Beruflich Dokumente

Kultur Dokumente

Attachment-001 13 01 - 468018697

Hochgeladen von

shambhujha0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

3 Ansichten5 SeitenTax

Originaltitel

ATTACHMENT-001_13_01_-468018697 (4)

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenTax

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

3 Ansichten5 SeitenAttachment-001 13 01 - 468018697

Hochgeladen von

shambhujhaTax

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 5

Form Node

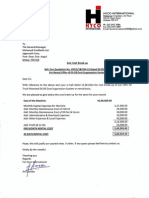

INCOME TAX.

HAYA SARAL

PROFESSION OP CAPITA Gi

ncaa

[iii EE ORECEANOL CECA

2 ADDRESS meena Choge) (BRR MOM ISAS SIUC

BAe

9 Penmiaenk Accourt Humbor (AN BI 34 PITIS Holl lo ba}

4 DaloofBith RISHTSLEIe)

1, SEX

“Hl FORM FOR RESIDENT INDIVIDUALEINDU ULORIDED FAMILY HOT

AGRICULUTURA

Buk CRIOASA IOI on Bese) tee

at 08

MING ECOME FRO

ARTA

MF

8, Acsosemont Yor Qev5~O 6

5: Stout Indi Hea undies amy Porividteng® 9. Retan : Onna or Reiaad — OA p val i

6, WordOrclelSpecid ranga Sonabhlpbur 10. Pastcars of Bank Accnurt (for peyant of round) \

Name of tho Book MICR Coca! Aeros of Beak Beach Tpecttecont —— pocaurt Murat |

[ BE CFP4S | (MeL Gn Bex Buria.—] (Scam; (Oieoosa ee]

‘CORPUTATION OF INCORE AROUNT

4. Income chargeabie under the head * Salaries * fAllach Fo 16] Rs. 3, 0,252 + Rs. Slea(L7C-aeog) (BT, 416 +f

2. Annus Value 1 Higher or Annwal rent receie of receivable / Reduced

annul end receled or receivable because of vacancy

3. Taxes acluty pai te local athorty [ore

4. Annual value of property (23) é ay

5. Less : Deductions claimed ws 24

(3) Tit percent of ru vaio

(0) eres payable on borrowed capt) © C227)

6, Total of above

7. Income chargeatte under the head * Income ftom House Property (4-6 ) TO}

8. Gross income from other sources Gross Amount ‘Amount Exempted

(2). Dividends from companies Ooo O-7d, '

(0) Disdonds from units oe |

(c). Interest D246 REM4

(8) Reval inceme fn machinery, plats, ee Cae Ceo

(6) others ate] cas

Total (RRR ]

8, Total of 8 above ( Gross amount minus Amount exempted ) (BFaa eo]

40, Dodson we 67

{a} Depreciation LT

® Cem

® Cea

11, Total of 10 above Cea :

12. Income chargeable undor the hoad * Income from Othor Sources * [9-14] Bead t

43, Gross Total Income (1474412) Ty 245-55

14 Doductions u/s on VIA AMOUNT AMOUNT

( wooo (Toe) (ec CSTR ETT] Gy oonnel owe)

(®) 800 oo {}00 [RBRG-ST] (Soo ("SV }

(©) 89 Fo (coon Ser}

15 Total of $4 above (SABER)

15 Total seme (13-15) (ay wo

Fr

4.7 Taxon tl Income

4B. Less Retole AMOUNT AMOUNT

(a) Sec. 88 (9) Soc. vec OF Ge)

(&) Sec, sea [0+ oo

19. Total of 18 above F s

20. Baloece tax payable (17-19)

21 Aid Surcharge

22. Tax payable [20+24]

23. Rebel uls 89

24. Batanee tax payable (22-23)

25.. Tax Deducled al Source (a) Salaies [EIS (0) Otrers[ 86S]

26. Total of 28 above

21._hdvance Tax paid (Alach copy of chafan) Dale | Amoat

(@) Upto 1505 (© 10 HI

() 0S to W912 : (0) 1605 to 3103

8. Total oD above

78, Tx pad ing tne proious yoor [26+20]

30, Inlorocl Payable Aumont

| (a) Section 2344 ail (€) Section 2346

(0) Section 2348 Talal loreal [avd]

34, Less : Self essessmord tax pad (Allach copy of challan )

2. Tax payable / Reltndable (24-79430-24 ive

Verification

1_SHAMBHU THA (name in fall and in block letter), son/daughter ©

TE 4, ARAYAN THA colemnly decase that to the best of Imowledge and belief, ©

> Hes and statements accompanying it axe coucet, complete an¢

stated and in accordance with the provisions of the Income Tax Act, 1961 ia sespect of Inceme changeable 10 Incon:

Tax for the previous year relevant to the assessment year Qa FOG

INCOM

Wax

Shobha Tha E

Signature of the Asscssee

Date _ 25 /F/ 2005

co: MCL, Tago Vihoy

lah

Receipt No, 22.9 S

Signature of th

Wd) care

the Incana-tu:

undar tha hes:

narg=3u

1984 for tae

lsries

iNane end Addr. of the Employer] Name and Designation of the Emplayee

[Mahanadi Coalfiakds Led | SHAMBH JHA, cosy CaQDBRIRe»

Lisgeuti Vihacs BURLA £ SMe

iSambalpur, aRrssa t

[TDS Circle where snnual Return{ Pariod Assesamant

[/Statenant under s2c.206 ix tof Fran f To Year

fhe filled. SAMBALeUR "2005 ‘2005.

DETAILS OF SALARY PAID AND ANY OTHER INCOME AND Tax DEDUCTED

Gross salary t

C£8S 7 ALIuw. axenptad = {

andar section 19 t

+ BALANCE 1-24 t

+ BEBUCT IONS + f

arid ded. Rs 30000, 1

operat, Tax Rs 2400.00 |

epleas on As 33SAB.00 0 |

i

t

!

t

t

t

z

@

Hous Prop.

3. Aggragate or 4 (a to

Das könnte Ihnen auch gefallen

- District Rainfall Normal 0Dokument18 SeitenDistrict Rainfall Normal 0shambhujhaNoch keine Bewertungen

- External AreawiseDokument1 SeiteExternal AreawiseshambhujhaNoch keine Bewertungen

- Laptop CpmparisionDokument1 SeiteLaptop CpmparisionshambhujhaNoch keine Bewertungen

- Noise PollutionDokument14 SeitenNoise PollutionshambhujhaNoch keine Bewertungen

- Aaq Data Monthly 2015-38356492Dokument36 SeitenAaq Data Monthly 2015-38356492shambhujhaNoch keine Bewertungen

- Lecture NotesDokument8 SeitenLecture NotesshambhujhaNoch keine Bewertungen

- NIT PWD Delhi Mechanical Road SweeperDokument16 SeitenNIT PWD Delhi Mechanical Road SweepershambhujhaNoch keine Bewertungen

- 45 Days Offer For Ds 50 at JagannathDokument1 Seite45 Days Offer For Ds 50 at JagannathshambhujhaNoch keine Bewertungen

- Ec Cepi ExtnDokument2 SeitenEc Cepi ExtnshambhujhaNoch keine Bewertungen

- NIT PWD Delhi Mechanical Road SweeperDokument16 SeitenNIT PWD Delhi Mechanical Road SweepershambhujhaNoch keine Bewertungen

- CSR Water RoadDokument7 SeitenCSR Water RoadshambhujhaNoch keine Bewertungen

- Anti Oxidant in HindiDokument5 SeitenAnti Oxidant in HindishambhujhaNoch keine Bewertungen

- Coal OB Dispatch Project WiseDokument4 SeitenCoal OB Dispatch Project WiseshambhujhaNoch keine Bewertungen

- DS 50 Fog CannonDokument5 SeitenDS 50 Fog CannonshambhujhaNoch keine Bewertungen

- Depth Ran Ge (M) Proved Indicated Inferred Total (BT) Share (%) 0-300 300-600 0-600 (Jharia) 600-1200 TotalDokument2 SeitenDepth Ran Ge (M) Proved Indicated Inferred Total (BT) Share (%) 0-300 300-600 0-600 (Jharia) 600-1200 TotalshambhujhaNoch keine Bewertungen

- Workshop On Environmental Legislation and Its Compliances 22 July 2009: Green Valley Club, Jagannath AreaDokument1 SeiteWorkshop On Environmental Legislation and Its Compliances 22 July 2009: Green Valley Club, Jagannath AreashambhujhaNoch keine Bewertungen

- CWG Nov05 Singh OverviewDokument19 SeitenCWG Nov05 Singh OverviewBharat KhemkaNoch keine Bewertungen

- Air Quality MonitoringDokument21 SeitenAir Quality MonitoringshambhujhaNoch keine Bewertungen

- StatusDokument1 SeiteStatusshambhujhaNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)