYP X LYTQ X

TYM =

10.00

15,000

0.38

8.00

20,000

0.50

6.00

5,000

0.13

40,000

1.00

Adjusted COS II

UF

UF

UF

UF

4b

6,000.00 F

P6,000 F

5a

P2,500 F

6d

( P27,216)

X

Y

Z

Adjusted Cost of Sales I

LYC x TYTQ x TYM =

8.00

15,000

0.45

7.00

20,000

0.45

4.50

5,000

0.09

40,000

1.00

GROSS PROFIT

SALES

150,000.00

160,000.00

30,000.00

340,000.00

TOTAL

COS

145,454.55

127,272.73

16,363.64

289,090.91

LYC x

8.00

7.00

4.50

LYQ x

LYM =

15,000

0.38

20,000

0.50

5,000

0.13

40,000

1.00

60,000.00

Sales this year

Sales this year at last year's prices

Decrease in sales due to change in price

Sales TY at LYP

Sales last year

Increase in the sales due to change in volume

Change in volume

33,600 / 420,000

or

P453,600 / P420,000

=

2 339447946.xlsx

ADJUSTED

SALES I

120,000.00

140,000.00

22,500.00

282,500.00

57,500.00

P426,384.00

(453,600.00)

(27,216.00) UF

(P426384 / 94%)

=

108%

P453,600.00

420,000.00

33,600.00

8%

Management Services by Luzviminda S. Payongayong

Y2006 edition

sales this year is 1.08% of last year.

7c

P13,154.40

Cost this year

Cost this year at last year's cost

P243,600 x 108%

Increase in cost due to change is cost price

P276,242.40

263,088.00

13,154.40 UF

8c

P19,488

Cost this year at last year's cost

Cost Last year

Increase in cost due to change in volume

P263,088.00

243,600.00

19,488.00 UF

9a

8% increase

see number 6

10 b

5% increase

Change in cost price /

% change

11 b

P20,000

12 a

P70,000

Cost this year at LYC

P13,154.40

263,088

or

P276,248.40 /

263,088

=

* cost this year is 105% of last year

Sales this year

Sales this year at last year's prices

13 Increase in sales due to change in price

=

1.05 or 105%

P1,237,500.00

(1,100,000.00)

137,500.00 F

(P1,237,500 /1.125%)

Sales TY at LYP

Sales last year

Increase in the sales due to change in volume

14 c

13 c

10%

P137,500

14 Change in volume

P100,000 / P1,000,000

or

P1,100,000 / P1,000,000

=

sales this year is 1.10% of last year.

Cost this year

Cost this year at last year's cost

P800,000 x 1.10%

12 Increase in cost due to change is cost price

3 339447946.xlsx

5%

P1,100,000.00

(1,000,000.00)

100,000.00

=

10%

110%

P950,000.00

(880,000.00)

70,000.00 UF

Management Services by Luzviminda S. Payongayong

Y2006 edition

Cost this year at last year's cost

Cost Last year

Increase in cost due to change in volume

P880,000.00

(800,000.00)

80,000.00 UF

15 a

7.955%

Change in cost price

P70,000 / 880,000

or

P950,000 / 800,000

= 1.07955

16 d

P84,000 favorable

2003 Actual sales

1 30,000 x (P225,000 / 22,500) =

2 30,000 x (P240,000 / 30,000) =

3 6,000 x (P45,000 / 7,500) =

Sales Price factory - favorable

300,000.00

240,000.00

36,000.00

2003 Actual cost of sales

1 30,000 x (P180,000 / 22,500) =

2 30,000 x (P210,000 / 30,000) =

3 6,000 x (P33,750 / 7,500) =

Cost of Sales factor - unfavorable

240,000.00

210,000.00

27,000.00

17 b

P42,000 unfavorable

18 b

P1.50

660,000.00

576,000.00

84,000.00

519,000.00

2003 Average Gross Profit at 2002 prices and costs:

(P576,000 - P477,000) / 66,000

19 a

P8,625 Favorable

2002 Average gross profit per unit (P510,000 - P423,750) / 60,000 =

x increase in units sold (66,000 - 60,000)

Quantity factor - favorable

20 b

P4,125 favorable

2003 Average gross profit at 2002 prices and costs

2002 Average gross profit per unit (P510,000 - P423,750) / 60,000

Increase in gross profit per unit

x 2003 units sold

Sales mix factor - favorable

4 339447946.xlsx

7.955%

477,000.00

42,000.00

1.50

1.4375

6,000

8,625

1.5000

1.4375

0.0625

66,000

4,125.00

Management Services by Luzviminda S. Payongayong

Y2006 edition

P150,000 F

120,000 UF

price

variance

40,000.00 F

20,000.00 F

(4,000.00) UF

56,000.00 F

cost

variance

20,000.00 UF

10,000.00 UF

(2,000.00) F

28,000.00 UF

28,000.00 F

Mix

5 339447946.xlsx

Management Services by Luzviminda S. Payongayong

Y2006 edition

Variance

31,818.18 F

(14,545.45) UF

(8,181.82) UF

9,090.91 F

Mix

variance

25,454.55 UF

(12,727.27) F

(6,136.36) F

6,590.91 UF

2,500.00 F

UF

6 339447946.xlsx

Management Services by Luzviminda S. Payongayong

Y2006 edition

7 339447946.xlsx

Management Services by Luzviminda S. Payongayong

Y2006 edition

8 339447946.xlsx

Management Services by Luzviminda S. Payongayong

Y2006 edition

CHAPTER 4

Gross Profit Analysis

PROBLEMS

4.1

solutions:

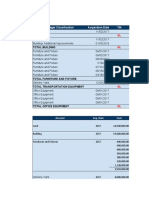

Sales

Cost of Sales

Gross Profit

Units sold

Selling price per unit

Cost of sales per unit

Y2015

194,250.00

100,270.00

93,980.00

18,500

10.50

5.42

1 Using the two factor method

Current Year's Sales

2008 Sales x 2008 Quantity

10.50 x

18,500.00

Y2014

175,000.00

105,000.00

70,000.00

17,500

10.00

6.00

194,250.00

Adjusted Sales

2007 Price x 2008 Quantity

10.00 x

18,500.00

Last Year's Sales

2007 Price x 2007 Quantity

10.00 x

17,500.00

Change in sales

Current Year's Cost of Sales

2008 Cost of Sales x 2008 Quantity

5.42 x

18,500.00

Adjusted Cost of Sales

2007 Cost x 2008 Quantity

6.00 x

185,000.00

175,000.00

100,270.00

18,500.00

111,000.00

Last Year's Cost of Sales

2007 Price x 2007 Quantity

6.00 x

17,500.00

Change in Cost of Sales

CHANGE IN GROSS PROFIT

105,000.00

2 Using the three factor method:

Accounting for change in sales:

Price:

(P10.50 - P10.00) x 17,500

Quantity:

(18,500-17,500) x 10.00

Quantity-price:

(P10.50 - P10.00) x (18,500 - 17,500)

9 339447946.xlsx PROBLEMS

8,750.00

10,000.00

500.00

Management Services by Luzviminda S. Payongayong

Y2006 edition

change in gross profit due to change in sales

19,250.00

Accounting for change in cost of sales:

Cost

(P5.42 - P6.00) x 17,500

Quantity:

(18,500-17,500) x 6

Quantity-price:

(P5.42- P6.00) x (18,500 - 17,500)

Change in gross profit due to change is cost of sales

CHANGE IN GROSS PROFIT

(10,150.00)

6,000.00

(580.00)

(4,730.00)

23,980.00

4.2

solutions:

Sales

Cost of Sales

Gross Profit

Units sold

Selling price per unit

Cost of sales per unit

Year 2

891,000.00

688,500.00

202,500.00

81,000

11.00

8.50

Year 1

840,000.00

945,000.00

(105,000.00)

105,000

8.00

9.00

Accounting for change in sales:

Price:

(P11.00 - P8.00) x 105,000

Quantity:

(81,000-105,000) x 8.00

Quantity-price:

(P11.00 - P8.00) x (81,000 - 105,000)

change in gross profit due to change in sales

315,000.00

(192,000.00)

(72,000.00)

51,000.00

Accounting for change in cost of sales:

Cost

(P8.50 - P9.00) x 105,000

Quantity:

(81,000-105,000) x 9

Quantity-price:

(P8.50- P9.00) x (81,000 - 105,000)

Change in gross profit due to change is cost of sales

CHANGE IN GROSS PROFIT

(52,500.00)

(216,000.00)

12,000.00

(256,500.00)

307,500.00

4.3

solutions:

Sales

Y2015

1,305,000.00

10 339447946.xlsx PROBLEMS

Y2014

1,160,000.00

Management Services by Luzviminda S. Payongayong

Y2006 edition

Cost of Sales

Gross Profit

using the two factor method:

843,900.00

461,100.00

696,000.00

464,000.00

unit cost decreased by 3%

Compute first the change is cost of sales:

Cost factor:

Cost of Sales this year

843,900.00

Less, Cost of sales this year at last year's cost

P843,900/97%

870,000.00

Change in cost of sales due to change in unit cost - unfavorable

(26,100.00)

Quantity factor

Cost of Sales this year at last year's cost

870,000.00

Less, Cost of Sales last year

696,000.00

Change in sales due to change in volume = FAV

174,000.00

NET CHANGE IN COST OF SALES - UNFAVORABLE

147,900.00

Based now on the above, the quantity changes could be determined as an increase of 25% as it showed

an increase in cost of sales this year at last year's cost. Thus change in sales can be computed using the change

in volume, as any change in volume of sales will also be the change in cost at quantity sold is common to sales and cost

To compute for the changes in sales:

Price factor:

Sales this year

Less, sales this year at last year's selling prices

1,160,000 x 1.25

Change in sales due to change in selling price -unfavorable

1,305,000.00

1,450,000.00

(145,000.00)

Quantity factory

Sales this year at last year's selling prices

Less, Sales last year

Change in sales due to change in volume - favorable

NET CHANGE IN SALES - FAVORABLE

NET CHANGE IN GROSS PROFITM - UNFAVORABLE

1,450,000.00

1,160,000.00

290,000.00

145,000.00

(2,900.00)

4.5

Y2015

yellow soap

black soap

totals

units

15,000

30,000

45,000

usp

20.00

8.00

ucp

12.00

3.93

sales

300,000.00

240,000.00

540,000.00

cost of sales

180,000.00

117,900.00

297,900.00

Y2014

yellow soap

black soap

totals

units

18,750

27,000

45,750

usp

18.00

8.40

ucp

12.60

4.00

sales

337,500.00

226,800.00

564,300.00

cost of sales

236,250.00

108,000.00

344,250.00

(24,300.00)

(46,350.00)

TOTAL CHANGES

(750.00) decrease

Price factor

11 339447946.xlsx PROBLEMS

Management Services by Luzviminda S. Payongayong

Y2006 edition

Sales this year

Sales this year at last year's prices

yellow soap

15,000

18.00

black soap

30,000

8.40

45,000

favorable

Cost factor

Cost of Sales this year

Cost of Sales this year at last year's cost

yellow soap

15,000

12.60

black soap

30,000

4.00

45,000

favorable

540,000.00

270,000.00

252,000.00

522,000.00

18,000.00

297,900.00

189,000.00

120,000.00

Quantity factor

Units sold this year at last year's average gross profit

45,000 x P4.80984

Last year's gross profit

favorable

Average gross profit =

220,050.00 / 45,750 =

Sales mix factor

This year's gross profit at last year's price and cost

522,000.00 309,000.00

Units sold this year at last year's average gross profit

45,000.00 x

4.80984

favorable

Increase ( Decrease) in Gross Profit

12 339447946.xlsx PROBLEMS

309,000.00

11,100.00

216,442.62

220,050.00

(3,607.38)

4.80984

213,000.00

216,442.62

(3,442.62)

22,050.00

Management Services by Luzviminda S. Payongayong

Y2006 edition

change

19,250.00 favorable

(4,730.00) favorable

23,980.00 favorable

9,250.00 favorable

10,000.00 favorable

19,250.00 favorable

(10,730.00) favorable

6,000.00 favorable

(4,730.00) favorable

23,980.00 favorable

favorable

favorable

favorable

13 339447946.xlsx PROBLEMS

Management Services by Luzviminda S. Payongayong

Y2006 edition

favorable

favorable

unfavorable

favorable

favorable

favorable

change

51,000.00

(256,500.00)

307,500.00

(24,000.00)

3.00

(0.50)

favorable

favorable

favorable

increased

decreased

favorable

unfavorable

unfavorable

favorable

favorable

unfavorable

favorable

favorable

favorable

change

145,000.00 favorable

14 339447946.xlsx PROBLEMS

Management Services by Luzviminda S. Payongayong

Y2006 edition

147,900.00 unfavorable

(2,900.00) unfavorable

26,100/870,000

(0.03)

174,000/696,000

0.25

rease of 25% as it showed

be computed using the change

tity sold is common to sales and cost.

145,000/1,450,000

(0.10)

290,000/1,160,000

0.25

gross profit

120,000.00

122,100.00

242,100.00

gross profit

101,250.00

118,800.00

220,050.00

22,050.00

15 339447946.xlsx PROBLEMS

Management Services by Luzviminda S. Payongayong

Y2006 edition

16 339447946.xlsx PROBLEMS

Management Services by Luzviminda S. Payongayong

Y2006 edition

4.5

products

yellow soap

black soap

Totals

Y2008

Sales

Price

variance

300,000.00

240,000.00

540,000.00

Adjusted

sales I

30,000.00

(12,000.00)

18,000.00

Quantity

Variance

270,000.00

252,000.00

522,000.00

(4,500.00)

(4,200.00)

(8,700.00)

Actual Sales

yellow

black

Adjusted sales I

yellow

black

TYP

20.00

8.00

x

x

x

x

x

x

15,000

30,000

TYM

./

./

45,000

45,000

.=

.=

x

x

x

TYQ

45,000

45,000

.

TYQ

45,000

45,000

LYP

18.00

8.40

x

x

x

15,000

30,000

TYM

./

./

45,000

45,000

.=

.=

LYP

18.00

8.40

x

x

x

LYQ

45,750

45,750

x

x

x

15,000

30,000

TYM

./

./

45,000

45,000

.=

.=

LYP

18.00

8.40

x

x

x

LYQ

45,750

45,750

x

x

x

18,750

27,000

LYM

./

./

45,750

45,750

.=

.=

Adjusted sales II

yellow

black

Budgeted Sales

yellow

black

products

yellow soap

black soap

Totals

Y2008

Cost

180,000.00

117,900.00

297,900.00

cost

variance

(9,000.00)

(2,100.00)

(11,100.00)

4 339447946.xlsx Sheet3

Adjusted

Cost I

189,000.00

120,000.00

309,000.00

Quantity

Variance

(3,150.00)

(2,000.00)

(5,150.00)

Management Services by Luzviminda S. Payongayong

Y2006 edition

Actual Sales

TYC

yellow

12.00

black

3.93

Adjusted sales I

LYC

yellow

12.60

black

4.00

x

x

x

x

x

x

15,000

30,000

TYM

./

./

45,000

45,000

.=

.=

x

x

x

TYQ

45,000

45,000

.

TYQ

45,000

45,000

x

x

x

15,000

30,000

TYM

./

./

45,000

45,000

.=

.=

LYC

12.60

4.00

x

x

x

LYQ

45,750

45,750

x

x

x

15,000

30,000

TYM

./

./

45,000

45,000

.=

.=

LYC

12.60

4.00

x

x

x

LYQ

45,750

45,750

x

x

x

18,750

27,000

LYM

./

./

45,750

45,750

.=

.=

Adjusted sales II

yellow

black

Budgeted Sales

yellow

black

TOTAL VARIANCE IN QUANTITY & MIX

CHANGE IN GROSS PROFIT - UNFAVORABLE

4 339447946.xlsx Sheet3

(3,550.00)

Management Services by Luzviminda S. Payongayong

Y2006 edition

Adjusted

Sales II

274,500.00

256,200.00

530,700.00

Mix

Variance

(63,000.00)

29,400.00

(33,600.00)

Y2007

Sales

337,500.00

226,800.00

564,300.00

300,000.00

240,000.00

540,000.00

270,000.00

252,000.00

522,000.00

18,000.00 FAV

274,500.00

256,200.00

530,700.00

(8,700.00) UF

337,500.00

226,800.00

564,300.00

(33,600.00) UF

(24,300.00) UF

Adjusted

Cost II

192,150.00

122,000.00

314,150.00

Mix

Variance

(44,100.00)

14,000.00

(30,100.00)

Y2007

cost

236,250.00

108,000.00

344,250.00

4 339447946.xlsx Sheet3

Management Services by Luzviminda S. Payongayong

Y2006 edition

180,000.00

117,900.00

297,900.00

189,000.00

120,000.00

309,000.00

(11,100.00) UF

192,150.00

122,000.00

314,150.00

(5,150.00) UF

236,250.00

108,000.00

344,250.00

(3,500.00)

(30,100.00) UF

(46,350.00) UF

22,050.00 UF

4 339447946.xlsx Sheet3

Das könnte Ihnen auch gefallen

- 06 Standard Costing KEYDokument13 Seiten06 Standard Costing KEYKlasz Klasz100% (1)

- 162 020Dokument5 Seiten162 020Angelli LamiqueNoch keine Bewertungen

- AssignmentDokument2 SeitenAssignmentLois JoseNoch keine Bewertungen

- Non-Routine DecisionsDokument5 SeitenNon-Routine DecisionsVincent Lazaro0% (1)

- ULO A Analyze Act1Dokument5 SeitenULO A Analyze Act1Marian B TersonaNoch keine Bewertungen

- AP Equity 1Dokument3 SeitenAP Equity 1Mark Michael Legaspi100% (1)

- Econ2 - No.1Dokument2 SeitenEcon2 - No.1Junvy AbordoNoch keine Bewertungen

- Accounting For Taxes & Employee BenefitsDokument5 SeitenAccounting For Taxes & Employee BenefitsAveryl Lei Sta.Ana100% (1)

- Special Revenue Recognition Special Revenue RecognitionDokument4 SeitenSpecial Revenue Recognition Special Revenue RecognitionCee Gee BeeNoch keine Bewertungen

- Chapter 8Dokument7 SeitenChapter 8Yenelyn Apistar CambarijanNoch keine Bewertungen

- CHAPTER 5 Cost Concepts, Classifications, and Cost Behavior: I True or False 16Dokument2 SeitenCHAPTER 5 Cost Concepts, Classifications, and Cost Behavior: I True or False 16Maryferd SisanteNoch keine Bewertungen

- Mockboard Ms 2014Dokument12 SeitenMockboard Ms 2014Mark Lord Morales Bumagat100% (1)

- BALIMBIN TBLTpg83-94Dokument14 SeitenBALIMBIN TBLTpg83-94mariyha Palanggana0% (1)

- Lesson 6 Business TaxesDokument9 SeitenLesson 6 Business TaxesReino CabitacNoch keine Bewertungen

- Solution Chapter 8Dokument20 SeitenSolution Chapter 8Clarize R. Mabiog100% (1)

- MASDokument7 SeitenMASHelen IlaganNoch keine Bewertungen

- 221 ExamsDokument10 Seiten221 ExamsElla Mae AgoniaNoch keine Bewertungen

- Cost Accounting - Exercise 1Dokument2 SeitenCost Accounting - Exercise 1Anna MaglinteNoch keine Bewertungen

- 2016 Vol 1 CH 8 Answers - Fin Acc SolManDokument7 Seiten2016 Vol 1 CH 8 Answers - Fin Acc SolManPamela Cruz100% (1)

- Orca Share Media1577676507201Dokument4 SeitenOrca Share Media1577676507201Jayr BVNoch keine Bewertungen

- Saint Joseph College of Sindangan Incorporated College of AccountancyDokument18 SeitenSaint Joseph College of Sindangan Incorporated College of AccountancyRendall Craig Refugio0% (1)

- Assignment On Forecasting 2020Dokument2 SeitenAssignment On Forecasting 2020Kim JennieNoch keine Bewertungen

- CMPC 221 Finals Quiz 2Dokument5 SeitenCMPC 221 Finals Quiz 2Maria CristinaNoch keine Bewertungen

- Chapter 16 AmponganDokument2 SeitenChapter 16 AmponganLaine Ricafort100% (2)

- Framework of AccountingDokument11 SeitenFramework of AccountingAngelica ManaoisNoch keine Bewertungen

- P1 1Dokument12 SeitenP1 1Donna Mae Hernandez0% (1)

- ParCor AccountingDokument2 SeitenParCor AccountinggirlieNoch keine Bewertungen

- Adv Acctg Ch. 15 Practice Problems HoyleDokument22 SeitenAdv Acctg Ch. 15 Practice Problems Hoylej loNoch keine Bewertungen

- Defined Benefit Plan-Midnight CompanyDokument2 SeitenDefined Benefit Plan-Midnight CompanyDyenNoch keine Bewertungen

- Problem 1Dokument4 SeitenProblem 1andrei jude matullanoNoch keine Bewertungen

- Solman EquityDokument12 SeitenSolman EquityBrunxAlabastroNoch keine Bewertungen

- 633833334841206250Dokument57 Seiten633833334841206250Ritesh Kumar Dubey100% (1)

- 3.3 Exercise - Improperly Accumulated Earnings TaxDokument2 Seiten3.3 Exercise - Improperly Accumulated Earnings TaxRenzo KarununganNoch keine Bewertungen

- Chapter 6 Just in Time and Bacflush AccountingDokument17 SeitenChapter 6 Just in Time and Bacflush AccountingだみNoch keine Bewertungen

- Chapter 12-14Dokument18 SeitenChapter 12-14Serena Van Der WoodsenNoch keine Bewertungen

- Module 1 ExamDokument4 SeitenModule 1 ExamTabatha Cyphers100% (2)

- Identify The Choice That Best Completes The Statement or Answers The QuestionDokument5 SeitenIdentify The Choice That Best Completes The Statement or Answers The QuestionErine ContranoNoch keine Bewertungen

- Cel 1 Prac 1 Answer KeyDokument15 SeitenCel 1 Prac 1 Answer KeyNJ MondigoNoch keine Bewertungen

- DocxDokument151 SeitenDocxJillianne JillNoch keine Bewertungen

- FINANCE LEASE-lecture and ExercisesDokument10 SeitenFINANCE LEASE-lecture and ExercisesJamie CantubaNoch keine Bewertungen

- A6 Share 221 eDokument2 SeitenA6 Share 221 eNika Ella SabinoNoch keine Bewertungen

- Accounting On Business Combination Quiz 2: Multiple ChoiceDokument13 SeitenAccounting On Business Combination Quiz 2: Multiple ChoiceTokkiNoch keine Bewertungen

- Nfjpia Region III Constitution & By-Laws - Final VersionDokument20 SeitenNfjpia Region III Constitution & By-Laws - Final VersionAdrianneHarveNoch keine Bewertungen

- I. Concept Notes Joint CostsDokument9 SeitenI. Concept Notes Joint CostsDanica Christele AlfaroNoch keine Bewertungen

- Overhead Costs Have Been Increasing Due To All of The Following EXCEPTDokument13 SeitenOverhead Costs Have Been Increasing Due To All of The Following EXCEPTElla Mae TuratoNoch keine Bewertungen

- Ae 114 - PrelimDokument8 SeitenAe 114 - PrelimMa Angelica BalatucanNoch keine Bewertungen

- Tutorial 13Dokument2 SeitenTutorial 13Subashini Maniam100% (1)

- Migriño - Quizzer 2 - Employee Benefits Part 1Dokument13 SeitenMigriño - Quizzer 2 - Employee Benefits Part 1jessamaeNoch keine Bewertungen

- Financial Management MDokument3 SeitenFinancial Management MYaj CruzadaNoch keine Bewertungen

- Problem 44Dokument2 SeitenProblem 44Arian AmuraoNoch keine Bewertungen

- Activity-Based Costing Activity Center Cost Driver Amount of Activity Center CostDokument2 SeitenActivity-Based Costing Activity Center Cost Driver Amount of Activity Center Costasdfghjkl zxcvbnmNoch keine Bewertungen

- Partnership - Operation, LiquidationDokument4 SeitenPartnership - Operation, LiquidationKenneth Bryan Tegerero TegioNoch keine Bewertungen

- Auditing Problem 2Dokument1 SeiteAuditing Problem 2jhobs100% (1)

- ULOd ANSWER KEYDokument2 SeitenULOd ANSWER KEYzee abadillaNoch keine Bewertungen

- AVERAGEDokument4 SeitenAVERAGEClyde RamosNoch keine Bewertungen

- Chapter 10Dokument9 SeitenChapter 10Patrick Earl T. PintacNoch keine Bewertungen

- Chapter 07 - ManAcc CabreraDokument7 SeitenChapter 07 - ManAcc CabreraNoruie MagabilinNoch keine Bewertungen

- Chapter 06 - Variable Costing As A Tool To Management PlanningDokument10 SeitenChapter 06 - Variable Costing As A Tool To Management PlanningBryan Ramos100% (1)

- Chapter 10Dokument9 SeitenChapter 10teresaypilNoch keine Bewertungen

- Solution To Assignment 6Dokument3 SeitenSolution To Assignment 6Khyla DivinagraciaNoch keine Bewertungen

- 5 Goals For 2014Dokument1 Seite5 Goals For 2014Maryferd SisanteNoch keine Bewertungen

- Ce Laws ContractDokument2 SeitenCe Laws ContractMaryferd SisanteNoch keine Bewertungen

- FunctionalDokument1 SeiteFunctionalMaryferd SisanteNoch keine Bewertungen

- Company Description: Pepsi-Cola Products Philippines, IncDokument10 SeitenCompany Description: Pepsi-Cola Products Philippines, IncMaryferd SisanteNoch keine Bewertungen

- 3rd DraftDokument45 Seiten3rd DraftMaryferd SisanteNoch keine Bewertungen

- Pepsi LayoutDokument45 SeitenPepsi LayoutMaryferd Sisante100% (1)

- PepsiCo Business Strategy and Competitive Advantage Om ExDokument20 SeitenPepsiCo Business Strategy and Competitive Advantage Om ExMaryferd Sisante100% (4)

- Pepsico, Inc.: 700 Anderson Hill Road Purchase, 10577-1444 U.S.A. Telephone: (914) 253-2000 Fax: (914) 253-2070 Web SiteDokument17 SeitenPepsico, Inc.: 700 Anderson Hill Road Purchase, 10577-1444 U.S.A. Telephone: (914) 253-2000 Fax: (914) 253-2070 Web SiteMaryferd SisanteNoch keine Bewertungen

- 1 ExistenceDokument1 Seite1 ExistenceMaryferd SisanteNoch keine Bewertungen

- CHAPTER 5 Cost Concepts, Classifications, and Cost Behavior: I True or False 16Dokument2 SeitenCHAPTER 5 Cost Concepts, Classifications, and Cost Behavior: I True or False 16Maryferd SisanteNoch keine Bewertungen

- Gov Coa CircularsDokument1 SeiteGov Coa CircularsMaryferd SisanteNoch keine Bewertungen

- Financial Statement Analysis - CPARDokument13 SeitenFinancial Statement Analysis - CPARxxxxxxxxx100% (2)

- IFS International Equity MarketDokument36 SeitenIFS International Equity MarketVrinda GargNoch keine Bewertungen

- Marketing ProjectDokument5 SeitenMarketing ProjectTamanna KotnalaNoch keine Bewertungen

- Business Plan For Plastic in Ethiopia Un Modified.Dokument37 SeitenBusiness Plan For Plastic in Ethiopia Un Modified.Yeruksew Fetene100% (1)

- Infosys Consulting in 2006Dokument8 SeitenInfosys Consulting in 2006parvathyjoy90Noch keine Bewertungen

- Business Report - Pham Thuy Linh - 11196343Dokument14 SeitenBusiness Report - Pham Thuy Linh - 11196343Thuy Linh PhamNoch keine Bewertungen

- FinMod 2022-2023 Tutorial Exercise + Answers Week 5Dokument36 SeitenFinMod 2022-2023 Tutorial Exercise + Answers Week 5jjpasemperNoch keine Bewertungen

- MGMT 1000 NotesDokument34 SeitenMGMT 1000 NotesaaquibnasirNoch keine Bewertungen

- 16 Emerging Concepts - New Public Management, Reinventing Government and Business Process Reengineering PDFDokument12 Seiten16 Emerging Concepts - New Public Management, Reinventing Government and Business Process Reengineering PDFavi nashNoch keine Bewertungen

- Classifications of Business ProposalDokument3 SeitenClassifications of Business ProposalMariah Janey VicenteNoch keine Bewertungen

- Ass Economics Iof EducationDokument20 SeitenAss Economics Iof EducationAsratderebNoch keine Bewertungen

- MINICOM Made in Rwanda PolicyDokument45 SeitenMINICOM Made in Rwanda PolicyJ-Claude DougNoch keine Bewertungen

- Global Marketing and Sales DevelopmentDokument15 SeitenGlobal Marketing and Sales Developmentdennis100% (2)

- Marketing MCQs 1Dokument29 SeitenMarketing MCQs 1Manish SoniNoch keine Bewertungen

- PPE Investments Working PaperDokument15 SeitenPPE Investments Working PaperMarriel Fate CullanoNoch keine Bewertungen

- Brannigan Soup Presentation 22 MayDokument33 SeitenBrannigan Soup Presentation 22 MayShubashini Mathyalingam100% (1)

- Getting Started in Currency Trading: Way of The Turtle Trend Following Mastering Trading Stress Currency KingsDokument1 SeiteGetting Started in Currency Trading: Way of The Turtle Trend Following Mastering Trading Stress Currency KingssabenasuhaimiNoch keine Bewertungen

- Mass Media and Ict in Development Communication: Comparison & ConvergenceDokument29 SeitenMass Media and Ict in Development Communication: Comparison & ConvergenceVaishali SharmaNoch keine Bewertungen

- Quiz UTSDokument7 SeitenQuiz UTSRuth SoesantoNoch keine Bewertungen

- Chapter 12 CUSTOMER SERVICEDokument42 SeitenChapter 12 CUSTOMER SERVICESYAZANA FIRAS SAMATNoch keine Bewertungen

- Tax Invoice (Original For Recipient) PL09: Packing CodeDokument9 SeitenTax Invoice (Original For Recipient) PL09: Packing CodeMohd ArifNoch keine Bewertungen

- GFT Three Drive BearishDokument2 SeitenGFT Three Drive BearishAklchanNoch keine Bewertungen

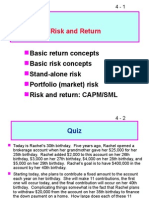

- Risk and ReturnDokument55 SeitenRisk and ReturnShukri Omar AliNoch keine Bewertungen

- KFC Case StudyDokument3 SeitenKFC Case StudyAnkita shaw100% (2)

- KWe3 Micro Student Ch01Dokument26 SeitenKWe3 Micro Student Ch01Richard TruongNoch keine Bewertungen

- Goldiam Share - Google SearchDokument5 SeitenGoldiam Share - Google SearchDudheshwar SinghNoch keine Bewertungen

- Parts of A Business PlanDokument4 SeitenParts of A Business PlanGrace BartolomeNoch keine Bewertungen

- On December 31, Year 1, Carme Company Reports Its ...Dokument2 SeitenOn December 31, Year 1, Carme Company Reports Its ...Iman naufalNoch keine Bewertungen

- 4 Application of Ss and DD TheoriesDokument60 Seiten4 Application of Ss and DD TheoriesMilon MirdhaNoch keine Bewertungen

- How The NSSF Has Grown Its Asset Base To Shs6 TrillionDokument2 SeitenHow The NSSF Has Grown Its Asset Base To Shs6 TrillionjadwongscribdNoch keine Bewertungen

- Forex Arcanum - System ManualDokument31 SeitenForex Arcanum - System ManualRodrigo Oliveira0% (1)