Beruflich Dokumente

Kultur Dokumente

Daisy Lifebasix PDF

Hochgeladen von

Charlene G GalesOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Daisy Lifebasix PDF

Hochgeladen von

Charlene G GalesCopyright:

Verfügbare Formate

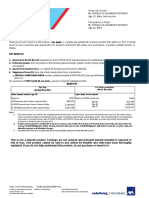

Proposed Insured:

DAISY V RANOLA

Age 49, Female, Non-smoker

Policyowner or Payor:

DAISY V RANOLA

Age 49, Female

Dear DAISY,

Thank you for your interest in AXA products. Life BasiX is a regular-pay variable life insurance product that addresses life's essential

needs for basic protection with opportunities for long-term investment. But unlike most investments, it provides multiple benefits as

follows:

KEY BENEFITS:

1. Guaranteed Death Benefit equivalent to at least 500% of the annual premium if no withdrawal is made.

2. Potential upsides from the portion of the premium placed in bonds, equities and/or money market instruments, depending on your

risk appetite.

3. Guaranteed loyalty bonus as a reward for keeping your investments with AXA.

For a premium of PHP 23,855.00 annually, you get to enjoy the following benefits:

BENEFITS

For You

(Living Benefits)

For Your Loved Ones

(Death Benefits)

When insured reaches age 65

Based on

4% annual rate of return, Account Value

Or 8% annual rate of return, Account Value

Or 10%annual rate of return, Account Value

Notes:

1.

2.

3.

Upon death of the Insured

(PHP) Based on 8% annual rate

348,701

498,710

597,629

Age 50

Age 60

Age 70

(PHP)

500,000

500,000

869,373

The values above are based on the projected performance of your chosen fund/s. Since the fund performance may vary, the values of your

units are not guaranteed and will depend on the actual investment performance at that given period. The illustrated returns on investments

are based on assumed annual rates of 4%, 8%, and 10%. These rates are for illustration purposes only and do not represent maximum or

minimum return on your fund.

If after purchasing the variable life insurance contract, you realize that it does not fit your financial needs, you may return the

contract to AXA Philippines within 15 days from the time you receive it. AXA Philippines will return to you the account value, the

bid-offer spread, and all initial charges.

Any withdrawal from the Living Benefit will correspondingly reduce the Death Benefit payable.

This is not a deposit product. Earnings are not assured and principal amount invested is exposed to risk

of loss. This product cannot be sold to you unless its benefits and risks have been thoroughly explained.

If you do not fully understand this product, do not purchase or invest in it.

Page 1 of 8 of Proposal No. 18.1.031816.910900

Printed on: 3/18/2016 11:38:47 AM Created on: 3/18/2016 11:38:36 AM

Version Number: 2015.18.1 - 01

Plan Code: BAX

Expiry Date: 6/18/2016

Date for Next Insurance Age: 11/25/2016

Philippine Peso

for: DAISY V RANOLA, 49, Female, Non-smoker

SPECIAL FEATURES

Top-up

Subject to the rules set by AXA Philippines from time to time, you have the option to increase the

benefits of your Policy by paying additional premiums on top of your regular premium which will

be used to buy more units on your chosen investment fund(s).

Premiums are paid throughout the life of your Policy, but you have the option to suspend payment

anytime as long as the Account Value is sufficient to cover these.

Premium Holiday

Loyalty Bonus

As long as your Policy remains in force, a 5% Loyalty Bonus will be paid on the 15th and 25th year

to increase your Account Value. The Bonus will be equal to 5% of the average of the month-end

Account Values for the last 120 months.

You have the option to increase your insurance protection, with no further proof of insurability, at

a minimal cost of insurance deduction on each anniversary of your Policy, before age 60 with the

Inflation Index Endorsement (IIE). This also does not require that you provide further proof if

insurability. The amount by which you can increase your coverage is based on the current

Consumer Price Index subject to a minimum that AXA Philippines may determine from time to

time.

Inflation Link

The succeeding pages of this proposal provide more details on the benefits and features of Life BasiX.

Again, thank you for your interest in AXA products. If you have questions, please call me at the number specified below, or call the AXA

Philippines Customer Care Hotline at Tel Nos: (02)5815-292 or (02)3231-292.

LAGUITAN, DONNA GONZALES

42615

024082

639335254391

Page 2 of 8 of Proposal No. 18.1.031816.910900

Printed on: 3/18/2016 11:38:47 AM

Version Number: 2015.18.1 - 01

Plan Code: BAX

Created on: 3/18/2016 11:38:36 AM

Expiry Date: 6/18/2016

Date for Next Insurance Age: 11/25/2016

Philippine Peso

for: DAISY V RANOLA, 49, Female, Non-smoker

Life BasiX is a regular-pay variable life insurance product where a portion of the premiums, net of the companys charges, is invested

into your choice of funds. Subject to the rules set by AXA Philippines from time to time, you can increase your investment anytime by

paying top-up premiums, but the value of the funds (and your policy benefits) may go up or down depending on market conditions. The

death benefit option you have elected is Level. The minimum Death Benefit in this proposal is PHP 119,2751.

Below are important details of the proposal along with how your investment will be allocated between the available funds. You may

change this allocation anytime depending on your investment goals and/or risk appetite.

Basic Plan and Supplements

Cover up to Age

Basic

Life BasiX

Total

Sum Insured (PHP)

23,855.00

23,855.00

500,000

100

You may also pay your premium in the following modes:

Modes of Payment

Modal Premium

(PHP)

Semi-Annual

11,927.50

Quarterly

5,963.75

1,987.93

Monthly

Annual Premium (PHP)

Fund Name

Philippine Wealth Balanced Fund

Fund Allocation

100%

Notes:

1.

This is the minimum Death Benefit at policy inception. The minimum Death Benefit for any policy year is equal to 500% of the annual regular Life Basix premium, plus

125% of each paid top-up premium, if any, less 125% of each partial withdrawal, if any.

2.

Premiums for all products are payable up to termination age. For the premium term of the supplement/s, if any, please refer to the supplement definition indicated in

the "Summary of the Riders Attached to this Proposal".

3.

See Product Notes for description of the funds.

Page 3 of 8 of Proposal No. 18.1.031816.910900

Printed on: 3/18/2016 11:38:47 AM

Version Number: 2015.18.1 - 01

Plan Code: BAX

Created on: 3/18/2016 11:38:36 AM

Expiry Date: 6/18/2016

Date for Next Insurance Age: 11/25/2016

Philippine Peso

for: DAISY V RANOLA, 49, Female, Non-smoker

ILLUSTRATION OF BENEFITS

The illustrated benefits of your policy (subject to actual market performance) are shown below.

ILLUSTRATION OF BENEFITS

Total Cumulative

End of

Regular Basic

4.00 % Rate of Return

8.00 % Rate of Return

Policy

Premium, Rider

Year Premiums and TopLiving Benefit

Death Benefit

Living Benefit

Death Benefit

up, if any, Paid

1

23,855

10,754

500,000

11,250

500,000

2

47,710

21,843

500,000

23,309

500,000

3

71,565

33,282

500,000

36,246

500,000

4

95,420

45,073

500,000

50,127

500,000

5

119,275

57,225

500,000

65,028

500,000

10

238,550

169,762

500,000

210,018

500,000

15

357,825

316,527

500,000

440,574

500,000

20

477,100

496,587

500,000

783,414

783,414

25

596,375

750,130

750,130

1,326,947

1,326,947

30

715,650

1,033,985

1,033,985

2,086,325

2,086,325

35

834,925

1,379,337

1,379,337

3,202,101

3,202,101

40

954,200

1,799,510

1,799,510

4,841,542

4,841,542

45

1,073,475

2,310,716

2,310,716

7,250,419

7,250,419

50

1,192,750

2,932,675

2,932,675

10,789,848

10,789,848

Age60

Age65

Age70

262,405

381,680

500,955

194,998

348,701

538,852

500,000

500,000

538,852

246,663

498,710

869,373

500,000

500,000

869,373

10.00 % Rate of Return

Living Benefit

Death Benefit

11,499

24,058

37,791

52,813

69,259

233,884

521,729

985,105

1,781,259

3,013,591

4,998,273

8,194,624

13,342,379

21,632,890

500,000

500,000

500,000

500,000

500,000

500,000

521,729

985,105

1,781,259

3,013,591

4,998,273

8,194,624

13,342,379

21,632,890

277,883

597,629

1,107,342

500,000

597,629

1,107,342

The rates of return shown above are for illustration purposes and are not based on past performance nor guarantee future performance. The actual return may

differ. The illustrated values are net of premium charges of 35%/35%/35%/35%/35% of the basic premium for the 1st to 5th policy years; all top-ups shall be subject to a

premium charge of 2%; Cost of Insurance has been deducted monthly from the illustrated values as well as Administration Charge amounting to Php1,200 p.a. The Annual

Premiums for any attached Supplement shall be deducted monthly from the illustrated values if the Policy is under Premium Holiday. An Asset Management Charge of 2% p.a.

for Philippine Wealth Bond, Philippine Wealth Balanced and Philippine Wealth Equity Funds and 2.5% p.a. for Opportunity, Chinese Tycoon and Spanish

American Legacy Funds have already been deducted from the illustrated values. The illustrated values are still subject to a surrender charge for withdrawals (partial or full)

transacted up to the 5th policy year. The surrender charge is equal to the amount withdrawn multiplied by a surrender factor of 100%/100%/25%/10%/5% for the 1st to 5th

years respectively.

This illustration shall form part of the insurance contract once the Policy is issued.

Page 4 of 8 of Proposal No. 18.1.031816.910900

Printed on: 3/18/2016 11:38:47 AM

Version Number: 2015.18.1 - 01

Plan Code: BAX

Created on: 3/18/2016 11:38:36 AM

Expiry Date: 6/18/2016

Date for Next Insurance Age: 11/25/2016

Philippine Peso

for: DAISY V RANOLA, 49, Female, Non-smoker

ILLUSTRATION OF BENEFITS (with Premium Holiday on Year 10)

You can choose to suspend payment for regular premium and top-ups as long as the Account Value of your Policy is sufficient to cover the

charges and pay for the premium of any supplement. This feature is called a Premium Holiday which you can apply for. Note that under

this feature, there is a possibility that your Account Value may be depleted and may result to your policy being terminated.

The following table is an example of the impact of a premium holiday at year 10 and/or withdrawals from the fund assuming different

rates of return. However, note that the rates of return are for illustration purposes only. They are not based on past performance nor

guarantee future returns.

Total Cumulative

End of

Regular Basic

Policy

Premium, Rider

Year Premiums and Top

-up, if any, Paid

1

23,855

2

47,710

3

71,565

4

95,420

5

119,275

10

238,550

15

238,550

20

238,550

25

238,550

30

238,550

35

238,550

40

238,550

45

238,550

50

238,550

Age60

Age65

Age70

238,550

238,550

238,550

ILLUSTRATION OF BENEFITS (with Premium Holiday on Year 10)

4.00 % Rate of Return

Living Benefit

8.00 % Rate of Return

Death Benefit

Living Benefit

10.00 % Rate of Return

Death Benefit

Living Benefit

Death Benefit

10,754

21,843

33,282

45,073

57,225

169,762

180,568

175,277

154,993

78,156

***

***

***

***

500,000

500,000

500,000

500,000

500,000

500,000

500,000

500,000

500,000

500,000

***

***

***

***

11,250

23,309

36,246

50,127

65,028

210,018

287,573

394,014

583,336

849,770

1,241,250

1,816,461

2,661,636

3,903,476

500,000

500,000

500,000

500,000

500,000

500,000

500,000

500,000

583,336

849,770

1,241,250

1,816,461

2,661,636

3,903,476

11,499

24,058

37,791

52,813

69,259

233,884

359,529

563,434

927,674

1,486,310

2,386,001

3,834,961

6,168,525

9,926,754

500,000

500,000

500,000

500,000

500,000

500,000

500,000

563,434

927,674

1,486,310

2,386,001

3,834,961

6,168,525

9,926,754

171,069

180,669

171,961

500,000

500,000

500,000

221,815

305,474

421,613

500,000

500,000

500,000

252,574

391,816

618,514

500,000

500,000

618,514

The rates of return shown above are for illustration purposes and are not based on past performance nor guarantee future performance. The actual return may

differ. The illustrated values are net of premium charges of 35%/35%/35%/35%/35% of the basic premium for the 1st to 5th policy years; all top-ups shall be subject to a

premium charge of 2%; Cost of Insurance has been deducted monthly from the illustrated values as well as Administration Charge amounting to Php1,200 p.a. The Annual

Premiums for any attached Supplement shall be deducted monthly from the illustrated values if the Policy is under Premium Holiday. An Asset Management Charge of 2% p.a.

for Philippine Wealth Bond, Philippine Wealth Balanced and Philippine Wealth Equity Funds and 2.5% p.a. for Opportunity, Chinese Tycoon and Spanish

American Legacy Funds have already been deducted from the illustrated values. The illustrated values are still subject to a surrender charge for withdrawals (partial or full)

transacted up to the 5th policy year. The surrender charge is equal to the amount withdrawn multiplied by a surrender factor of 100%/100%/25%/10%/5% for the 1st to 5th

years respectively.

The contract term is specified in the illustration of benefits in this proposal. Please refer to the assumptions below used in the above

example.

Other Assumptions:

1. This example assumes that all premiums shown in the above table are paid in full when due and as planned with no premium holiday in the first

10 policy years. It assumes the current scale of charges remains unchanged.

2. A loyalty bonus estimated to be 5% of the average Account Value from 6th to 15th policy years on the 15th year, 5% of the average Account

Value from the 16th to 25th policy years on the 25th year is included in this illustration. The bonus will be equal to 5% of the average of the

month-end Account Values over the last 120 months.

3. The proposed policy charges used in this illustration summary are based on the standard risk class without taking into account your own

circumstances (e.g. occupation and health condition, etc). Risk class will be determined according to our underwriting guidelines. The

investment gains/risks associated with this plan are solely to your account.

Page 5 of 8 of Proposal No. 18.1.031816.910900

Printed on: 3/18/2016 11:38:48 AM

Version Number: 2015.18.1 - 01

Plan Code: BAX

Created on: 3/18/2016 11:38:36 AM

Expiry Date: 6/18/2016

Date for Next Insurance Age: 11/25/2016

Philippine Peso

for: DAISY V RANOLA, 49, Female, Non-smoker

Notes on the illustration of Benefits

1.

All payments and benefits shown are in Philippine pesos. Payments are acceptable in policy currency only.

2.

AXA Philippines reserves the right to adjust the Basic and Supplement premiums, and any charges in this plan.

3.

The quoted values are illustrations only of the key features, benefits and assumptions of the chosen insurance plans. If your application is

accepted, you will receive a policy contract, which will include detailed terms, conditions, and exclusions. A new Illustration of Benefits will be

provided in the contract, which may differ from this proposed illustration.

4.

The benefits and premiums of the Index-linked Increase Endorsement, if any, are not included in the summary in the previous page.

5.

The benefits are based on the projected performance of your chosen fund/s. Since fund performance may vary, the values of your units are not

guaranteed and will depend on the actual investment performance at that given period. The illustrated returns on investments are based on

assumed annual rates of 4.00%, 8.00%, and 10.00%. These rates are for illustration purposes only and do not represent maximum or

minimum return on your fund value.

6.

A bid-offer spread, which is the difference between the bid price and the offer price units, may be determined by AXA Philippines from time to

time. The above illustration is based on a bid-offer spread of 5%.

7.

This illustration summary relates to your Life BasiX only, and excludes any Supplements in this proposal. It assumes that all premiums are paid

in full when due and as planned with no premium holiday and the current scale of charges remains unchanged. Any deviation from this will

change the illustrated values accordingly.

8.

A loyalty bonus, credited on the 15th and 25th policy years, is included in the illustration. The bonus is estimated to be 5% of the average of

the month-end Account Values over the last 120 months.

9.

The proposed policy charges used in this illustration summary are based on the standard risk class without taking into account your own

circumstances (e.g. occupation and health condition, etc). Risk class will be determined according to our underwriting guidelines. The

investment gains/risks associated with this plan are solely to your account.

Product Notes

1.

Life Basix is a regular-pay variable life insurance plan. Only the minimum Death Benefit is guaranteed while the Policy is in-force. The rest of

the benefits, namely the partial and full withdrawal values and the actual Death Benefit at time of death, all depend on the investment

experience of separate account(s) linked to the Policy.

Under the INCREASING DEATH BENEFIT OPTION, your beneficiaries will receive the Policy Sum Insured plus the Account Value at time of death.

While under the LEVEL DEATH BENEFIT option, your beneficiaries will receive the Policy Sum Insured less the partial withdrawals made for the

2.

3.

past twelve (12) months, or the Account Value at time of death, whichever is higher.

The living benefits shown in the illustration summary are equal to the Account Value of the Policy.

The client may choose from the following funds. If client chooses to invest in more than one fund, a minimum allocation of 10% on one fund is

required. The total allocation should always be 100%.

a.

Philippine Wealth Bond Fund - This Bond Fund is an actively managed fixed income fund that seeks to capitalize on capital and

income growth through investments in interest-bearing securities issued by the Philippine Government and money market

instruments issued by banks.

b.

Philippine Wealth Balanced Fund - This Balanced Fund is designed to achieve long-term growth through both interest income

and capital gains with an emphasis on providing a modest level of risk. It seeks to manage risk by diversifying asset classes and

industry groups through investment in bonds issued by the Philippine government and equities issued by Philippine corporations

comprising the Philippine Stock Exchange Index.

c.

Philippine Wealth Equity Fund - This Equity Fund seeks to achieve long-term growth of capital by investing mainly in equities of

Philippine corporations comprising the Philippine Stock Exchange Index. The fund aims to provide access to a diversified portfolio of

equities from different industries.

d.

Opportunity Fund - This equity fund aims to achieve long term growth through capital gains and dividends by investing in equities

of Philippine corporations that will provide access to a diversified portfolio of equities from different industries.

e.

Chinese Tycoon Fund - This equity fund aims to achieve medium to long term growth through capital gains and dividends by

investing in equities that will provide access to a management themed-portfolio reflective of the Chinese-Filipino entrepreneurial

spirit through strategic investments in Philippine companies from different industries.

f.

Spanish American Legacy Fund - This equity fund aims to achieve medium to long term growth through capital gains and

dividends by investing in equities that will provide access to a management themed-portfolio through strategic investments in

Philippine companies from different industries with Spanish/American heritage.

4.

The Bid Price of an Investment Fund is the price for cancelling a Unit of the Investment Fund as determined in accordance with the Valuation

provision.

5.

The Offer Price of an Investment Fund is the price for creating a Unit of the Investment Fund as determined in accordance with the Valuation

provision.

Page 6 of 8 of Proposal No. 18.1.031816.910900

Printed on: 3/18/2016 11:38:48 AM

Version Number: 2015.18.1 - 01

Plan Code: BAX

Created on: 3/18/2016 11:38:36 AM

Expiry Date: 6/18/2016

Date for Next Insurance Age: 11/25/2016

Philippine Peso

for: DAISY V RANOLA, 49, Female, Non-smoker

Attached Supplements

Summary of the Riders Attached to this Proposal

1.

The Index-linked Increase Endorsement (IIE) allows you to increase your insurance benefits at the rate of inflation with no

additional medical or processing requirements so you can be sure the value of your benefits cope with future costs.

NOTES:

1.

The rates shown, if any, are those currently in effect. The rates applicable upon renewal of the Supplement will be those in effect at the date of

renewal.

2.

For a detailed description of the Supplements, including exclusions and other provisions, please refer to the policy contract.

Page 7 of 8 of Proposal No. 18.1.031816.910900

Printed on: 3/18/2016 11:38:48 AM

Version Number: 2015.18.1 - 01

Plan Code: BAX

Created on: 3/18/2016 11:38:36 AM

Expiry Date: 6/18/2016

Date for Next Insurance Age: 11/25/2016

Philippine Peso

for: DAISY V RANOLA, 49, Female, Non-smoker

DECLARATIONS AND ACKNOWLEDGMENTS

DECLARATIONS

1. It is my understanding that the total premium I am going to pay when I purchase this plan shall consist of the Life BasiX premium, regular

top-up premium, and Supplement premiums shown above, if any. I was also made aware that only the Life BasiX premium and top-up

premiums will be allocated to purchase units of the investment fund/s I will choose.

2. I confirm having read and understood the information in this proposal. My Financial Advisor/Financial Executive fully explained to me the

features and charges that will be made on my plan, and that the actual variable plan benefits will reflect the actual investment experience of

the separate account into which my fund is invested. I also confirm that I will fully assume all investment gains / risks associated with the

purchase of this plan.

Acknowledgment of Variability

Variable Life Insurance Plan

I acknowledge that:

I have applied with AXA Philippines for a Variable Life Policy, and have reviewed the illustration(s) that shows how a variable life insurance

policy performs using AXA Philippines assumptions and based on Insurance Commissions guidelines on interest rates.

I understand that since fund performance may vary, the values of my units are not guaranteed and will depend on the actual performance at

that given period and that the value of my Policy could be less than the capital invested. The unit values of my Variable Life Insurance are

periodically published.

I understand that the investment risks under the Policy are to be borne solely by me, as the policyholder.

Product Transparency Declaration

By signing off on the items listed below, I acknowledge that the same have been discussed with and thoroughly explained to me.

I understand that I am buying an investment-linked insurance product.

I understand that the principal and earnings are not guaranteed and that the value of my unit investment (NAVPU) may go up or down depending on

the performance of the separate funds.

I understand that the funds will be invested in Equities and/or Bonds or a combination thereof, and will be subject to changes in market conditions.

The available funds and the risks that they bear have been thoroughly discussed with me, and I have made my Fund Allocation decision based on my

own judgment of and tolerance for these risks.

I understand that this product is appropriate for a long-term investment horizon.

I understand that I will have zero (0) withdrawal value during the first two (2) years of the policy because the amount withdrawn will be subject to

100% surrender charge on the first two (2) years.

CONFORME:

These declarations and acknowledgments are made with the knowledge of

the AXA representative whose signature appears below:

_____________________________

Applicant/Policy Owner

Signature over Printed Name

____________________

Date

_____________________________________

Financial Advisor/Financial Executive

Signature over Printed Name

________________________

Date

TO BE FILLED UP BY AXA PHILIPPINES

These declarations and acknowledgments are valid for

the following policy/ies with policy number/s:

_________________________

_________________________

_________________________

_________________________

_________________________

_________________________

Disclosure of Conflict of Interest

The Company adopts a Conflict of Interest Policy and undertakes to disclose any material information which gives rise to actual or potential conflict of interest to

our customers. Company likewise takes all reasonable steps to ensure fair dealings with our customers.

General Disclaimer

All information and opinions provided are of a general nature and for information purposes only. The information and any opinions herein are based upon

sources believed to be reliable. AXA Philippines, its officers and directors make no representations or warranty, expressed or implied, with respect to the

correctness, completeness of the information and opinions in this document. Investment or participation in the Fund(s) is subject to risk and possible loss of

principal. Please carefully read the policy and endorsements and consider the investment objectives, risks, charges and expenses before investing. You should

seek professional advice from your financial, tax, accounting or legal consultant before making an investment. Past performance is not indicative of future

performance.

THIS FINANCIAL PRODUCT OF AXA PHILIPPINES IS NOT INSURED BY THE PHILIPPINE DEPOSIT

INSURANCE CORPORATION (PDIC) AND IS NOT GUARANTEED BY METROBANK OR PS BANK.

Page 8 of 8 of Proposal No. 18.1.031816.910900

Printed on: 3/18/2016 11:38:48 AM

Version Number: 2015.18.1 - 01

Plan Code: BAX

Created on: 3/18/2016 11:38:36 AM

Expiry Date: 6/18/2016

Date for Next Insurance Age: 11/25/2016

Das könnte Ihnen auch gefallen

- RPT Life Basic XDokument9 SeitenRPT Life Basic XKhryz CallëjaNoch keine Bewertungen

- JuanDelaCruz AxeleratorDokument8 SeitenJuanDelaCruz AxeleratorOmar Jayson Siao VallejeraNoch keine Bewertungen

- RPT Life Basic XDokument13 SeitenRPT Life Basic XIrish BuragaNoch keine Bewertungen

- R PT Axel EratorDokument7 SeitenR PT Axel EratorLoy LoyNoch keine Bewertungen

- Life BasiX Proposal for Gene Theodore AvilaDokument10 SeitenLife BasiX Proposal for Gene Theodore Avilagene theodore avilaNoch keine Bewertungen

- Adap - LifebasixDokument13 SeitenAdap - LifebasixKat EspanoNoch keine Bewertungen

- AXA Life BasiX Proposal for Mrs. STARBUCKS MUNADokument10 SeitenAXA Life BasiX Proposal for Mrs. STARBUCKS MUNAneilmijares23Noch keine Bewertungen

- AXA Life BasiX Plan for Renzi Javier De CastroDokument12 SeitenAXA Life BasiX Plan for Renzi Javier De CastroMarc Darrel OmbaoNoch keine Bewertungen

- Proposed Life Insurance Plan for Aliyah and JocelynDokument9 SeitenProposed Life Insurance Plan for Aliyah and JocelynJocelyn CelynNoch keine Bewertungen

- Proposed Insured: Mr. Felix Juliano Fresco JR Age 27, Male, Non-Smoker Policyowner or Payor: Mr. Felix Juliano Fresco JR Age 27, MaleDokument10 SeitenProposed Insured: Mr. Felix Juliano Fresco JR Age 27, Male, Non-Smoker Policyowner or Payor: Mr. Felix Juliano Fresco JR Age 27, Malefelixfresco3Noch keine Bewertungen

- ICICI Pru LifeTime Super: A regular premium unit-linked planDokument3 SeitenICICI Pru LifeTime Super: A regular premium unit-linked planmniarunNoch keine Bewertungen

- MM AssignmentDokument16 SeitenMM AssignmentRahul ParasharNoch keine Bewertungen

- HDFC SL CrestDokument4 SeitenHDFC SL CrestPreetinder Singh BrarNoch keine Bewertungen

- ISECURE - Low Cost Life InsuranceDokument8 SeitenISECURE - Low Cost Life InsuranceShankar VasuNoch keine Bewertungen

- Axa PhilDokument13 SeitenAxa PhilKat EspanoNoch keine Bewertungen

- Met Smart Plus BrochureDokument5 SeitenMet Smart Plus BrochurenivasiNoch keine Bewertungen

- ICICI Pru Assure WealthDokument2 SeitenICICI Pru Assure WealthPavan Kumar RanguduNoch keine Bewertungen

- 3036 SmartCash v1 r21Dokument16 Seiten3036 SmartCash v1 r21valdyrheimNoch keine Bewertungen

- Manulife Peso Affluence Builder's key featuresDokument8 SeitenManulife Peso Affluence Builder's key featuresPenielle SaguindanNoch keine Bewertungen

- SmartSampoornaRaksha BrochureDokument14 SeitenSmartSampoornaRaksha BrochureTechnical AkashNoch keine Bewertungen

- SmartSampoornaRaksha BrochureDokument14 SeitenSmartSampoornaRaksha Brochuresanket bhosaleNoch keine Bewertungen

- Lifetime Super Pension: Benefits in DetailDokument4 SeitenLifetime Super Pension: Benefits in DetailSathish KumarNoch keine Bewertungen

- New Pension PlusDokument2 SeitenNew Pension Plusrsgk75Noch keine Bewertungen

- 40yrs MOST18 NEW 112222Dokument5 Seiten40yrs MOST18 NEW 112222Lance AunzoNoch keine Bewertungen

- Prosperity Campaign FlyerDokument6 SeitenProsperity Campaign FlyerNelly HNoch keine Bewertungen

- Bajaj Future Gain Web PDFDokument17 SeitenBajaj Future Gain Web PDFPhanindra YellapragadaNoch keine Bewertungen

- A Plan With NO Health Questions and Medical Check-UpsDokument20 SeitenA Plan With NO Health Questions and Medical Check-UpsSubang Jaya Youth ClubNoch keine Bewertungen

- Why Choose AXELERATOR?: Optional CoverageDokument2 SeitenWhy Choose AXELERATOR?: Optional CoverageKhryz CallëjaNoch keine Bewertungen

- Eric Tyson's three laws of insurance and top PH insurersDokument3 SeitenEric Tyson's three laws of insurance and top PH insurersRhia shin PasuquinNoch keine Bewertungen

- Lakshya Plus v1Dokument10 SeitenLakshya Plus v1Mahadevan VenkatesanNoch keine Bewertungen

- Icici Brochure - PENSION PLAN ULIPDokument10 SeitenIcici Brochure - PENSION PLAN ULIPAbhishek PrabhakarNoch keine Bewertungen

- SmartSampoornaRaksha_BrochureDokument16 SeitenSmartSampoornaRaksha_BrochureSuraj DubeyNoch keine Bewertungen

- Future Invest BrochureDokument20 SeitenFuture Invest BrochureAnonymous SKbL67p9Noch keine Bewertungen

- A LifeLinkDokument18 SeitenA LifeLinkFathiBestNoch keine Bewertungen

- I Secure More BrochureDokument2 SeitenI Secure More BrochureAnand RajgopalNoch keine Bewertungen

- Chapter # 3: Functioning of SLICDokument9 SeitenChapter # 3: Functioning of SLICraul_0189Noch keine Bewertungen

- IPP protects against inflation with increasing coverageDokument25 SeitenIPP protects against inflation with increasing coveragebelrayNoch keine Bewertungen

- Product Summary:: Jeevan ChhayaDokument4 SeitenProduct Summary:: Jeevan ChhayaSumit PandeyNoch keine Bewertungen

- PNB Metlife Smart Pletinium PlanDokument5 SeitenPNB Metlife Smart Pletinium PlanPurnima PurohitNoch keine Bewertungen

- Aviva i-Growth Plan Accelerates Savings With Loyalty AdditionsDokument1 SeiteAviva i-Growth Plan Accelerates Savings With Loyalty AdditionsVarun SharmaNoch keine Bewertungen

- Futura KFD - UAE MSP11934 PDFDokument20 SeitenFutura KFD - UAE MSP11934 PDFsardust2020Noch keine Bewertungen

- What Are The Benefits of Inflation ShieldDokument3 SeitenWhat Are The Benefits of Inflation ShieldJessica Nicole ManalangNoch keine Bewertungen

- A-Plus Criticalcare Brochure Full 20130529 FinalDokument8 SeitenA-Plus Criticalcare Brochure Full 20130529 Finalnusthe2745Noch keine Bewertungen

- Sales and Distribution PresentationDokument12 SeitenSales and Distribution PresentationRaushan kumarNoch keine Bewertungen

- Bharti AXA Life expands hiring, branches 33Dokument5 SeitenBharti AXA Life expands hiring, branches 33Arpit ChourasiaNoch keine Bewertungen

- Kotak Assured Income PlanDokument9 SeitenKotak Assured Income Plandinesh2u85Noch keine Bewertungen

- Bajaj Allianz Super CashGain Insurance Plan SummaryDokument2 SeitenBajaj Allianz Super CashGain Insurance Plan SummaryElangovan PurushothamanNoch keine Bewertungen

- I-Great TerasDokument23 SeitenI-Great Terasapi-240706460Noch keine Bewertungen

- HDFC Click 2 Protect Plus: What Are The Key Features of This PlanDokument5 SeitenHDFC Click 2 Protect Plus: What Are The Key Features of This PlanAniket DesaiNoch keine Bewertungen

- 302 InsuranceDokument15 Seiten302 InsuranceManoj PundirNoch keine Bewertungen

- Bharti AXA Life Hires 10,000 Insurance Advisors, Opens 50 New Branches During FY19Dokument5 SeitenBharti AXA Life Hires 10,000 Insurance Advisors, Opens 50 New Branches During FY19Arpit Chourasia100% (1)

- Fulfil dreams with HDFC Life Super Income PlanDokument8 SeitenFulfil dreams with HDFC Life Super Income PlanSajeed ShaikhNoch keine Bewertungen

- I Don't Want To Postpone My Loved Ones' Aspirations: Bharti AXA Life Secure Income PlanDokument15 SeitenI Don't Want To Postpone My Loved Ones' Aspirations: Bharti AXA Life Secure Income PlanSandhya AgrawalNoch keine Bewertungen

- PrudentialDokument5 SeitenPrudentialManish RaiNoch keine Bewertungen

- GEM BrochureDokument40 SeitenGEM BrochuremuruganandaNoch keine Bewertungen

- A Non-Linked, Non-Participating, Individual, Pure Risk Premium/Savings, Life Insurance ProductDokument7 SeitenA Non-Linked, Non-Participating, Individual, Pure Risk Premium/Savings, Life Insurance ProductvijayNoch keine Bewertungen

- Should Immediate Annuities Be a Tool in Your Retirement Planning Toolbox?Von EverandShould Immediate Annuities Be a Tool in Your Retirement Planning Toolbox?Noch keine Bewertungen

- Dividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.Von EverandDividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.Noch keine Bewertungen

- Tax Free Wealth: Learn the strategies and loopholes of the wealthy on lowering taxes by leveraging Cash Value Life Insurance, 1031 Real Estate Exchanges, 401k & IRA InvestingVon EverandTax Free Wealth: Learn the strategies and loopholes of the wealthy on lowering taxes by leveraging Cash Value Life Insurance, 1031 Real Estate Exchanges, 401k & IRA InvestingNoch keine Bewertungen

- Jeevan Saral Surrender Analysis: To Convince Policyholders To Continue The PolicyDokument11 SeitenJeevan Saral Surrender Analysis: To Convince Policyholders To Continue The Policykrishna-almightyNoch keine Bewertungen

- Investor Preferences and Types of Investment OptionsDokument26 SeitenInvestor Preferences and Types of Investment OptionsMubeenNoch keine Bewertungen

- Travel Insurance FormDokument2 SeitenTravel Insurance FormAnonymous Nw6c3H0Noch keine Bewertungen

- Ic Mock Exam Set C PDFDokument11 SeitenIc Mock Exam Set C PDFHerson LaxamanaNoch keine Bewertungen

- Reinsurance Industry in IndiaDokument18 SeitenReinsurance Industry in Indiapriyank2380804621100% (12)

- Wo 0802mylawang (FT1292 Sec 2.20) Kerja Repair JambatanDokument14 SeitenWo 0802mylawang (FT1292 Sec 2.20) Kerja Repair JambatanEncik ComotNoch keine Bewertungen

- Privatization in Healthcare PPT at CollegeDokument25 SeitenPrivatization in Healthcare PPT at Collegeabhijit4287Noch keine Bewertungen

- Deed of Mortgage Document SummaryDokument27 SeitenDeed of Mortgage Document Summaryadv shilpa patheyNoch keine Bewertungen

- ELECTRONIC EQUIPMENT INSURANCE PresentationDokument32 SeitenELECTRONIC EQUIPMENT INSURANCE Presentationm_dattaias90% (10)

- Calanoc Vs CADokument2 SeitenCalanoc Vs CANC BergoniaNoch keine Bewertungen

- Insurance SubrogationDokument18 SeitenInsurance SubrogationRakesh K S100% (1)

- Amanita NetDokument7 SeitenAmanita NetgsanghaNoch keine Bewertungen

- Chapter 8Dokument28 SeitenChapter 8PRIYANKA H MEHTANoch keine Bewertungen

- Investment Property Answer KeyDokument4 SeitenInvestment Property Answer KeyC/PVT DAET, SHAINA JOYNoch keine Bewertungen

- Notification No. 25/2012-Service Tax: Download From:Simple Tax India Dot NetDokument70 SeitenNotification No. 25/2012-Service Tax: Download From:Simple Tax India Dot NetSai Krishna MaddukuriNoch keine Bewertungen

- Risk Management Strategiesand Performance of Construction (Good Theoretical LR)Dokument148 SeitenRisk Management Strategiesand Performance of Construction (Good Theoretical LR)Ismail A IsmailNoch keine Bewertungen

- Insurance Law FPDokument25 SeitenInsurance Law FPhari krishnanNoch keine Bewertungen

- Great Pacific Life Insurance Corp Vs CADokument7 SeitenGreat Pacific Life Insurance Corp Vs CALeigh BarcelonaNoch keine Bewertungen

- STAR - Employee Benefits Insurance Manual 2019-2020-1Dokument36 SeitenSTAR - Employee Benefits Insurance Manual 2019-2020-1utkarsh kumarNoch keine Bewertungen

- IAIS Issues Paper on Solvency Assessments and Actuarial IssuesDokument50 SeitenIAIS Issues Paper on Solvency Assessments and Actuarial Issuesthanhtam3819Noch keine Bewertungen

- Taxation - Quick Notes - FinalsDokument17 SeitenTaxation - Quick Notes - FinalsRoseanneNoch keine Bewertungen

- Web Aggregator SyllabusDokument5 SeitenWeb Aggregator Syllabussam franklinNoch keine Bewertungen

- Valenzuela Hardwood vs. CA upholds private carrier exemptionDokument3 SeitenValenzuela Hardwood vs. CA upholds private carrier exemptionMikee RañolaNoch keine Bewertungen

- Andhra Pradesh State Council of Higher Education: Poultry FarmingDokument4 SeitenAndhra Pradesh State Council of Higher Education: Poultry FarmingP vasuNoch keine Bewertungen

- ICICI Pru Smart Life BrochureDokument23 SeitenICICI Pru Smart Life Brochuresrinivas reddyNoch keine Bewertungen

- Welcome Package 42-14 The Indep.Dokument7 SeitenWelcome Package 42-14 The Indep.Chris VisNoch keine Bewertungen

- Financial ServicesDokument20 SeitenFinancial ServicesProjNoch keine Bewertungen

- Political Violence InsuranceDokument17 SeitenPolitical Violence InsuranceYigermal TesfayeNoch keine Bewertungen

- Employer Employee Relationship CasesDokument26 SeitenEmployer Employee Relationship CasesGelyn DiazNoch keine Bewertungen

- Ike Perlmutter Motion, Part 2Dokument35 SeitenIke Perlmutter Motion, Part 2Law&CrimeNoch keine Bewertungen